Global Medical Polymers Market

Market Size in USD Billion

CAGR :

%

USD

40.23 Billion

USD

77.27 Billion

2024

2032

USD

40.23 Billion

USD

77.27 Billion

2024

2032

| 2025 –2032 | |

| USD 40.23 Billion | |

| USD 77.27 Billion | |

|

|

|

|

Medical Polymers Market Size

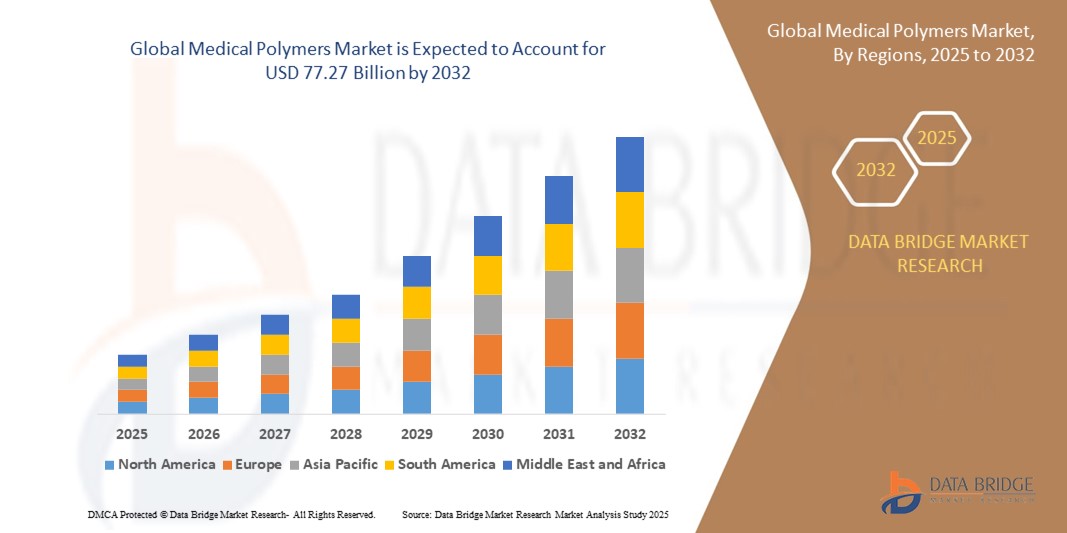

- The global medical polymers market size was valued at USD 40.23 billion in 2024 and is expected to reach USD 77.27 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is primarily driven by the increasing demand for advanced medical devices, rising adoption of biocompatible materials, and technological advancements in polymer manufacturing for healthcare applications

- Growing healthcare expenditure, an aging population, and the rising prevalence of chronic diseases are further fueling the demand for medical polymers, positioning them as critical materials in modern medical applications

Medical Polymers Market Analysis

- Medical polymers, including fibers, resins, elastomers, and biodegradable polymers, are essential in the production of medical devices, packaging, and implants due to their biocompatibility, flexibility, and durability

- The surge in demand is driven by the growing need for minimally invasive medical procedures, advancements in 3D printing for medical applications, and the increasing use of polymers in personalized medicine and drug delivery systems

- North America dominated the medical polymers market with the largest revenue share of 32.8% in 2024, attributed to advanced healthcare infrastructure, high adoption of innovative medical technologies, and the presence of major industry players

- Europe is expected to be the fastest-growing region during the forecast period, driven by increasing investments in healthcare innovation, a growing aging population, and rising demand for biodegradable polymers in medical applications

- The fibers and resins segment dominated the largest market revenue share of 73.2% in 2024, driven by their extensive use in medical devices and packaging due to their high chemical and electrical resistance, durability, and cost-effectiveness. Materials such as polypropylene (PP) and polyethylene (PE) are widely adopted for their biocompatibility and versatility in applications such as catheters, surgical instruments, and prosthetics

Report Scope and Medical Polymers Market Segmentation

|

Attributes |

Medical Polymers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Polymers Market Trends

