Global Medical Gases Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.19 Billion

USD

6.09 Billion

2024

2032

USD

3.19 Billion

USD

6.09 Billion

2024

2032

| 2025 –2032 | |

| USD 3.19 Billion | |

| USD 6.09 Billion | |

|

|

|

|

Medical Gases-Equipment Market Size

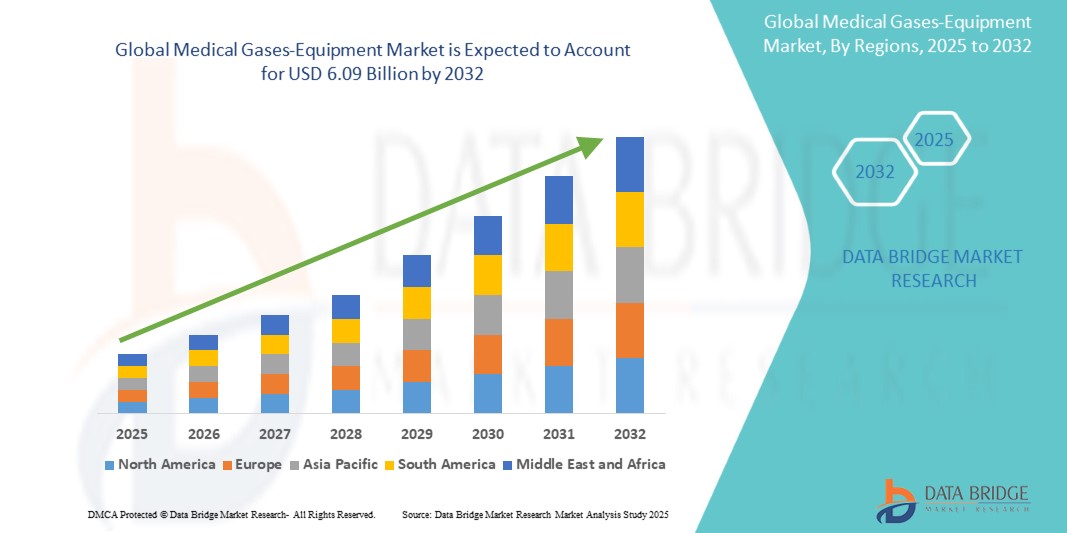

- The global medical gases-equipment market was valued at USD 3.19 billion in 2024 and is expected to reach USD 6.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.0%, primarily driven by the anticipated launch of medical gas equipment

- This growth is driven by factors such as the aging population, increasing prevalence of chronic diseases, and growth in surgical procedures

Medical Gases-Equipment Market Analysis

- The medical gases and equipment sector is a vital component of the healthcare industry, providing essential tools and substances used in various medical treatments, surgeries, and diagnostic procedures

- Medical gases refer to gases specifically manufactured for medical use, including oxygen, nitrous oxide, carbon dioxide, medical air, helium, and nitrogen

- The global medical gases and equipment market is experiencing significant growth, driven by several key factors. One of the primary drivers is the rising prevalence of chronic diseases such as chronic obstructive pulmonary disease (COPD), asthma, and cardiovascular disorders, which has led to a growing demand for therapeutic gases like oxygen and medical air

- The North America region stands out as one of the dominant regions for Medical Gases-Equipment, driven by its advanced healthcare infrastructure, high adoption of advanced technologies, and rise in prevalence of chronic diseases

- For instance, according to NIHCM Foundation, chronic diseases are the leading cause of illness, death, and disability in the U.S., affecting more than half of the population. Approximately 6 in 10 Americans live with at least 1 chronic disease, leading to significant health and economic burdens

- Medical gases are crucial for patient care, especially in respiratory therapy, anesthesia, surgery, and intensive care units (ICUs). For instance, oxygen is widely used for patients with respiratory conditions, while nitrous oxide serves as an anesthetic agent in surgeries and dental procedures

Report Scope and Medical Gases-Equipment Market Segmentation

|

Attributes |

Medical Gases-Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Gases-Equipment Market Trends

“Integration of Smart Technologies in Medical Gas Systems”

- A key emerging trend in the medical gases and equipment market is the integration of smart technologies and IoT (Internet of Things) into gas delivery and monitoring systems. Hospitals and healthcare facilities are increasingly adopting digital gas management systems that can monitor gas flow rates, tank levels, pressure, and leakage in real-time

