Global Medical Imaging Agents Market

Market Size in USD Billion

CAGR :

%

USD

11.48 Billion

USD

14.50 Billion

2025

2033

USD

11.48 Billion

USD

14.50 Billion

2025

2033

| 2026 –2033 | |

| USD 11.48 Billion | |

| USD 14.50 Billion | |

|

|

|

|

Medical Imaging Agents Market Size

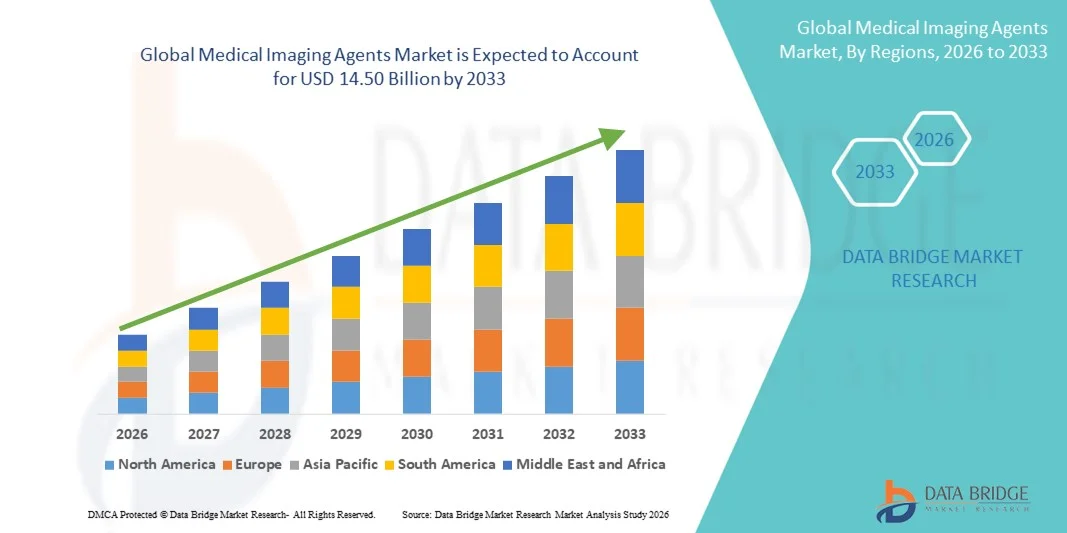

- The global medical imaging agents market size was valued at USD 11.48 billion in 2025 and is expected to reach USD 14.50 billion by 2033, at a CAGR of 2.97% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within diagnostic imaging systems and advanced imaging modalities, leading to increased digitalization and improved diagnostic capabilities in both hospitals and diagnostic centers

- Furthermore, rising demand for accurate, rapid, and non-invasive diagnostic solutions is establishing medical imaging agents as essential components in modern healthcare workflows. These converging factors are accelerating the uptake of medical imaging agents, thereby significantly boosting the industry's growth

Medical Imaging Agents Market Analysis

- Medical imaging agents are contrast agents used to enhance the visibility of internal body structures in diagnostic imaging procedures such as MRI, CT, ultrasound, and nuclear imaging, making them vital for accurate disease diagnosis and monitoring

- The market growth is primarily driven by the rising prevalence of chronic diseases, increasing demand for early diagnosis, and growing adoption of advanced imaging technologies across hospitals and diagnostic centers

- North America dominated the medical imaging agents market with the largest revenue share of approximately 40.0% in 2025, supported by well-established healthcare infrastructure, high healthcare spending, and strong adoption of advanced imaging modalities and contrast agents

- Asia-Pacific is expected to be the fastest-growing region in the medical imaging agents market during the forecast period, driven by increasing healthcare investments, expanding diagnostic imaging facilities, growing prevalence of chronic diseases, and improving access to advanced healthcare services

- Cancer segment dominated the largest market revenue share of 31.2% in 2025, driven by increasing cancer incidence and demand for early diagnosis and treatment monitoring

Report Scope and Medical Imaging Agents Market Segmentation

|

Attributes |

Medical Imaging Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Imaging Agents Market Trends

