Global Medical Oxygen Cylinder Market

Market Size in USD Billion

CAGR :

%

USD

5.09 Billion

USD

8.58 Billion

2025

2033

USD

5.09 Billion

USD

8.58 Billion

2025

2033

| 2026 –2033 | |

| USD 5.09 Billion | |

| USD 8.58 Billion | |

|

|

|

|

Medical Oxygen Cylinder Market Size

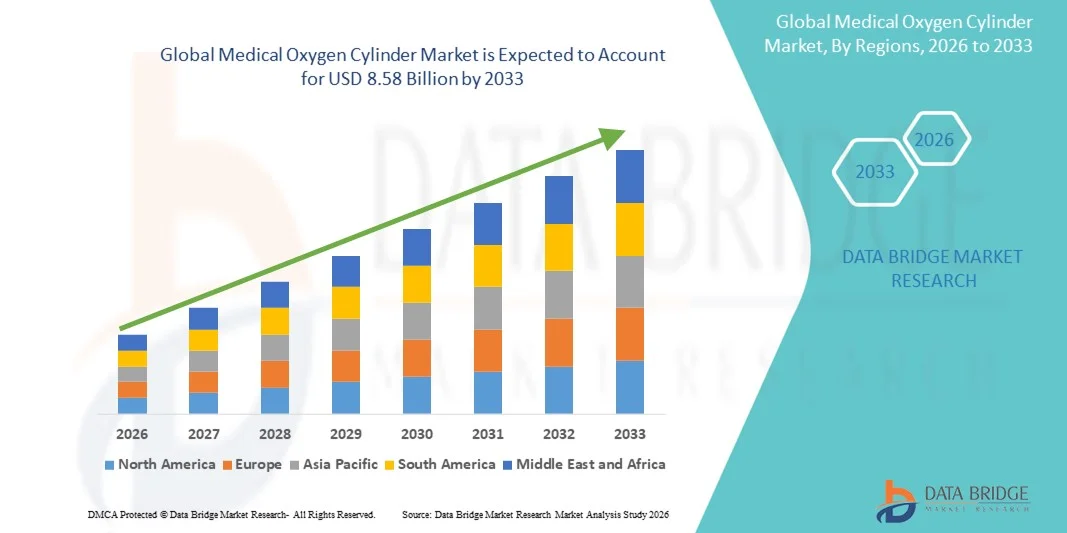

- The global medical oxygen cylinder market size was valued at USD 5.09 billion in 2025 and is expected to reach USD 8.58 billion by 2033, at a CAGR of 6.76% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory diseases, rising demand for home healthcare, and advancements in medical gas technologies, leading to enhanced availability, safety, and portability of medical oxygen cylinders in both clinical and home settings

- Furthermore, growing awareness of oxygen therapy for patients with chronic obstructive pulmonary disease (COPD), COVID-19 recovery, and other respiratory conditions is establishing medical oxygen cylinders as essential healthcare equipment. These converging factors are accelerating the uptake of Medical Oxygen Cylinder solutions, thereby significantly boosting the overall growth of the market

Medical Oxygen Cylinder Market Analysis

- Medical oxygen cylinders, essential for storing and delivering medical‑grade oxygen in hospitals, clinics, and home care settings, are increasingly vital due to their critical role in treating respiratory illnesses, emergency care, and long‑term oxygen therapy for chronic conditions

- The escalating demand for medical oxygen cylinders is primarily driven by the rising prevalence of respiratory diseases (such as COPD and pneumonia), increased home healthcare adoption, and the need for dependable oxygen delivery systems in both developed and emerging markets. Ongoing innovations—such as lightweight materials and safer valve technologies—are further accelerating market adoption

- North America dominated the medical oxygen cylinder market with the largest revenue share of approximately 40% in 2025, supported by well‑established healthcare infrastructure, high patient awareness, and strong presence of leading medical gas equipment manufacturers. The U.S. accounted for the majority of regional revenue due to extensive hospital utilization and growing uptake of home oxygen therapy solutions

