Global Medical Device Engineering Market

Market Size in USD Billion

CAGR :

%

USD

7.66 Billion

USD

11.83 Billion

2024

2032

USD

7.66 Billion

USD

11.83 Billion

2024

2032

| 2025 –2032 | |

| USD 7.66 Billion | |

| USD 11.83 Billion | |

|

|

|

|

Medical Device Engineering Market Analysis

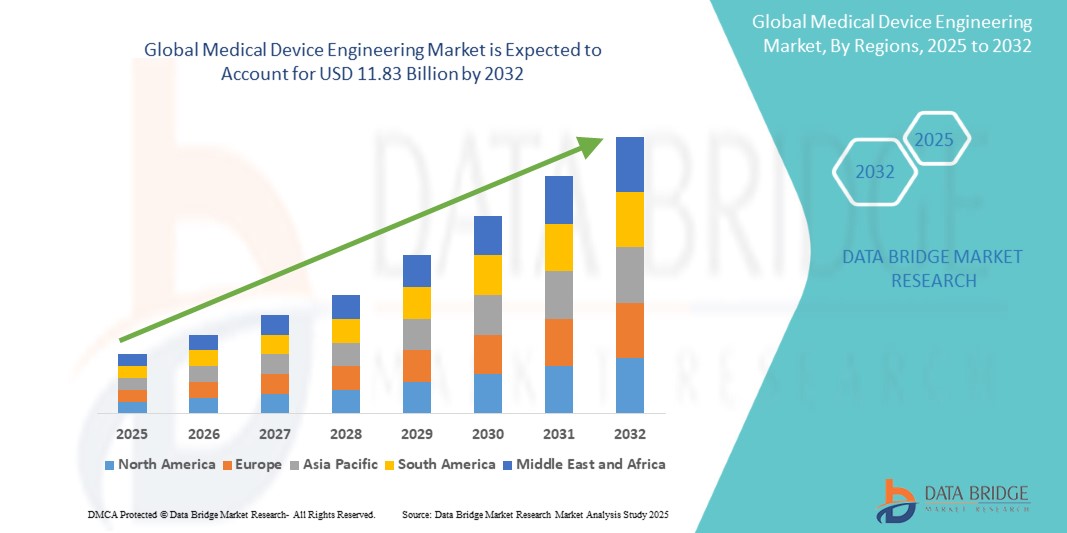

The medical device engineering market is experiencing robust growth, driven by advancements in healthcare technology, increased investment in R&D, and rising demand for innovative medical solutions. With a market size projected to grow at a CAGR of over 5.8%, the industry benefits from the development of minimally invasive devices, wearable health technologies, and diagnostic tools powered by AI and IoT. Key factors influencing this growth include the aging global population and the rising prevalence of chronic diseases, which necessitate advanced medical devices for effective management. Regulatory changes, such as the EU's MDR (Medical Device Regulation) and stringent FDA requirements, are driving companies to invest in high-quality engineering solutions to ensure compliance and safety. Technological advancements, including 3D printing, robotics, and smart materials, are reshaping medical device engineering. These innovations enable faster prototyping, cost efficiency, and enhanced device functionality. The Asia-Pacific region is emerging as a significant contributor, driven by lower manufacturing costs and a growing healthcare infrastructure. Challenges like high R&D costs and regulatory hurdles remain, but the demand for cutting-edge medical devices in diagnostics, treatment, and monitoring systems ensures a positive trajectory for the industry. The integration of digital health solutions will further propel this market.

Medical Device Engineering Market Size

Global medical device engineering market size was valued at USD 7.66 billion in 2024 and is projected to reach USD 11.83 billion by 2032, with a CAGR of 5.8% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Medical Device Engineering Market Trends

“Artificial Intelligence (AI) and Machine Learning (ML) Integration in Medical Devices”

One of the most transformative trends in medical device engineering market is the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities. AI and ML are enabling medical devices to perform more advanced functions such as diagnostics, data analysis, and personalized treatment recommendations, which are paving the way for a new generation of “smart” medical devices

AI-driven medical devices can analyze complex datasets and identify patterns that may not be apparent to human operators. For instance, AI algorithms embedded in imaging devices such as MRI and CT scanners help radiologists detect abnormalities such as tumors, fractures, or blood clots more accurately and at an earlier stage. This is helping healthcare providers make quicker and more accurate diagnoses, leading to better patient outcomes. AI-enabled devices can create individualized treatment plans by analyzing a patient’s unique physiological data, medical history, and genetic information. This is particularly valuable in fields like oncology, where treatments can be tailored to the specific genetic profile of a patient’s tumor, improving the effectiveness of therapies.

