Global Medical Device Technologies Market

Market Size in USD Billion

CAGR :

%

USD

539.14 Billion

USD

814.95 Billion

2024

2032

USD

539.14 Billion

USD

814.95 Billion

2024

2032

| 2025 –2032 | |

| USD 539.14 Billion | |

| USD 814.95 Billion | |

|

|

|

|

Medical Device Technologies Market Size

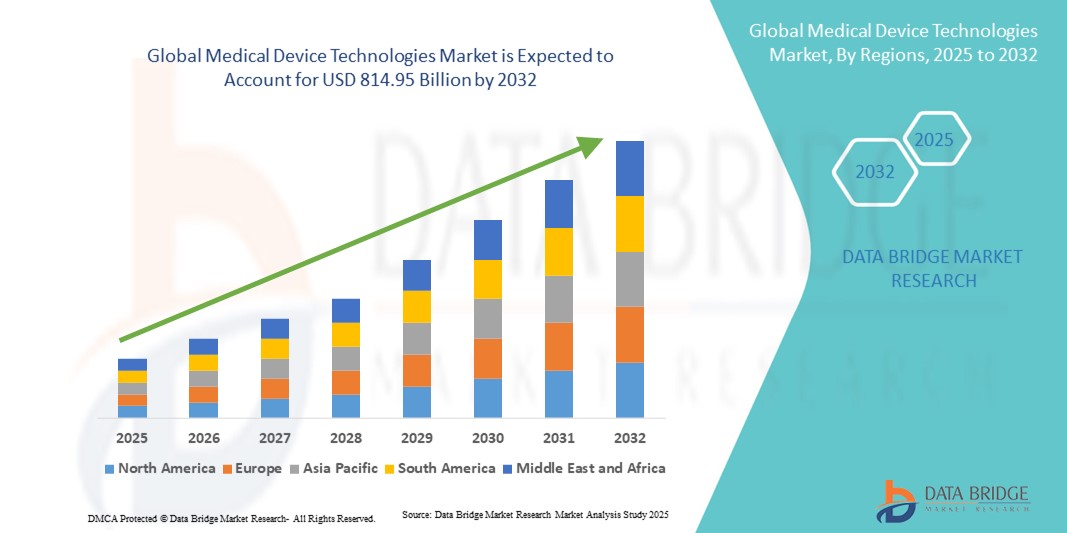

- The global medical device technologies market size was valued at USD 539.14 billion in 2024 and is expected to reach USD 814.95 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within advanced healthcare technologies, leading to increased efficiency, accuracy, and automation in medical procedures

- Furthermore, rising demand for innovative medical solutions that enhance patient care, reduce procedural risks, and improve diagnostic and therapeutic outcomes is driving the uptake of medical device technologies solutions, thereby significantly boosting the industry's growth

Medical Device Technologies Market Analysis

- Medical Device Technologies are increasingly vital components of modern healthcare systems in both hospitals and clinics due to their ability to enhance diagnostic accuracy, streamline patient care, and support advanced therapeutic interventions. These technologies play a critical role in improving healthcare outcomes, increasing operational efficiency, and integrating with broader hospital IT and patient management systems

- The escalating demand for Medical Device Technologies is primarily fueled by rising healthcare expenditure, growing prevalence of chronic and lifestyle-related diseases, and increasing adoption of advanced diagnostic and therapeutic solutions. Furthermore, ongoing technological innovations, regulatory approvals, and modernization of healthcare infrastructure are driving widespread adoption across developed and emerging markets

- North America dominated the medical device technologies market with the largest revenue share of 41.5% in 2024, driven by high healthcare expenditure, strong adoption of advanced medical technologies, and a well-established presence of key industry players. The U.S. experienced substantial growth in installations across hospitals, clinics, and research facilities due to ongoing innovations and the expansion of healthcare infrastructure

- Asia-Pacific is expected to be the fastest-growing region in the medical device technologies market during the forecast period, with a high CAGR, owing to increasing urbanization, rising healthcare investments, and growing demand for advanced diagnostic and therapeutic solutions. Rapid modernization of healthcare infrastructure in countries such as China, India, and Southeast Asia is further accelerating adoption

- The In Vitro Diagnostics (IVD) segment dominated the medical device technologies market with a market revenue share of 35.8% in 2024, driven by rising demand for early disease detection, increasing prevalence of chronic illnesses, and growing adoption of automated diagnostic systems in hospitals and clinics. IVD devices enable rapid and accurate testing of blood, urine, and other biological samples, which helps in timely diagnosis and treatment

