Global Medical Device Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

74.49 Billion

USD

189.79 Billion

2024

2032

USD

74.49 Billion

USD

189.79 Billion

2024

2032

| 2025 –2032 | |

| USD 74.49 Billion | |

| USD 189.79 Billion | |

|

|

|

|

Medical Device Outsourcing Market Size

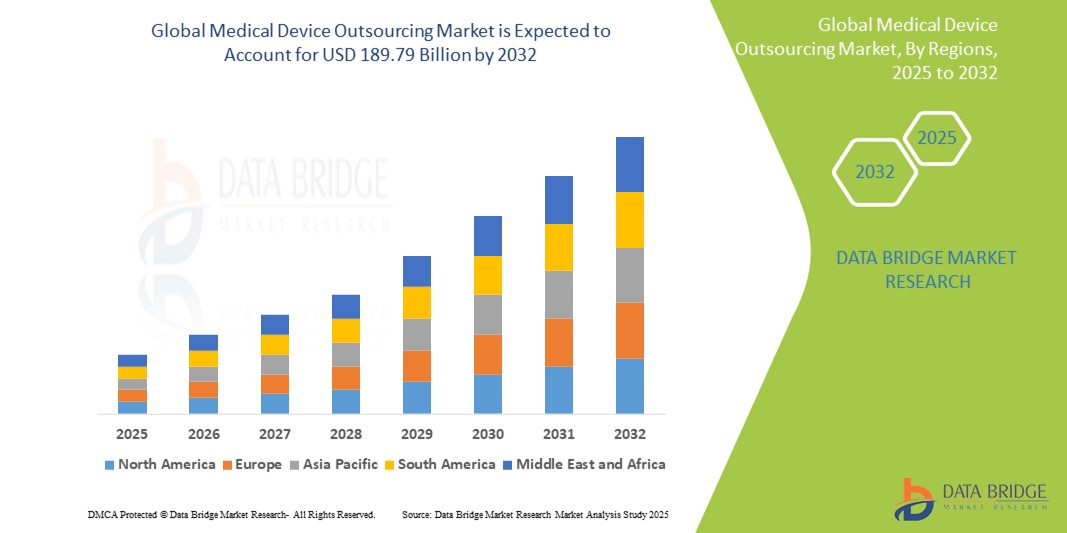

- The global medical device outsourcing market size was valued at USD 74.49 billion in 2024 and is expected to reach USD 189.79 billion by 2032, at a CAGR of 12.4% during the forecast period

- The market growth for medical device outsourcing is largely fueled by the increasing complexity of medical devices and stringent regulatory landscapes, coupled with the rising pressure on original equipment manufacturers (OEMs) to reduce operational costs and accelerate time-to-market. These factors lead to increased reliance on specialized external partners

- Furthermore, rising demand from medical device companies for specialized expertise, advanced manufacturing capabilities, and integrated supply chain solutions is establishing outsourcing as a strategic imperative for modern device development and production. These converging factors are accelerating the uptake of medical device outsourcing solutions, thereby significantly boosting the industry's growth

Medical Device Outsourcing Market Analysis

- Medical devices, offering complex solutions for diagnosis, treatment, and patient care, are increasingly vital components of modern healthcare systems in both clinical and home settings due to their enhanced precision, technological sophistication, and critical role in patient outcomes

- The escalating demand for medical device outsourcing is primarily fueled by the widespread need for cost optimization among manufacturers, growing regulatory complexities, and a rising preference for specialized expertise in product development and manufacturing

- North America dominates the medical device outsourcing market with the largest revenue share of 38.42% in 2024. This leadership is characterized by a mature healthcare industry, stringent regulatory environment, high R&D investments, and a strong presence of key medical device OEMs and outsourcing service providers

- Asia-Pacific is expected to be the fastest growing region in the medical device outsourcing market during the forecast period. This rapid expansion is due to increasing cost efficiencies in manufacturing, rising healthcare expenditure, and a growing pool of skilled labor in countries like China and India

- Contract manufacturing and materials segment dominates the medical device outsourcing market with a share of 45.50% in 2024. This dominance is fueled by the growing reliance of original equipment manufacturers (OEMs) on third-party providers for large-scale production, assembly, and component sourcing, enabling them to reduce infrastructure costs and accelerate time-to-market

Report Scope and Medical Device Outsourcing Market Segmentation

|

Attributes |

Medical Device Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Outsourcing Market Trends

“Comprehensive Service Models and Strategic Partnerships in Medical Device Outsourcing”

- A significant and accelerating trend in the global medical device outsourcing market is the deepening strategic shift towards comprehensive, end-to-end solutions and robust partnership models between OEMs and outsourcing providers. This fusion of capabilities is significantly enhancing efficiency, innovation, and speed-to-market for medical devices

