Global Metabolic Disorders Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

62.00 Billion

USD

110.58 Billion

2021

2029

USD

62.00 Billion

USD

110.58 Billion

2021

2029

| 2022 –2029 | |

| USD 62.00 Billion | |

| USD 110.58 Billion | |

|

|

|

|

Metabolic Disorders Therapeutics Market Analysis and Size

The metabolic disorders therapeutics market is projected to witness major growth during the forecast period. Increasing cases of hypertension, cardiomyopathy, diabetes and hypercholesterolemia boost the metabolic syndrome market. Factors such as adaptation of unhealthy lifestyle, increased stress in daily life & malnutrition and family history with cardiac disease are also increasing the market growth. Many major market players are contributing a lot in drug discovery and development. COVID-19 also had a major impact on the market growth.

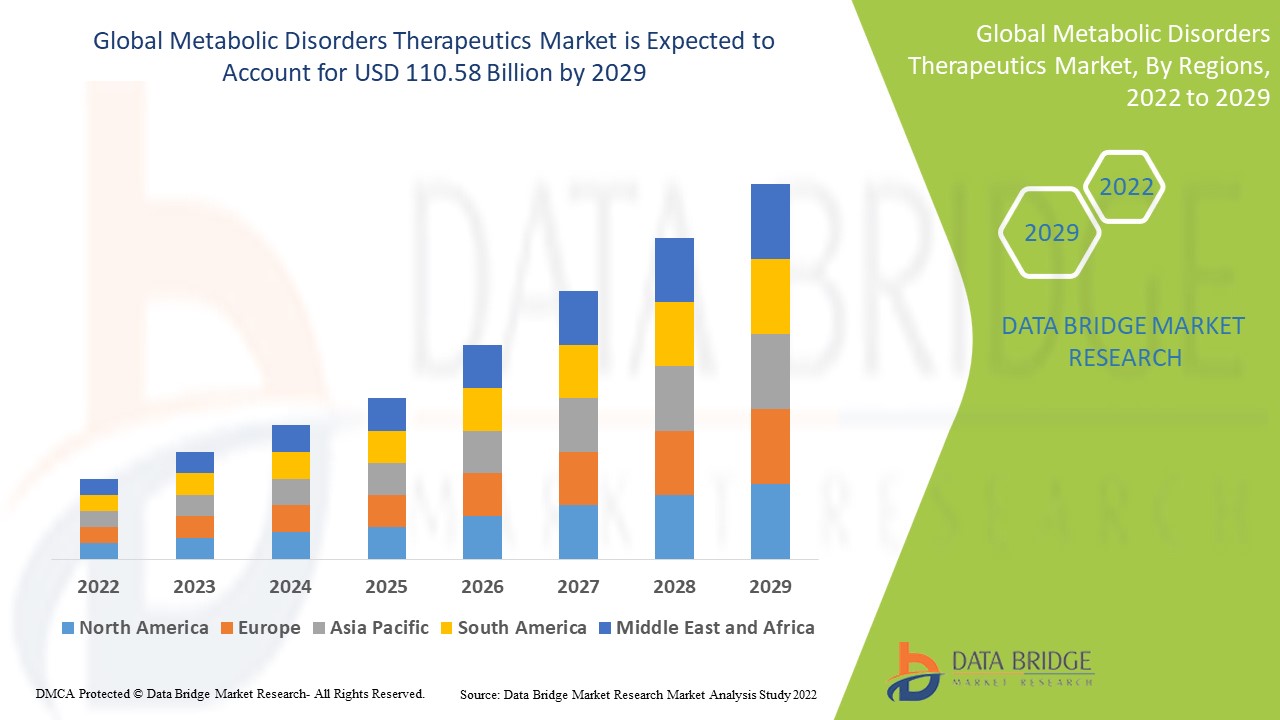

Data Bridge Market Research analyses a growth rate in the metabolic disorders therapeutics market in the forecast period 2022-2029. The expected CAGR of metabolic disorders therapeutics market is tend to be around 7.50% in the mentioned forecast period. The market was valued at USD 62 billion in 2021, and it would grow upto USD 110.58 billion by 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Metabolic Disorders Therapeutics Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Therapy Type (Enzyme Replacement Therapy, Substrate Reduction Therapy, Gene Therapy, Drug Therapy, Others), Application (Lysosomal Storage Diseases, Diabetes, Obesity, Hypercholesterolemia, Others), End-Users (Hospitals, Homecare, Speciality Centres, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Atkins Global (U.S.), Herbalife International of America Inc., (U.S.), Nutrisystem Inc., (U.S.), Abbott (U.S.), Kellogg Co. (U.S.), mega Laboratories, Inc. (U.S.), Johnson & Johnson Private Limited (U.S.), Medtronic (Ireland.), Apollo Endosurgery Inc., (U.S.), GSK plc (U.K), Olympus Corporation (India), WW International Inc., (U.S.), Jenny Craig (U.S.), Gold’s Gym (U.S.), DSM (Netherlands), Brunswick (U.S.), Amer Sports (Finland), Johnson Health Tech (U.S.), Technogym SpA (Italy), Shaklee Corporation (U.S.), Nature's Sunshine Products, Inc., (U.S.) and Novo Nordisk A/S (Denmark) |

|

Market Opportunities |

|

Market Definition

Metabolic syndrome is the condition of grouped diseases that occur together and increases the risk of heart disease, stroke and type 2 diabetes. These conditions involve high blood sugar, abnormal cholesterol level, increased blood pressure, excess body fat around the waist, increased blood pressure. Having one of the diseases doesn’t mean patient suffering from metabolic syndrome but, having two to three diseases at the same time increases the risk of metabolic syndrome. Symptom involves increased thirst & urination, blurred vision and fatigue. It is of great importance to the healthcare sector and thus is expected to rise high in the forecast period.

