Global Medium Earth Orbit Meo Satellite Payload Market

Market Size in USD Billion

CAGR :

%

USD

3.52 Billion

USD

10.63 Billion

2025

2033

USD

3.52 Billion

USD

10.63 Billion

2025

2033

| 2026 –2033 | |

| USD 3.52 Billion | |

| USD 10.63 Billion | |

|

|

|

|

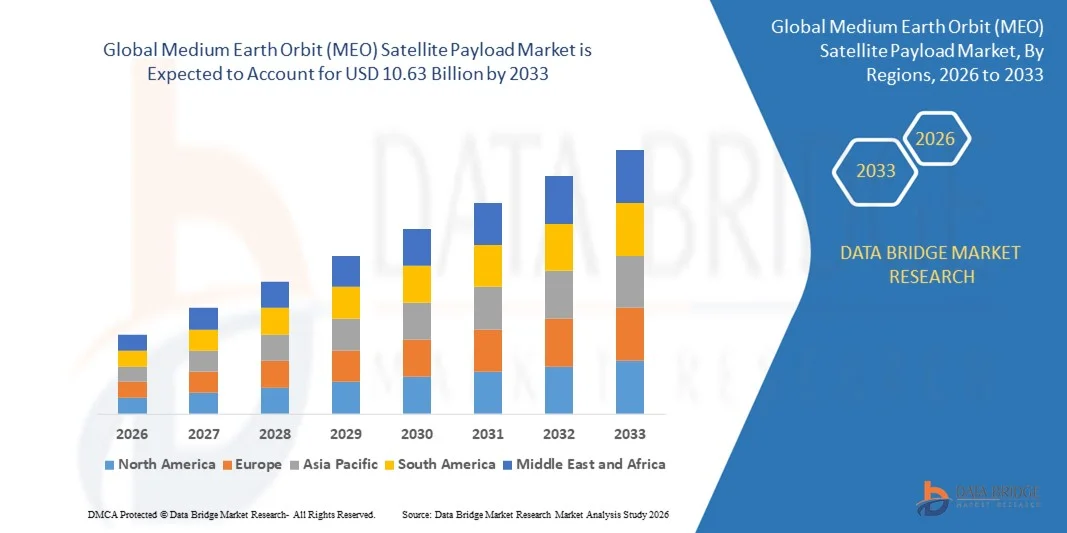

Medium Earth Orbit (MEO) Satellite Payload Market Size

- The global medium earth orbit (MEO) satellite payload market size was valued at USD 3.52 billion in 2025 and is expected to reach USD 10.63 billion by 2033, at a CAGR of 14.79% during the forecast period

- The market growth is largely fuelled by the increasing demand for reliable telecommunication services, high-resolution imaging, and advanced navigation systems in civil, military, and commercial sectors

- The rapid deployment of small and medium-to-heavy satellites for communication and Earth observation applications is further driving the adoption of MEO satellite payloads

Medium Earth Orbit (MEO) Satellite Payload Market Analysis

- Rising focus on high-speed internet connectivity, precise positioning, and real-time Earth monitoring is boosting the need for advanced MEO satellite payloads

- The increasing adoption of small satellite platforms and the growing number of space missions for scientific research, telecommunication, and surveillance are creating new market opportunities

- North America dominated the MEO satellite payload market with the largest revenue share in 2025, driven by increasing demand for reliable satellite communication networks, advanced navigation services, and robust government-backed space programs.

- Asia-Pacific region is expected to witness the highest growth rate in the global medium earth orbit (MEO) satellite payload market, driven by rising demand for broadband connectivity, remote sensing, and navigation services, coupled with growing space exploration activities and private sector participation in countries such as India, China, and Japan

- The communication payload segment held the largest market revenue share in 2025, driven by the rising demand for high-speed data transmission, broadband connectivity, and global satellite communication networks. Communication payloads provide low-latency, high-throughput services, making them critical for telecommunication and internet-based applications

Report Scope and Medium Earth Orbit (MEO) Satellite Payload Market Segmentation

|

Attributes |

Medium Earth Orbit (MEO) Satellite Payload Key Market Insights |

|

Segments Covered |

• By Payload Type: Communication Payload, Imaging Payload, Navigation Payload, and Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Medium Earth Orbit (MEO) Satellite Payload Market Trends

