Global Medical Loupes Market

Market Size in USD Million

CAGR :

%

USD

444.91 Million

USD

837.02 Million

2025

2033

USD

444.91 Million

USD

837.02 Million

2025

2033

| 2026 –2033 | |

| USD 444.91 Million | |

| USD 837.02 Million | |

|

|

|

|

Medical Loupes Market Size

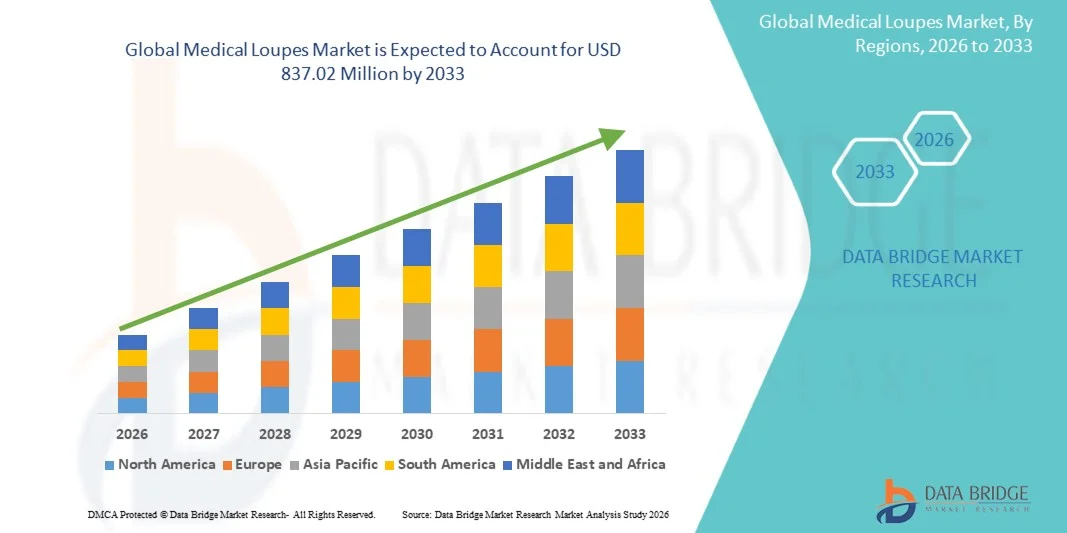

- The global medical loupes market size was valued at USD 444.91 million in 2025 and is expected to reach USD 837.02 million by 2033, at a CAGR of 8.22% during the forecast period

- The market growth is largely fueled by the increasing adoption of magnification devices in surgical, dental, and medical procedures, growing demand for enhanced visualization and ergonomics among healthcare professionals, and ongoing technological advancements in optics and lightweight materials

- Furthermore, rising emphasis on precision and accuracy in minimally invasive procedures, expanding healthcare infrastructure globally, and the preference for ergonomic and customized loupe solutions are driving demand in both clinical and outpatient settings. These converging factors are accelerating the uptake of medical loupes, thereby significantly boosting industry growth over the coming decade

Medical Loupes Market Analysis

- Medical loupes, offering magnified visualization for dental, surgical, and medical procedures, are increasingly vital tools in modern healthcare due to their ability to enhance precision, reduce eye strain, and improve ergonomics for practitioners in both clinical and surgical settings

- The escalating demand for medical loupes is primarily fueled by the growing focus on minimally invasive procedures, rising adoption among dental and surgical professionals, and increasing awareness of the benefits of ergonomically designed magnification devices for long-term health and efficiency

- North America dominated the medical loupes market with the largest revenue share of 39.8% in 2025, characterized by advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and a strong presence of key industry players, with the U.S. witnessing substantial uptake in both hospitals and dental clinics driven by innovations in lightweight, customizable, and LED-integrated loupes

- Asia-Pacific is expected to be the fastest growing region in the medical loupes market during the forecast period due to increasing healthcare investments, rising numbers of dental and surgical professionals, and growing awareness of precision tools in emerging economies

- Surgical segment dominated the medical loupes market with a market share of 45.2% in 2025, driven by their critical role in enhancing accuracy during complex surgical procedures and their widespread adoption among surgeons for improved visualization and patient outcomes

