Global Medical Imaging Workstations Market

Market Size in USD Billion

CAGR :

%

USD

8.02 Billion

USD

15.66 Billion

2024

2032

USD

8.02 Billion

USD

15.66 Billion

2024

2032

| 2025 –2032 | |

| USD 8.02 Billion | |

| USD 15.66 Billion | |

|

|

|

|

Medical Imaging Workstations Market Size

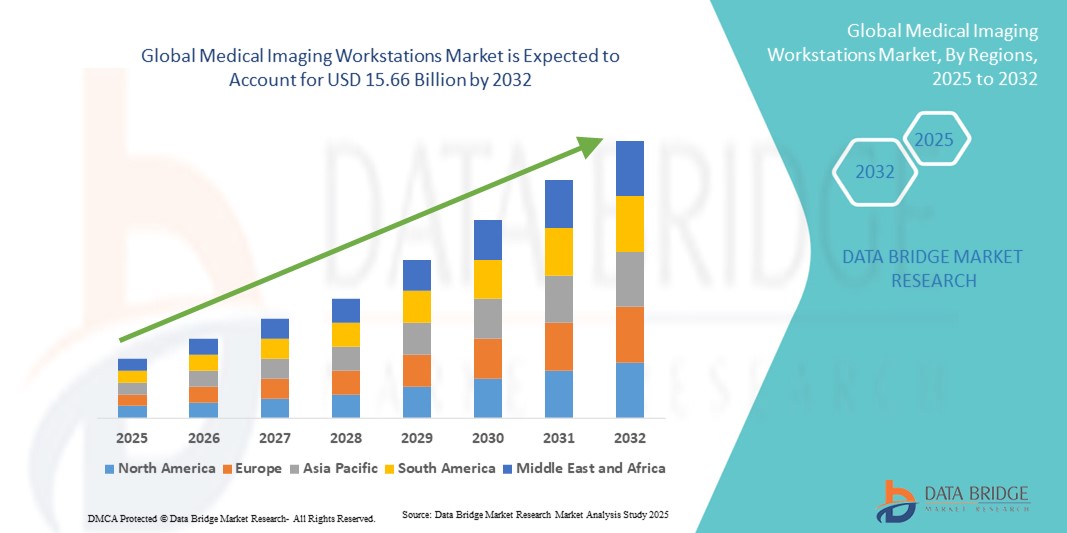

- The global medical imaging workstations market size was valued at USD 8.02 billion in 2024 and is expected to reach USD 15.66 billion by 2032, at a CAGR of 8.72% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging technologies and the integration of sophisticated software platforms, leading to enhanced diagnostic capabilities and workflow efficiency in healthcare facilities

- Furthermore, rising demand for precise, high-resolution imaging and real-time data analysis across hospitals, diagnostic centers, and research institutions is accelerating the uptake of Medical Imaging Workstations solutions, thereby significantly boosting the industry's growth

Medical Imaging Workstations Market Analysis

- Medical Imaging Workstations, providing advanced platforms for viewing, analyzing, and managing medical images, are increasingly vital components of modern healthcare facilities in both hospitals and diagnostic centers due to their high-resolution imaging capabilities, integration with PACS (Picture Archiving and Communication Systems), and support for multi-modality imaging workflows

- The escalating demand for Medical Imaging Workstations is primarily fueled by the rising adoption of advanced imaging techniques such as MRI, CT, PET, and ultrasound, increasing prevalence of chronic diseases, and growing emphasis on accurate and efficient diagnostic workflows

- North America dominated the medical imaging workstations market with the largest revenue share of 42.3% in 2024, supported by high healthcare expenditure, advanced hospital infrastructure, and the presence of leading imaging workstation providers. The U.S. experienced substantial growth in installations, particularly in large hospital networks and specialty diagnostic centers, driven by innovations in software integration, 3D imaging, and real-time image processing solutions. Strong focus on workflow efficiency, early disease detection, and regulatory compliance further reinforce the region’s leadership

- Asia-Pacific is expected to be the fastest-growing region in the medical imaging workstations market during the forecast period, with a high CAGR, driven by rapid urbanization, rising healthcare investments, and growing demand for advanced imaging solutions in countries such as China, India, and Japan. Expansion of hospital networks, government initiatives to improve healthcare infrastructure, and increasing adoption of digital imaging solutions are accelerating market growth across the region

- The Thick Client segment dominated the medical imaging workstations market with a market revenue share of 41.2% in 2024, driven by its high processing power, local data storage, and ability to handle complex multi-modality imaging applications efficiently.