- Asia‑Pacific is expected to be the fastest‑growing region in the medical oxygen cylinder market during the forecast period, with a CAGR of around 7.8% projected through 2033, driven by rising healthcare investments, increasing respiratory disease burden, expanding hospital infrastructure, and growing focus on access to oxygen therapy in China, India, and Southeast Asia

- The Continuous Flow segment held the largest revenue share of 52.1% in 2025, driven by high demand in hospitals, operating rooms, and emergency care units requiring a constant oxygen supply

Report Scope and Medical Oxygen Cylinder Market Segmentation

|

Attributes |

Medical Oxygen Cylinder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Drive DeVilbiss Healthcare, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Oxygen Cylinder Market Trends

Increasing Adoption of Advanced Medical Oxygen Delivery Systems

- A significant and accelerating trend in the global medical oxygen cylinder market is the growing use of portable, lightweight, and high-capacity oxygen cylinders for hospitals, clinics, home care, and emergency applications. These advanced cylinders are enhancing patient mobility, enabling continuous oxygen therapy, and supporting critical care in diverse settings

- For instance, in 2024, Linde Healthcare introduced a new portable oxygen cylinder with integrated flow meters and lightweight composite materials, making it easier for patients to receive oxygen therapy at home

- The adoption of high-pressure and composite cylinders is rising due to their improved safety, longer service life, and reduced handling risks compared to traditional steel cylinders

- Increasing awareness of oxygen therapy for chronic respiratory diseases such as COPD, asthma, and COVID-19 recovery is driving demand for reliable and easy-to-use oxygen cylinders

- Hospitals and home care providers are increasingly investing in advanced oxygen cylinders to ensure uninterrupted supply and efficient patient management

- Overall, the trend toward portable, efficient, and safer oxygen delivery solutions is shaping clinical practices and home healthcare services globally

Medical Oxygen Cylinder Market Dynamics

Driver

Rising Demand Due to Respiratory Disorders and Aging Population

- The increasing prevalence of respiratory disorders, coupled with a growing elderly population requiring supplemental oxygen therapy, is a major driver for the Medical Oxygen Cylinder market. These cylinders are critical in emergency care, home oxygen therapy, and hospital ICU settings

- For instance, in 2023, a major healthcare provider in India expanded its home oxygen delivery services by adopting portable medical oxygen cylinders to meet rising demand among patients with chronic respiratory illnesses

- The COVID-19 pandemic highlighted the importance of oxygen therapy, further accelerating adoption in both developed and emerging markets

- Rising awareness of respiratory health, government initiatives to ensure oxygen availability, and hospital infrastructure expansion are boosting market growth

- In addition, increasing investments by healthcare providers in emergency preparedness and critical care equipment support the growing demand for medical oxygen cylinders

Restraint/Challenge

High Cost and Supply Chain Challenges

- Despite the growing demand, the high cost of advanced medical oxygen cylinders and challenges in supply chain logistics remain significant barriers, particularly in developing regions and remote areas

- For instance, some rural hospitals in Africa reported intermittent oxygen cylinder shortages due to transportation and manufacturing limitations, affecting patient care

- Maintenance, refilling infrastructure, and safety compliance requirements can further increase operational costs for hospitals and home care providers

- Variability in quality standards across manufacturers and regulatory complexities in different regions can also limit adoption

- Addressing these challenges through affordable solutions, improved supply chain management, and regional manufacturing capabilities is essential for sustained growth in the Medical Oxygen Cylinder market

Medical Oxygen Cylinder Market Scope

The market is segmented on the basis of product, technology, end user, size, cylinder type, and application.

- By Product

On the basis of product, the Medical Oxygen Cylinder market is segmented into Portable Oxygen Concentrators & Cylinders, Stationary Oxygen Concentrators & Cylinders, and Oxygen Concentrators & Cylinders. The Portable Oxygen Concentrators & Cylinders segment dominated the largest market revenue share of 45.3% in 2025, driven by rising demand for mobility and home-based oxygen therapy solutions. Patients with chronic respiratory conditions such as COPD and pulmonary fibrosis prefer portable devices for their lightweight, easy-to-use design. Technological innovations have improved battery life, oxygen output, and portability, making these devices highly convenient for travel and daily use. Growing awareness about respiratory health, coupled with government reimbursements and insurance coverage, further supports the segment’s dominance. Integration with mobile health applications and pulse oximeters allows for remote monitoring and ensures patient compliance. Emergency responders and ambulance services increasingly rely on portable oxygen cylinders, contributing to market expansion. The adoption is widespread in both developed and emerging regions. Furthermore, collaborations between manufacturers and healthcare providers for distribution and training programs enhance consumer confidence. Continuous innovation in sensor technology and design ergonomics also fuels growth. The segment remains highly competitive, encouraging price optimization and feature enhancements. Overall, the portable segment combines convenience, technological advancement, and regulatory support to remain the largest revenue contributor in 2025.

