Global Medtech Ipo Innovations Market

Market Size in USD Billion

CAGR :

%

USD

1.98 Billion

USD

6.62 Billion

2024

2032

USD

1.98 Billion

USD

6.62 Billion

2024

2032

| 2025 –2032 | |

| USD 1.98 Billion | |

| USD 6.62 Billion | |

|

|

|

|

MedTech IPO Innovations Market Size

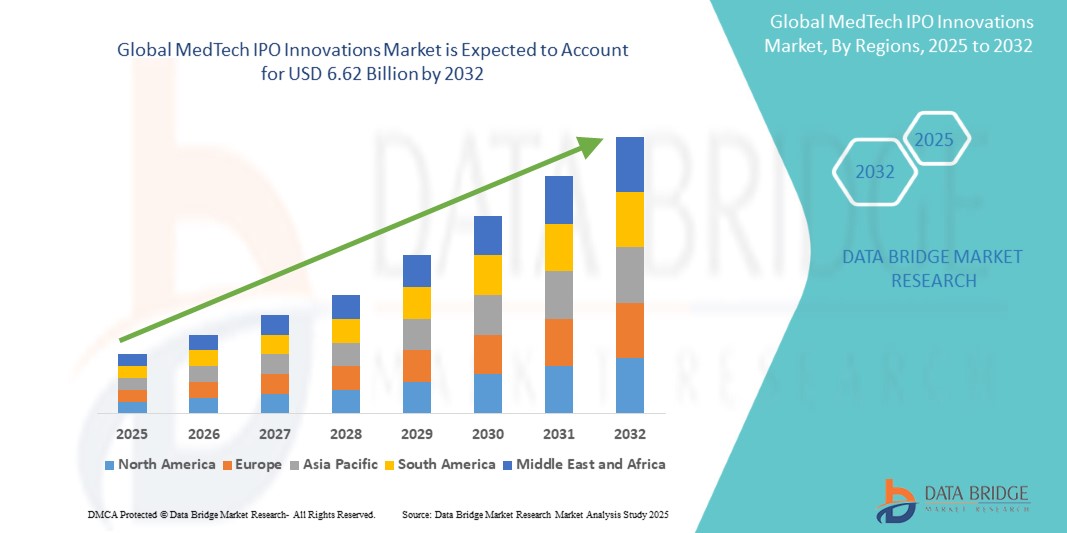

- The global medtech IPO innovations market size was valued at USD 1.98 billion in 2024 and is expected to reach USD 6.62 billion by 2032, at a CAGR of 16.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced medical technologies and continuous innovation within the healthcare sector, leading to accelerated digitalization and modernization across hospitals, clinics, and surgical centers

- Furthermore, rising investor interest in cutting-edge medical solutions, coupled with strong demand for minimally invasive procedures and improved patient care outcomes, is establishing MedTech IPO Innovations as a transformative force within the healthcare industry. These converging factors are accelerating the uptake of MedTech IPO Innovations solutions, thereby significantly boosting the industry's growth

MedTech IPO Innovations Market Analysis

- MedTech IPO Innovations, encompassing advanced medical technologies introduced through initial public offerings, are increasingly vital in reshaping healthcare delivery across areas such as diagnostics, therapeutics, and surgical solutions due to their focus on innovation, accessibility, and investor-driven growth

- The escalating demand for MedTech IPO innovations is primarily fueled by rising healthcare investments, growing prevalence of chronic diseases, increasing adoption of AI and digital health solutions, and a strong pipeline of IPO-backed startups targeting unmet medical needs

- North America dominated the global medtech IPO innovations market with the largest revenue share of 41.3% in 2024, supported by high R&D expenditure, advanced healthcare infrastructure, and the presence of leading MedTech companies actively leveraging IPOs to expand their portfolios. The U.S. continues to drive growth with significant IPO launches in digital health, minimally invasive surgery, and biotech-enabled devices

- Asia-Pacific is expected to be the fastest growing region in the global medtech IPO innovations market during the forecast period, registering a CAGR from 2025 to 2032, driven by rising urbanization, expanding healthcare access, and increased investor interest in MedTech startups across China, India, and Japan

