Global Medicinal Chemistry For Drug Discovery Market

Market Size in USD Billion

CAGR :

%

USD

6.94 Billion

USD

19.25 Billion

2024

2032

USD

6.94 Billion

USD

19.25 Billion

2024

2032

| 2025 –2032 | |

| USD 6.94 Billion | |

| USD 19.25 Billion | |

|

|

|

|

Medicinal Chemistry for Drug Discovery Market Size

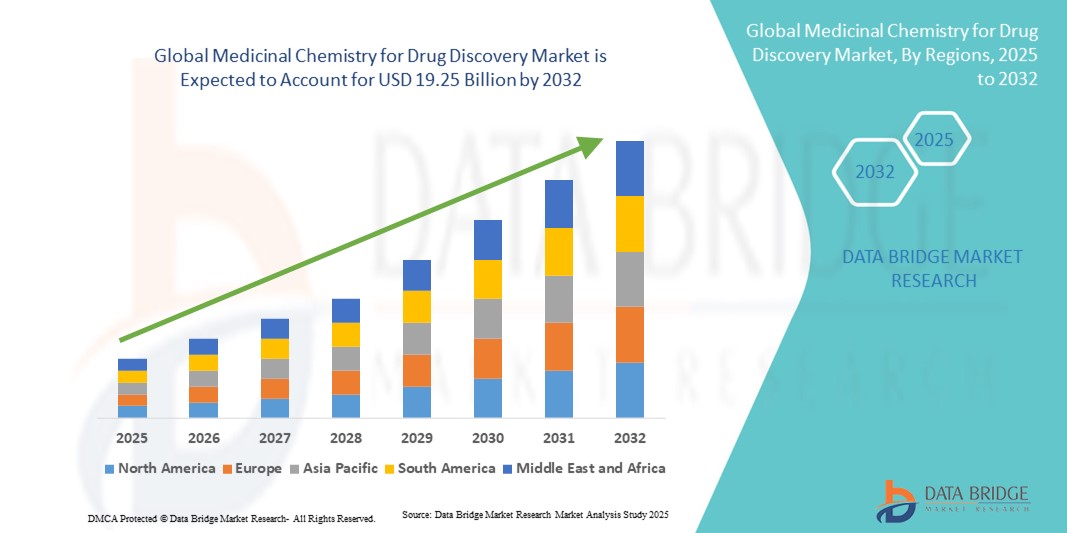

- The global medicinal chemistry for drug discovery market size was valued at USD 6.94 billion in 2024 and is expected to reach USD 19.25 billion by 2032, at a CAGR of 13.60% during the forecast period

- The market growth is largely driven by advancements in synthetic chemistry, high-throughput screening, and computer-aided drug design, enabling faster and more efficient identification of novel drug candidates

- Furthermore, increasing investments by pharmaceutical and biotechnology companies, coupled with the rising demand for innovative therapies for chronic and rare diseases, are positioning medicinal chemistry as a critical component of the modern drug discovery pipeline. These converging factors are accelerating the adoption of medicinal chemistry tools and platforms, thereby significantly propelling the industry's growth

Medicinal Chemistry for Drug Discovery Market Analysis

- Medicinal chemistry for drug discovery, involving the design, synthesis, and optimization of small molecules for therapeutic applications, is becoming an essential part of modern pharmaceutical R&D, enabling faster identification and development of novel drug candidates for various disease areas

- The growing adoption of high-throughput screening, computer-aided drug design, and AI-driven predictive models is primarily driving demand, alongside increasing pressure on pharmaceutical companies to accelerate drug discovery timelines and reduce development costs

- North America dominated the medicinal chemistry for drug discovery market with the largest revenue share of 39% in 2024, supported by a strong presence of leading pharmaceutical and biotechnology firms, high R&D expenditure, and early adoption of advanced drug discovery platforms, particularly in the U.S., where innovations in computational chemistry and precision medicine are accelerating pipeline development

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by increasing investments in pharmaceutical R&D, expanding biotechnology hubs, and rising collaborations between local research institutions and global pharma companies

- Hit-to-lead identification segment dominated the market with a share of 43.2% in 2024, driven by its critical role in selecting promising compounds from initial hits and optimizing their properties for efficacy, safety, and drug-such asness before advancing to preclinical and clinical development stages

Report Scope and Medicinal Chemistry for Drug Discovery Market Segmentation

|

Attributes |

Medicinal Chemistry for Drug Discovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medicinal Chemistry for Drug Discovery Market Trends

