Global Medical Device Passivation Acid Bath Solutions Market

Market Size in USD Million

CAGR :

%

USD

55.00 Million

USD

145.80 Million

2024

2032

USD

55.00 Million

USD

145.80 Million

2024

2032

| 2025 –2032 | |

| USD 55.00 Million | |

| USD 145.80 Million | |

|

|

|

|

Medical Device Passivation Acid Bath Solutions Market Size

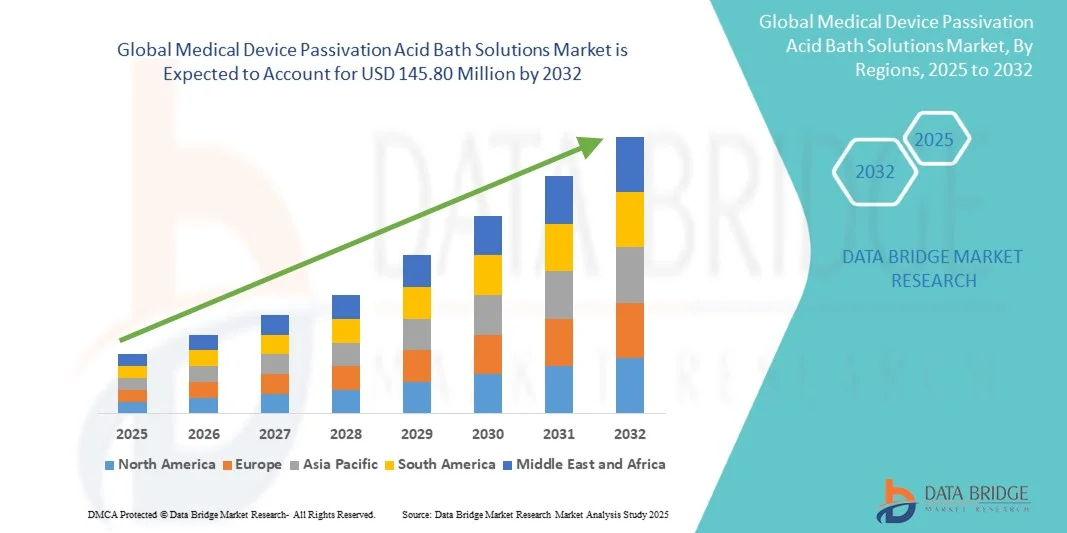

- The global medical device passivation acid bath solutions market size was valued at USD 55.00 million in 2024 and is expected to reach USD 145.80 million by 2032, at a CAGR of 12.96% during the forecast period

- The market growth is primarily driven by the increasing demand for high-performance corrosion resistance and biocompatibility in surgical instruments, implants, and diagnostic devices, supported by stringent regulatory standards across the healthcare industry

- Furthermore, the rising adoption of eco-friendly, citric-based chemistries alongside automated and validated passivation systems is enhancing safety, efficiency, and compliance, making these solutions the preferred choice among medical device OEMs and contract manufacturers. These converging factors are accelerating the uptake of passivation acid bath solutions, thereby significantly propelling the industry’s growth

Medical Device Passivation Acid Bath Solutions Market Analysis

- Medical device passivation acid bath solutions, used to enhance corrosion resistance and ensure biocompatibility of stainless steel and titanium-based devices, are critical to the manufacturing of surgical instruments, implants, and diagnostic tools due to their ability to meet stringent regulatory and quality standards

- The rising demand for these solutions is fueled by the rapid expansion of the medical device industry, increasing focus on patient safety, and the shift toward eco-friendly citric acid formulations that reduce hazardous waste while maintaining high performance

- North America dominated the medical device passivation acid bath solutions market with the largest revenue share of 38.7% in 2024, supported by advanced healthcare infrastructure, strict FDA and ISO compliance requirements, and the presence of leading medical device manufacturers relying on validated passivation processes

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by expanding medical device production hubs, cost-effective manufacturing, and growing exports of surgical instruments and implants

- The Citric acid passivation segment dominated the medical device passivation acid bath solutions market with a share of 45.8% in 2024, reflecting its increasing adoption as a safer, environmentally sustainable alternative to nitric acid, particularly among OEMs and contract manufacturers seeking greener, compliant passivation methods

