Global Medical Drones Market

Market Size in USD Million

CAGR :

%

USD

361.10 Million

USD

1,262.88 Million

2024

2032

USD

361.10 Million

USD

1,262.88 Million

2024

2032

| 2025 –2032 | |

| USD 361.10 Million | |

| USD 1,262.88 Million | |

|

|

|

|

Medical Drones Market Size

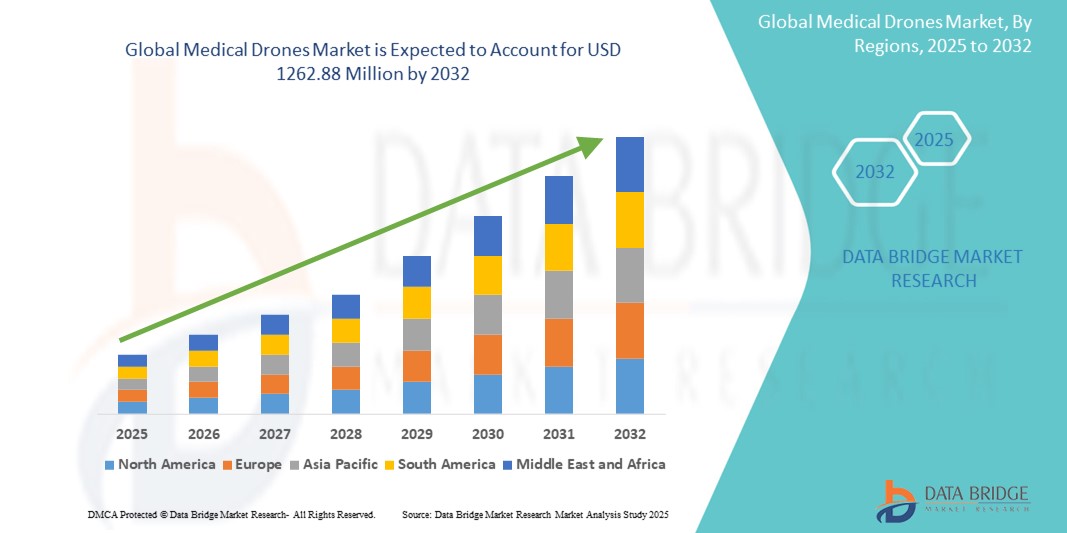

- The global medical drones market size was valued at USD 363.10 million in 2024 and is expected to reach USD 1,262.88 million by 2032, at a CAGR of 16.86% during the forecast period

- The market growth is largely fueled by the increasing demand for rapid, contactless delivery of medical supplies—especially in remote and underserved regions—coupled with technological advancements in UAVs and automation

- Furthermore, rising investments by governments and private healthcare stakeholders to improve emergency response logistics and the integration of AI and real-time tracking systems are establishing medical drones as a reliable, efficient component of future healthcare infrastructure. These converging factors are accelerating the deployment of medical drone solutions, thereby significantly boosting the industry's growth

Medical Drones Market Analysis

- Medical drones, offering unmanned aerial delivery of critical healthcare supplies such as blood, vaccines, medicines, and lab samples, are becoming increasingly vital in emergency response systems and last-mile healthcare delivery, especially in remote and hard-to-reach regions, due to their speed, autonomy, and ability to bypass traditional infrastructure constraints

- The escalating demand for medical drones is primarily fueled by the growing need for faster and more reliable medical logistics, rising healthcare digitization, and increased support from governments and global health organizations for drone-based healthcare solutions

- North America dominated the medical drones market with the largest revenue share of 39.2% in 2024, driven by strong regulatory support, high investment in healthcare innovation, and active pilot programs in the U.S. for drone-assisted medical supply chains involving both public health agencies and private companies

- Asia-Pacific is expected to be the fastest growing region in the medical drones market during the forecast period due to growing rural healthcare demands, large-scale trials in countries such as India and China, and rising public-private collaboration in medical drone infrastructure

- Fixed-wing segment dominated the medical drones market with a market share of 45.9% in 2024, favored for its longer flight range, higher payload capacity, and operational efficiency in covering vast rural or rugged terrains

Report Scope and Medical Drones Market Segmentation

|

Attributes |

Medical Drones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Drones Market Trends

“Improved Emergency Logistics Through AI and Autonomous Flight Capabilities”

- A significant and accelerating trend in the global medical drones market is the integration of artificial intelligence (AI), automation, and advanced navigation technologies to enhance emergency response logistics and delivery efficiency. These technologies enable drones to make real-time flight decisions, avoid obstacles, and optimize delivery routes, dramatically improving their reliability in critical healthcare missions