Enhanced Diagnostic Precision Through AI-Enabled Imaging Platforms

- A significant and accelerating trend in the global medical imaging agents market is the deepening integration of artificial intelligence (AI) with advanced imaging platforms, which is significantly enhancing diagnostic accuracy and clinical decision-making

- For instance, AI-enabled imaging systems can optimize contrast enhancement protocols and improve lesion detection, thereby increasing the diagnostic value of medical imaging agents in oncology and cardiology

- AI integration enables automated image segmentation and quantification, which helps clinicians to track disease progression more accurately and supports personalized treatment planning

- The combination of AI algorithms with imaging agents is also improving workflow efficiency by reducing scan time and minimizing repeat examinations

- This trend towards intelligent imaging analytics is reshaping expectations for diagnostic imaging performance, prompting healthcare providers to invest in AI-compatible contrast media and radiotracers

- Consequently, companies such as GE Healthcare and Siemens Healthineers are expanding AI-enabled imaging solutions that rely heavily on advanced contrast agents for improved clinical outcomes

Medical Imaging Agents Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Diagnostic Imaging Demand

- The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological diseases is a major driver for the medical imaging agents market

- For instance, in March 2024, Bayer AG announced expanded production capacity and R&D investment for its radiology contrast media portfolio to support growing global demand for diagnostic imaging procedures, particularly in oncology and cardiology applications

- Rising demand for early diagnosis and disease monitoring is increasing the need for advanced imaging agents in hospitals and diagnostic centers

- Growing geriatric population and expanding healthcare access in emerging economies are boosting the adoption of diagnostic imaging procedures

- Increasing government initiatives for cancer screening and preventive healthcare programs are driving higher imaging utilization

- The rising number of imaging centers and hospital-based radiology departments is creating strong demand for contrast media and radiopharmaceuticals

Restraint/Challenge

Stringent Regulatory Requirements and High Cost of Imaging Agents

- Stringent regulatory requirements and long approval timelines for contrast agents and radiopharmaceuticals pose a major challenge for market growth

- For instance, regulatory agencies such as the U.S. FDA and the European Medicines Agency (EMA) have intensified post-marketing surveillance and safety evaluations for gadolinium-based contrast agents, increasing compliance costs and approval timelines for manufacturers

- Imaging agents require extensive clinical trials, safety validation, and compliance with strict manufacturing standards, resulting in prolonged development cycles

- High R&D costs and complex manufacturing processes limit market entry for smaller companies and delay product launches

- In addition, the high cost of advanced imaging agents, especially targeted radiopharmaceuticals, can restrict adoption in price-sensitive regions

- Overcoming these challenges through streamlined regulatory pathways and cost-effective manufacturing will be essential for sustained market expansion

Medical Imaging Agents Market Scope

The market is segmented on the basis of isotope, modality, application, and end users.

- By Isotope

On the basis of isotope, the Medical Imaging Agents market is segmented into Technetium, Thallium, Gallium, Iodine, Samarium, Rhenium, Fluorodeoxy Glucose, Rubidium, and Others. Technetium segment dominated the largest market revenue share of 28.4% in 2025, driven by its extensive clinical usage in nuclear medicine and favorable half-life properties. Technetium-99m is widely preferred for diagnostic procedures such as bone scans, cardiac imaging, and renal studies. Its established supply chain and generator systems make it readily available in hospitals and diagnostic centers. Technetium-based agents are known for high image clarity and low radiation exposure. The segment benefits from cost-effectiveness and broad application across multiple clinical areas. Strong clinician familiarity and a proven safety profile further support its dominance. In addition, ongoing research and stable regulatory approvals maintain high adoption rates. The presence of robust nuclear medicine infrastructure in developed regions also strengthens the segment. Technetium remains the standard choice for many routine imaging procedures. Therefore, it held the largest market share in 2025.

