Global Medical Equipment Rental Market

Market Size in USD Million

CAGR :

%

USD

23,660.90 Million

USD

48,547.80 Million

2022

2030

USD

23,660.90 Million

USD

48,547.80 Million

2022

2030

| 2023 –2030 | |

| USD 23,660.90 Million | |

| USD 48,547.80 Million | |

|

|

|

|

Market Analysis and Size

Medical equipment leasing as a means of acquiring medical gadgets is still a resource that hospitals are attempting to use to aid with these issues. According to the research, the medical equipment rental business grew by 2.9 percent in 2018 to USD 4 billion in sales. Furthermore, the geriatric population is growing, with the world's aged population growing rapidly. Today, 8.5 percent of the world's population (617 million) is 65 or older.

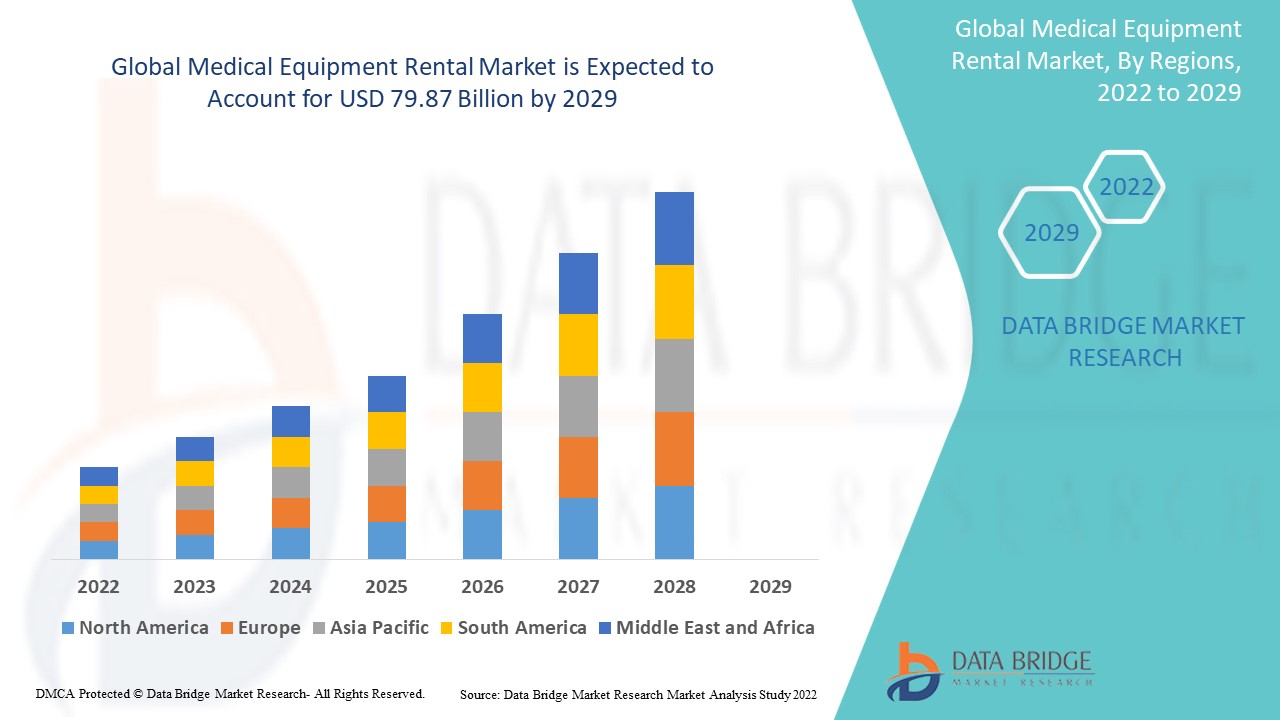

Data Bridge Market Research analyses that the medical equipment rental market which was USD 53.65 billion in 2021, would rocket up to USD 79.87 billion by 2029, and is expected to undergo a CAGR of 5.10% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