- These smart systems enhance safety, efficiency, and regulatory compliance by sending alerts in case of anomalies and automatically logging usage data for audits and inventory management

- Moreover, the integration of remote monitoring features allows healthcare providers to track patient usage in homecare settings, reducing the need for in-person checks and enabling timely refills or interventions. This trend reflects a broader shift toward digitized and automated healthcare infrastructure, improving patient outcomes while optimizing operational costs

- For instance, according to an article published in the National Library of Medicine, system integrates sensors, controllers, network protocols, and centralized servers to monitor the quality, pressure, and flow of gases like oxygen and nitrous oxide. Each building should equipped with medical gas sensors that monitor parameters such as gas type, pressure, and leakage

- Therefore, the rise in integration of smart technologies in medical gas systems boost the growth of medical gases-equipment market during the forecast period

Medical Gases-Equipment Market Dynamics

Driver

“Increasing Prevalence and Incidence of Acute Lung Injury”

- Patients with acute lung injuries are being widely reported due to numerous factors such as the increasing aged population and the rising number of patients with sepsis and pneumonia, among others

- However, most people get diagnosed with lung injuries and acute respiratory distress syndrome only at the late stages. The disease is a rapidly progressive condition occurring in patients with damaged lungs, causing bodily fluids to leak

- The number of cases of acute respiratory distress syndrome and lung injuries is increasing due to the emergence of various respiratory illness-causing viruses in recent years

For instance,

- In November 2021, the National Center for Biotechnology Information (NCBI) published an article on "Acute Respiratory Distress Syndrome," which estimated that in the United States, the incident rate ranges from 64.2 to 78.9 cases/per 100,000 people. They reported that 25% of patients were mild cases, whereas the remaining 75% were moderate to severe

- In April 2023, according to the article published by Institute for Health Metrics and Evaluation, chronic respiratory disease is third leading cause of death globally with air pollution killing 1.3 million people

- Thus, the incidence and prevalence of chronic respiratory diseases keep increasing, and the disease has been widely recognized as a major clinical problem worldwide, carrying a high morbidity and mortality burden. Hence, increasing prevalence and incidence rates of acute lung injuries and accompanied acute respiratory distress syndrome is expected to drive market growth

Opportunity

“Rising Demand for Home Healthcare and Portable Devices”

- The global healthcare landscape is undergoing a significant transformation, with a clear shift from hospital-based care to home-based care models. This trend is largely driven by the increasing prevalence of chronic respiratory conditions such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea—especially among the aging population. As a result, there is a growing need for medical gases and equipment that can be safely and efficiently used in non-clinical environments.

- One of the most prominent areas of growth within this trend is the demand for portable oxygen therapy devices. These include portable oxygen concentrators, lightweight gas cylinders, and compact delivery systems designed for easy use by patients in their homes or while traveling. Such devices offer greater mobility, independence, and comfort, particularly for elderly individuals and patients requiring long-term oxygen therapy.

For instance,

- The Global Initiative for Chronic Obstructive Lung Disease (GOLD) has highlighted the importance of accessible respiratory care. The 2023 report emphasizes strategies for COPD management, which include considerations for home-based care, especially in regions like Asia-Pacific where healthcare infrastructure is evolving

- In March 2022, according to an article published in the National Library of Medicine, the Use of Portable Oxygen Concentrators in Low-Resource Settings such as austere locations, military combat zones, rural Emergency Medical Services (EMS), and during disasters is currently increase

- Overall, the demand for user-friendly, reliable, and portable gas delivery systems is expected to grow rapidly in the coming years, making home healthcare one of the most lucrative and impactful segments of the medical gases and equipment market.

Restraint/Challenge

“Stringent Regulatory Requirements and Compliance Standards”

- One major restraint in the medical gases and equipment market is the complex and stringent regulatory landscape governing the production, storage, transportation, and usage of medical gases. Regulatory authorities such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and various national health bodies require manufacturers to adhere to strict quality, purity, and safety standards.

- Compliance involves rigorous certification processes, regular inspections, documentation, and maintenance of safety protocols. For instance, medical gases are classified as pharmaceutical products in many regions, which means they must meet Good Manufacturing Practices (GMP). This adds to the cost, time, and resource burden for manufacturers and distributors, especially smaller players, potentially slowing down innovation and market entry.

- These regulatory hurdles can delay product approvals, restrict international trade, and pose significant barriers for new entrants, thereby restraining overall market growth.

