Global Medical Grade Titanium Anodization Treatment Market

Market Size in USD Million

CAGR :

%

USD

75.00 Million

USD

203.51 Million

2024

2032

USD

75.00 Million

USD

203.51 Million

2024

2032

| 2025 –2032 | |

| USD 75.00 Million | |

| USD 203.51 Million | |

|

|

|

|

Medical-Grade Titanium Anodization Treatment Market Size

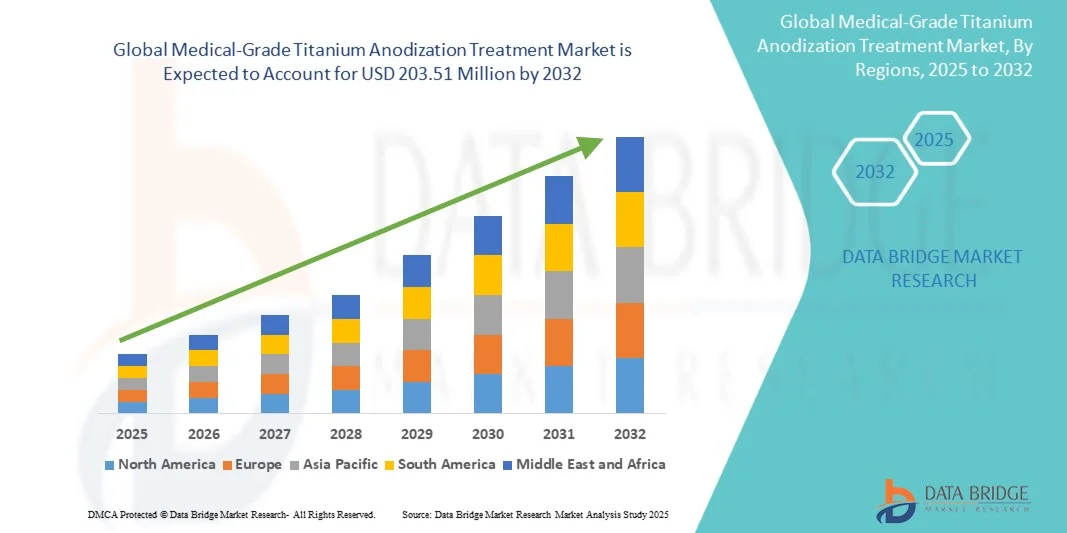

- The global medical-grade titanium anodization treatment market size was valued at USD 75 million in 2024 and is expected to reach USD 203.51 million by 2032, at a CAGR of 13.29% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced surface treatment technologies and ongoing technological innovations in medical-grade titanium anodization. The rising focus on improving biocompatibility, corrosion resistance, and aesthetic quality of titanium-based implants and surgical instruments is driving demand across healthcare and medical device sectors

- Furthermore, growing awareness among healthcare providers and manufacturers regarding the advantages of anodized titanium, such as enhanced durability, reduced infection risk, and customization of color and surface properties, is accelerating the uptake of Medical-Grade Titanium Anodization Treatment solutions. These converging factors are significantly boosting the growth of the industry across hospitals, dental clinics, and specialized medical device manufacturers

Medical-Grade Titanium Anodization Treatment Market Analysis

- Medical-Grade Titanium Anodization Treatment is increasingly adopted in orthopedic, dental, and surgical implants due to its ability to enhance corrosion resistance, biocompatibility, and implant longevity

- Rising demand is fueled by the growing prevalence of chronic conditions requiring implants, increasing preference for advanced surface treatments, and technological innovations in anodization processes

- North America dominated the medical-grade titanium anodization treatment market with the largest revenue share of 46.55% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative implant technologies, and the strong presence of leading medical device manufacturers

- Asia-Pacific is expected to be the fastest-growing region in the medical-grade titanium anodization treatment market during the forecast period, projected to expand at a CAGR from 2025 to 2032, fueled by rising healthcare investments, growing surgical volumes, and increasing disposable incomes in countries such as China and India

- Orthopedic Implants dominated the medical-grade titanium anodization treatment market with a 42.7% revenue share in 2024, driven by the growing incidence of bone fractures, rising demand for joint replacement surgeries, and increasing cases of spinal disorders globally

Report Scope and Medical-Grade Titanium Anodization Treatment Market Segmentation

|

Attributes |

Medical-Grade Titanium Anodization Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical-Grade Titanium Anodization Treatment Market Trends

“Enhanced Convenience Through AI and Advanced Surface Engineering”

- A significant and accelerating trend in the global medical-grade titanium anodization treatment market is the integration of advanced digital technologies such as artificial intelligence (AI), machine learning, and data-driven modeling into surface modification techniques. These innovations are enabling greater precision, consistency, and efficiency in producing medical-grade titanium implants with enhanced biocompatibility and mechanical properties

