Global Metabolic Endoscopic Device Market

Market Size in USD Million

CAGR :

%

USD

396.00 Million

USD

1,271.63 Million

2024

2032

USD

396.00 Million

USD

1,271.63 Million

2024

2032

| 2025 –2032 | |

| USD 396.00 Million | |

| USD 1,271.63 Million | |

|

|

|

|

Metabolic Endoscopic Device Market Size

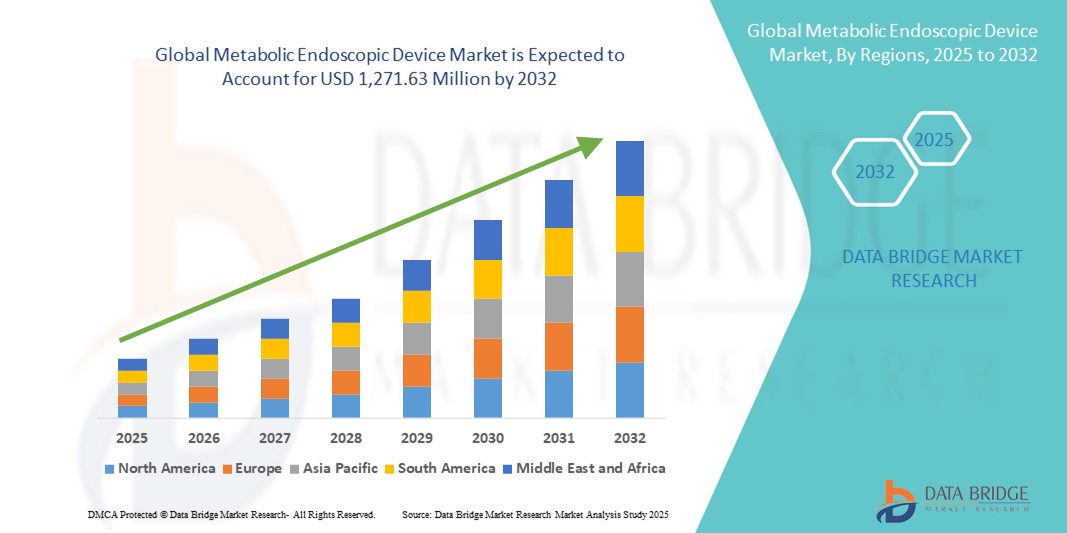

- The global metabolic endoscopic device market size was valued at USD 396.0 million in 2024 and is expected to reach USD 1,271.63 million by 2032, at a CAGR of 15.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected medical devices and advanced diagnostic tools, leading to increased digitalization and automation in healthcare facilities

- Furthermore, rising demand for minimally invasive procedures, enhanced patient outcomes, and integration of smart technology in endoscopic devices are driving the development and adoption of metabolic endoscopic device solutions. These converging factors are significantly boosting the growth of the metabolic endoscopic device market

Metabolic Endoscopic Device Market Analysis

- Metabolic endoscopic devices, providing minimally invasive diagnostic and therapeutic solutions for metabolic disorders, are becoming essential tools in modern healthcare settings due to their precision, reduced recovery times, and ability to improve patient outcomes across both hospital and outpatient care environments

- The market growth is largely fueled by the increasing prevalence of metabolic disorders and the rising adoption of minimally invasive diagnostic and therapeutic endoscopic devices, which enable effective management of obesity, diabetes, and related conditions across the globe

- North America dominated the metabolic endoscopic device market with the largest revenue share of 38.7% in 2024, supported by early adoption of innovative medical devices, high healthcare expenditure, and strong R&D activities by key market players. The U.S. continues to lead with rapid installation of metabolic endoscopic systems in hospitals and specialized clinics

- Asia-Pacific is expected to be the fastest-growing region in the metabolic endoscopic device market during the forecast period, with a projected CAGR of 13.2% from 2024 to 2032. Growth is driven by rising urbanization, expanding healthcare access, increasing disposable incomes, and government initiatives to improve healthcare infrastructure in countries such as China, India, Japan, and Australia

- The endoscopic surgical devices segment dominated the metabolic endoscopic device market with a revenue share of 38.6% in 2024, driven by its indispensable role in performing minimally invasive metabolic surgeries. This segment’s growth is closely linked to the increasing global prevalence of obesity and related metabolic disorders, which have escalated the demand for surgical interventions that are less invasive and offer quicker patient recovery