(Device Type: Personal/Home Care Equipment, Electronic/Digital Equipment, Surgical Equipment, Durable Medical Equipment [Long Term Care, Acute Care, and Emergency and Trauma], Storage and Transport; and End-user: Personal/Home Care Medical Equipment Rental [Chronic and Geriatric Patients, Preventive Care/Monitoring, and Short Term and Outpatient Care] and Institutional Medical Equipment Rental [Hospitals, Healthcare Centers, Medical Nursing Homes, and Medical Research Laboratories/Institutions) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Apria Healthcare Group, Inc. (U.S), Centric Health Ltd. (Canada), Hill-ROM Services, Inc. (U.S), Nunn’s Home Medical Equipment (U.S), Huron Consulting Group Inc. (U.S), US Med-Equip, Inc. (U.S), Universal Health Services, Inc. (U.S), Woodley Equipment Company Ltd. (U.K), Walgreen Co. (U.S), Westside Medical Supply, Inc. (U.S), China Huarong Financial Leasing Co. Ltd., (China), Meridian Group International (U.S), Mizuho Leasing Company, Limited (Japan), MediCapital Rent (Netherlands), General Electric (U.K) |

|

Market Opportunities |

|

Market Definition

The leasing or renting of medical equipment is known as medical equipment rental. Medical equipment rental or leasing has become a popular alternative to purchasing for a variety of end-users, including medical institutions and others. Medical equipment is available for rent on a daily, weekly, or monthly basis.

Medical Equipment Rental Market Dynamics

Drivers

- Need for home healthcare

The global medical equipment rental industry is expected to develop due to increased demand for home healthcare services as a result of reduced hospital stays during the ongoing COVID-19 epidemic. Furthermore, in the approaching years, an increase in the number of disabled and senior patients is expected to increase demand for rental equipment.

- Rising incidences of disorders

The number of disabled people is increasing due to rising rates of skeletal and neurological problems and muscular dystrophy. Patients with various chronic illnesses choose to receive therapy at home to avoid lengthy hospital stays. In order to avoid lengthy hospital stays, these patients might hire a variety of medical devices. This element is likely to help the medical equipment rental industry grow in the coming years.

-

Growing prevalence of chronic diseases

Chronic medical disorders include high blood pressure, diabetes, and cardiovascular and respiratory diseases necessitate ongoing monitoring. Furthermore, the American Diabetes Association predicts that by 2050, one out of every three persons in the United States would have diabetes. The rising number of persons diagnosed with these diseases is driving demand for home health care medical devices and services, which is expected to fuel demand for medical equipment rental. As a result of the rising number of people diagnosed with chronic diseases, various home care medical devices such as rehabilitation devices, diabetes supplies, and mobility devices are becoming more popular.

- Rising geriatric population

People's life expectancy has increased as a result of medical advancements, with an increasing number of people living above the age of 50. The United Nations estimates that the number of persons aged 60 and more would rise from 841 million in 2013 to over 2 billion by 2050. Changing demographics and an ageing population are pushing a significant portion of the population into higher sickness classifications, requiring ongoing medical care.

Opportunities

The increased demand for therapeutic and monitoring equipment is also driving the market. This need is due to global improvements in healthcare infrastructure and ongoing technological developments in the medical equipment rental market. Renting innovative medical equipment is cost-effective to keep up with new technology. Furthermore, persons who require mobility devices on a temporary basis prefer to rent.

Restraints/Challenges

- Lack of insurance coverage and price knowledge

Due to a lack of awareness and sufficient knowledge about medical equipment rental and leasing, smaller hospitals and individual patients contract considerably more expensive rental agreements than necessary. As a result, medical technology companies should collaborate closely with governments and healthcare organisations to increase acceptance of medical equipment rental, encouraging insurance companies to reimburse it and educating potential customers and medical practitioners about reasonable rental prices.

This medical equipment rental market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the medical equipment rental market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Medical Equipment Rental Market

The COVID-19 epidemic has wreaked havoc on medical device supply networks. The supply chain business is experiencing a labour shortage as a result of the shelter-in-place rules. However, due to the continuing coronavirus epidemic, there has been an unexpected increase in demand for breathing equipment. DME rental companies are meeting these needs for both hospital and home care patients. Various local manufacturers have devised a marketing plan that involves renting out this equipment, based on the short-term necessity of these products and to enhance sales. As a result, throughout the pandemic crisis, the market for DME rental is expected to rise at a healthy CAGR.

