Global Medication Dispensing And Packaging Systems Market

Market Size in USD Million

CAGR :

%

USD

199.20 Million

USD

337.18 Million

2024

2032

USD

199.20 Million

USD

337.18 Million

2024

2032

| 2025 –2032 | |

| USD 199.20 Million | |

| USD 337.18 Million | |

|

|

|

|

Medication Dispensing and Packaging Systems Market Size

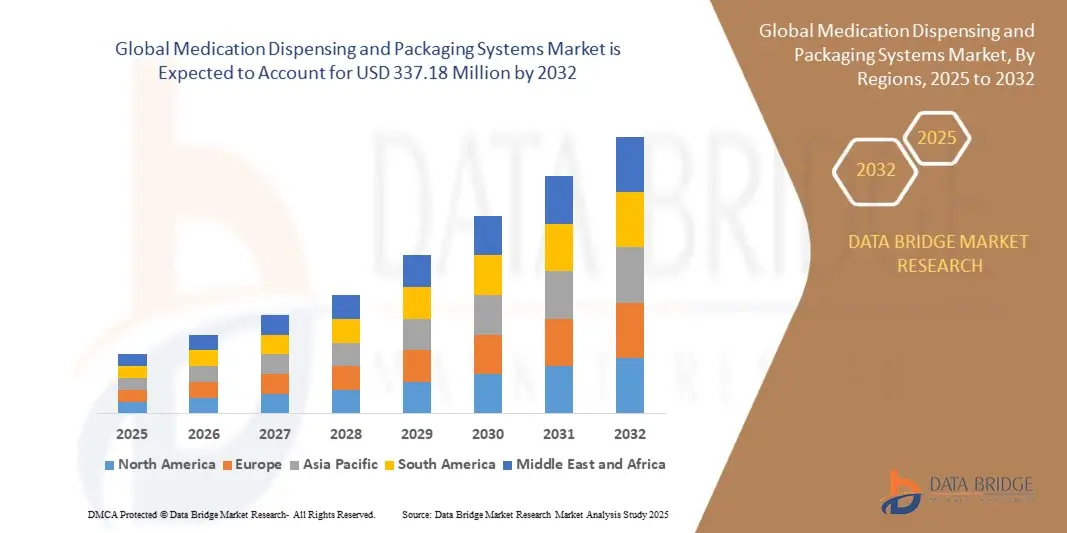

- The global medication dispensing and packaging systems market size was valued at USD 199.2 million in 2024 and is expected to reach USD 337.18 million by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is primarily driven by the increasing need for automation in pharmacies to enhance efficiency, reduce medication errors, and improve patient safety, along with rising demand for streamlined medication management in healthcare facilities

- Growing awareness of the benefits of automated dispensing systems in improving workflow efficiency and ensuring accurate medication delivery is further propelling market demand across hospital and retail pharmacy channels

Medication Dispensing and Packaging Systems Market Analysis

- The medication dispensing and packaging systems market is experiencing robust growth as healthcare providers prioritize automation to enhance operational efficiency and patient care quality

- Rising demand from hospital pharmacies and long-term care facilities is encouraging manufacturers to innovate with high-speed, high-capacity, and user-friendly dispensing solutions

- North America dominates the medication dispensing and packaging systems market with the largest revenue share of 36.2% in 2024, driven by advanced healthcare infrastructure, high adoption of automation technologies, and stringent regulations on medication safety

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid healthcare infrastructure development, increasing healthcare expenditure, and growing awareness of automated dispensing benefits, particularly in countries such as China, India, and Japan

- The above 40 ppm segment dominated the largest market revenue share of 58.2% in 2024, driven by its high efficiency and ability to meet the demands of large-scale pharmacies. These high-speed systems are favored for their capacity to handle high prescription volumes, reduce operational bottlenecks, and improve throughput in busy environments

Report Scope and Medication Dispensing and Packaging Systems Market Segmentation

|

Attributes |

Medication Dispensing and Packaging Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medication Dispensing and Packaging Systems Market Trends

Increasing Integration of AI and IoT Technologies

- The global medication dispensing and packaging systems market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies

- These technologies enable advanced automation, real-time data processing, and analytics, providing deeper insights into medication inventory management, dispensing accuracy, and patient adherence