Report Scope and Medical Imaging Workstations Market Segmentation

|

Attributes |

Medical Imaging Workstations Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Imaging Workstations Market Trends

Enhanced Efficiency Through Advanced Imaging Integration

- A significant and accelerating trend in the global medical imaging workstations market is the deepening integration of advanced imaging software, AI-assisted diagnostic tools, and seamless interoperability with hospital PACS (Picture Archiving and Communication Systems) and RIS (Radiology Information Systems). This fusion of technologies is significantly enhancing diagnostic accuracy, workflow efficiency, and patient management across healthcare facilities

- For instance, modern 3D reconstruction workstations enable radiologists to analyze multi-modality images from MRI, CT, and PET scans on a single platform, streamlining complex diagnostic processes. Similarly, advanced imaging suites provide real-time image processing and collaborative reporting features, improving communication between radiologists, surgeons, and referring physicians

- Integration of intelligent software tools allows automated detection of anomalies, prioritization of critical cases, and enhanced image visualization, facilitating faster and more accurate clinical decision-making. Continuous improvements in workstation hardware and software ensure compatibility with emerging imaging modalities and increasing image volumes, supporting hospitals and diagnostic centers in managing high patient throughput

- The seamless integration of medical imaging workstations with electronic health records and digital storage solutions facilitates centralized management of patient imaging data. Clinicians can access historical scans, track disease progression, and share critical findings with colleagues, improving treatment planning and patient outcomes

- This trend towards more efficient, interconnected, and high-performance imaging systems is fundamentally reshaping expectations for diagnostic services. Consequently, companies such as Siemens Healthineers, GE Healthcare, and Philips are developing workstations with advanced image processing, automated reporting, and cloud-enabled features to support modern radiology practices

- The demand for workstations that offer comprehensive imaging analysis, integration with hospital IT infrastructure, and enhanced workflow efficiency is growing rapidly across both hospitals and diagnostic centers, as healthcare providers increasingly prioritize accuracy, speed, and seamless interoperability in patient care

Medical Imaging Workstations Market Dynamics

Driver

Growing Need Due to Increasing Demand for Advanced Diagnostic Capabilities

- The rising prevalence of complex diseases, coupled with the growing demand for accurate and efficient diagnostic imaging, is a significant driver for the heightened adoption of Medical Imaging Workstations. Hospitals and diagnostic centers increasingly require workstations that can handle high-resolution images, multi-modality data, and advanced post-processing tools to support critical clinical decisions

- For instance, in April 2024, Siemens Healthineers introduced its latest Syngo Carbon workstation platform, designed to streamline radiology workflows, enhance image analysis, and enable remote collaboration among clinicians. Such technological advancements by key players are expected to drive significant growth in the Medical Imaging Workstations market during the forecast period

- As healthcare providers aim to improve diagnostic accuracy and patient outcomes, modern imaging workstations offer features such as AI-assisted image reconstruction, automated anomaly detection, and advanced visualization capabilities. These solutions enhance efficiency and reduce diagnostic errors, making them indispensable in hospitals, specialty clinics, and research centers

- Furthermore, the growing adoption of tele-radiology and cloud-based imaging solutions is encouraging healthcare facilities to invest in integrated workstations that allow seamless access to patient imaging data, support remote consultations, and enable real-time reporting across multiple sites

- The need for standardized imaging workflows, compliance with regulatory requirements, and integration with hospital information systems and PACS further propels the adoption of sophisticated Medical Imaging Workstations, ensuring that healthcare providers can meet increasing patient volumes without compromising on quality or efficiency