Report Scope and Medical Device Passivation Acid Bath Solutions Market Segmentation

|

Attributes |

Medical Device Passivation Acid Bath Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Passivation Acid Bath Solutions Market Trends

“Growing Shift Toward Eco-Friendly Citric Acid Passivation”

- A significant and accelerating trend in the global medical device passivation acid bath solutions market is the transition from nitric acid to citric acid formulations, driven by environmental concerns, worker safety, and compliance with stringent healthcare regulations

- For instance, companies are launching advanced citric acid–based chemistries that minimize hazardous waste and reduce toxic emissions, making them more sustainable while maintaining the same level of corrosion resistance required for medical devices

- The adoption of citric-based solutions enables safer operations in manufacturing facilities by lowering risks associated with handling strong oxidizers, while also simplifying neutralization and disposal processes, which is critical in regulated environments

- Furthermore, the use of eco-friendly formulations supports OEMs in meeting global sustainability targets and aligning with greener supply chain requirements, thereby enhancing their brand reputation and regulatory readiness

- This trend towards safer, greener, and equally effective passivation solutions is reshaping the industry, with leading players increasingly promoting citric acid chemistries as the new standard for surgical instruments, implants, and diagnostic device finishing

- The demand for eco-friendly passivation solutions that provide regulatory compliance, reduced environmental footprint, and enhanced workplace safety is rapidly increasing across both OEMs and contract manufacturers worldwide

Medical Device Passivation Acid Bath Solutions Market Dynamics

Driver

“Rising Demand for Corrosion Resistance and Regulatory Compliance”

- The increasing need for reliable corrosion resistance in stainless steel and titanium-based medical devices, coupled with stringent FDA and ISO standards, is a significant driver for the heightened demand for passivation acid bath solutions

- For instance, in 2024 several device manufacturers expanded validated passivation lines with automated monitoring systems to meet MDR and ISO 13485 compliance requirements, highlighting how regulations are directly fueling demand for these solutions

- As medical devices become more complex and patient safety concerns intensify, passivation treatments ensure biocompatibility and long-term performance, making them an essential step in the manufacturing process for implants and surgical instruments

- Furthermore, the growing global production of surgical tools and implants, especially in regions with rising healthcare investments, is making passivation solutions indispensable for manufacturers looking to meet export quality standards

- The demand for validated, automated passivation systems with traceability and documentation capabilities is expanding rapidly, particularly among leading OEMs seeking to maintain consistent product quality across global manufacturing facilities

- The emphasis on compliance-driven quality control, combined with expanding healthcare infrastructure, continues to propel adoption of passivation acid bath solutions across both established and emerging medical device manufacturing markets

Restraint/Challenge

“Chemical Handling Risks and Compliance Costs”

- Concerns surrounding the use of strong acids such as nitric, which pose risks of skin irritation, toxic fume exposure, and hazardous waste generation, represent a significant restraint to broader adoption of traditional passivation solutions

- For instance, reports of operator safety issues and stricter environmental disposal regulations have made some manufacturers hesitant to continue using nitric acid, accelerating the need for safer alternatives despite higher upfront costs

- Addressing these risks requires the development of safer chemistries, investment in advanced ventilation, and robust neutralization systems, all of which increase operational costs and create barriers for smaller manufacturers

- Furthermore, the costs associated with maintaining compliance such as validation studies, waste treatment infrastructure, and documentation requirements can burden facilities, particularly those operating on thin margins or in cost-sensitive markets

- The relatively higher price of validated citric-based solutions and automated systems compared to legacy nitric acid baths may discourage adoption among budget-constrained manufacturers, despite long-term operational and safety benefits

- Overcoming these challenges through safer formulations, improved process automation, and cost-optimized compliance solutions will be essential for the sustained growth and broader adoption of passivation acid bath solutions globally

Medical Device Passivation Acid Bath Solutions Market Scope

The market is segmented on the basis of process type, application, technology, and end user.