Global Metabolic Disorders Therapeutics Market Dynamics

Drivers

- Rising Awareness For Disease Treatment

Increasing awareness among patients and several healthcare professionals for the treatment of different types of metabolic syndromes and more and more usage of combination therapy are the major factors that are expected to boost the demand for global metabolic syndrome market during the forecast period of 2022-2029.

- Increased Clinical Studies and Government Initiatives

The global metabolic syndrome market is projected to be driven by the rising R&D investments in drug discovery and development and the increasing prevalence of diabetes. For instance, as per the reports of International Diabetes Federation, for the treatment of diabetes as a metabolic syndrome, about 415 million people are currently affected by diabetes worldwide and it is hoped to increase to 642 million diabetic people by the year 2040.

Opportunities

- Increasing Demand for Retail Pharmacies

Increase in the number of metabolic syndromes therapeutics being delivered through retail pharmacies and rise in the number of retail pharmacies in highly developed countries create opportunities for the market growth. In addition to this, patients prefer retail pharmacies for purchasing drugs, as these are easily accessible.

- Rising Demand of Drug Therapy

The drug therapy is driving the market because of its extensive usage as a result if ease of administration and high-reliability rate. This therapy is anticipated to maintain its growth even due to its advanced ways of administering medicines without disturbing daily patient lives. Furthermore, the launch of smart drug delivery devices and smart dosage control methods are projected to boost the segment further.

Restraints/Challenges

- Lack of Skilled Professionals

Lack of trained healthcare professionals who are unaware of the knowledge of the treatment methods for this disease could reduce the growth of the global metabolic disorders therapeutics market over a forecast period.

- High Cost

The huge expenditure of the treatment methods hamper the market growth.

This global metabolic disorders therapeutics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global metabolic disorders therapeutics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Global Metabolic Disorders Therapeutics Market

The Covid-19 pandemic let a negative impact on the global metabolic disorders therapeutics market because the utmost priority was given to Covid-19 patients for treatment. Numerous medical colleges and hospitals were reorganised and helped in the structure so that they can accommodate more patients diagnosed with Covid-19. Discovery and development of drugs for the types of metabolic syndromes also slowed down during the pandemic, but it wasn’t in a pause and now in the post pandemic era, it is growing again.