The Fluorodeoxy Glucose (FDG) segment is anticipated to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by rising cancer incidence and increasing adoption of PET/CT imaging. FDG is the most widely used PET tracer for oncology applications due to its ability to detect metabolic activity in tumors. Growing investments in cancer diagnosis and treatment centers support FDG demand. Expansion of PET infrastructure in emerging markets further fuels growth. Advancements in radiopharmaceutical manufacturing and distribution also improve accessibility. FDG is increasingly used for therapy monitoring and personalized medicine. The rising prevalence of chronic diseases and aging population further contribute to the segment’s growth. Strong research activities and clinical trials continue to support FDG adoption. Government initiatives promoting cancer screening also boost market expansion. Therefore, FDG is expected to be the fastest-growing isotope segment.

- By Modality

On the basis of modality, the Medical Imaging Agents market is segmented into X-Ray/CT, MRI, Ultrasound, SPECT, and PET. PET segment dominated the largest market revenue share of 34.6% in 2025, owing to its superior sensitivity and accuracy in functional imaging. PET is widely used for oncology, cardiology, and neurology diagnostics, especially for early disease detection and treatment monitoring. The integration of PET/CT and PET/MRI systems has enhanced diagnostic performance and clinical outcomes. Growing demand for precision medicine and targeted therapy supports PET adoption. In addition, increasing availability of PET scanners in hospitals and diagnostic centers drives market growth. PET imaging agents such as FDG have strong clinical acceptance. High investment in cancer diagnosis infrastructure further strengthens the segment. The rising number of cancer cases worldwide increases PET usage. PET is also preferred due to its ability to detect metabolic changes earlier than other modalities. Therefore, PET held the largest market share in 2025.

The MRI segment is expected to witness the fastest CAGR of 16.8% from 2026 to 2033, driven by growing demand for non-invasive imaging with superior soft tissue contrast. MRI is increasingly used in neurology, musculoskeletal, and cardiovascular imaging due to its detailed anatomical visualization. Advances in MRI contrast agents and scanner technologies enhance diagnostic accuracy. Rising chronic disease prevalence and increasing healthcare infrastructure investments support MRI growth. MRI’s radiation-free nature makes it preferable for repeated imaging and pediatric applications. The expansion of MRI facilities in emerging economies further boosts market demand. Integration of AI and improved imaging protocols improves efficiency and outcomes. Therefore, MRI is expected to be the fastest-growing modality segment.

- By Application

On the basis of application, the Medical Imaging Agents market is segmented into Cardiology, Cancer, Gastrointestinal, Musculoskeletal, Neurology, Nephrology, Obstetrics and Gynecology, Pulmonary, Hepatology, and Others. Cancer segment dominated the largest market revenue share of 31.2% in 2025, driven by increasing cancer incidence and demand for early diagnosis and treatment monitoring. Imaging agents play a key role in tumor detection, staging, and therapy response evaluation. PET and SPECT modalities are extensively used in oncology imaging. Rising number of cancer treatment centers and improved access to diagnostic facilities support segment growth. Increasing government initiatives and screening programs for cancer further boost adoption. The availability of advanced radiopharmaceuticals such as FDG contributes to high usage. In addition, growing awareness about cancer detection encourages routine imaging. Oncology remains a priority for healthcare spending globally. Therefore, cancer held the largest market share in 2025.

The Neurology segment is anticipated to witness the fastest CAGR of 17.5% from 2026 to 2033, driven by rising prevalence of neurological disorders such as Alzheimer’s and Parkinson’s disease. Advanced imaging agents help in early detection and monitoring of neurodegenerative conditions. Growing geriatric population and increasing healthcare awareness support segment growth. PET and MRI imaging are commonly used for brain imaging and diagnosis. Increased research and clinical trials in neurology also drive demand for specialized imaging agents. Expansion of diagnostic infrastructure in developing regions further boosts adoption. Therefore, neurology is expected to be the fastest-growing application segment.

- By End Users

On the basis of end users, the Medical Imaging Agents market is segmented into Hospitals and Clinics, Diagnostic Centers, and Academic Institutes & Research Organizations. Hospitals and Clinics segment dominated the largest market revenue share of 45.1% in 2025, due to availability of advanced imaging infrastructure and high patient volumes. Hospitals provide comprehensive diagnostic services including PET, CT, MRI, and SPECT. Presence of specialized radiologists and integrated healthcare systems supports high adoption. Hospitals also perform routine and emergency imaging procedures, driving continuous demand for imaging agents. Large hospitals and multi-specialty clinics have higher capacity for advanced imaging modalities. Government hospitals in emerging regions also contribute significantly to market demand. Therefore, hospitals and clinics remained the dominant end-user segment in 2025.