Report Scope and Medical Device Technologies Market Segmentation

|

Attributes |

Medical Device Technologies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Technologies Market Trends

Growing Adoption of Advanced Diagnostic and Therapeutic Solutions

- A significant and accelerating trend in the global medical device technologies market is the widespread adoption of advanced diagnostic, monitoring, and therapeutic devices that are designed to enhance clinical accuracy, efficiency, and patient outcomes. Healthcare providers are increasingly relying on these technologies to support early disease detection, personalized treatment plans, and improved operational workflows

- For instance, manufacturers are introducing next-generation imaging systems, laboratory diagnostic instruments, minimally invasive surgical devices, and smart monitoring tools that offer higher precision, faster results, and reduced procedural risks. These devices are rapidly gaining traction across hospitals, specialty clinics, and diagnostic centers worldwide

- Advanced medical devices are now being integrated with hospital IT systems and electronic health records, allowing seamless data sharing, real-time patient monitoring, and enhanced clinical decision-making. This connectivity is driving improvements in patient safety, workflow efficiency, and overall healthcare delivery quality

- The trend towards more intelligent, automated, and reliable medical devices is fundamentally reshaping clinical practices. Hospitals and clinics are prioritizing the adoption of devices that not only improve outcomes but also reduce operational costs and minimize human error during diagnosis and treatment

- Manufacturers are focusing on innovations that combine technological sophistication with ease of use, regulatory compliance, and patient safety, creating solutions that meet the growing expectations of modern healthcare systems. The result is a rapid increase in adoption across both developed and emerging markets, supporting the overall growth of the Medical Device Technologies sector

Medical Device Technologies Market Dynamics

Driver

Growing Need Due to Rising Adoption of Advanced Healthcare Technologies

- The increasing prevalence of complex medical conditions and the growing demand for precise, efficient, and safe healthcare solutions are significant drivers for the heightened adoption of advanced medical devices

- For instance, he All India Institute of Medical Sciences (AIIMS) in Delhi installed a new surgical robot in its General Surgery Department, signaling broader integration of robotic surgical systems into public healthcare. Concurrently, the Apollo Cancer Centre in Kolkata performed India's first robotic-assisted excision of a rare prostatic stromal tumor

- As healthcare providers focus on improving patient outcomes and operational efficiency, advanced medical devices offer capabilities such as real-time monitoring, predictive diagnostics, and automated therapeutic delivery, providing substantial advantages over conventional devices

- Furthermore, the growing integration of connected healthcare systems and digital solutions is enabling seamless data exchange and interoperability across devices, enhancing decision-making and workflow efficiency in hospitals and clinics

- The demand for devices that support minimally invasive procedures, telemedicine, and remote patient monitoring, combined with the increasing availability of user-friendly and AI-enabled medical device technologies solutions, is further contributing to market growth

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Concerns surrounding the cybersecurity vulnerabilities of connected medical device technologies pose a significant challenge to broader market penetration. As these devices rely on network connectivity and software platforms, they are susceptible to hacking attempts, ransomware attacks, and data breaches, raising anxieties among healthcare providers and patients about the security of sensitive medical information and operational integrity

- For instance, high-profile reports of vulnerabilities in connected healthcare devices have made some hospitals and clinics hesitant to adopt advanced digital medical solutions, delaying the integration of AI-enabled, IoT-based, and remote monitoring technologies

- Addressing these cybersecurity concerns through robust encryption, secure authentication protocols, and regular software and firmware updates is crucial for building trust among end users. Companies focusing on Medical Device Technologies emphasize advanced encryption methods, multi-factor authentication, and compliance with regulatory standards such as HIPAA and FDA cybersecurity guidelines to reassure buyers. In addition, the relatively high initial cost of some advanced Medical Device Technologies systems compared to conventional devices can act as a barrier for budget-conscious healthcare institutions, particularly in developing regions. While more cost-effective solutions are entering the market, premium features such as AI-based diagnostics, remote patient monitoring, or integrated automation often come with higher price points

- While prices for basic digital devices are gradually decreasing, the perceived premium for advanced, connected technologies can still hinder widespread adoption, especially for healthcare providers who do not immediately require the full suite of features offered

- Overcoming these challenges through enhanced cybersecurity measures, targeted training for healthcare personnel, consumer education on best practices, and the development of more affordable medical device technologies options will be vital for sustained market growth and wider adoption across hospitals, clinics, and research organizations

Medical Device Technologies Market Scope

The market is segmented on the basis of device area, type, and end user.