Global Metabolic Disorders Therapeutics Market Scope

The global metabolic disorders therapeutics market is segmented on the basis of therapy type, application, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Therapy Type

- Enzyme Replacement Therapy

- Substrate Reduction Therapy

- Gene Therapy

- Drug Therapy

- Others

Application

- Lysosomal Storage Diseases

- Diabetes

- Obesity

- Hypercholesterolemia

- Others

End-Users

- Hospitals

- Homecare

- Speciality Centres

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Metabolic Disorders Therapeutics Market Regional Analysis/Insights

The global metabolic disorders therapeutics market is analysed and market size insights and trends are provided by therapy type, application, distribution channel and end-user as referenced above.

The major countries covered in the global metabolic disorders therapeutics market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to have the highest market growth due to increased geriatric population, and presence of key manufacture of the product.

Asia-Pacific dominates the market due to increased prevalence of coronary heart diseases and related disorders, increased awareness programmes on the healthy lifestyle and number of generic drugs.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Metabolic Disorders Therapeutics Market Share Analysis

The global metabolic disorders therapeutics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global metabolic disorders therapeutics market.

Key players operating in the global metabolic disorders therapeutics market include:

- Atkins Global (U.S.)

- Herbalife International of America Inc., (U.S.)

- Nutrisystem Inc., (U.S.)

- Abbott (U.S.)

- Kellogg Co. (U.S.)

- mega Laboratories, Inc. (U.S.)

- Johnson & Johnson Private Limited (U.S.)

- Medtronic (Ireland)

- Apollo Endosurgery Inc., (U.S.)

- GSK plc (U.K)

- Olympus Corporation (India)

- WW International Inc., (U.S.)

- jenny Craig (U.S.)

- Gold’s Gym (U.S.)

- DSM (Netherlands)

- Brunswick (U.S.)

- Amer Sports (Finland)

- Johnson Health Tech (U.S.)

- Technogym SpA (Italy)

- Shaklee Corporation (U.S.)

- Nature's Sunshine Products, Inc., (U.S.)

- Novo Nordisk A/S (Denmark)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY BASED MODELLING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

5.3 STRATEGIC INITIATIVES

6 EPIDEMIOLOGY

6.1 DISEASE PREVALENCE BY COUNTRY

6.2 DISEASE INCIDENCE BY COUNTRY

6.3 RISK FACTORS

(FACTORS THAT INCREASE THE LIKELIHOOD OF DEVELOPING A DISEASE, SUCH AS AGE, GENDER, LIFESTYLE FACTORS, ENVIRONMENTAL EXPOSURES, AND GENETIC PREDISPOSITION)

6.4 HEALTHCARE UTILIZATION

(HOW THE DISEASE AFFECTS HEALTHCARE UTILIZATION, SUCH AS HOSPITALIZATIONS, EMERGENCY ROOM VISITS, AND OUTPATIENT VISITS)

