Global Medical Imaging Phantoms Market

Market Size in USD Billion

CAGR :

%

USD

206.50 Billion

USD

289.19 Billion

2025

2033

USD

206.50 Billion

USD

289.19 Billion

2025

2033

| 2026 –2033 | |

| USD 206.50 Billion | |

| USD 289.19 Billion | |

|

|

|

|

Medical Imaging Phantoms Market Size

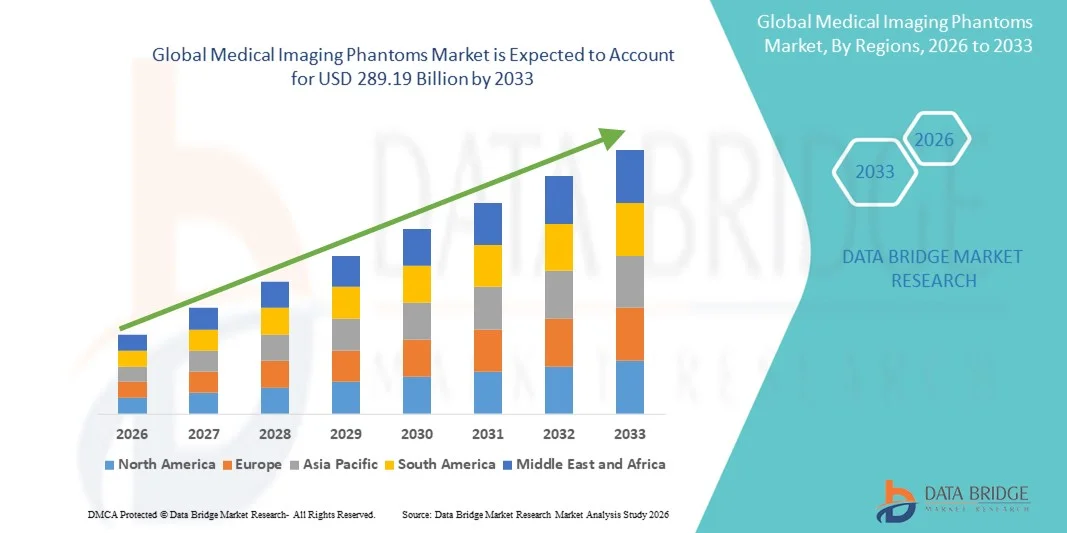

- The global medical imaging phantoms market size was valued at USD 206.5 billion in 2025 and is expected to reach USD 289.19 billion by 2033, at a CAGR of 4.30% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced imaging technologies, such as MRI, CT, and ultrasound, and growing demand for quality assurance and calibration tools in hospitals, diagnostic centers, and research facilities

- Furthermore, rising focus on precision diagnostics, technological advancements in phantom materials, and regulatory emphasis on imaging standardization are accelerating the uptake of Medical Imaging Phantoms solutions, thereby significantly boosting the industry's growth

Medical Imaging Phantoms Market Analysis

- Medical Imaging Phantoms, used for calibration, quality control, and performance evaluation of imaging systems, are increasingly vital components in hospitals, diagnostic centers, and research facilities due to their ability to ensure imaging accuracy, reproducibility, and patient safety

- The escalating demand for medical imaging phantoms is primarily fueled by the growing adoption of advanced imaging modalities, rising healthcare investments, and increased focus on regulatory compliance and precision diagnostics

- North America dominated the Medical Imaging Phantoms market with the largest revenue share of 38.77% in 2025, supported by advanced healthcare infrastructure, high adoption of imaging technologies, and strong research and development activities, with the U.S. experiencing significant growth in phantom usage across hospitals, diagnostic centers, and academic research facilities

- Asia-Pacific is expected to be the fastest-growing region in the Medical Imaging Phantoms market during the forecast period, projected to record a CAGR of 12.4% from 2026 to 2033, driven by rising healthcare expenditures, increasing installation of advanced imaging equipment, and growing research activities in countries such as China, India, and Japan

- The False Organ segment dominated with a revenue share of 38.9% in 2025, due to its ability to closely mimic human tissue, density, and anatomical structures for realistic imaging

Report Scope and Medical Imaging Phantoms Market Segmentation

|

Attributes |

Medical Imaging Phantoms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• IBA Dosimetry (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Imaging Phantoms Market Trends

Growing Need Due to Increasing Diagnostic Accuracy and Advanced Imaging Applications

- The rising demand for high-precision medical imaging and quality control in hospitals, diagnostic centers, and research institutions is a key driver for the Medical Imaging Phantoms market. These phantoms are essential for calibrating, testing, and validating imaging devices such as CT, MRI, ultrasound, and PET systems