Rise of Advanced Medium Earth Orbit (MEO) Satellite Payloads

- The growing adoption of MEO satellite payloads is transforming the satellite communication and remote sensing landscape by enabling high-speed data transmission, precise navigation, and extensive coverage for telecommunication, scientific research, and surveillance applications. These payloads allow operators to deliver improved connectivity and operational efficiency while reducing latency and service gaps

- Increasing demand for broadband connectivity, high-resolution imaging, and real-time monitoring is accelerating the deployment of MEO satellites across civil, military, and commercial sectors. These payloads provide reliable coverage over wide areas, making them particularly effective for global communication networks and environmental monitoring

- The scalability and modular design of modern MEO satellite payloads are making them attractive for both established satellite operators and emerging space ventures. Users benefit from enhanced signal quality, faster data throughput, and easier integration with existing satellite constellations.

- For instance, in 2023, several telecommunication operators upgraded their satellite networks with MEO payloads, reporting improved network coverage, reduced latency, and better service delivery across urban and remote regions

- While MEO satellite payloads are witnessing strong adoption, their impact depends on continued technological innovation, cost-effective production, and interoperability with other orbital systems. Manufacturers must focus on high-performance, energy-efficient, and resilient payloads to fully capitalize on the growing demand

Medium Earth Orbit (MEO) Satellite Payload Market Dynamics

Driver

Rising Demand for High-Speed Connectivity and Real-Time Data Transmission

- The increasing need for uninterrupted communication, precise navigation, and real-time data across civil, military, and commercial applications is driving the adoption of MEO satellite payloads. High-speed payloads ensure reliable coverage for a wide range of satellite services, including broadband, remote sensing, and surveillance. This trend is further supported by the expansion of satellite constellations aiming to provide global coverage and redundancy

- Satellite operators are increasingly aware of the operational and financial benefits of MEO payloads, including reduced latency, higher bandwidth, and enhanced signal reliability. This awareness is boosting adoption across telecommunication, scientific research, and navigation sectors. Improved payload performance also allows operators to offer premium services and compete effectively in global markets

- Government initiatives and private investments promoting satellite internet, smart city projects, and space-based monitoring are encouraging deployment of advanced MEO payloads. Regulatory support and funding programs further drive the market growth. In addition, partnerships between public and private organizations are accelerating technology adoption and facilitating faster payload deployment timelines

- For instance, in 2022, several government-backed satellite programs in Europe and North America invested in MEO payloads to enhance global communication networks, improve environmental monitoring, and support defense applications. These initiatives helped demonstrate the feasibility of large-scale MEO constellations and validated their commercial potential

- While rising connectivity and data demands are driving market growth, there remains a need for cost-effective payloads, advanced energy management, and seamless integration with other orbital systems to sustain adoption. Continuous R&D in lightweight materials, low-power electronics, and modular payload designs is expected to further enhance market scalability and operational efficiency

Restraint/Challenge

High Development Costs and Technical Complexity Limiting Adoption

- The high capital investment required for advanced MEO satellite payloads, including communication modules, imaging sensors, and navigation systems, limits accessibility for emerging satellite operators. Cost remains a significant barrier for widespread adoption. In addition, high launch expenses and insurance costs further increase the financial burden, especially for startups and smaller operators

- In many regions, the lack of technical expertise and qualified engineers restricts effective payload deployment and satellite integration. Improper design or handling can reduce operational efficiency, increase maintenance costs, and shorten satellite lifespan. This challenge is exacerbated by the need for continuous monitoring, payload calibration, and software optimization to maintain peak performance

- Supply chain limitations for high-precision components, specialized electronics, and propulsion systems further constrain market penetration. Many smaller operators continue to rely on conventional LEO or GEO payloads, limiting the growth of MEO systems. Moreover, geopolitical restrictions on certain components and materials can delay project timelines and increase dependency on select suppliers

- For instance, in 2023, several emerging space ventures in Asia-Pacific postponed MEO payload deployment due to high development costs and insufficient technical support. These delays affected service rollouts, disrupted satellite network planning, and limited the ability to scale operations in competitive markets

- While satellite technology continues to advance, addressing cost, complexity, and skill gaps remains critical. Market stakeholders must focus on modular, user-friendly, and cost-efficient payloads to maximize adoption and long-term market potential. Innovations in additive manufacturing, standardized payload architectures, and advanced automation in assembly and testing are expected to reduce costs and accelerate deployment in the coming years

Medium Earth Orbit (MEO) Satellite Payload Market Scope

The MEO satellite payload market is segmented on the basis of payload type, payload weight, vehicle type, frequency band, application, and end use

- By Payload Type

On the basis of payload type, the market is segmented into communication payload, imaging payload, navigation payload, and others. The communication payload segment held the largest market revenue share in 2025, driven by the rising demand for high-speed data transmission, broadband connectivity, and global satellite communication networks. Communication payloads provide low-latency, high-throughput services, making them critical for telecommunication and internet-based applications.

