Global Medical Morphine Market

Market Size in USD Billion

CAGR :

%

USD

24.10 Billion

USD

48.60 Billion

2024

2032

USD

24.10 Billion

USD

48.60 Billion

2024

2032

| 2025 –2032 | |

| USD 24.10 Billion | |

| USD 48.60 Billion | |

|

|

|

|

Medical Morphine Market Size

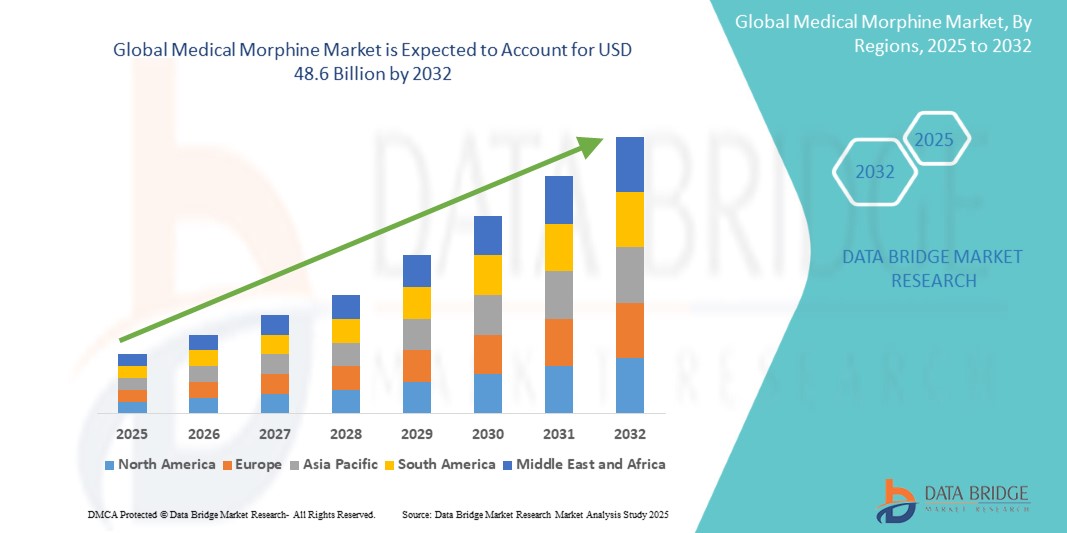

- The Global Medical Morphine Market was valued at USD 24.1 billion in 2024 and is expected to reach USD 48.6 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.6%, primarily driven by rising prevalence of chronic pain conditions

- This growth is driven by factors such as advancements in drug delivery technologies, and increased surgical procedures

Medical Morphine Market Analysis

- Medical morphine is a critical analgesic used for managing moderate to severe pain, particularly in post-operative care, palliative treatment, and chronic pain conditions such as cancer-related pain. It acts directly on the central nervous system to relieve discomfort and improve patient quality of life

- The demand for medical morphine is significantly driven by the rising prevalence of chronic diseases, including cancer, arthritis, and terminal illnesses. The growing global aging population, who are more prone to such conditions, also fuels the market’s expansion

- The North America region stands out as one of the dominant regions for the medical morphine market, supported by strong healthcare systems, high cancer incidence rates, and the widespread use of morphine in pain management protocols

- For instance, the U.S. sees consistently high rates of cancer diagnoses and surgical procedures requiring pain control, making morphine an integral part of clinical practice. From major hospital networks to hospice care, morphine remains a key therapeutic tool across care settings

- Globally, medical morphine is ranked among the top essential medications for pain management by the World Health Organization (WHO), particularly for cancer and end-of-life care, underlining its pivotal role in effective, humane healthcare delivery

Report Scope and Medical Morphine Market Segmentation

|

Attributes |

Medical Morphine Key Market Insights |

|

Segments Covered |

By Route of Administration: Oral, Injectables, Others By Application: Arthritis, Cancer, Myocardial Infarction, Kidney Stones, Diarrhea, Others By End Users: Hospitals and Clinics, Ambulatory Surgical Centers, Homecare, Others By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Morphine Market Trends

“Rising Focus on Patient-Centric Pain Management & Advanced Drug Delivery Systems”

- A notable trend in the medical morphine market is the shift toward patient-centric pain management, where morphine is increasingly integrated into multimodal analgesia protocols to ensure effective and safer outcomes

- Advancements in drug delivery technologies, such as extended-release oral morphine and patient-controlled analgesia (PCA) systems, have enhanced the efficiency and precision of pain management

- For instance, extended-release formulations provide consistent analgesia with fewer side effects, while PCA devices empower patients to manage their own pain within prescribed limits, boosting satisfaction and recovery

- Integration of digital health monitoring with morphine administration is also emerging, enabling clinicians to track dosing, detect complications early, and personalize pain management strategies

- These innovations are not only improving patient outcomes but also addressing concerns related to opioid misuse, making morphine use safer and more targeted in clinical practice

Medical Morphine Market Dynamics

Driver

“Increasing Burden of Chronic and Cancer-Related Pain”

- The rising prevalence of chronic illnesses such as cancer, osteoarthritis, and neuropathy is one of the leading drivers of the global medical morphine market. These conditions often result in severe, persistent pain requiring strong analgesics.