- For instance, in March 2023, CIRS launched a new line of multi-modality anthropomorphic phantoms designed to simulate human tissue across CT, MRI, and PET imaging. This innovation enables more accurate device calibration and supports safer, higher-quality diagnostics

- Healthcare providers are increasingly focusing on patient safety and image accuracy, prompting higher adoption of phantoms to ensure devices are performing optimally

- The growing use of advanced imaging modalities in oncology, cardiology, and neurology is further fueling demand, as precise calibration is critical for early disease detection and treatment planning

- In addition, medical training programs and research institutes are incorporating phantoms into their curriculum to allow practical hands-on learning without risk to patients

Medical Imaging Phantoms Market Dynamics

Driver

Increasing Awareness of Standardization and Regulatory Compliance

- Healthcare facilities and imaging device manufacturers are under growing pressure to comply with international standards such as IEC, AAPM, and ISO for imaging device performance

- For instance, in June 2022, Phantom Laboratory released CT and MRI dose measurement phantoms certified to AAPM standards, enabling healthcare providers to validate imaging protocols in compliance with regulatory requirements

- The emphasis on patient safety and reproducibility in clinical studies is encouraging hospitals and research institutions to integrate phantoms into routine workflows

- Continuous monitoring and standardization of imaging devices also reduce operational errors, improve diagnostic outcomes, and minimize risks associated with repeated scans

Restraint/Challenge

High Cost and Limited Accessibility in Emerging Markets

- The relatively high cost of advanced medical imaging phantoms can be a barrier, especially in developing regions or smaller healthcare facilities with limited budgets

- For instance, high-fidelity anthropomorphic phantoms incorporating multi-modality features often come at premium prices, limiting adoption to larger hospitals and research centers

- Availability of phantoms can also be limited in certain regions due to supply chain constraints or lack of local distributors

- To overcome these challenges, companies are developing affordable, modular phantoms and expanding distribution networks, but high upfront costs and maintenance expenses remain key adoption hurdles

- Addressing these limitations through cost-effective solutions, regional partnerships, and educational programs is crucial for sustained growth of the Medical Imaging Phantoms market

Medical Imaging Phantoms Market Scope

The market is segmented on the basis of device type, end-users, and material.

- By Device Type

On the basis of device type, the Medical Imaging Phantoms market is segmented into X-ray/Fluoroscopy Phantoms, Ultrasound Phantoms, CT Phantoms, MRI Phantoms, Nuclear Imaging Phantoms, and Others. The CT Phantoms segment dominated the largest market revenue share of 35.6% in 2025, owing to the increasing use of CT imaging for diagnostic and interventional procedures worldwide. CT phantoms are crucial for calibration, performance testing, and quality assurance of CT scanners, ensuring accurate imaging and radiation dose optimization. Hospitals and diagnostic centers prefer CT phantoms to maintain compliance with regulatory standards and accreditation programs. The segment benefits from rising adoption of multi-slice and advanced CT systems. Increasing imaging procedures in oncology, cardiovascular, and neurological disorders support demand. Continuous innovations in phantom design improve reproducibility and accuracy. Healthcare providers prioritize phantoms for staff training and scanner verification. CT phantom sales are bolstered by growing investments in medical imaging infrastructure. Integration with automated imaging analysis and research applications enhances utility. Emerging markets show strong adoption due to expanding diagnostic capabilities. Long-term contracts with hospitals and imaging centers ensure steady revenue. Demand is also fueled by clinical trials and academic research applications.

The Ultrasound Phantoms segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by the increasing use of ultrasound in point-of-care diagnostics, cardiology, obstetrics, and musculoskeletal imaging. Ultrasound phantoms are widely used for equipment calibration, staff training, and procedure simulations. Rising adoption in emerging markets is supported by cost-effective solutions and portable ultrasound systems. Technological advancements in tissue-mimicking materials improve realism and durability. Growing interest in minimally invasive procedures accelerates usage. Increasing training programs in medical schools and hospitals boost demand. Manufacturers are developing specialized phantoms for advanced imaging applications. Regulatory standards for equipment safety encourage widespread adoption. Integration into clinical workflow simulations enhances user experience. Telemedicine and remote diagnostic training programs support growth. Rising prevalence of chronic diseases drives imaging utilization. Expansion in private diagnostic centers contributes to sales. Online distribution channels facilitate easier procurement.

- By End-Users

On the basis of end-users, the Medical Imaging Phantoms market is segmented into Hospitals, Academic and Research Institutes, Diagnostic and Reference Laboratories, and Medical Device Companies. The Hospitals segment dominated with a revenue share of 46.7% in 2025, owing to the high volume of imaging procedures performed daily and the need for regular calibration and quality assurance. Hospitals rely on phantoms to ensure consistent imaging performance across multiple modalities. Clinical staff training programs increase demand for high-quality phantoms. Hospitals also require phantoms to comply with safety regulations and accreditation standards. Integration into radiology and cardiology departments ensures frequent usage. Investment in advanced imaging technologies further drives adoption. Hospital purchasing contracts often include long-term supply agreements. Phantoms are essential for patient safety and dose optimization. Use in interventional radiology and oncology procedures supports repeat demand. Technological upgrades in imaging equipment increase replacement cycles. Large hospitals and multi-specialty centers dominate consumption.

