Global Medical Nitrile Gloves Market

Market Size in USD Billion

CAGR :

%

USD

6.45 Billion

USD

17.99 Billion

2025

2033

USD

6.45 Billion

USD

17.99 Billion

2025

2033

| 2026 –2033 | |

| USD 6.45 Billion | |

| USD 17.99 Billion | |

|

|

|

|

Medical Nitrile Gloves Market Size

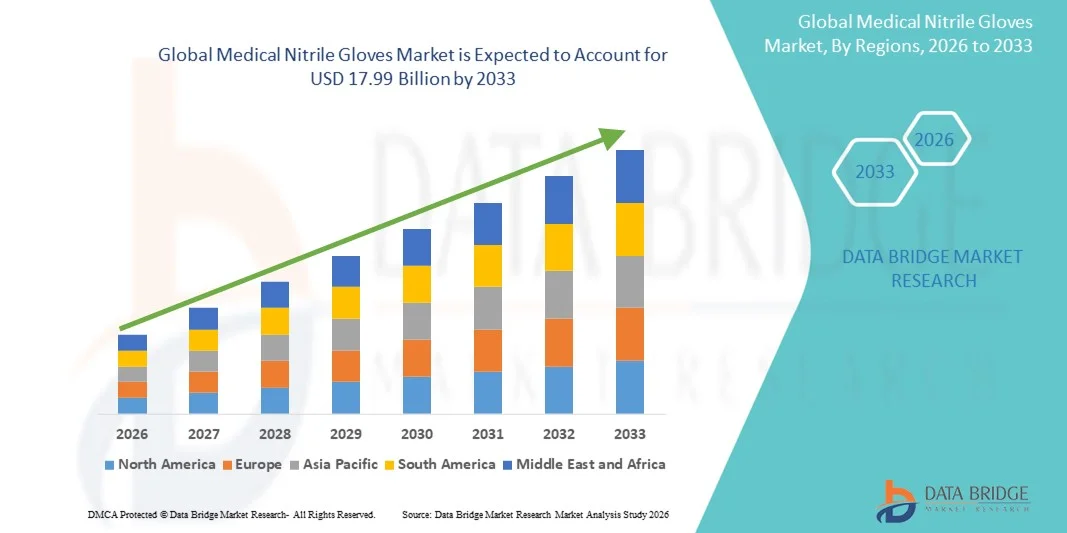

- The global Medical Nitrile Gloves market size was valued at USD 6.45 billion in 2025 and is expected to reach USD 17.99 billion by 2033, at a CAGR of 13.68% during the forecast period

- The market growth is largely fueled by the increasing emphasis on infection prevention and control across healthcare settings, along with the rising number of surgical procedures and routine medical examinations worldwide, which is driving consistent demand for high-quality disposable protective gloves

- Furthermore, growing awareness regarding occupational safety, strict regulatory standards for healthcare worker protection, and the shift from latex to nitrile gloves due to superior puncture resistance and hypoallergenic properties are accelerating the uptake of Medical Nitrile Gloves solutions, thereby significantly boosting the industry’s growth

Medical Nitrile Gloves Market Analysis

- Medical nitrile gloves are critical disposable protective products used across healthcare, laboratory, and pharmaceutical settings to prevent cross-contamination and ensure compliance with infection prevention standards. Their latex-free nature, high puncture resistance, and chemical protection make them a preferred choice over vinyl and latex gloves

- The growth of the medical nitrile gloves market is primarily driven by rising global healthcare expenditure, increasing surgical and diagnostic procedures, heightened focus on infection control post-pandemic, and strict regulatory requirements for personal protective equipment in medical environments

- North America accounted for the largest share of the medical nitrile gloves market at approximately 34.7% in 2025, supported by high consumption rates in hospitals, strong regulatory enforcement by healthcare authorities, and continuous demand from outpatient clinics and diagnostic laboratories in the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region, registering strong growth due to large-scale glove manufacturing in countries such as Malaysia, Thailand, and China, expanding healthcare access, rising population, and increased government spending on public health infrastructure