Recent Development

- In June 2020, MedOne Company announced the launch of a new centre for renting and servicing medical equipment. The new facility will be located in North Carolina. U.S.

- In March 2020, Martab equipment management services has been acquired by Med-Equip. The purchase is being made in order to provide rentals of custom-built gadgets such as home testing kits.

Global Medical Equipment Rental Market Scope

The medical equipment rental market is segmented on the basis of type and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Personal / Home care Equipment

- Electronic / Digital Equipment

- Surgical Equipment

- Durable Medical Equipment

- Long Term Care

- Acute Care

- Emergency and Trauma

- Storage and Transport

End-user

- Personal / Home Care Medical Equipment Rental

- Chronic and Geriatric Patients

- Preventive Care / Monitoring

- Short Term and Outpatient Care

- Institutional Medical Equipment Rental

- Hospitals

- Healthcare Centers

- Medical Nursing Homes

- Medical Research Laboratories/Institutions

Medical Equipment Rental Market Regional Analysis/Insights

The medical equipment rental market is analysed and market size insights and trends are provided by country, type and end-user as referenced above.

The countries covered in the medical equipment rental market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is dominating the global medical equipment rental market because of the presence of a large number of private healthcare facilities, including private hospitals, clinics, and diagnostic centres, an increase in the ageing population, and a high incidence/prevalence of various diseases, there is a high healthcare infrastructure and government support for it.

Asia-Pacific is the fastest growing region in the market for contract manufacturing of medical devices due to an increasing incidence of chronic and infectious diseases, improved population income and affordability, greater awareness of healthcare and governmental healthcare spending, and increased private healthcare investment.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The medical equipment rental market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for medical equipment rental market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the medical equipment rental market. The data is available for historic period 2010-2020.

Competitive Landscape and Medical Equipment Rental Market Share Analysis

The medical equipment rental market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to medical equipment rental market.

Some of the major players operating in the medical equipment rental market are:

- Apria Healthcare Group, Inc. (U.S)

- Centric Health Ltd. (Canada)

- Hill-ROM Services, Inc. (U.S)

- Nunn’s Home Medical Equipment (U.S)

- Huron Consulting Group Inc. (U.S)

- US Med-Equip, Inc. (U.S)

- Universal Health Services, Inc. (U.S)

- Woodley Equipment Company Ltd. (U.K)

- Walgreen Co. (U.S)

- Westside Medical Supply, Inc. (U.S)

- China Huarong Financial Leasing Co. Ltd., (China)

- Meridian Group International (U.S)

- Mizuho Leasing Company, Limited (Japan)

- MediCapital Rent (Netherlands)

- General Electric (U.K)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MEDICAL EQUIPMENT RENTAL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MEDICAL EQUIPMENT RENTAL MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MEDICAL EQUIPMENT RENTAL MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6. INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7. INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8. COST ANALYSIS BREAKDOWN

9. TECHNONLOGY ROADMAP

10. INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11. REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12. REIMBURSEMENT FRAMEWORK

13. OPPUTUNITY MAP ANALYSIS

14. VALUE CHAIN ANALYSIS

15. HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.10 ECONOMIC DEVELOPMENT

16. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, BY PRODUCT

16.1 OVERVIEW

(NOTE: MARKET VALUE, VOLUME AND ASP ANALYSIS WOULD BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS OF PRODUCT)