Restraint/Challenge

Concerns Regarding High Initial Costs and Integration Complexities

- The relatively high capital investment required for advanced medical imaging workstations poses a challenge, particularly for small and mid-sized healthcare facilities. High-end systems with multi-modality support, AI tools, and large storage capacities can be cost-prohibitive, limiting adoption in budget-constrained regions

- For instance, healthcare centers in developing countries may delay or avoid upgrading to modern workstations due to initial costs, even though the long-term benefits include improved diagnostic accuracy and workflow efficiency

- Integration complexities with existing hospital information systems, PACS, and electronic health record platforms can also hinder seamless deployment. Ensuring compatibility across different software and imaging modalities requires substantial planning, training, and IT support

- Addressing these challenges through flexible financing models, modular workstation designs, and vendor-provided integration support is essential to facilitate broader adoption. Additionally, ongoing software updates, user training programs, and scalable solutions can help healthcare facilities maximize the return on investment while enhancing clinical capabilities

- Overcoming cost and integration barriers, while demonstrating the value of enhanced diagnostic accuracy and workflow efficiency, will be vital for sustained growth of the global Medical Imaging Workstations market

Medical Imaging Workstations Market Scope

The market is segmented on the basis of modality, components, usage mode, application, clinical specialty type, and end users.

- By Modality

On the basis of modality, the Medical Imaging Workstations market is segmented into MRI, CT, Ultrasound, Mammography, Direct Digital Radiography, Digital X-Ray Computed Radiography, and Others. The MRI segment dominated the largest market revenue share of 38.6% in 2024, driven by the growing demand for high-resolution imaging for neurological, musculoskeletal, and oncological diagnostics. MRI workstations provide advanced imaging reconstruction, multi-planar visualization, and compatibility with AI-based analysis tools, ensuring precise diagnostics and workflow efficiency. Hospitals and diagnostic centers are increasingly deploying MRI workstations due to the critical role of MRI in early disease detection and complex case management. Continuous upgrades in imaging protocols, software integration, and workstation performance reinforce the leadership of the MRI segment. The segment also benefits from strong vendor support, integration with PACS, and the rising number of MRI installations in emerging regions. MRI workstations are essential for specialty hospitals, academic research centers, and large multi-disciplinary clinics. The growing awareness of non-invasive imaging for early diagnosis further supports market dominance.

The Direct Digital Radiography (DDR) segment is expected to witness the fastest growth at a CAGR of 13.4% from 2025 to 2032, fueled by the need for faster image acquisition, lower radiation exposure, and integration with PACS and hospital information systems. DDR workstations enable quick image review, better workflow efficiency, and support for emergency and high-throughput environments. Increasing adoption in outpatient clinics, orthopedic imaging centers, and emergency departments contributes to rapid market expansion. Technological advancements in high-resolution detectors, real-time image enhancement, and remote access capabilities further support growth. Vendors are introducing compact, cost-effective DDR workstations suitable for small and mid-sized hospitals. The rising preference for digital solutions over analog systems, along with the demand for improved diagnostic speed, reinforces adoption.

- By Components

On the basis of components, the medical imaging workstations market is segmented into visualization software, display units, display controller cards, CPUs, and others. The visualization software segment dominated the largest market revenue share of 36.9% in 2024, driven by its ability to provide advanced image processing, multi-modality integration, and real-time 3D reconstruction capabilities. Hospitals and imaging centers prioritize workstations with powerful visualization software to enhance diagnostic accuracy and streamline workflows. Software updates, AI-assisted analysis, and user-friendly interfaces reinforce the dominance of this segment. Integration with PACS, RIS, and other hospital IT systems ensures operational efficiency. Visualization software also supports multi-disciplinary applications in radiology, cardiology, oncology, and neurology. Continuous investment in research and development by key vendors is enhancing software features, rendering it indispensable for high-end imaging centers. Compatibility with both thin and thick client workstations further strengthens its market position.