Report Scope and Medical Loupes Market Segmentation

|

Attributes |

Medical Loupes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Loupes Market Trends

“Advancements in Ergonomic and LED-Integrated Loupes”

- A significant and accelerating trend in the global medical loupes market is the adoption of lightweight, ergonomic, and LED-integrated loupes that enhance practitioner comfort, reduce eye strain, and improve precision during procedures

- For instance, the Orascoptic LED loupes feature adjustable magnification with integrated lighting, allowing dentists and surgeons to maintain optimal posture while performing intricate procedures. Similarly, SurgiTel loupes offer customizable ergonomic designs and enhanced illumination for long-duration surgeries

- Advanced optical technologies in modern loupes, such as auto-focus and high-definition optics, enable practitioners to achieve clearer visualization of surgical or dental sites, improving procedural accuracy and patient outcomes. For instance, Designs for Vision loupes utilize high-definition optics combined with LED lighting to deliver consistent magnification and illumination

- The seamless integration of ergonomic design and LED lighting in medical loupes facilitates prolonged use without fatigue, enabling professionals to perform complex procedures more efficiently and safely

- This trend towards more precise, comfortable, and technologically enhanced loupes is fundamentally reshaping expectations among healthcare professionals. Consequently, companies such as Heine and Vision Engineering are developing loupes with adjustable magnification, integrated lighting, and ergonomic frames for superior clinical performance

- The demand for advanced, ergonomic, and LED-equipped medical loupes is growing rapidly across both dental and surgical sectors, as practitioners increasingly prioritize precision, efficiency, and comfort in their procedures

Medical Loupes Market Dynamics

Driver

“Increasing Demand for Precision and Minimally Invasive Procedures”

- The growing emphasis on precision-driven and minimally invasive surgeries is a significant driver for the heightened demand for medical loupes

- For instance, in March 2025, Designs for Vision launched a new LED surgical loupe system aimed at enhancing visibility during microsurgeries, demonstrating how innovation is driving adoption in hospitals and clinics

- Medical loupes provide magnified visualization, reducing procedural errors, improving ergonomics, and supporting better patient outcomes, offering a clear advantage over standard magnification tools

- Furthermore, the increasing adoption of dental and surgical procedures that require high precision is making medical loupes an essential tool for healthcare professionals across various specialties

- Enhanced features such as adjustable magnification, lightweight frames, and integrated lighting enable practitioners to perform complex procedures efficiently, driving continuous market growth

- The expansion of dental and surgical training programs worldwide is further driving demand, as students and professionals seek high-quality magnification tools to improve skill acquisition and procedural accuracy

- Rising awareness of eye health and posture-related ergonomics among healthcare practitioners is encouraging investments in advanced loupes that reduce strain during long procedures, supporting broader adoption

Restraint/Challenge

“High Cost and Training Requirements”

- The relatively high cost of advanced medical loupes, including LED integration and customizable optics, poses a significant challenge to widespread market adoption

- For instance, premium loupes from companies such as SurgiTel or Orascoptic can cost several thousand dollars, making them less accessible to small clinics or practitioners in developing regions

- Additionally, the need for proper training to effectively use magnification devices and maintain correct ergonomic posture can slow adoption among new practitioners

- While some mid-range loupes have become more affordable, the premium pricing of advanced models still limits penetration, particularly among budget-conscious professionals or educational institutions

- Overcoming these challenges through the development of cost-effective, easy-to-use loupes and training programs will be vital for sustained growth and broader adoption in global healthcare settings

- Limited awareness of the long-term benefits of advanced loupes in smaller clinics and rural healthcare settings also constrains market growth, as many practitioners rely on basic magnification tools

- Complexity in maintenance and calibration of high-end loupes, especially LED or camera-integrated models, can deter adoption among users seeking low-maintenance solutions

Medical Loupes Market Scope

The market is segmented on the basis of product type, lens type, application, price category, and sales channel.

