Global Metal Cans And Glass Jars Market

Market Size in USD Billion

CAGR :

%

USD

26.82 Billion

USD

32.17 Billion

2024

2032

USD

26.82 Billion

USD

32.17 Billion

2024

2032

| 2025 –2032 | |

| USD 26.82 Billion | |

| USD 32.17 Billion | |

|

|

|

|

Global Metal Cans and Glass Jars Market Size

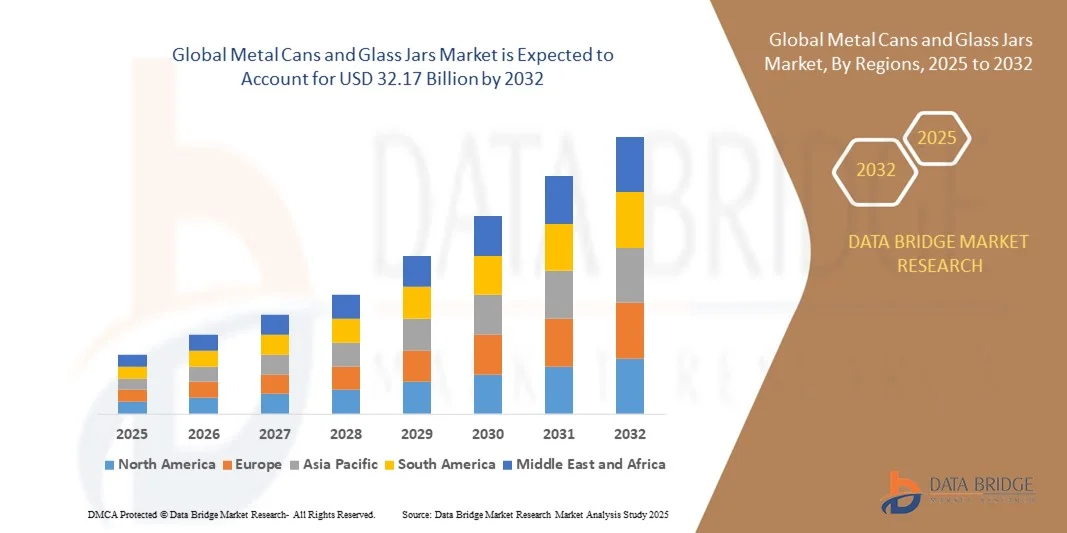

- The global metal cans and glass jars market size was valued at USD 26.82 billion in 2024 and is projected to reach USD 32.17 billion by 2032, growing at a CAGR of 2.30% during the forecast period.

- The market expansion is primarily driven by increasing demand for sustainable, recyclable, and eco-friendly packaging solutions across food, beverage, and personal care industries, as consumers and regulators push for reduced plastic usage.

- Moreover, advancements in packaging technologies, enhanced shelf life, and aesthetic appeal are making metal cans and glass jars more attractive to brands, further propelling market adoption and long-term industry growth.

Global Metal Cans and Glass Jars Market Analysis

- Metal cans and glass jars, known for their durability, recyclability, and preservation capabilities, are increasingly essential in the packaging industry across food, beverages, pharmaceuticals, and cosmetics, driven by consumer demand for sustainable and safe packaging alternatives.

- The rising preference for eco-friendly, BPA-free, and reusable packaging is a key driver of growth, along with stricter environmental regulations and growing awareness of plastic pollution among consumers and manufacturers.

- Asia-Pacific dominated the global metal cans and glass jars market with the largest revenue share of 36.6% in 2024, supported by mature food and beverage industries, advanced recycling infrastructure, and strong regulatory support for sustainable packaging, particularly in the U.S. where demand from organic and premium product segments is accelerating.

- North America is projected to be the fastest growing region during the forecast period due to rapid urbanization, expanding middle-class population, and increasing demand for packaged and ready-to-eat foods in countries like China and India.

- The metal cans segment dominated the market with the largest revenue share of 56.8% in 2024, primarily due to their widespread use in packaging beverages, preserved foods, and pet food.