16.2 PERSONAL/HOME CARE PRODUCTS

16.2.1 MOBILITY AIDS & ASSISTIVE DEVICES

16.2.1.1. WHEELCHAIRS

16.2.1.1.1. MANUAL WHEELCHAIRS

16.2.1.1.2. ELECTRIC (POWERED) WHEELCHAIRS

16.2.1.1.2.1 STANDARD ELECTRIC WHEELCHAIRS

16.2.1.1.2.2 HEAVY-DUTY/BARIATRIC ELECTRIC WHEELCHAIRS

16.2.1.1.2.3 STANDING POWER WHEELCHAIRS

16.2.1.1.2.4 FOLDING & PORTABLE POWER WHEELCHAIRS

16.2.1.1.2.5 OTHERS

16.2.1.2. WALKERS & ROLLATORS

16.2.1.2.1. WALKERS

16.2.1.2.1.1 STANDARD WALKERS (NO WHEELS)

16.2.1.2.1.2 TWO-WHEEL WALKERS

16.2.1.2.2. ROLLATORS

16.2.1.2.2.1 THREE-WHEEL ROLLATORS

16.2.1.2.2.2 FOUR-WHEEL ROLLATORS WITH SEATS

16.2.1.2.2.3 UPRIGHT WALKERS

16.2.1.3. CRUTCHES & CANES

16.2.1.3.1. CRUTCHES

16.2.1.3.1.1 UNDERARM (AXILLARY) CRUTCHES

16.2.1.3.1.2 FOREARM (LOFSTRAND) CRUTCHES

16.2.1.3.1.3 PLATFORM CRUTCHES

16.2.1.3.2. CANES

16.2.1.3.2.1 QUAD CANES

16.2.1.3.2.2 ADJUSTABLE & FOLDING CANES

16.2.1.4. MOBILITY SCOOTERS

16.2.1.4.1. 3-WHEEL MOBILITY SCOOTERS

16.2.1.4.2. 4-WHEEL MOBILITY SCOOTERS

16.2.1.4.3. OTEHRS

16.2.2 PATIENT HANDLING & TRANSFER EQUIPMENT

16.2.2.1. HOSPITAL BEDS

16.2.2.1.1. MANUAL HOSPITAL BEDS

16.2.2.1.2. SEMI-ELECTRIC HOSPITAL BEDS

16.2.2.1.3. FULLY ELECTRIC HOSPITAL BEDS

16.2.2.1.4. ICU BEDS

16.2.2.1.5. OTEHRS

16.2.2.2. PATIENT LIFTS

16.2.2.2.1. CEILING LIFTS

16.2.2.2.2. MOBILE FLOOR LIFTS

16.2.2.2.3. SIT-TO-STAND LIFTS

16.2.2.2.4. OTHERS

16.2.2.3. TRANSFER AIDS

16.2.2.3.1. STAIR LIFTS

16.2.2.3.2. WHEELCHAIR RAMPS

16.2.2.3.3. TRANSFER BOARDS

16.2.3 RESPIRATORY THERAPY EQUIPMENT

16.2.3.1. OXYGEN THERAPY EQUIPMENT

16.2.3.1.1. OXYGEN CONCENTRATORS

16.2.3.1.1.1 STATIONARY OXYGEN CONCENTRATORS

16.2.3.1.1.2 PORTABLE OXYGEN CONCENTRATORS (POC)

16.2.3.1.1.3 HIGH-FLOW OXYGEN CONCENTRATORS

16.2.3.1.2. OXYGEN CYLINDERS & TANKS

16.2.3.1.2.1 REFILLABLE OXYGEN CYLINDERS

16.2.3.1.2.2 LIQUID OXYGEN TANKS

16.2.3.1.2.3 PORTABLE OXYGEN SYSTEMS

16.2.3.2. VENTILATION EQUIPMENT

16.2.3.2.1. CPAP (CONTINUOUS POSITIVE AIRWAY PRESSURE) MACHINES

16.2.3.2.2. BIPAP (BILEVEL POSITIVE AIRWAY PRESSURE) MACHINES

16.2.3.2.3. HOME MECHANICAL VENTILATORS

16.2.3.2.4. TRANSPORT VENTILATORS

16.2.3.2.5. ICU-GRADE VENTILATORS

16.2.3.3. NEBULIZERS & AIRWAY CLEARANCE DEVICES

16.2.3.3.1. JET NEBULIZERS

16.2.3.3.2. ULTRASONIC NEBULIZERS

16.2.3.3.3. MESH NEBULIZERS

16.2.3.4. AIRWAY CLEARANCE DEVICES

16.2.3.4.1. COUGH ASSIST MACHINES

16.2.3.4.2. CHEST PERCUSSION VESTS

16.2.3.5. REHABILITATION & PHYSIOTHERAPY EQUIPMENT

16.2.3.5.1. PHYSICAL THERAPY EQUIPMENT

16.2.3.5.1.1 RESISTANCE BANDS & THERAPY BALLS

16.2.3.5.1.2 TENS (TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION) MACHINES

16.2.3.5.1.3 HYDROTHERAPY EQUIPMENT

16.3 ELECTRONIC MEDICAL EQUIPMENT

16.3.1 DIAGNOSTIC & MONITORING DEVICES

16.3.1.1. IMAGING EQUIPMENT

