Global Medical Device Testing Market

Market Size in USD Billion

CAGR :

%

USD

5.20 Billion

USD

11.82 Billion

202

2032

USD

5.20 Billion

USD

11.82 Billion

202

2032

| 203 –2032 | |

| USD 5.20 Billion | |

| USD 11.82 Billion | |

|

|

|

|

Medical Device Testing Market Size

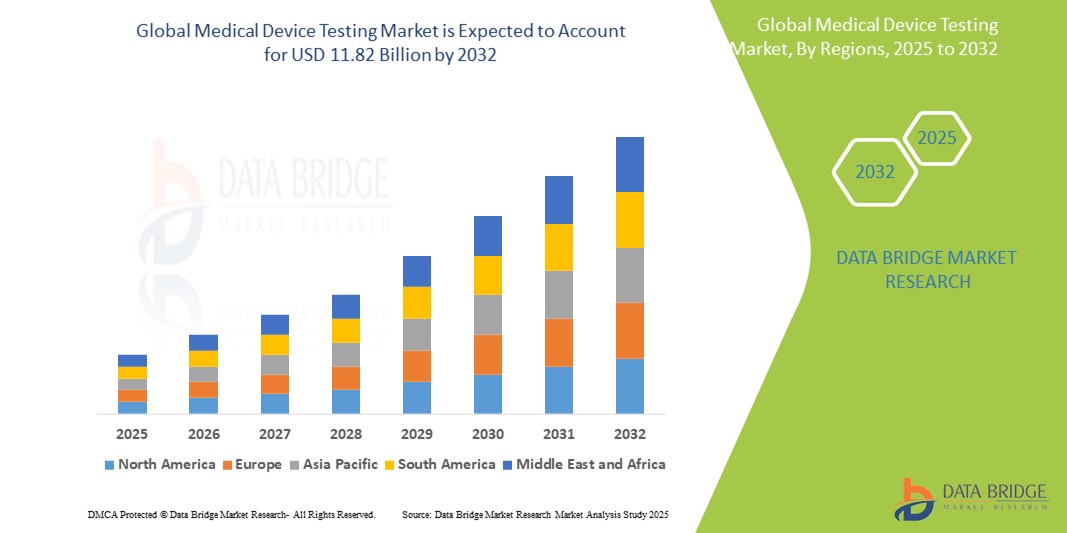

- The global medical device testing market size was valued at USD 5.20 billion in 2024 and is expected to reach USD 11.82 billion by 2032, at a CAGR of 10.80% during the forecast period

- This growth is driven by the increasing demand for safer, more reliable medical devices, technological advancements in testing methodologies, and the growing number of regulatory requirements for medical device approvals worldwide. Additionally, the rise in chronic diseases, an aging population, and the expanding healthcare sector are contributing to the growing need for comprehensive medical device testing

Medical Device Testing Market Analysis

- Medical device testing is a crucial part of the product development cycle, ensuring that medical devices meet regulatory standards, are safe for patient use, and perform as intended across various healthcare applications, including diagnostics, monitoring, and therapeutic devices

- The demand for medical device testing is primarily driven by the increasing number of medical device innovations, stringent regulatory requirements, and growing concerns regarding patient safety

- North America dominates the global medical device testing market, accounting for a significant share in 2024, estimated at approximately 40.2%. This dominance is attributed to the presence of major medical device manufacturers, well-established regulatory frameworks

- The Asia-Pacific (APAC) region is the fastest-growing in the global medical device testing market. The growth is attributed to rapidly expanding healthcare infrastructure, rising healthcare spending, and an increasing demand for advanced medical technologies in countries like China, India, and Japan

- The in-vitro diagnostics (IVD) testing segment is projected to dominate the global medical device testing market, holding approximately 33% of the total market share. This dominance is driven by the increasing demand for accurate diagnostic tools, especially in response to the growing burden of chronic diseases

Report Scope and Medical Device Testing Market Segmentation

|

Attributes |

Medical Device Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Testing Market Trends

“Integration of Digital Health Solutions & AI in Device Testing”

- One prominent trend in the medical device testing market is the increasing integration of digital health solutions and artificial intelligence (AI) in the testing and validation processes. These innovations are enhancing the accuracy, efficiency, and speed of testing, while also improving patient safety

- The incorporation of AI-powered tools and advanced data analytics enables real-time monitoring, predictive testing, and faster regulatory compliance, making it easier for manufacturers to test devices across various stages of development

- For instance, In July 2023, Charles River Laboratories introduced AI-based testing services to speed up the evaluation of medical devices, enhancing testing precision and helping meet the evolving regulatory standards in the U.S.

