Global Medium Duty Truck Market

Market Size in USD Billion

CAGR :

%

USD

52.23 Billion

USD

80.16 Billion

2024

2032

USD

52.23 Billion

USD

80.16 Billion

2024

2032

| 2025 –2032 | |

| USD 52.23 Billion | |

| USD 80.16 Billion | |

|

|

|

|

Medium Duty Truck Market Size

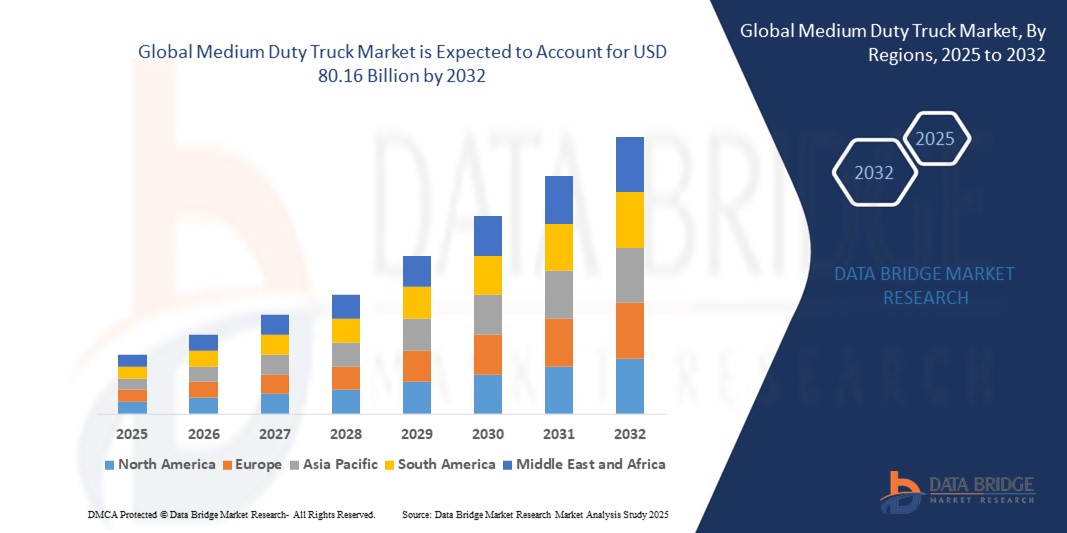

- The global medium duty truck market size was valued at USD 52.23 billion in 2024 and is expected to reach USD 80.16 billion by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is largely fueled by the rising demand for efficient freight movement driven by e-commerce expansion, infrastructure development, and increasing urbanization, which require versatile medium duty trucks for both regional and last-mile transportation

- Furthermore, growing emphasis on sustainability, coupled with advancements in electric and hybrid technologies, is pushing fleet operators and manufacturers to adopt cleaner, more fuel-efficient trucks. These converging factors are significantly boosting the adoption of medium duty trucks across global markets

Medium Duty Truck Market Analysis

- Medium duty trucks are commercial vehicles designed to handle payloads and applications between light-duty vans and heavy-duty trucks, making them essential for logistics, distribution, construction, and municipal operations. Their versatility allows deployment in both urban deliveries and regional transport networks

- The escalating demand for medium duty trucks is primarily fueled by the rapid growth of e-commerce, expansion of supply chain networks, and government initiatives promoting low-emission vehicles. In addition, the integration of telematics, safety systems, and connectivity solutions is enhancing fleet efficiency, further accelerating market adoption

- North America dominated the medium duty truck market with a share of 36.7% in 2024, due to strong demand from logistics, e-commerce, and construction sectors

- Asia-Pacific is expected to be the fastest growing region in the medium duty truck market during the forecast period due to rapid urbanization, growing trade, and infrastructure development in countries such as China, India, and Japan

- Diesel segment dominated the market with a market share of 59.2% in 2024, due to its long-standing dominance in commercial transport due to fuel efficiency, torque strength, and durability for medium-load operations. Diesel-powered trucks are the preferred choice for construction and logistics companies that require dependable performance over longer distances and rugged terrains. Established fueling infrastructure worldwide further strengthens the continued reliance on diesel vehicles in this segment

Report Scope and Medium Duty Truck Market Segmentation

|

Attributes |

Medium Duty Truck Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Medium Duty Truck Market Trends