- The Hospitals segment dominated the global medtech IPO innovations market with the largest market revenue share of 44.2% in 2024, reflecting their role as the primary hubs for advanced medical technologies and high-value device adoption

Report Scope and MedTech IPO Innovations Market Segmentation

|

Attributes |

MedTech IPO Innovations Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

MedTech IPO Innovations Market Trends

Enhanced Convenience Through Digital Health and Connected Care Platforms

- A significant and accelerating trend in the global medtech IPO innovations market is the deepening integration of digital health technologies with connected care platforms such as telemedicine, mobile health apps, and remote patient monitoring systems. This integration is significantly enhancing user convenience, patient engagement, and clinical outcomes across diverse healthcare settings

- For instance, IPO-funded MedTech firms are increasingly launching devices that seamlessly connect with digital platforms, enabling real-time health data collection and transmission to physicians for more efficient monitoring and timely interventions. Wearable biosensors and minimally invasive diagnostics are at the forefront of this innovation

- Integration with connected platforms allows advanced features such as continuous vital sign tracking, predictive health alerts, and personalized treatment recommendations. For instance, remote monitoring tools supported by MedTech IPO innovators are enabling healthcare providers to detect early signs of complications in chronic disease patients, improving outcomes and reducing hospital readmissions

- Furthermore, connected care solutions provide patients with the ease of accessing medical support from home, minimizing travel and waiting times while ensuring continuity of care. This hands-free accessibility aligns with the growing global preference for digital-first healthcare experiences

- The seamless integration of MedTech devices with telehealth ecosystems and electronic health records (EHR) systems facilitates centralized control and data management across the healthcare continuum. Through a single interface, providers can manage patient diagnostics, treatment adherence, and follow-up care, creating a unified and automated healthcare experience

- This trend toward more intelligent, intuitive, and interconnected MedTech solutions is fundamentally reshaping patient and provider expectations for modern healthcare. Consequently, companies funded through IPOs are accelerating development of next-generation devices that integrate with digital health platforms and distribution channels, supporting long-term growth and accessibility

- The demand for MedTech innovations that offer seamless digital integration and convenience is growing rapidly across both developed and emerging markets, as healthcare systems increasingly prioritize affordability, accessibility, and comprehensive patient-centered solutions

MedTech IPO Innovations Market Dynamics

Driver

Growing Need Due to Rising Healthcare Demands and Technological Advancements

- The MedTech IPO Innovations Market is experiencing strong momentum as healthcare systems worldwide face increasing demand for advanced, cost-efficient, and patient-centric technologies. The rising prevalence of chronic diseases, the global aging population, and the growing focus on minimally invasive procedures are key factors driving this growth

- For instance, in February 2024, several MedTech firms that entered the IPO market used raised funds to expand their pipelines in robotic surgery platforms, next-generation diagnostic imaging, and AI-based clinical decision support systems. These advancements highlight how IPOs serve as critical enablers of innovation and scale

- As hospitals and clinics prioritize digital transformation, MedTech innovators are developing devices and platforms that integrate seamlessly with data-driven healthcare ecosystems. This ensures better patient outcomes, operational efficiency, and predictive care models

- Moreover, rising investor confidence in healthcare technology, coupled with favorable government initiatives supporting medical R&D and innovation hubs, is further fueling IPO activity. These converging trends position MedTech IPOs as a vital pathway for capitalizing on the next wave of healthcare transformation

- The emphasis on personalized medicine, wearable health monitoring devices, and precision diagnostics is also reshaping patient care, encouraging more MedTech startups to pursue IPOs to fund expansion and commercialization

Restraint/Challenge

High Regulatory Barriers and Cost Pressures

- One of the major challenges in the medtech IPO innovations market lies in navigating stringent regulatory requirements. Obtaining approvals for novel medical devices and technologies demands extensive clinical testing, safety validations, and long approval timelines, which can delay commercialization

- For instance, newly listed MedTech firms often encounter heightened regulatory scrutiny from agencies such as the FDA, EMA, or regional authorities, increasing both financial and compliance burdens