The navigation payload segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing need for precise positioning, timing, and navigation services across civil, commercial, and defense sectors. Navigation payloads are essential for GPS augmentation, fleet tracking, and scientific missions, offering high accuracy and reliability for end users.

- By Payload Weight

On the basis of payload weight, the market is segmented into low weight, medium weight, and high weight. The low-weight segment held the largest market revenue share in 2025, attributed to lower launch costs, faster deployment, and suitability for small satellite constellations. Low-weight payloads provide flexible and cost-effective solutions for commercial and civil satellite missions.

The medium-weight segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of advanced sensors and high-capacity communication modules. Medium-weight payloads are critical for MEO satellites designed for multi-mission applications, including remote sensing, telecommunication, and navigation services.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into small satellite and medium-to-heavy satellite. The small satellite segment held the largest market revenue share in 2025 due to cost efficiency, reduced development time, and growing deployment of satellite constellations for communication and Earth observation. Small satellites offer rapid launch cycles and scalable solutions for commercial operators.

The medium-to-heavy satellite segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the need for high-capacity payloads and global coverage. Medium-to-heavy satellites provide robust platforms for critical government, defense, and commercial missions requiring complex payload integration.

- By Frequency Band

On the basis of frequency band, the market is segmented into C, K/KU/KA band, S and L band, X band, UHF and VHF band, and other bands. The K/KU/KA band segment held the largest market revenue share in 2025, fueled by high data transmission rates, wide adoption in telecommunication services, and broadband applications. These frequency bands support high-throughput satellite communication and global connectivity initiatives.

The X band segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increased use in defense, scientific research, and surveillance applications. X band payloads offer high precision and secure communication capabilities for military and government missions.

- By Application

On the basis of application, the market is segmented into telecommunication, remote sensing, scientific research, surveillance, and navigation. The telecommunication segment held the largest market revenue share in 2025, driven by the rising demand for satellite-based internet, broadband expansion, and global connectivity. Telecommunication payloads are essential for supporting commercial and civil communication networks.

The navigation segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing requirements for precise positioning, timing, fleet tracking, and smart transportation applications. Navigation payloads are increasingly deployed in civil, commercial, and defense sectors.

- By End Use

On the basis of end use, the market is segmented into civil, military, and commercial. The commercial segment held the largest market revenue share in 2025 due to the growing number of private satellite operators, commercial space programs, and satellite internet initiatives. Commercial payloads are central to global communication and service-oriented satellite missions.

The military segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising defense modernization programs, secure communication needs, and intelligence, surveillance, and reconnaissance applications. Military payloads provide critical support for defense and national security operations.

Medium Earth Orbit (MEO) Satellite Payload Market Regional Analysis

- North America dominated the MEO satellite payload market with the largest revenue share in 2025, driven by increasing demand for reliable satellite communication networks, advanced navigation services, and robust government-backed space programs.

- Satellite operators in the region highly value low-latency communication, high-throughput payloads, and advanced imaging and navigation capabilities that support civil, military, and commercial satellite applications.

- This widespread adoption is further supported by substantial investment in space infrastructure, advanced technological expertise, and strong public-private partnerships, establishing North America as a leading hub for MEO satellite payload deployment.

U.S. MEO Satellite Payload Market Insight

The U.S. MEO satellite payload market captured the largest revenue share in 2025 within North America, driven by the rapid expansion of satellite-based broadband services, navigation networks, and Earth observation programs. Government initiatives, such as the modernization of GPS and investments in next-generation telecommunication satellites, are fueling market growth. Private players are also deploying high-throughput payloads to enhance global connectivity, defense surveillance, and scientific research capabilities. The integration of advanced payload technologies with AI-enabled satellite operations is further boosting the market.