- By Process Type

On the basis of process type, the medical device passivation acid bath solutions market is segmented into nitric acid passivation, citric acid passivation, and other chemistries. The Citric acid passivation segment dominated the market with a share of 45.8% in 2024, driven by its eco-friendly profile, safety advantages, and compliance with evolving environmental regulations. Manufacturers are increasingly adopting citric formulations as they minimize hazardous waste, reduce operator risks, and provide equal or superior corrosion resistance compared to nitric acid. The segment benefits from global sustainability initiatives and stricter chemical disposal norms, which favor greener solutions in medical device production. Citric acid passivation is especially gaining traction among OEMs and contract manufacturers seeking validated, sustainable processes that align with FDA and ISO requirements. In addition, ongoing innovations in citric-based chemistries are enhancing process efficiency and cost-effectiveness, further strengthening this segment’s leadership in the global market.

The Nitric acid passivation segment is expected to witness the fastest growth rate of 7.9% from 2025 to 2032, supported by its deep-rooted acceptance, proven track record, and ability to deliver robust corrosion resistance across a wide range of stainless-steel medical devices. Despite increasing environmental regulations, nitric acid solutions remain critical for applications where extremely high-performance and validated passivation outcomes are required. This segment continues to find growth in regions with strong regulatory frameworks, particularly in the U.S. and Europe, where legacy systems and validated nitric processes are entrenched in OEM quality protocols. In addition, innovations such as controlled fume extraction, closed-loop acid recycling, and hybrid nitric formulations are enabling safer and more compliant nitric passivation operations, boosting its adoption rate in highly regulated end-use environments.

- By Application

On the basis of application, the medical device passivation acid bath solutions market is segmented into implants, surgical instruments & trays, minimally invasive instruments & endoscopes, and diagnostic & housings. Implants accounted for the largest market revenue share in 2024, driven by the critical importance of biocompatibility and long-term corrosion resistance in orthopedic, cardiovascular, and dental implants. Regulatory agencies mandate validated passivation for implants, ensuring consistent adoption among OEMs. The high cost of implants, combined with stringent quality and performance requirements, makes passivation an indispensable step in the manufacturing process. Furthermore, rising global demand for implantable devices due to aging populations and the increasing prevalence of chronic conditions further boosts demand in this segment. The implant category benefits from high compliance-driven investments, ensuring it remains the dominant application area.

Minimally invasive instruments & endoscopes are projected to be the fastest-growing application segment through 2032, fueled by the global shift toward minimally invasive surgeries. These instruments have complex geometries and narrow channels, requiring advanced passivation techniques such as ultrasonic-assisted processes for complete treatment. The growth of minimally invasive procedures, which reduce patient recovery time and hospital stays, is significantly expanding demand for specialized passivation solutions. In addition, manufacturers are investing in precision-engineered devices that require tailored chemistries to ensure long-term durability and biocompatibility, making this the most dynamic application segment during the forecast period.

- By Technology

On the basis of technology, the medical device passivation acid bath solutions market is segmented into immersion bath passivation, ultrasonic-assisted passivation, tunnel passivation, and automated systems. Immersion bath passivation dominated the market in 2024 with the largest revenue share, as it remains the most widely adopted and cost-effective method for treating stainless steel and titanium components. Its simplicity, compatibility with standard chemistries, and scalability make it the go-to process for OEMs and contract manufacturers. Immersion baths are particularly favored for high-volume production of surgical instruments and trays, where uniform surface treatment is essential. This method’s dominance is reinforced by decades of use, existing infrastructure, and widespread industry familiarity, making it difficult for newer technologies to displace it quickly.

Automated systems are expected to register the fastest growth rate from 2025 to 2032, driven by increasing demand for consistency, safety, and compliance in validated processes. Automation minimizes human error, improves reproducibility, and ensures traceability required under FDA and ISO standards. Large OEMs are particularly adopting automated passivation systems that integrate chemical dosing, monitoring, and data recording to streamline audits and compliance documentation. As labor costs rise and regulatory pressures intensify, automation delivers long-term cost savings while enhancing quality assurance. This makes automated passivation systems the fastest-expanding technology segment in the market.

- By End User

On the basis of end user, the medical device passivation acid bath solutions market is segmented into medical device OEMs, contract manufacturers, third-party passivation service providers, and hospitals. Medical device OEMs held the largest market share in 2024, as they represent the primary users of validated passivation processes to ensure compliance and quality across their product lines. OEMs invest heavily in in-house passivation systems, often using both nitric and citric chemistries, to meet regulatory expectations for implants and surgical instruments. Their dominance is driven by the scale of production, the need for stringent documentation, and their direct responsibility for device safety and performance. With strong regulatory oversight in North America and Europe, OEMs are positioned as the most influential buyers of passivation solutions.