- High R&D expenditures, combined with cost pressures from healthcare providers and insurers, create an additional challenge for companies to sustain profitability post-IPO. This is particularly critical for early-stage firms that rely heavily on IPO capital for clinical trials and commercialization

- Uncertainty across global regulatory landscapes—especially in emerging markets—further complicates expansion strategies for MedTech IPO-backed companies

- To overcome these barriers, firms must invest in stronger regulatory frameworks, foster partnerships with established healthcare institutions, and develop scalable innovations that balance affordability with advanced technology. These measures will be crucial for maintaining investor confidence and ensuring long-term success in the MedTech IPO Innovations Market

MedTech IPO Innovations Market Scope

The market is segmented on the basis of type, application area, technology focus, and clinical setting

• By Type

On the basis of type, the global medtech IPO innovations market is segmented into AI-Driven diagnostics, robotic surgery platforms, wearable health devices, minimally invasive surgical tools, and others. The AI-driven diagnostics segment dominated the largest market revenue share of 36.5% in 2024, driven by its transformative ability to deliver faster and more accurate disease detection across multiple specialties including cardiology, oncology, and neurology. Healthcare systems are heavily investing in AI-powered imaging, predictive algorithms, and data-driven platforms to improve diagnostic accuracy and reduce human error. These solutions are increasingly being integrated with hospital workflows, reducing turnaround time for test results and improving patient outcomes. Furthermore, IPO-backed funding is providing AI-focused startups with capital to accelerate product commercialization. Growing regulatory approvals and partnerships with major hospitals also strengthen adoption. With the rising global demand for precision medicine, AI diagnostics have established themselves as the backbone of innovation in MedTech. Their ability to continuously improve accuracy with machine learning models ensures long-term dominance in the type segment.

The wearable health devices segment is anticipated to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by increasing consumer demand for real-time health monitoring, preventive care, and personalized wellness management. Smartwatches, ECG patches, and continuous glucose monitoring systems are among the most widely adopted wearable solutions, seamlessly integrating with mobile apps and cloud platforms. These devices empower patients to monitor vital parameters and share data with clinicians, improving disease management and patient engagement. The segment is further supported by rising investments in remote care, where wearable devices play a critical role in reducing hospital readmissions. IPO-funded startups are rapidly innovating in biosensor technology, enhancing accuracy and affordability of wearables. The expansion of 5G and IoT infrastructure further facilitates their adoption, ensuring seamless connectivity and real-time reporting. Given the shift towards proactive healthcare and preventive diagnostics, wearable devices are set to become one of the most disruptive forces in the MedTech industry.

• By Application Area

On the basis of application area, the global medtech IPO innovations market is segmented into cardiology, orthopedics, neurology, oncology, general surgery, and others. The cardiology segment accounted for the largest market revenue share of 31.4% in 2024, owing to the increasing global burden of cardiovascular diseases and the urgent need for advanced diagnostic and therapeutic solutions. AI-enabled cardiac imaging, wearable ECG monitors, and minimally invasive catheter technologies are transforming cardiac care. Hospitals are adopting IPO-backed innovations in real-time heart monitoring, predictive risk analysis, and AI-driven diagnostic tools to enhance patient survival rates. Cardiology innovations also benefit from a strong ecosystem of partnerships between medical device firms and academic institutions. The prevalence of lifestyle diseases such as hypertension and obesity further increases demand for innovative cardiology solutions. Governments and healthcare providers are prioritizing cardiac health investments, reinforcing this segment’s dominance. With continuous research and growing reliance on advanced monitoring systems, cardiology maintains its position as the leading application segment.

The oncology segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, propelled by the increasing incidence of cancer worldwide and the strong demand for early detection and personalized treatment solutions. Innovations in liquid biopsy, AI-based tumor imaging, and robotic-assisted oncology surgeries are shaping the future of cancer diagnostics and therapy. IPO-funded MedTech companies are leveraging genomics and AI to create precision oncology solutions, significantly improving treatment effectiveness. Advanced radiation and surgical technologies are also being commercialized through IPO investments, expanding access to minimally invasive oncology care. The oncology segment is further driven by the adoption of data-driven platforms that integrate patient history, genomics, and diagnostic results for personalized care. Partnerships with leading cancer institutes accelerate clinical validation and regulatory approval. With strong patient demand and technological breakthroughs, oncology is set to outpace other segments in growth, positioning it as the fastest expanding application area.