- By Product Type

On the basis of product type, the medical loupes market is segmented into Through The Lens (TTL) and Flip-Up Loupes. The TTL segment dominated the market with the largest revenue share of 52% in 2025, driven by its superior optical clarity, lightweight design, and customized fit that allows practitioners to achieve precise focus directly through the lens. TTL loupes are widely preferred in both dental and surgical procedures due to their enhanced ergonomics, reducing neck and back strain during long operations. Hospitals and high-end dental clinics often invest in TTL loupes because they provide consistent magnification, integrated LED lighting options, and compatibility with additional visualization tools such as cameras. The precision and comfort offered by TTL designs make them an essential choice for professionals seeking long-term efficiency and accuracy. Their strong adoption in North America and Europe, where procedural accuracy and ergonomics are highly valued, further consolidates their dominance.

The Flip-Up loupes segment is expected to witness the fastest growth at a CAGR of 8.3% from 2026 to 2035, fueled by its versatility and affordability. Flip-up designs allow users to move the magnifying lenses out of the line of sight when not in use, making them suitable for practitioners who perform a variety of procedures in a single session. Their lower cost compared to TTL loupes encourages adoption among small clinics, educational institutions, and emerging markets. Flip-up loupes are particularly gaining traction in Asia-Pacific due to rising numbers of dental and surgical practices seeking cost-effective yet functional magnification tools. Their modular design, combined with customizable LED attachments, also contributes to their popularity among practitioners who prefer flexibility and ease of use.

- By Lens Type

On the basis of lens type, the medical loupes market is segmented into Galilean and prismatic. The Galilean segment dominated the market with a market share of 60% in 2025, driven by its simple optical design, lightweight construction, and ease of use for general dentistry and basic surgical procedures. Galilean lenses provide adequate magnification for routine work, are easier to maintain, and are cost-effective, making them a preferred choice for both beginners and seasoned practitioners in small and medium-sized clinics. Their wide availability, combined with compatibility with TTL and Flip-Up frames, further strengthens their dominance. Galilean loupes are especially popular in North America due to the preference for ergonomic and low-maintenance optical solutions.

The Prismatic segment is expected to witness the fastest growth at a CAGR of 9.1% from 2026 to 2035, fueled by the demand for high magnification and better depth perception in complex surgical procedures. Prismatic loupes use a sophisticated optical path that provides clearer visualization at higher magnifications while maintaining a comfortable working distance. They are increasingly adopted in microsurgery, periodontology, and endodontic procedures, where precision is critical. Their integration with LED illumination and camera systems also enhances procedural documentation and training applications. Growth in emerging markets, where modern surgical centers are expanding, further accelerates the adoption of prismatic loupes.

- By Application

On the basis of application, the medical loupes market is segmented into dentistry and surgical. The Surgical segment dominated the market with a share of 45.2% in 2025, driven by the adoption of minimally invasive and microsurgical procedures requiring high optical clarity and precision. Surgeons rely on TTL and prismatic loupes with integrated LED lighting for neurosurgery, ophthalmology, ENT, and cardiovascular procedures. Ergonomic benefits, camera integration for training and documentation, and advanced hospital infrastructure in North America and Europe reinforce the dominance of this segment

The Dentistry segment is expected to witness the fastest growth at a CAGR of 8.5% from 2026 to 2035, fueled by increasing demand for precision in restorative, endodontic, and orthodontic procedures. TTL and Flip-Up loupes with LED lighting reduce hand fatigue and improve outcomes. Rising dental clinic numbers, educational programs, and growing awareness of ergonomics and magnification benefits in emerging markets support strong growth. Additionally, awareness of ergonomics and the benefits of magnification for long-term practitioner health is contributing to the rising adoption rate in this segment.

- By Price Category

On the basis of price category, the market is segmented into low, medium, and high. The High-price segment dominated the market with a share of 50% in 2025, due to the premium adoption of advanced TTL and prismatic loupes integrated with LED illumination, ergonomic frames, and camera systems. High-end loupes are favored by dental and surgical professionals seeking maximum optical clarity, durability, and comfort for long-duration procedures. Their adoption is particularly strong in developed regions such as North America and Europe, where precision and ergonomics are prioritized over cost. Professionals view high-end loupes as long-term investments that improve productivity and reduce physical strain.