Integration of AI and Computational Drug Design

- A significant and accelerating trend in the global medicinal chemistry for drug discovery market is the integration of artificial intelligence (AI), machine learning, and computational chemistry platforms to streamline drug design and optimization processes. This fusion of technologies is enhancing the efficiency, accuracy, and speed of hit-to-lead identification and lead optimization

- For instance, Schrödinger’s drug discovery platform utilizes AI-driven molecular modeling and predictive algorithms to identify potential drug candidates faster, while Exscientia employs automated AI systems for designing novel compounds with optimized pharmacokinetic properties

- AI integration enables features such as predicting bioactivity, toxicity, and off-target effects, allowing chemists to prioritize compounds with higher success potential. In addition, computational approaches reduce the need for extensive trial-and-error synthesis, thereby cutting time and R&D costs

- The seamless combination of AI with high-throughput screening and structure-based drug design facilitates a centralized approach to compound selection, optimization, and preclinical evaluation, creating a more efficient and iterative drug discovery workflow

- This trend towards more intelligent, predictive, and automated medicinal chemistry processes is fundamentally reshaping expectations for drug discovery efficiency. Consequently, companies such as Insilico Medicine and Atomwise are developing AI-enabled platforms to accelerate compound identification and optimize lead candidates

- The demand for medicinal chemistry solutions integrating AI and computational platforms is growing rapidly across pharmaceutical and biotechnology sectors, as organizations increasingly prioritize faster development timelines and cost-effective innovation

Medicinal Chemistry for Drug Discovery Market Dynamics

Driver

Rising Demand for Novel Therapeutics and Faster Drug Development

- The increasing need for innovative therapies across oncology, rare diseases, and chronic conditions, combined with the pressure to reduce drug development timelines, is a significant driver for medicinal chemistry adoption

- For instance, in 2024, Pfizer and AstraZeneca expanded their AI-driven medicinal chemistry initiatives to accelerate lead identification for oncology pipelines, reflecting the strategic importance of advanced drug discovery tools

- Companies are increasingly investing in computational chemistry, high-throughput screening, and fragment-based drug design to optimize compound libraries and increase the probability of clinical success

- The growing collaboration between pharmaceutical companies, biotech startups, and academic institutions is further driving demand for integrated medicinal chemistry platforms that streamline the drug discovery process

- Advanced tools for structure-based design, predictive ADMET modeling, and automated synthesis are key factors propelling the adoption of medicinal chemistry approaches, enhancing the efficiency of both early-stage research and preclinical development

Restraint/Challenge

High Costs and Regulatory Hurdles in Drug Discovery

- The high cost of advanced medicinal chemistry platforms, combined with the complexity of regulatory compliance for new chemical entities, poses a significant challenge to widespread adoption. As drug discovery relies on sophisticated equipment, computational infrastructure, and highly skilled personnel, smaller companies or research labs may face barriers to entry

- For instance, developing AI-driven drug design solutions or accessing high-throughput screening facilities often requires substantial investment, which can limit adoption in emerging markets

- Regulatory scrutiny on novel compounds, including preclinical safety and environmental impact assessments, adds further complexity and time to the drug discovery process

- Addressing these challenges through cost-effective platform development, cloud-based computational chemistry solutions, and partnerships with contract research organizations (CROs) is crucial for broadening market penetration

- Balancing innovation, affordability, and compliance will be vital for sustained growth in the medicinal chemistry for drug discovery market

Medicinal Chemistry for Drug Discovery Market Scope

The market is segmented on the basis of process, design, drug type, therapeutic area, and end user.

- By Process

On the basis of process, the medicinal chemistry for drug discovery market is segmented into target selection, target validation, hit-to-lead identification, lead optimization, and candidate validation. The hit-to-lead identification segment dominated the market with the largest revenue share of 43.2% in 2024, as it plays a crucial role in filtering promising compounds from initial screening hits and optimizing them for potency, selectivity, and drug-such asness. This process ensures that only the most viable candidates advance to preclinical studies, reducing development costs and increasing clinical success probability. Companies are increasingly leveraging AI, computational chemistry, and high-throughput screening to enhance hit-to-lead efficiency. Fragment-based and structure-based approaches are widely applied to accelerate decision-making in this stage. The importance of this step in modern drug discovery pipelines makes it indispensable.