- The Powder-free segment accounted for the largest market revenue share of 81.3% in 2025, driven by stringent regulatory restrictions on powdered gloves and increasing safety concerns among healthcare professionals

Report Scope and Medical Nitrile Gloves Market Segmentation

|

Attributes |

Medical Nitrile Gloves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Hartalega Holdings Berhad (Malaysia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Nitrile Gloves Market Trends

Rising Preference for Latex-Free and High-Performance Protective Gloves

- A significant and accelerating trend in the global medical nitrile gloves market is the increasing shift toward latex-free, high-performance disposable gloves due to rising concerns over latex allergies and the need for superior barrier protection in healthcare settings

- Healthcare providers, laboratories, and diagnostic centers are increasingly adopting nitrile gloves because of their enhanced puncture resistance, chemical protection, and durability compared to latex and vinyl alternatives

- For instance, in 2024, several hospitals across North America and Europe transitioned fully to nitrile gloves to comply with updated occupational safety and infection control standards, reflecting the growing reliance on nitrile-based products

- The growing emphasis on infection prevention and control, particularly after global public health emergencies, has significantly increased routine glove usage across hospitals, clinics, and outpatient care facilities

- In addition, advancements in glove manufacturing technology, such as thinner yet stronger nitrile formulations, are improving comfort and tactile sensitivity, further boosting adoption among healthcare professionals

- The expansion of healthcare infrastructure in emerging economies and the rising number of surgical and diagnostic procedures continue to support sustained demand for medical nitrile gloves globally

Medical Nitrile Gloves Market Dynamics

Driver

Increasing Healthcare Expenditure and Stringent Infection Control Standards

- The growing focus on healthcare safety, combined with rising healthcare expenditure worldwide, is a major driver of the Medical Nitrile Gloves market

- Governments and healthcare organizations are enforcing strict infection control protocols that mandate the use of disposable medical gloves during examinations, surgeries, and patient handling

- For instance, in 2025, several national health agencies strengthened hospital hygiene regulations, resulting in higher procurement volumes of nitrile gloves across public healthcare facilities

- The rising prevalence of chronic diseases, increasing surgical procedures, and expanding diagnostic testing volumes are directly contributing to higher glove consumption

- Nitrile gloves are preferred due to their resistance to chemicals, oils, and biological contaminants, making them suitable for a wide range of medical applications

- Growth in home healthcare services and outpatient care facilities further supports market expansion, as these settings increasingly rely on disposable protective gloves to maintain hygiene standards

Restraint/Challenge

Raw Material Price Volatility and Environmental Concerns

- Despite strong demand, the Medical Nitrile Gloves market faces challenges related to fluctuations in raw material prices, particularly nitrile butadiene rubber, which can impact manufacturing costs and profit margins

- For instance, volatility in petrochemical supply chains during 2023–2024 led to periodic price increases for nitrile gloves, affecting procurement budgets for hospitals and clinics

- Environmental concerns associated with the disposal of single-use medical gloves also present a growing challenge, as healthcare systems generate significant volumes of medical waste

- Regulatory pressure to adopt sustainable practices and biodegradable alternatives may increase compliance costs for manufacturers

- In addition, supply chain disruptions and dependency on a limited number of raw material suppliers can create availability challenges during periods of high demand

- Addressing these restraints through sustainable material innovation, recycling initiatives, and supply chain diversification will be critical for long-term growth of the Medical Nitrile Gloves market

Medical Nitrile Gloves Market Scope

The market is segmented on the basis of product, type, application, usage, sterility, distribution channel, and end use.

