Global Medical Practice Management Software Market

Market Size in USD Billion

CAGR :

%

USD

8.87 Billion

USD

18.08 Billion

2024

2032

USD

8.87 Billion

USD

18.08 Billion

2024

2032

| 2025 –2032 | |

| USD 8.87 Billion | |

| USD 18.08 Billion | |

|

|

|

|

Medical Practice Management Software Market Size

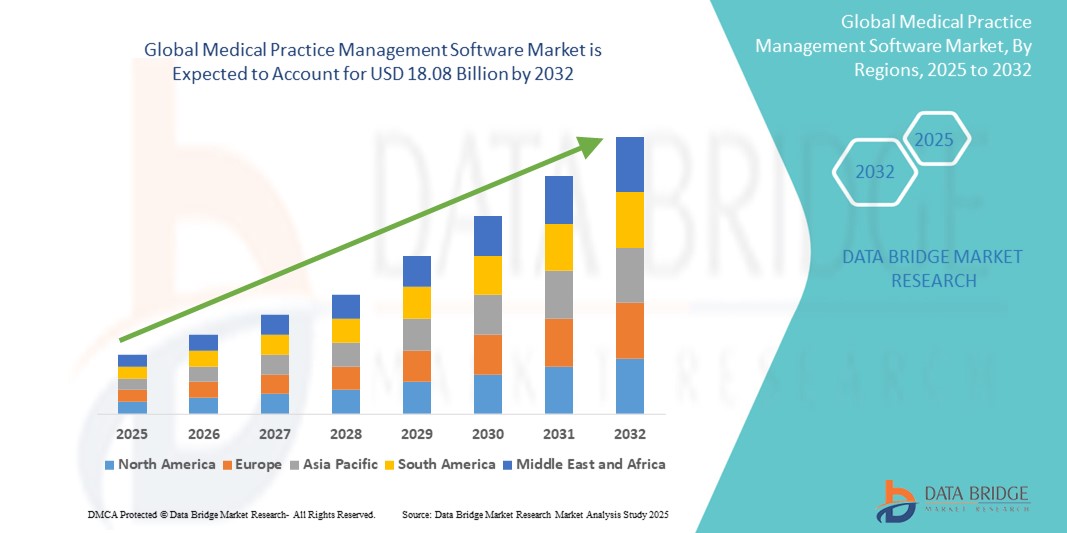

- The global medical practice management software market size was valued at USD 8.87 billion in 2024 and is expected to reach USD 18.08 billion by 2032, at a CAGR of 9.30% during the forecast period

- The market growth is largely fueled by the increasing need for efficient workflow management, electronic documentation, and administrative automation in healthcare practices, driving adoption across clinics and hospitals worldwide

- Furthermore, rising demand for integrated solutions that streamline patient scheduling, billing, and compliance is establishing medical practice management software as an essential tool in modern healthcare settings. These converging factors are accelerating digital transformation in the sector, thereby significantly boosting the industry's growth

Medical Practice Management Software Market Analysis

- Medical practice management software (MPMS), designed to streamline administrative and operational tasks in healthcare facilities, is becoming increasingly essential in both small and large medical practices due to its ability to improve workflow efficiency, reduce administrative burden, and enhance patient management

- The growing demand for MPMS is primarily fueled by the digitization of healthcare systems, rising patient volumes, and the need for integrated solutions that handle scheduling, billing, reporting, and compliance with regulatory standards

- North America dominated the medical practice management software market with the largest revenue share of 43% in 2024, driven by well-established healthcare infrastructure, supportive government initiatives for electronic health record adoption, and high penetration of IT solutions in medical facilities, particularly in the U.S. where small to mid-sized practices are increasingly turning to cloud-based MPMS platforms

- Asia-Pacific is expected to be the fastest growing region in the medical practice management software market during the forecast period due to expanding healthcare access, growing investments in health IT infrastructure, and rising demand for cost-effective practice solutions

- The cloud-based segment dominated the medical practice management software market with a market share of 46.3% in 2024, driven by its scalability, lower upfront costs, remote accessibility, and increasing preference among healthcare providers for flexible and secure solutions

Report Scope and Medical Practice Management Software Market Segmentation

|

Attributes |

Medical Practice Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Practice Management Software Market Trends

“Cloud-Based Solutions and AI-Driven Automation Transforming Healthcare Administration”