The Low-price segment is expected to witness the fastest growth at a CAGR of 9% from 2026 to 2035, driven by increasing adoption in emerging markets, small clinics, and dental colleges. Budget-friendly Flip-Up and Galilean loupes enable practitioners to access basic magnification without significant capital expenditure. The rising focus on providing affordable healthcare solutions and training tools is also driving this segment’s growth. Their lightweight and portable nature, coupled with the availability of entry-level LED attachments, makes them highly suitable for first-time buyers and educational purposes.

- By Sales Channel

On the basis of sales channel, the medical loupes market is segmented into online and offline. The Offline segment dominated the market with a market share of 65% in 2025, driven by traditional distribution through dental suppliers, medical equipment distributors, and direct sales to hospitals and clinics. Practitioners often prefer in-person trials to evaluate comfort, optical clarity, and frame fit before purchasing. Offline channels also provide personalized customer support, calibration services, and maintenance, reinforcing their dominance in the global market.

The Online segment is expected to witness the fastest growth at a CAGR of 11% from 2026 to 2035, fueled by e-commerce platforms, manufacturer websites, and B2B marketplaces that make advanced loupes more accessible globally. Online sales allow practitioners in remote areas or emerging markets to order customized TTL or Flip-Up loupes conveniently. Promotions, competitive pricing, and the ability to compare multiple brands online further accelerate adoption. The COVID-19 pandemic and increasing digitalization of healthcare procurement processes have also boosted online sales channels significantly.

Medical Loupes Market Regional Analysis

- North America dominated the medical loupes market with the largest revenue share of 39.8% in 2025, characterized by advanced healthcare infrastructure, high adoption of cutting-edge surgical technologies, and a strong presence of key industry players

- Healthcare professionals in the region highly value the enhanced precision, superior depth perception, and ergonomic benefits offered by TTL and prismatic loupes with integrated LED lighting. The availability of high-end loupes from leading manufacturers and widespread use in both hospitals and dental clinics further supports adoption

- This dominance is reinforced by strong investments in surgical training programs, increasing numbers of microsurgeries, and the integration of loupes with camera systems for documentation and telemedicine. High disposable incomes, technologically advanced healthcare settings, and an emphasis on patient outcomes establish medical loupes as essential tools for both clinical and surgical applications

U.S. Medical Loupes Market Insight

The U.S. medical loupes market captured the largest revenue share of 42% in 2025 within North America, fueled by widespread adoption of precision surgical and dental procedures and the emphasis on ergonomics for practitioners. Healthcare professionals are increasingly prioritizing the use of TTL and prismatic loupes with LED integration to enhance visualization, reduce eye strain, and improve patient outcomes. The growing demand for minimally invasive and microsurgical procedures, coupled with investments in surgical and dental training programs, further propels the market. Additionally, the integration of loupes with camera systems for documentation and telemedicine is significantly contributing to market growth. Strong healthcare infrastructure and high disposable incomes among professionals reinforce the dominance of the U.S. market.

Europe Medical Loupes Market Insight

The Europe medical loupes market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by well-established healthcare systems, increasing numbers of surgical procedures, and the adoption of advanced optical tools. Practitioners are drawn to ergonomic and LED-equipped loupes that provide precision for complex surgeries and dental work. The increase in urbanization, rising hospital investments, and demand for modern training tools foster adoption. European countries such as Germany, France, and Italy are witnessing strong growth in both private and public healthcare facilities, with loupes incorporated into hospitals, dental clinics, and training institutions.

U.K. Medical Loupes Market Insight

The U.K. medical loupes market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of ergonomic benefits, the growing trend of minimally invasive procedures, and a desire for enhanced precision in surgeries and dentistry. Safety and accuracy concerns encourage healthcare professionals to adopt TTL and Flip-Up loupes. The U.K.’s strong healthcare infrastructure, robust medical training programs, and accessibility to advanced optical devices continue to stimulate market growth.

Germany Medical Loupes Market Insight

The Germany medical loupes market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of precision tools and ergonomic practices in surgical and dental fields. Germany’s advanced hospital infrastructure, emphasis on innovation, and adoption of high-quality prismatic and LED-integrated loupes promote market growth. Integration with training programs and camera systems for procedural documentation is also gaining traction. The market reflects a preference for durable, high-performance loupes that support long-duration procedures while maintaining comfort and accuracy.

