Global Medical X Ray Detectors Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

3.66 Billion

2024

2032

USD

2.44 Billion

USD

3.66 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 3.66 Billion | |

|

|

|

|

Medical X-Ray Detectors Market Size

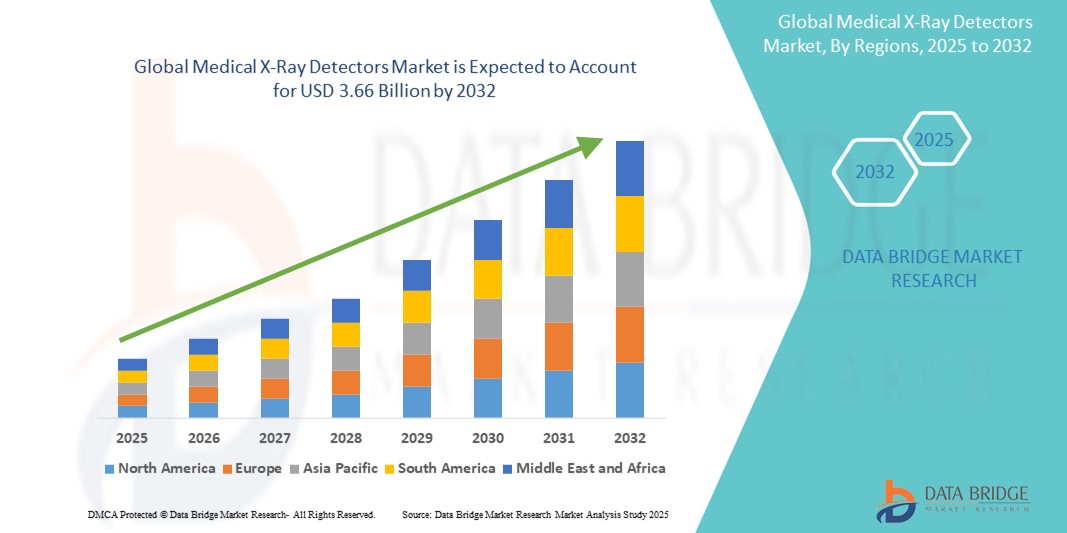

- The global medical X-Ray detectors market size was valued at USD 2.44 billion in 2024 and is expected to reach USD 3.66 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the rising adoption and continuous technological advancements in digital imaging and diagnostic equipment, particularly within hospitals, diagnostic centers, and ambulatory settings. This trend is promoting increased deployment of medical X-ray detectors as healthcare facilities shift from traditional analog systems to digital radiography solutions

- Furthermore, growing demand for faster, more accurate diagnostic tools—coupled with rising incidences of chronic diseases such as cancer, cardiovascular disorders, and orthopedic conditions—is establishing medical X-ray detectors as a vital component in modern medical imaging. These converging factors are accelerating the uptake of Medical X-Ray Detectors solutions, thereby significantly boosting the industry's growth

Medical X-Ray Detectors Market Analysis

- Medical X-ray detectors, crucial components in diagnostic imaging systems, are widely adopted in healthcare facilities due to their ability to enhance image quality, reduce radiation exposure, and support faster diagnosis in both digital radiography (DR) and computed radiography (CR) systems. Their application spans across hospitals, imaging centers, and dental clinics, playing a pivotal role in disease detection and patient monitoring

- The growing demand for medical X-ray detectors is primarily fueled by increasing incidences of chronic diseases, a rising aging population, and growing preferences for minimally invasive diagnostics.In addition, the shift from analog to digital imaging systems in both developed and emerging markets continues to accelerate adoption

- North America dominated the medical X-ray detectors market with the largest revenue share of 41.6% in 2024, attributed to the early adoption of advanced imaging technologies, high healthcare spending, and the strong presence of leading manufacturers. The U.S., in particular, experienced robust growth due to increased hospital investments in digital radiography and mobile imaging units, driven by aging infrastructure upgrades and evolving regulatory standards

- Asia-Pacific is expected to be the fastest growing region in the medical X-ray detectors market during the forecast period, fueled by increasing healthcare infrastructure investments, rising awareness of early disease diagnosis, and growing government initiatives supporting digital healthcare transformation across countries such as China, India, and Japan

