Global Medical Device M

Market Size in USD Million

CAGR :

%

USD

509.65 Million

USD

1,053.38 Million

2025

2033

USD

509.65 Million

USD

1,053.38 Million

2025

2033

| 2026 –2033 | |

| USD 509.65 Million | |

| USD 1,053.38 Million | |

|

|

|

|

Global Medical Device M&A & Strategic Consolidation Market Segmentation, By Deal Type (Mergers, Acquisitions, Strategic Alliances & Joint Ventures, and Minority Stake Investments), Device Focus Area (Diagnostic Devices, Therapeutic Devices, Surgical Devices, and Monitoring & Imaging Devices) - Industry Trends and Forecast to 2033

Medical Device M&A & Strategic Consolidation Market Size

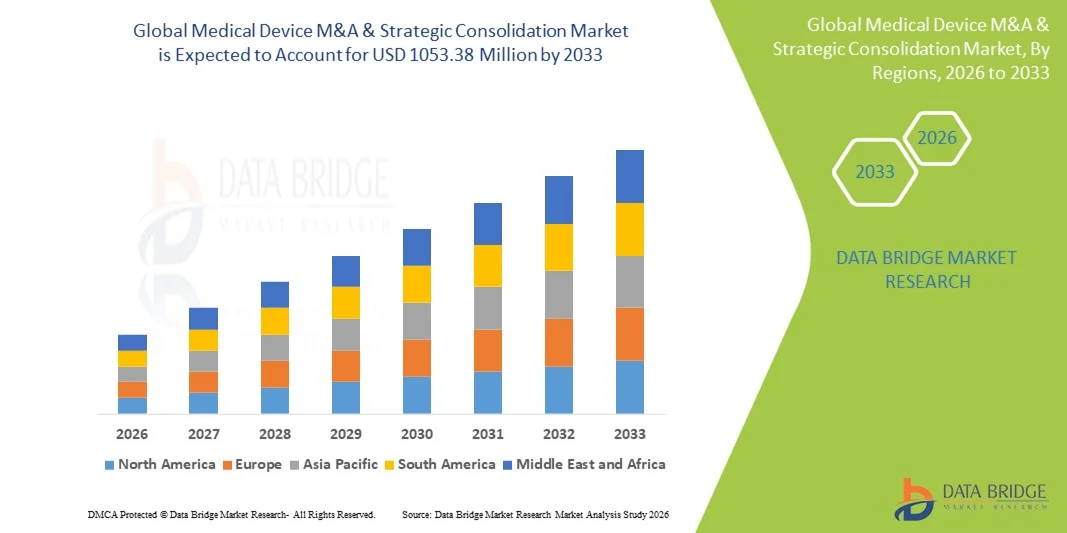

- The global medical device M&A & strategic consolidation market size was valued at USD 509.65 Million in 2025 and is expected to reach USD 1053.38 Million by 2033, at a CAGR of 9.50% during the forecast period

- The market growth is largely driven by increasing innovation intensity and technological advancement across the medical device industry, encouraging companies to pursue mergers, acquisitions, and strategic partnerships to expand product portfolios, strengthen technological capabilities, and accelerate time-to-market across global healthcare systems

- Furthermore, rising competitive pressure, the need for scale and operational efficiency, and growing demand for integrated and value-based healthcare solutions are positioning Medical Device M&A & Strategic Consolidation as a key strategy for market expansion, geographic penetration, and long-term growth, thereby significantly boosting overall industry momentum

Medical Device M&A & Strategic Consolidation Market Analysis

- Medical Device M&A & Strategic Consolidation, encompassing mergers, acquisitions, joint ventures, and strategic alliances among medical device manufacturers and technology providers, has become a critical mechanism for strengthening competitive positioning, expanding product portfolios, and accelerating innovation across both developed and emerging healthcare markets

- The escalating activity in this market is primarily fueled by rising R&D costs, increasing regulatory complexity, pressure to achieve economies of scale, and growing demand for integrated, value-based healthcare solutions, prompting companies to consolidate capabilities, access new technologies, and enter high-growth therapeutic segments

- North America dominated the medical device M&A & strategic consolidation market with the largest revenue share of approximately 41.8% in 2025, supported by a highly mature medical device ecosystem, strong presence of global medtech leaders, high deal activity in the U.S., robust capital availability, and a strong focus on innovation-driven acquisitions in areas such as digital health, minimally invasive devices, and diagnostics