Report Scope and Metabolic Endoscopic Device Market Segmentation

|

Attributes |

Metabolic Endoscopic Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metabolic Endoscopic Device Market Trends

Revolutionizing Metabolic Endoscopy with AI and Voice-Activated Features

- A significant and accelerating trend in the global metabolic endoscopic device market is the increasing integration of artificial intelligence (AI) and popular voice-controlled ecosystems. This combination of advanced technologies is greatly enhancing user convenience, procedural efficiency, and device control for healthcare providers

- For instance, certain advanced metabolic endoscopic systems now incorporate AI algorithms that assist clinicians by providing real-time image analysis, automatic detection of abnormalities, and procedural guidance during endoscopic examinations. Integration with voice assistants allows hands-free operation, enabling medical professionals to control device settings, capture images, or switch views using simple voice commands, thereby maintaining sterility and improving workflow

- AI capabilities also enable these devices to learn from accumulated procedural data to optimize performance, reduce errors, and offer predictive insights. For instance, some metabolic endoscopic platforms use AI to enhance image resolution and highlight metabolic tissue variations, improving diagnostic accuracy and treatment outcomes

- The seamless integration of these devices with hospital information systems and smart healthcare platforms facilitates centralized management of patient data and device operation. This interoperability allows for better coordination between different diagnostic tools and streamlined patient monitoring

- This move towards AI-enabled, voice-interactive metabolic endoscopic devices is reshaping user expectations by providing more intuitive, efficient, and connected diagnostic solutions. Leading companies in the market are investing in developing devices that combine intelligent automation, voice command compatibility, and enhanced data analytics to support healthcare providers in delivering precise metabolic assessments

- Demand for metabolic endoscopic devices with embedded AI and voice control features is growing rapidly across hospitals, diagnostic centers, and specialized clinics, driven by the increasing emphasis on minimally invasive procedures, accuracy, and operational convenience

Metabolic Endoscopic Device Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Metabolic Disorders and Technological Advancements

- The increasing incidence of metabolic diseases such as obesity, type 2 diabetes, and related gastrointestinal conditions is driving strong demand for innovative, minimally invasive diagnostic and therapeutic solutions. This is significantly propelling the adoption of metabolic endoscopic devices across globe

- For instance, in 2024, several leading healthcare providers have expanded their use of advanced endoscopic technologies for bariatric and metabolic interventions, improving patient outcomes through less invasive procedures and shorter recovery times. Such advancements by major medical centers are expected to stimulate further growth in the metabolic endoscopic device market during the forecast period

- Growing awareness among patients and physicians regarding the benefits of endoscopic metabolic procedures, such as reduced surgical risks and enhanced precision, is leading to higher acceptance and broader utilization of these devices in clinical practice

- Furthermore, continuous innovations in device design, including improved imaging capabilities, enhanced maneuverability, and integration with AI-driven diagnostics, are enabling more effective treatment options and expanding the clinical applications of metabolic endoscopic devices

- The rising focus on personalized medicine and minimally invasive treatments, along with expanding healthcare infrastructure in emerging economies, is creating new opportunities for manufacturers to introduce next-generation metabolic endoscopic devices in both hospital and outpatient settings

Restraint/Challenge

Concerns Regarding Regulatory Compliance and High Costs

- Despite the promising growth prospects, the metabolic endoscopic device market faces challenges related to stringent regulatory approvals and compliance requirements across different regions. Navigating the complex regulatory landscape can delay product launches and increase development costs for manufacturers

- In addition, the relatively high cost of metabolic endoscopic devices and related procedures may limit accessibility, particularly in low- and middle-income countries where healthcare budgets are constrained. This financial barrier can slow adoption among healthcare providers and patients alike

- The need for specialized training and skilled personnel to operate these advanced devices also presents a challenge, as inadequate expertise may impact procedural outcomes and limit wider implementation in some regions

- Addressing these challenges through streamlined regulatory pathways, cost optimization strategies, and investment in clinical training programs will be critical to unlocking the full market potential and ensuring sustained adoption of metabolic endoscopic technologies globally

Metabolic Endoscopic Device Market Scope

The market is segmented on the basis of device type, procedure type, technology, application, and end user.