- By Device Area

On the basis of device area, the medical device technologies market is segmented into in vitro diagnostics (IVD), cardiology devices, orthopedic devices, diagnostic imaging devices, endoscopy devices, ophthalmology devices, drug delivery devices, wound management devices, and other Device Areas. The In Vitro Diagnostics (IVD) segment dominated the largest market revenue share of 35.8% in 2024, driven by rising demand for early disease detection, increasing prevalence of chronic illnesses, and growing adoption of automated diagnostic systems in hospitals and clinics. IVD devices enable rapid and accurate testing of blood, urine, and other biological samples, which helps in timely diagnosis and treatment. Advanced technologies such as molecular diagnostics and point-of-care testing further enhance the utility of IVD devices in modern healthcare.

The Diagnostic Imaging Devices segment is expected to witness the fastest growth at a CAGR of 12.4% from 2025 to 2032. This growth is driven by technological advancements in imaging modalities such as MRI, CT, and ultrasound, which improve diagnostic accuracy and patient outcomes. The increasing demand for non-invasive diagnostic tools, coupled with rising healthcare expenditure and the expansion of imaging centers, supports this rapid adoption. In addition, integration with AI and digital imaging systems allows for enhanced image analysis and workflow efficiency, further fueling market growth in this segment.

- By Type

On the basis of type, the medical device technologies market is segmented into Molecular Diagnostics, Diagnostic Imaging, Non-Invasive Monitoring, Drug Delivery, Mobility Aid Technologies, Micro-Fluids and MEMS, Bio-Implants, Biomaterials, Minimal/Non-Invasive Surgery, and Telemedicine. The Molecular Diagnostics segment held the largest market revenue share of 30.6% in 2024. Its dominance is supported by the increasing need for personalized medicine, growing prevalence of infectious diseases, and advancements in genomic testing. Molecular diagnostics allow highly sensitive and specific detection of diseases at a molecular level, helping clinicians make informed treatment decisions and improving patient outcomes.

The Telemedicine segment is expected to witness the fastest growth at a CAGR of 14.2% from 2025 to 2032, driven by the global shift towards remote healthcare services, accelerated by the COVID-19 pandemic. Telemedicine platforms, combined with connected medical devices, allow real-time monitoring of patients’ health from remote locations, increasing accessibility to healthcare and reducing hospital visits. Continuous technological innovations, including AI-enabled virtual consultations, wearable monitoring devices, and secure data platforms, are further boosting adoption in both developed and emerging markets.

- By End User

On the basis of end user, the medical device technologies market is segmented into Hospitals and Clinics, Medical Device Industries, Pharmaceutical and Research Organizations, and Others. The Hospitals and Clinics segment dominated the largest market revenue share of 42.3% in 2024. Hospitals are major consumers of advanced medical devices due to their high patient volumes, critical care needs, and demand for accurate diagnostics and minimally invasive procedures. Investments in modern medical infrastructure and adoption of automated and connected devices further drive this segment’s dominance.

The Pharmaceutical and Research Organizations segment is expected to witness the fastest growth at a CAGR of 13.7% from 2025 to 2032. This is due to the increasing demand for advanced diagnostic and monitoring technologies in clinical research, drug development, and laboratory testing. These organizations require precise, scalable, and high-throughput medical devices to accelerate research, ensure compliance, and optimize outcomes. Continuous innovation in molecular diagnostics, microfluidics, and non-invasive monitoring systems is enabling rapid adoption of medical devices in this sector, contributing to its high growth rate.

Medical Device Technologies Market Regional Analysis

- North America dominated the medical device technologies market with the largest revenue share of 41.5% in 2024, driven by high healthcare expenditure, strong adoption of advanced medical technologies, and a well-established presence of key industry players

- The region benefits from robust healthcare infrastructure, increasing hospital and clinic capacities, and substantial investments in modern diagnostic and therapeutic solutions. Rising demand for high-precision medical devices, improved patient monitoring, and minimally invasive treatment systems is further fueling market growth

- Collaborative initiatives between public and private healthcare providers, as well as continuous technological innovation, are also strengthening the market in Canada, Mexico, and other North American countries

U.S. Medical Device Technologies Market Insight

The U.S. medical device technologies market captured the largest revenue share of 78% in 2024 within North America, fueled by the rapid adoption of advanced diagnostic systems, therapeutic devices, and patient monitoring solutions across hospitals, clinics, and research facilities. Increasing focus on improving patient outcomes, operational efficiency, and integration with hospital IT systems is driving widespread adoption. Continuous innovation by domestic manufacturers and rising investments in healthcare infrastructure are further bolstering market expansion.

