Global Memory Ip Market

Market Size in USD Billion

CAGR :

%

USD

6.81 Billion

USD

20.82 Billion

2024

2032

USD

6.81 Billion

USD

20.82 Billion

2024

2032

| 2025 –2032 | |

| USD 6.81 Billion | |

| USD 20.82 Billion | |

|

|

|

|

Memory IP Market Size

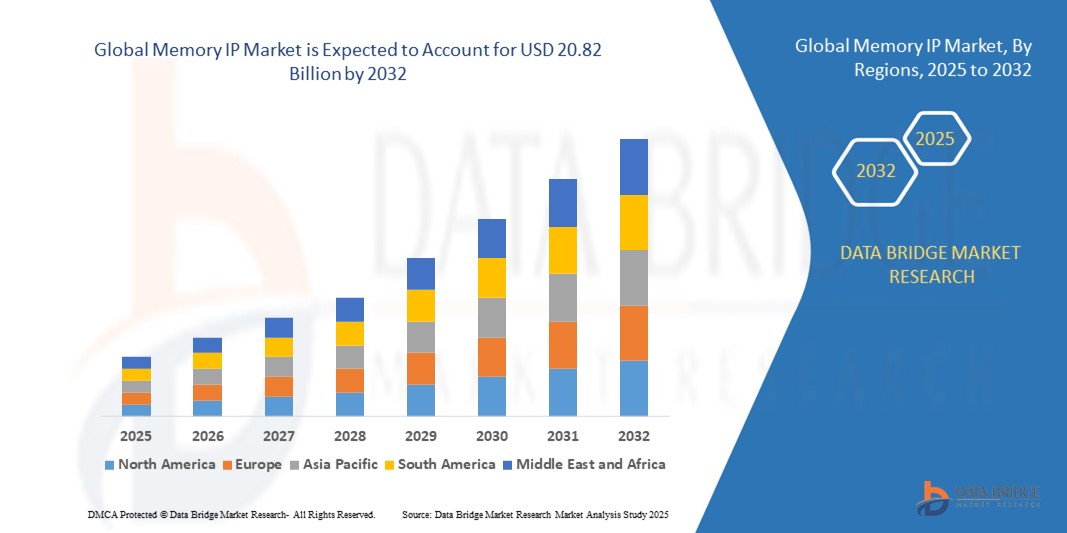

- The global memory IP market size was valued at USD 6.81 billion in 2024 and is expected to reach USD 20.82 billion by 2032, at a CAGR of 15.00% during the forecast period

- The market growth is primarily driven by the increasing demand for high-performance memory solutions in AI, 5G, IoT, and automotive electronics, along with rising adoption of advanced semiconductor technologies.

- Growing consumer demand for faster, more efficient, and low-power memory solutions in mobile devices and computing applications is further propelling market expansion across both IP providers and foundry channels

Memory IP Market Analysis

- The memory IP market is experiencing robust growth as industries prioritize high-speed, low-power, and scalable memory solutions to support advanced applications such as AI, machine learning, and autonomous driving

- Increasing demand from consumer electronics and automotive sectors is encouraging IP vendors to innovate with high-bandwidth, energy-efficient, and reliable memory solutions

- North America dominated the memory IP market with the largest revenue share of 33.2% in 2024, driven by a mature semiconductor industry, significant R&D investments, and strong demand for memory IP in computing and AI applications

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid advancements in semiconductor manufacturing, increasing adoption of 5G and IoT devices, and rising demand for memory IP in countries such as China, Japan, South Korea, and Taiwan

- The Dynamic Random-Access Memory segment dominated the largest market revenue share of 51.2% in 2024, driven by its widespread use in high-performance computing and consumer electronics due to its high-speed data access and cost-effectiveness. DRAM's simple architecture, requiring only one transistor and capacitor per bit, allows for higher density and lower costs, making it ideal for applications such as smartphones, PCs, and data centers

Report Scope and Memory IP Market Segmentation

|

Attributes |

Memory IP Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Memory IP Market Trends

Increasing Integration of AI and Advanced Memory Technologies

- The global memory IP market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and advanced memory technologies such as High Bandwidth Memory (HBM) and 3D NAND

- These technologies enable enhanced data processing and storage capabilities, providing deeper insights into system performance, data access patterns, and predictive optimization for memory-intensive applications

- AI-powered memory IP solutions facilitate proactive system optimization, identifying performance bottlenecks and enabling efficient data management before they impact system functionality

- For instance, companies are developing AI-driven memory controllers that optimize data flow in real-time for applications such as autonomous vehicles and data centers, improving efficiency and reducing latency

- This trend is enhancing the value proposition of memory IP solutions, making them more attractive to semiconductor manufacturers and end-users across various industries

- AI algorithms can analyze vast datasets from memory usage patterns, optimizing cache management, reducing power consumption, and improving data retrieval speeds in applications such as AI computing and IoT devices

Memory IP Market Dynamics

Driver

Rising Demand for High-Performance Computing and IoT Applications

- The increasing demand for high-performance computing, driven by applications such as AI, machine learning, and big data analytics, is a major driver for the global memory IP market