The lead optimization segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the need to refine compounds’ pharmacokinetic, pharmacodynamic, and safety profiles before clinical trials. Advanced platforms, including AI-driven design and structure-based optimization, allow precise modifications that enhance efficacy and minimize toxicity. Pharmaceutical and biotechnology companies are prioritizing lead optimization to reduce late-stage failures. Rising demand for precision therapeutics, especially in oncology and rare diseases, is further driving the adoption of optimized lead development workflows. This subsegment is projected to see rapid adoption due to its direct impact on the success of downstream clinical trials.

- By Design

On the basis of design, the medicinal chemistry for drug discovery market is segmented into fragment-based variation, structure-based drug design, diversity-oriented synthesis, chemogenomics, natural products, and others. The structure-based drug design segment dominated the market in 2024, leveraging 3D protein structures and computational modeling to rationally design molecules with improved binding affinity and reduced off-target effects. This approach improves success rates during hit-to-lead and lead optimization stages and allows chemists to predict molecular interactions accurately. Its wide adoption in pharmaceutical R&D highlights its importance in modern drug discovery.

The fragment-based variation segment is expected to witness the fastest growth during the forecast period, driven by its efficiency in generating high-quality lead compounds. By combining small chemical fragments into potent molecules, researchers reduce synthesis complexity while accelerating the discovery process. Integration with AI and high-throughput screening enhances its utility. Fragment-based approaches are increasingly applied in oncology, neurology, and infectious disease research, contributing to market expansion. Companies are investing in fragment-based platforms to optimize lead generation and improve the quality of candidate molecules.

- By Drug Type

On the basis of drug type, the medicinal chemistry for drug discovery market is segmented into small molecules and biologics. The small molecules segment dominated the market in 2024 due to their well-established development pathways, oral bioavailability, and cost-effective synthesis. Small molecules can target a wide range of disease mechanisms, and their structural versatility allows extensive optimization during hit-to-lead and lead optimization stages. They remain the backbone of medicinal chemistry-driven drug discovery.

The biologics segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing focus on monoclonal antibodies, peptides, and protein-based therapeutics for oncology, autoimmune, and rare diseases. Advances in protein engineering, bioconjugation, and targeted delivery systems are accelerating biologics development. The growing demand for precision therapeutics is boosting adoption of medicinal chemistry tools for biologics design. Companies are leveraging computational modeling to optimize biologic candidates efficiently. Biologics are expected to contribute significantly to revenue growth in the coming years.

- By Therapeutic Area

On the basis of therapeutic area, the medicinal chemistry for drug discovery market is segmented into oncology, neurology, infectious and immune system diseases, cardiovascular diseases, digestive system diseases, and others. The oncology segment dominated the market in 2024 due to the high prevalence of cancer worldwide and the urgent need for novel targeted therapies. Medicinal chemistry approaches, including structure-based and fragment-based strategies, are extensively used to develop small molecules and biologics targeting oncogenic pathways. The demand for faster, more effective cancer therapies drives investment in drug discovery platforms. Oncology-focused R&D remains a priority for pharmaceutical and biotechnology companies, reinforcing this segment’s dominance.

The neurology segment is expected to witness the fastest CAGR during the forecast period, fueled by increasing investments in therapies for neurodegenerative disorders such as Alzheimer’s and Parkinson’s diseases. The complexity of CNS targets, coupled with the rising need for disease-modifying treatments, drives the adoption of advanced medicinal chemistry tools to design molecules capable of crossing the blood-brain barrier with optimized efficacy and safety profiles. Computational chemistry and AI-based platforms are playing an increasingly important role. Rising prevalence of neurological disorders globally underscores the growth potential in this segment.

- By End User

On the basis of end user, the medicinal chemistry for drug discovery market is segmented into contract research organizations (CROs), pharmaceuticals and biotechnology companies, academic and research institutes, and others. The pharmaceuticals and biotechnology companies segment dominated the market in 2024, driven by extensive R&D budgets, in-house medicinal chemistry teams, and adoption of cutting-edge platforms to accelerate drug discovery pipelines. These organizations prioritize efficiency, cost reduction, and early-stage success, fueling demand for integrated hit-to-lead and lead optimization solutions. Their investments in AI and computational chemistry enhance speed and precision.

The contract research organizations (CROs) segment is anticipated to witness the fastest growth during the forecast period, as pharmaceutical companies increasingly outsource early-stage drug discovery to specialized CROs for cost savings, access to expertise, and faster timelines. CROs leverage AI, high-throughput screening, and computational chemistry platforms to provide scalable, efficient, and reliable services. Growing collaboration between CROs and pharma/biotech companies drives market expansion. This segment is expected to see increasing adoption due to its flexibility, scalability, and access to specialized medicinal chemistry expertise.