Report Scope and Medical Device Engineering Market Segmentation

|

Attributes |

Agriculture Rollers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

L&T Technology Services Limited (India), Infosys Limited (India), HCL Technologies Limited (India), Cyient (India), Wipro (India), Tech Mahindra Limited (India), TATA Consultancy Services Limited (India), FLEX LTD (U.S.), Capgemini (France), Embien Technologies India Pvt Ltd. (India), Alten Group (France), Accenture (Ireland), Consonance (Poland), Althea Group (U.S.), MED INSTITUTE (U.S.), Saraca Solutions Private Limited (India), Nemedio Inc. (U.S.), Sternum (Israel), Medcrypt (U.S.), MCRA, LLC (U.S.), North American Science Associates, LLC (U.S.), MedQtech (Sweden), Veranex (U.S.), Ontogen Medtech LLC (U.S.), Seisa Media (U.S.), and Simplexity Product Development (U.S.). |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device Engineering Market Definition

Medical device engineering is a multidisciplinary field focused on the design, development, and manufacturing of devices used for medical purposes, such as diagnosis, treatment, monitoring, or prevention of diseases. It integrates principles of mechanical, electrical, software, and biomedical engineering to create innovative and reliable devices, ranging from wearable health monitors and imaging systems to minimally invasive surgical tools and prosthetics. This field emphasizes compliance with stringent regulatory standards, safety, and user-centered design to ensure efficacy and patient comfort. Advances in materials science, robotics, and digital health technologies, like AI and IoT, are reshaping medical device engineering for improved healthcare outcomes.

Medical Device Engineering Market Dynamics

Drivers

- Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as cardiovascular disease, diabetes, cancer, and respiratory disorders is a major driver for the medical device engineering market. Chronic diseases are long-term, often lifestyle-related conditions that require ongoing monitoring, management, and treatment. As these diseases become more common due to factors such as aging populations, urbanization, and sedentary lifestyles, there is a growing need for medical devices that can aid in diagnostics, monitoring, and treatment. Conditions such as diabetes and cardiovascular diseases necessitate constant monitoring. Devices such as glucose monitors, heart rate monitors, and even wearable ECGs have become essential for patients, allowing for real-time health tracking and quick response to adverse events.

For instance, according to 2021 International Diabetes Federation (IDF) report, 10.5% of the adult population (20-79 years) has diabetes, with almost half unaware that they are living with the condition. By 2045, IDF projections show that 1 in 8 adults, approximately 783 million, will be living with diabetes, an increase of 46%.

The demand for medical devices used in managing chronic diseases has led to innovations in portable, user-friendly, and cost-effective devices, making healthcare more accessible. For instance, the development of connected devices that transmit data to healthcare providers in real time is helping to address chronic disease management at both the patient and system levels. This trend is expected to increase, contributing significantly to the growth of the medical device engineering market.

- Technological Advancements in Medical Devices

Rapid technological innovation is a powerful driver in the medical device engineering market, reshaping devices and enhancing their capabilities. Advances in fields such as artificial intelligence, robotics, 3D printing, and biocompatible materials are enabling the development of sophisticated medical devices that offer greater precision, automation, and adaptability to individual patient needs. The adoption of these advanced technologies is enabling the medical device market to meet growing demands for more effective, efficient, and patient-centered solutions. Companies investing in these technologies are poised to capture market share by offering innovative devices that are easier for clinicians to use and provide enhanced clinical benefits. For instance, Philips leverages AI in its diagnostic imaging devices, such as the IntelliSpace AI Workflow Suite. This platform uses AI to enhance imaging quality, speed up diagnostic workflows, and assist in earlier, more accurate diagnosis. It's designed for radiologists to streamline imaging operations and provide improved patient outcomes. As healthcare systems worldwide increasingly adopt these advanced solutions, the medical device engineering market is expected to experience robust growth driven by technological progress.