- The fixed detectors segment dominated the medical X-Ray detectors market with a market share of 58.6% in 2024, due to their widespread use in hospital radiology departments and imaging centers where high-volume imaging is required. These detectors are preferred for their stability, high throughput capabilities, and integration into permanent diagnostic setups, making them essential in routine clinical workflows and advanced imaging applications

Report Scope and Medical X-Ray Detectors Market Segmentation

|

Attributes |

Medical X-Ray Detectors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical X-Ray Detectors Market Trends

“Technological Advancements and Enhanced Imaging Capabilities Driving Market Growth”

- A significant and accelerating trend in the global medical X-Ray detectors market is the shift from traditional analog systems to advanced digital radiography, offering enhanced image clarity, faster processing times, and lower radiation exposure. This transition is driving widespread adoption across hospitals, diagnostic centers, and outpatient clinics

- For instance, in 2024, several hospitals in Europe and North America upgraded to flat-panel digital detectors as part of their modernization programs to improve diagnostic throughput and reduce operational costs. These detectors provide real-time imaging, enabling faster and more accurate clinical decision-making

- The introduction of wireless and portable X-ray detector systems has further expanded use cases in emergency care, intensive care units (ICUs), and field diagnostics. These detectors offer mobility and flexibility in settings where space and access are limited

- In addition, detector designs with higher dynamic range and advanced scintillator materials now allow for superior imaging of dense tissues, aiding in early diagnosis of critical conditions such as cancers, bone fractures, and cardiovascular diseases

- Radiology departments are increasingly adopting detectors with longer lifespans, enhanced durability, and ease of integration into existing PACS (Picture Archiving and Communication Systems), reducing the need for frequent replacements and minimizing downtime

- This technological evolution, combined with growing demand for non-invasive and accurate diagnostics, is reshaping the expectations of healthcare providers and positioning medical X-ray detectors as indispensable tools in modern clinical workflows

Medical X-Ray Detectors Market Dynamics

Driver

“Growing Need Due to Technological Advancements and Digital Imaging Adoption”

- The increasing global shift from conventional film-based radiography to digital imaging systems is a significant driver of growth in the medical X-Ray detectors market. Enhanced image quality, reduced radiation exposure, and faster processing times are key factors accelerating the adoption of advanced X-ray detectors

- For instance, in January 2024, Canon Medical Systems launched its latest portable digital X-ray detector with AI-powered features to improve workflow efficiency in emergency care and ICU settings. This innovation reflects the market’s evolution toward smart and integrated radiological solutions

- Rising awareness about early disease detection, coupled with increasing investment in radiology infrastructure—especially in emerging economies—is fostering the widespread deployment of flat panel detectors and mobile radiography systems

- Furthermore, the growing demand for wireless, lightweight, and portable detectors in remote and point-of-care applications is expanding the use of Medical X-Ray Detectors beyond traditional hospital settings

- The trend toward AI integration, cloud-based imaging storage, and interoperability with hospital information systems (HIS) and PACS further enhances diagnostic efficiency, creating a strong incentive for healthcare providers to upgrade their existing imaging equipment

Restraint/Challenge

“High Equipment Cost and Integration Challenges in Resource-Limited Settings”

- One of the major barriers to the broader adoption of Medical X-Ray Detectors is the high initial investment required for digital imaging equipment. This challenge is especially prominent in low- and middle-income countries where healthcare budgets are constrained

- In addition, integrating advanced detectors with legacy systems, including hospital PACS and imaging software, can be technically complex and costly, hindering smooth implementation across all care settings

- For instance, older diagnostic centers may face challenges adapting to digital radiography without overhauling their infrastructure, which adds to overall expenditure and delays digital transition

- Further, the need for trained professionals and radiologists to operate and interpret high-resolution digital imaging also limits adoption, particularly in rural areas with workforce shortages

- To address these issues, companies such as Carestream Health and Fujifilm Holdings Corporation are focusing on affordable, AI-integrated, and compact detector systems designed for emerging markets. Enhancing training programs, offering value-based pricing, and expanding service networks will be essential to unlock the full growth potential of the global Medical X-Ray Detectors Market

Medical X-Ray Detectors Market Scope

The market is segmented on the basis of type, panel size, portability, application, and end user.