- For instance, Zipline’s drones use computer vision and autonomous flight algorithms to deliver blood and vaccines across remote regions in Rwanda and Ghana with near pinpoint accuracy and minimal human intervention. Similarly, Matternet’s M2 drones, used in partnership with UPS and healthcare providers in the U.S., offer automated payload swapping and charging, allowing continuous and timely deliveries

- AI-powered drones can assess weather conditions, reroute in-flight to avoid delays, and maintain secure chain-of-custody for sensitive medical cargo. Some systems also feature AI-enhanced diagnostics and live video feeds, enabling real-time coordination between healthcare providers and logistics operators

- The convergence of AI and autonomy allows for scalable medical drone operations with minimal infrastructure, making them ideal for developing regions with poor road connectivity or during emergencies such as pandemics or natural disasters

- This trend is driving the development of more intelligent, efficient, and scalable drone delivery systems, reshaping expectations in healthcare logistics. Companies such as Wingcopter and Swoop Aero are investing in AI-enabled drones with enhanced payload management and automated dispatching systems for national-scale deployment

- The growing demand for rapid, contactless, and data-driven delivery systems is propelling the adoption of AI-integrated medical drones in both public health systems and private logistics networks worldwide

Medical Drones Market Dynamics

Driver

“Rising Need for Timely Medical Deliveries and Healthcare Access in Remote Areas”

- The increasing demand for rapid, reliable medical deliveries—particularly in remote, underserved, or disaster-affected areas—is a major driver for the growing use of medical drones. These UAVs offer a cost-effective, time-saving alternative to traditional ground transport, especially where infrastructure is lacking or delayed access could mean life-threatening consequences

- For instance, in May 2024, India’s Ministry of Health expanded its ‘i-Drone’ initiative with expanded BVLOS (Beyond Visual Line of Sight) drone corridors to deliver blood and medical supplies across rural regions, reinforcing the role of drones in last-mile health logistics.

- Medical drones offer features such as GPS-guided navigation, real-time tracking, cold-chain management, and automated drop-off, which make them ideal for transporting vaccines, diagnostics, antivenoms, and organ samples

- Furthermore, ongoing partnerships between governments, international health agencies (such as UNICEF and WHO), and drone manufacturers are creating strong frameworks for pilot programs and regulatory approvals, accelerating market penetration

- The ability of drones to bridge healthcare gaps in rural areas, enhance emergency preparedness, and reduce time-to-care in life-critical scenarios is significantly boosting their adoption in public health strategies globally

Restraint/Challenge

“Regulatory Barriers and Airspace Restrictions”

- Despite the technological advancements, regulatory constraints and complex airspace management issues remain key challenges limiting the widespread deployment of medical drones. Many countries still lack comprehensive policies for commercial or autonomous drone operations, especially in populated areas or near healthcare facilities

- For instance, strict FAA regulations in the U.S. around BVLOS operations, pilot certification, and air traffic coordination have slowed large-scale drone integration in medical logistics, requiring extensive waivers or special exemptions

- Furthermore, concerns around drone safety, privacy, potential mid-air collisions, and the risk of delivery failures in densely populated or extreme-weather zones contribute to hesitancy among regulators and healthcare institutions

- To address these concerns, manufacturers must focus on incorporating fail-safe mechanisms, real-time air traffic coordination technologies, and strong cybersecurity protocols to secure sensitive health data and delivery payloads

- In addition, high upfront costs associated with drone infrastructure, maintenance, and staff training may deter adoption in resource-constrained health systems. While innovative leasing and pay-per-use models are emerging, cost barriers continue to impact scalability in some regions

Medical Drones Market Scope

The market is segmented on the basis of type, technology, application, package size, and end user.

- By Type

On the basis of type, the medical drones market is segmented into fixed wing, rotor drones, and hybrid drones. The fixed wing segment dominated the market with the largest revenue share of 45.9% in 2024, attributed to its ability to cover longer distances at higher speeds, making it particularly suitable for rural and remote medical deliveries. Fixed-wing drones offer higher payload capacity and better energy efficiency, supporting applications such as blood, vaccine, and organ transport over vast geographic areas with minimal landing infrastructure.

The rotor drones segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their vertical take-off and landing (VTOL) capabilities, which enable delivery in dense urban areas and confined spaces such as hospitals and emergency zones. Rotor drones are ideal for short-distance, time-sensitive deliveries where precise drop-off is essential.