Europe MEO Satellite Payload Market Insight

The Europe MEO satellite payload market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in space-based telecommunication, remote sensing, and scientific missions. European countries are prioritizing next-generation satellite networks for broadband coverage, Earth monitoring, and defense applications. The market is also supported by regulatory incentives, research collaborations, and the development of indigenous satellite payload manufacturing capabilities.

U.K. MEO Satellite Payload Market Insight

The U.K. MEO satellite payload market is expected to witness rapid growth from 2026 to 2033, fueled by growing demand for high-capacity communication payloads and government-backed navigation and surveillance initiatives. The U.K.’s advanced aerospace ecosystem, skilled engineering workforce, and strong focus on satellite R&D are promoting the adoption of medium Earth orbit payloads for both commercial and defense applications.

Germany MEO Satellite Payload Market Insight

The Germany MEO satellite payload market is expected to witness strong growth from 2026 to 2033, driven by the country’s strategic focus on space-based infrastructure, precision navigation, and Earth observation. Germany’s well-established aerospace industry, investment in satellite manufacturing, and emphasis on technological innovation are key factors accelerating MEO payload adoption. In addition, integration with European Union satellite initiatives enhances operational capabilities and market expansion.

Asia-Pacific MEO Satellite Payload Market Insight

The Asia-Pacific MEO satellite payload market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising investments in regional satellite constellations, telecommunication networks, and remote sensing projects in countries such as China, India, and Japan. Rapid urbanization, increasing internet penetration, and government-backed space programs are fueling adoption. The region is also emerging as a hub for satellite payload manufacturing, contributing to affordability, accessibility, and scalability of MEO satellite solutions.

Japan MEO Satellite Payload Market Insight

The Japan MEO satellite payload market is expected to witness significant growth from 2026 to 2033, supported by the country’s high technological expertise, demand for precise navigation services, and expansion of communication satellite networks. Japan’s integration of advanced payloads in Earth observation, scientific research, and defense applications is driving market adoption. Furthermore, the focus on smart city infrastructure and satellite-based IoT connectivity enhances market potential.

China MEO Satellite Payload Market Insight

The China MEO satellite payload market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid expansion of satellite constellations, growing middle-class internet demand, and government initiatives supporting telecommunication, navigation, and remote sensing applications. China’s investment in high-throughput payloads, indigenous satellite manufacturing, and space-based monitoring systems is further propelling the market across civil, commercial, and defense sectors.

Medium Earth Orbit (MEO) Satellite Payload Market Share

The Medium Earth Orbit (MEO) Satellite Payload industry is primarily led by well-established companies, including:

- Airbus S.A.S. (France)

- Raytheon Technologies (U.S.)

- Thales Group (France)

- Lockheed Martin Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Boeing (U.S.)

- Viasat, Inc. (U.S.)

- SpaceX (U.S.)

- SSL (U.S.)

- MDA Corporation (Canada)

- Lucix Corporation (U.S.)

- Mitsubishi Electric Corporation (Japan)

- ISRO (India)

- General Dynamics Mission Systems, Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- Intelsat (Luxembourg)

- BALL CORPORATION (U.S.)

- Analog Devices, Inc. (U.S.)

- JSAT International Inc. (Japan)

- Cobham Limited (U.K.)

Latest Developments in Global Medium Earth Orbit (MEO) Satellite Payload Market

- In August 2024, Lockheed Martin completed the acquisition of Terran Orbital, aimed at enhancing its advanced satellite manufacturing capabilities. This strategic move strengthens Lockheed Martin’s position in the satellite technology sector, enabling faster development of next-generation payloads and more robust satellite platforms. The acquisition is expected to improve operational efficiency, expand production capacity, and provide competitive advantages in civil, defense, and commercial space markets

- In May 2024, Portal Space Systems launched the Supernova satellite bus, designed for high in-space maneuverability. Capable of moving from Low-Earth Orbit (LEO) to Geostationary Orbit (GEO) in hours, Medium-Earth Orbit (MEO) in minutes, and Cislunar space in days, the bus enhances mission flexibility and operational efficiency. This innovation supports rapid deployment of multi-orbit satellites, benefiting telecommunication, navigation, and scientific research applications, while advancing the overall competitiveness of satellite solutions in the global market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.