The Academic and Research Institutes segment is expected to witness the fastest CAGR of 17.5% from 2026 to 2033, driven by increasing investments in medical education, research programs, and imaging technology studies. Research institutions use phantoms for protocol development, training, and validation of new imaging techniques. Growing demand for hands-on training modules enhances adoption. Collaboration with hospitals and medical device companies increases utilization. Phantoms are crucial for evaluating innovative imaging methods and software. Increasing grants and funding for biomedical research support growth. Emerging markets show rising adoption due to expanding medical schools. Integration in simulation-based training programs enhances practical learning. Development of multi-modality phantoms expands research capabilities. Academic partnerships with manufacturers foster new product development. Conferences and workshops promote usage in experimental setups. Digital imaging and AI applications in research drive phantom demand.

- By Material

On the basis of material, the market is segmented into Stimulating Devices and False Organ. The False Organ segment dominated with a revenue share of 38.9% in 2025, due to its ability to closely mimic human tissue, density, and anatomical structures for realistic imaging. False organ phantoms are widely used in hospitals, academic institutions, and research labs for equipment calibration and procedural training. Their adoption is supported by advancements in polymer and gel-based materials that simulate organ properties. False organ phantoms enable accurate radiation dose measurements and image quality verification. Increasing focus on patient safety and procedure optimization drives demand. Integration with multi-modality imaging systems enhances usability. Manufacturers continuously improve organ-specific phantoms for clinical and research applications. Demand is fueled by regulatory requirements for equipment testing. Training programs for radiologists and technicians rely on realistic phantoms. Use in surgical planning and interventional procedures supports repeat purchases. Emerging markets adopt false organ phantoms for teaching and low-cost imaging solutions.

The Stimulating Devices segment is expected to witness the fastest CAGR of 16.8% from 2026 to 2033, driven by the growing need for phantoms that simulate physiological responses such as tissue motion and perfusion. Stimulating devices help train staff in dynamic imaging scenarios. Their use is expanding in advanced MRI, CT, and ultrasound systems. Research applications for testing imaging protocols and AI software accelerate adoption. Integration in training simulators improves hands-on learning experiences. Technological advancements allow customization of stimulation patterns. Rising investments in simulation-based medical education fuel demand. Hospitals and academic institutes adopt stimulating phantoms for procedural rehearsal. Portable and compact stimulating phantoms enable broader accessibility. Use in interventional radiology and cardiology enhances application scope. Manufacturers focus on R&D to enhance realism and durability. The segment benefits from increasing healthcare expenditure and imaging adoption worldwide.

Medical Imaging Phantoms Market Regional Analysis

- North America dominated the medical imaging phantoms market with the largest revenue share of 38.77% in 2025

- Driven by the presence of advanced healthcare infrastructure, widespread adoption of cutting-edge imaging technologies, and strong research and development activities across both academic and industrial institutions

- Hospitals, diagnostic centers, and research laboratories increasingly rely on phantoms for calibration, quality assurance, and training, strengthening the market’s growth in the region

U.S. Medical Imaging Phantoms Market Insight

The U.S. medical imaging phantoms market accounted for the largest share in North America, fueled by substantial investments in imaging equipment, rigorous regulatory standards for medical diagnostics, and growing demand for precision and reliability in imaging procedures. Additionally, the country’s strong focus on biopharmaceutical research, academic research funding, and advanced hospital networks further drives the adoption of medical imaging phantoms.

Europe Medical Imaging Phantoms Market Insight

The Europe medical imaging phantoms market is projected to expand at a significant CAGR during the forecast period, primarily supported by increasing utilization of advanced imaging systems, stringent regulatory standards for diagnostic accuracy, and a growing focus on research and development across healthcare institutions. European hospitals and academic centers are progressively integrating phantoms into imaging workflows to ensure high-quality patient care and training.

U.K. Medical Imaging Phantoms Market Insight

The U.K. medical imaging phantoms market dominated the European market with the largest revenue share of 36.5% in 2025, bolstered by its robust healthcare system, high adoption of advanced imaging modalities, and strong funding for medical research and academic initiatives. Hospitals, diagnostic centers, and research laboratories increasingly employ phantoms for calibration, quality assurance, and procedural training, establishing the country as a key market leader in Europe.