The Diagnostic Centers segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, driven by rising outpatient imaging demand and growth of standalone diagnostic facilities. Diagnostic centers provide cost-effective and convenient imaging services for patients. Expansion of private diagnostic networks and partnerships increases access to imaging modalities. Rising health insurance coverage and preventive screening programs boost patient visits to diagnostic centers. Many centers are now equipped with PET/CT and MRI scanners, enhancing service offerings. The convenience and affordability of diagnostic centers support rapid market growth. Therefore, diagnostic centers are expected to be the fastest-growing end-user segment.

Medical Imaging Agents Market Regional Analysis

- North America dominated the medical imaging agents market with the largest revenue share of approximately 40.0% in 2025, supported by a well-established healthcare infrastructure, high healthcare expenditure, and strong adoption of advanced diagnostic imaging technologies

- The region benefits from widespread availability of imaging modalities such as MRI, CT, PET, and SPECT, driving consistent demand for contrast agents and radiopharmaceuticals

- High prevalence of chronic diseases, including cancer and cardiovascular disorders, significantly contributes to imaging procedure volumes

U.S. Medical Imaging Agents Market Insight

The U.S. medical imaging agents market accounted for the largest revenue share within North America in 2025, driven by high utilization of advanced imaging procedures and strong clinical demand for accurate diagnostics. The country has a large installed base of MRI, CT, and PET scanners, which fuels consistent consumption of imaging agents. Rising cancer incidence and increasing emphasis on early disease detection further support market growth. In addition, the presence of leading imaging agent manufacturers, robust R&D activities, and rapid regulatory approvals contribute to sustained market expansion. The growing adoption of personalized medicine and molecular imaging techniques is also propelling demand for specialized imaging agents across healthcare facilities.

Europe Medical Imaging Agents Market Insight

The Europe medical imaging agents market is projected to expand at a steady CAGR during the forecast period, driven by increasing diagnostic imaging volumes and rising demand for early disease detection. Strong government healthcare systems and growing investments in medical imaging infrastructure support market growth. The region shows high adoption of MRI and CT imaging, particularly for oncology, neurology, and cardiovascular applications. Technological advancements in contrast agents and radiopharmaceuticals further enhance diagnostic accuracy. In addition, the aging population and rising burden of chronic diseases across European countries continue to drive demand for medical imaging agents in both public and private healthcare settings.

U.K. Medical Imaging Agents Market Insight

The U.K. medical imaging agents market is anticipated to grow at a noteworthy CAGR over the forecast period, supported by increasing diagnostic imaging demand within the National Health Service (NHS). Rising awareness of early diagnosis and preventive healthcare is encouraging higher utilization of imaging procedures. Growth in cancer screening programs and neurological diagnostics further fuels demand for imaging agents. The U.K.’s focus on healthcare modernization and expansion of diagnostic centers supports market development. In addition, increasing adoption of advanced imaging technologies such as PET-CT contributes to sustained market growth.

Germany Medical Imaging Agents Market Insight

The Germany medical imaging agents market is expected to expand at a considerable CAGR during the forecast period, driven by strong healthcare infrastructure and high adoption of technologically advanced imaging systems. Germany is a key hub for medical technology innovation, supporting the development and use of high-quality imaging agents. Rising diagnostic imaging procedures for oncology and cardiovascular diseases contribute significantly to market demand. The country’s emphasis on precision diagnostics and patient safety promotes the adoption of advanced contrast agents. In addition, strong regulatory standards and increasing healthcare investments support long-term market growth.

Asia-Pacific Medical Imaging Agents Market Insight

The Asia-Pacific medical imaging agents market is expected to witness the fastest CAGR during the forecast period of 2026 to 2033, driven by rapidly expanding healthcare infrastructure and increasing healthcare investments. Rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders significantly boosts diagnostic imaging demand. Improving access to advanced healthcare services and growing adoption of imaging modalities such as CT, MRI, and PET support market growth. Government initiatives aimed at strengthening diagnostic capabilities further accelerate adoption. In addition, the expansion of diagnostic centers and hospitals across emerging economies contributes to the region’s rapid growth.

