Global Membrane Chromatography Market

Market Size in USD Million

CAGR :

%

USD

7.61 Million

USD

18.85 Million

2024

2032

USD

7.61 Million

USD

18.85 Million

2024

2032

| 2025 –2032 | |

| USD 7.61 Million | |

| USD 18.85 Million | |

|

|

|

|

Membrane Chromatography Market Size

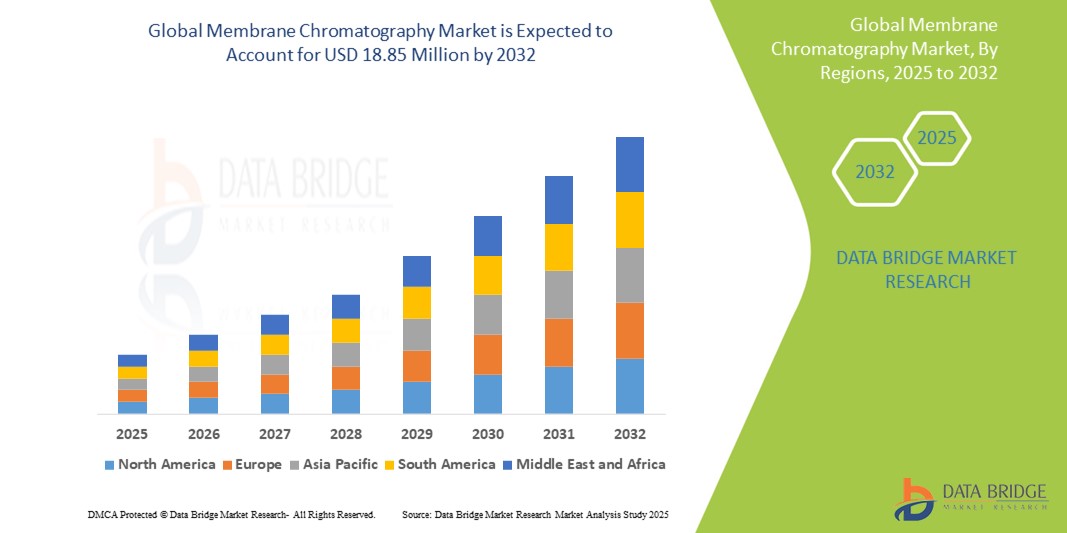

- The global membrane chromatography market size was valued at USD 7.61 million in 2024 and is expected to reach USD 18.85 million by 2032, at a CAGR of 12.00% during the forecast period

- This growth is driven by factors such as increasing demand for biopharmaceuticals, advancements in membrane technology and cost-effective and scalable solutions

Membrane Chromatography Market Analysis

- Membrane chromatography is a critical technique used in the purification of biomolecules, including therapeutic proteins, monoclonal antibodies, and vaccines. It offers high efficiency and scalability in bioprocessing applications

- The demand for membrane chromatography is significantly driven by the increasing demand for biopharmaceuticals and the need for efficient and cost-effective purification methods in large-scale production processes

- North America is expected to dominate the membrane chromatography market, accounting for 45.9% market share. This dominance is driven by advanced biopharmaceutical manufacturing capabilities, strong research infrastructure, and the presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the membrane chromatography market, with an estimated CAGR of 12.6%. This growth is driven by rapid expansion in biopharmaceutical manufacturing, increasing government support for biotechnology, and rising investments in healthcare infrastructure

- The ion exchange membrane chromatography segment is expected to dominate the market with a market share of 49.6% due to its widespread adoption in the purification of monoclonal antibodies and its crucial role in downstream processing. The versatility, cost-effectiveness, and high-resolution purification capabilities of this technique make it a preferred choice for removing impurities such as host cell proteins and DNA, significantly enhancing bioprocessing efficiency and supporting market growth

Report Scope and Membrane Chromatography Market Segmentation

|

Attributes |

Membrane Chromatography Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Membrane Chromatography Market Trends