- For instance, AI-powered platforms are increasingly being used to optimize anodization parameters, including voltage, electrolyte composition, and duration, ensuring reproducible results for applications such as orthopedic and dental implants. By continuously analyzing outcomes, AI systems can recommend adjustments that improve surface uniformity, corrosion resistance, and osseointegration potential

- Machine learning applications are also helping predict long-term implant performance by analyzing vast datasets from clinical trials and laboratory studies. This predictive capability provides manufacturers and healthcare providers with valuable insights into implant longevity and patient outcomes

- Furthermore, AI-enabled monitoring systems are being developed to oversee the anodization process in real time, automatically identifying deviations and correcting them instantly, thereby minimizing human error and maximizing quality assurance

- The integration of these digital solutions with medical-grade titanium anodization is not only streamlining manufacturing but also facilitating the customization of implants for patient-specific needs, such as personalized dental implants or specialized orthopedic devices

- This trend toward digitalization and AI-enabled production is fundamentally reshaping expectations in the medical device industry, pushing companies to adopt more intelligent and automated anodization systems. Consequently, key players are investing heavily in R&D to develop advanced anodization platforms that incorporate AI-driven optimization and predictive analytics

- The growing demand for high-performance implants that combine durability, safety, and biocompatibility is accelerating the uptake of AI-integrated anodization solutions across both established healthcare systems and emerging markets

Medical-Grade Titanium Anodization Treatment Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Chronic Diseases and Surgical Procedures”

- The increasing global burden of orthopedic disorders, dental conditions, and cardiovascular diseases, coupled with the growing number of surgical interventions, is a key driver fueling the demand for medical-grade titanium anodization treatments

- For instance, in March 2024, researchers at the University of California reported advancements in anodization-based surface coatings that improved bone integration in titanium orthopedic implants, highlighting the growing clinical focus on enhancing implant outcomes through innovative treatments

- As the prevalence of fractures, joint replacements, and dental implant surgeries continues to rise, the need for implants with superior biocompatibility, long-term stability, and corrosion resistance is becoming critical. Anodized titanium addresses these needs effectively by creating bioactive surfaces that promote osseointegration and reduce implant failure rates

- Furthermore, the growing geriatric population, who are more prone to degenerative conditions requiring surgical implants, is expanding the demand base for advanced titanium anodization solutions. The trend is reinforced by increasing healthcare expenditure, expansion of specialized surgical centers, and rising patient awareness of implant quality and longevity

- The ability of anodized titanium to combine functional durability with patient safety and regulatory compliance positions it as an essential component in the future of medical implantology and surgical instrumentation

Restraint/Challenge

“Concerns Regarding High Processing Costs and Technical Complexities”

- Despite its benefits, the medical-grade titanium anodization treatment market faces challenges related to the relatively high costs of processing and the technical complexities involved in achieving consistent results across large-scale production

- The anodization process requires strict control over multiple variables such as electrolyte composition, current density, and treatment duration, and deviations can lead to defects or inconsistencies in implant performance. Ensuring reproducibility across high volumes remains a significant technical hurdle

- For instance, research findings published in 2023 highlighted that variations in anodization parameters could impact the uniformity of oxide layers, leading to differences in implant corrosion resistance and bone bonding capability. These challenges necessitate advanced monitoring systems and highly skilled personnel, increasing the overall cost of production

- In addition, the high initial investment required for specialized equipment and cleanroom facilities limits adoption by smaller manufacturers, particularly in developing regions. This creates a barrier for broader industry penetration, despite the growing need for such treatments

- Another concern is the limited awareness among certain healthcare providers and patients regarding the long-term benefits of anodized implants compared to conventional untreated titanium. This knowledge gap can slow adoption in markets where cost remains the primary decision factor

- Overcoming these challenges through the development of cost-efficient processing technologies, broader industry training, and stronger regulatory support will be vital to ensuring sustained market growth and wider accessibility to anodized titanium-based solutions

Medical-Grade Titanium Anodization Treatment Market Scope

The market is segmented on the basis of type, treatment type, application, and end user.

• By Type

On the basis of type, the Medical-Grade Titanium Anodization Treatment market is segmented into Grade 1 Titanium, Grade 2 Titanium, Grade 3 Titanium, Grade 4 Titanium, and Others. The Grade 4 Titanium segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its unmatched combination of mechanical strength, corrosion resistance, and exceptional biocompatibility. These characteristics make it the preferred choice for critical applications such as load-bearing orthopedic implants, spinal fixation devices, and cardiovascular stents where long-term reliability is essential. Its consistent performance under high stress conditions ensures patient safety, while its extensive use in complex surgical instruments and custom implant designs reinforces its stronghold in the market. In addition, the widespread adoption of Grade 4 Titanium by leading manufacturers for premium and high-demand procedures highlights its pivotal role in the medical implant industry.