7 REGULATORY FRAMEWORK

7.1 REGULATORY APPROVAL PROCESS

7.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

7.3 REGULATORY APPROVAL PATHWAYS

7.4 LICENSING AND REGISTRATION

7.5 POST-MARKETING SURVEILLANCE

7.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

8 PIPELINE ANALYSIS

8.1 CLINICAL TRIAL STATUS

8.1.1 CANDIDATE/AGENT

8.1.2 PROPERTIES

8.1.3 COMPANY NAME

8.1.4 THERAPEUTIC AREA

8.1.5 PRODUCT NAME

8.1.6 GENERIC NAME

8.1.7 TYPE

8.1.8 RESEARCH CODE

8.1.9 INDICATION

8.1.10 ORIGINATOR

8.1.11 SPONSOR

8.1.12 COLLABORATOR

8.1.13 LICENSOR

8.1.14 LICENSEE

8.2 DISTRIBUTION OF PRODUCTS BY PHASE

8.2.1 PRECLINICAL/RESEARCH PROJECT

8.2.2 PHASE I

8.2.3 PHASE II

8.2.4 PHASE III

8.2.5 PHSE IV

8.3 NUMBER OF SUBJECTS IN CLINICAL TRIALS

8.3.1 PHASE I

8.3.2 PHASE II

8.3.3 PHASE III

8.4 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

8.4.1 PRECLINICAL/RESEARCH PROJECT

8.4.2 PHASE I

8.4.3 PHASE II

8.4.4 PHASE III

8.4.5 PHASE IV

8.5 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

8.5.1 PRECLINICAL/RESEARCH PROJECT

8.5.2 PHASE I

8.5.3 PHASE II

8.5.4 PHASE III

8.5.5 PHASE IV

8.6 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

8.6.1 PRECLINICAL/RESEARCH PROJECT

8.6.2 PHASE I

8.6.3 PHASE II

8.6.4 PHASE III

8.6.5 PHASE IV

9 MARKETED DRUG ANALYSIS

9.1 DRUG

9.1.1 BRAND NAME

9.1.2 GENERICS NAME

9.2 THERAPEUTIC INDIACTION

9.3 PHARACOLOGICAL CLASS OD THE DRUG

9.4 DRUG PRIMARY INDICATION

9.5 MARKET STATUS

9.6 MEDICATION TYPE

9.7 DRUG DOSAGES FORM

9.8 DOSAGES AVAILABILITY

9.9 PACKAGING TYPE

9.1 DRUG ROUTE OF ADMINISTRATION

9.11 DOSING FREQUENCY

9.12 DRUG INSIGHT

AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

9.12.1 FORECAST MARKET OUTLOOK

9.12.2 CROSS COMPETITION

9.12.3 THERAPEUTIC PORTFOLIO

9.12.4 CURRENT DEVELOPMENT SCENARIO

10 MARKET ACCESS

10.1 10-YEAR MARKET FORECAST

10.2 CLINICAL TRIAL RECENT UPDATES

10.3 ANNUAL NEW FDA APPROVED DRUGS

10.4 DRUGS MANUFACTURER AND DEALS

10.5 MAJOR DRUG UPTAKE

10.6 CURRENT TREATMENT PRACTICES

10.7 IMPACT OF UPCOMING THERAPY

11 R & D ANALYSIS

11.1 COMPARATIVE ANALYSIS

11.2 DRUG DEVELOPMENTAL LANDSCAPE

11.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

11.4 THERAPEUTIC ASSESSMENT

11.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

12 PATENT ANALYSIS

12.1 PATENT LANDSCAPE

12.2 USPTO NUMBER

12.3 PATENT EXPIRY

12.3.1 US PATENT EXPIRY

12.3.2 EUROPE PATENT EXPIRY

12.4 EPIO NUMBER

12.5 PATENT STRENGTH AND QUALITY

12.6 PATENT CLAIMS

12.7 PATENT CITATIONS

12.8 PATENT LITIGATION AND LICENSING

12.9 FILE OF PATENT

12.1 PATENT RECEIVED CONTRIES

12.11 TECHNOLOGY BACKGROUND

13 COMPETITIVE INTELLIGENCE TRACKING DATA

13.1 CLINICAL TRIAL MONITORING ANALYSIS

13.2 REGULATORY AND COMMERCIAL MONITORING ANALYSIS

14 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY THERAPY TYPE

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS )

14.1 OVERVIEW

14.2 ENZYME REPLACEMENT THERAPY

14.2.1 IMIGLUCERASE

14.2.1.1. MARKET VALUE (USD MILLION)

14.2.1.2. MARKET VOLUME (UNITS)

14.2.1.3. AVERAGE SELLING PRICE (USD)

14.2.2 VELAGLUCERASE ALFA

14.2.2.1. MARKET VALUE (USD MILLION)

14.2.2.2. MARKET VOLUME (UNITS)

14.2.2.3. AVERAGE SELLING PRICE (USD)

14.2.3 TALIGLUCERASE ALFA

14.2.3.1. MARKET VALUE (USD MILLION)

14.2.3.2. MARKET VOLUME (UNITS)

14.2.3.3. AVERAGE SELLING PRICE (USD)

14.2.4 AGALSIDASE ALFA

14.2.4.1. MARKET VALUE (USD MILLION)

14.2.4.2. MARKET VOLUME (UNITS)

14.2.4.3. AVERAGE SELLING PRICE (USD)

14.2.5 AGALSIDASE BETA

14.2.5.1. MARKET VALUE (USD MILLION)

14.2.5.2. MARKET VOLUME (UNITS)

14.2.5.3. AVERAGE SELLING PRICE (USD)

14.2.6 ALGLUCOSIDASE ALFA

14.2.6.1. MARKET VALUE (USD MILLION)

14.2.6.2. MARKET VOLUME (UNITS)

14.2.6.3. AVERAGE SELLING PRICE (USD)

14.2.7 IDURSULFASE

14.2.7.1. MARKET VALUE (USD MILLION)

14.2.7.2. MARKET VOLUME (UNITS)

14.2.7.3. AVERAGE SELLING PRICE (USD)

14.2.8 GALSULFASE

14.2.8.1. MARKET VALUE (USD MILLION)

14.2.8.2. MARKET VOLUME (UNITS)

14.2.8.3. AVERAGE SELLING PRICE (USD)

14.2.9 ALDURAZYME

14.2.9.1. MARKET VALUE (USD MILLION)

14.2.9.2. MARKET VOLUME (UNITS)

14.2.9.3. AVERAGE SELLING PRICE (USD)

14.2.10 BETAINE

14.2.10.1. MARKET VALUE (USD MILLION)

14.2.10.2. MARKET VOLUME (UNITS)

14.2.10.3. AVERAGE SELLING PRICE (USD)

14.2.11 CYSTEAMINE

14.2.11.1. MARKET VALUE (USD MILLION)

14.2.11.2. MARKET VOLUME (UNITS)

14.2.11.3. AVERAGE SELLING PRICE (USD)

14.2.12 LARONIDASE

14.2.12.1. MARKET VALUE (USD MILLION)

14.2.12.2. MARKET VOLUME (UNITS)

14.2.12.3. AVERAGE SELLING PRICE (USD)

14.2.13 IDURSULFASE

14.2.13.1. MARKET VALUE (USD MILLION)

14.2.13.2. MARKET VOLUME (UNITS)

14.2.13.3. AVERAGE SELLING PRICE (USD)

14.2.14 GALSULFASE

14.2.14.1. MARKET VALUE (USD MILLION)

14.2.14.2. MARKET VOLUME (UNITS)

14.2.14.3. AVERAGE SELLING PRICE (USD)

14.2.15 ALDURAZYME

14.2.15.1. MARKET VALUE (USD MILLION)

14.2.15.2. MARKET VOLUME (UNITS)

14.2.15.3. AVERAGE SELLING PRICE (USD)

14.2.16 OTHER

14.3 GENE THERAPY

14.3.1 STRIMVELIS

14.3.1.1. MARKET VALUE (USD MILLION)

14.3.1.2. MARKET VOLUME (UNITS)

14.3.1.3. AVERAGE SELLING PRICE (USD)

14.3.2 VALOCTOCOGENE ROXAPARVOVEC

14.3.2.1. MARKET VALUE (USD MILLION)

14.3.2.2. MARKET VOLUME (UNITS)

14.3.2.3. AVERAGE SELLING PRICE (USD)

14.3.3 ETRANACOGENE DEZAPARVOVEC

14.3.3.1. MARKET VALUE (USD MILLION)

14.3.3.2. MARKET VOLUME (UNITS)

14.3.3.3. AVERAGE SELLING PRICE (USD)

14.3.4 VOLANESORSEN

14.3.4.1. MARKET VALUE (USD MILLION)

14.3.4.2. MARKET VOLUME (UNITS)

14.3.4.3. AVERAGE SELLING PRICE (USD)