- These advancements are transforming the medical device testing process, facilitating better decision-making, reducing the time to market for devices, and supporting manufacturers in adhering to stringent regulatory requirements

Medical Device Testing Market Dynamics

Driver

“Increasing Demand for High-Quality and Compliant Medical Devices”

- The growing demand for high-quality, reliable, and compliant medical devices is significantly driving the global medical device testing market. As medical device manufacturers strive to meet stringent regulatory standards and ensure patient safety, there is an increasing need for comprehensive testing solutions across various device categories, including diagnostics, monitoring, and therapeutic devices

- As healthcare systems globally expand, particularly in emerging markets, the demand for advanced medical technologies and devices is rising. This is driving manufacturers to adopt extensive testing protocols to comply with evolving regulations and meet market needs

- Manufacturers are also increasingly seeking specialized, regulatory-compliant, and customizable testing solutions to ensure their products meet both safety and performance standards in the healthcare sector

For instance,

- In March 2024, Charles River Laboratories partnered with a leading European medical device manufacturer to offer advanced testing services, ensuring regulatory compliance and product reliability for their new line of implantable devices

- As a result of the growing need for reliable and compliant medical devices, the demand for comprehensive medical device testing services is experiencing significant growth, especially in regions with expanding healthcare infrastructure and regulatory requirements

Opportunity

“Integration of AI and Automation in Medical Device Testing”

- The integration of AI and automation in medical device testing presents a significant opportunity to enhance efficiency, accuracy, and speed in the testing and validation processes. These technologies can streamline repetitive testing procedures, improve data analysis, and ensure that devices meet regulatory standards more effectively

- AI-powered systems can continuously analyze test data, predict potential device failures, and automate the documentation process, reducing human error and ensuring consistency in test results. This automation allows for faster time-to-market for medical devices while ensuring compliance with stringent regulations

- The ability to integrate AI-based predictive analytics in testing systems is expected to drive demand for more advanced and cost-effective medical device testing solutions across industries

For instance,

- In January 2024, Medistri SA partnered with AI-focused tech firm Veeva Systems to introduce a new AI-driven testing platform for medical devices, enabling automated regulatory compliance checks and predictive quality assurance for critical healthcare devices

- The integration of AI and automation in medical device testing is expected to significantly improve testing efficiency, reduce operational costs, and enhance the reliability of medical devices, leading to widespread adoption of these advanced technologies in the global medical device testing market

Restraint/Challenge

“High Costs of Testing and Regulatory Compliance”

- The high costs associated with medical device testing and regulatory compliance present a significant challenge to market growth, particularly for small and medium-sized enterprises (SMEs) in emerging markets

- Medical device testing, especially for advanced or high-risk devices, requires substantial investment in specialized equipment, skilled labor, and compliance with stringent global regulations. This can be a significant financial burden for companies with limited budgets, especially when testing involves complex procedures like clinical trials or long-term performance evaluations

- The ongoing costs, including testing for various regulatory agencies (e.g., FDA, CE Mark), as well as maintaining compliance with evolving healthcare standards, can further add to the financial challenges for manufacturers

For instance,

- In March 2024, a report by Eurofins Scientific highlighted that small medical device manufacturers in emerging markets face challenges in meeting international regulatory standards due to the significant costs involved in comprehensive testing and certification processes

- These financial barriers may deter companies from investing in necessary testing procedures or adopting new testing technologies, leading to delays in product launches or lower market entry for smaller players. As a result, the high costs associated with medical device testing could hinder the growth of the market in the long term

Medical Device Testing Market Scope

The market is segmented on the basis of service type, testing type, phase, sourcing type, device class and product.

|

Segmentation |

Sub-Segmentation |

|

By Service Type |

|

|

By Testing Type |

|

|

By Phase |

|

|

By Sourcing Type |

|

|

By Device Class |

|

|

By Product |

|

In 2025, the in-vitro diagnostics segment is projected to dominate the industrial boilers market with the largest share in the fuel product segment.

The IVD testing segment is projected to dominate the global medical device testing market, holding approximately 33% of the total market share. This dominance is attributed to the increasing demand for accurate and rapid diagnostic tools, especially in response to the growing burden of chronic diseases and the rising need for non-invasive testing methods. IVD testing solutions, such as molecular diagnostics, point-of-care testing, and personalized medicine, offer high accuracy, speed, and convenience, making them a preferred choice for healthcare providers and patients alike. In addition, the continued advancements in digital health and automation further support the widespread adoption of IVD testing solutions across various healthcare settings, ranging from hospitals to home-care environments.

The cybersecurity testing is expected to account for the largest share during the forecast period in testing type segments

The cybersecurity testing segment is projected to hold a significant share of the market, estimated at approximately 35% in 2025. This dominance is due to the increasing importance of safeguarding medical devices against cybersecurity threats as healthcare systems become more interconnected through the Internet of Things (IoT) and cloud-based technologies. With the rise of cyberattacks targeting healthcare institutions and medical devices, ensuring the security of devices such as pacemakers, insulin pumps, and diagnostic equipment has become a top priority.