The Stationary Oxygen Concentrators & Cylinders segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, due to rising demand in hospitals, clinics, and rehabilitation centers requiring uninterrupted oxygen supply. These devices provide high oxygen output suitable for patients with severe respiratory conditions. Adoption is increasing in emerging markets as healthcare infrastructure expands. Energy-efficient designs, noise reduction, and reliability improvements further drive growth. Integration with emergency backup systems ensures continuous patient care. Technological advancements, such as smart monitoring and alarm systems, enhance usability and safety. Rising government initiatives and funding for healthcare facilities encourage adoption. Hospitals prefer stationary systems for multi-patient usage and critical care applications. The segment benefits from long-term contracts with healthcare institutions. Continuous product development ensures adherence to regulatory standards. Stationary oxygen devices are increasingly included in hospital modernization projects. Growing awareness among healthcare providers about patient safety contributes to accelerated adoption. Overall, the stationary segment is emerging as the fastest-growing product category in the market.

- By Technology

On the basis of technology, the market is segmented into Continuous Flow and Pulse Flow. The Continuous Flow segment held the largest revenue share of 52.1% in 2025, driven by high demand in hospitals, operating rooms, and emergency care units requiring a constant oxygen supply. Continuous flow systems are preferred for acute and critical care patients due to their reliable and consistent oxygen delivery. They are compatible with multiple oxygen delivery devices including masks, cannulas, and ventilators. Hospitals and clinics favor continuous flow systems for regulatory compliance and patient safety. The segment benefits from innovations that improve accuracy, performance, and ease of use. Integration with monitoring systems allows healthcare providers to track usage effectively. Continuous flow systems are widely used in high-dependency units and respiratory wards. They are ideal for patients with severe respiratory conditions. Manufacturers continue to improve portability, energy efficiency, and durability. Clinical guidelines often recommend continuous flow for chronic and acute respiratory care. The segment dominates both developed and emerging markets due to established healthcare infrastructure.

The Pulse Flow segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, driven by rising home care adoption and demand for energy-efficient oxygen delivery systems. Pulse flow technology delivers oxygen only during inhalation, conserving oxygen and battery life. This makes devices suitable for portable oxygen concentrators and ambulatory use. Integration with smart sensors allows adaptive oxygen delivery based on patient breathing patterns. Growing home-based therapy programs and telehealth monitoring accelerate adoption. Patients prefer pulse flow devices for mobility, convenience, and cost-effectiveness. Increasing awareness among caregivers enhances market potential. Technological advancements improve accuracy and reliability. Rising investments in home healthcare infrastructure, particularly in Asia-Pacific and Latin America, support growth. Manufacturers are focusing on ergonomic designs and compact devices. Pulse flow systems reduce operational costs for long-term therapy. Overall, the segment is gaining rapid traction due to innovation and suitability for home care applications.

- By End User

On the basis of end user, the market is segmented into Home Care and Non-Homecare. The Home Care segment accounted for the largest market revenue share of 49.6% in 2025, driven by increasing chronic respiratory diseases and preference for home-based oxygen therapy. Patients and caregivers favor home care solutions for comfort, reduced hospital visits, and convenience. Government reimbursement policies and insurance coverage enhance affordability and adoption. Portable oxygen concentrators and cylinders are widely used in home settings. Integration with mobile health apps and remote monitoring systems ensures patient adherence and safety. Growth is also supported by awareness campaigns and patient education programs. Home care devices are available in multiple sizes and technologies to meet diverse patient needs. Rising aging populations and prevalence of COPD and sleep apnea further drive demand. Manufacturers are innovating to improve portability, noise reduction, and oxygen delivery accuracy. Telehealth adoption is increasing, integrating smart oxygen therapy solutions. Home care expansion is especially significant in developed regions with robust healthcare infrastructure. Overall, home care remains the dominant end-user segment.