Japan Medical Imaging Agents Market Insight

The Japan medical imaging agents market is gaining steady traction due to the country’s advanced healthcare system and high adoption of diagnostic imaging technologies. Japan has one of the highest densities of imaging equipment globally, supporting strong demand for imaging agents. The aging population significantly drives the need for diagnostic procedures related to oncology, neurology, and cardiovascular diseases. Continuous technological advancements in imaging modalities further enhance diagnostic efficiency. In addition, strong emphasis on early disease detection and preventive care supports sustained market growth across healthcare facilities.

China Medical Imaging Agents Market Insight

The China medical imaging agents market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by rapid expansion of healthcare infrastructure and increasing diagnostic imaging volumes. Rising urbanization and growing healthcare awareness are boosting demand for advanced diagnostic procedures. Government investments in public healthcare and expansion of diagnostic centers further support market growth. Increasing prevalence of chronic diseases and cancer screening initiatives drive the use of imaging agents. Moreover, the presence of domestic manufacturers and improving access to advanced imaging technologies are key factors propelling market expansion in China.

Medical Imaging Agents Market Share

The Medical Imaging Agents industry is primarily led by well-established companies, including:

• GE Healthcare (U.S.)

• Siemens Healthineers (Germany)

• Philips Healthcare (Netherlands)

• Bayer AG (Germany)

• Bracco Imaging (Italy)

• Guerbet (France)

• Lantheus Medical Imaging (U.S.)

• Cardinal Health (U.S.)

• Fujifilm Holdings (Japan)

• Nihon Kohden (Japan)

• Curium (France)

• IBA (Belgium)

• Jubilant Radiopharma (India)

• Nordion (Canada)

• Isologic Innovative Radiopharmaceuticals (Canada)

• Jubilant Pharma (India)

• Bracco Diagnostics (Italy)

• Mallinckrodt Pharmaceuticals (U.S.)

• Sagent Pharmaceuticals (U.S.)

• Ion Beam Applications (Belgium)

Latest Developments in Global Medical Imaging Agents Market

- In November 2021, the U.S. Food and Drug Administration (FDA) approved pafolacianine (Cytalux), a first-in-class optical imaging agent used to assist in the intraoperative detection of certain cancer lesions, enhancing surgical precision in oncology procedures

- In September 2022, Guerbet’s macrocyclic MRI contrast agent Gadopiclenol (Elucirem/Vueway) was approved for medical use in the United States, offering high relaxivity imaging with lower gadolinium exposure compared to traditional agents

- In December 2023, the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion recommending marketing authorization for Vueway (gadopiclenol) MRI contrast agent, further expanding its availability across Europe

- In April 2024, Guerbet announced the first commercial administration of its macrocyclic gadolinium-based contrast agent Elucirem (gadopiclenol) to patients in Germany, marking its initial commercial rollout in the European market

- In April 2024, the FDA approved pegulicianine (Lumisight), an optical imaging agent aiding intraoperative detection of cancerous tissue in breast cancer surgeries, representing a novel therapeutic visualization tool

- In July 2024, Lantheus Medical Imaging introduced its advanced ultrasound contrast agent Definity Vial in India and signed a distribution agreement with J.B. Chemicals & Pharmaceuticals Ltd., expanding regional access to innovative imaging solutions

- In January 2025, GE HealthCare announced the acquisition of a startup specializing in macrocyclic manganese-based MRI contrast agents, aimed at accelerating development of safer, next-generation imaging agents with improved diagnostic profiles

- In March 2025, Taejoon Pharm Co. Ltd. expanded production capacity for iodinated contrast media at its South Korean facility by 15% to meet rising demand in the Asia-Pacific region, reflecting ongoing supply growth to address imaging needs

- In May 2025, Royal Philips launched the RADIQAL (Radiation Dose and Image Quality Trial) study across European and U.S. hospitals to generate real-world evidence on its ultra-low X-ray dose technology used with contrast media in coronary procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.