Germany Medical Imaging Phantoms Market Insight

Germany medical imaging phantoms market is expected to be the fastest-growing country in Europe, projected to record a CAGR of 11.8% from 2026 to 2033. Growth is driven by increasing investments in hospital modernization programs, expansion of diagnostic imaging infrastructure, and a strong emphasis on technological innovation. The rising use of phantoms for staff training, quality control, and validation of complex imaging procedures is accelerating market adoption across clinical and research facilities.

Asia-Pacific Medical Imaging Phantoms Market Insight

The Asia-Pacific medical imaging phantoms market region is expected to be the fastest-growing market during the forecast period, projected to record a CAGR of 12.4% from 2026 to 2033. This growth is fueled by rising healthcare expenditures, expanding installation of advanced imaging equipment, and increasing research and clinical activities in countries such as China, India, and Japan. The region’s expanding hospital infrastructure and growing emphasis on diagnostic accuracy are also contributing to higher adoption of medical imaging phantoms.

China Medical Imaging Phantoms Market Insight

China medical imaging phantoms market held the largest share in the Asia-Pacific market, supported by rapid urbanization, increasing healthcare investments, and government initiatives aimed at modernizing medical infrastructure. Hospitals and research centers are increasingly adopting phantoms to ensure the accuracy, safety, and efficiency of diagnostic imaging.

India Medical Imaging Phantoms Market Insight

India medical imaging phantoms market is expected to be the fastest-growing country in the region, driven by rising healthcare spending, increasing installation of advanced imaging modalities, and growing awareness of patient safety and procedural quality. The expanding network of hospitals, diagnostic centers, and academic institutions is accelerating the demand for medical imaging phantoms across the country.

Medical Imaging Phantoms Market Share

The Medical Imaging Phantoms industry is primarily led by well-established companies, including:

• IBA Dosimetry (Germany)

• Modus Medical Devices (Canada)

• QRM (Germany)

• PTW-Freiburg (Germany)

• Unfors RaySafe (Sweden)

• Phantom Laboratory (U.S.)

• Scandidos (Sweden)

• Fluke Biomedical (U.S.)

• IBA Dosimetry (Switzerland)

• Medical Devices & Imaging Solutions (U.K.)

• Beijing Best Imaging Tech (China)

• Mirion Technologies (U.S.)

• Radiology Support Devices (RSD) (U.S.)

• PTW (Germany)

• RS Medical Imaging Solutions (U.K.)

• IBA Dosimetry (U.S.)

• QRM GmbH (Germany)

Latest Developments in Global Medical Imaging Phantoms Market

- In November 2022, Standard Imaging unveiled an entirely new line of tissue‑equivalent dosimetry and imaging phantoms designed to serve both diagnostic and therapeutic imaging needs. The launch included specialized phantoms for head, thorax, and body applications, as well as dedicated phantoms for MRI geometric distortion checks, CT/SIM QA, and stereotactic radiosurgery (SRS/SBRT) verification. These phantoms allow healthcare professionals to conduct comprehensive quality assurance and calibration of imaging systems, improving diagnostic accuracy and patient safety while streamlining QA workflows in hospitals and research institutions

- In June 2023, Gold Standard Phantoms announced the advancement of the PREDICT project, funded by the European Union’s Horizon Europe / EIC Accelerator program. This project focuses on developing high-fidelity, next-generation imaging phantoms that replicate human tissue more realistically than traditional phantoms. These innovations are expected to enable precise simulation of organ and tissue behavior across multiple imaging modalities, helping hospitals, research labs, and manufacturers improve the performance and reliability of CT, MRI, and PET systems

- In March 2023, Diagnomatic, part of Pro-Project Group, obtained official approval to market the ACR MRI Medium Phantom in compliance with the American College of Radiology (ACR) standards. This phantom is specifically designed for MRI quality assurance, providing precise measurements of geometric distortion, image uniformity, and spatial resolution. The approval highlights the growing emphasis on regulatory compliance and standardized QA procedures in MRI facilities worldwide, ensuring that imaging systems deliver accurate diagnostics while maintaining patient safety

- In July 2024, RSD Radiology Support Devices announced the upcoming launch of multimodality phantoms capable of functioning across CT, MRI, and X-ray platforms. These phantoms are engineered for hospitals and imaging centers to perform quality assurance across multiple modalities without needing separate phantom units for each type of imaging system. This development is particularly significant for large diagnostic centers aiming to optimize operational efficiency, reduce costs, and ensure consistent imaging quality across all equipment

- In December 2024, a market analysis report projected that the global Medical Imaging Phantoms market would reach approximately USD 255.7 million by 2030, driven by rising adoption of advanced imaging technologies, increasing demand for quality assurance, and the expansion of diagnostic infrastructure globally. The forecast underscores the strategic importance of phantoms in hospitals, research facilities, and manufacturing setups to maintain imaging precision, comply with regulatory standards, and improve patient outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.