• By Technology Focus

On the basis of technology focus, the global medtech IPO innovations market is segmented into artificial intelligence & machine learning, internet of medical things (IoMT), 3D printing & personalized implants, nanotechnology, and augmented/virtual reality. The artificial intelligence & machine learning segment held the largest market revenue share of 39.7% in 2024, driven by its wide application across diagnostics, drug discovery, and predictive analytics. AI platforms are enabling healthcare providers to process vast datasets, identify disease patterns, and deliver precise treatments. Hospitals worldwide are increasingly adopting AI-enabled imaging tools to detect conditions earlier and improve treatment outcomes. IPO-funded firms are at the forefront of bringing commercial-ready AI solutions into mainstream clinical workflows. These tools also enhance operational efficiency, reducing diagnostic time and resource utilization. The growing regulatory support for AI applications in healthcare further strengthens adoption. With its ability to integrate into multiple verticals including diagnostics, oncology, and surgery, AI & ML remains the most dominant technology focus, underpinning MedTech’s future growth.

The 3D printing & personalized implants segment is projected to witness the fastest CAGR of 21.3% from 2025 to 2032, supported by the rising demand for customized surgical implants, prosthetics, and anatomical models. Surgeons increasingly rely on 3D-printed solutions to perform complex surgeries with higher accuracy and reduced risks. IPO-backed MedTech startups are developing scalable platforms for affordable patient-specific implants, particularly in orthopedics and reconstructive surgery. 3D printing also enables faster prototyping and reduces time to market for new devices. This technology’s versatility extends into dental care, cranial reconstruction, and cardiac applications. Its adoption is further enhanced by cost efficiency, as customized implants reduce revision surgery needs and improve patient outcomes. With strong investor interest and accelerating clinical adoption, 3D printing has become the fastest-growing segment within the technology focus, promising to redefine patient-specific care delivery.

• By Clinical Setting

On the basis of clinical setting, the global medtech IPO innovations market is segmented into hospitals, ambulatory surgical centers, remote/home care, specialty clinics, and others. The Hospitals segment dominated the largest market revenue share of 44.2% in 2024, reflecting their role as the primary hubs for advanced medical technologies and high-value device adoption. Hospitals are the first to implement IPO-funded innovations in robotic surgery, AI diagnostics, and minimally invasive surgical tools due to their complex patient cases and large-scale infrastructure. Their purchasing power enables early adoption of new devices, often supported by partnerships with MedTech startups and established manufacturers. Hospitals also act as key validation centers for clinical trials and pilot programs, accelerating regulatory approvals. With rising patient volumes and demand for cutting-edge care, hospitals remain the central drivers of MedTech adoption. The combination of resources, expertise, and partnerships ensures their leadership position in clinical settings.

The remote/home care segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, driven by the global shift toward decentralized healthcare and the rising adoption of telemedicine and connected devices. IPO-backed companies are launching wearable health monitors, remote diagnostic kits, and digital health platforms that transmit real-time patient data to clinicians. This reduces hospital readmissions and enhances chronic disease management. The aging population, combined with rising healthcare costs, is fueling demand for home-based care solutions. Remote care technologies are being widely adopted for cardiac monitoring, diabetes management, and post-surgical recovery. The expansion of IoMT and 5G connectivity further accelerates this trend, enabling seamless patient-clinician interactions. As patients increasingly prioritize convenience and affordability, remote/home care emerges as the fastest growing clinical setting, reshaping the future of healthcare delivery.