The Grade 2 Titanium segment is projected to witness the fastest CAGR of 7.3% from 2025 to 2032. This growth is fueled by its moderate mechanical strength, excellent machinability, and versatility, making it particularly suitable for dental implants and minimally invasive surgical applications. The cost-effectiveness of Grade 2 Titanium, combined with its adaptability for customized implant designs, is driving increased adoption among specialty clinics and smaller hospitals. Rising demand in emerging markets for patient-specific implants, coupled with ongoing research to enhance its surface properties for improved clinical outcomes, is further accelerating growth in this segment.

• By Treatment Type

On the basis of treatment type, the market is segmented into Anodic Oxidation, Micro-Arc Oxidation, Electrochemical Anodization, and Others. Anodic Oxidation held the largest revenue share of 41.2% in 2024, owing to its capability to generate uniform oxide layers that significantly enhance surface hardness, wear resistance, and corrosion protection. This treatment also enables color customization, which is highly valued in dental and orthopedic implants for both functional and aesthetic purposes. Its standardized protocols ensure reproducibility and reliability, making it the go-to method for high-volume implant production. The ability of Anodic Oxidation to improve implant lifespan and support complex surgical designs has reinforced its dominant position in the market.

Micro-Arc Oxidation is expected to record the fastest CAGR of 8.1% from 2025 to 2032. The treatment produces highly porous and bioactive oxide layers that promote superior osseointegration, accelerating healing and improving implant stability in orthopedic and cardiovascular applications. Ongoing advancements in coating technologies and increasing adoption of implants requiring enhanced surface bioactivity are driving rapid growth. The rising preference for innovative implants with better clinical outcomes, especially in specialized healthcare centers and research institutions, further strengthens the segment’s growth trajectory.

• By Application

On the basis of application, the market is segmented into Orthopedic Implants, Dental Implants, Cardiovascular Devices, Surgical Instruments, and Others. Orthopedic Implants dominated the market with a 42.7% revenue share in 2024, driven by the growing incidence of bone fractures, rising demand for joint replacement surgeries, and increasing cases of spinal disorders globally. The need for implants that are not only biocompatible but also capable of withstanding high mechanical loads and stress has established anodized titanium as the material of choice in this segment. Its superior corrosion resistance and durability ensure long-term stability within the human body, making it indispensable for orthopedic applications. Furthermore, continuous advancements in implant design, particularly in trauma fixation devices and customized orthopedic solutions developed in hospitals and research centers, further solidify the segment’s dominant position in the market.

Dental Implants are projected to witness the fastest CAGR of 7.6% from 2025 to 2032. Rising rates of tooth loss due to aging populations, periodontal diseases, and trauma are fueling the demand for durable and aesthetically pleasing solutions. Anodized titanium implants are increasingly favored in dentistry for their ability to resist corrosion, promote osseointegration, and allow for color customization that matches natural teeth. In addition, the growth of cosmetic dentistry and the widespread availability of specialized dental clinics are accelerating the adoption of advanced implant solutions. Technological innovations in surface treatments that improve bone bonding and patient comfort are further strengthening the growth outlook for this segment.

• By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, Research Institutes, Dental Clinics, and Others. Hospitals dominated the market with a revenue share of 46.3% in 2024, supported by the large volume of surgical procedures involving titanium-based implants across orthopedics, cardiovascular interventions, and general surgeries. Hospitals are major purchasers of advanced surface-treated implants, as they operate under stringent regulatory frameworks that demand high levels of patient safety and implant reliability. Their ability to adopt innovative anodization techniques on a large scale, along with the presence of multidisciplinary surgical departments and research-driven implant evaluations, has reinforced their dominant role in the market.

Specialty Clinics are expected to witness the fastest CAGR of 7.8% from 2025 to 2032. The rapid growth of these clinics is supported by the rising demand for focused medical services, such as orthopedic, dental, and minimally invasive surgical procedures, where patient-specific and advanced implant solutions are prioritized. Specialty Clinics are increasingly adopting medical-grade anodization technologies to enhance implant longevity, accelerate patient recovery, and provide superior treatment outcomes. Their smaller but highly specialized setups allow for faster implementation of technological innovations and personalized care, driving strong momentum in this segment across both developed and emerging healthcare markets.