The Non-Homecare segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, driven by hospitals, clinics, and emergency care units requiring high-capacity oxygen systems. Non-homecare adoption is fueled by rising hospitalizations for respiratory illnesses and need for uninterrupted oxygen delivery. Hospitals and critical care units prefer stationary oxygen concentrators and fixed cylinders. Expansion of healthcare infrastructure in emerging regions contributes to market growth. Integration with patient monitoring and alarm systems ensures safety and adherence to clinical guidelines. Long-term contracts and government funding support adoption. Hospitals benefit from high-efficiency systems and reduced operational costs. Non-homecare growth is supported by innovations in energy efficiency and automated monitoring. The segment is crucial for emergency response, operating rooms, and ICU setups. Overall, non-homecare is the fastest-growing end-user category.

- By Size

On the basis of size, the market is segmented into 10L, 40L, 50L, and 100L cylinders. The 10L cylinder segment dominated the largest revenue share of 41.8% in 2025, driven by home care and emergency use due to portability, ease of handling, and convenience. Patients prefer lightweight cylinders for mobility and outpatient therapy. Small cylinders are compatible with portable oxygen concentrators and allow convenient storage at home. Manufacturers focus on durable and ergonomic designs. Rising chronic respiratory diseases increase demand for portable oxygen solutions. Integration with pulse oximeters and mobile monitoring enhances patient compliance. Emergency medical responders widely use 10L cylinders for short-term interventions. Home-based therapy programs often employ 10L cylinders for travel. Lightweight design reduces caregiver burden. The segment benefits from affordability and accessibility. Technological improvements support accuracy and oxygen flow consistency. Overall, 10L cylinders are the preferred choice for patients and home care applications.

The 50L and 100L cylinder segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, fueled by hospital and industrial adoption where higher oxygen capacity is required. Large cylinders provide uninterrupted supply for critical care, operating rooms, and emergency response. Hospitals prefer 50L and 100L cylinders for multi-patient use and reduced refill frequency. Infrastructure expansion in emerging markets supports adoption. Large cylinders integrate with central piping systems in hospitals. Technological advancements enhance safety and pressure regulation. The segment is critical for high-dependency units and respiratory wards. Manufacturing innovations reduce weight while increasing durability. Contractual supply agreements with healthcare providers are expanding. Overall, large-size cylinders represent the fastest-growing segment in the market.

- By Cylinder Type

On the basis of cylinder type, the market is segmented into Fixed and Portable cylinders. The Portable cylinder segment held the largest market revenue share of 47.2% in 2025, supported by home care adoption, emergency medical services, and patient mobility requirements. Portability improves therapy adherence and allows continuous oxygen delivery during travel. Integration with pulse flow and smart monitoring enhances usability. Lightweight and durable designs increase convenience. Portable cylinders are preferred for outpatient therapy, rehabilitation centers, and ambulatory services. Technological innovation improves oxygen output consistency and battery efficiency. Patients and caregivers favor portable options for reduced hospital dependency. Regulatory approvals ensure safety and reliability. Global home healthcare growth accelerates adoption. Emergency response teams widely adopt portable systems. Overall, portability drives dominance in cylinder type.

The Fixed cylinder segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by hospital infrastructure expansion and high-capacity oxygen demand. Fixed cylinders are ideal for operating rooms, ICUs, and respiratory departments. Hospitals require uninterrupted supply and high-volume delivery. Integration with central oxygen pipelines ensures efficiency and safety. Growth is driven by investments in critical care infrastructure. Technological improvements include automated monitoring and pressure regulation. Long-term hospital contracts support expansion. Large-capacity fixed cylinders reduce operational burden and refill frequency. Emergent healthcare facilities in developing countries drive growth. Overall, fixed cylinders are the fastest-growing type segment in institutional settings.