Report Scope and Global Metal Cans and Glass Jars Market Segmentation

|

Attributes |

Metal Cans and Glass Jars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Metal Cans and Glass Jars Market Trends

Sustainable Innovation and Smart Packaging Integration

- A significant and accelerating trend in the global Metal Cans and Glass Jars Market is the evolution toward sustainable innovation and the integration of smart packaging technologies. Manufacturers are increasingly embedding intelligent features into packaging formats while enhancing eco-friendliness through recyclable materials and energy-efficient production methods

- For instance, companies such as Ball Corporation and Ardagh Group are investing in lightweighting technologies and digital printing on metal cans to reduce carbon footprint while enabling product-level traceability and consumer engagement through QR codes and NFC tags. Similarly, glass packaging innovators such as Gerresheimer AG are exploring smart caps and embedded sensors for pharmaceutical and premium food applications

- Smart packaging features are enabling real-time monitoring of freshness, temperature, and tamper-evidence, especially valuable in sectors like food and healthcare. These innovations not only help reduce waste and improve safety but also support brand transparency and consumer trust. For example, smart jars equipped with freshness indicators are being used to signal spoilage or compromised seals in real time

- Furthermore, digital integration with inventory systems and supply chains is optimizing logistics and shelf management, especially for high-value or sensitive products. Smart labels and barcodes on cans and jars are being adopted for efficient tracking, improving traceability and quality control across global distribution networks

- This growing trend toward eco-conscious and connected packaging is driving demand from both consumers and brands. Companies such as Amcor Limited are developing recyclable metal and glass alternatives with integrated smart features, responding to the dual need for sustainability and digital interactivity

- The push for intelligent, traceable, and sustainable packaging solutions is fundamentally reshaping the metal cans and glass jars market. As consumers and regulatory bodies continue to demand transparency and environmental responsibility, this convergence of sustainability and smart technology is poised to redefine packaging standards across industries

Global Metal Cans and Glass Jars Market Dynamics

Driver

Growing Demand Driven by Sustainability Goals and Convenience in Packaging

-

The global metal cans and glass jars market is witnessing a surge in demand, largely fueled by the growing emphasis on environmental sustainability, regulatory pressure to reduce plastic usage, and increasing consumer preference for recyclable and reusable packaging materials

- For Instance, in March 2024, Ardagh Group announced a strategic expansion of its lightweight glass production line, aiming to reduce carbon emissions while maintaining durability—an initiative that aligns with the EU’s Green Deal and corporate sustainability goals. Such efforts by leading companies are expected to significantly accelerate the market’s growth

- Consumers are increasingly favoring eco-conscious brands that use metal cans and glass jars, especially in the food, beverage, and cosmetics sectors, where these materials preserve product quality, enhance shelf appeal, and support a circular economy

- Furthermore, brands are turning to glass and metal packaging for premium positioning, as these materials convey quality and luxury. Convenience is also a major factor, with innovations like easy-open metal can lids, resealable jars, and microwave-safe glass containers improving user experience and functionality

- The demand for ready-to-eat meals, beverages, and health products in durable, portable, and recyclable packaging is contributing to the widespread adoption of metal and glass solutions across developed and emerging markets. Manufacturers are also investing in smart labeling and traceable packaging to enhance transparency and consumer trust

Restraint/Challenge

High Energy Consumption and Fragility Concerns

-

Despite their many advantages, metal cans and glass jars face challenges that may hinder market growth, particularly related to their energy-intensive manufacturing processes and higher logistical costs due to weight and fragility.

- For instance, the production of glass requires high-temperature furnaces, which consume large amounts of energy and result in significant CO₂ emissions. Although many companies are transitioning to renewable energy sources, the carbon footprint remains a concern for environmentally conscious stakeholders.

- Breakability of glass also limits its usability in certain applications, especially in transport-heavy supply chains or in regions with limited protective infrastructure. Additionally, glass packaging requires careful handling, specialized storage, and often more expensive shipping solutions, which can deter adoption by cost-sensitive manufacturers.

- While innovations such as lightweight glass and improved metal alloys are helping to mitigate some of these issues, cost remains a significant barrier, especially for small and mid-sized enterprises in emerging markets.

- To overcome these obstacles, industry players are focusing on technological advancements, such as hybrid packaging solutions, closed-loop recycling systems, and AI-driven quality control processes that reduce waste and energy usage, thereby making metal and glass packaging more viable and competitive in the long term

Global Metal Cans and Glass Jars Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the global metal cans and glass jars market is segmented into metal cans and glass jars. The metal cans segment dominated the market with the largest revenue share of 56.8% in 2024, primarily due to their widespread use in packaging beverages, preserved foods, and pet food. Metal cans are favored for their durability, excellent barrier properties, and recyclability, making them suitable for long-shelf-life products and high-volume distribution. Their lightweight nature and ease of transportation also make them attractive to manufacturers aiming to reduce logistics costs.