Asia-Pacific Medical Loupes Market Insight

The Asia-Pacific medical loupes market is poised to grow at the fastest CAGR of 10% during 2026–2035, driven by expanding healthcare infrastructure, rising numbers of dental and surgical professionals, and growing awareness of magnification tools in countries such as China, Japan, and India. The region’s increasing inclination towards modern surgical techniques, supported by government initiatives promoting healthcare development, is driving adoption. Furthermore, emerging markets are seeing growing availability of affordable TTL and Flip-Up loupes, expanding access to both clinical and dental practitioners.

Japan Medical Loupes Market Insight

The Japan medical loupes market is gaining momentum due to high technological adoption, advanced hospital infrastructure, and strong focus on ergonomics and precision in surgical and dental procedures. The Japanese market emphasizes LED-integrated and camera-compatible loupes for improved procedural outcomes and documentation. Aging healthcare professionals and rising demand for user-friendly magnification solutions in both dental and surgical sectors are further boosting adoption.

India Medical Loupes Market Insight

The India medical loupes market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing number of dental and surgical practitioners, and increasing adoption of modern magnification tools. TTL and Flip-Up loupes are becoming standard in hospitals, clinics, and dental colleges. Government initiatives promoting healthcare infrastructure and affordable loupes from domestic manufacturers are key factors propelling market growth. Rising awareness of ergonomic benefits and precision enhancement in procedures further support adoption in both clinical and educational settings.

Medical Loupes Market Share

The Medical Loupes industry is primarily led by well-established companies, including:

- Medi Loupes (U.S.)

- Nanjing Ymarda Optical Instrument Factory (China)

- Designs for Vision, Inc. (U.S.)

- Orascoptic (U.S.)

- Keeler Ltd (U.K.)

- Admetec (U.K.)

- Univet S.r.l. (Italy)

- SheerVision Inc. (U.S.)

- NEITZ INSTRUMENTS Co., Ltd. (Japan)

- Den Mat Holdings, LLC (U.S.)

- Enova Illumination, Inc. (U.S.)

- Xenosys Co., Ltd. (South Korea)

- Rose Micro Solutions (U.S.)

- LumaDent, Inc. (U.S.)

- Optergo AB (Sweden)

- Crystal Optics Co., Ltd. (South Korea)

- ErgonoptiX (France)

- CareMed (South Africa)

- Macto Loupes (UAE)

- The Loupes Company (U.K.)

What are the Recent Developments in Global Medical Loupes Market?

- In March 2025, Carl Zeiss Meditec AG unveiled its latest ZEISS EyeMag medical loupes at the International Dental Show (IDS) 2025, showcasing redesigned optics, multiple magnification options (2.0× to 5×), and ergonomic lightweight frames tailored for microsurgical dentistry and enhanced procedural precision and comfort. This portfolio refresh reinforces ZEISS’s position in advancing loupe technology with customizable and high‑performance visualization solutions

- In November 2024, Ocutrx Technologies, Inc. unveiled its advanced ‘DigiLoupes’ headset at AWE EU 2024 in Vienna, introducing an innovative digital surgical loupe system designed to replace traditional analog loupes with an extended reality (XR)‑enabled device offering surgical and preoperative imaging views, enhanced magnification, and real‑time data overlays to improve visualization and procedural precision for surgeons and dental professionals

- In October 2024, Unify Medical’s “Amplio” digital loupe system was widely recognized as one of TIME magazine’s Best Inventions of 2024, highlighting its wearable advanced visualization platform that delivers microscope‑level clarity and recording capability for surgeons. This acknowledgment underscores significant innovation in surgical visualization and digital loupes for enhanced precision and training applications

- In August 2023, Unify Medical commenced its first clinical trial for wearable surgical visualization technology, marking a key step toward validating and commercializing next‑generation digital loupes and imaging systems designed to enhance surgical accuracy and procedural outcomes

- In July 2023, Unify Medical entered a know‑how agreement with the Mayo Clinic to advance fluorescence‑guided surgical visualization technologies, underscoring a collaborative push to integrate cutting‑edge imaging with loupe‑such as systems to refine real‑time tissue identification during operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.