- By Product

On the basis of product, the Medical Nitrile Gloves market is segmented into Disposable and Durable. The Disposable segment dominated the largest market revenue share of 72.5% in 2025, driven by the extensive and routine use of single-use gloves across hospitals, clinics, diagnostic laboratories, emergency care units, and outpatient facilities. Disposable nitrile gloves are preferred due to their superior resistance to punctures, chemicals, and blood-borne pathogens. Rising global awareness regarding infection prevention and hospital-acquired infections significantly supports demand. Increased surgical procedures and diagnostic testing volumes further drive consumption. Regulatory mandates emphasizing single-use protective equipment reinforce adoption. Disposable gloves offer convenience, ease of disposal, and reduced contamination risk. Their availability in bulk packaging enhances cost efficiency for healthcare institutions. Growth in home healthcare and ambulatory care further increases demand. Expanding healthcare infrastructure in emerging economies supports volume growth. High replacement frequency sustains recurring demand. These combined factors ensure continued dominance of disposable gloves globally.

The Durable segment is expected to witness the fastest CAGR of 8.1% from 2026 to 2033, driven by increasing adoption in laboratory research, pharmaceutical manufacturing, and specialized medical environments. Durable nitrile gloves provide enhanced thickness, superior tear resistance, and extended wear life compared to disposable variants. Rising focus on sustainability and reduction of medical waste encourages reusable glove solutions. Pharmaceutical and biotech companies increasingly prefer durable gloves for prolonged usage. Advances in material science have improved flexibility and comfort, supporting wider acceptance. Cost savings over repeated usage further enhance adoption. Growth in laboratory testing and research activities globally supports expansion. Increased awareness of environmental impact drives demand. Regulatory acceptance of reusable gloves in controlled settings further boosts growth. These factors collectively position durable gloves as the fastest-growing product segment.

- By Type

On the basis of type, the Medical Nitrile Gloves market is segmented into Powdered and Powder-free. The Powder-free segment accounted for the largest market revenue share of 81.3% in 2025, driven by stringent regulatory restrictions on powdered gloves and increasing safety concerns among healthcare professionals. Powder-free gloves reduce risks of allergic reactions, respiratory complications, and post-surgical inflammation. Hospitals and surgical centers strongly prefer powder-free nitrile gloves for patient and staff safety. Improved manufacturing techniques have enhanced donning ease without powder use. Superior tactile sensitivity supports adoption in precision-based medical procedures. Increasing surgical volumes globally further drive demand. Healthcare institutions prioritize contamination-free environments, supporting growth. Powder-free gloves also comply with international safety standards. Growing awareness among healthcare workers accelerates adoption. Increased use in diagnostic laboratories sustains consumption. These factors collectively ensure market dominance of powder-free gloves.

The Powdered segment is projected to register the fastest CAGR of 6.2% from 2026 to 2033, driven by continued demand in cost-sensitive healthcare settings and emerging economies. Powdered gloves offer ease of donning and lower production costs, making them suitable for high-volume, low-risk applications. Expanding healthcare access in developing regions supports adoption. Smaller clinics and non-critical care facilities continue to use powdered variants. Local manufacturing capabilities enhance availability. Limited regulatory restrictions in select regions sustain demand. Growing outpatient services contribute to usage. Despite declining demand in developed markets, consistent regional consumption supports growth. Affordability remains a key driver. Increased government healthcare spending in emerging economies fuels adoption. These factors support steady growth of powdered gloves.

- By Application

On the basis of application, the Medical Nitrile Gloves market is segmented into Examination Gloves and Surgical Gloves. The Examination Gloves segment dominated the largest market revenue share of 64.9% in 2025, driven by high usage frequency across routine medical examinations, diagnostics, and patient care activities. Examination gloves are widely used in hospitals, clinics, emergency rooms, and laboratories. Rising patient visits and diagnostic testing volumes strongly support demand. These gloves provide adequate protection at lower costs, making them suitable for non-surgical procedures. Growing emphasis on infection prevention further accelerates adoption. Availability in multiple sizes improves usability. Increased home healthcare and telemedicine services support demand. Expansion of outpatient care facilities contributes to volume growth. Rising occupational safety awareness among healthcare workers fuels consumption. Continuous replacement cycles ensure recurring revenue. These factors collectively drive dominance.