- AI-powered dispensing systems can proactively identify potential errors in medication packaging, such as incorrect dosages or pill mismatches, before they reach patients

- For instance, companies are developing AI-driven platforms that analyze prescription patterns to optimize inventory levels or predict medication demand based on seasonal trends or patient demographics

- IoT integration allows seamless connectivity between dispensing systems, pharmacy information systems (PIS), and electronic medical records (EMR), enabling real-time tracking and improved workflow efficiency

- This trend enhances the value proposition of medication dispensing and packaging systems, making them more appealing to hospital pharmacies, retail pharmacies, and long-term care facilities

Medication Dispensing and Packaging Systems Market Dynamics

Driver

Rising Demand for Automation and Patient Safety

- The increasing demand for automated medication management solutions, driven by the need for enhanced patient safety and operational efficiency, is a major driver for the global medication dispensing and packaging systems market

- These systems improve accuracy by reducing human errors in dispensing and packaging, offering features such as automated prescription validation, barcode scanning, and real-time inventory tracking

- Regulatory mandates, particularly in North America, which dominates the market with a 40% revenue share in 2023, are pushing for the adoption of automated systems to meet stringent medication safety standards

- The proliferation of IoT and advancements in cloud-based solutions are enabling faster data processing and integration with digital health platforms, supporting sophisticated pharmacy services

- Pharmacies and healthcare facilities are increasingly adopting these systems as standard solutions to manage rising prescription volumes and enhance patient-centric care

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- The high initial investment required for hardware, software, and integration of medication dispensing and packaging systems remains a significant barrier, particularly for smaller pharmacies and facilities in emerging markets such as parts of Asia-Pacific, despite it being the fastest-growing region

- Retrofitting existing pharmacy setups with advanced dispensing systems can be complex and costly, limiting adoption in cost-sensitive regions.

- Data privacy and security concerns are a major challenge, as these systems collect and transmit sensitive patient and prescription data, raising risks of breaches or non-compliance with regulations such as GDPR or HIPA

- The fragmented regulatory landscape across countries, particularly regarding data storage and usage, complicates operations for global manufacturers and service providers

- These factors can deter adoption, especially in regions with high cost sensitivity or stringent data privacy awareness, potentially slowing market growth

Medication Dispensing and Packaging Systems market Scope

The market is segmented on the basis of packaging speed, canister capacity, and end user.

- By Packaging Speed

On the basis of packaging speed, the global medication dispensing and packaging systems market is segmented into 20 - 40 ppm, above 40 ppm, and up to 20 ppm. The above 40 ppm segment dominated the largest market revenue share of 58.2% in 2024, driven by its high efficiency and ability to meet the demands of large-scale pharmacies. These high-speed systems are favored for their capacity to handle high prescription volumes, reduce operational bottlenecks, and improve throughput in busy environments. Their advanced automation capabilities, paired with precision in dispensing, make them ideal for high-volume settings seeking scalability and reliability.

The 20 - 40 ppm segment is expected to register the fastest growth rate from 2025 to 2032, as mid-sized pharmacies and facilities increasingly adopt automated systems to balance cost and efficiency. These systems offer flexibility for operations that require moderate throughput while maintaining accuracy and minimizing labor costs. The growing trend toward automation in mid-tier healthcare facilities and the need for efficient medication management further propel this segment’s growth.

- By Canister Capacity

On the basis of canister capacity, the global medication dispensing and packaging systems market is categorized into 101 - 300 canisters, above 300 canisters, and up to 100 canisters. The above 300 canisters segment accounted for the highest revenue share in 2024, supported by the need for high-capacity systems in large-scale hospital and mail-order pharmacies. These systems can store a wide variety of medications, enabling seamless dispensing for complex prescriptions and high patient volumes. Their integration with advanced inventory management software and compatibility with diverse medication types make them essential for large operations.

The 101 - 300 canisters segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the increasing adoption of automated dispensing systems in small to mid-sized pharmacies. These systems provide a cost-effective solution for facilities looking to scale operations without investing in large-scale infrastructure. The growing focus on reducing medication errors and improving operational efficiency in smaller healthcare settings, combined with advancements in compact, high-capacity canister designs, accelerates this segment’s growth.