- This substantial financial barrier can deter smaller clinics and hospitals with limited budgets from upgrading their equipment or investing in new technologies, leading to a reliance on outdated tools

For instance,

- In June 2022, the U.S. Food and Drug Administration (FDA) issued multiple warning letters to medical gas manufacturers for failing to comply with Current Good Manufacturing Practices (cGMP). Some companies were cited for issues such as inadequate labeling, failure to properly test gas purity, and improper storage conditions for gases like oxygen and nitrous oxide

- These regulatory violations led to temporary shutdowns of production facilities and product recalls, causing significant financial losses and supply chain disruptions. It also delayed the approval and distribution of new products, impacting patient care in dependent sectors such as emergency services and respiratory therapy

Medical Gases-Equipment Market Scope

The market is segmented on the basis type, application, product, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Product |

|

|

By End-Users

|

|

Medical Gases-Equipment Market Regional Analysis

“North America is the Dominant Region in the Medical Gases-Equipment Market”

- North America dominates the Medical Gases-Equipment market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and strong presence of key market players

- The U.S. holds a significant share due to substantial healthcare spending, rising prevalence of respiratory disease, and rising demand for home healthcare services

- The availability of well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthen the market.

- Additionally, the presence of leading market players and ongoing research and development activities contribute to the U.S.'s prominent position in this sector.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Medical Gases-Equipment market, driven by expanding healthcare infrastructure. Many countries in the region, including India, China, Indonesia, and Vietnam, are significantly increasing investments in healthcare infrastructure. This includes the construction of new hospitals, critical care centers, and the upgrade of existing facilities, which boosts the demand for centralized medical gas supply systems and associated equipment.

- There is a notable rise in the incidence of chronic respiratory illnesses, such as COPD, asthma, and sleep apnea, especially in urban areas with high pollution levels. These conditions require long-term oxygen therapy, driving demand for medical gases and home-care respiratory devices.

- Countries like Japan, South Korea, and China are experiencing a rapidly aging population, increasing the need for elderly care and long-term home healthcare solutions — key segments that rely heavily on portable oxygen equipment and respiratory support systems.

- Governments across the region are implementing healthcare reforms and public-private partnerships to improve access to quality healthcare. Programs aimed at rural healthcare delivery have also increased the distribution of medical gas equipment in remote areas.

Medical Gases-Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Linde plc (Ireland)

- Air Products Inc. (U.S.)

- Air Liquide (France)

- Atlas Copco AB (Sweden)

- Messer SE & Co. KGaA (Germany)

- GCE Group (Sweden)

- Praxair Technology, Inc. (U.S.)

- SOL SpA (Italy)

- MATHESON TRI-GAS, INC. (U.S.)

- Rotarex (Luxembourg)

- Medical Gas Solutions Inc. (United Kingdom)

- Amico Group of Companies (Canada)

- BeaconMedaes (U.S.)

- DCC plc (Ireland)

- TAIYO NIPPON SANSO CORPORATION (Japan)

- Ohio Medical (U.S.)

- Airgas, Inc. (U.S.)

- Allied Healthcare Products, Inc. (U.S.)

Latest Developments in Global Medical Gases-Equipment Market

- In March 2023, Atlas Copco AB acquired the operating assets of FS Medical Technology, a company that specializes in the sale, verification, and testing of piped medical and laboratory gas equipment and systems. This acquisition aligns with Atlas Copco’s strategy to expand its presence in the healthcare sector.

- In January 2023, Atlas Copco AB also acquired MedCore Services Inc., a Canadian company that services piped medical gas equipment, including medical air systems, vacuum systems, and pipeline infrastructure. MedCore serves both public healthcare institutions and private clinics, further expanding Atlas Copco’s footprint in North America.

- In October 2022, ESAB Corporation, a global leader in fabrication and gas control technology, announced the acquisition of Ohio Medical, LLC, a prominent manufacturer of oxygen regulators and centralized gas systems. The acquisition was made from a private investor group for a cash purchase price of $127 million, strengthening ESAB’s position in the medical gas market.

- In July 2020, Air Liquide completed the acquisition of Sasol’s 16 Air Separation Units (ASUs) located in Secunda, South Africa. With this acquisition, Air Liquide now operates the world’s largest oxygen production site, and has committed to reducing its CO₂ emissions by 30% to 40% over the next ten years as part of its sustainability goals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.