The Surgical Gloves segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by the rising number of surgical procedures globally. Surgical gloves offer superior sterility, durability, and precision compared to examination gloves. Increasing prevalence of chronic diseases fuels surgical demand. Aging populations worldwide further contribute to higher surgical volumes. Hospitals increasingly adopt nitrile surgical gloves due to latex allergy concerns. Technological advancements improve glove fit and tactile sensitivity. Growth in minimally invasive surgeries supports adoption. Expanding healthcare infrastructure in emerging economies accelerates demand. Strict infection control regulations further boost usage. Premium pricing enhances revenue growth. These factors position surgical gloves as the fastest-growing application segment.

- By Usage

On the basis of usage, the Medical Nitrile Gloves market is segmented into Disposable Gloves and Reusable Gloves. The Disposable Gloves segment held the largest market revenue share of 75.8% in 2025, driven by strict hygiene standards across healthcare environments. Disposable gloves minimize cross-contamination risks during patient interactions. High patient turnover in hospitals supports continuous demand. Regulatory guidelines strongly favor single-use protective equipment. Ease of disposal enhances workflow efficiency. Rising diagnostic and laboratory testing volumes increased consumption. Emergency and trauma care services further boost usage. Growing awareness of healthcare-associated infections sustains demand. Expansion of healthcare facilities globally supports dominance. High replacement rates ensure consistent revenue generation. These factors maintain leadership.

The Reusable Gloves segment is expected to grow at the fastest CAGR of 7.4% from 2026 to 2033, driven by sustainability initiatives and waste reduction efforts. Reusable nitrile gloves are increasingly adopted in controlled medical and laboratory environments. Healthcare providers seek cost-efficient long-term solutions. Advances in sterilization technologies enhance safety and usability. Environmental regulations encourage reusable alternatives. Research laboratories increasingly prefer reusable gloves. Improved durability and comfort boost acceptance. Cost savings over repeated use support adoption. Growing environmental awareness among healthcare institutions accelerates growth. These trends collectively drive segment expansion.

- By Sterility

On the basis of sterility, the Medical Nitrile Gloves market is segmented into Sterile Gloves and Non-sterile Gloves. The Non-sterile Gloves segment dominated the largest market revenue share of 68.4% in 2025, driven by widespread use in routine examinations and non-invasive procedures. Non-sterile gloves are cost-effective and suitable for high-volume applications. Hospitals and clinics prefer them for general patient care. Rising outpatient visits support sustained demand. Ease of procurement and storage enhances adoption. Increased diagnostic testing volumes contribute to growth. Home healthcare services further boost consumption. Growing healthcare access in emerging economies supports demand. High replacement frequency ensures recurring revenue. These factors sustain dominance.

The Sterile Gloves segment is anticipated to register the fastest CAGR of 8.9% from 2026 to 2033, driven by rising surgical and invasive procedures. Sterile gloves are essential for infection prevention in operating rooms. Increasing adoption in specialty hospitals supports growth. Regulatory compliance requirements strengthen demand. Technological improvements in sterilization enhance product reliability. Growth in advanced surgical procedures fuels adoption. Expansion of healthcare infrastructure globally accelerates usage. Rising focus on patient safety drives demand. Premium pricing supports revenue growth. These factors position sterile gloves as a high-growth segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Brick and Mortar and E-commerce. The Brick and Mortar segment accounted for the largest market revenue share of 62.7% in 2025, driven by established hospital procurement systems and long-term supplier contracts. Hospitals and large clinics prefer offline procurement for bulk purchases to ensure product authenticity and regulatory compliance. Reliable supply chains strengthen dominance. Distributor networks enhance accessibility. Bulk purchasing agreements reduce costs for healthcare institutions. Presence in major metro cities ensures rapid availability. Hospital inventory practices favor brick-and-mortar procurement. Ease of quality inspection before purchase reinforces adoption. Expansion of healthcare infrastructure globally sustains demand. Long-standing vendor relationships further support market leadership. Institutional buying policies prioritize offline channels. These factors collectively maintain dominance.