Contract manufacturers are projected to be the fastest-growing end-user segment during the forecast period, driven by the trend of outsourcing medical device production to specialized third parties. Contract manufacturers provide flexibility and cost efficiency, allowing OEMs to focus on R&D and commercialization. These firms increasingly invest in validated, automated passivation systems to meet the quality expectations of global clients. The growth of medical device exports from Asia-Pacific, particularly China and India, is further propelling contract manufacturers’ demand for high-performance passivation solutions. Their rapid expansion and ability to serve multiple OEMs make them the fastest-growing customer base in the market.

Medical Device Passivation Acid Bath Solutions Market Regional Analysis

- North America dominated the medical device passivation acid bath solutions market with the largest revenue share of 38.7% in 2024, supported by advanced healthcare infrastructure, strict FDA and ISO compliance requirements, and the presence of leading medical device manufacturers relying on validated passivation processes

- Manufacturers in the region prioritize high-performance, validated passivation processes to ensure corrosion resistance and biocompatibility of implants, surgical instruments, and diagnostic devices, making these solutions indispensable in production workflows

- This widespread adoption is further supported by well-established manufacturing standards, high technological expertise, and a strong focus on quality assurance and traceability, positioning passivation solutions as a critical component of medical device production in both OEM and contract manufacturing facilities

U.S. Medical Device Passivation Acid Bath Solutions Market Insight

The U.S. medical device passivation acid bath solutions market captured the largest revenue share of 82% in 2024 within North America, fueled by the high concentration of leading medical device OEMs and contract manufacturers. Manufacturers are prioritizing validated passivation processes to ensure corrosion resistance and biocompatibility of implants, surgical instruments, and diagnostic devices. The strong regulatory framework, including FDA and ISO standards, drives the adoption of both nitric and citric acid passivation solutions. Growing emphasis on automation and eco-friendly chemistries further propels market growth. In addition, widespread investment in high-tech production facilities ensures consistent quality and compliance. The U.S. market remains the benchmark for validated passivation adoption worldwide.

Europe Medical Device Passivation Acid Bath Solutions Market Insight

The Europe medical device passivation acid bath solutions market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict regulatory requirements and the need for high-quality medical devices. Increasing urbanization, coupled with rising exports of surgical instruments and implants, fosters the adoption of validated passivation processes. European manufacturers are increasingly adopting eco-friendly citric acid solutions to meet environmental and worker safety standards. The region is witnessing strong growth across implants, surgical instruments, and diagnostic device segments. Investments in automated systems enhance process reliability and traceability. High compliance awareness and focus on sustainability are accelerating market adoption.

U.K. Medical Device Passivation Acid Bath Solutions Market Insight

The U.K. medical device passivation acid bath solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of medical device manufacturing and stringent regulatory oversight. Demand for high-quality implants, surgical instruments, and diagnostic components necessitates validated and automated passivation processes. Concerns over biocompatibility and corrosion resistance are encouraging OEMs and contract manufacturers to adopt advanced chemistries. The U.K.’s robust manufacturing infrastructure and strong emphasis on compliance and quality standards continue to stimulate market growth. Increased awareness of environmentally safe chemistries such as citric acid further supports expansion.

Germany Medical Device Passivation Acid Bath Solutions Market Insight

The Germany medical device passivation acid bath solutions market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of process standardization and sustainable manufacturing. German medical device manufacturers emphasize precision, quality, and environmental compliance, making validated citric and nitric passivation solutions essential. The country’s advanced industrial infrastructure and innovation-driven ecosystem encourage adoption of automated and ultrasonic-assisted passivation systems. Growing exports of medical devices and surgical instruments are boosting demand. Manufacturers prioritize high traceability and compliance, aligning with local regulatory expectations. Sustainable, high-performance solutions are becoming increasingly preferred in both residential and commercial healthcare manufacturing.

Asia-Pacific Medical Device Passivation Acid Bath Solutions Market Insight

The Asia-Pacific medical device passivation acid bath solutions market is poised to grow at the fastest CAGR from 2025 to 2032, driven by expanding medical device manufacturing hubs in China, India, and Japan. Rapid urbanization, rising disposable incomes, and increased global exports of implants and surgical instruments are fueling adoption. The region is embracing eco-friendly chemistries such as citric acid for safer, compliant operations. Governments are promoting medical technology infrastructure and smart manufacturing practices. The affordability and scalability of passivation solutions are attracting OEMs and contract manufacturers asuch as. APAC’s focus on high-quality, validated processes is rapidly strengthening the regional market.