- Memory IP solutions, such as DRAM and NAND, enhance system performance by providing high-speed data access and storage for connected devices, data centers, and IoT ecosystems

- Government initiatives promoting smart cities and Industry 4.0 are contributing to the widespread adoption of memory IP in various applications

- The proliferation of 5G technology and the expansion of IoT devices are further enabling the growth of memory IP applications, offering faster data transfer rates and lower latency for advanced computing needs

- Semiconductor manufacturers are increasingly integrating advanced memory IP solutions as standard components to meet performance demands and enhance system scalability

Restraint/Challenge

High Development Costs and Data Security Concerns

- The substantial investment required for designing, licensing, and integrating advanced memory IP solutions, such as HBM and 3D NAND, can be a significant barrier for smaller companies and emerging markets

- Integrating memory IP into complex semiconductor designs can be technically challenging and resource-intensive

- In addition, data security and intellectual property protection pose major challenges. Memory IP solutions handle vast amounts of sensitive data, raising concerns about potential vulnerabilities, data breaches, and compliance with global data protection standards

- The fragmented regulatory landscape across different countries regarding intellectual property rights and data security further complicates operations for global memory IP providers

- These factors can deter adoption and limit market expansion, particularly in regions with high cost sensitivity or stringent data privacy regulations

Memory IP market Scope

The market is segmented on the basis of type and application.

- By Memory Type

On the basis of memory type, the global memory IP market is segmented into Dynamic Random-Access Memory (DRAM), Non-volatile Memory (NAND), Flash Technology, Static Random-Access Memory (SRAM), and Read-Only Memory (ROM). The Dynamic Random-Access Memory segment dominated the largest market revenue share of 51.2% in 2024, driven by its widespread use in high-performance computing and consumer electronics due to its high-speed data access and cost-effectiveness. DRAM's simple architecture, requiring only one transistor and capacitor per bit, allows for higher density and lower costs, making it ideal for applications such as smartphones, PCs, and data centers. Its critical role in supporting AI, cloud computing, and 5G technologies further solidifies its market dominance.

The NAND segment is expected to register the fastest growth rate from 2025 to 2032, as demand for non-volatile memory surges in applications requiring persistent data storage. NAND flash memory, used in SSDs, USB drives, and memory cards, benefits from its ability to retain data without power, making it essential for consumer electronics, automotive systems, and data centers. The rise of 3D NAND technology, offering higher storage density and improved performance, along with increasing adoption in IoT devices and enterprise storage, drives this segment’s rapid growth.

- By Application

On the basis of application, the global memory IP market is segmented into computing, mobile devices, networking equipment, automotive electronics, consumer electronics, industrial applications, and aerospace and defense. The consumer electronics segment held the largest revenue share in 2024, attributed to the exponential growth of smartphones, tablets, and smart home devices. Memory IP solutions, particularly DRAM and NAND, are critical for enhancing device performance, enabling faster data processing, and supporting advanced features such as gaming and multimedia. The increasing consumer demand for high-speed, high-capacity memory in devices further amplifies this segment’s dominance.

The automotive electronics segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the rapid adoption of advanced driver-assistance systems (ADAS), infotainment systems, and autonomous driving technologies. Memory IP, including DRAM and NAND flash, is essential for real-time data processing and storage in connected and electric vehicles. The growing complexity of automotive electronics, coupled with the integration of AI and IoT, drives the demand for reliable, high-performance memory solutions. Stringent safety and performance standards in the automotive sector further accelerate the adoption of advanced memory IP technologies.

Memory IP Market Regional Analysis

- North America dominated the memory IP market with the largest revenue share of 33.2% in 2024, driven by a mature semiconductor industry, significant R&D investments, and strong demand for memory IP in computing and AI applications

- Consumers and industries prioritize memory IP for enhancing device performance, reducing power consumption, and enabling faster data processing, particularly in regions with advanced technological infrastructure

- Growth is supported by advancements in memory technologies, such as high-speed DRAM and NAND flash, alongside rising adoption in both OEM and aftermarket segments across various applications

U.S. Memory IP Market Insight

The U.S. memory IP market captured the largest revenue share of 84.5% in 2024 within North America, fueled by strong demand from the computing and consumer electronics sectors, as well as growing adoption in automotive electronics. The trend toward high-performance computing and increasing integration of memory IP in AI and IoT devices further boosts market expansion. The presence of leading semiconductor companies and innovation hubs complements market growth, creating a dynamic ecosystem.

Europe Memory IP Market Insight

The Europe memory IP market is expected to witness significant growth, supported by regulatory emphasis on energy-efficient technologies and the increasing adoption of memory IP in automotive and industrial applications. Consumers and industries seek memory solutions that enhance device performance while optimizing power consumption. Growth is prominent in both new device integrations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising technological advancements and environmental concerns.

U.K. Memory IP Market Insight

The U.K. market for memory IP is expected to witness rapid growth, driven by demand for high-performance memory solutions in mobile devices and networking equipment. Increased focus on device efficiency and data processing capabilities encourages adoption. Evolving regulations promoting energy-efficient technologies influence consumer and industry choices, balancing performance with compliance.