Opportunities

- Expansion in Wearable and Remote Monitoring Devices

With the rise in telemedicine and demand for proactive health management, wearable and remote monitoring devices present a substantial opportunity in the medical device engineering market. These devices, including smartwatches, continuous glucose monitors, and cardiac monitors, allow for real-time health monitoring outside of traditional clinical settings. The ability to track vital signs such as heart rate, oxygen levels, and glucose provides continuous patient data and empowers individuals to manage their health more effectively. Wearable devices offer immense value for patients managing chronic conditions like diabetes, hypertension, and heart disease. With increasing awareness of preventive healthcare and growing investment in wearable technologies, this segment is anticipated to see significant growth. According to market research, the wearable medical device segment is expected to grow at a high CAGR over the next decade, contributing heavily to the overall medical device market’s expansion.

For instance, in August 2024, Dexcom announced its new over-the-counter continuous glucose monitor Stelo is officially available for purchase in the U.S. The Stelo Glucose Biosensor System is an over-the-counter (OTC) integrated Continuous Glucose Monitor (iCGM) intended to continuously measure, record, analyze, and display glucose values in people 18 years and older not on insulin. The Stelo Glucose Biosensor System helps to detect normal (euglycemic) and low or high (dysglycemic) glucose levels. The Stelo Glucose Biosensor System may also help the user better understand how lifestyle and behavior modification, including diet and exercise, impact glucose excursion. Thus, the increase in availability of wearable and remote monitoring devices is expected to drives the growth of the market during the forecast period.

- Growing Demand for Minimally Invasive Surgical Devices

The shift toward minimally invasive procedures presents another substantial opportunity for medical device engineering. Minimally invasive surgical (MIS) devices, including laparoscopic instruments, robotic-assisted surgery tools, and endoscopic devices, reduce recovery time, cause less trauma, and minimize postoperative complications. The market for MIS devices is expanding as patients and healthcare providers seek options that shorten hospital stays and improve patient outcomes. MIS techniques involve smaller incisions, which reduce the risk of infection, pain, and scarring. Robotic-assisted surgery, for instance, enables greater precision in complex procedures such as cardiac and orthopedic surgeries, improving outcomes and recovery times.

This trend is being bolstered by technological advancements in robotics, imaging, and surgical tools. The MIS devices market is expected to see robust growth, with projections indicating high demand, particularly in orthopedic, cardiovascular, and gastrointestinal applications. The opportunity is also enhanced by an aging population that often requires surgical interventions for chronic conditions, which MIS techniques can address with fewer complications and faster recoveries. For instance, Stryker’s Mako System is a robotic-assisted platform that enables orthopedic surgeons to perform precise, minimally invasive knee and hip replacement surgeries. The Mako System integrates 3D imaging and robotic arms, allowing for improved precision and patient-specific surgical planning. The introduction of this type of devices boost the growth of market during the forecast period.

Restraints/Challenges

- Regulatory Compliance and Approval Delays

One of the most significant challenges facing the medical device engineering industry is navigating complex and stringent regulatory requirements. To obtain regulatory approval, medical devices must undergo rigorous testing and clinical trials to demonstrate safety and efficacy. This process can be time-consuming and expensive, often leading to delays in product launches and market entry. Moreover, the regulatory landscape is constantly evolving, with new regulations and standards being introduced. This can create additional challenges for manufacturers, who must stay updated on the latest requirements and adapt their products accordingly.

Furthermore, the regulatory landscape can vary significantly across different countries. Obtaining approvals in multiple markets can be a complex and costly process. This can hinder the global distribution of medical devices and limit market access.

- High Initial Costs of Medical Device

The high cost of medical devices is a significant barrier to the growth of the medical device engineering market. Expensive materials, complex manufacturing processes, and stringent regulatory requirements contribute to the overall cost of these devices. As a result, healthcare providers, especially in developing countries, may struggle to afford advanced medical technologies, limiting market adoption. Additionally, high prices can deter innovation from smaller companies that lack the financial resources to invest in R&D and comply with regulatory standards. This restricts the accessibility and scalability of new technologies.

For instance, according to the American Council on Science and Health, the cost of medical devices are rarely mentioned. It represents about 5% of healthcare spending, or roughly USD120 billion in 2017. Therefore, the high cost of medical devices restraints to the growth of the medical device engineering market.