Japan Medical Device Passivation Acid Bath Solutions Market Insight

The Japan medical device passivation acid bath solutions market is gaining momentum due to the country’s advanced manufacturing technology, strict regulatory standards, and high demand for surgical and diagnostic instruments. Adoption of validated and automated passivation processes ensures consistent corrosion resistance and biocompatibility. Integration with modern production systems and environmental compliance initiatives fuels growth. Manufacturers are increasingly switching to citric acid formulations to minimize chemical hazards. The emphasis on precision and safety aligns with global export requirements. Japan’s focus on innovative manufacturing drives market expansion in both domestic and international medical device sectors.

India Medical Device Passivation Acid Bath Solutions Market Insight

The India medical device passivation acid bath solutions market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid growth in medical device production, rising exports, and government initiatives promoting medical manufacturing clusters. Adoption of validated passivation solutions is increasing among both OEMs and contract manufacturers to meet international quality standards. The availability of cost-effective citric acid and automated systems supports efficient and sustainable operations. India’s expanding middle-class healthcare infrastructure and smart manufacturing practices are key growth drivers. Strong domestic manufacturers and growing global supply chain integration are further propelling market adoption.

Medical Device Passivation Acid Bath Solutions Market Share

The medical device passivation acid bath solutions industry is primarily led by well-established companies, including:

- JAYCO CHEMICAL SOLUTIONS (U.S.)

- Best Technology, Inc. (U.S.)

- Able Electropolishing Co., Inc. (U.S.)

- Novation Inc. (U.S.)

- Trinity Precision Solutions, Inc. (U.S.)

- Valence Surface Technologies (U.S.)

- RBP Chemical Technology, Inc. (U.S.)

- Celco Inc. (U.S.)

- Pro-Tech Design & Manufacturing, Inc. (U.S.)

- Brulin. (U.S.)

- Harrison Electropolishing L.P. (U.S.)

- New England Electropolishing (U.S.)

- Britech Electropolishing, Inc. (U.S.)

- Control Electropolishing (U.S.)

- Ferry Machine (U.S.)

- AMF Technologies, Inc. (U.S.)

- Aerosol Devices (U.S.)

- Met One Instruments, Inc. (U.S.)

- TSI (U.S.)

- Particle Measuring Systems (U.S.)

What are the Recent Developments in Medical Device Passivation Acid Bath Solutions Market?

- In September 2025, Alliance Chemical published a definitive guide to nitric acid passivation, emphasizing its robustness and proven track record for high-performance applications in aerospace, medical device, and military components. The guide provides detailed process parameters for different steel grades based on ASTM A967 and covers non-negotiable safety protocols, reinforcing the importance of stringent standards in passivation processes

- In November 2024, JAYCO Chemical Solutions launched the JC CitraPass 5220M, a high-performance citric acid detergent designed for passivation in the medical device industry. This product is optimized for ultrasonic and immersion applications, effectively passivating 300 series, 17-4, and 400 series stainless steel alloys (ASTM 967)

- In November 2024, Bales USA published a guide on citric acid passivation of stainless steel, emphasizing its advantages over nitric acid, especially for medical tooling. The guide highlights that citric acid passivation leaves no dangerous nitrates, heavy metals, or residual acids on the surface of stainless steel components, making it easier for manufacturers to meet rigorous biocompatibility and cleanliness standards

- In September 2023, Swiss company Borer Chemie AG introduced the deconex® MT 19 and MT 41 spray chemicals to enhance the cleaning and passivation process for stainless steel in medical instruments and implants. These spray chemicals are designed to remove free iron and other contaminants from the surface, improving corrosion resistance and ensuring the longevity of medical devices

- In September 2022, Garzanti Specialties published an article on how to make the passivation process for medical devices simpler, cheaper, and more environmentally friendly. The article highlighted the growing trend of using citric acid-based products, which are more biodegradable and safer than traditional nitric acid. It referenced a product that offers an effective passivation solution while being biodegradable and not requiring the treatment of heavy metal precipitates

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.