- By End User

On the basis of end user, the global medication dispensing and packaging systems market is segmented into hospital pharmacies, long-term care pharmacies, mail order pharmacies, and retail pharmacies. The hospital pharmacies segment held the largest revenue share in 2024, attributed to the rising demand for automated systems to manage complex medication regimens and high patient turnover. These systems enhance patient safety by minimizing dispensing errors, streamline workflows, and ensure compliance with stringent regulatory standards. The integration of dispensing systems with electronic health records (EHRs) further drives their adoption in hospital settings.

The retail pharmacies segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the rapid expansion of retail pharmacy chains and the increasing adoption of automation to enhance customer service. Retail pharmacies are leveraging these systems to reduce wait times, improve prescription accuracy, and support the growing demand for personalized medication packaging. The rise in chronic disease prevalence and the shift toward patient-centric care models further amplify the need for efficient dispensing and packaging solutions in this sector.

Medication Dispensing and Packaging Systems Market Regional Analysis

- North America dominates the medication dispensing and packaging systems market with the largest revenue share of 36.2% in 2024, driven by advanced healthcare infrastructure, high adoption of automation technologies, and stringent regulations on medication safety

- End users, including hospital pharmacies, long-term care pharmacies, mail order pharmacies, and retail pharmacies, prioritize systems that enhance medication accuracy, reduce errors, and improve operational efficiency, particularly in regions with advanced healthcare systems

- Growth is supported by technological advancements in dispensing systems, such as high-speed packaging and smart canister technologies, alongside rising adoption in both hospital and retail pharmacy segments

U.S. Medication Dispensing and Packaging Systems Market Insight

The U.S. medication dispensing and packaging systems market captured the largest revenue share of 77.1% in 2024 within North America, fueled by strong demand for automation in hospital and retail pharmacies and growing awareness of medication error reduction benefits. The trend towards smart healthcare solutions and stringent regulatory standards for patient safety further boost market expansion. Integration of advanced dispensing systems in healthcare facilities complements aftermarket sales, creating a robust product ecosystem.

Europe Medication Dispensing and Packaging Systems Market Insight

The European market for medication dispensing and packaging systems is expected to witness significant growth, driven by regulatory emphasis on patient safety and medication accuracy. End users seek systems that improve dispensing efficiency while ensuring compliance with stringent healthcare regulations. Growth is prominent in both hospital and long-term care pharmacy installations, with countries such as Germany and France showing significant uptake due to increasing healthcare digitization and aging populations.

U.K. Medication Dispensing and Packaging Systems Market Insight

The U.K. market is expected to witness rapid growth, driven by demand for automated dispensing systems that enhance medication accuracy and patient safety in urban and suburban healthcare settings. Increased focus on operational efficiency and rising awareness of error reduction benefits encourage adoption. Evolving healthcare regulations also influence end-user choices, balancing system capabilities with compliance.

Germany Medication Dispensing and Packaging Systems Market Insight

Germany is expected to witness rapid growth in the medication dispensing and packaging systems market, attributed to its advanced healthcare infrastructure and high focus on patient safety and operational efficiency. German healthcare providers prefer technologically advanced systems with high packaging speeds (above 40 ppm) and large canister capacities (above 300 canisters) to reduce errors and improve workflow. Integration of these systems in premium healthcare facilities and retail pharmacies supports sustained market growth.

Asia-Pacific Medication Dispensing and Packaging Systems Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding healthcare infrastructure and rising healthcare expenditure in countries such as China, India, and Japan. Increasing awareness of medication safety, error reduction, and operational efficiency is boosting demand across hospital pharmacies, long-term care pharmacies, mail order pharmacies, and retail pharmacies. Government initiatives promoting healthcare automation and patient safety further encourage the adoption of advanced dispensing and packaging systems.

Japan Medication Dispensing and Packaging Systems Market Insight

Japan’s medication dispensing and packaging systems market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced systems that enhance medication accuracy and patient safety. The presence of major healthcare technology manufacturers and integration of dispensing systems in hospital pharmacies accelerate market penetration. Rising interest in aftermarket solutions for retail pharmacies also contributes to growth.