- By Device Type

On the basis of device type, the metabolic endoscopic device market is segmented into endoscopic surgical devices, catheters & accessories, energy devices, visualization systems, and others. The endoscopic surgical devices segment dominated the largest market revenue share of 38.6% in 2024, driven by its indispensable role in performing minimally invasive metabolic surgeries. This segment’s growth is closely linked to the increasing global prevalence of obesity and related metabolic disorders, which have escalated the demand for surgical interventions that are less invasive and offer quicker patient recovery.

The energy devices segment is anticipated to witness the fastest growth rate with a CAGR of 19.3% from 2025 to 2032, fueled by continuous technological advancements in radiofrequency and laser-based metabolic treatment devices. These innovations are significantly enhancing surgical precision, improving patient outcomes, and reducing post-operative complications, thereby driving adoption across healthcare settings.

- By Procedure Type

On the basis of procedure type, the metabolic endoscopic device market is segmented into bariatric surgery, gastrointestinal surgery, metabolic disease diagnosis, and others. Bariatric surgery held the largest market revenue share of 44.1% in 2024, primarily due to the growing acceptance of surgical interventions as effective solutions for obesity management and associated metabolic conditions. The rising incidence of obesity worldwide has made bariatric surgery a critical treatment modality, supported by advances in minimally invasive techniques that reduce risks and improve recovery.

The metabolic disease diagnosis segment is expected to register the fastest CAGR of 17.8% from 2025 to 2032, driven by the increasing demand for early and accurate detection of metabolic disorders. This growth is propelled by the development and adoption of advanced endoscopic diagnostic tools that enable precise evaluation, facilitating timely intervention and better management of metabolic diseases.

- By Technology

On the basis of technology, the metabolic endoscopic device market is segmented into flexible endoscopes, rigid endoscopes, capsule endoscopes, and hybrid systems. The flexible endoscopes segment led the market with a revenue share of 41.7% in 2024, largely due to their superior adaptability and enhanced patient comfort during metabolic procedures. These endoscopes allow for easier navigation through complex anatomical structures, reducing procedure time and improving clinical outcomes.

Capsule endoscopes are projected to grow at a rapid CAGR of 18.5% during the forecast period, driven by their minimally invasive, painless nature and increasing acceptance among clinicians for metabolic diagnostics. Their ability to provide comprehensive imaging without discomfort makes them particularly appealing in patient-centric care.

- By Application

On the basis of application, the metabolic endoscopic device market is segmented into obesity treatment, diabetes management, gastrointestinal disorder treatment, and others. The obesity treatment segment accounted for the largest market revenue share of 46.3% in 2024, supported by the rising global prevalence of obesity and the growing preference for minimally invasive endoscopic interventions as alternatives to traditional surgery. These procedures offer reduced recovery times and lower risk profiles, encouraging wider adoption.

The diabetes management segment is expected to grow at a CAGR of 16.7% from 2025 to 2032, driven by the expanding diabetic population worldwide and ongoing advancements in metabolic therapy devices that enhance treatment efficacy and patient outcomes.

- By End User

On the basis of end user, the metabolic endoscopic device market is segmented into hospitals, ambulatory surgical centers, specialty clinics, research institutes, and others. Hospitals dominated the market with a revenue share of 52.4% in 2024, owing to their well-established infrastructure, availability of advanced equipment, and specialized medical professionals capable of performing complex metabolic endoscopic procedures.

Ambulatory surgical centers are forecasted to witness the fastest CAGR of 20.1% during 2025–2032, fueled by the increasing shift toward outpatient surgeries that offer cost-effective, convenient, and efficient care delivery models. This trend is supported by rising patient preference for minimally invasive procedures performed outside traditional hospital settings.

Metabolic Endoscopic Device Market Regional Analysis

- North America dominated the metabolic endoscopic device market with the largest revenue share of 38.7% in 2024

- Driven by early adoption of innovative medical devices, high healthcare expenditure, and strong research and development activities by key market players

- The U.S. continues to lead the region with rapid installation of metabolic endoscopic systems in hospitals and specialized clinics, supported by advanced healthcare infrastructure and growing patient awareness

U.S. Metabolic Endoscopic Device Market Insight

The U.S. metabolic endoscopic device market captured the largest revenue share of 55% within North America, fueled by widespread adoption of advanced metabolic endoscopic technologies in clinical and outpatient settings. Rising rates of obesity and metabolic disorders, along with continuous investments in healthcare innovation and infrastructure, are driving strong market growth. The preference for minimally invasive procedures and the integration of digital health technologies are further boosting demand.