- Asia-Pacific is expected to be the fastest-growing region in the Medical Device M&A & Strategic Consolidation market during the forecast period, registering a CAGR of around 9.6%, driven by rapid expansion of healthcare infrastructure, rising domestic medtech companies, increasing cross-border acquisitions, and growing investor interest in cost-efficient manufacturing and high-growth patient populations

- The acquisitions segment dominated the largest market revenue share of approximately 46.8% in 2025, driven by large medical device companies acquiring innovative startups to expand product portfolios and technological capabilities

Report Scope and Medical Device M&A & Strategic Consolidation Market Segmentation

|

Attributes |

Medical Device M&A & Strategic Consolidation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (Ireland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device M&A & Strategic Consolidation Market Trends

Increasing Strategic Acquisitions to Expand Technology Portfolios and Global Reach

- A prominent and accelerating trend in the global medical device M&A & strategic consolidation market is the growing number of mergers, acquisitions, and strategic partnerships aimed at strengthening product portfolios, expanding geographic presence, and accelerating innovation. Leading medical device companies are actively pursuing acquisitions to gain access to specialized technologies, regulatory approvals, and established distribution networks

- For instance, in 2024, several multinational medical device manufacturers completed acquisitions of mid-sized firms specializing in minimally invasive surgical tools and diagnostic devices, enabling faster market entry and enhanced competitive positioning across North America and Europe

- In addition, consolidation activities are increasingly focused on high-growth segments such as cardiovascular devices, orthopedic implants, and digital health solutions, where companies seek to complement internal R&D with external innovation

- This trend is also driven by the need to achieve economies of scale, optimize manufacturing capabilities, and streamline supply chains in a highly regulated and competitive global market. As a result, strategic consolidation is reshaping market structure and intensifying competition among established players

- Overall, the growing emphasis on inorganic growth strategies reflects a broader industry shift toward long-term value creation through portfolio diversification, operational efficiency, and global expansion

Medical Device M&A & Strategic Consolidation Market Dynamics

Driver

Pressure to Innovate Amid Rising Healthcare Demand and Regulatory Complexity

- The Medical Device M&A & Strategic Consolidation market is strongly driven by increasing global healthcare demand, aging populations, and the rising prevalence of chronic diseases, which are pushing companies to rapidly innovate and scale operations. Mergers and acquisitions enable firms to accelerate product development and bring advanced medical technologies to market more efficiently

- For instance, in 2025, several U.S. and European medical device companies entered strategic mergers to combine clinical expertise and regulatory capabilities, helping them navigate complex approval processes and reduce time-to-market for new devices

- Furthermore, tightening regulatory standards across regions such as the U.S., Europe, and Asia-Pacific are encouraging companies to consolidate resources and expertise to ensure compliance while maintaining profitability

- Healthcare providers’ increasing demand for integrated, cost-effective, and clinically proven solutions is also encouraging consolidation, as larger organizations are better positioned to meet large-scale procurement and long-term service requirements

- Collectively, these factors are driving sustained M&A activity as companies seek to remain competitive, innovative, and resilient in an evolving global healthcare landscape

Restraint/Challenge

Integration Risks, High Transaction Costs, and Regulatory Scrutiny

- Despite strong momentum, the Medical Device M&A & Strategic Consolidation market faces notable challenges related to post-merger integration, high transaction costs, and increased regulatory scrutiny. Integrating operations, corporate cultures, and product pipelines can be complex and time-consuming, often impacting short-term performance

- For instance, in 2024, certain cross-border medical device acquisitions encountered delays due to extended antitrust reviews and compliance assessments in regions such as the European Union and Asia-Pacific, affecting deal timelines and synergies

- In addition, the high financial investment required for large-scale acquisitions can strain balance sheets, particularly for mid-sized companies, increasing exposure to financial and operational risks

- Variations in regulatory frameworks across countries further complicate consolidation efforts, as companies must align quality standards, clinical data requirements, and post-market surveillance obligations

- Overcoming these challenges will require careful due diligence, robust integration planning, and proactive regulatory engagement. Companies that effectively manage these risks are more likely to realize long-term benefits from strategic consolidation and sustain growth in the global Medical Device M&A & Strategic Consolidation market

Medical Device M&A & Strategic Consolidation Market Scope

The market is segmented on the basis of deal type and device focus area.