- A significant and accelerating trend in the global medical practice management software (MPMS) market is the widespread shift toward cloud-based solutions integrated with artificial intelligence (AI) and machine learning. This transformation is revolutionizing how healthcare practices manage scheduling, billing, patient communications, and reporting

- For instance, Athenahealth and AdvancedMD offer robust cloud-based platforms that leverage AI to automate appointment reminders, optimize billing cycles, and generate actionable insights from clinical and financial data. These capabilities enhance administrative efficiency and improve patient engagement

- AI-enabled MPMS solutions can intelligently predict no-show risks, recommend optimal scheduling, and detect anomalies in billing or coding. This helps reduce revenue leakage and streamline daily operations. Kareo, for instance, incorporates smart scheduling and billing optimization tools driven by predictive analytics

- Cloud integration also ensures scalability, automatic updates, and remote accessibility, which are particularly valuable for multi-location practices or providers with telehealth components. Unified cloud-based interfaces allow seamless coordination across front desk, clinical, and back-office functions, improving overall workflow efficiency

- This trend toward cloud-native, intelligent MPMS platforms is reshaping expectations for practice operations, with providers seeking flexible, secure, and automation-driven solutions. Companies such as eClinicalWorks are advancing their offerings with AI-powered documentation tools and integrated patient engagement modules to meet evolving provider needs

- The demand for cloud-based MPMS with smart automation features is rapidly growing across both large healthcare systems and independent practices, driven by rising regulatory complexity, the push for interoperability, and the need for operational resilience in dynamic care environments

Medical Practice Management Software Market Dynamics

Driver

“Increasing Healthcare Digitalization and Workflow Optimization Needs”

- The global push toward healthcare digitalization, along with the need to streamline practice workflows, is a major driver for the adoption of medical practice management software

- For instance, in 2024, DrChrono introduced AI-powered tools that support real-time eligibility checks, automated charge capture, and advanced reporting, reducing administrative workload and improving revenue cycle efficiency

- With the growing volume of patients and complexity in healthcare administration, MPMS offers capabilities such as appointment scheduling, insurance verification, claims processing, and regulatory compliance—all from a single platform

- As providers aim to reduce administrative burden, improve accuracy, and ensure timely reimbursements, MPMS platforms have become essential tools for practice optimization

- The rise in telemedicine services and value-based care models further fuels demand for integrated, cloud-based MPMS that support seamless virtual visits, documentation, and follow-ups

- In addition, government incentives and regulatory mandates for electronic health record (EHR) adoption are encouraging healthcare providers to implement complementary MPMS solutions for better clinical and financial alignment

Restraint/Challenge

“Data Privacy Concerns and High Implementation Costs”

- Despite its many benefits, the adoption of MPMS is challenged by concerns over data privacy, cybersecurity risks, and the high initial costs associated with deployment and training

- Medical data is highly sensitive, and any breaches can result in serious legal and financial repercussions. Compliance with regulations such as HIPAA in the U.S. and GDPR in Europe requires rigorous data protection protocols, which can be complex and costly for smaller practices to implement

- For instance, smaller clinics often struggle with allocating resources for secure cloud infrastructure, staff training, and ongoing software maintenance. Moreover, integration with existing EHR systems or third-party applications can be technically challenging and time-consuming

- While major vendors such as NextGen Healthcare and Allscripts emphasize their commitment to data security and offer compliance-ready platforms, skepticism remains among some providers regarding storing patient information in the cloud

- To overcome these barriers, vendors are offering modular pricing models, improved user support, and stronger encryption and authentication features. Nevertheless, the need for regulatory compliance and upfront investments remains a constraint for full-scale adoption, especially in developing markets or among budget-conscious providers

Medical Practice Management Software Market Scope

The market is segmented on the basis of product type, component, delivery mode, and end user.

- By Product Type

On the basis of product type, the medical practice management software market is segmented into integrated and standalone solutions. The integrated segment held the largest market revenue share in 2024, owing to the growing demand for all-in-one solutions that combine clinical, financial, and administrative functionalities in a single platform. Integrated systems streamline data sharing between EHR, billing, and scheduling modules, enhancing workflow efficiency and minimizing redundancy.

