Global Metal Bellows Market

Market Size in USD Billion

CAGR :

%

USD

2.14 Billion

USD

2.74 Billion

2024

2032

USD

2.14 Billion

USD

2.74 Billion

2024

2032

| 2025 –2032 | |

| USD 2.14 Billion | |

| USD 2.74 Billion | |

|

|

|

|

Metal Bellows Market Size

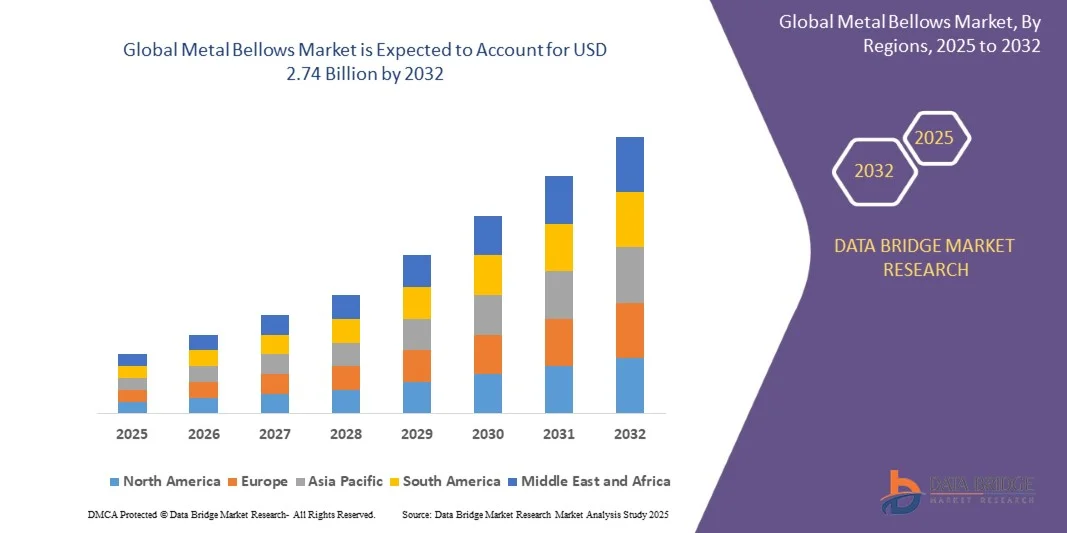

- The global metal bellows market size was valued at USD 2.14 billion in 2024 and is projected to reach USD 2.74 billion by 2032, growing at a CAGR of 3.10% during the forecast period

- Market expansion is primarily driven by increasing demand across aerospace, automotive, and semiconductor industries, where precision, pressure control, and vibration absorption are critical

- Moreover, the push for miniaturization and higher performance in industrial systems is fueling innovation in metal bellows design and materials. These trends are enhancing adoption across diverse applications, supporting sustained growth in the global metal bellows market

Metal Bellows Market Analysis

- Metal bellows, offering flexible, hermetically sealed components that absorb movement, pressure, and vibration, are essential in precision applications across aerospace, automotive, medical, and semiconductor industries due to their reliability, durability, and ability to operate under extreme conditions

- The growing demand for metal bellows is primarily driven by increased investments in industrial automation, miniaturized components for electronics, and stringent performance requirements in mission-critical systems

- Asia-Pacific dominated the global metal bellows market of 38.7% in 2024, driven by the increasing availability of raw material suppliers, retailers, and manufacturers, which supports efficient production and supply chain capabilities across key industries

- North America is expected to register the highest CAGR during the forecast period, fueled by strategic mergers and acquisitions, as well as growing collaborations with OEMs for the joint development of advanced metal bellows solutions across aerospace, defense, and industrial sectors

- Edge-welded bellows segment dominated the global metal bellows market with a market share of 44.2% in 2024, attributed to their superior flexibility, compact design, and ability to withstand high pressure and temperature in advanced engineering applications

Report Scope and Metal Bellows Market Segmentation

|

Attributes |

Metal Bellows key Market insight |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metal Bellows Market Trends

“Technological Advancements Driving Performance and Customization”

- A significant and accelerating trend in the Global Metal Bellows Market is the growing integration of advanced materials, precision manufacturing techniques, and simulation technologies, enabling enhanced performance, reliability, and application-specific customization across a wide range of industries

- For instance, manufacturers are increasingly adopting high-grade alloys such as Inconel and Hastelloy for bellows used in aerospace and chemical processing applications, where extreme temperatures and corrosive environments demand superior material performance