- By Deal Type

On the basis of deal type, the Global Medical Device M&A & Strategic Consolidation market is segmented into mergers, acquisitions, strategic alliances & joint ventures, and minority stake investments. The acquisitions segment dominated the largest market revenue share of approximately 46.8% in 2025, driven by large medical device companies acquiring innovative startups to expand product portfolios and technological capabilities. Acquisitions enable rapid market entry and reduce internal R&D risks. Established players leverage acquisitions to gain regulatory-approved products and intellectual property. Increasing competition encourages consolidation for scale advantages. Cost synergies and operational efficiencies further support dominance. Strong private equity participation fuels acquisition activity. High cash reserves among global medtech leaders sustain deal momentum. Geographic expansion through acquisitions remains a key driver. Portfolio diversification strengthens long-term growth strategies. Regulatory clarity in major markets supports transaction completion. Acquisitions also accelerate digital and AI-enabled device integration. Overall, acquisitions remain the preferred consolidation route.

The strategic alliances & joint ventures segment is expected to witness the fastest CAGR of around 14.9% from 2026 to 2033, driven by rising collaboration between medtech firms and technology companies. Partnerships reduce financial risk while enabling innovation sharing. Co-development of AI-driven and connected devices boosts adoption. Joint ventures support entry into emerging markets. Increasing regulatory complexity favors shared expertise models. Flexible collaboration structures attract mid-sized firms. R&D cost optimization drives alliance formation. Academic-industry partnerships expand. Faster time-to-market supports growth. Cross-border alliances increase global reach. Digital health convergence accelerates partnerships. Strategic flexibility makes this segment highly attractive.

- By Device Focus Area

On the basis of device focus area, the Global Medical Device M&A & Strategic Consolidation market is segmented into diagnostic devices, therapeutic devices, surgical devices, and monitoring & imaging devices. The therapeutic devices segment accounted for the largest market revenue share of about 38.6% in 2025, driven by high demand for cardiovascular, orthopedic, and neurology treatment solutions. Rising chronic disease prevalence fuels investment interest. Therapeutic devices generate recurring revenues through consumables and upgrades. Strong reimbursement frameworks support acquisitions. High clinical impact increases valuation attractiveness. Advanced implant technologies drive deal volume. Innovation in minimally invasive therapies accelerates consolidation. Mature regulatory pathways reduce approval risk. Global aging populations increase demand. Pipeline expansion strategies favor therapeutics. Strong hospital demand supports long-term growth. As a result, therapeutic devices dominate deal activity.

The monitoring & imaging devices segment is projected to grow at the fastest CAGR of approximately 16.2% from 2026 to 2033, driven by digital health adoption and AI-enabled diagnostics. Remote patient monitoring demand accelerates investment. Imaging technologies support early diagnosis and precision care. Integration with IoT platforms enhances value. Hospitals prioritize real-time data solutions. Home healthcare expansion boosts monitoring device interest. Cloud-based imaging analytics attract strategic buyers. Software-hardware convergence drives M&A activity. Regulatory support for digital diagnostics encourages growth. Venture funding strengthens innovation pipelines. Expansion of telehealth ecosystems accelerates consolidation. This segment represents a key future growth engine.

Medical Device M&A & Strategic Consolidation Market Regional Analysis

- North America dominated the medical device M&A & strategic consolidation market with the largest revenue share of approximately 41.8% in 2025

- Supported by a highly mature medical device ecosystem, strong presence of global medtech leaders, high deal activity, and robust capital availability

- The region benefits from continuous innovation in areas such as digital health, minimally invasive devices, diagnostics, and connected medical technologies, which is driving strategic acquisitions and partnerships

U.S. Medical Device M&A & Strategic Consolidation Market Insight

The U.S. medical device M&A & strategic consolidation market accounted for the largest share within North America in 2025, driven by an active mergers and acquisitions landscape, strong venture capital and private equity participation, and a high concentration of leading medical device manufacturers. Companies are increasingly pursuing strategic consolidation to expand product portfolios, gain access to advanced technologies, and strengthen their market presence across high-growth therapeutic areas.

Europe Medical Device M&A & Strategic Consolidation Market Insight

The Europe Medical Device M&A & Strategic Consolidation market is projected to expand at a steady CAGR during the forecast period, supported by a strong regulatory framework, growing focus on innovation, and increasing consolidation among mid-sized medical device manufacturers. Cross-border acquisitions and partnerships are gaining traction as companies seek geographic expansion and access to specialized technologies.

U.K. Medical Device M&A & Strategic Consolidation Market Insight

The U.K. medical device M&A & strategic consolidation market is expected to witness notable growth over the forecast period, driven by an expanding medtech startup ecosystem, strong research base, and increasing investor interest in high-value medical technologies. Strategic collaborations and acquisitions are particularly focused on digital health, diagnostics, and minimally invasive solutions.