Europe Medical Device Technologies Market Insight

The Europe medical device technologies market is projected to expand at a substantial CAGR throughout the forecast period, supported by rising healthcare expenditure, modernization of clinical infrastructure, and growing awareness of advanced medical technologies. Adoption is strong in hospitals and specialty clinics, with technologies such as precision imaging, laboratory diagnostics, and minimally invasive therapeutic devices contributing to improved clinical efficiency and patient safety.

U.K. Medical Device Technologies Market Insight

The U.K. medical device technologies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened healthcare investment and the adoption of innovative diagnostic and therapeutic solutions. Hospitals and clinics are increasingly prioritizing equipment that enhances workflow efficiency, treatment accuracy, and compliance with stringent regulatory standards, leading to steady market growth.

Germany Medical Device Technologies Market Insight

The Germany medical device technologies market is expected to expand at a considerable CAGR during the forecast period, supported by advanced healthcare infrastructure, increasing focus on technological innovation, and strong regulatory frameworks. Hospitals and research centers are adopting high-precision diagnostic, monitoring, and therapeutic devices, which contribute to patient safety, operational efficiency, and higher standards of care.

Asia-Pacific Medical Device Technologies Market Insight

The Asia-Pacific medical device technologies market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, rising healthcare investments, and growing demand for advanced diagnostic and therapeutic solutions. Countries such as China, India, and Southeast Asia are modernizing healthcare infrastructure, expanding hospital networks, and adopting innovative medical devices, supporting widespread market adoption and growth.

Japan Medical Device Technologies Market Insight

The Japan medical device technologies market is gaining momentum due to advanced healthcare infrastructure, rapid urbanization, and a strong emphasis on patient safety and operational efficiency. Hospitals and clinics are increasingly investing in cutting-edge diagnostic, monitoring, and therapeutic devices to improve treatment outcomes and streamline medical workflows.

China Medical Device Technologies Market Insight

The China medical device technologies market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by expanding healthcare infrastructure, high rates of investment in medical technology, and rapid urbanization. Hospitals and clinics are increasingly adopting advanced diagnostic and therapeutic devices, with government initiatives supporting healthcare modernization, improved accessibility, and greater adoption of high-quality medical technologies.

Medical Device Technologies Market Share

The medical device technologies industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Johnson & Johnson and its affiliates (U.S.)

- Siemens (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Smith+Nephew (U.K.)

- General Electric Company (U.S.)

- Zenith Healthcare Limited (India)

- QIAGEN (Germany)

- Olympus America (U.S.)

- Novartis AG (Germany)

- BIOMÉRIEUX (France)

- BD (U.S.)

Latest Developments in Global Medical Device Technologies Market

- In April 2021, Abbott, a global leader in healthcare and diagnostics, launched its new imaging platform powered by Ultreon 1.0 Software, now CE Marked in Europe. This innovative platform combines optical coherence tomography (OCT) with artificial intelligence to enhance visualization for physicians. By integrating AI-driven insights, Abbott aims to improve diagnostic accuracy and patient outcomes, reinforcing its commitment to advancing global Medical Device Technologies

- In July 2022, Thermo Fisher Scientific, a leading provider of laboratory and diagnostic solutions, introduced advanced clinical and research tools at the AACC 2022 conference. These solutions are designed to improve productivity and flexibility in diagnostics development, supporting applications such as allergy, autoimmune, and drug monitoring testing. This launch highlights Thermo Fisher’s dedication to innovation in the expanding Medical Device Technologies market

- In November 2023, Roche, a global healthcare leader, unveiled the LightCycler PRO System, a next-generation qPCR system for clinical diagnostics and research. This advanced platform enhances personalized healthcare by providing precise, rapid, and flexible diagnostic capabilities. Roche’s initiative underscores its commitment to supporting research and diagnostic advancements in the global Medical Device Technologies market

- In October 2024, Johnson & Johnson MedTech, a pioneer in medical devices, launched the VOLT Variable Angle Optimized Locking Technology Plating System for orthopedic surgeries. This system improves fracture management through enhanced stability and efficiency, enabling better patient outcomes. The launch demonstrates Johnson & Johnson MedTech’s dedication to driving innovation in the Medical Device Technologies industry worldwide

- In April 2025, Siemens, a global leader in medical and industrial technology, showcased its latest pharmaceutical manufacturing innovations at Hannover Messe 2025. The solutions aim to accelerate digital transformation, optimize production, and support sustainability goals in pharmaceutical and medical device operations. Siemens’ initiative reinforces its position as a key player in the evolving Medical Device Technologies market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.