- By Type

On the basis of type, the medical X-Ray detectors market is segmented into flat panel detectors, computed radiography detectors, line scan detectors, charged coupled device (CCD) detectors, and mobile detectors. The flat panel detector segment held the largest market revenue share of 47.8% in 2024, driven by its superior image quality, faster acquisition times, and reduced radiation exposure. These detectors are widely adopted in modern radiology practices for their efficiency and ease of integration into existing systems.

The mobile detectors segment is expected to witness the fastest CAGR of 12.3% from 2025 to 2032, fueled by the growing demand for bedside imaging in ICUs, emergency rooms, and remote healthcare settings. Their portability and wireless capabilities make them essential for improving patient outcomes in time-sensitive situations.

- By Panel Size

On the basis of panel size, the medical X-Ray detectors market is segmented into small area and large area. The large area segment dominated the market with a revenue share of 55.1% in 2024, attributed to its extensive use in general radiography, chest imaging, and full-body diagnostics. These detectors support high-resolution imaging across large anatomical areas, enhancing diagnostic accuracy.

The small area segment is projected to expand at the highest CAGR of 10.8% during the forecast period, driven by its adoption in dental, orthopedic, and pediatric imaging applications where focused, high-detail imaging is essential.

- By Portability

On the basis of portability, the medical X-Ray detectors market is segmented into fixed detectors and portable detectors. The fixed detectors segment held the largest revenue share of 58.6% in 2024, due to their widespread use in hospital radiology departments and imaging centers where high-volume imaging is required.

The portable detectors segment is expected to register the fastest CAGR of 13.5% from 2025 to 2032, owing to their growing utilization in emergency, trauma, and home healthcare settings where flexibility and rapid deployment are critical.

- By Application

On the basis of application, the medical X-Ray detectors market is segmented into medical imaging, dental application, security application, veterinary application, and industrial application. The medical imaging segment dominated the market with a revenue share of 62.7% in 2024, driven by the increasing prevalence of chronic diseases and rising demand for diagnostic imaging across hospitals and diagnostic labs.

The veterinary application segment is anticipated to witness the fastest growth at a CAGR of 11.9%, propelled by increasing pet ownership and the growing demand for advanced imaging technologies in animal healthcare.

- By End User

On the basis of end user, the medical X-Ray detectors market is segmented into hospitals, diagnostic laboratories, original equipment manufacturers (OEMs), clinics, and ICUs. The hospital segment accounted for the largest market share of 49.3% in 2024, supported by a high volume of patient admissions, a broad range of imaging requirements, and ongoing investments in upgrading diagnostic infrastructure.

The ICU segment is expected to grow at the fastest CAGR of 12.1% during the forecast period, driven by the need for real-time, bedside imaging solutions to support critical care and trauma patients.

Medical X-Ray Detectors Market Regional Analysis

- North America dominated the medical X-Ray detectors market with the largest revenue share of 41.6% in 2024, driven by the region's strong focus on advanced diagnostic imaging technologies, widespread adoption of digital radiography, and favorable reimbursement policies

- The region benefits from robust healthcare infrastructure, increased investment in radiology departments, and growing demand for early and accurate diagnostic tools

- The presence of major players such as GE Healthcare, Carestream Health, and Canon Medical Systems further enhances innovation and accessibility in the North American market

U.S. Medical X-Ray Detectors Market Insight

The U.S. medical X-Ray detectors market accounted for 85% of the North American revenue share in 2024, owing to high healthcare spending, rising chronic disease prevalence, and a strong emphasis on early disease detection. Technological advancements in flat panel detectors, mobile radiography, and AI integration are reshaping hospital workflows. The increasing demand for portable and wireless detectors in ICUs, emergency rooms, and outpatient clinics is also fueling market expansion across the U.S.

Europe Medical X-Ray Detectors Market Insight

The Europe medical X-Ray detectors market is projected to grow at a substantial CAGR during the forecast period, supported by growing digital transformation in healthcare and increasing government investments in modern imaging infrastructure. Countries such as Germany, France, and the U.K. are witnessing increased adoption of digital radiography in both public and private healthcare settings. The region also benefits from strong regulatory frameworks encouraging the use of low-radiation, high-efficiency imaging systems.