Electrification and Adoption of Hybrid Medium Duty Trucks

- Electrification and the adoption of hybrid models are transforming the medium duty truck market, as manufacturers and fleet operators seek improved fuel efficiency and lower emissions. Hybrid and electric trucks are gaining traction across regional logistics, municipal fleets, and last-mile delivery due to regulatory pressures and evolving customer demand

- For instance, Daimler Trucks North America has introduced hybrid and all-electric medium duty models under its Freightliner brand for urban distribution and municipal services, supporting fleets transitioning to cleaner vehicles

- Advancements in battery technology are extending range and payload capacity for electric medium duty trucks, helping operators broaden applications from light urban routes to regional distribution

- Continued development of public and private charging infrastructure is facilitating the practical adoption of electric trucks by enabling flexible deployment and minimizing operational downtime

- In addition, government incentives, tax credits, and regulatory mandates are accelerating the shift toward electrified fleets and supporting manufacturer investments in hybrid and electric platforms

- Expansion of telematics and fleet management solutions is optimizing vehicle utilization and energy consumption for hybrid models, increasing overall cost savings and operational efficiency

- Growing interest in alternative fuels and renewable energy integration is supporting hybrid drivetrain development with plug-in, fuel cell, and biofuel-compatible options, further diversifying the market landscape

Medium Duty Truck Market Dynamics

Driver

Rising Automotive Industry

- Growth in the global automotive sector is directly driving demand for medium duty trucks suited for a wide range of commercial, municipal, and industrial applications. Expansion in construction, urbanization, and e-commerce continues to increase delivery and fleet requirements

- For instance, Navistar International supplies medium duty trucks for diverse segments, including logistics, public works, and construction, meeting rising demand from established and emerging economies

- Expanding infrastructure projects, urban development initiatives, and municipal investments require versatile vehicles capable of meeting changing regulatory and operational requirements

- In addition, increasing globalization of manufacturing and supply chains is boosting cross-regional freight demand, driving up procurement and deployment of medium duty vehicles by large operators

- The surge in parcel delivery, especially with e-commerce expansion, necessitates scalable truck platforms for reliable and efficient last-mile and regional logistics

Restraint/Challenge

High Operational Costs

- High total operational costs, including maintenance, fuel, insurance, and financing, present a major challenge in medium duty truck deployment and ownership. Operators must carefully manage expenses to ensure profitability and cost competitiveness in crowded logistics markets

- For instance, fleet managers utilizing models from Hino Motors have reported elevated maintenance costs for new hybrid drivetrains compared to legacy diesel units, impacting ROI for early adopters

- Rising fuel prices and varying energy costs for different powertrain types can erode operational savings and complicate long-term financial planning for fleets

- Complexity in vehicle financing and leasing terms further impacts cash flow management and may discourage small fleet operators and independent businesses from expanding fleets

- Uncertainty in regulatory environments, such as changing emissions standards or incentives, can influence operational costs and lead to capital risk for truck owners and operators

Medium Duty Truck Market Scope

The market is segmented on the basis of vehicle type, fuel type, application, and end-user.

- By Vehicle Type

On the basis of vehicle type, the medium duty truck market is segmented into conventional trucks, cabover trucks, cutaway van chassis, and stripped chassis. The conventional truck segment dominated the largest market revenue share in 2024, driven by its strong preference in North America and parts of Europe due to familiar design, high driver comfort, and suitability for longer hauls. Conventional trucks also provide easier engine accessibility for maintenance, which reduces downtime and enhances operational efficiency for fleet owners. Their adaptability across multiple applications, including logistics, construction, and distribution, further contributes to their dominance in the market.

The cabover truck segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its increasing adoption in densely populated urban regions across Asia-Pacific and Europe. Cabover trucks offer superior maneuverability, compact design, and improved visibility, making them highly efficient for last-mile deliveries and congested city routes. The rising e-commerce industry and rapid expansion of urban logistics are driving demand for these trucks. Their ability to maximize cargo space due to the absence of a protruding hood is also boosting their acceptance among fleet operators.

- By Fuel Type

On the basis of fuel type, the medium duty truck market is segmented into diesel, gasoline, hybrid, and electric. The diesel segment held the largest market revenue share of 59.2% in 2024, supported by its long-standing dominance in commercial transport due to fuel efficiency, torque strength, and durability for medium-load operations. Diesel-powered trucks are the preferred choice for construction and logistics companies that require dependable performance over longer distances and rugged terrains. Established fueling infrastructure worldwide further strengthens the continued reliance on diesel vehicles in this segment.