The display units segment is expected to witness the fastest growth at a CAGR of 12.8% from 2025 to 2032, fueled by increasing demand for high-resolution, color-accurate monitors that support multi-modality imaging and advanced clinical review. Display units enhance image interpretation, support 3D visualization, and reduce diagnostic errors. The growing adoption of digital imaging and PACS integration is encouraging hospitals to upgrade display technologies. Rising demand in outpatient centers and specialty clinics also supports expansion. Technological advancements such as OLED and 4K resolution panels are improving clinician confidence and workflow efficiency. Vendors are offering ergonomic, large-format monitors tailored for diagnostic accuracy. Increasing awareness of display quality’s role in patient safety and diagnostic confidence further drives adoption.

- By Usage Mode

On the basis of usage mode, the market is segmented into thin client and thick client. The thick client segment dominated the largest market revenue share of 41.2% in 2024, driven by its high processing power, local data storage, and ability to handle complex multi-modality imaging applications efficiently. Hospitals and large diagnostic centers prefer thick clients for tasks requiring real-time processing, 3D reconstruction, and advanced image analysis. Thick client workstations support integration with PACS, RIS, and visualization software, enabling seamless workflow across radiology and specialty departments. High reliability, robust hardware specifications, and compatibility with multiple imaging modalities reinforce market leadership. The segment also benefits from strong vendor presence, widespread adoption in academic hospitals, and critical care facilities. Frequent upgrades and ongoing support services enhance its appeal to large-scale healthcare institutions.

The thin client segment is expected to witness the fastest growth at a CAGR of 13.5% from 2025 to 2032, fueled by increasing adoption of cloud-based and networked imaging solutions. Thin clients reduce IT infrastructure costs, simplify maintenance, and allow remote access to imaging data, supporting telemedicine and distributed diagnostic networks. Hospitals and diagnostic centers in emerging regions are increasingly deploying thin clients to lower capital expenditure. Integration with cloud PACS, AI-assisted diagnostic tools, and web-based access enhances functionality. The segment’s flexibility, scalability, and lower energy consumption make it appealing to both small and medium-sized healthcare facilities. Rising interest in remote consultations and centralized image processing workflows further accelerates adoption globally.

- By Application

On the basis of application, the market is segmented into diagnostic imaging, clinical review, advanced imaging, 3D imaging, and others. The diagnostic imaging segment dominated the largest market revenue share of 39.7% in 2024, driven by the growing demand for accurate, timely, and multi-modality diagnostic solutions across hospitals and imaging centers. Workstations in this segment support high-resolution image analysis, automated reporting, and multi-planar reconstruction. Integration with PACS, RIS, and EMR systems improves workflow efficiency and reduces diagnostic turnaround time. Hospitals and specialty centers prioritize diagnostic imaging workstations for oncology, cardiology, and neurology cases. Continuous software and hardware upgrades, alongside vendor-led support, enhance market leadership. The segment’s dominance is reinforced by increasing patient volumes, expanding hospital networks, and the need for accurate and reproducible imaging results.

The 3D Imaging segment is expected to witness the fastest growth at a CAGR of 14.1% from 2025 to 2032, fueled by rising adoption in surgical planning, oncology, and advanced cardiovascular imaging. 3D imaging workstations provide volumetric reconstructions, multi-angle visualization, and integration with treatment planning systems. The increasing need for precision-guided interventions in hospitals and specialty centers supports market growth. Vendors are offering advanced software algorithms, AI-assisted segmentation, and real-time visualization tools. Growth is further driven by the rising number of complex procedures requiring detailed anatomical visualization. Improved image processing, enhanced user interfaces, and adoption in research hospitals reinforce the segment’s rapid expansion.