- For instance, many medical device companies are now seeking outsourcing partners capable of managing the entire product lifecycle, from design and development to manufacturing, regulatory affairs, and post-market surveillance. This integrated approach offers a streamlined pathway for complex medical device projects

- The focus on end-to-end solutions enables OEMs to leverage specialized expertise across the value chain, ensuring regulatory compliance, optimizing production processes, and mitigating risks. This allows them to concentrate on core competencies such as R&D and market strategy

- The seamless collaboration between medical device OEMs and outsourcing partners, often involving shared knowledge and resources, facilitates centralized control over various aspects of product development and commercialization. Through a unified approach, companies can manage design iterations, production scaling, and global distribution, creating a cohesive and agile operational experience

- This trend towards more integrated, strategic, and collaborative outsourcing partnerships is fundamentally reshaping expectations for medical device development and manufacturing. Consequently, service providers are evolving to offer broader portfolios, investing in advanced technologies and regulatory expertise to support increasingly complex client needs

Medical Device Outsourcing Market Dynamics

Driver

“Growing Need Due to Rising Device Complexity and Cost Pressures”

- The increasing complexity of medical devices, involving advanced technologies and multidisciplinary expertise, coupled with escalating cost pressures on original equipment manufacturers (OEMs), is a significant driver for the heightened demand for medical device outsourcing

- For instance, medical device companies are increasingly leveraging outsourcing partners to manage intricate processes such as micro-assembly, advanced material integration, and complex software development. Such strategic collaborations are expected to drive the medical device outsourcing industry growth in the forecast period

- As OEMs become more aware of the challenges in maintaining in-house capabilities for every specialized aspect of device development and production, outsourcing offers access to cutting-edge technologies, specialized skills, and streamlined processes, providing a compelling alternative to internal expansion

- Furthermore, the growing trend for medical device companies to focus on their core competencies (e.g., R&D, marketing) and the desire for greater operational flexibility are making outsourcing an integral component of their business strategy. This offers seamless integration with various stages of the product lifecycle

- The convenience of scaling production up or down, accessing global manufacturing networks, and benefitting from contract manufacturers' economies of scale are key factors propelling the adoption of medical device outsourcing in both established and emerging companies. The trend towards specialized service providers and the increasing availability of end-to-end outsourcing solutions further contribute to market growth

Restraint/Challenge

“Concerns Regarding Intellectual Property Protection and High Initial Transition Costs”

- Concerns surrounding the protection of intellectual property (IP) and proprietary data shared with outsourcing partners pose a significant challenge to broader market penetration. As medical device OEMs share sensitive product designs, manufacturing processes, and clinical data, they are susceptible to potential breaches or misuse, raising anxieties among potential clients about safeguarding their innovations

- For instance, high-profile reports of IP disputes or data vulnerabilities in the broader manufacturing outsourcing sector have made some OEMs hesitant to fully embrace outsourcing, particularly for their most innovative and critical products

- Addressing these IP concerns through robust contractual agreements, stringent data security protocols, and verifiable audit trails is crucial for building client trust. Outsourcing companies increasingly emphasize their adherence to international standards and security certifications in their marketing to reassure potential partners. Additionally, the relatively high initial costs associated with transitioning manufacturing or R&D processes to an outsourcing partner, including validation, training, and potential re-tooling, can be a barrier to adoption for some companies, particularly smaller ones or those with limited capital

- While the long-term cost benefits of outsourcing are significant, the perceived upfront investment and the complexity of migrating existing operations can still hinder widespread adoption, especially for those who do not see an immediate ROI or who have deeply embedded legacy systems

Medical Device Outsourcing Market Scope

The global medical device outsourcing market is segmented on the basis of services, product, device type, application, and end user.

- By Services

On the basis of services, the medical device outsourcing market is segmented into quality assurance, regulatory affairs services, product design and development services, product testing and sterilization services, product implementation services, product upgrade services, product maintenance services, raw material services, medical electrical equipment services, contract manufacturing and materials, and chemical characterization. The contract manufacturing and materials segment held the largest market revenue share 45.50% in 2024. This dominance is driven by the increasing need for OEMs to optimize production costs, access specialized manufacturing capabilities, and scale operations efficiently without significant capital investment.

The quality assurance services segment is anticipated to witness the fastest growth rate from 2025 to 2032. This growth is fueled by the escalating regulatory scrutiny and the critical importance of ensuring product safety and efficacy, driving a high demand for specialized quality management and compliance expertise.

- By Product

On the basis of product, the medical device outsourcing market is segmented into finished goods, electronics, and raw materials. The finished goods segment held the largest market revenue share in 2024, driven by the increasing trend of OEMs outsourcing the complete manufacturing and assembly of their medical devices to specialized contract manufacturers. This allows for streamlined production and faster market entry.

