Global Medical Fiber Optics Market

Market Size in USD Billion

CAGR :

%

USD

1.11 Billion

USD

1.85 Billion

2024

2032

USD

1.11 Billion

USD

1.85 Billion

2024

2032

| 2025 –2032 | |

| USD 1.11 Billion | |

| USD 1.85 Billion | |

|

|

|

|

Medical Fiber Optics Market Size

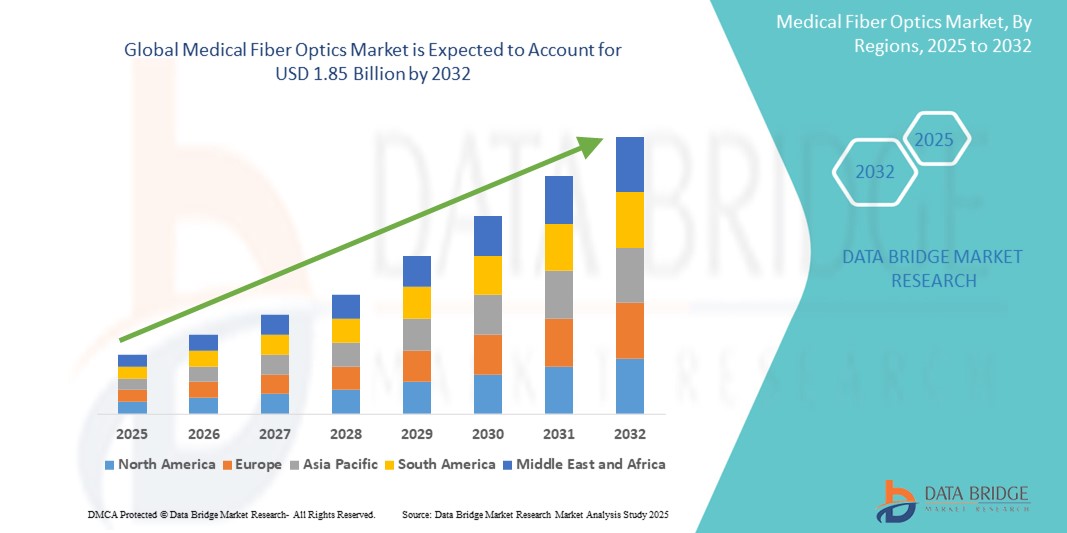

- The global medical fiber optics market size was valued at USD 1.11 billion in 2024 and is expected to reach USD 1.85 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the increasing demand for minimally invasive surgeries and advanced diagnostic procedures, driving the adoption of fiber optic technologies across various medical applications including endoscopy, imaging, and laser delivery systems. The ability of fiber optics to provide high-resolution imaging and precise light transmission in compact and flexible formats makes it indispensable in modern healthcare settings

- Furthermore, the rising need for real-time data transmission, enhanced illumination, and precision in surgical environments is establishing medical fiber optics as a critical component in advanced medical equipment. These converging factors are accelerating the uptake of medical fiber optics solutions, thereby significantly boosting the industry’s growth across hospitals, diagnostic centers, and surgical facilities worldwide

Medical Fiber Optics Market Analysis

- Medical fiber optics, offering high-precision light transmission, are becoming increasingly vital in various healthcare applications such as endoscopy, laser surgeries, phototherapy, and biomedical sensors due to their flexibility, non-electromagnetic interference, and biocompatibility

- The escalating demand for minimally invasive surgeries, advanced diagnostic imaging, and real-time data transmission is primarily fueling the growth of the medical fiber optics market, with hospitals and specialty clinics integrating these technologies to enhance accuracy and patient outcomes

- North America dominated the medical fiber optics market with the largest revenue share of 40.01% in 2024, driven by strong healthcare infrastructure, increasing adoption of advanced medical technologies, and a robust presence of key industry players

- Asia-Pacific is projected to be the fastest-growing region in the medical fiber optics market, expanding at a CAGR of 8.4% from 2025 to 2032, owing to rising healthcare investments, growing demand for minimally invasive procedures, and increasing awareness of advanced medical equipment across China, India, and Southeast Asia