- By Clinical Specialty Type

On the basis of clinical specialty type, the market is segmented into cardiology, oncology, general imaging, obstetrics and gynecology, orthopedics, liver, neuro, breast health, urology, and others. The cardiology segment dominated the largest market revenue share of 37.5% in 2024, attributed to the growing prevalence of cardiovascular diseases and the need for precise imaging for early diagnosis and ongoing patient management. Workstations in cardiology support multi-modality imaging, automated analysis, and integration with hospital information systems. Adoption in cardiac care units, specialty heart hospitals, and large diagnostic centers is high due to the criticality of accurate imaging for patient outcomes. Continuous improvements in software, visualization tools, and integration with advanced modalities reinforce market leadership. Training programs, vendor support, and multi-user access enhance operational efficiency. Rising patient awareness and the increasing number of cardiac diagnostic procedures sustain dominance.

The neuro segment is expected to witness the fastest growth at a CAGR of 13.7% from 2025 to 2032, driven by rising prevalence of neurological disorders and increasing demand for high-resolution neuroimaging. Neuro workstations support advanced MRI, CT, and functional imaging analysis for brain mapping, surgical planning, and research applications. Adoption is increasing in academic hospitals, neuroscience centers, and specialized clinics. Vendors are integrating AI-based segmentation, multi-modal image fusion, and real-time visualization features. Expansion of neurology and neurorehabilitation services, alongside government initiatives for neurological disease management, further accelerates growth.

- By End Users

On the basis of end users, the market is segmented into hospitals, diagnostic centers, ambulatory centers, and others. The hospitals segment dominated the largest market revenue share of 42.8% in 2024, driven by high patient volumes, complex imaging requirements, and investment in multi-modality workstations. Hospitals adopt advanced imaging solutions for radiology, cardiology, oncology, and neurology applications. Integration with PACS, RIS, and EMR systems ensures workflow efficiency and accurate diagnosis. Large hospitals and academic centers require high-performance workstations capable of handling advanced imaging, 3D reconstruction, and clinical review tasks. Vendor support, training, and long-term service agreements reinforce the segment’s market leadership. Regulatory compliance and quality assurance standards further drive adoption in this segment.

The diagnostic centers segment is expected to witness the fastest growth at a CAGR of 14.5% from 2025 to 2032, fueled by the increasing number of outpatient diagnostic facilities and the rising demand for advanced imaging technologies. These centers adopt workstations for quick, accurate diagnostics with high patient throughput. Integration with cloud PACS and telemedicine platforms supports remote consultations and multi-location connectivity. The growing emphasis on preventive healthcare, early diagnosis, and cost-effective imaging solutions accelerates adoption. Expansion of specialty centers and rising investments in modern imaging equipment reinforce the segment’s rapid growth trajectory.

Medical Imaging Workstations Market Regional Analysis

- North America dominated the medical imaging workstations market with the largest revenue share of 42.3% in 2024, supported by high healthcare expenditure, advanced hospital infrastructure, and the presence of leading imaging workstation providers

- Strong focus on workflow efficiency, early disease detection, and regulatory compliance further reinforce the region’s leadership

- The adoption of integrated workstations that allow seamless access to multi-modality imaging data and support tele-radiology services is enhancing operational efficiency and clinical outcomes

U.S. Medical Imaging Workstations Market Insight

The U.S. medical imaging workstations market captured the largest revenue share of 68% in 2024 within North America, fueled by the widespread implementation of advanced imaging modalities such as MRI, CT, and PET, and the increasing demand for AI-assisted diagnostic tools. Hospitals and diagnostic centers are prioritizing investments in workstations that provide high-resolution image rendering, automated reporting, and efficient workflow management. The focus on improving diagnostic accuracy, reducing patient turnaround time, and ensuring compliance with healthcare standards is driving robust growth in the U.S. market.

Europe Medical Imaging Workstations Market Insight

The Europe medical imaging workstations market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising healthcare spending, increasing prevalence of chronic diseases, and the need for efficient diagnostic solutions. The adoption of advanced workstations capable of handling large imaging datasets and supporting multi-specialty diagnostics is increasing across hospitals and imaging centers. Integration with hospital information systems (HIS) and PACS platforms, along with emphasis on data security and compliance with EU regulations, further propels growth in the region.