“Increasing Integration of Advanced Materials and Smart Polymers”

- The global medical polymers market is experiencing a notable trend toward the integration of advanced materials, such as smart polymers and bioresorbable polymers, driven by innovations in material science

- These advanced polymers enable enhanced functionality, such as controlled drug release, shape-memory properties, and responsiveness to environmental stimuli such as temperature or pH, improving patient outcomes

- Smart polymer-based telematics solutions facilitate real-time monitoring of medical devices, enabling proactive adjustments in applications such as implants or drug delivery systems

- For instance, companies are developing biodegradable polymer platforms that degrade naturally in the body, reducing the need for surgical removal, and smart polymers that adapt to physiological conditions for personalized treatments

- This trend enhances the appeal of medical polymers for healthcare providers, medical device manufacturers, and patients by offering improved performance and sustainability

- Advanced algorithms and material design tools are being used to analyze polymer properties, optimizing their mechanical strength, biocompatibility, and degradation rates for specific medical application

Medical Polymers Market Dynamics

Driver

“Rising Demand for Advanced Medical Devices and Sustainable Materials”

- Growing consumer and healthcare provider demand for advanced medical devices, such as minimally invasive implants, wearable devices, and diagnostic tools, is a key driver for the global medical polymers market

- Medical polymers enhance device functionality through properties such as biocompatibility, flexibility, and durability, supporting applications such as catheters, prosthetics, and surgical instruments

- Government regulations, particularly in Europe with initiatives such as the Medical Device Regulation (MDR), are promoting the adoption of high-quality, biocompatible polymers to ensure patient safety

- The rise of sustainable healthcare practices and the development of eco-friendly biodegradable polymers are further expanding market applications, aligning with global environmental goals

- Manufacturers are increasingly incorporating medical-grade polymers as standard materials in devices to meet regulatory standards and enhance product value

Restraint/Challenge

“High Development Costs and Stringent Regulatory Compliance”

- The significant investment required for research, development, and testing of medical-grade polymers, along with their integration into devices, poses a barrier to market adoption, particularly for smaller manufacturers

- Developing and scaling advanced polymers, such as biodegradable or smart polymers, involves complex processes that increase production costs

- Data security and regulatory compliance present major challenges, as medical polymers must meet stringent biocompatibility and safety standards, raising concerns about material consistency and long-term performance

- The diverse regulatory frameworks across regions, such as the FDA in North America and EMA in Europe, complicate compliance for global manufacturers, requiring extensive documentation and testing

- These factors can deter investment and slow market growth, especially in cost-sensitive markets or regions with high regulatory scrutiny

Medical Polymers market Scope

The market is segmented on the basis of product type, application, and manufacturing technology.

- By Product Type

On the basis of product type, the global medical polymers market is segmented into fibers and resins, medical elastomers, and biodegradable medical polymers. The fibers and resins segment dominated the largest market revenue share of 73.2% in 2024, driven by their extensive use in medical devices and packaging due to their high chemical and electrical resistance, durability, and cost-effectiveness. Materials such as polypropylene (PP) and polyethylene (PE) are widely adopted for their biocompatibility and versatility in applications such as catheters, surgical instruments, and prosthetics.

The biodegradable medical Polymers segment is expected to witness the fastest growth rate of 10.3% from 2025 to 2032. This growth is propelled by increasing demand for sustainable and eco-friendly materials, such as polylactic acid (PLA) and polyhydroxyalkanoate (PHA), in applications such as drug delivery systems, surgical implants, and tissue engineering, driven by environmental concerns and regulatory support for biodegradable materials.

- By Application

On the basis of application, the global medical polymers market is segmented into medical device packaging, medical components, orthopedic soft goods, wound care, cleanroom supplies, biopharm devices, mobility aids, sterilization and infection prevention, tooth implants, denture-based materials, other implants, and others. The medical device packaging segment dominated with a revenue share of 34.7% in 2024, attributed to its critical role in ensuring sterility, safety, and integrity of medical devices. Polymers provide durable, flexible, and sterilization-compatible packaging solutions, meeting stringent regulatory requirements.