Germany Memory IP Market Insight

Germany is expected to witness rapid growth in the memory IP market, attributed to its advanced semiconductor and automotive manufacturing sectors, coupled with a high consumer focus on energy efficiency and performance. German industries prefer technologically advanced memory solutions, such as SRAM and DRAM, that enhance device functionality and contribute to lower power consumption. The integration of memory IP in premium devices and aftermarket solutions supports sustained market growth.

Asia-Pacific Memory IP Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding semiconductor production and rising demand for memory IP in countries such as China, India, and Japan. Increasing adoption in mobile devices, consumer electronics, and automotive electronics is boosting demand. Government initiatives promoting digital transformation and energy efficiency further encourage the use of advanced memory IP solutions.

Japan Memory IP Market Insight

Japan’s memory IP market is expected to witness rapid growth due to strong consumer and industry preference for high-quality, technologically advanced memory solutions that enhance device performance and reliability. The presence of major electronics manufacturers and the integration of memory IP in OEM devices accelerate market penetration. Rising interest in aftermarket customization for consumer electronics and networking equipment also contributes to growth.

China Memory IP Market Insight

China holds the largest share of the Asia-Pacific memory IP market, propelled by rapid urbanization, rising device ownership, and increasing demand for memory solutions in computing and mobile devices. The country’s growing middle class and focus on smart technology support the adoption of advanced memory IP. Strong domestic semiconductor manufacturing capabilities and competitive pricing enhance market accessibility.

Memory IP Market Share

The memory IP industry is primarily led by well-established companies, including:

- Synopsys, Inc. (U.S.)

- Arm Limited (U.K.)

- Cadence Design Systems, Inc. (U.S.)

- Rambus.com (U.S.)

- SAMSUNG (South Korea)

- Taiwan Semiconducter Manufacturing Company Limited (Taiwan)

- Qualcomm Technologies, Inc. (U.S.)

- Micron Technology, Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- Fujitsu Semiconductor Memory Solution (Japan)

- Magnachip (South Korea)

- Novatek Microelectronics Corp. (Taiwan)

- Etron Technology, Inc. (Taiwan)

- Winbond (Taiwan)

- Intregrated Silicon Solution Inc. (U.S.)

What are the Recent Developments in Global Memory IP Market?

- In July 2024, Adisyn Ltd announced a strategic collaboration with 2D Generation Ltd, an Israel-based semiconductor IP company, to co-develop high-performance, energy-efficient semiconductor solutions for AI and data centers. The partnership focuses on innovative chip design, including electronic photonic power systems, systems-on-chip (SoC), and systems-in-package (SiP) modules. These technologies aim to overcome scalability and energy challenges in next-gen computing, while supporting Adisyn’s dual-track strategy in AI enablement and cybersecurity. The collaboration also aligns with 2D Generation’s role in the EU’s Connecting Chips Joint Undertaking, alongside partners such as NVIDIA and Applied Materials

- In May 2024, Siemens Digital Industries Software introduced the Solido™ IP Validation Suite, a cutting-edge solution designed to improve memory IP validation and accelerate chip development. This suite streamlines the quality assurance process for semiconductor IP, including standard cells, memories, and IP blocks. It features tools such as Solido Crosscheck™ for multi-domain QA and Solido IPdelta™ for version-to-version comparison, helping design teams detect issues early and reduce costly re-spins. By integrating with Siemens’ Calibre® platform, it ensures robust validation and faster time-to-market for advanced chip designs

- In April 2024, Guerrilla RF, Inc. finalized the acquisition of Gallium Semiconductor’s complete portfolio of GaN power amplifiers and front-end modules, including all associated intellectual property (IP). This strategic move strengthens Guerrilla RF’s capabilities in developing advanced GaN devices tailored for wireless infrastructure, military, and satellite communications. The acquisition includes both released components and new cores under development, accelerating Guerrilla RF’s growth as an RFIC and MMIC supplier. The integration is expected to be seamless, leveraging shared foundry partners and complementary product lines

- In March 2024, Synopsys Inc. announced the acquisition of Intrinsic ID, a leading provider of Physical Unclonable Function (PUF) IP used in system-on-chip (SoC) designs. This strategic move enhances Synopsys’s semiconductor IP portfolio by adding production-proven PUF technology, enabling SoC designers to embed unique identifiers directly into chips using the inherent physical characteristics of silicon. The acquisition supports secure design innovation for smart and connected devices, while expanding Synopsys’s R&D footprint in the Netherlands through a new center of excellence for PUF technology in Eindhoven

- In February 2024, Synopsys, Inc. unveiled the industry’s first complete 1.6T Ethernet IP solution, designed to meet the escalating bandwidth and performance demands of AI, hyperscale data centers, and high-performance computing. The solution includes multi-rate, multi-channel Ethernet MAC and PCS controllers, silicon-proven 224G Ethernet PHY IP, and advanced verification IP. It delivers up to 40% latency reduction and 50% lower power consumption compared to existing 800G implementations. This launch empowers chip designers to build faster, more efficient SoCs for next-gen AI workloads and data-intensive applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.