U.K. Medical Imaging Workstations Market Insight

The U.K. medical imaging workstations market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing investments in digital imaging infrastructure, expansion of private and public hospital networks, and rising demand for precise diagnostic capabilities. Advanced workstations with AI-assisted analysis, real-time collaboration features, and multi-modality support are increasingly deployed in radiology departments to improve efficiency and patient outcomes.

Germany Medical Imaging Workstations Market Insight

The Germany medical imaging workstations market is expected to expand at a considerable CAGR during the forecast period, fueled by significant government investments in healthcare infrastructure, emphasis on high-quality diagnostics, and increasing adoption of digital health solutions. Hospitals and specialty diagnostic centers are integrating workstations that provide advanced visualization, 3D reconstruction, and automated reporting, enabling precise diagnostics and better clinical workflow management. Continuous innovation in workstation technology, including software integration and interoperability with hospital systems, supports market growth.

Asia-Pacific Medical Imaging Workstations Market Insight

The Asia-Pacific medical imaging workstations market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising healthcare investments, and increasing demand for advanced imaging solutions in countries such as China, India, and Japan. Expansion of hospital networks, government initiatives to enhance healthcare infrastructure, and growing adoption of digital imaging solutions are accelerating market growth across the region. The region is also witnessing increased installation of multi-modality workstations capable of AI-assisted diagnostics, remote collaboration, and efficient data management, supporting the high growth trajectory.

Japan Medical Imaging Workstations Market Insight

The Japan medical imaging workstations market is gaining momentum due to the country’s advanced healthcare system, high-tech culture, and increasing need for efficient diagnostic imaging. Hospitals and diagnostic centers are adopting workstations that enable real-time image processing, 3D reconstruction, and integration with hospital information systems. Growing awareness about early detection of chronic and age-related diseases is further boosting demand for high-performance imaging workstations in both public and private healthcare facilities.

China Medical Imaging Workstations Market Insight

The China medical imaging workstations market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid expansion of hospital networks, increasing investments in healthcare infrastructure, and rising demand for advanced imaging solutions. Adoption of workstations with high-resolution imaging, automated reporting, and cloud-based collaboration features is increasing across hospitals, diagnostic centers, and specialty clinics. Government initiatives promoting digital healthcare and smart hospital projects, along with the growing middle-class population and high rates of technological adoption, are key factors propelling market growth in China.

Medical Imaging Workstations Market Share

The medical imaging workstations industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V.(Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Carestream Health (U.S.)

- Agfa-Gevaert Group (Belgium)

- Esaote S.p.A. (Italy)

- Sectra AB (Sweden)

- INFINITT Healthcare Co. Ltd. (South Korea)

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- Smith+Nephew (U.K.)

- Boston Scientific Corporation (U.S.)

- Erbe Elektromedizin GmbH (Germany)

Latest Developments in Global Medical Imaging Workstations Market

- In March 2025, GE HealthCare and NVIDIA announced a collaboration to advance autonomous diagnostic imaging. The partnership focuses on developing AI-enabled X-ray and ultrasound systems using NVIDIA's Isaac for Healthcare platform. This initiative aims to enhance diagnostic workflows and reduce clinician workload

- In March 2025, Canon Medical Systems received regulatory clearance for significant AI enhancements to its Aquilion ONE / INSIGHT Edition CT scanner. The upgrades include the PIQE 1024 matrix and SilverBeam technologies, expanding the system's capabilities across a broader range of clinical applications

- In April 2025, Turner Imaging Systems announced its acceptance into NVIDIA's Connect program. This collaboration is set to accelerate the development of AI-powered portable X-ray solutions, aiming to redefine point-of-care diagnostics

- In August 2025, Sectra announced that six Canadian healthcare providers would consolidate imaging with its cloud-based enterprise imaging solution. This move is expected to enhance patient care through improved collaboration and streamlined workflows across multiple sites

- In May 2025, Konica Minolta Healthcare Americas launched the Exa Teleradiology platform. This cloud-based solution is designed to facilitate AI-enhanced teleradiology workflow efficiencies across multiple systems and facilities, aiming to improve the reading experience for remote radiologists

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.