Medicinal Chemistry for Drug Discovery Market Regional Analysis

- North America dominated the medicinal chemistry for drug discovery market with the largest revenue share of 39% in 2024, supported by a strong presence of leading pharmaceutical and biotechnology firms, high R&D expenditure, and early adoption of advanced drug discovery platforms

- The region benefits from early adoption of cutting-edge technologies such as AI-driven drug design, high-throughput screening, and computational chemistry platforms, which streamline hit-to-lead identification, lead optimization, and candidate validation processes

- The U.S., in particular, shows strong growth due to substantial investments in oncology, neurology, and rare disease therapeutics, coupled with supportive government initiatives and collaborations between academic institutions and industry players

U.S. Medicinal Chemistry for Drug Discovery Market Insight

The U.S. medicinal chemistry for drug discovery market captured the largest revenue share in 2024 within North America, driven by substantial investments in pharmaceutical R&D and advanced drug discovery platforms. The country benefits from the rapid adoption of AI-driven drug design, high-throughput screening, and computational chemistry tools, accelerating hit-to-lead identification and lead optimization. Pharmaceutical and biotechnology companies prioritize developing therapies for oncology, neurology, and rare diseases, increasing demand for sophisticated medicinal chemistry solutions. Strong collaborations between academic institutions and industry players further stimulate innovation. In addition, regulatory support, robust intellectual property protection, and access to highly skilled medicinal chemists contribute to the market's leadership. The growing focus on precision medicine and faster drug development timelines is expected to sustain market growth.

Europe Medicinal Chemistry for Drug Discovery Market Insight

The Europe medicinal chemistry for drug discovery market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased investments in pharmaceutical R&D and growing adoption of computational drug design platforms. Stringent regulatory requirements and the rising need for innovative therapeutics are fostering the use of medicinal chemistry approaches across the region. Countries such as Germany, France, and Switzerland are investing heavily in infrastructure for drug discovery, including high-throughput screening and AI-based lead optimization. European pharmaceutical companies are increasingly integrating medicinal chemistry platforms into both in-house and outsourced workflows. The region also benefits from strong academic and research collaborations, enabling efficient translation of research into drug candidates. Rising demand for treatments in oncology, neurology, and infectious diseases continues to support market expansion.

U.K. Medicinal Chemistry for Drug Discovery Market Insight

The U.K. medicinal chemistry for drug discovery market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s strong pharmaceutical and biotechnology sector and focus on advanced drug discovery technologies. Increased emphasis on homegrown innovation, government-supported R&D programs, and partnerships with academic research institutes promote the adoption of medicinal chemistry solutions. The growing pipeline of oncology, neurology, and rare disease therapeutics is creating demand for hit-to-lead identification and lead optimization platforms. In addition, the U.K.’s favorable regulatory framework and skilled workforce enhance its attractiveness as a hub for drug discovery. Investments in AI-assisted drug design and structure-based optimization are accelerating the development of high-quality candidate molecules. The presence of prominent CROs offering specialized medicinal chemistry services further stimulates growth.

Germany Medicinal Chemistry for Drug Discovery Market Insight

The Germany medicinal chemistry for drug discovery market is expected to expand at a considerable CAGR during the forecast period, fueled by strong pharmaceutical R&D investment and a focus on innovative therapeutic solutions. Germany’s advanced infrastructure, emphasis on technology-driven drug discovery, and integration of AI and computational chemistry tools promote market adoption. The country prioritizes environmentally sustainable and cost-efficient drug discovery practices, driving demand for fragment-based and structure-based design platforms. The growing pipeline in oncology, neurology, and cardiovascular therapeutics is enhancing the need for medicinal chemistry services. Collaborations between research institutes and pharmaceutical companies ensure rapid translation of laboratory findings into viable drug candidates. Germany’s position as a European innovation hub supports its continued leadership in medicinal chemistry-driven drug discovery.

Asia-Pacific Medicinal Chemistry for Drug Discovery Market Insight

The Asia-Pacific medicinal chemistry for drug discovery market is poised to grow at the fastest CAGR during the forecast period, driven by increasing pharmaceutical R&D investments in countries such as China, Japan, and India. Rapid urbanization, rising healthcare expenditures, and government initiatives promoting biotechnology innovation are supporting market expansion. The region benefits from a large talent pool of skilled medicinal chemists and computational chemists, accelerating the adoption of AI-driven hit-to-lead and lead optimization platforms. APAC is increasingly becoming a hub for contract research organizations (CROs) that provide cost-effective medicinal chemistry services to global pharmaceutical companies. Strong focus on oncology, neurology, and infectious disease research further propels growth. Integration of advanced technologies and collaborations with global firms are improving efficiency, speed, and output quality in drug discovery.