China Medication Dispensing and Packaging Systems Market Insight

China holds the largest share of the Asia-Pacific medication dispensing and packaging systems market, propelled by rapid urbanization, rising healthcare demands, and increasing adoption of automated medication management solutions. The country’s growing middle class and focus on smart healthcare support the adoption of systems with packaging speeds of 20–40 ppm and canister capacities of 101–300 canisters. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Medication Dispensing and Packaging Systems Market Share

The medication dispensing and packaging systems industry is primarily led by well-established companies, including:

- BD (Becton, Dickinson and Company) (U.S.)

- Omnicell, Inc. (U.S.)

- Swisslog Healthcare (Switzerland)

- Yuyama Co., Ltd. (Japan)

- ARxIUM (U.S.)

- Capsa Healthcare (U.S.)

- Parata Systems, LLC (U.S.)

- ScriptPro LLC (U.S.)

- Cerner Corporation (U.S.)

- McKesson Corporation (U.S.)

- TOSHO Inc. (Japan)

- JVM Co., Ltd. (South Korea)

- Meditech (U.S.)

What are the Recent Developments in Global Medication Dispensing and Packaging Systems Market?

- In December 2024, Omnicell UK & Ireland announced a strategic partnership with Gollmann Kommissioniersysteme GmbH, a German leader in robotic pharmacy automation. This collaboration integrates Gollmann’s advanced robotic storage and dispensing systems into Omnicell’s retail and central pharmacy solutions, aiming to enhance operational efficiency, patient safety, and regulatory compliance. The partnership leverages Omnicell’s HubXpert software with Gollmann’s compact, modular technology to streamline real-time medication workflows. It reflects Omnicell’s commitment to delivering cutting-edge automation across hospital and community pharmacy settings, while addressing growing pressures on healthcare providers

- In October 2024, Omnia Technologies, a global platform specializing in automation and bottling systems, acquired Tecnomaco, an Italian manufacturer renowned for its pharmaceutical packaging machinery. Tecnomaco, founded in 1994, designs and produces equipment for liquid filling, capping, labeling, blistering, and powder dosing, serving the pharmaceutical, nutraceutical, and cosmetic industries. This acquisition significantly expands Omnia’s Life Sciences division, strengthening its technological portfolio and global service capabilities. With over 1,000 machines installed across 90 countries, Tecnomaco’s integration reinforces Omnia’s commitment to innovation and market leadership in pharmaceutical automation

- In July 2024, Berry Global Group introduced a new range of specialized closures and couplings for its Politainer combi pack, creating a fully closed dispensing system for sensitive liquids. This innovation allows safe, air-free dispensing of products such as inks, chemicals, pharmaceuticals, cosmetics, and foods, minimizing contamination risks and improving product integrity. The Politainer’s collapsible polyethylene container within a cardboard outer ensures nearly complete evacuation while reducing plastic use by up to 75% compared to rigid containers. This launch underscores Berry’s commitment to technological advancement, sustainability, and supply chain efficiency

- In June 2024, BoomerangFX, a cloud-based SaaS provider for aesthetic medicine practices, partnered with DrFirst to launch an integrated e-prescribing system across North America. This collaboration introduces a unified medication management platform within BoomerangFX’s practice management suite, streamlining workflows and enhancing patient engagement. By incorporating DrFirst’s Rcopia and RxInform tools, the system offers secure electronic prescribing, access to medication history, drug interaction alerts, and automated patient messaging. While focused on aesthetic medicine, this partnership reflects a broader healthcare trend toward cloud-based digital solutions that improve prescription accuracy, reduce abandonment rates, and boost operational efficiency

- In November 2023, iA (Innovation Associates), a U.S.-based pharmacy fulfillment company, partnered with Euclid Medical Products to integrate Euclid’s Axial Adherence Packaging Technology into iA’s NEXiA® Enterprise Software Suite. This strategic collaboration enhances pharmacy fulfillment by enabling more accurate and efficient multi-dose medication packaging. The integration supports centralized dispensing workflows, improves patient adherence, and expands pharmacy providers’ ability to offer personalized medication delivery options beyond traditional bottles or vials. By combining advanced robotics with intelligent software, the partnership aims to streamline operations and elevate patient care across retail, specialty, and health system pharmacy settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medication Dispensing And Packaging Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medication Dispensing And Packaging Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medication Dispensing And Packaging Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.