- By Application

On the basis of application, the market is segmented into Emergency Room, Operating Room, Respiratory Department, and Household. The Respiratory Department segment dominated the largest revenue share of 43.5% in 2025, driven by the high prevalence of respiratory illnesses and continuous oxygen therapy requirements. Hospitals and clinics rely on high-capacity cylinders for multiple patients. Integration with monitoring systems ensures safety and compliance with clinical protocols. Technological innovations, such as adaptive oxygen delivery, enhance performance. Respiratory wards require constant oxygen availability for critical care. High adoption is observed in hospitals across developed and emerging markets. Chronic respiratory disease prevalence fuels demand. Regulatory guidelines support continuous oxygen supply in clinical settings. Devices are increasingly integrated with patient monitoring dashboards. Efficiency and reliability are critical for hospital applications. Overall, respiratory departments remain the dominant application segment.

The Household segment is expected to witness the fastest CAGR of 21.4% from 2026 to 2033, driven by rising home-based oxygen therapy, patient awareness, and portable device adoption. Telehealth and mobile monitoring systems enhance adherence. Convenience and independence encourage home adoption. Portable oxygen cylinders are increasingly used in outpatient and home rehabilitation programs. Home care growth is supported by government reimbursements and insurance policies. Ergonomic and lightweight designs increase usability. Integration with pulse flow technology ensures efficient oxygen delivery. Rising chronic respiratory diseases and aging populations boost demand. Affordability and accessibility in emerging regions support rapid growth. Technological enhancements, such as app integration and monitoring, further accelerate adoption. Overall, households represent the fastest-growing application segment.

Medical Oxygen Cylinder Market Regional Analysis

- North America dominated the medical oxygen cylinder market with the largest revenue share of approximately 40% in 2025, supported by well-established healthcare infrastructure, high patient awareness, and strong presence of leading medical gas equipment manufacturers

- The region’s growth is driven by extensive hospital utilization, rising adoption of home oxygen therapy solutions, and increasing integration of oxygen delivery systems in chronic respiratory care programs

- High healthcare spending, advanced hospital infrastructure, and growing demand for portable and user-friendly oxygen cylinders further reinforce North America’s leading position

U.S. Medical Oxygen Cylinder Market Insight

The U.S. medical oxygen cylinder market accounted for the majority of regional revenue in 2025, driven by widespread use in hospitals, clinics, and home healthcare settings. The growing prevalence of chronic respiratory diseases, coupled with increasing awareness of oxygen therapy benefits, is propelling market growth. Additionally, the presence of major medical gas equipment manufacturers and strong distribution networks further strengthens the U.S. market position.

Europe Medical Oxygen Cylinder Market Insight

The Europe Medical Oxygen Cylinder market is projected to grow steadily during the forecast period, supported by rising patient awareness, well-established healthcare systems, and increasing demand for home oxygen therapy. Countries such as Germany, France, and the U.K. are witnessing adoption of portable and advanced oxygen cylinders in hospitals and homecare setups.

U.K. Medical Oxygen Cylinder Market Insight

The U.K. Medical Oxygen Cylinder market is expected to register notable growth, driven by increasing prevalence of respiratory disorders, expansion of homecare services, and government initiatives promoting access to oxygen therapy. Adoption of lightweight and portable oxygen cylinders in hospitals and homecare environments is boosting market demand.

Germany Medical Oxygen Cylinder Market Insight

The Germany medical oxygen cylinder market is expected to expand at a considerable CAGR, fueled by the country’s strong healthcare infrastructure, increasing chronic respiratory disease burden, and focus on advanced medical gas delivery systems. Hospitals and homecare providers are increasingly adopting modern, safety‑compliant oxygen cylinders for patient management.

Asia-Pacific Medical Oxygen Cylinder Market Insight

The Asia-Pacific medical oxygen cylinder market is expected to be the fastest-growing region during the forecast period, with a projected CAGR of around 7.8% through 2033. Growth is driven by rising healthcare investments, increasing respiratory disease burden, expanding hospital infrastructure, and growing focus on improving access to oxygen therapy in countries such as China, India, and Southeast Asia.