Japan Medicinal Chemistry for Drug Discovery Market Insight

The Japan medicinal chemistry for drug discovery market is gaining momentum due to the country’s strong pharmaceutical sector, technological advancement, and demand for innovative therapeutics. Rapid urbanization and an aging population drive the need for novel treatments in oncology, neurology, and metabolic disorders. Japanese companies are increasingly adopting AI-assisted medicinal chemistry and high-throughput screening to optimize hit-to-lead and lead optimization processes. Integration with computational chemistry and structure-based drug design enhances the efficiency and accuracy of drug discovery. Collaborations between domestic pharmaceutical companies, CROs, and academic institutions support the rapid development of candidate molecules. Government initiatives promoting biotechnology and precision medicine further strengthen market growth in Japan.

India Medicinal Chemistry for Drug Discovery Market Insight

The India medicinal chemistry for drug discovery market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country’s growing pharmaceutical industry, expanding R&D infrastructure, and increasing adoption of advanced drug discovery technologies. India is emerging as a hub for contract research organizations (CROs) and outsourcing services, providing cost-effective medicinal chemistry solutions to global pharmaceutical companies. Investments in AI-driven drug design, computational chemistry, and high-throughput screening are enhancing efficiency in hit-to-lead identification and lead optimization. Rising prevalence of chronic and infectious diseases is fueling demand for innovative therapeutics. Government initiatives supporting biotech and pharmaceutical innovation, coupled with a skilled talent pool, are facilitating market expansion. The availability of affordable medicinal chemistry platforms is further enabling small and mid-sized companies to adopt advanced drug discovery processes.

Medicinal Chemistry for Drug Discovery Market Share

The medicinal chemistry for drug discovery industry is primarily led by well-established companies, including:

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Insilico Medicine, Inc. (U.S.)

- Recursion Pharmaceuticals, Inc. (U.S.)

- Sygnature Discovery Ltd (U.K.)

- Symeres (Netherlands)

- Isomorphic Labs (U.K.)

- BioCryst Pharmaceuticals, Inc. (U.S.)

- Atomwise, Inc. (U.S.)

- Evotec SE (Germany)

- Metrion Biosciences Ltd (U.K.)

- Oncodesign Services (France)

- Paraza Pharma Inc. (Canada)

- Pharmaron Beijing Co., Ltd. (China)

- SYNthesis Med Chem (Australia)

- Taros Chemicals GmbH & Co. KG (Germany)

- TOLREMO therapeutics AG (Switzerland)

- Vagdevi InnoScience (India)

- C4X Discovery Holdings plc (U.K.)

What are the Recent Developments in Global Medicinal Chemistry for Drug Discovery Market?

- In August 2025, AbbVie announced a strategic acquisition of Gilgamesh Pharmaceuticals' experimental depression drug, bretisilocin, in a deal valued up to USD 1.2 billion. Bretisilocin targets the 5-HT2A serotonin receptor, similar to psilocybin and LSD, but offers a shorter psychoactive experience with sustained therapeutic effects. This acquisition aligns with AbbVie's strategy to expand its neurological drug portfolio following the expiration of Humira's patent protection

- In June 2025, Welsh biotech company Draig Therapeutics secured USD 140 million in Series A funding to advance its lead drug candidate, DT-101, for the treatment of severe depression and other neurological disorders. DT-101 targets neurotransmitter imbalances by modulating glutamate and GABA systems and is administered orally

- In April 2025, a team of scientists uncovered the mechanism of cellular uptake for large and polar drugs. They devised a novel strategy to optimize the capacity of drug delivery into these cells, potentially allowing intravenous medications to be taken orally

- In August 2024, researchers at Moffitt Cancer Center developed a novel sulfur fluoride exchange (SuFEx) reagent. This reagent allows for highly controlled production of sulfur-based molecules, including sulfinamides and sulfonimidamides, which are essential in drug synthesis

- In July 2024, scientists unveiled a new class of ultra-stable chiral molecules, which are crucial for drug development. These molecules maintain their structure over time, reducing the risk of unwanted side effects and enhancing the efficacy of drugs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.