U.K. Medical X-Ray Detectors Market Insight

The U.K. medical X-Ray detectors market is expected to grow at a notable CAGR, driven by the rising demand for minimally invasive diagnostics and the modernization of NHS imaging services. Initiatives such as NHSX are pushing for digital radiography and AI-based diagnostic tools, further promoting the adoption of advanced X-ray detectors Increased prevalence of respiratory, orthopedic, and cancer-related conditions is also fueling demand.

Germany Medical X-Ray Detectors Market Insight

The Germany medical X-Ray detectors market is anticipated to expand at a considerable CAGR, propelled by strong medical device manufacturing capabilities, rising healthcare funding, and a high rate of hospital digitization. German hospitals are actively replacing analog systems with flat panel detectors to improve diagnostic accuracy and efficiency. Government incentives for digital healthcare transformation and energy-efficient medical devices are further contributing to growth.

Asia-Pacific Medical X-Ray Detectors Market Insight

The Asia-Pacific medical X-Ray detectors market is forecast to grow at the fastest CAGR of 24% from 2025 to 2032, driven by expanding healthcare access, rapid urbanization, and government initiatives promoting digital health. Countries such as China, Japan, and India are investing heavily in radiology infrastructure, particularly in rural and semi-urban areas. The shift from conventional to digital radiography in hospitals and diagnostic labs is accelerating demand for cost-effective and portable X-ray detector solutions.

Japan Medical X-Ray Detectors Market Insight

The Japan medical X-Ray detectors market is gaining momentum due to the country’s emphasis on innovation, aging population, and growing adoption of home healthcare solutions. Japan is one of the early adopters of wireless, compact, and AI-enabled detectors, especially in urban healthcare settings. Integration with PACS systems and a preference for high-resolution, low-dose imaging are key drivers in the Japanese market.

China Medical X-Ray Detectors Market Insight

China medical X-Ray detectors market held the largest revenue share in Asia-Pacific in 2024, driven by its rapidly expanding middle class, government-backed health reforms, and robust local manufacturing of X-ray equipment. China's growing number of public and private hospitals are transitioning to digital radiography for better workflow and patient throughput. Key domestic players and favorable regulatory frameworks are making medical X-ray detectors more accessible across primary and tertiary care facilities.

Medical X-Ray Detectors Market Share

The medical X-Ray detectors market industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- Toshiba Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Carestream Health (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Ziehm Imaging GmbH (Germany)

- Canon Inc. (Japan)

- FUJIFILM Holdings Corporation (Japan)

- GMM PFAUDLER (India)

- Danaher Corporation (U.S.)

- PLANMECA OY (Finland)

- VATECH (India)

- Villa Sistemi Medicali Spa (Italy)

- Midmark Corporation (U.S.)

- Apteryx Imaging Inc. (Canada)

- Varian Medical Systems, Inc. (U.K.)

- Hamamatsu Photonics K.K. (Japan)

- KA Imaging (Canada)

Latest Developments in Global Medical X-Ray Detectors Market

- In March 2025, Canon Medical Systems USA received FDA 510(k) clearance for its advanced Adora DRFi system, a hybrid radiography/fluoroscopy solution featuring the wireless CXDI-RF B1 detector. This system enhances operational efficiency by allowing both imaging modalities in a single room. This milestone reinforces Canon’s commitment to innovation and strengthens its leadership in the evolving Medical X-Ray Detectors market

- In May 2025, United Imaging announced FDA approval for its uAngio Aviva interventional X-ray system. Equipped with robotic 8-axis control and intelligent image guidance (uVERA IQ), the system delivers precision and efficiency in complex vascular procedures. This development illustrates the company’s continued focus on next-gen X-ray detector technologies to meet interventional radiology demands

- In March 2025, Gleamer, a medical imaging AI company, received FDA clearance for ChestView, an AI-powered software that supports radiologists by identifying 10 major findings on chest X-rays. This approval marks a significant advancement in AI-enabled X-ray diagnostics, reflecting the growing convergence of AI and detector technology in radiological practices

- In March 2025, Detection Technology launched the X-Panel 43108a FQI, the largest dynamic flat-panel X-ray detector on the market. Designed for industrial use, the detector measures 43 × 108 cm and offers ultra-fast scanning for large and complex components. This innovation demonstrates Detection Technology’s expansion into high-end digital detector applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.