- Pure silica fiber segment dominated the medical fiber optics market with a market share of 47.6% in 2024, driven by its superior thermal stability, high transmission efficiency, and biocompatibility, making it ideal for a wide range of medical applications including endoscopy and laser delivery

Report Scope and Medical Fiber Optics Market Segmentation

|

Attributes |

Medical Fiber Optics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Fiber Optics Market Trends

“Rising Demand for Minimally Invasive Procedures and Precision Diagnostics”

- A significant and accelerating trend in the global medical fiber optics market is the increasing use of fiber optics in minimally invasive surgeries and advanced diagnostic techniques. The ability of fiber optics to transmit light and images through compact, flexible fibers makes them ideal for use in endoscopy, laparoscopy, and other guided imaging procedures

- For instance, medical fiber optic cables are widely used in endoscopes, allowing physicians to visualize internal organs with high clarity while minimizing trauma to the patient. The demand for such procedures continues to rise due to faster recovery times, reduced hospital stays, and growing patient preference for non-invasive treatments

- Fiber optics are also being utilized in laser delivery systems for procedures such as lithotripsy and photodynamic therapy, where precise targeting is essential. Their compatibility with different wavelengths of light and ability to function in challenging environments make them essential in surgical and diagnostic applications

- The integration of medical fiber optics into real-time imaging systems and surgical robots further enhances precision and improves clinical outcomes. In addition, fiber-optic sensors are increasingly used to monitor temperature, pressure, and biochemical markers in various medical environments

- This growing application base across cardiology, oncology, neurology, and gastroenterology is expanding the scope of fiber optics in healthcare. As healthcare providers emphasize early diagnosis, patient safety, and minimally invasive solutions, the role of medical fiber optics is becoming central to innovation in modern medicine

- With continued advancements in fiber materials, miniaturization, and biocompatibility, manufacturers such as SCHOTT AG and Biolitec AG are developing next-generation fiber optic solutions tailored for a wide range of clinical needs. The rising focus on precision medicine and advanced surgical techniques is expected to further accelerate adoption across both developed and emerging healthcare markets

Medical Fiber Optics Market Dynamics

Driver

“Growing Need Due to Rising Demand for Minimally Invasive Procedures and Diagnostic Accuracy”

- The increasing demand for minimally invasive surgical techniques and the growing need for precision diagnostics are significant drivers fueling the adoption of medical fiber optics across the global healthcare sector

- For instance, in April 2024, Boston Scientific Corporation announced a technological enhancement in its endoscopic systems, integrating advanced fiber optic cables to improve image clarity and flexibility during GI procedures. Such initiatives by key market players are expected to accelerate the growth of the medical fiber optics industry during the forecast period

- As healthcare providers increasingly prioritize patient safety, faster recovery, and reduced procedural trauma, the use of fiber optic-based tools such as endoscopes, laparoscopes, and light guides becomes essential. These tools offer superior imaging and maneuverability in confined anatomical regions, making them invaluable in modern surgical environments

- Furthermore, the integration of medical fiber optics in laser-based treatments, such as photodynamic therapy, and in real-time monitoring devices, such as fiber optic sensors for temperature and pressure, is transforming patient care by enabling higher precision and real-time feedback during interventions

- The convenience of flexible design, compatibility with a wide range of medical devices, and the ability to function in delicate internal procedures have made fiber optics a preferred choice for healthcare professionals. With the expansion of outpatient surgical centers and home-based diagnostics, the demand for compact and user-friendly medical fiber optic systems continues to grow

Restraint/Challenge

“High Initial Costs and Technical Complexity”

- The high production and implementation costs associated with advanced medical fiber optics remain a significant barrier to widespread adoption, particularly in low- and middle-income countries. The manufacturing process involves precision engineering, biocompatible materials, and strict quality control, all of which contribute to the elevated costs

- For instance, multi-channel fiber optic cables used in image-guided surgeries or high-intensity laser delivery systems can be prohibitively expensive for smaller healthcare facilities with limited budgets

- Moreover, the technical complexity of integrating fiber optics into existing surgical platforms and diagnostic equipment requires specialized training and infrastructure, which may be lacking in underdeveloped or rural healthcare settings

- The industry must also address maintenance and durability challenges, as repeated sterilization or bending of fiber cables can degrade performance over time. This creates ongoing costs for hospitals and clinics

- To overcome these challenges, manufacturers are increasingly investing in R&D to develop cost-effective, durable, and easy-to-use medical fiber optic solutions. Collaborations with healthcare providers for education and support are also essential to enhance the accessibility and reliability of these technologies across various medical domains

Medical Fiber Optics Market Scope

The market is segmented on the basis of type, fiber type, usage, end user, and application.