Medical Device Testing Market Regional Analysis

“North America Holds the Largest Share in the Medical Device Testing Market”

- North America dominates the global medical device testing market, accounting for approximately 40.2% of the market share in 2024

- The U.S. holds a significant share of approximately 35% of the global medical device testing market in 2024. This dominance is driven by the high demand for advanced medical devices, a well-established healthcare system, and continuous innovations in medical device technologies and testing solutions

- The availability of well-established regulatory frameworks, such as FDA approval processes, and growing investments in research & development by leading medical device manufacturers further strengthen the market in North America

- In addition, the increasing focus on patient safety, regulatory compliance, and the adoption of cutting-edge testing technologies, such as AI and automation, are fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Medical Device Testing Market”

- The Asia-Pacific (APAC) region is expected to witness the highest growth rate in the global medical device testing market, driven by rapid healthcare infrastructure development, growing demand for medical devices, and increasing regulatory compliance requirements

- Countries such as China, India, and Japan are emerging as key markets due to their expanding healthcare systems, rising demand for advanced medical technologies, and increasing focus on patient safety and regulatory standards

- China, with its large healthcare sector and significant investments in medical device manufacturing, is driving substantial demand for medical device testing services. The country is also focusing on improving regulatory standards and enhancing the quality of healthcare, further propelling the adoption of advanced testing solutions

- India, with its burgeoning healthcare industry and growing demand for affordable and innovative medical devices, is experiencing rapid adoption of medical device testing solutions to meet rising patient needs

- Increased government initiatives and private sector investments in healthcare infrastructure are further contributing to the market growth in the region

Medical Device Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Intertek Group plc (U.K.)

- SGS SA (Switzerland)

- Bureau Veritas (France)

- TUV SUD (Germany)

- TUV Rheinland (Germany)

- Pace (U.S.)

- Charles River Laboratories (U.S.)

- Biomedical Device Labs (U.S.)

- UL LLC (U.S.)

- North American Science Associates, LLC (U.S.)

- Medistri SA (Switzerland)

- WuXi AppTec (China)

- NSF (U.S.)

- Labcorp (U.S.)

- Eurofins Scientific (Luxembourg)

- Nelson Laboratories, LLC - A Sotera Health company (U.S.)

- Gateway Analytical (U.S.)

- ITC ZLIN (Czech Republic)

- Element Materials Technology (U.K.)

- EndoLab Mechanical Engineering GmbH (Germany)

- Hohenstein (Germany)

- Medical Engineering Technologies Ltd. (U.K.)

- Bioneeds (India)

- Cigniti (India)

- Arbro Pharmaceuticals Private Limited & Auriga Research Private Limited (India)

- Q Laboratories (U.S.)

- IMR Test Labs (U.S.)

Latest Developments in Global Medical Device Testing Market

- In January 2025, IMQ Group entered the Indian market by launching Elettra Tech Labs, a joint venture focused on testing and inspection services for medical devices and electrical and electronic products. This expansion strengthens IMQ’s global presence, supporting Indian businesses in meeting rigorous quality and safety standards while facilitating international market access. The initiative aligns with India’s growing medical device sector, leveraging advanced testing technologies to enhance compliance and innovation

- In March 2024, Stryker expanded its prototype and testing facility in India, marking a significant milestone in its research and development footprint. The 55,600-square-foot facility integrates cutting-edge infrastructure and enhanced microbiology capabilities, strengthening product assurance and innovation. This expansion supports rigorous life cycle testing of medical devices, ensuring compliance with global regulatory standards. The facility also features advanced prototyping tools, including plastic 3D printing and metal machining, reinforcing Stryker’s commitment to medical technology advancements

- In March 2024, TidalSense, a UK-based respiratory device company, launched a pilot study to evaluate its N-Tidal device, designed to diagnose asthma in children. Conducted in partnership with the University of Nottingham and Nottingham University Hospitals NHS Trust, the study involves 75 children under five years old with asthma and viral wheeze. Unlike traditional spirometry tests, which require complex breathing maneuvers, N-Tidal uses capnography to measure CO₂ levels during normal breathing, making diagnosis easier and more accessible

- In June 2023, TÜV SÜD inaugurated a state-of-the-art microbiology and chemistry laboratory in New Brighton, Minnesota, reinforcing its commitment to high-quality medical device testing services. Accredited under ISO 17025, the facility specializes in biological and chemical testing, supporting medical device companies in accelerating research and development. Equipped with advanced technology, the lab offers microbiology, reusable device testing, chemistry, biocompatibility, and packaging assessments. This expansion strengthens TÜV SÜD’s global laboratory network, ensuring precision and compliance for medical innovation

- In July 2022, Eurofins Scientific acquired WESSLING Hungary, strengthening its environmental, food, and BioPharma product testing capabilities across Europe. WESSLING Hungary, a leading laboratory, generated €15 million in revenue in 2021 and employed over 300 staff, reinforcing Eurofins’ commitment to high-quality analytical services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.