The orthopedic soft goods segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by the rising prevalence of musculoskeletal disorders, an aging population, and increasing demand for minimally invasive procedures. Polymers such as elastomers and fibers are increasingly used in braces, supports, and other orthopedic devices due to their lightweight and biocompatible properties.

- By Manufacturing Technology

On the basis of manufacturing technology, the global medical polymers market is segmented into extrusion tubing, compression moulding, injection moulding, and others. The injection moulding segment held the largest market revenue share of 60.8% in 2024, owing to its precision, scalability, and ability to produce complex, high-quality medical components such as syringes, catheters, and implants. Its widespread adoption in large-scale production drives its dominance.

The extrusion tubing segment is expected to witness significant growth from 2025 to 2032, driven by its critical role in producing medical tubing for applications such as catheters and IV lines. The demand for minimally invasive surgeries and advancements in polymer extrusion techniques are key factors fueling this segment’s growth.

Medical Polymers Market Regional Analysis

- North America dominated the medical polymers market with the largest revenue share of 32.8% in 2024, attributed to advanced healthcare infrastructure, high adoption of innovative medical technologies, and the presence of major industry players

- Consumers and manufacturers prioritize medical polymers for their biocompatibility, durability, and versatility, particularly in applications such as medical device packaging, implants, and wound care

- Growth is supported by advancements in polymer technologies, including biodegradable and elastomeric materials, alongside rising adoption in both medical device manufacturing and healthcare applications

U.S. Medical Polymers Market Insight

The U.S. medical polymers market captured the largest revenue share of 75.8% in 2024 within North America, fueled by strong demand for medical-grade polymers in device manufacturing and packaging. Increasing awareness of infection prevention and sterilization, coupled with a robust healthcare sector, drives market expansion. The trend toward minimally invasive devices and custom implants further boosts the adoption of advanced polymers in both OEM and aftermarket segments.

Europe Medical Polymers Market Insight

The Europe medical polymers market is expected to witness the fastest growth rate, supported by stringent regulatory standards for medical devices and a focus on patient safety and comfort. Demand is driven by applications in orthopedic soft goods, wound care, and biopharm devices. Countries such as Germany and France show significant uptake due to rising investments in healthcare innovation and sustainable polymer solutions.

U.K. Medical Polymers Market Insight

The U.K. market for medical polymers is expected to witness rapid growth, driven by increasing demand for biocompatible materials in medical device packaging and mobility aids. Growing awareness of the benefits of biodegradable polymers and rising healthcare expenditures encourage adoption. Evolving regulations on medical device safety and sustainability further influence consumer and manufacturer preferences.

Germany Medical Polymers Market Insight

Germany is expected to witness the fastest growth rate in the European medical polymers market, attributed to its advanced medical device manufacturing sector and high focus on precision and quality. German manufacturers prioritize polymers that offer superior performance in applications such as tooth implants and sterilization equipment. The integration of advanced manufacturing technologies such as injection moulding supports sustained market growth.

Asia-Pacific Medical Polymers Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding healthcare infrastructure and rising demand for medical devices in countries such as China, India, and Japan. Increasing awareness of advanced polymer applications in wound care, implants, and cleanroom supplies boosts market demand. Government initiatives promoting healthcare accessibility and innovation further encourage the use of medical polymers.

Japan Medical Polymers Market Insight

Japan’s medical polymers market is expected to witness rapid growth due to strong consumer and manufacturer preference for high-quality, biocompatible polymers that enhance medical device performance and patient safety. The presence of leading medical device manufacturers and the integration of polymers in OEM applications accelerate market penetration. Rising interest in biodegradable polymers for sustainable healthcare solutions also contributes to growth.