The electric truck segment is expected to witness the fastest growth from 2025 to 2032, driven by stringent emission regulations, government incentives, and increasing corporate commitments to sustainability. The growth of charging infrastructure, coupled with advancements in battery technology leading to higher range and faster charging, is making electric medium duty trucks more viable. Rising adoption by logistics companies for short-haul urban distribution is fueling this shift. In addition, lower operational costs and reduced maintenance requirements are incentivizing businesses to transition toward electric fleets.

- By Application

On the basis of application, the medium duty truck market is segmented into logistics, construction, distribution, and others. The logistics segment dominated the market in 2024, as medium duty trucks serve as a backbone for freight and goods transportation in both urban and regional networks. Their ability to handle varied payload capacities while ensuring fuel efficiency makes them the preferred choice for logistics providers. The surge in global trade, expansion of supply chain networks, and growth in e-commerce have all contributed significantly to the dominance of this segment.

The construction segment is projected to experience the fastest growth from 2025 to 2032, fueled by increasing infrastructure development projects across emerging economies and rapid urbanization worldwide. Medium duty trucks are essential in transporting construction materials, tools, and equipment efficiently across diverse terrains. The need for versatile vehicles that can operate both on highways and off-road construction sites enhances the demand for this segment. Public-private investments in smart cities and industrial development projects further strengthen the growth trajectory of construction applications.

- By End-User

On the basis of end-user, the medium duty truck market is segmented into fleet operators, construction companies, logistics companies, and others. The fleet operators segment dominated the market in 2024, owing to their large-scale adoption of medium duty trucks for diversified applications including delivery, distribution, and regional haulage. Fleet operators benefit from economies of scale and often prioritize vehicle performance, durability, and total cost of ownership, factors that strongly support medium duty truck utilization. The rising trend of leasing and fleet management services has further amplified this dominance.

The logistics companies segment is expected to record the fastest growth from 2025 to 2032, supported by the exponential rise of e-commerce, online retail, and the need for efficient last-mile connectivity. Logistics providers are increasingly investing in medium duty trucks that offer fuel efficiency, smart connectivity, and adaptability for multiple cargo types. The expansion of cold chain logistics for perishable goods is also contributing to growth in this category. Moreover, partnerships between logistics companies and truck OEMs for electric fleet adoption are further driving momentum in this segment.

Medium Duty Truck Market Regional Analysis

- North America dominated the medium duty truck market with the largest revenue share of 36.7% in 2024, driven by strong demand from logistics, e-commerce, and construction sectors

- The region benefits from a well-established transportation infrastructure, rising replacement demand for aging fleets, and growing adoption of technologically advanced trucks with enhanced fuel efficiency

- Fleet operators in North America prioritize medium duty trucks for their versatility in urban deliveries and regional haulage, which is further reinforced by stringent emission regulations pushing OEMs toward cleaner technologies. The increasing integration of telematics, safety systems, and driver-assist features also strengthens adoption across the region

U.S. Medium Duty Truck Market Insight

The U.S. medium duty truck market captured the largest revenue share in 2024 within North America, supported by robust demand from logistics and distribution companies. The country’s flourishing e-commerce sector is significantly driving the need for medium duty trucks for last-mile deliveries and regional freight movement. In addition, the U.S. has been at the forefront of adopting electric and hybrid medium duty trucks, spurred by federal incentives and sustainability commitments from fleet operators. Continuous investments in smart fleet management systems and connectivity solutions are also contributing to market growth, making the U.S. the most dominant contributor in the region.

Europe Medium Duty Truck Market Insight

The Europe medium duty truck market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent emission norms, sustainability goals, and the rapid electrification of commercial vehicles. The region’s logistics and construction industries rely heavily on medium duty trucks for efficient goods movement across urban and semi-urban routes. European consumers and businesses emphasize eco-friendly transportation solutions, which is driving the adoption of electric and hybrid medium duty trucks. Moreover, advancements in autonomous driving technologies and digital fleet solutions are expected to further propel the European market during the forecast period.

U.K. Medium Duty Truck Market Insight

The U.K. medium duty truck market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by expanding urban logistics demand and increasing investments in green transportation. With rising congestion in metropolitan areas, medium duty trucks are becoming central to last-mile delivery strategies for retail and e-commerce sectors. Government initiatives supporting zero-emission zones are accelerating the adoption of electric medium duty trucks. The U.K.’s developed road infrastructure, combined with growing adoption of telematics and connected vehicle systems, is creating a favorable growth environment.