The E-commerce segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by increasing digitalization of healthcare procurement and B2B online platforms. Smaller clinics, telemedicine providers, and home healthcare services increasingly prefer online channels. Competitive pricing, fast delivery, and convenience boost adoption. Wide product availability online supports selection flexibility. Emerging economies with growing internet penetration further support expansion. Online marketplaces reduce dependency on local distributors. Faster order processing and doorstep delivery attract buyers. Integration with procurement software enhances efficiency. E-commerce facilitates access to premium and imported gloves. Online channels allow comparison of multiple brands and bulk orders. Rising awareness of digital platforms promotes adoption. These factors collectively drive rapid growth.

- By End Use

On the basis of end use, the Global Medical Nitrile Gloves market is segmented into Medical & Healthcare and Pharmaceutical. The Medical & Healthcare segment dominated the largest market revenue share of 78.6% in 2025, driven by extensive glove usage across hospitals, clinics, diagnostic centers, and emergency care units. Rising patient admissions, surgical procedures, and outpatient services fuel demand. Strict infection prevention and control guidelines reinforce consumption. Occupational safety requirements enhance adoption. Expansion of healthcare infrastructure globally sustains demand. Growing awareness of healthcare-associated infections supports continued usage. Home healthcare and telemedicine services contribute to adoption. Large-scale hospital procurement strengthens market share. Rising diagnostic testing and vaccination programs further drive consumption. Disposable and examination gloves are widely used in this segment. Regular replacement cycles ensure recurring revenue. These factors collectively maintain segment leadership.

The Pharmaceutical segment is projected to register the fastest CAGR of 7.8% from 2026 to 2033, driven by increasing pharmaceutical manufacturing, biologics production, and R&D activities. Strict contamination control requirements in laboratories and production facilities drive glove usage. Growth in vaccine production supports adoption. Rising contract manufacturing activities in biotech and pharma further fuel demand. Compliance with cGMP and FDA regulations reinforces glove consumption. Advanced research and development activities require sterile, high-precision gloves. Expansion of pharmaceutical facilities in emerging economies accelerates adoption. Increasing focus on employee safety and hygiene strengthens demand. Reusable and sterile gloves are widely used. Technological advancements in glove material support precision work. These factors collectively make pharmaceuticals the fastest-growing end-use segment.

Medical Nitrile Gloves Market Regional Analysis

- North America dominated the medical nitrile gloves market with the largest revenue share of approximately 34.7% in 2025, supported by high consumption volumes across hospitals, outpatient clinics, and diagnostic laboratories. The region’s dominance is driven by stringent infection control standards, strong regulatory oversight by healthcare authorities, and consistent demand for single-use protective gloves across healthcare settings

- Healthcare providers in North America prioritize high-quality, latex-free nitrile gloves due to their superior puncture resistance, chemical protection, and reduced risk of allergic reactions. The widespread adoption of nitrile gloves is further reinforced by strict occupational safety regulations and established procurement systems in hospitals and healthcare facilities

- Sustained demand is also supported by high healthcare spending, a large patient base, and a well-developed medical infrastructure, positioning medical nitrile gloves as an essential component of infection prevention protocols across both public and private healthcare institutions

U.S. Medical Nitrile Gloves Market Insight

The U.S. medical nitrile gloves market captured the largest revenue share within North America in 2025, driven by extensive usage in hospitals, ambulatory surgical centers, and diagnostic laboratories. Rising awareness regarding infection prevention, stringent FDA regulations, and continuous demand from routine medical procedures and emergency care settings continue to support market growth. Additionally, the presence of major glove manufacturers and distributors ensures consistent supply and product innovation in the U.S. market.

Europe Medical Nitrile Gloves Market Insight

The Europe medical nitrile gloves market is projected to expand at a steady CAGR during the forecast period, driven by strong regulatory frameworks for healthcare safety, increasing surgical procedures, and heightened focus on hygiene standards. Countries across Western and Northern Europe demonstrate high adoption rates due to strict workplace safety regulations and expanding healthcare services.