Japan Medical Oxygen Cylinder Market Insight

The Japan medical oxygen cylinder market is gaining momentum due to increasing demand for home oxygen therapy and advanced respiratory care solutions. Hospitals and clinics are adopting modern oxygen cylinders for efficient patient management, supported by a technologically advanced healthcare system and growing elderly population.

China Medical Oxygen Cylinder Market Insight

The China medical oxygen cylinder market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rising incidence of respiratory diseases, increasing hospital beds, and strong government support for oxygen therapy programs. The adoption of portable and stationary oxygen cylinders is expanding across hospitals, clinics, and homecare settings, further boosting market growth.

Medical Oxygen Cylinder Market Share

The Medical Oxygen Cylinder industry is primarily led by well-established companies, including:

• Drive DeVilbiss Healthcare, Inc. (U.S.)

• Oxygen Plus Medical Inc. (U.S.)

• Praxair, Inc. (U.S.)

• Air Liquide S.A. (France)

• Linde plc (Ireland)

• Becton, Dickinson and Company (U.S.)

• Invacare Corporation (U.S.)

• Chart Industries, Inc. (U.S.)

• Philips Respironics (Netherlands)

• Respironics, Inc. (U.S.)

• Medline Industries, Inc. (U.S.)

• Fisher & Paykel Healthcare (New Zealand)

• Harvard Apparatus (U.S.)

• GCE Group AB (Sweden)

• Caire Inc. (U.S.)

Latest Developments in Global Medical Oxygen Cylinder Market

- In December 2022, Air Liquide opened a new oxygen plant and cylinder filling station in Maharashtra, India, featuring a new Air Separation Unit (ASU) and Cylinder Filling Station (CFS) with a production capacity of 70 tonnes per day and the ability to fill 3,000 medical oxygen cylinders per day. This facility was established to support healthcare facilities and small/medium‑sized enterprises in handling rising oxygen demand due to respiratory illnesses and improved healthcare infrastructure. The increased production capacity enhances local supply reliability and reduces the need for long‑distance cylinder transport, especially in healthcare settings

- In May 2024, DelveInsight Business Research LLP reported that the global medical oxygen cylinders market is accelerating significantly owing to rising respiratory ailments and elderly populations, highlighting that manufacturers are increasingly advancing cylinder safety, portability, and usability through new product innovations. This development underscores an industry‑wide shift toward more user‑friendly and clinically adaptable oxygen cylinders for diverse healthcare environments such as hospitals, ambulances, and home care

- In January 2024, Linde plc — in collaboration with Air Liquide Medical Systems — launched a new range of lightweight “Linde Light” medical gas cylinders, engineered for improved portability and handling by healthcare professionals across clinical and emergency settings. These lightweight cylinders reduce physical strain on caregivers and improve operational efficiency in hospitals and care center

- In March 2024, Air Products and Chemicals, Inc. entered into a strategic partnership with Medtronic to develop and commercialize advanced medical gas solutions, aimed at improving patient safety and operational efficiency in healthcare facilities. The collaboration combines Air Products’ expertise in medical gases with Medtronic’s clinical solutions, signaling deeper integration of oxygen delivery systems within patient care workflows.

- In September 2024, Arunachal Pradesh Chief Minister inaugurated a large‑scale liquid medical oxygen (LMO) plant and cylinder‑refilling facility across multiple locations in India, featuring 10,000‑litre storage capacity and the ability to refill up to 40 cylinders simultaneously. The facility includes integrated ICU and emergency care services, significantly enhancing regional access to medical oxygen for critical patients

- In October 2024, Unitaid announced a USD 22 million regional manufacturing initiative for medical oxygen in sub‑Saharan Africa, known as the East African Programme on Oxygen Access (EAPOA). The initiative aims to triple local oxygen production capacity and reduce prices by up to 27 %, increasing availability of oxygen cylinders and related equipment for hospitals and clinics in underserved regions

- In February 2025, the Lancet Global Health Commission on Medical Oxygen Security released a report estimating that nearly 5 billion people lack reliable access to medical oxygen worldwide, and recommended that annual investment of approximately USD 6.8 billion is needed to close the gap. The report highlights global health infrastructure challenges and catalyzes increased investment in oxygen cylinder supply chains and delivery systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.