• By Type

On the basis of type, the medical fiber optics market is segmented into pure silica fiber, polycrystalline fiber, and polymer optical. The pure silica fiber segment dominated the market with the largest revenue share of 47.6% in 2024, driven by its superior thermal stability, high transmission efficiency, and biocompatibility, making it ideal for a wide range of medical applications including endoscopy and laser delivery.

The polymer optical fiber segment is projected to witness the fastest CAGR of 8.9% from 2025 to 2032, due to its flexibility, ease of handling, and lower cost, making it increasingly suitable for disposable applications and compact medical devices.

• By Fiber Type

On the basis of fiber type, the medical fiber optics market is categorized into single-mode optical fiber and multimode optical fiber. The multimode optical fiber segment accounted for the largest market revenue share of 56.3% in 2024, due to its capability to transmit high optical power and support various illumination and laser delivery procedures in minimally invasive surgeries.

The single-mode optical fiber segment is expected to grow at the fastest CAGR of 7.4% from 2025 to 2032, supported by its high precision, narrow bandwidth, and suitability for high-resolution imaging and diagnostics in ophthalmology and neurology.

• By Usage

Based on usage, the medical fiber optics market is segmented into re-usable and disposable. The re-usable segment held the largest share of 61.2% in 2024, owing to its cost-effectiveness for high-volume institutions and ability to withstand repeated sterilizations without performance degradation.

The disposable segment is anticipated to witness the fastest CAGR of 9.1% during the forecast period, as rising concerns about cross-contamination, infection control, and convenience drive demand for single-use fiber optic tools.

• By End User

On the basis of end user, the medical fiber optics market is segmented into hospitals, ambulatory surgical centers, specialty clinics, contract research organizations (cros), and diagnostic laboratories.

The hospitals segment captured the largest market share of 48.7% in 2024, supported by widespread adoption of fiber optics in surgeries, diagnostics, and advanced imaging across large healthcare facilities.

The ambulatory surgical centers segment is projected to register the fastest CAGR of 8.6% from 2025 to 2032, driven by the rising trend of outpatient procedures and demand for minimally invasive and cost-effective technologies.

• By Application

On the basis of end user, the medical fiber optics market is segmented into image transmission, laser signal delivery, illumination, laser soldering, and fiber optic confocal scanning. The image transmission segment led the market with the highest revenue share of 38.9% in 2024, owing to the essential role of fiber optics in delivering high-resolution real-time images in endoscopy and microscopy.

The laser signal delivery segment is expected to grow at the highest CAGR of 9.3% during the forecast period, driven by the expanding use of laser-based diagnostics and surgical treatments across medical disciplines such as oncology, dermatology, and urology.

Medical Fiber Optics Market Regional Analysis

- North America dominated the medical fiber optics market with the largest revenue share of 40.01% in 2024, driven by rising demand for minimally invasive surgeries, high healthcare spending, and the presence of advanced healthcare infrastructure

- Strong adoption of endoscopy, imaging, and laser-based surgeries, along with key players such as Boston Scientific Corporation and Integra Lifesciences, reinforces North America’s market leadership

- Favorable reimbursement policies and technological advancements in optical diagnostics are further supporting market growth across the region

U.S. Medical Fiber Optics Market Insight

The U.S. medical fiber optics market accounted for 88% of the North American market revenue in 2024, owing to the widespread adoption of fiber-optic-enabled medical devices, robust investment in healthcare R&D, and increasing surgical volumes. Growing demand for high-resolution imaging in procedures such as colonoscopy and laparoscopy, and the integration of laser fiber optics in surgical robotics are boosting market expansion in the U.S.