14.3.5 PEGVALIASE

14.3.5.1. MARKET VALUE (USD MILLION)

14.3.5.2. MARKET VOLUME (UNITS)

14.3.5.3. AVERAGE SELLING PRICE (USD)

14.3.6 OTHER

14.4 SMALL MOLECULE-BASED THERAPY

14.4.1 METFORMIN

14.4.1.1. MARKET VALUE (USD MILLION)

14.4.1.2. MARKET VOLUME (UNITS)

14.4.1.3. AVERAGE SELLING PRICE (USD)

14.4.2 SULFONYLUREAS

14.4.2.1. MARKET VALUE (USD MILLION)

14.4.2.2. MARKET VOLUME (UNITS)

14.4.2.3. AVERAGE SELLING PRICE (USD)

14.4.3 DPP-4 INHIBITORS

14.4.3.1. SITAGLIPTIN

14.4.3.1.1. MARKET VALUE (USD MILLION)

14.4.3.1.2. MARKET VOLUME (UNITS)

14.4.3.1.3. AVERAGE SELLING PRICE (USD)

14.4.3.2. SAXAGLIPTIN

14.4.3.2.1. MARKET VALUE (USD MILLION)

14.4.3.2.2. MARKET VOLUME (UNITS)

14.4.3.2.3. AVERAGE SELLING PRICE (USD)

14.4.4 SGLT2 INHIBITORS

14.4.4.1. CANAGLIFLOZIN

14.4.4.1.1. MARKET VALUE (USD MILLION)

14.4.4.1.2. MARKET VOLUME (UNITS)

14.4.4.1.3. AVERAGE SELLING PRICE (USD)

14.4.4.2. EMPAGLIFLOZIN

14.4.4.2.1. MARKET VALUE (USD MILLION)

14.4.4.2.2. MARKET VOLUME (UNITS)

14.4.4.2.3. AVERAGE SELLING PRICE (USD)

14.4.5 EZETIMIBE

14.4.5.1. MARKET VALUE (USD MILLION)

14.4.5.2. MARKET VOLUME (UNITS)

14.4.5.3. AVERAGE SELLING PRICE (USD)

14.4.6 TETRAHYDROBIOPTERIN

14.4.6.1. MARKET VALUE (USD MILLION)

14.4.6.2. MARKET VOLUME (UNITS)

14.4.6.3. AVERAGE SELLING PRICE (USD)

14.4.7 D-PENICILLAMINE

14.4.7.1. MARKET VALUE (USD MILLION)

14.4.7.2. MARKET VOLUME (UNITS)

14.4.7.3. AVERAGE SELLING PRICE (USD)

14.4.8 TRIENTINE

14.4.8.1. MARKET VALUE (USD MILLION)

14.4.8.2. MARKET VOLUME (UNITS)

14.4.8.3. AVERAGE SELLING PRICE (USD)

14.4.9 OTHER

14.5 SUBSTRATE REDUCTION THERAPY

14.5.1 ZAVESCA

14.5.1.1. MARKET VALUE (USD MILLION)

14.5.1.2. MARKET VOLUME (UNITS)

14.5.1.3. AVERAGE SELLING PRICE (USD)

14.5.2 GALAFOLD

14.5.2.1. MARKET VALUE (USD MILLION)

14.5.2.2. MARKET VOLUME (UNITS)

14.5.2.3. AVERAGE SELLING PRICE (USD)

14.5.3 OTHER

14.6 CELLULAR TRANSPLANTATION

14.6.1 HEMATOPOIETIC STEM CELL TRANSPLANTATION (HSCT)

14.6.1.1. MARKET VALUE (USD MILLION)

14.6.1.2. MARKET VOLUME (UNITS)

14.6.1.3. AVERAGE SELLING PRICE (USD)

14.6.2 ISLET CELL TRANSPLANTATION

14.6.2.1. MARKET VALUE (USD MILLION)

14.6.2.2. MARKET VOLUME (UNITS)

14.6.2.3. AVERAGE SELLING PRICE (USD)

14.6.3 PANCREATIC ISLET CELL ENCAPSULATION

14.6.3.1. MARKET VALUE (USD MILLION)

14.6.3.2. MARKET VOLUME (UNITS)

14.6.3.3. AVERAGE SELLING PRICE (USD)

14.6.4 NEURAL STEM CELL TRANSPLANTATION

14.6.4.1. MARKET VALUE (USD MILLION)

14.6.4.2. MARKET VOLUME (UNITS)

14.6.4.3. AVERAGE SELLING PRICE (USD)

14.7 OTHERS

15 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 LYSOSOMAL STORAGE DISEASES