Europe Metabolic Endoscopic Device Market Insight

The Europe metabolic endoscopic device market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing awareness of metabolic diseases and growing adoption of minimally invasive procedures. Rising healthcare expenditure, technological advancements, and supportive government policies in countries such as Germany and the U.K. are fostering market growth across residential, commercial, and hospital settings.

U.K. Metabolic Endoscopic Device Market Insight

The U.K. metabolic endoscopic device market is expected to grow at a notable CAGR, supported by increasing emphasis on home automation technologies and the demand for early diagnosis and effective management of metabolic disorders. Heightened concerns about health safety and enhanced healthcare infrastructure are encouraging adoption among both healthcare providers and patients.

Germany Metabolic Endoscopic Device Market Insight

The Germany’s metabolic endoscopic device market is anticipated to witness considerable growth due to growing awareness of metabolic health, demand for advanced and eco-friendly medical devices, and a strong focus on healthcare innovation. Well-developed infrastructure and sustainability initiatives in Germany promote integration of metabolic endoscopic devices, particularly in residential and commercial healthcare facilities.

Asia-Pacific Metabolic Endoscopic Device Market Insight

The Asia-Pacific metabolic endoscopic device market is poised to grow at the fastest CAGR of 13.2% during the forecast period from 2024 to 2032, driven by rising urbanization, increasing disposable incomes, technological advancements, and government initiatives aimed at strengthening healthcare infrastructure. Key countries such as China, India, Japan, and Australia are leading adoption, supported by growing awareness and expanding access to metabolic endoscopic procedures.

Japan Metabolic Endoscopic Device Market Insight

The Japan metabolic endoscopic device market growth is supported by its advanced healthcare infrastructure, high-tech culture, and rapid urbanization. The country’s aging population increases demand for easier-to-use and secure metabolic endoscopic solutions. The integration of these devices with IoT technologies such as home security and lighting systems is driving market expansion in both residential and commercial sectors.

China Metabolic Endoscopic Device Market Insight

The China metabolic endoscopic device market accounted for the largest revenue share in the Asia-Pacific region in 2024, due to its expanding middle class, rapid urbanization, and high technological adoption rates. The country is one of the largest markets for metabolic endoscopic devices, with growing popularity across residential, commercial, and rental properties. Government support for smart city initiatives and strong domestic manufacturing capabilities are key factors propelling market growth in China.

Metabolic Endoscopic Device Market Share

The metabolic endoscopic device industry is primarily led by well-established companies, including:

- Fractyl Health, Inc. (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Cook (U.S.)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- BD (U.S.)

- Conmed Corporation (U.S.)

- Smith + Nephew (U.K.)

- Pentax Medical (Japan)

- Karl Storz SE & Co. KG (Germany)

- Fujifilm Holdings Corporation (Japan)

Latest Developments in Global Metabolic Endoscopic Device Market

- In April 2024, Medtronic unveiled advancements in artificial intelligence (AI) at the Genius Summit 2024, focusing on enhancing gastrointestinal (GI) endoscopic care. The company highlighted collaborations aimed at integrating AI into endoscopic procedures, improving diagnostic accuracy and procedural efficiency. These innovations underscore Medtronic's commitment to advancing endoscopic care through AI-driven solutions

- In April 2024, Boston Scientific acquired a Singapore-based endoscopic startup specializing in AI-driven image analysis software. This acquisition aims to integrate intelligent diagnostics into Boston Scientific's endoscopic systems, enhancing capabilities in metabolic disease interventions. The move reflects the company's strategy to strengthen its market presence in the Asia-Pacific region

- In February 2023, Olympus Corporation acquired Taewoong Medical Co., Ltd., a Korean gastrointestinal stent company, for USD 370 million. This acquisition is aimed at expanding Olympus's gastrointestinal endotherapy product portfolio, enhancing its capabilities in treating metabolic diseases through advanced endoscopic interventions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.