MedTech IPO Innovations Market Regional Analysis

- North America dominated the medtech IPO innovations market with the largest revenue share of 41.3% in 2024, supported by strong R&D expenditure

- Advanced healthcare infrastructure, and the presence of leading MedTech companies actively pursuing IPOs to expand their portfolios

- The region’s leadership is reinforced by continuous investments in digital health, robotic surgery, and AI-powered diagnostics, alongside favorable regulatory pathways that encourage innovation and commercialization of new technologies

U.S. MedTech IPO Innovations Market Insight

The U.S. medtech IPO innovations market captured the largest revenue share of 80.5% in 2024 within North America, driven by significant IPO launches in minimally invasive surgery platforms, biotech-enabled devices, and digital therapeutics. Strong venture capital funding, combined with investor confidence in MedTech advancements, is accelerating the pace of IPOs. Moreover, strategic partnerships between healthcare providers and MedTech startups are boosting adoption, while regulatory clarity from the FDA supports a healthy pipeline of IPO-ready firms.

Europe MedTech IPO Innovations Market Insight

The Europe medtech IPO innovations market is projected to expand steadily throughout the forecast period, supported by strict healthcare regulations, strong adoption of advanced diagnostic technologies, and an increasing focus on sustainability in healthcare solutions. The region benefits from a well-established research ecosystem and favorable investor sentiment in MedTech companies.

U.K. MedTech IPO Innovations Market Insight

The U.K. medtech IPO innovations market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by government-backed R&D initiatives, an active biotech hub, and a surge in MedTech startups accessing capital through IPOs. Increasing demand for precision medicine and digital health solutions is also fueling expansion.

Germany MedTech IPO Innovations Market Insight

The Germany medtech IPO innovations market is expected to expand at a considerable CAGR, driven by the country’s focus on high-tech healthcare innovation and eco-conscious medical solutions. Germany’s robust regulatory framework and strong venture ecosystem support MedTech firms in scaling through IPOs, particularly in diagnostics, imaging, and minimally invasive technologies.

Asia-Pacific MedTech IPO Innovations Market Insight

The Asia-Pacific medtech IPO innovations market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, expanding healthcare access, and rising investor interest in MedTech startups across the region. Countries such as China, India, and Japan are emerging as hubs for IPO activity, supported by government incentives, improved healthcare infrastructure, and strong demand for affordable yet innovative healthcare solutions.

Japan MedTech IPO Innovations Market Insight

The Japan medtech IPO innovations market is gaining momentum due to its advanced technology landscape, emphasis on minimally invasive care, and growing demand for healthcare solutions that cater to its aging population. Japanese MedTech firms are increasingly leveraging IPOs to fund R&D in robotic-assisted surgery and advanced imaging technologies, further boosting growth.

China MedTech IPO Innovations Market Insight

The China medtech IPO innovations market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a rapidly expanding middle class, increased healthcare spending, and strong government backing for medical technology innovation. Domestic MedTech companies are increasingly turning to IPOs to scale production and expand internationally, with focus areas including AI-driven diagnostics, wearable health devices, and next-generation surgical platforms.

MedTech IPO Innovations Market Share

The MedTech IPO Innovations industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Johnson & Johnson and it’s affiliates (U.S.)

- Abbott (U.S.)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Zimmer Biomet (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Smith & Nephew plc (U.K.)

- Siemens Healthineers AG (Germany)

- BD (U.S.)

- Terumo Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

Latest Developments in Global MedTech IPO Innovations Market

- In February 2021, Butterfly Network, a developer of handheld whole-body ultrasound on a chip, completed its merger with Longview Acquisition Corp. and began trading on the New York Stock Exchange. This transaction marked one of the most notable medtech SPAC listings of that year

- In June 2024, Insightec, a leader in focused ultrasound technologies, announced a USD 150 million equity financing round led by Fidelity Management & Research Company to support its global expansion and clinical development of MRI-guided focused ultrasound platforms

- In October 2024, Ceribell, a company specializing in AI-enabled rapid seizure detection headbands for hospitals, completed an upsized initial public offering and began trading on the Nasdaq Global Select Market under the ticker CBLL, raising about USD 180 million to expand sales and product development

- In June 2025, Omada Health, a digital-health company focused on chronic condition management, successfully completed its initial public offering on Nasdaq, reflecting renewed investor confidence in digital health IPOs

- In August 2025, HeartFlow, an AI-enabled cardiac diagnostics company, completed a successful Nasdaq debut that valued the firm at more than USD 2 billion and provided funds to accelerate the commercialization of its 3D coronary imaging technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.