China Medical Polymers Market Insight

China holds the largest share of the Asia-Pacific medical polymers market, propelled by rapid urbanization, increasing healthcare investments, and growing demand for medical device packaging and components. The country’s expanding middle class and focus on advanced healthcare technologies support the adoption of medical-grade polymers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Medical Polymers Market Share

The medical polymers industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- DSM (Netherlands)

- Celanese Corporation (U.S.)

- DuPont (U.S.)

- Eastman Chemical Company (U.S.)

- Evonik Industries (Germany)

- Exxon Mobil Corporation (U.S.)

- Foryou Medical (China)

- KRATON CORPORATION (U.S.)

- Messe Düsseldorf GmbH (Germany)

- Shanghai New Shanghua Polymer Material Co.,Ltd. (China)

- Ningbo Yonghua Resin Co., Ltd (China)

- SABIC (Saudi Arabia)

- The Lubrizol Corporation (U.S.)

- Victrex plc (U.K.)

- China Haohua Chemical Group Co., Ltd (China)

- Weigao Holding Co Ltd (China)

- Solvay (Belgium)

What are the Recent Developments in Global Medical Polymers Market?

- In April 2025, researchers at Worcester Polytechnic Institute (WPI), led by Assistant Professor Jiawei Yang, announced the development of a novel hydrogel-based medical adhesive designed to securely attach implanted medical devices—such as pacemakers and insulin pumps—to human tissues. This adhesive combines a transparent solid hydrogel layer with a clear liquid polymer layer, engineered to mimic the mechanical properties of soft, wet biological tissues. The innovation addresses a critical challenge in medical device integration and represents a major advancement in long-term, biocompatible adhesion for implantable technologies.

- In February 2025, ALBIS announced a strategic collaboration with Arkema to distribute its high-performance, medical-grade polymers across Europe, North Africa, and the Middle East. The agreement includes materials such as Pebax MED thermoplastic elastomers, Rilsan MED polyamide 11, Rilsamid MED polyamide 12, Rilsan MED Clear, and Kynar MED PVDF. These polymers are known for their biocompatibility, chemical resistance, and flexibility, making them ideal for minimally invasive devices, medical tubing, and other critical healthcare applications. The partnership enhances ALBIS’s healthcare portfolio and supports the growing demand for advanced medical polymer solutions

- In March 2024, SABIC, in collaboration with the dialysis department at Jessa Hospital in Belgium, successfully demonstrated the feasibility of recycling used medical plastic into high-quality, medical-grade polymers. This proof-of-concept pilot project involved converting non-contaminated medical plastic waste into pyrolysis oil, which was then used to produce TRUCIRCLE™ polymers with the same performance and safety standards as virgin materials. The initiative highlights SABIC’s commitment to sustainability and circular economy principles in the medical polymers market, offering a scalable model for reducing medical plastic waste and promoting responsible material reuse

- In January 2024, Seqens entered into a strategic agreement with Pleryon Therapeutics, a biotech startup, to develop and manufacture a GMP-grade polymer for the treatment of osteoarthritis. The polymer will be produced at Seqens’ state-of-the-art cGMP facility in Aramon, France, which was recently modernized with a €15 million investment. This collaboration highlights Seqens’ growing focus on specialized medical polymers for targeted therapeutic applications, including nucleic acid delivery, controlled-release excipients, and Class IIb & III medical devices. For Pleryon, the partnership secures the development of its lead clinical candidate aimed at addressing unmet needs in aging populations

- In August 2023, Medtronic, a global leader in medical technology, launched the Resolute Onyx Gen4 drug-eluting stent (DES). This next-generation stent features a bio-absorbable polymer coating designed to deliver zotarolimus, a drug that helps prevent restenosis (re-narrowing of the artery). The Gen4 version builds on Medtronic’s proven BioLinx™ polymer technology, offering enhanced deliverability, visibility, and conformability for complex percutaneous coronary interventions (PCI). This launch underscores the ongoing innovation in medical devices that leverage advanced polymer technologies to improve patient outcomes in cardiovascular care.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medical Polymers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medical Polymers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medical Polymers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.