The glass jars segment is expected to witness the fastest CAGR of 21.3% from 2025 to 2032, driven by growing consumer preference for non-toxic, BPA-free, and reusable packaging, particularly in premium food, cosmetics, and pharmaceutical applications. Glass jars are perceived as more sustainable and aesthetically appealing, and their transparency enhances product visibility—making them ideal for high-end or organic product lines.

- By Application

On the basis of application, the market is segmented into preserved food, pet food, milk powder, and others. The preserved food segment accounted for the largest market revenue share of 44.1% in 2024, driven by the increasing demand for shelf-stable food products across both developed and emerging markets. Glass jars and metal cans offer excellent protection from oxygen, moisture, and light, making them ideal for storing fruits, vegetables, sauces, pickles, and ready-to-eat meals. Their compatibility with thermal processing and long shelf life are key reasons behind their dominance in the preserved food sector.

The pet food segment is anticipated to witness the fastest CAGR of 20.6% from 2025 to 2032, owing to rising pet ownership globally and growing consumer awareness regarding the nutritional integrity and freshness of pet food products. Metal cans are especially favored in this segment for their ability to preserve wet food, maintain aroma, and meet regulatory standards for pet safety and quality.

Global Metal Cans and Glass Jars Market Regional Analysis

- Asia Pacific dominated the global metal cans and glass jars market with the largest revenue share of 36.6% in 2024, driven by strong demand across the food, beverage, and personal care sectors, along with a well-established packaging and recycling infrastructure.

- Consumers in the region increasingly prefer sustainable, recyclable, and BPA-free packaging, with metal cans and glass jars seen as safer and more environmentally responsible alternatives to plastic. This shift is especially evident in premium product categories where packaging quality influences purchase decisions.

- The region’s market leadership is further supported by stringent environmental regulations, high consumer awareness regarding product safety and sustainability, and the presence of leading packaging companies innovating in lightweight, resealable, and smart packaging formats. These factors collectively position metal cans and glass jars as preferred packaging solutions for both mass-market and niche, health-conscious consumers across North America.

U.S. Metal Cans and Glass Jars Market Insight

The U.S. metal cans and glass jars market captured the largest revenue share of 79% in North America in 2024, driven by increasing consumer preference for sustainable and eco-friendly packaging solutions across the food, beverage, and personal care sectors. The shift away from single-use plastics, combined with regulatory pressure and consumer awareness, is fueling demand for recyclable packaging formats. In the U.S., glass jars are especially favored in organic and premium food segments, while aluminum and steel cans dominate in the beverage and pet food markets. Innovations in lightweighting, smart labeling, and resealable features further enhance market growth, with manufacturers catering to both functionality and aesthetic appeal.

Europe Metal Cans and Glass Jars Market Insight

The Europe metal cans and glass jars market is projected to grow at a strong CAGR throughout the forecast period, driven by stringent environmental regulations and increasing emphasis on circular economy practices. Countries across Europe are phasing out plastic packaging in favor of recyclable alternatives such as glass and metal. The region’s well-developed recycling infrastructure and consumer demand for clean-label and zero-waste products are accelerating adoption. Growth is particularly strong in the food preservation, dairy, and personal care sectors. Brands are also turning to glass for luxury and organic product positioning, while metal cans remain a staple in beverages and canned foods.

U.K. Metal Cans and Glass Jars Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, supported by increased demand for sustainable packaging, especially within the retail food and beverage sectors. British consumers are highly conscious of environmental issues, prompting retailers and manufacturers to transition toward glass jars and metal cans over plastic containers. The rise in plant-based and health-focused foods has further accelerated the use of premium glass packaging. Additionally, government policies and extended producer responsibility schemes are encouraging the use of recyclable and reusable packaging, reinforcing market growth across both foodservice and retail channels.

Germany Metal Cans and Glass Jars Market Insight

The Germany metal cans and glass jars market is expected to expand at a significant CAGR, driven by the country’s leadership in sustainability, recycling, and packaging innovation. With a well-established deposit-return system and a strong public preference for eco-conscious packaging, Germany remains a key growth market. Glass jars are widely used in the dairy, condiments, and baby food sectors, while metal cans dominate in beverages and processed foods. Local manufacturers continue to invest in lightweight and energy-efficient production technologies, enhancing the viability of glass and metal as long-term sustainable alternatives.