Medical Device Engineering Market Scope

The market is segmented on the basis of service type and device type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Product Innovation & Design/Industrial Design Services

- Prototyping Services

- Electronics Engineering Services

- Software Development & Testing Services

- Connectivity And Mobility Services

- Cybersecurity Services

- Product Testing Services

- Regulatory Consulting Services

- Product Support & Maintenance Service

Device Type

- Diagnostic Imaging Equipment

- Surgical Equipment

- Patient Monitoring Devices & Life Support Devices

- Medical Lasers

- IVD Devices

- Other Medical Devices

Medical Device Engineering Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, device type, service type as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to advancements in medical device technology and high healthcare expenditure, presence of key players. Additionally, the high cost of medical device and high adoption rate of medical device are expected to further fuel the market's growth.

Asia-Pacific is expected to be the fastest growing due to the region's rapidly increasing population. Government initiatives and investments aimed at modernizing healthcare sector, along with increasing awareness among people about the benefits of advanced medical devices, surge in start-up activity in medical devices are contributing to the market's expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Medical Device Engineering Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Medical Device Engineering Market Leaders Operating in the Market Are:

- L&T Technology Services Limited (India)

- Infosys Limited (India)

- HCL Technologies Limited (India)

- Cyient (India)

- Wipro (India)

- Tech Mahindra Limited (India)

- TATA Consultancy Services Limited (India)

- FLEX LTD (U.S.)

- Capgemini (France)

- Embien Technologies India Pvt Ltd. (India)

- Alten Group (France)

- Accenture (Ireland)

- Consonance (Poland)

- Althea Group (U.S.)

- MED INSTITUTE (U.S.)

- Saraca Solutions Private Limited (India)

- Nemedio Inc. (U.S.)

- Sternum (Israel)

- Medcrypt (U.S.)

- MCRA, LLC (U.S.)

- North American Science Associates, LLC (U.S.)

- MedQtech (Sweden)

- Veranex (U.S.)

- Ontogen Medtech LLC (U.S.)

- Seisa Media (U.S.)

- Simplexity Product Development (U.S.)

Latest Developments in Medical Device Engineering Market

- In November 2023, L&T Technology Services Limited (LTTS) (India) partnered with NVIDIA Corporation (U.S.) to develop software-defined architectures for medical devices, specifically for endoscopy, aimed at improving image quality and product scalability

- In October 2023, Alten Group (France) acquired East Japan Institute of Technology Co., Ltd. (Japan). This acquisition supports Alten’s strategy to strengthen its engineering capabilities in Japan and reach a significant market presence, establishing itself as a leading engineering services provider in the region

- In January 2022, HCL Technologies Limited (India) acquired Starschema (U.S.), a move that enhances HCL's digital engineering capabilities, especially in dassssta engineering, and broadens its footprint in Central and Eastern Europe

- In September 2024, Vision Engineering, a U.K. designer, manufacturer, and exporter of ergonomic microscopes and measuring systems, launched OPTA, a cost-effective entry-level product for its patented optical stereo microscope technology. Available for less than $1,200, with a choice of three stands and two lenses, OPTA redefines the entry point for users to benefit from Vision Engineering’s image quality, ergonomic design, and ease of use. This product aims to enhance image quality and ergonomics, making advanced microscopy more accessible. The launch of this type of devices boosts the growth of medical device engineering market

- In June 2022, Siemens Healthineers introduces Symbia Pro.specta, a single photon emission computed tomography/computed tomography (SPECT/CT) system with CE mark and Food and Drug Administration (FDA) clearance that has advanced SPECT and CT imaging technologies. Capabilities include a low-dose CT of up to 64 slices for impressive detail, automatic SPECT motion correction for additional image clarity, and an intuitive and automated workflow to guide the user through the entire decision-making process of the examination

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICAL DEVICE ENGINEERING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEDICAL DEVICE ENGINEERING MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MEDICAL DEVICE ENGINEERING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6. INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7. INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8. COST ANALYSIS BREAKDOWN

9. TECHNONLOGY ROADMAP

10. INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11. REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12. REIMBURSEMENT FRAMEWORK