Germany Medium Duty Truck Market Insight

The Germany medium duty truck market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong manufacturing and industrial base. Germany is witnessing rapid growth in the adoption of hybrid and electric medium duty trucks due to its ambitious climate goals and sustainability targets. The integration of digital fleet management tools, coupled with advanced safety and automation features, is reshaping fleet operations across logistics and construction sectors. In addition, Germany’s focus on innovation and eco-friendly technologies makes it a key growth driver within Europe.

Asia-Pacific Medium Duty Truck Market Insight

The Asia-Pacific medium duty truck market is poised to grow at the fastest CAGR from 2025 to 2032, supported by rapid urbanization, growing trade, and infrastructure development in countries such as China, India, and Japan. The expansion of e-commerce and retail distribution channels is fueling the need for medium duty trucks in both domestic and cross-border logistics. Government investments in road infrastructure and the promotion of cleaner vehicle technologies are further enhancing demand. In addition, the region’s role as a hub for truck manufacturing enables affordable availability, expanding adoption across both small fleet operators and large logistics providers.

Japan Medium Duty Truck Market Insight

The Japan medium duty truck market is gaining momentum due to its strong logistics network, aging population, and demand for compact yet efficient freight solutions. Japan’s focus on technology integration, including connected vehicle systems and autonomous driving features, is shaping the adoption of medium duty trucks. Sustainability initiatives and incentives for low-emission vehicles are pushing fleet operators toward hybrid and electric models. Furthermore, the need for efficient trucks in urban distribution and regional freight transport continues to drive the market in Japan.

China Medium Duty Truck Market Insight

The China medium duty truck market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, the booming e-commerce sector, and strong domestic manufacturing capabilities. China’s logistics and construction industries represent a major demand hub for medium duty trucks, with both private and state-owned enterprises expanding fleets. The country’s push toward electric mobility and smart city development is accelerating the adoption of electric medium duty trucks. Availability of cost-effective options from local manufacturers, combined with government incentives, positions China as the dominant growth contributor in the region.

Medium Duty Truck Market Share

The medium duty truck industry is primarily led by well-established companies, including:

- Daimler AG (Germany)

- Volvo Group (Sweden)

- Isuzu Motors Ltd. (Japan)

- Hino Motors Ltd. (Japan)

- PACCAR Inc. (U.S.)

- Ford Motor Company (U.S.)

- MAN Truck & Bus AG (Germany)

- Navistar International Corporation (U.S.)

- Tata Motors Limited (India)

- Scania AB (Sweden)

Latest Developments in Global Medium Duty Truck Market

- In July 2023, Daimler Truck and Torc Robotics announced a strategic partnership aimed at developing autonomous medium-duty trucks. Daimler will supply the truck platforms, while Torc will contribute its advanced autonomous driving systems. This collaboration is expected to accelerate the commercialization of self-driving medium-duty trucks in North America, addressing driver shortages, improving fleet efficiency, and setting new benchmarks for safety and logistics automation in the regional market

- In May 2023, Hino Motors formed a joint venture with Isuzu Motors to co-develop electric medium-duty trucks. The alliance combines the strengths of both companies in engineering and production, creating a pathway for the development of next-generation electric trucks to be marketed under both brands. This joint venture is likely to enhance competitiveness in the growing electric commercial vehicle market, expand product offerings, and meet rising demand for zero-emission trucks across global markets

- In April 2023, Mitsubishi Fuso Truck and Bus Corporation acquired a 10% stake in Nikola Corporation, a U.S.-based electric vehicle startup. This investment provides Mitsubishi Fuso with access to Nikola’s expertise in electric and hydrogen-powered vehicle technologies, supporting the acceleration of its own medium-duty electric truck development. The move underscores Mitsubishi’s commitment to advancing sustainable mobility and strengthens its position in the competitive electric truck landscape

- In 2023, Volvo Group launched a new range of medium-duty electric trucks equipped with advanced battery technology designed to increase driving range and overall performance. This product introduction directly addresses fleet operators’ concerns regarding vehicle range and charging efficiency, thereby boosting adoption rates. Volvo’s expansion of its electric portfolio enhances its leadership in sustainable transport solutions and supports global emission reduction initiatives

- In 2023, Ford Motor Company unveiled its latest medium-duty truck model featuring advanced driver-assist technologies and enhanced connectivity solutions. These innovations are aimed at improving driver safety and enabling more efficient fleet management through real-time data integration. By focusing on digitalization and driver-centric features, Ford strengthens its competitive edge in the market and appeals to fleet operators seeking operational efficiency and reduced downtime

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.