Germany Medical Device M&A & Strategic Consolidation Market Insight

The Germany medical device M&A & strategic consolidation market is anticipated to grow at a considerable CAGR, supported by the country’s strong manufacturing base, emphasis on engineering excellence, and leadership in medical technology innovation. German companies are actively engaging in strategic mergers to enhance global competitiveness and expand into emerging markets.

Asia-Pacific Medical Device M&A & Strategic Consolidation Market Insight

The Asia-Pacific medical device M&A & strategic consolidation market region is expected to be the fastest-growing market, registering a CAGR of around 9.6% during the forecast period. Growth is driven by rapid expansion of healthcare infrastructure, rising domestic medical device manufacturers, increasing cross-border acquisitions, and growing investor interest in cost-efficient manufacturing and high-growth patient populations across emerging economies.

Japan Medical Device M&A & Strategic Consolidation Market Insight

The Japan medical device M&A & strategic consolidation market is gaining momentum due to a strong focus on technological innovation, an aging population driving demand for advanced medical solutions, and increasing strategic alliances between domestic and international players. Companies are leveraging mergers and acquisitions to strengthen R&D capabilities and expand global reach.

China Medical Device M&A & Strategic Consolidation Market Insight

China medical device M&A & strategic consolidation market accounted for a significant share of the Asia-Pacific market in 2025, supported by rapid growth of domestic medtech companies, favorable government policies, and increasing investments in healthcare innovation. Strategic consolidations are focused on scaling production capabilities, expanding product pipelines, and strengthening competitiveness in both domestic and international markets.

Medical Device M&A & Strategic Consolidation Market Share

The Medical Device M&A & Strategic Consolidation industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Johnson & Johnson (U.S.)

• Abbott (U.S.)

• Stryker Corporation (U.S.)

• Boston Scientific (U.S.)

• B.D. (U.S.)

• Siemens Healthineers (Germany)

• GE HealthCare (U.S.)

• Philips Healthcare (Netherlands)

• Zimmer Biomet (U.S.)

• Danaher Corporation (U.S.)

• Baxter International (U.S.)

• Olympus Corporation (Japan)

• Smith+Nephew (U.K.)

• Terumo Corporation (Japan)

• Edwards Lifesciences (U.S.)

• Alcon (Switzerland)

• Cardinal Health (U.S.)

• Canon Medical Systems (Japan)

• Fujifilm Holdings (Japan)

Latest Developments in Global Medical Device M&A & Strategic Consolidation Market

- In February 2025, Stryker Corporation completed its acquisition of Inari Medical for about USD4.9 billion, expanding its presence in the peripheral and venous vascular markets with Inari’s innovative clot removal and thrombectomy devices. The deal exemplifies a strategic consolidation in the interventional medical device segment and highlights demand for technologies addressing venous thromboembolism and related conditions

- In January 2025, Zimmer Biomet announced plans to acquire Paragon 28 in a deal valued at approximately USD1.1 billion, bolstering its orthopedic surgical device offerings, particularly in foot and ankle treatments and joint replacement products. This strategic acquisition is expected to close in the first half of 2025 and expands Zimmer Biomet’s footprint in ambulatory surgery centers and orthopedic specialties

- In March 2025, Boston Scientific agreed to acquire SoniVie Ltd. for about USD400 million upfront (with up to USD 200 million in milestone payments), bringing into its portfolio the TIVUS intravascular ultrasound system for treating hypertension via renal denervation, illustrating portfolio diversification into high-growth, niche specialties within interventional cardiology and vascular care

- In May 2025, Merit Medical announced the acquisition of Biolife Delaware for approximately USD120 million, adding patented hemostatic devices (StatSeal and WoundSeal) to its product line, enhancing its offerings in post-procedure care and simplifying clinical workflows for physicians and healthcare providers

- In August 2025, Alcon agreed to acquire STAAR Surgical for about USD1.5 billion in equity value, expanding its surgical portfolio with the EVO family of Implantable Collamer® Lenses (ICL), which are widely used in refractive vision correction; this deal underscores consolidation trends in ophthalmic surgical devices

- In September 2025, Quasar Medical completed the acquisition of Nordson Corporation’s contract manufacturing businesses in Ireland and Mexico, strengthening its global contract development and manufacturing capabilities and supporting broader consolidation of medical device supply and production functions under unified operational structures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.