13. OPPUTUNITY MAP ANALYSIS

14. VALUE CHAIN ANALYSIS

15. HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.10 ECONOMIC DEVELOPMENT

16. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, BY SERVICE TYPE

16.1 OVERVIEW

16.2 PRODUCT DESIGN & DEVELOPMENT

16.2.1 CONCEPTUALIZATION & IDEATION

16.2.2 INDUSTRIAL & MECHANICAL DESIGN

16.2.3 USER-CENTERED DESIGN (UCD) & ERGONOMICS

16.2.4 MATERIALS & COMPONENT SELECTION

16.2.5 FINITE ELEMENT ANALYSIS (FEA) & SIMULATION

16.2.6 DESIGN FOR MANUFACTURING (DFM)

16.3 PROTOTYPING & TESTING

16.3.1 RAPID PROTOTYPING (3D PRINTING, CNC, INJECTION MOLDING)

16.3.2 MECHANICAL, ELECTRICAL & THERMAL TESTING

16.3.3 PRECLINICAL TESTING & VALIDATION

16.3.4 BIOCOMPATIBILITY & TOXICITY TESTING

16.3.5 FAILURE MODE & EFFECTS ANALYSIS (FMEA)

16.4 MANUFACTURING & SUPPLY CHAIN MANAGEMENT

16.4.1 CONTRACT MANUFACTURING (OEM & ODM)

16.4.2 COMPONENT SOURCING & SUPPLY CHAIN OPTIMIZATION

16.4.3 CLEANROOM & STERILE MANUFACTURING

16.4.4 LEAN MANUFACTURING & SIX SIGMA PRACTICES

16.4.5 QUALITY CONTROL & ASSURANCE (ISO 13485, GMP)

16.5 REGULATORY COMPLIANCE & CONSULTING

16.5.1 RISK MANAGEMENT & SAFETY ASSESSMENTS

16.5.2 CLINICAL & REGULATORY STRATEGY CONSULTING

16.5.3 REGULATORY SUBMISSIONS (FDA, CE MARKING, ISO CERTIFICATION)

16.5.4 POST-MARKET SURVEILLANCE & COMPLIANCE AUDITS

16.5.5 LEGAL & ETHICAL CONSIDERATIONS

16.6 EMBEDDED SYSTEMS & SOFTWARE DEVELOPMENT

16.7 OTHER

17. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, BY DEVICE TYPE

17.1 OVERVIEW

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

17.2 DIAGNOSTIC DEVICES

17.2.1 IMAGING SYSTEMS

17.2.1.1. MAGNETIC RESONANCE IMAGING (MRI)

17.2.1.1.1. OPEN MRI

17.2.1.1.2. CLOSED MRI

17.2.1.2. COMPUTED TOMOGRAPHY (CT) SCANNERS

17.2.1.2.1. LOW-SLICE CT (1-16 SLICES)

17.2.1.2.2. MID-SLICE CT (32-64 SLICES)

17.2.1.2.3. HIGH-SLICE CT (128+ SLICES)

17.2.1.2.4. CONE BEAM CT (CBCT)

17.2.1.2.5. SPECTRAL CT

17.2.1.3. ULTRASOUND DEVICES

17.2.1.3.1. 2D ULTRASOUND

17.2.1.3.2. 3D/4D ULTRASOUND

17.2.1.3.3. DOPPLER ULTRASOUND

17.2.1.3.4. PORTABLE & HANDHELD ULTRASOUND

17.2.1.3.5. HIGH-INTENSITY FOCUSED ULTRASOUND (HIFU)

17.2.1.4. X-RAY SYSTEMS

17.2.1.4.1. ANALOG X-RAY

17.2.1.4.2. DIGITAL RADIOGRAPHY (DR)

17.2.1.4.3. COMPUTED RADIOGRAPHY (CR)

17.2.1.4.4. FLUOROSCOPY SYSTEMS

17.2.1.5. POSITRON EMISSION TOMOGRAPHY (PET) SCANNERS

17.2.1.5.1. PET-CT SYSTEMS

17.2.1.5.2. PET-MRI SYSTEMS

17.2.1.5.3. STANDALONE PET SCANNERS

17.2.2 IN-VITRO DIAGNOSTIC (IVD) EQUIPMENT

17.2.2.1. MOLECULAR DIAGNOSTICS

17.2.2.1.1. POLYMERASE CHAIN REACTION (PCR)

17.2.2.1.2. NEXT-GENERATION SEQUENCING (NGS)

17.2.2.1.3. DNA MICROARRAYS

17.2.2.1.4. ISOTHERMAL NUCLEIC ACID AMPLIFICATION

17.2.2.2. IMMUNOASSAYS

17.2.2.2.1. ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA)