- Advanced fabrication methods like laser welding and hydroforming are improving product consistency and enabling the production of complex, miniaturized bellows for critical uses in semiconductor equipment and medical devices. Moreover, the integration of finite element analysis (FEA) and computer-aided design (CAD) tools allows engineers to simulate real-world stress, fatigue, and thermal conditions, significantly optimizing bellows design before production

- This technological shift is also enabling greater product customization, allowing manufacturers to tailor wall thickness, convolution geometry, and spring rates to meet highly specific performance criteria in automotive exhaust systems, space applications, and precision instrumentation

- The rising demand for compact, lightweight, and durable components in next-generation technologies is pushing the boundaries of bellows engineering. As a result, companies like MW Industries and Servometer are investing in R&D to deliver metal bellows that meet stricter tolerances, offer longer operational lifespans, and perform reliably in extreme or vacuum environments

- This trend towards performance-driven innovation is reshaping market expectations and strengthening the role of metal bellows as indispensable components in critical high-tech and industrial systems across global markets

Metal Bellows Market Dynamics

Driver

“Growing Demand Driven by Industrial Expansion and Technological Precision”

- The rising need for precision-engineered components in high-performance industries such as aerospace, automotive, energy, and medical devices is a key driver for the growing demand in the global metal bellows market

- For instance, in March 2024, MW Industries announced the expansion of its metal bellows manufacturing capabilities to support increased demand from aerospace and semiconductor sectors, incorporating advanced automation and testing technologies. Such strategic expansions by key players are expected to boost market growth during the forecast period

- As industries increasingly demand components that can withstand high pressure, temperature, and corrosive environments, metal bellows offer a reliable solution due to their flexibility, durability, and ability to maintain hermetic seals under extreme conditions

- Additionally, the trend toward miniaturization and higher efficiency in systems design is driving the integration of compact, lightweight bellows into next-generation equipment. This is especially evident in semiconductor manufacturing, medical instrumentation, and space exploration applications

- The ability of metal bellows to absorb thermal expansion, compensate for misalignment, and maintain precision in motion and pressure control systems makes them indispensable in advanced engineering applications. The growing investment in infrastructure, automation, and clean energy projects across both developed and developing regions is further propelling demand

- Furthermore, increased emphasis on product customization and shorter development cycles is pushing manufacturers to leverage simulation-based design and advanced prototyping techniques, fostering innovation and faster time-to-market for high-performance bellows solutions

Restraint/Challenge

“High Production Costs and Design Complexity”

- The high cost of advanced raw materials such as Inconel, Hastelloy, and titanium, coupled with the precision manufacturing processes required to produce metal bellows, presents a major restraint for broader adoption, particularly among small to mid-sized manufacturers or cost-sensitive end users

- For example, edge-welded and hydroformed bellows used in aerospace or medical applications demand extremely tight tolerances and cleanroom manufacturing conditions, which significantly increases production time and operational costs

- Furthermore, the design and engineering of custom metal bellows for highly specific applications can be both time-consuming and complex. This can delay product development and limit scalability for rapidly changing industry requirements

- The lack of standardized design frameworks for niche applications often requires extensive R&D, simulation, and validation, increasing the total cost of ownership. Smaller OEMs may face challenges in meeting both technical and budgetary constraints when integrating high-performance bellows into their systems

- Addressing these challenges through the development of cost-effective materials, streamlined manufacturing processes, and modular design approaches will be essential to improve accessibility and adoption. Industry leaders are increasingly investing in automation and digital twin technologies to optimize production and reduce lead times while maintaining high quality standards

- Despite these efforts, the high entry cost and engineering complexity continue to act as barriers for widespread adoption, particularly in emerging markets and industries with limited technical expertise or infrastructure

Metal Bellows Market Scope

The metal bellows market is segmented on the basis of material, product, application and end user.

• By Material

On the basis of material, the global metal bellows market is segmented into titanium alloys, stainless steel alloys, nickel alloys, and others. The stainless steel alloys segment dominated the market with the largest revenue share of 39.5% in 2024, attributed to its high strength, corrosion resistance, and cost-effectiveness across diverse industrial applications. Stainless steel bellows are widely used in sectors such as automotive, power generation, and water treatment due to their durability and availability in various grades.

The titanium alloys segment is projected to witness the fastest CAGR from 2025 to 2032, driven by its exceptional strength-to-weight ratio and resistance to extreme temperatures and corrosive environments. These properties make titanium alloys especially attractive in aerospace, defense, and high-end semiconductor applications. Although more expensive, titanium bellows are gaining traction in precision and mission-critical systems where performance outweighs cost.