“Advancements in Membrane Chromatography Technology”

- One prominent trend in the evolution of membrane chromatography is the increasing integration of advanced membrane materials and optimized separation techniques

- These innovations enhance the purification process by offering higher selectivity, capacity, and efficiency, improving the overall performance of biopharmaceutical production

- For instance, newer membrane technologies, such as high-performance ion-exchange and affinity membranes, enable the efficient purification of complex biomolecules such as monoclonal antibodies and vaccines

- These advancements are transforming the membrane chromatography market, enhancing scalability and reducing operational costs, which drives the demand for next-generation purification solutions in biomanufacturing and diagnostics

Membrane Chromatography Market Dynamics

Driver

“Increasing Demand for Biopharmaceuticals”

- The growing demand for biopharmaceuticals, including monoclonal antibodies, therapeutic proteins, and vaccines, is significantly contributing to the increased need for membrane chromatography solutions

- As the biotechnology and pharmaceutical industries expand, the requirement for efficient, scalable, and cost-effective purification techniques is growing, making membrane chromatography a preferred choice in bioprocessing applications

- Increased focus on developing and producing biologic drugs, particularly in immunotherapy and cancer treatment, is also driving the adoption of membrane chromatography

For instance,

- According to a report by GlobalData published in 2023, the global biologics market is expected to surpass USD 500 billion by 2030, significantly boosting the need for advanced purification technologies such as membrane chromatography

- The growing demand for biopharmaceuticals and the expanding biotechnology industry are driving the adoption of membrane chromatography for efficient, scalable, and cost-effective purification

Opportunity

“Technological Advancements and Integration with Automation”

- Recent advancements in membrane materials and integration with automated systems are enhancing the performance of membrane chromatography

- These innovations allow for higher throughput, improved efficiency, and reduced operational costs, which makes membrane chromatography more accessible and attractive to biopharmaceutical manufacturers

- Automation in membrane chromatography is particularly beneficial for large-scale production and continuous bioprocessing, where the demand for high-speed, high-efficiency purification methods is increasing

For instance,

- In 2024, a leading pharmaceutical company announced the integration of automated membrane chromatography systems into its large-scale production lines, which helped reduce production time by 30% and cut operational costs by 20%

- Advancements in membrane materials and automation are enhancing membrane chromatography performance, improving efficiency, scalability, and cost-effectiveness for biopharmaceutical production

Restraint/Challenge

“High Initial Capital Investment and Operational Costs”

- The high capital investment required for advanced membrane chromatography systems remains a significant challenge for many small and medium-sized biotech companies

- While membrane chromatography offers efficiency and scalability, the initial cost of acquiring advanced systems, along with the maintenance and operational expenses, can be prohibitive for companies with limited budgets

For instance,

- According to an article from BioProcess International in 2023, smaller biotech companies are often faced with the dilemma of high upfront costs associated with adopting new purification technologies, limiting their ability to scale their production efficiently

- Consequently, these high costs can hinder market penetration in regions with less established healthcare infrastructure and limit access to the latest membrane chromatography technologies

Membrane Chromatography Market Scope

The market is segmented on the basis of type, technique and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technique |

|

|

By End User |

|

In 2025, the ion membrane chromatography is projected to dominate the market with a largest share in technique segment

The ion exchange membrane chromatography segment is expected to dominate the membrane chromatography market with the largest share of 49.6% in 2025 due to its widespread adoption in the purification of monoclonal antibodies and its crucial role in downstream processing. As a leading technique for high-resolution purification, its versatility and cost-effectiveness enhance outcomes, driving market growth. The technique’s efficiency in removing impurities such as host cell proteins and DNA further reinforces its prominence in downstream bioprocessing, contributing to its market dominance.