17.2.2.2.2. CHEMILUMINESCENCE IMMUNOASSAY (CLIA)

17.2.2.2.3. RADIOIMMUNOASSAY (RIA)

17.2.2.3. HEMATOLOGY ANALYZERS

17.2.2.3.1. 3-PART HEMATOLOGY ANALYZERS

17.2.2.3.2. 5-PART HEMATOLOGY ANALYZERS

17.2.2.3.3. POINT-OF-CARE HEMATOLOGY DEVICES

17.2.2.4. POINT-OF-CARE TESTING DEVICES

17.2.2.4.1. GLUCOSE MONITORING SYSTEMS

17.2.2.4.2. RAPID ANTIGEN/ANTIBODY TESTS

17.2.2.4.3. HOME PREGNANCY & FERTILITY KITS

17.2.2.4.4. INFECTIOUS DISEASE RAPID TESTS

17.3 THERAPEUTIC DEVICES

17.3.1 SURGICAL INSTRUMENTS & ROBOTICS

17.3.1.1. MINIMALLY INVASIVE SURGERY (MIS) DEVICES

17.3.1.1.1. LAPAROSCOPIC INSTRUMENTS

17.3.1.1.2. ENDOSCOPIC INSTRUMENTS

17.3.1.1.3. ARTHROSCOPIC DEVICES

17.3.1.1.4. ROBOTIC-ASSISTED MIS SYSTEMS

17.3.1.2. ROBOT-ASSISTED SURGERY (RAS) SYSTEMS

17.3.1.2.1. ORTHOPEDIC SURGERY ROBOTS

17.3.1.2.2. NEUROSURGERY ROBOTS

17.3.1.2.3. UROLOGY & GYNECOLOGY SURGERY ROBOTS

17.3.2 IMPLANTABLE MEDICAL DEVICES

17.3.2.1. ORTHOPEDIC IMPLANTS

17.3.2.1.1. HIP IMPLANTS

17.3.2.1.2. KNEE IMPLANTS

17.3.2.1.3. SPINAL IMPLANTS

17.3.2.1.4. TRAUMA FIXATION DEVICES

17.3.2.2. CARDIOVASCULAR IMPLANTS

17.3.2.2.1. PACEMAKERS

17.3.2.2.2. IMPLANTABLE CARDIOVERTER DEFIBRILLATORS (ICDS)

17.3.2.2.3. HEART VALVES

17.3.2.2.4. CORONARY & PERIPHERAL STENTS

17.3.2.3. NEUROSTIMULATION DEVICES

17.3.2.3.1. DEEP BRAIN STIMULATORS (DBS)

17.3.2.3.2. SPINAL CORD STIMULATORS (SCS)

17.3.2.3.3. VAGUS NERVE STIMULATORS (VNS)

17.3.2.3.4. SACRAL NERVE STIMULATORS

17.3.2.4. COCHLEAR & AUDITORY IMPLANTS

17.3.2.4.1. COCHLEAR IMPLANTS

17.3.2.4.2. BONE-ANCHORED HEARING AIDS (BAHA)

17.3.3 DRUG DELIVERY SYSTEMS

17.3.3.1. SMART INFUSION PUMPS

17.3.3.1.1. LARGE VOLUME PUMPS (LVP)

17.3.3.1.2. SYRINGE INFUSION PUMPS

17.3.3.1.3. PATIENT-CONTROLLED ANALGESIA (PCA) PUMPS

17.3.3.1.4. INSULIN PUMPS

17.3.3.2. SMART INHALERS

17.3.3.2.1. METERED-DOSE INHALERS (MDIS)

17.3.3.2.2. DRY POWDER INHALERS (DPIS)

17.3.3.2.3. NEBULIZERS

17.4 PATIENT MONITORING DEVICES

17.4.1 WEARABLE MEDICAL DEVICES

17.4.1.1. SMARTWATCHES & FITNESS TRACKERS

17.4.1.1.1. HEART RATE MONITORING

17.4.1.1.2. BLOOD OXYGEN (SPO2) MONITORING

17.4.1.1.3. ECG MONITORING

17.4.1.2. CONTINUOUS GLUCOSE MONITORS (CGM)

17.4.1.2.1. REAL-TIME CGM (RTCGM)

17.4.1.2.2. INTERMITTENTLY SCANNED CGM (ISCGM)

17.4.2 REMOTE PATIENT MONITORING (RPM) SYSTEMS

17.4.2.1. CARDIAC MONITORING DEVICES

17.4.2.1.1. HOLTER MONITORS

17.4.2.1.2. IMPLANTABLE LOOP RECORDERS

17.4.2.1.3. WIRELESS ECG

17.4.2.2. RESPIRATORY MONITORING DEVICES

17.4.2.2.1. PULSE OXIMETERS

17.4.2.2.2. CAPNOGRAPHY SYSTEMS

17.4.2.3. NEUROLOGICAL MONITORING DEVICES