Europe Medical Fiber Optics Market Insight

The Europe medical fiber optics market held the second-largest revenue share of 28.3% in the global medical fiber optics market in 2024, driven by increasing healthcare modernization and adoption of advanced diagnostic and surgical technologies. The presence of global players such as SCHOTT AG and Biolitec AG, alongside a focus on early disease detection, is spurring demand for fiber optics in Germany, France, and the U.K.

U.K. Medical Fiber Optics Market Insight

The U.K. medical fiber optics market accounted for 22.4% of the European market in 2024, driven by rising investments in digital healthcare and growing use of fiber-optic tools in diagnostics and outpatient procedures. Public sector healthcare innovation, supported by the NHS and technology adoption in specialty clinics, is a key growth catalyst.

Germany Medical Fiber Optics Market Insight

The Germany medical fiber optics market captured a revenue share of 26.1% of the European market in 2024, supported by its highly developed medical device industry, advanced hospital systems, and early integration of fiber optic technologies in surgical applications.

Asia-Pacific Medical Fiber Optics Market Insight

The Asia-Pacific medical fiber optics market is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, with a market revenue share of 21.4% in 2024. Rapid healthcare infrastructure development in countries such as China, Japan, and India, along with growing demand for cost-effective, minimally invasive surgical tools, are propelling regional market growth. Favorable government policies and increasing medical tourism further support adoption.

Japan Medical Fiber Optics Market Insight

The Japan medical fiber optics market accounted for 27.8% of the Asia-Pacific medical fiber optics market in 2024, driven by the country’s strong emphasis on high-tech healthcare solutions and the growing need for non-invasive diagnostic tools for its aging population.

China Medical Fiber Optics Market Insight

The China medical fiber optics market held the largest share of 42.6% in the Asia-Pacific medical fiber Optics market in 2024, fueled by expanding middle-class healthcare spending, government support for domestic medical device manufacturing, and demand for advanced endoscopic and imaging technologies.

Medical Fiber Optics Market Share

The medical fiber optics industry is primarily led by well-established companies, including:

- Newport Corporation (U.S.)

- Coherent Corp. (U.S.)

- Molex LLC (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Fiberoptics Technology Incorporated (U.S.)

- Timbercon, Inc. (U.S.)

- Sunoptic Technologies (U.S.)

- Vitalcor Inc (U.S.)

- TRUMPF (Germany)

- Boston Scientific Corporation (U.S.)

- IPG Photonics Corporation (U.S.)

- Olympus America (U.S.)

- SCHOTT AG (Germany)

- Biolitec AG (Germany)

Latest Developments in Global Medical Fiber Optics Market

- In April 2023, SCHOTT AG, a leading manufacturer of specialty glass and fiber optics, announced the expansion of its medical fiber optic production facility in Germany. The move aims to meet rising global demand for high-performance imaging and illumination components used in endoscopy and minimally invasive surgeries. This strategic investment reinforces SCHOTT’s position in delivering precision optical solutions tailored for next-generation medical technologies

- In March 2023, Boston Scientific Corporation launched a new line of laser fiber delivery systems for its urology portfolio, designed to enhance energy transmission efficiency during procedures such as lithotripsy. These innovations are expected to improve patient outcomes while reducing procedure time, showcasing the role of advanced medical fiber optics in modern surgical interventions

- In February 2023, Integra LifeSciences partnered with Fiberoptics Technology Incorporated (FTI) to co-develop custom fiber bundles for neurosurgical and orthopedic imaging applications. This collaboration emphasizes the industry's shift toward integrated, compact, and high-resolution visualization tools in complex surgical procedures

- In January 2023, Olympus America unveiled a new fiber optic confocal endomicroscopy platform, designed for real-time cellular imaging during endoscopic procedures. The system enhances early cancer detection by allowing clinicians to visualize tissue morphology at the microscopic level without requiring a biopsy

- In January 2023, TRUMPF Medical Systems launched a next-generation laser fiber system for tissue ablation and soft tissue management in cardiovascular surgeries. With improved flexibility and thermal efficiency, the new solution highlights the expanding role of fiber optics in laser-assisted medical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.