• By Product

On the basis of product, the global metal bellows market is segmented into edge-welded bellows, mechanically formed bellows, electroformed bellows, and others. The edge-welded bellows segment dominated the market with a revenue share of 44.2% in 2024, owing to their superior flexibility, high pressure resistance, and compact design. These are widely used in aerospace, semiconductor, and medical equipment applications where space constraints and high performance are critical.

The electroformed bellows segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand in ultra-precise environments such as medical instruments and vacuum systems. Electroforming allows for thin-walled, lightweight bellows with extremely fine tolerances, ideal for sensitive measurement and control applications. As miniaturization trends continue, this segment is gaining momentum in next-gen engineering applications.

• By Application

On the basis of application, the global metal bellows market is segmented into corrosive medium, high precision measuring instrument, sealing and connecting element, and compensating element. The sealing and connecting element segment held the largest market revenue share of 37.6% in 2024, as metal bellows are critical in providing leak-proof seals in piping systems, pumps, and valves across oil & gas, chemical, and power generation sectors. Their ability to compensate for misalignment and absorb vibrations makes them indispensable in fluid systems.

The high precision measuring instrument segment is anticipated to witness the fastest CAGR during the forecast period, driven by the increasing use of bellows in pressure sensors, actuators, and vacuum systems. Demand for high-accuracy instrumentation in semiconductor, aerospace, and medical applications is expanding rapidly, driving the need for bellows with ultra-tight tolerances and minimal hysteresis.

• By End User

On the basis of end user, the global metal bellows market is segmented into aerospace and defense, automotive, power generation, water treatment, oil and gas, semiconductor, and others. The Aerospace and Defense segment dominated the market with a revenue share of 31.8% in 2024, supported by high demand for reliable, lightweight, and durable components capable of withstanding extreme conditions. Bellows are used in fuel systems, avionics, and hydraulic systems to ensure performance and safety.

The semiconductor segment is projected to register the fastest CAGR from 2025 to 2032, propelled by the rising demand for precision components in chip manufacturing and vacuum systems. The need for ultra-clean, leak-tight, and miniature bellows in semiconductor fabrication equipment is growing with the advancement of microelectronics and the expansion of fab facilities worldwide.

Metal Bellows Market Regional Analysis

- North America dominated the Global Metal Bellows Market with the largest revenue share of 38.7% in 2024, driven by strong industrial infrastructure, advanced manufacturing capabilities, and high demand from sectors such as aerospace, defense, and semiconductors

- Industries in the region prioritize precision-engineered components like metal bellows for their reliability, durability, and ability to perform under extreme operating conditions, especially in applications requiring pressure control, thermal expansion management, and leak-proof sealing

- This market leadership is further supported by significant R&D investments, presence of key industry players, and growing adoption of automation and high-performance systems, establishing metal bellows as essential components in mission-critical applications across aerospace, automotive, and energy sectors

U.S. Metal Bellows Market Insight

The U.S. metal bellows market captured the largest revenue share of 81% in 2024 within North America, driven by its mature industrial base and high demand from aerospace, defense, and semiconductor sectors. The U.S. leads in advanced manufacturing and is at the forefront of adopting precision-engineered components such as metal bellows for applications requiring high durability, flexibility, and leak-tight performance. The country’s focus on space exploration, military modernization, and clean energy initiatives is also driving demand. Additionally, strong investments in R&D and automation technologies support continued innovation, making the U.S. a key hub for metal bellows production and consumption.

Europe Metal Bellows Market Insight

The Europe metal bellows market is projected to expand at a substantial CAGR throughout the forecast period, supported by stringent industry regulations, technological innovation, and robust demand from automotive, energy, and industrial sectors. The region’s commitment to sustainability and precision engineering enhances the adoption of high-quality metal bellows for sealing, expansion compensation, and vibration isolation. Europe is also witnessing a rise in demand for custom-designed bellows used in high-precision instrumentation and renewable energy systems, particularly in Germany and the Nordic countries. Increasing emphasis on energy efficiency and emission control in industrial operations further fuels growth.

U.K. Metal Bellows Market Insight

The U.K. metal bellows market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased investments in aerospace, automotive, and high-tech manufacturing. The demand for flexible, corrosion-resistant components has grown alongside the push for performance optimization in critical systems. Additionally, the U.K.'s well-established engineering sector and focus on advanced materials and additive manufacturing are fostering the development of specialized metal bellows. Government-backed initiatives in clean energy and aerospace research also contribute to the rising adoption of precision bellows in both existing and emerging industrial applications.