The viral vector is expected to account for the largest share during the forecast period in type market

In 2025, the viral vectors segment is expected to dominate the membrane chromatography market with the largest market share of approximately 28.7% due to the escalating demand for gene therapies and vaccines. As a critical component in delivering genetic material, viral vectors benefit from the high throughput and efficient purification capabilities of membrane chromatography, driving market growth. The technique’s scalability and cost-effectiveness further contribute to its widespread adoption in biopharmaceutical manufacturing, reinforcing its market dominance.

Membrane Chromatography Market Regional Analysis

“North America Holds the Largest Share in the Membrane Chromatography Market”

- North America dominates the membrane chromatography market, accounting for 45.9% market share. This dominance is driven by advanced biopharmaceutical manufacturing capabilities, strong research infrastructure, and the presence of key market players

- U.S. holds a significant share, with around 35.3%, due to the high demand for biologics, including monoclonal antibodies, vaccines, and gene therapies, along with robust investments in biopharmaceutical R&D and manufacturing

- The availability of well-established regulatory frameworks, government funding for biologics research, and a mature biotechnology industry further strengthen the market in this region

- In addition, the rising prevalence of chronic diseases and the growing focus on personalized medicine are driving the adoption of advanced purification technologies, including membrane chromatography, to enhance production efficiency and product quality

“Asia-Pacific is Projected to Register the Highest CAGR in the Membrane Chromatography Market”

- Asia-Pacific is expected to witness the highest growth rate in the membrane chromatography market, with an estimated CAGR of 12.6%. This growth is driven by rapid expansion in biopharmaceutical manufacturing, increasing government support for biotechnology, and rising investments in healthcare infrastructure

- Countries such as China, India, and South Korea are emerging as key markets due to the growing demand for biologics, increasing healthcare spending, and a large patient population

- Japan, with its advanced pharmaceutical manufacturing technology and significant investment in biologics research, remains a crucial market for membrane chromatography. The country continues to lead in the adoption of innovative purification technologies to enhance production efficiency

- India is projected to register the highest CAGR of 18.4% in the membrane chromatography market, driven by expanding healthcare infrastructure, growing biosimilars production, and increasing investments in biopharmaceutical manufacturing

Membrane Chromatography Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Danaher Corporation (U.S.)

- Asahi Kasei Corporation (Japan)

- Thermo Fisher Scientific, Inc. (U.S.)

- 3M (U.S.)

- GE Healthcare (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- Repligen Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Regis Technologies, Inc. (U.S.)

- Purilogics (U.S.)

- Porex (U.S.)

- Membrane Solutions, LLC (U.S.)

- Pall Corporation (U.S.)

- Pendotech (Germany)

Latest Developments in Global Membrane Chromatography Market

- In January 2025, Sartorius AG, a global leader in laboratory equipment, announced the launch of its latest automated membrane chromatography system, designed to improve scalability and efficiency in biopharmaceutical manufacturing. The system integrates with Sartorius’ advanced bioreactor platforms, offering real-time monitoring of protein purification processes. This development aims to enhance high-throughput production of monoclonal antibodies and vaccines, contributing to the growing demand for biologics

- In December 2024, Merck KGaA introduced a new line of high-performance membrane chromatography columns that promise significant reductions in purification time and costs. These columns are designed specifically for viral vector production, catering to the booming gene therapy market. The new membranes enhance recovery rates and purity, allowing for faster production cycles while maintaining product quality

- In November 2024, Danaher Corporation showcased its latest advancements in membrane chromatography technology at the BioProcess International Conference. Their new offering integrates with automated systems, streamlining the entire purification process for biologics and reducing operational costs by up to 25%. This innovation is expected to support the increased demand for cell and gene therapies, making it easier for manufacturers to scale up production

- In October 2024, Pall Biotech announced the commercial availability of a new membrane chromatography solution specifically designed for large-scale purification of therapeutic proteins. The platform is equipped with enhanced performance characteristics, including higher flow rates and improved capacity, enabling faster processing of high-value biopharmaceuticals such as monoclonal antibodies and biosimilars. The solution also offers cost-effective scalability, making it an attractive choice for pharmaceutical manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.