The electronics segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing integration of advanced electronics and software into modern medical devices, increasing the need for specialized electronic component manufacturing and assembly.

- By Device Type

On the basis of device type, the medical device outsourcing market is segmented into Class I, Class II, and Class III. The Class II medical devices segment held the largest market revenue share in 2024. This dominance is attributed to the wide range and high volume of devices categorized as Class II which frequently require outsourcing for their manufacturing and regulatory support.

The Class III medical devices segment is expected to witness the fastest CAGR from 2025 to 2032. This growth is driven by the increasing complexity, higher risk, and more stringent regulatory requirements associated with these devices, necessitating highly specialized outsourcing expertise in design, manufacturing, and regulatory affairs.

- By Application

On the basis of application, the medical device outsourcing market is segmented into cardiology, diagnostic imaging, orthopedic, IVD, Ophthalmic, general, plastic surgery, drug delivery, dental, endoscopy, diabetes care, and others. The cardiology segment accounted for the largest market revenue share in 2024, driven by the high prevalence of cardiovascular diseases globally and the continuous innovation in cardiovascular devices that often require complex manufacturing and development services.

The plastic surgery segment is expected to witness the fastest CAGR from 2025 to 2032. This growth is driven by the rising demand for aesthetic and reconstructive procedures, leading to an increasing need for specialized instruments and implants whose development and manufacturing are often outsourced.

- By End User

On the basis of end user, the medical device outsourcing market is segmented into small medical device company, medium medical device company, large medical device company, and others. The large medical device company segment accounted for the largest market revenue share in 2024, driven by their extensive product portfolios, global reach, and strategic emphasis on outsourcing to achieve cost efficiencies and focus on core competencies.

The small medical device company segment is expected to witness the fastest CAGR from 2025 to 2032. This growth is fueled by their limited in-house resources and capital, making outsourcing a crucial strategy to access manufacturing capabilities, regulatory expertise, and product development support necessary to bring their innovative devices to market.

Medical Device Outsourcing Market Regional Analysis

- North America dominates the medical device outsourcing market with the largest revenue share 38.42% in 2024. This leadership is driven by a well-established medical device industry, stringent regulatory environment, and high demand for specialized services from numerous large and small medical device companies

- Medical device OEMs in the region highly value the specialized expertise, cost efficiencies, and access to advanced manufacturing technologies offered by outsourcing partners. This allows for seamless integration into complex product development and production cycles

- This widespread adoption is further supported by significant investments in R&D, a strong focus on compliance and quality, and the growing preference for strategic partnerships to accelerate innovation and market entry. These factors establish outsourcing as a favored solution for both product development and large-scale manufacturing within the region

U.S. Medical Device Outsourcing Market Insight

The U.S. medical device outsourcing market captured a substantial revenue share of 50.4% of the North American market in 2024. This dominance is fueled by the stringent regulatory environment (FDA), the increasing complexity of medical devices, and the continuous pressure on OEMs to reduce costs and accelerate time-to-market. Medical device companies in the U.S. are increasingly prioritizing specialized expertise in areas like contract manufacturing, product design, and regulatory affairs. The strong presence of both large pharmaceutical and biotech companies, alongside a thriving startup ecosystem focused on innovative medical technologies, further propels the outsourcing industry. Moreover, significant investments in R&D and the need for scalable production capabilities are significantly contributing to the market's expansion.

Europe Medical Device Outsourcing Market Insight

The Europe medical device outsourcing market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by the robust regulatory framework (EU MDR/IVDR), an aging population increasing the demand for advanced medical devices, and the rising need for specialized manufacturing capabilities. The increase in chronic diseases, coupled with a focus on cost-efficiency and quality among European medical device manufacturers, is fostering the adoption of outsourcing services. European companies are also drawn to the expertise in complex device development and the compliance support offered by outsourcing partners. The region is experiencing significant growth across various service segments, including contract manufacturing and regulatory affairs, with outsourcing being integral to both new product development and existing portfolio management.

U.K. Medical Device Outsourcing Market Insight

The U.K. medical device outsourcing market is anticipated to grow at a noteworthy CAGR during the forecast period. This growth is driven by the increasing complexity of regulatory requirements post-Brexit, a strong life sciences sector, and a desire for efficient access to global supply chains.In addition, concerns regarding R&D costs and time-to-market are encouraging both domestic and international medical device companies to choose specialized outsourcing solutions. The UK’s embrace of advanced manufacturing technologies, alongside its robust R&D infrastructure and access to a skilled workforce, is expected to continue to stimulate market growth.