- With aging populations worldwide, there is a growing number of patients requiring long-term pain relief for end-of-life care or age-associated diseases.

- Cancer pain, in particular, remains a significant application area, with morphine being one of the most commonly prescribed opioids under WHO's essential medicines list for palliative care.

➤ For instance, according to the World Health Organization, over 70% of late-stage cancer patients experience pain that often requires opioid treatment, highlighting morphine’s critical role.

➤ In May 2023, the International Agency for Research on Cancer reported that the global cancer burden reached 20 million new cases, emphasizing the increasing demand for effective pain relief options. - As the number of surgical procedures rises globally, morphine remains a frontline solution for post-operative pain management, further reinforcing its relevance in hospital settings and intensive care units.

Opportunity

“Expansion of Palliative Care and Home-Based Pain Management Solutions”

- With the rise in chronic and terminal illnesses, there is growing recognition of the need for comprehensive palliative care services, especially in low- and middle-income countries. Morphine’s affordability and effectiveness make it a cornerstone of such care.

- The expansion of home-based healthcare services also creates new opportunities for morphine use, particularly through transdermal patches and oral sustained-release tablets.

➤ For example, in July 2024, the International Association for Hospice and Palliative Care (IAHPC) emphasized the need to make essential opioids like morphine more accessible in community settings to ensure quality care.

➤ In March 2023, several governments in Africa and Asia initiated efforts to expand morphine distribution through community pharmacies and home-based care networks to address unmet needs in end-of-life care. - Innovations in mobile health platforms and remote patient monitoring are also supporting the safer administration and oversight of morphine therapy at home.

Restraint/Challenge

“Stringent Regulations and Risk of Opioid Abuse”

- One of the major restraints for the global medical morphine market is the strict regulatory framework and increasing scrutiny due to the opioid epidemic, particularly in developed markets like the U.S.

- The potential for misuse, addiction, and overdose has led to tighter control measures, including limited prescription durations, heightened monitoring, and extensive documentation requirements.

➤ For instance, the U.S. Centers for Disease Control and Prevention (CDC) guidelines for prescribing opioids emphasize risk assessment and limit opioid use for chronic pain, affecting morphine accessibility in some cases.

➤ In June 2024, several European countries revised opioid prescribing laws, introducing electronic prescription tracking and restricting high-dose formulations to reduce misuse. - These regulatory challenges can hinder the availability of morphine in certain regions, especially for patients with legitimate medical needs, thereby impacting market growth.

- Additionally, fears of legal repercussions and social stigma may lead some physicians to underprescribe morphine, contributing to undertreated pain and reduced quality of life for patients.

Medical Morphine Market Scope

The market is segmented on the basis route of administration, application, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Route of Administration |

|

|

By Application |

|

|

By End Users |

|

|

By Distribution Channel |

|

Medical Morphine Market Regional Analysis

“North America is the Dominant Region in the Medical Morphine Market”

- North America leads the global medical morphine market, driven by its well-established healthcare systems, widespread use of opioid-based pain management, and high prevalence of chronic diseases and cancer.

- The United States accounts for the largest share, owing to the strong presence of pharmaceutical companies, favorable reimbursement policies, and significant focus on palliative and hospice care.

- The region also benefits from advanced pain management protocols, high healthcare spending, and a growing aging population with increased demand for end-of-life care and chronic pain relief.

- Additionally, the presence of national guidelines for controlled morphine use, combined with robust supply chain networks and trained healthcare professionals, enhances patient access and supports consistent market growth across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to register the fastest growth in the global medical morphine market due to the rising prevalence of cancer and chronic pain-related conditions, particularly among the aging population.

- Countries like India, China, and Japan are driving demand due to evolving pain management practices, increased awareness of palliative care, and growing healthcare infrastructure.

- India, in particular, is seeing policy reforms aimed at improving access to essential opioids for cancer pain and terminal illnesses, supported by initiatives from both the government and non-governmental organizations.

- In China, healthcare reforms and increased availability of opioids in tertiary hospitals are contributing to market expansion, while Japan's advanced medical system and emphasis on quality of life in elderly care fuel consistent morphine usage.

- The overall growth is further supported by collaborations with global pharmaceutical companies, expanding home healthcare services, and greater integration of morphine into public health pain management strategies.

Medical Morphine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Mallinckrodt Pharmaceuticals (U.S)

- Alcaliber S.A (Spain)

- Sanofi (France)

- Johnson Matthey (U.K)

- Northeast Pharmaceutical Group Co., Ltd (China)

- Sun Pharmaceutical Industries Ltd (India)

- Teva Pharmaceutical Industries Ltd (Israel)

- Pfizer Inc (U.S)

- Cipla Inc. (India)

- Mylan N.V. (U.S)

- Fresenius Kabi USA (Germany)

- DAIICHI SANKYO COMPANY (Japan)

- Allergan (U.S)

- Pacira BioSciences, Inc. (U.S)

- Endo Pharmaceuticals Inc. (U.S)

- Tris Pharma, Inc (U.S)

- Purdue Pharma L.P. (U.S)

- VERVE HEALTH CARE LTD. (India)

- Taj Pharmaceuticals Limited (India)

- AbbVie Inc. (U.S)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.