16.3.1.1.1. PORTABLE X-RAY MACHINES

16.3.1.1.2. ULTRASOUND MACHINES

16.3.1.1.3. MRI MACHINES

16.3.1.1.4. CT SCANNERS

16.3.1.2. VITAL SIGNS MONITORING DEVICES

16.3.1.3. BLOOD PRESSURE MONITORS

16.3.1.3.1. ECG MACHINES

16.3.1.3.2. EEG MACHINES

16.3.1.3.3. PULSE OXIMETERS

16.3.1.4. WEARABLE HEALTH DEVICES

16.3.1.5. SMARTWATCHES WITH HEALTH TRACKING

16.3.1.6. WEARABLE ECG MONITORS

16.3.2 SURGICAL & THERAPEUTIC EQUIPMENT

16.3.2.1. SURGICAL INSTRUMENTS

16.3.2.1.1. ELECTROSURGICAL UNITS (ESUS)

16.3.2.1.2. LAPAROSCOPIC INSTRUMENTS

16.3.2.1.3. ANESTHESIA MACHINES

16.3.2.2. INFUSION & DRUG DELIVERY DEVICES

16.3.2.2.1. INFUSION PUMPS

16.3.2.2.1.1 VOLUMETRIC INFUSION PUMPS

16.3.2.2.1.2 SYRINGE INFUSION PUMPS

16.3.2.2.1.3 PCA (PATIENT-CONTROLLED ANALGESIA) PUMPS

16.3.2.2.2. INSULIN PUMPS

16.3.3 HOME HEALTHCARE & TELEMEDICINE EQUIPMENT

16.3.3.1. HOME DIALYSIS EQUIPMENT

16.3.3.1.1. HEMODIALYSIS MACHINES

16.3.3.1.2. PERITONEAL DIALYSIS MACHINES

16.3.3.2. REMOTE PATIENT MONITORING (RPM) DEVICES

16.3.3.2.1. CONNECTED ECG

16.3.3.2.2. SMART GLUCOSE MONITORS

16.4 STORAGE & TRANSPORT EQUIPMENT

16.4.1 MEDICAL STORAGE SOLUTIONS

16.4.1.1. MEDICAL REFRIGERATION UNITS

16.4.1.1.1. MEDICAL FREEZERS

16.4.1.1.2. VACCINE REFRIGERATORS

16.4.1.1.3. BLOOD STORAGE REFRIGERATORS

16.4.1.2. STERILE STORAGE SOLUTIONS

16.4.1.2.1. AUTOCLAVE CABINETS

16.4.1.2.2. MEDICAL CARTS

16.4.1.2.3. SHELVING SYSTEMS

16.4.2 PATIENT TRANSPORT EQUIPMENT

16.4.2.1. AMBULANCE STRETCHERS

16.4.2.1.1. MANUAL STRETCHERS

16.4.2.1.2. HYDRAULIC STRETCHERS

16.4.2.1.3. ELECTRIC STRETCHERS

16.4.2.1.4. PEDIATRIC STRETCHERS

16.4.2.2. WHEELCHAIR VANS & MOBILITY VEHICLES

16.4.2.2.1. MODIFIED VANS

16.4.2.2.2. AMBULANCES WITH LIFTS

16.5 OTHER

17. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, BY PAYMENT MODEL

17.1 OVERVIEW

17.2 OUT-OF-POCKET PAYMENTS

17.3 INSURANCE-COVERED RENTALS

17.4 GOVERNMENT-FUNDED PROGRAMS

17.5 CORPORATE & INSTITUTIONAL LEASING

18. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, BY BUSINESS MODEL

18.1 OVERVIEW

18.2 SHORT-TERM RENTAL

18.3 LONG-TERM RENTAL

18.4 LEASE-TO-OWN

18.5 SUBSCRIPTION-BASED MODEL

18.6 PAY-PER-USE MODEL

18.7 OTHERS

19. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, BY END USER

19.1 OVERVIEW

19.2 : PERSONAL/HOME CARE

19.2.1 CHRONIC PATIENTS

19.2.2 GERIATRIC PATIENTS

19.2.3 PREVENTIVE CARE/MONITORING

19.2.4 AND SHORT TERM AND OUTPATIENT CARE

19.3 INSTITUTIONAL

19.4 HOSPITALS & CLINICS

19.4.1 GENERAL HOSPITALS

19.4.2 SPECIALTY CLINICS

19.5 DIAGNOSTIC CENTERS

19.5.1 IMAGING CENTERS

19.5.2 PATHOLOGY LABS

19.6 HOME HEALTHCARE PROVIDERS

19.7 AMBULATORY SURGICAL CENTERS (ASCS)

19.8 LONG-TERM CARE FACILITIES

19.9 REHABILITATION CENTERS

19.10 ELDERLY CARE HOMES

19.11 SPECIALTY CLINICS