17.4.2.3.1. EEG MONITORS

17.4.2.3.2. ELECTROMYOGRAPHY (EMG) DEVICES

17.5 HEALTHCARE IT & DIGITAL HEALTH SOLUTIONS

17.5.1 TELEMEDICINE PLATFORMS

17.5.1.1. VIDEO CONSULTATION PLATFORMS

17.5.1.1.1. GENERAL TELECONSULTATION

17.5.1.1.2. TELEPSYCHIATRY

17.5.1.1.3. TELEDERMATOLOGY

17.5.1.1.4. TELENEUROLOGY

17.5.1.2. REMOTE PATIENT MANAGEMENT SYSTEMS

17.5.1.2.1. MOBILE HEALTH APPS

17.5.1.2.2. AI-BASED SYMPTOM CHECKERS

17.5.2 ELECTRONIC HEALTH RECORDS (EHR)

17.5.2.1. CLOUD-BASED EHR

17.5.2.2. ON-PREMISE EHR

17.5.2.3. AI-DRIVEN EHR SYSTEMS

17.5.3 AI-BASED DIAGNOSTIC & DECISION-SUPPORT TOOLS

17.5.3.1. AI IN RADIOLOGY & IMAGING

17.5.3.2. AI IN PATHOLOGY

17.5.3.3. AI FOR HISTOPATHOLOGICAL IMAGE ANALYSIS

17.5.3.4. AUTOMATED CYTOLOGY ANALYSIS

17.6 OTHERS

18. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 CARDIOVASCULAR

18.3 ORTHOPEDICS

18.4 NEUROLOGY

18.5 ONCOLOGY

18.6 RESPIRATORY

18.7 GENERAL SURGERY

18.8 OPHTHALMOLOGY

18.9 DENTAL

18.10 OTHERS

19. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, BY END USER

19.1 OVERVIEW

19.2 MEDICAL DEVICE MANUFACTURERS

19.3 CONTRACT MANUFACTURING ORGANIZATIONS (CMOS) & CONTRACT DEVELOPMENT AND MANUFACTURING ORGANIZATIONS (CDMOS)

19.4 HOSPITALS & HEALTHCARE PROVIDERS

19.5 REMOTE PATIENT MONITORING PROVIDERS

19.6 REGULATORY & COMPLIANCE BODIES

19.7 OTHERS

20. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, BY COUNTRY

GLOBAL MEDICAL DEVICE ENGINEERING MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 U.K.

20.2.3 ITALY

20.2.4 FRANCE

20.2.5 SPAIN

20.2.6 RUSSIA

20.2.7 SWITZERLAND

20.2.8 TURKEY

20.2.9 BELGIUM

20.2.10 NETHERLANDS

20.2.11 DENMARK

20.2.12 SWEDEN

20.2.13 POLAND

20.2.14 NORWAY

20.2.15 FINLAND

20.2.16 REST OF EUROPE

20.3 ASIA-PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 SINGAPORE

20.3.6 THAILAND

20.3.7 INDONESIA

20.3.8 MALAYSIA

20.3.9 PHILIPPINES

20.3.10 AUSTRALIA

20.3.11 NEW ZEALAND

20.3.12 VIETNAM

20.3.13 TAIWAN

20.3.14 REST OF ASIA-PACIFIC

20.4 SOUTH AMERICA

20.4.1 BRAZIL

20.4.2 ARGENTINA

20.4.3 REST OF SOUTH AMERICA

20.5 MIDDLE EAST AND AFRICA

20.5.1 SOUTH AFRICA

20.5.2 EGYPT

20.5.3 BAHRAIN

20.5.4 UNITED ARAB EMIRATES

20.5.5 KUWAIT

20.5.6 OMAN

20.5.7 QATAR

20.5.8 SAUDI ARABIA

20.5.9 REST OF MEA

20.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, SWOT AND DBMR ANALYSIS

22. GLOBAL MEDICAL DEVICE ENGINEERING MARKET, COMPANY PROFILE

22.1 3M HEALTH CARE

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHIC PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 ABBOTT LABORATORIES