The standalone segment is expected to witness the fastest growth from 2025 to 2032, particularly among small and independent practices seeking cost-effective, customizable tools. Standalone solutions allow clinics to selectively deploy features such as billing or appointment scheduling without the overhead of full integration, providing flexibility and simplified training requirements for staff.

- By Component

On the basis of component, the medical practice management software market is segmented into software and services. The software segment dominated the market in 2024, driven by increased digitalization of healthcare operations and the widespread adoption of cloud and web-based platforms. These software tools are essential for automating front-office tasks, managing claims, reducing paperwork, and ensuring data accuracy.

The services segment is projected to grow rapidly during the forecast period, owing to the rising demand for implementation support, system customization, training, and ongoing technical assistance. As more practices adopt advanced MPMS tools, service providers are playing a crucial role in ensuring smooth onboarding and compliance with evolving healthcare regulations.

- By Delivery Mode

On the basis of delivery mode, the medical practice management software market is segmented into on-premises/desktop-only, web-based, and cloud-based solutions. The cloud-based segment led the market with 46.3% in 2024, capturing the largest revenue share due to its scalability, low upfront costs, and remote accessibility. Cloud platforms are increasingly preferred by small and medium-sized practices for their automatic updates, data backup capabilities, and reduced IT maintenance burden.

The web-based segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its compatibility with multiple devices and ease of access via internet browsers. Web-based MPMS provides a balance between functionality and affordability, attracting growing adoption across emerging healthcare markets.

- By End User

On the basis of end user, the medical practice management software market is segmented into physicians, pharmacists, diagnostic labs, and others. The physicians segment dominated the market in 2024, accounting for the largest revenue share as MPMS tools are extensively used in private practices, outpatient clinics, and specialty care centers for managing appointments, prescriptions, and billing operations.

The diagnostic labs segment is anticipated to grow at the fastest rate through 2032, driven by the need for efficient lab scheduling, test result tracking, and integration with EHR systems. The increasing demand for laboratory digitization and automation is prompting labs to adopt MPMS platforms tailored for sample management and compliance tracking.

Medical Practice Management Software Market Regional Analysis

- North America dominated the medical practice management software market with the largest revenue share of 43% in 2024, driven by well-established healthcare infrastructure, supportive government initiatives for electronic health record adoption, and high penetration of IT solutions in medical facilities, particularly in the U.S. where small to mid-sized practices are increasingly turning to cloud-based MPMS platforms

- Providers in the region prioritize integrated platforms that enhance administrative efficiency, support value-based care models, and ensure compliance with regulations such as HIPAA

- This strong market presence is further supported by high healthcare expenditure, a digitally mature medical workforce, and ongoing innovation from regional vendors offering cloud-based and AI-powered MPMS solutions tailored to the needs of both small practices and large healthcare systems

U.S. Medical Practice Management Software Market Insight

The U.S. medical practice management software market captured the largest revenue share of 83% in 2024 within North America, driven by the country’s advanced healthcare infrastructure, high EHR adoption rates, and strong regulatory mandates such as HIPAA and MACRA. Practices across the U.S. are increasingly investing in MPMS solutions to streamline operations, enhance revenue cycle management, and meet compliance requirements. The widespread integration of cloud-based platforms and AI-driven automation is further fueling adoption among both large healthcare systems and independent practices.

Europe Medical Practice Management Software Market Insight

The Europe medical practice management software market is projected to expand at a notable CAGR throughout the forecast period, supported by government-led digital health initiatives, a growing need for workflow optimization, and rising pressure on healthcare systems to improve administrative efficiency. With increasing emphasis on data protection under GDPR, providers are turning to MPMS platforms that offer secure, compliant solutions. Demand is growing across public and private practices, particularly in Western Europe, where integrated digital healthcare ecosystems are becoming the norm.

U.K. Medical Practice Management Software Market Insight

The U.K. medical practice management software market is anticipated to grow at a robust CAGR during the forecast period, propelled by national efforts to digitize healthcare services under the NHS framework. Practices are adopting MPMS to reduce administrative workload, support telehealth services, and improve patient management. The rising need for real-time access to patient data and seamless interoperability between care settings is encouraging the adoption of cloud-based and AI-supported practice management platforms.

Germany Medical Practice Management Software Market Insight

The Germany medical practice management software market is expected to expand steadily, fueled by rising investments in health IT, strict data protection laws, and a demand for scalable, interoperable solutions. The integration of MPMS with Germany’s Telematics Infrastructure is gaining traction, particularly in outpatient settings. Emphasis on privacy, quality care delivery, and efficient claims processing is steering providers toward modern, secure software systems tailored to Germany’s healthcare environment.