Germany Metal Bellows Market Insight

The Germany metal bellows market is expected to expand at a considerable CAGR during the forecast period, fueled by its global leadership in automotive engineering, mechanical manufacturing, and industrial automation. German manufacturers demand high-precision bellows for applications such as emission control systems, hydraulic actuators, and semiconductor fabrication tools. The country’s strong emphasis on R&D, quality standards, and innovation drives continual development of advanced bellows solutions. Furthermore, the integration of smart manufacturing (Industry 4.0) principles into production processes is boosting demand for high-performance, durable components like metal bellows in key industrial ecosystems.

Asia-Pacific Metal Bellows Market Insight

The Asia-Pacific metal bellows market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, propelled by rapid industrialization, rising manufacturing output, and infrastructure development in countries such as China, Japan, India, and South Korea. Growing demand in automotive, electronics, and semiconductor industries is accelerating adoption of metal bellows across the region. Government initiatives promoting industrial automation, energy efficiency, and local component manufacturing further support market expansion. Additionally, cost-effective production capabilities and increasing exports make Asia-Pacific not only a large consumer base but also a key global supplier of metal bellows.

Japan Metal Bellows Market Insight

The Japan metal bellows market is gaining momentum due to the country’s strong engineering legacy, advanced manufacturing capabilities, and growing adoption of miniaturized components. Precision bellows are widely used in robotics, medical devices, and semiconductor manufacturing—industries where Japan maintains a global competitive edge. Japan’s high demand for compact, durable, and cleanroom-compatible components supports continued growth. Additionally, the country's aging infrastructure and ongoing technological upgrades in public and private sectors are increasing the need for high-performance bellows in HVAC, water treatment, and other industrial systems.

China Metal Bellows Market Insight

The China metal bellows market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding industrial output, and strong domestic demand for high-performance components. China’s dominance in electronics, automotive, and machinery manufacturing positions it as both a major consumer and producer of metal bellows. The government’s focus on high-end manufacturing and smart factories is encouraging the use of advanced sealing and compensating components across sectors. Furthermore, local manufacturers are increasingly investing in automation and precision engineering to meet global quality standards, strengthening China’s role in the international bellows supply chain.

Metal Bellows Market Share

The metal bellows industry is primarily led by well-established companies, including:

- WITZENMANN (Germany)

- BOA Group (U.K.)

- Senior Flexonics (U.S.)

- Shuguang Group (China)

- MIRAPRO (South Korea)

- Flexider (France)

- Hyspan Precision Products, Inc. (U.S.)

- Technoflex (India)

- Penflex (India)

- KSM Co., Ltd. (South Korea)

- Duraflex (U.S.)

- Weldmac Manufacturing Co (India)

What are the Recent Developments in Metal Bellows Market?

- In May 2023, MW Industries, Inc., a U.S.-based leader in precision-engineered components, announced the expansion of its metal bellows manufacturing capabilities at its Illinois facility. This strategic move aims to meet growing demand from the aerospace and semiconductor sectors, enhancing production efficiency and enabling the delivery of highly customized, high-performance bellows solutions. The investment underscores MW Industries’ commitment to supporting mission-critical industries with advanced engineering and precision manufacturing.

- In April 2023, EagleBurgmann, a global sealing technology provider headquartered in Germany, launched a new series of high-pressure metal bellows seals designed for demanding chemical and petrochemical applications. This innovation focuses on increasing durability, corrosion resistance, and operational life in extreme environments, reflecting EagleBurgmann's ongoing dedication to safety, sustainability, and product excellence in fluid handling systems.

- In March 2023, BOA Group, a German manufacturer specializing in flexible metal components, unveiled its next-generation hydroformed metal bellows for use in hydrogen fuel cell systems. This development aligns with Europe’s green energy transition goals and addresses the growing need for durable, lightweight, and high-integrity components in zero-emission transportation. The launch reinforces BOA Group’s position as a key player in the clean energy and mobility sector.

- In February 2023, Technetics Group, a leading U.S.-based manufacturer of engineered sealing solutions, announced a strategic partnership with a major semiconductor equipment supplier to co-develop ultra-clean, high-precision metal bellows for use in vacuum and gas delivery systems. The collaboration aims to accelerate innovation in chip manufacturing, emphasizing Technetics’ role in enabling advanced semiconductor fabrication through specialized component engineering.

- In January 2023, Senior Flexonics, part of the U.K.-based Senior plc, introduced a new line of automotive-grade metal bellows for thermal expansion compensation in electric vehicle (EV) exhaust and cooling systems. This product launch reflects the company’s response to the rapid shift toward electrification in the automotive sector and highlights its commitment to delivering lightweight, durable, and high-performance solutions that enhance vehicle efficiency and longevity.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.