15.2.1 GAUCHER'S DISEASE

15.2.2 FABRY DISEASE

15.2.3 POMPE DISEASE

15.2.4 HURLER - SCHEIE

15.2.5 SANFILIPO A

15.2.6 OTHERS

15.3 DIABETES

15.4 OBESITY

15.5 INHERITED METABOLIC DISORDERS

15.6 HYPERCHOLESTEROLEMIA

15.7 GALACTOSEMIA

15.8 MAPLE SYRUP URINE DISEASE (MSUD)

15.9 MEDIUM-CHAIN ACYL-COA DEHYDROGENASE (MCAD) DEFICIENCY

15.1 CONGENITAL ADRENAL HYPERPLASIA (CAH)

15.11 OTHER

16 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY THERAPY TYPE

16.1 OVERVIEW

16.2 MONOTHERAPY

16.3 COMBINATION THERAPY

17 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY DRUG TYPE

17.1 OVERVIEW

17.2 BRANDED

17.2.1 CEREZYME

17.2.2 VPRIV

17.2.3 REPLAGAL

17.2.4 GLIPIZIDE

17.2.5 ATORVASTATIN

17.2.6 CYSTAGON

17.2.7 LARONIDASE

17.2.8 ALDURAZYME

17.2.9 CYSTADANE

17.2.10 OTHER

17.3 GENERICS

18 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTARTION

18.1 OVERVIEW

18.2 ORAL

18.2.1 CAPSULE

18.2.2 TABLETS

18.2.3 OTHER

18.3 PARENTERAL

18.3.1 INTRAVENOUS

18.3.2 SUBCUTANEOUS

18.3.3 INTRAMUSCULAR

18.4 OTHER

19 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY PATIENT TYPE

19.1 OVERVIEW

19.2 PEDIATRIC

19.3 ADULT

19.3.1 MALE

19.3.2 FEMALE

19.4 GERIATRIC

19.4.1 MALE

19.4.2 FEMALE

20 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY END USER

20.1 OVERVIEW

20.2 HOSPITALS

20.2.1 PUBLIC

20.2.2 PRIVATE

20.3 SPECIALITY CLINICS

20.4 HOME CARE

20.5 AMBULATORY SURGICAL CENTERS

20.6 OTHERS

21 GLOBAL. METABOLIC DISORDERS THERAPEUTICS MARKET, BY DISTRIBUTION CHANNEL

21.1 OVERVIEW

21.2 DIRECT TENDER

21.3 RETAIL PHARMACIES

21.3.1 HOSPITAL PHARMACIES

21.3.2 RETAIL PHARMACIES

21.3.3 ONLINE PHARMACIES

21.3.4 OTHER

21.4 OTHERS

22 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, BY REGION

GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 U.K.

22.2.3 ITALY

22.2.4 FRANCE

22.2.5 SPAIN

22.2.6 RUSSIA

22.2.7 SWITZERLAND

22.2.8 TURKEY

22.2.9 BELGIUM

22.2.10 NETHERLANDS

22.2.11 DENMARK

22.2.12 SWEDEN

22.2.13 POLAND

22.2.14 NORWAY

22.2.15 FINLAND

22.2.16 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 SINGAPORE

22.3.6 THAILAND

22.3.7 INDONESIA

22.3.8 MALAYSIA

22.3.9 PHILIPPINES

22.3.10 AUSTRALIA

22.3.11 NEW ZEALAND

22.3.12 VIETNAM

22.3.13 TAIWAN

22.3.14 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 EGYPT

22.5.3 BAHRAIN

22.5.4 UNITED ARAB EMIRATES

22.5.5 KUWAIT

22.5.6 OMAN

22.5.7 QATAR

22.5.8 SAUDI ARABIA

22.5.9 REST OF MEA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS

24.8 REGULATORY CHANGES

24.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL METABOLIC DISORDERS THERAPEUTICS MARKET, COMPANY PROFILE

25.1 NOVO NORDISK A/S

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 SANOFI S.A.(GENZYME)