- By Technology

On the basis of technology, the medical drones market is segmented into fully autonomous, semi-autonomous, and remotely operated drones. The fully autonomous segment held the largest revenue share in 2024, fueled by advancements in AI, GPS navigation, and real-time route optimization. These drones operate with minimal human intervention, enabling scalable and consistent delivery operations for critical healthcare logistics in both urban and remote regions.

The semi-autonomous segment is anticipated to register robust growth during the forecast period, as hybrid models that combine human oversight with automated functions gain traction in pilot programs and transitional regulatory environments. This model offers a balance between control and efficiency, especially in areas where full autonomy is not yet permitted

- By Application

On the basis of application, the medical drones market is segmented into acute care, vaccination programs, blood bank transferring, and drug/pharmaceutical transferring. The blood bank transferring segment led the market in 2024 due to increasing demand for rapid, temperature-controlled delivery of blood and plasma, particularly in emergency and trauma situations. Drones offer a reliable solution to overcome delays associated with conventional transport in congested or inaccessible regions.

The vaccination programs segment is projected to grow at the fastest pace during forecast period, driven by global immunization campaigns and the need to maintain cold-chain logistics. Drones play a key role in transporting temperature-sensitive vaccines to rural areas during disease outbreaks and public health initiatives.

- By Package Size

On the basis of package size, the medical drones market is segmented into less than 2 kg, 2–5 kg, and more than 5 kg. The 2–5 kg segment accounted for the largest market share in 2024, as it aligns with the typical payload range for most healthcare delivery missions, including vaccines, medicines, and small equipment. This range strikes a balance between mobility and carrying capacity, making it widely applicable across health systems.

The more than 5 kg segment is expected to grow rapidly during forecast period, driven by advancements in drone power systems and demand for larger deliveries, such as diagnostic devices, multi-unit medical kits, or bulk pharmaceutical consignments in disaster or pandemic scenarios.

- By End User

On the basis of end user, the medical drones market is segmented into government organizations, emergency medical services (EMS), and blood banks. The government organizations segment dominated the market in 2024, supported by national drone programs, public-private partnerships, and regulatory pilots led by ministries of health and defense in countries such as India, Rwanda, and the U.S. These initiatives are crucial in deploying medical drones for mass-scale healthcare delivery and disaster relief.

The emergency medical services (EMS) segment is expected to record the highest CAGR from 2025 to 2032, as EMS providers increasingly utilize drones for critical care delivery, such as rapid AED deployment or first aid supplies, to reduce response times in high-mortality emergencies.

Medical Drones Market Regional Analysis

- North America dominated the medical drones market with the largest revenue share of 39.2% in 2024, driven by strong regulatory support, high investment in healthcare innovation, and active pilot programs in the U.S. for drone-assisted medical supply chains involving both public health agencies and private companies

- The region has seen rapid adoption of drone-based delivery systems for blood, vaccines, and emergency supplies, especially in remote or underserved communities

- High healthcare expenditure, favorable FAA waivers for drone trials, and strong collaboration between tech startups and public health agencies further bolster market growth, positioning North America as a leading region in the medical drone revolution for both rural access and urban emergency response

U.S. Medical Drones Market Insight

The U.S. medical drones market captured the largest revenue share of 79% in 2024 within North America, driven by strong government backing, early regulatory adoption through FAA drone integration programs, and rising demand for rapid emergency response. The U.S. is leveraging drones for time-sensitive deliveries, including blood, organs, and vaccines, particularly in remote or disaster-hit areas. Increasing collaborations between healthcare providers and drone technology firms, along with advancements in autonomous flight systems, are accelerating the adoption of medical drones across both civilian and military healthcare infrastructure.

Europe Medical Drones Market Insight

The Europe medical drones market is projected to expand at a substantial CAGR throughout the forecast period, fueled by regulatory reforms supporting unmanned aircraft in healthcare logistics and cross-border supply chain applications. Rising emphasis on sustainability, coupled with healthcare system digitization, is fostering drone adoption for reducing delivery times and costs. European nations are increasingly deploying medical drones in emergency services and rural healthcare access, with pilots and public-private partnerships gaining momentum in Germany, Switzerland, and France.

U.K. Medical Drones Market Insight

The U.K. medical drones market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by government-led trials under the Future Flight Challenge and NHS collaborations for real-time medicine delivery. The country is actively testing drone networks for delivering chemotherapy and pathology samples, especially in island and rural regions. Growing interest in decarbonizing healthcare logistics and improving operational efficiency is positioning medical drones as a vital innovation in the U.K.’s evolving healthcare infrastructure.