19.11.1 ONCOLOGY CLINICS

19.11.2 CARDIOLOGY CLINICS

19.11.3 MEDICAL NURSING HOMES

19.11.4 MEDICAL RESEARCH LABORATORIES/INSTITUTIONS)

19.11.5 OTHERS

20. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, BY COUNTRY

GLOBAL MEDICAL EQUIPMENT RENTAL MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 U.K.

20.2.3 ITALY

20.2.4 FRANCE

20.2.5 SPAIN

20.2.6 RUSSIA

20.2.7 SWITZERLAND

20.2.8 TURKEY

20.2.9 BELGIUM

20.2.10 NETHERLANDS

20.2.11 DENMARK

20.2.12 SWEDEN

20.2.13 POLAND

20.2.14 NORWAY

20.2.15 FINLAND

20.2.16 REST OF EUROPE

20.3 ASIA-PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 SINGAPORE

20.3.6 THAILAND

20.3.7 INDONESIA

20.3.8 MALAYSIA

20.3.9 PHILIPPINES

20.3.10 AUSTRALIA

20.3.11 NEW ZEALAND

20.3.12 VIETNAM

20.3.13 TAIWAN

20.3.14 REST OF ASIA-PACIFIC

20.4 SOUTH AMERICA

20.4.1 BRAZIL

20.4.2 ARGENTINA

20.4.3 REST OF SOUTH AMERICA

20.5 MIDDLE EAST AND AFRICA

20.5.1 SOUTH AFRICA

20.5.2 EGYPT

20.5.3 BAHRAIN

20.5.4 UNITED ARAB EMIRATES

20.5.5 KUWAIT

20.5.6 OMAN

20.5.7 QATAR

20.5.8 SAUDI ARABIA

20.5.9 REST OF MEA

20.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

21. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, SWOT AND DBMR ANALYSIS

22. GLOBAL MEDICAL EQUIPMENT RENTAL MARKET, COMPANY PROFILE

22.1 PRIME MEDICINE

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHIC PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 SOMAGENETIX AG

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHIC PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 ORCHARD THERAPEUTICS

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHIC PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 GÉNÉTHON

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHIC PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 MAXCYTE, INC.

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHIC PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 ROCKET PHARMACEUTICALS

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHIC PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 SANGAMO THERAPEUTICS

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHIC PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 SHENZHEN GENO-IMMUNE MEDICAL INSTITUTE

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHIC PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 MAYO CLINIC

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHIC PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.10 BOSTON CHILDREN'S HOSPITAL

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHIC PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

RECENT DEVELOPMENTS NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

23. RELATED REPORTS

24. CONCLUSION

25. QUESTIONNAIRE

26. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.