25.2.1 COMPANY OVERVIEW

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENTS

25.3 BOEHRINGER INGELHEIM GMB

25.3.1 COMPANY OVERVIEW

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENTS

25.4 ELI LILLY AND COMPANY

25.4.1 COMPANY OVERVIEW

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENTS

25.5 MERCK KGAA

25.5.1 COMPANY OVERVIEW

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENTS

25.6 AMGEN, INC.

25.6.1 COMPANY OVERVIEW

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENTS

25.7 ASTRAZENECA PLC

25.7.1 COMPANY OVERVIEW

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENTS

25.8 ACTELION PHARMACEUTICALS LTD.

25.8.1 COMPANY OVERVIEW

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENTS

25.9 SHIRE (TAKEDA PHARMACEUTICALS)

25.9.1 COMPANY OVERVIEW

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENTS

25.1 ABBVIE, INC.

25.10.1 COMPANY OVERVIEW

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENTS

25.11 BIOCON LTD.

25.11.1 COMPANY OVERVIEW

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENTS

25.12 BIOMARIN PHARMACEUTICAL, INC.

25.12.1 COMPANY OVERVIEW

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENTS

25.13 BRISTOL-MYERS SQUIBB COMPANY

25.13.1 COMPANY OVERVIEW

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENTS

25.14 CIPLA, INC.

25.14.1 COMPANY OVERVIEW

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENTS

25.15 CYMABAY THERAPEUTICS, INC.

25.15.1 COMPANY OVERVIEW

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENTS

25.16 AMICUS THERAPEUTICS, INC.

25.16.1 COMPANY OVERVIEW

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENTS

25.17 ULTRAGENYX PHARMACEUTICAL INC.

25.17.1 COMPANY OVERVIEW

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENTS

25.18 REGENERON PHARMACEUTICALS INC.

25.18.1 COMPANY OVERVIEW

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENTS

25.19 SANGAMO THERAPEUTICS

25.19.1 COMPANY OVERVIEW

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENTS

25.2 ORCHARD THERAPEUTICS INC

25.20.1 COMPANY OVERVIEW

25.20.2 REVENUE ANALYSIS

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 PRODUCT PORTFOLIO

25.20.5 RECENT DEVELOPMENTS

25.21 LEADIANT BIOSCIENCES, INC.

25.21.1 COMPANY OVERVIEW

25.21.2 REVENUE ANALYSIS

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 PRODUCT PORTFOLIO

25.21.5 RECENT DEVELOPMENTS

25.22 UNIQURE N.V.

25.22.1 COMPANY OVERVIEW

25.22.2 REVENUE ANALYSIS

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 PRODUCT PORTFOLIO

25.22.5 RECENT DEVELOPMENTS

25.23 BLUEBIRD BIO, INC.

25.23.1 COMPANY OVERVIEW

25.23.2 REVENUE ANALYSIS

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 PRODUCT PORTFOLIO

25.23.5 RECENT DEVELOPMENTS

25.24 GENETHON

25.24.1 COMPANY OVERVIEW

25.24.2 REVENUE ANALYSIS

25.24.3 GEOGRAPHIC PRESENCE

25.24.4 PRODUCT PORTFOLIO

25.24.5 RECENT DEVELOPMENTS

25.25 AGTC

25.25.1 COMPANY OVERVIEW

25.25.2 REVENUE ANALYSIS

25.25.3 GEOGRAPHIC PRESENCE

25.25.4 PRODUCT PORTFOLIO

25.25.5 RECENT DEVELOPMENTS

*NoTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

26 RELATED REPORTS

27 CONCLUSION

28 QUESTIONNAIRE

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.