Asia-Pacific Metal Cans and Glass Jars Market Insight

The Asia-Pacific metal cans and glass jars market is poised to grow at the fastest CAGR of 22.1% from 2025 to 2032, driven by rapid urbanization, expanding middle-class populations, and increased consumption of packaged food and beverages in countries like China, India, and Japan. Government policies promoting sustainable packaging and reductions in plastic waste are accelerating the shift toward metal and glass alternatives. Moreover, APAC’s growing role as a manufacturing hub for food and beverage products is further propelling demand. Technological advancements in production efficiency and packaging design are making these options more accessible to a broader consumer base.

Japan Metal Cans and Glass Jars Market Insight

The Japan market is experiencing steady growth, fueled by a national preference for high-quality, hygienic, and visually appealing packaging. Japanese consumers value glass jars for their purity and reusability, particularly in segments such as baby food, desserts, and health supplements. Metal cans continue to be used extensively for beverages, teas, and canned seafood. Additionally, Japan’s zero-waste movement and cultural emphasis on minimalism are encouraging the use of recyclable and reusable packaging, pushing manufacturers to adopt glass and metal over plastic. The demand is also supported by government-backed recycling initiatives and innovations in compact, easy-to-open designs.

China Metal Cans and Glass Jars Market Insight

The China metal cans and glass jars market held the largest revenue share in Asia-Pacific in 2024, driven by a booming packaged food and beverage industry, rapid urbanization, and rising consumer awareness of sustainability. As one of the largest producers and consumers of packaged goods, China is witnessing a significant shift away from plastics in favor of glass and metal packaging, particularly in e-commerce and premium product segments. The expansion of domestic manufacturing capacity for eco-friendly packaging and government efforts to curb plastic waste are further accelerating adoption. Metal cans remain dominant in ready-to-drink beverages and pet food, while glass jars gain traction in health and wellness products.

Global Metal Cans and Glass Jars Market Share

The Metal Cans and Glass Jars industry is primarily led by well-established companies, including:

- Rexam PLC (U.K.)

- Kaira Can Company Limited (India)

- Ball Corporation (U.S.)

- Wiegand-Glas GmbH (Germany)

- Crown Holdings Inc. (U.S.)

- Ardagh Group (Luxembourg)

- Amcor Limited (Australia)

- Stolzle-Oberglas GmbH (Austria)

- Bormioli Rocco SpA (Italy)

- Gerresheimer AG (Germany)

- Heinz-Glass GmbH (Germany)

- Piramal Glass Limited (India)

- Shishe & Gaz Glass Manufacturing Co. (Turkey)

What are the Recent Developments in Global Metal Cans and Glass Jars Market?

- In April 2023, Ardagh Group, a global leader in sustainable packaging solutions, launched a strategic initiative in South Africa to expand its metal cans and glass jars production capacity. This move aims to meet the growing demand for eco-friendly packaging in the region’s food and beverage sectors. By leveraging its advanced manufacturing technologies and global expertise, Ardagh Group is addressing regional sustainability goals while strengthening its position in the rapidly expanding Global Metal Cans and Glass Jars Market.

- In March 2023, Ball Corporation, a veteran player in metal packaging, introduced a new line of lightweight aluminum cans specifically designed for the dairy and beverage industries. The innovation focuses on reducing material usage without compromising durability, supporting sustainability efforts and cost-efficiency. This product launch highlights Ball Corporation’s commitment to advancing packaging technology tailored to industry needs while driving growth in the global market.

- In March 2023, Amcor Limited successfully partnered with several leading beverage brands in India to develop customized glass jar solutions targeting premium food and beverage products. This initiative supports local manufacturers with innovative, high-quality packaging that aligns with consumer demand for recyclable and reusable options. Amcor’s project exemplifies the growing importance of sustainable packaging in emerging markets, reinforcing its leadership in the Global Metal Cans and Glass Jars Market.

- In February 2023, Crown Holdings Inc., a major global metal packaging company, announced a strategic partnership with a leading European food cooperative to launch a recyclable metal can line for pet food products. This collaboration aims to enhance sustainability while improving product shelf life and consumer convenience. Crown Holdings’ initiative reflects the increasing trend toward environmentally responsible packaging solutions within the pet food industry.

- In January 2023, Piramal Glass Limited, a prominent manufacturer of specialty glass packaging, unveiled a new eco-friendly glass jar collection at the World Packaging Conference 2023. Featuring lightweight designs and improved recyclability, the collection caters to the cosmetics and pharmaceutical sectors. Piramal Glass’s innovation highlights the integration of advanced technology and sustainability in glass packaging, enhancing consumer appeal and environmental impact within the global market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metal Cans And Glass Jars Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metal Cans And Glass Jars Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metal Cans And Glass Jars Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.