Asia-Pacific Medical Practice Management Software Market Insight

The Asia-Pacific medical practice management software market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by growing healthcare digitalization, government-backed health reforms, and expanding private sector investments. Countries such as China, India, and Japan are seeing rapid adoption of cloud-based and mobile-compatible MPMS solutions to support increasing patient loads and enhance operational efficiency. The demand is particularly strong in urban clinics and private hospitals seeking cost-effective and scalable platforms.

Japan Medical Practice Management Software Market Insight

The Japan medical practice management software market is gaining traction due to a highly urbanized healthcare system, aging population, and growing demand for streamlined administrative processes. Japanese clinics and hospitals are adopting MPMS to support coordinated care, telemedicine, and remote monitoring. Strong demand for digital platforms that align with Japan’s health IT standards and its emphasis on automation and data security are key factors contributing to market growth.

India Medical Practice Management Software Market Insight

The India medical practice management software market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a rapidly growing healthcare sector, digital health initiatives such as Ayushman Bharat, and rising penetration of internet and mobile technologies. MPMS adoption is accelerating across multi-specialty clinics, diagnostic labs, and individual practices, with demand for cloud-based, low-cost platforms rising sharply. Local vendors and start-ups are playing a crucial role by offering scalable solutions tailored to the unique needs of India's diverse healthcare ecosystem.

Medical Practice Management Software Market Share

The medical practice management software industry is primarily led by well-established companies, including:

- athenahealth (U.S.)

- AdvancedMD, Inc. (U.S.)

- eClinicalWorks (U.S.)

- NXGN Management, LLC. (U.S.)

- Veradigm LLC (U.S.)

- McKesson Corporation (U.S.)

- Tebra Technologies, Inc. (U.S.)

- Greenway Health, LLC (U.S.)

- Oracle (U.S.)

- Epic Systems Corporation (U.S.)

- Henry Schein, Inc. (U.S.)

- Practice Fusion, Inc. (U.S.)

- GE HealthCare (U.S.)

- CompuGroup Medical (Germany)

- DocEngage (India)

- Practo Technologies Pvt. Ltd (India)

What are the Recent Developments in Global Medical Practice Management Software Market?

- In April 2023, Athenahealth introduced new AI-powered enhancements to its medical practice management platform, including predictive analytics for patient scheduling and automated claim denial management. These features are aimed at reducing administrative burden, improving revenue cycle efficiency, and enabling healthcare providers to deliver more proactive care. This development underscores Athenahealth’s commitment to leveraging advanced technologies to streamline practice operations and optimize financial performance for medical practices of all sizes

- In March 2023, AdvancedMD, a leading cloud-based healthcare technology company, launched an updated suite of integrated tools that includes mobile-first features for appointment scheduling, patient intake, and billing. The enhancements aim to support hybrid care models and improve patient-provider communication. This move reflects AdvancedMD’s focus on delivering user-friendly, scalable MPMS solutions that cater to evolving practice needs in a digital-first healthcare landscape

- In February 2023, Kareo and PatientPop—now operating as Tebra—announced expanded AI-based functionality in their all-in-one medical practice management platform. The update includes automated billing, patient engagement tools, and smart reporting dashboards, helping small to mid-sized practices manage care delivery and business operations more efficiently. This strategic development marks Tebra’s continued investment in accessible, comprehensive MPMS solutions tailored for independent providers

- In January 2023, eClinicalWorks launched its new Practice Management Dashboard, offering customizable data visualization tools for operational metrics such as patient flow, revenue trends, and billing accuracy. By integrating AI-driven insights, this update empowers healthcare administrators to make data-backed decisions in real time. The initiative aligns with the broader industry push toward data-driven practice management and improved clinical-operational synergy

- In January 2023, NextGen Healthcare unveiled its NextGen Enterprise PM 6.0, featuring enhanced interoperability, updated compliance features, and expanded automation for claims and collections management. Designed for multi-specialty and enterprise-level healthcare organizations, the platform emphasizes scalability and security. This development highlights NextGen’s focus on supporting complex healthcare environments through robust, regulatory-compliant MPMS platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.