U.K. Medical Nitrile Gloves Market Insight

The U.K. medical nitrile gloves market is expected to grow at a notable CAGR, supported by rising demand from the National Health Service (NHS), increasing outpatient care, and growing emphasis on infection control practices. The shift away from latex-based gloves further supports nitrile glove adoption across healthcare facilities.

Germany Medical Nitrile Gloves Market Insight

The Germany medical nitrile gloves market is anticipated to expand at a considerable CAGR, fueled by a well-established healthcare system, high surgical volumes, and strict occupational safety standards. Germany’s strong regulatory environment and emphasis on quality medical supplies continue to drive consistent demand for nitrile gloves.

Asia-Pacific Medical Nitrile Gloves Market Insight

The Asia-Pacific medical nitrile gloves market is projected to be the fastest-growing region during the forecast period, driven by large-scale glove manufacturing in countries such as Malaysia, Thailand, and China, expanding healthcare access, rising population, and increasing government investment in public health infrastructure. The region’s role as a global manufacturing hub significantly enhances supply availability and cost competitiveness.

Japan Medical Nitrile Gloves Market Insight

The Japan medical nitrile gloves market is gaining steady momentum due to the country’s advanced healthcare system, aging population, and high standards for hygiene and patient safety. Rising demand from hospitals and long-term care facilities continues to support nitrile glove adoption.

China Medical Nitrile Gloves Market Insight

The China medical nitrile gloves market accounted for a significant revenue share in Asia-Pacific in 2025, driven by expanding healthcare infrastructure, increasing domestic manufacturing capacity, and growing demand from hospitals and clinics. Government initiatives to strengthen public health preparedness and infection control are further propelling market growth in China.

Medical Nitrile Gloves Market Share

The Medical Nitrile Gloves industry is primarily led by well-established companies, including:

• Hartalega Holdings Berhad (Malaysia)

• Supermax Corporation Berhad (Malaysia)

• Kossan Rubber Industries (Malaysia)

• Semperit AG Holding (Austria)

• CarePlus Group (Thailand)

• Medline Industries, Inc. (U.S.)

• Cardinal Health (U.S.)

• Kimberly-Clark Corporation (U.S.)

• Shanghai Dahua Medical Apparatus Co., Ltd. (China)

• YTY Group (China)

• Riverstone Holdings Limited (U.K.)

• Sempermed (Germany)

• Unigloves (U.K.)

• Sri Trang Gloves (Thailand)

• VGlove (India)

• Aerotex Healthcare (India)

• Ammex Corporation (U.S.)

• SafeHands (U.S.)

Latest Developments in Global Medical Nitrile Gloves Market

- In March 2023, SafeSource Direct introduced a new American-made nitrile exam glove designed for maximum feel and sensitivity, featuring about 3.5 mil thickness and FDA 510(k) clearance — catering to high-usage clinical environments requiring reliable tactile performance

- In April 2024, Hartalega launched an advanced chemotherapy-rated nitrile glove line engineered for oncology and high-risk pharmaceutical environments, featuring enhanced chemical barrier protection and improved tactile sensitivity to support safe handling of hazardous drugs in healthcare settings

- In April 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Hartalega Holdings Berhad for its new nitrile medical gloves plant in Malaysia, increasing production capacity and helping ensure continued supply of medical-grade gloves to the U.S. market.

- In May 2025, Hyderabad’s Wadi Surgicals introduced India’s first accelerator-free nitrile gloves under its Enliva brand, developed through international collaboration to eliminate common allergenic accelerators while maintaining strength and chemical resistance

- In October 2025, Top Glove Corporation Berhad announced the opening of a new manufacturing facility in Saudi Arabia to expand local production capacity — a strategic move to enhance supply chain efficiency and reduce import dependency in the GCC region

- In September 2025, Hartalega Holdings Berhad unveiled a new line of eco-friendly nitrile gloves utilizing sustainable materials in their production, aligning product development with global sustainability trends and increasing preference for environmentally responsible PPE

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.