Germany Medical Drones Market Insight

The Germany medical drones market is expected to expand at a considerable CAGR during the forecast period, driven by the country's emphasis on medical innovation, robust logistics networks, and stringent quality assurance standards. Germany’s healthcare institutions are piloting drone services for transporting lab specimens and emergency supplies. With increasing support from federal agencies and integration into broader e-health strategies, medical drones are gaining traction in both public hospitals and private medical centers.

Asia-Pacific Medical Drones Market Insight

The Asia-Pacific medical drones market is poised to grow at the fastest CAGR during 2025 to 2032, driven by healthcare accessibility challenges, growing population densities, and rapid technological adoption across countries such as China, India, and South Korea. Governments in the region are investing in drone corridors for vaccine and drug delivery, especially in disaster-prone and remote territories. Rising investments in drone infrastructure and increasing partnerships with global UAV firms are making Asia-Pacific a major hub for medical drone deployment and innovation.

Japan Medical Drones Market Insight

The Japan medical drones market is gaining momentum due to strong government focus on aging population needs, disaster preparedness, and high-tech logistics solutions. Medical drones are increasingly used in trials for rapid delivery of medications and emergency kits in mountainous and disaster-affected zones. Japan’s strategic initiatives under its Society 5.0 vision, emphasizing IoT and robotics integration in public services, are propelling the expansion of drone-assisted healthcare delivery.

India Medical Drones Market Insight

The India medical drones market accounted for the largest market revenue share in Asia-Pacific in 2024, bolstered by successful drone medicine delivery pilots such as “Medicine from the Sky.” The country’s vast geography, coupled with underserved rural healthcare zones, makes drones an ideal solution for bridging accessibility gaps. Government programs under Digital India and the liberalized drone policy (2021) are encouraging startups and health-tech firms to scale drone-based supply chains for vaccines, blood, and essential medicines across state borders.

Medical Drones Market Share

The medical drones industry is primarily led by well-established companies, including:

- Zipline International Inc. (U.S.)

- Wingcopter (Germany)

- Swoop Aero Pty Ltd (Australia)

- Matternet (U.S.)

- EHang Holdings Limited (China)

- DJI (China)

- Volansi, Inc. (U.S.)

- Skyports (U.K.)

- Draganfly Inc. (Canada)

- Avy B.V. (Netherlands)

- Vayu, Inc. (U.S.)

- Manna Aero (Ireland)

- UPS Flight Forward Inc. (U.S.)

- Dronamics (Bulgaria)

- Airbus S.A.S. (France)

- Blueflite, Inc. (U.S.)

- Aeronext Inc. (Japan)

- SkyLIFE Technologies, Inc. (U.S.)

- F-drones (Singapore)

What are the Recent Developments in Global Medical Drones Market?

- In April 2023, Zipline, a leading drone delivery service provider, launched its Platform 2 system, capable of precision delivery within a 6-foot radius using autonomous droids. This innovation aims to enhance last-mile healthcare logistics by delivering sensitive medical supplies such as blood, vaccines, and medications directly to hospitals, clinics, and homes. The launch reinforces Zipline’s commitment to revolutionizing medical logistics with highly accurate, fast, and sustainable drone solutions

- In March 2023, India’s Ministry of Civil Aviation, in collaboration with the World Economic Forum, expanded the “Medicine from the Sky” initiative to multiple states, enabling drone-based medical deliveries in remote and underserved regions. This large-scale pilot program demonstrates the growing confidence in drones as vital tools for improving healthcare accessibility, particularly in regions with limited infrastructure, and highlights India's proactive role in integrating UAVs into public health logistics

- In February 2023, German drone manufacturer Wingcopter partnered with Skyports and the UK's National Health Service (NHS) to trial drone deliveries of essential medical supplies across Scotland’s Highlands and islands. The initiative is focused on reducing delivery times, improving access to critical medicines, and testing autonomous drone routes in complex terrains, reflecting Europe's increasing focus on integrating drones into healthcare supply chains

- In February 2023, U.S.-based DroneUp, backed by Walmart, announced plans to extend its drone delivery services to include medical products through collaborations with healthcare providers. The expansion aligns with the company's goal of transforming last-mile delivery in suburban and urban areas, reinforcing the value of medical drones in reducing time-to-treatment and streamlining healthcare logistics in the U.S.

- In January 2023, Swoop Aero, an Australian drone logistics company, partnered with UNICEF to deploy medical drones in Malawi for the distribution of childhood vaccines and diagnostic samples. This effort aims to enhance healthcare equity and reach remote populations efficiently. The initiative illustrates the growing use of drone technology in humanitarian health missions and underscores the role of public-private partnerships in scaling medical drone operations globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.