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHIC PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 BAXTER INTERNATIONAL

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHIC PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 BECTON DICKINSON COMPANY

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHIC PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 BOSTON SCIENTIFIC CORPORATION

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHIC PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 CANON MEDICAL SYSTEMS CORPORATION

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHIC PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 CARDINAL HEALTH

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHIC PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 DANAHER CORPORATION

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHIC PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 FRESENIUS MEDICAL CARE

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHIC PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.10 GE HEALTHCARE

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHIC PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 HOLOGIC, INC.

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHIC PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT DEVELOPMENTS

22.12 INTUITIVE SURGICAL

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHIC PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT DEVELOPMENTS

22.13 JOHNSON & JOHNSON

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHIC PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT DEVELOPMENTS

22.14 MEDTRONIC PLC

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHIC PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT DEVELOPMENTS

22.15 PHILIPS HEALTHCARE

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHIC PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT DEVELOPMENTS

22.16 RESMED INC.

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHIC PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT DEVELOPMENTS

22.17 ROCHE DIAGNOSTICS INTERNATIONAL LTD

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHIC PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT DEVELOPMENTS

22.18 SIEMENS HEALTHINEERS AG

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHIC PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT DEVELOPMENTS

22.19 SMITH & NEPHEW PLC.

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHIC PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT DEVELOPMENTS

22.20 STRYKER CORPORATION

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHIC PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT DEVELOPMENTS

22.21 TERUMO CORPORATION

22.21.1 COMPANY OVERVIEW

22.21.2 REVENUE ANALYSIS

22.21.3 GEOGRAPHIC PRESENCE

22.21.4 PRODUCT PORTFOLIO

22.21.5 RECENT DEVELOPMENTS

22.22 THERMO FISHER SCIENTIFIC, INC.

22.22.1 COMPANY OVERVIEW

22.22.2 REVENUE ANALYSIS

22.22.3 GEOGRAPHIC PRESENCE

22.22.4 PRODUCT PORTFOLIO

22.22.5 RECENT DEVELOPMENTS

22.23 ZIMMER BIOMET HOLDINGS, INC.

22.23.1 COMPANY OVERVIEW

22.23.2 REVENUE ANALYSIS

22.23.3 GEOGRAPHIC PRESENCE

22.23.4 PRODUCT PORTFOLIO

22.23.5 RECENT DEVELOPMENTS

22.24 FLEX HEALTH SOLUTIONS

22.24.1 COMPANY OVERVIEW

22.24.2 REVENUE ANALYSIS

22.24.3 GEOGRAPHIC PRESENCE

22.24.4 PRODUCT PORTFOLIO

22.24.5 RECENT DEVELOPMENTS

22.25 JABIL HEALTHCARE

22.25.1 COMPANY OVERVIEW

22.25.2 REVENUE ANALYSIS

22.25.3 GEOGRAPHIC PRESENCE

22.25.4 PRODUCT PORTFOLIO

22.25.5 RECENT DEVELOPMENTS

22.26 SANMINA CORPORATION

22.26.1 COMPANY OVERVIEW

22.26.2 REVENUE ANALYSIS

22.26.3 GEOGRAPHIC PRESENCE

22.26.4 PRODUCT PORTFOLIO

22.26.5 RECENT DEVELOPMENTS

22.27 CELESTICA HEALTHTECH

22.27.1 COMPANY OVERVIEW

22.27.2 REVENUE ANALYSIS

22.27.3 GEOGRAPHIC PRESENCE

22.27.4 PRODUCT PORTFOLIO

22.27.5 RECENT DEVELOPMENTS

22.28 INTEGER HOLDINGS CORPORATION

22.28.1 COMPANY OVERVIEW

22.28.2 REVENUE ANALYSIS

22.28.3 GEOGRAPHIC PRESENCE

22.28.4 PRODUCT PORTFOLIO

22.28.5 RECENT DEVELOPMENTS

RECENT DEVELOPMENTS NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

23. RELATED REPORTS

24. CONCLUSION

25. QUESTIONNAIRE

26. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.