Germany Medical Device Outsourcing Market Insight

The Germany medical device outsourcing market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing demand for high-quality, precision-engineered medical devices and the emphasis on advanced manufacturing solutions (Industry 4.0). Germany’s well-developed industrial infrastructure, combined with its focus on innovation and stringent quality standards, promotes the adoption of medical device contract manufacturing and related services. The integration of advanced automation and robotics in production processes is also becoming increasingly prevalent, with a strong preference for secure and compliant solutions aligning with local industry expectations.

Asia-Pacific Medical Device Outsourcing Market Insight

The Asia-Pacific medical device outsourcing market is poised to grow at the fastest CAGR of 13.15% during the forecast period of 2025 to 2032. This rapid growth is driven by increasing healthcare expenditure, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing attractiveness as a cost-effective manufacturing hub, supported by government initiatives promoting local production and foreign investment in healthcare, is driving the adoption of outsourcing. Furthermore, as APAC continues to develop its medical device ecosystem, the affordability and accessibility of outsourcing services are expanding to a wider range of medical device companies.

Japan Medical Device Outsourcing Market Insight

The Japan medical device outsourcing market is gaining momentum due to the country’s high-tech manufacturing capabilities, stringent quality standards, and demand for innovative medical technologies. The Japanese market places a significant emphasis on precision and reliability, and the adoption of outsourcing is driven by the increasing need for specialized expertise in areas like micro-fabrication, advanced materials, and complex electronic assembly. The integration of advanced robotics and automation in manufacturing processes is fueling growth. Moreover, Japan's aging population is likely to spur demand for highly specialized medical devices, increasing the need for outsourcing partners capable of meeting these demanding requirements.

China Medical Device Outsourcing Market Insight

The China medical device outsourcing market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's vast manufacturing capacity, rapidly expanding healthcare market, and high rates of technological adoption in production. China stands as a significant global hub for medical device manufacturing, and outsourcing services are becoming increasingly popular for both domestic and international OEMs seeking cost efficiencies and rapid scalability. The push towards domestic innovation and the availability of affordable, high-quality outsourcing options, alongside strong local contract manufacturers, are key factors propelling the market in China.

Medical Device Outsourcing Market Share

The medical device outsourcing industry is primarily led by well-established companies, including:

- SGS Société Générale de Surveillance SA (Switzerland)

- Intertek Group plc (U.K.)

- WuXi AppTec (China)

- North American Science Associates, LLC. (U.S.)

- Sterigenics U.S., LLC (U.S.)

- Charles River Laboratories (U.S.)

- Celestica Inc. (Canada)

- FLEX LTD. (Singapore)

- Heraeus Group (Germany)

- Integer Holdings Corporation (U.S.)

- Nortech Systems, Inc. (U.S.)

- Plexus Corp. (U.S.)

- Sanmina Corporation (U.S.)

- Eurofins Scientific (Luxembourg)

- TE Connectivity (Switzerland)

- ICON plc (Ireland)

- Parexel International (MA) Corporation (U.S.)

- Labcorp (U.S.)

- Tecomet, Inc. (U.S.)

- IQVIA (U.S.)

Latest Developments in Global Medical Device Outsourcing Market

- In April 2023, SGS Société Générale de Surveillance SA expanded its medical device testing services by launching a new state-of-the-art laboratory in Shanghai, China. This facility is equipped to offer comprehensive biocompatibility, electrical safety, and performance testing, supporting regional and global clients in accelerating product development and regulatory compliance. The expansion reflects SGS’s commitment to strengthening its outsourcing capabilities and presence in the Asia-Pacific medical device market

- In March 2023, Integer Holdings Corporation, a leading medical device outsource manufacturer, announced the opening of its new innovation and manufacturing facility in Galway, Ireland. This site is focused on the development of next-generation catheter-based technologies and other complex medical devices. The strategic investment aims to meet increasing demand for outsourcing in interventional and cardiovascular segments

- In March 2023, Eurofins Scientific acquired Molecular Testing Labs, a U.S.-based diagnostics laboratory specializing in infectious disease and genetic testing. The acquisition enables Eurofins to bolster its capabilities in clinical diagnostics and expand its footprint in medical device testing, reinforcing its leadership in outsourced healthcare solutions

- In February 2023, TE Connectivity, a global provider of connectivity and sensor solutions, announced enhancements to its medical device outsourcing services with new micro-miniature connector solutions for minimally invasive medical procedures. These innovations cater to the growing trend of miniaturization in medical technology and underscore the company’s role in delivering high-precision outsourced components for advanced medical devices

- In January 2023, Jabil Inc., a leading manufacturing services company, revealed the expansion of its healthcare division with a new innovation center in the U.S., focused on medical device design, engineering, and regulatory support. This center is part of Jabil’s strategic effort to offer end-to-end outsourcing services, from concept to commercialization, catering to the increasing complexity and customization needs of OEMs in the medical device industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.