Medical-Grade Titanium Anodization Treatment Market Regional Analysis

- North America dominated the medical-grade titanium anodization treatment market with the largest revenue share of 46.55% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative implant technologies, and the strong presence of leading medical device manufacturers

- The region’s growth is further supported by increasing surgical procedures, the rising prevalence of chronic conditions requiring implants, and continuous R&D investments in surface treatment technologies that enhance biocompatibility and durability of titanium-based implants

- Favorable reimbursement policies and a robust regulatory framework also strengthen market penetration, making North America the global leader in the adoption of titanium anodization treatments across orthopedic, dental, and surgical applications

U.S. Medical-Grade Titanium Anodization Treatment Market Insight

The U.S. medical-grade titanium anodization treatment market captured the largest revenue share of 82% in 2024 within North America, fueled by a high volume of implant procedures, advanced healthcare infrastructure, and strong collaborations between medical device companies and research institutions. The U.S. market is further driven by rapid adoption of cutting-edge anodization technologies that improve implant performance, as well as increasing demand for minimally invasive surgeries. The presence of leading manufacturers and continuous clinical innovations position the U.S. as a major contributor to the global market.

Europe Medical-Grade Titanium Anodization Treatment Market Insight

The Europe medical-grade titanium anodization treatment market is projected to expand at a significant CAGR during the forecast period, primarily driven by stringent quality standards in medical devices, rising demand for biocompatible implants, and growing awareness about advanced surface modification techniques. Increasing adoption of titanium anodization in dental, orthopedic, and cardiovascular implants is contributing to market growth. In addition, government support for advanced healthcare technologies and the region’s focus on patient safety and sustainability further foster adoption.

U.K. Medical-Grade Titanium Anodization Treatment Market Insight

The U.K. medical-grade titanium anodization treatment market is anticipated to grow steadily during the forecast period, supported by rising investments in healthcare modernization, increased demand for dental and orthopedic implants, and the strong presence of research institutions advancing biomaterials technology. Concerns over implant failures and the push for longer-lasting, durable solutions are also driving greater adoption of anodized titanium implants across hospitals and specialty clinics.

Germany Medical-Grade Titanium Anodization Treatment Market Insight

The Germany medical-grade titanium anodization treatment market is expected to expand at a notable CAGR during the forecast period, driven by the country’s leadership in advanced manufacturing technologies, precision engineering, and healthcare innovation. Germany’s emphasis on sustainability and eco-conscious medical device production further supports the adoption of titanium anodization. The market benefits from the presence of globally renowned implant manufacturers and the rising use of anodization in orthopedic, dental, and trauma implants.

Asia-Pacific Medical-Grade Titanium Anodization Treatment Market Insight

The Asia-Pacific medical-grade titanium anodization treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by rising healthcare investments, growing surgical volumes, and increasing disposable incomes in emerging economies such as China and India. Rapid urbanization, an aging population, and government support for expanding healthcare infrastructure are accelerating demand. The region’s role as a major hub for medical device manufacturing also boosts accessibility and affordability of advanced anodization treatments.

Japan Medical-Grade Titanium Anodization Treatment Market Insight

The Japan medical-grade titanium anodization treatment market is witnessing strong growth, supported by the country’s technological advancements, high surgical volumes, and a rapidly aging population. The demand for titanium implants with enhanced biocompatibility and durability is increasing, particularly in orthopedic and dental applications. Japan’s strong focus on medical R&D and integration of advanced biomaterial technologies ensures continuous innovation, making it a significant contributor within Asia-Pacific.

China Medical-Grade Titanium Anodization Treatment Market Insight

The China medical-grade titanium anodization treatment market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a rapidly expanding middle class, growing healthcare investments, and rising awareness of advanced implant technologies. China is also home to a strong base of domestic manufacturers producing cost-effective implants with anodization treatments, boosting accessibility for a large patient population. In addition, government initiatives supporting healthcare modernization and the rapid increase in surgical volumes strengthen the country’s position as a dominant force in the regional market.

Medical-Grade Titanium Anodization Treatment Market Share

The medical-grade titanium anodization treatment industry is primarily led by well-established companies, including:

- Renishaw plc (U.K.)

- EOS GmbH (Germany)

- Metoxit AG (Switzerland)

- Advanced Titanium (India)

Latest Developments in Medical-Grade Titanium Anodization Treatment Market

- In September 2023, Paragon Medical announced the acquisition of Industrial Anodizing Inc., a company specializing in titanium Type II and Type III anodizing. This acquisition enhances Paragon’s capability to offer advanced anodization as part of its medical device manufacturing services. Paragon

- In January 2025, Danco Medical (part of Lincotek Group) announced plans to open a second production site in Warsaw, Indiana (U.S.) to expand capacity for anodizing (including titanium) and deep image graphics, adding automation and larger tanks to better support medical device customers

- In July 2024, Danco Medical completed testing and validation of its Color Titanium Anodizing process, laser marking, and passivation for additive-manufactured titanium alloys (i.e. porous or complex structures). This development allows for anodizing of more intricate implant geometries that were previously challenging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.