Global Metal Forging Market

Market Size in USD Billion

CAGR :

%

USD

94.88 Billion

USD

149.52 Billion

2024

2032

USD

94.88 Billion

USD

149.52 Billion

2024

2032

| 2025 –2032 | |

| USD 94.88 Billion | |

| USD 149.52 Billion | |

|

|

|

|

Metal Forging Market Size

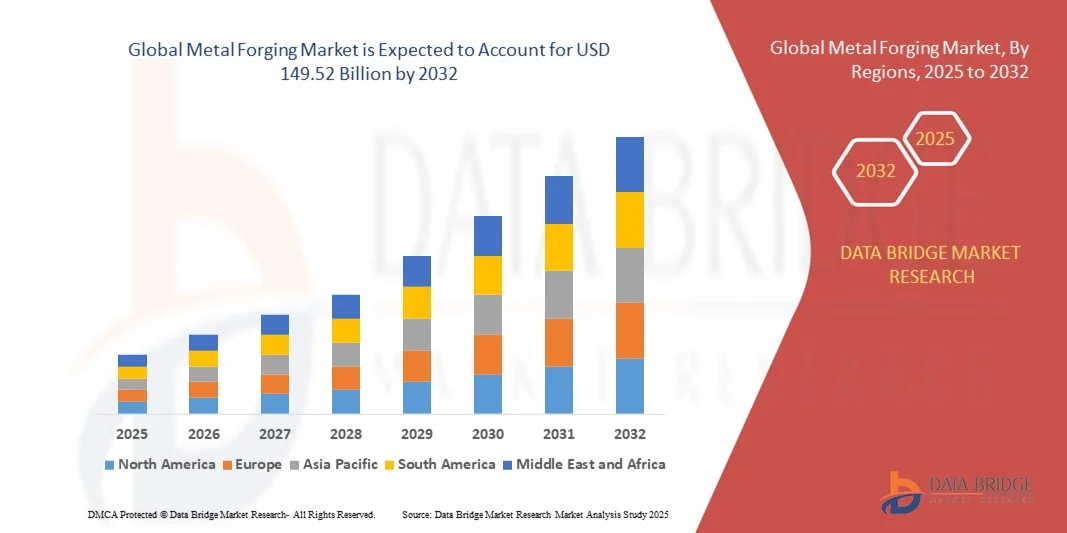

- The global metal forging market size was valued at USD 94.88 billion in 2024 and is expected to reach USD 149.52 billion by 2032, at a CAGR of 5.85% during the forecast period

- The market growth is largely fueled by increasing industrialization, rising demand for high-strength components in automotive, aerospace, and construction sectors, and continuous technological advancements in forging processes such as precision forging, hot and cold forging, and additive-assisted forging

- Furthermore, the growing need for lightweight, durable, and high-performance materials in transportation, defense, and energy applications is driving adoption of forged components, while the integration of advanced alloys and automated forging systems is enhancing production efficiency and product quality, thereby significantly boosting the industry’s growth

Metal Forging Market Analysis

- Metal forging involves shaping metals under compressive forces to produce strong, durable, and precision-engineered components. Forged parts are widely used in automotive engines, aerospace components, industrial machinery, and defense equipment due to their superior mechanical properties, reliability, and fatigue resistance

- The escalating demand for metal forging is primarily fueled by rapid growth in end-use industries, the shift toward lightweight and high-strength materials, increasing adoption of automation and advanced manufacturing technologies, and a strong focus on efficiency, quality, and sustainability in production processes

- Asia-Pacific dominated the metal forging market with a share of 54% in 2024, due to rapid industrialization, rising automotive and aerospace manufacturing, and strong presence of forging production hubs

- North America is expected to be the fastest growing region in the metal forging market during the forecast period due to strong demand for forged components in automotive, aerospace, oil & gas, and construction sectors

- Automotive segment dominated the market with a market share of 42.5% in 2024, due to the continuous need for high-strength, durable components such as crankshafts, gears, axles, and suspension parts. Automotive manufacturers rely heavily on forged components to ensure vehicle safety, performance, and longevity. The adoption of lightweight materials in passenger and commercial vehicles further supports the demand for forged parts, as these components balance weight reduction with mechanical robustness. Well-established automotive supply chains and consistent demand for replacement and aftermarket parts reinforce the dominance of this segment

Report Scope and Metal Forging Market Segmentation

|

Attributes |

Metal Forging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metal Forging Market Trends

Rising Use of Lightweight, High-Strength Forged Components

- A major trend influencing the global metal forging market is the rising usage of lightweight yet high-strength forged components across industries such as automotive, aerospace, and construction. The need for materials that balance performance, safety, and sustainability is driving manufacturers toward advanced forging techniques to produce components with higher structural integrity and reduced weight

- For instance, Bharat Forge has been actively supplying forged aluminum and titanium parts for aerospace and automotive OEMs, showcasing how leading companies are shifting to lighter yet durable components to meet efficiency and performance requirements. Similar strategies across the sector are accelerating the development of forged products with higher precision and quality standards

- The increasing production of electric vehicles and hybrid cars has heightened the demand for lightweight forged aluminum and magnesium parts that improve fuel efficiency while maintaining durability. This trend is also extending to battery enclosures and e-mobility structural components, which require strong forged solutions for safety and performance assurance

- In the aerospace sector, forged titanium and high-strength alloys are becoming critical for structural parts and turbine components due to their ability to withstand high stress and extreme temperatures. In addition, construction and heavy machinery industries are increasingly relying on forged steel for long-lasting components in high-load systems

- Customization in forging processes, such as closed-die and precision forging methods, is enabling the production of complex geometries that meet the performance requirements of modern machinery and lightweight transport systems. Such innovations enhance material utilization, reduce waste, and strengthen the competitiveness of forged products

- The continuous shift toward lightweight and high-strength forged components is reshaping the market’s growth prospects, with industries aligning their adoption strategies to improve performance, safety, and efficiency in line with global sustainability and productivity targets. This ensures that forged products will remain integral to critical industrial applications moving forward

Metal Forging Market Dynamics

Driver

Growing Industrialization and Demand for Durable Metal Parts

- The rapid industrialization and economic expansion across emerging markets is significantly boosting the demand for forged components that offer durability, high load-bearing performance, and reliability. As industries expand their production capacities, forged parts continue to serve as essential inputs in automotive, energy, and construction equipment manufacturing

- For instance, Larsen & Toubro (L&T) Heavy Engineering has strengthened its forging capabilities to supply durable parts for oil and gas, energy, and infrastructure projects. This underlines how leading companies are directly investing in forging operations to meet the durability standards required for critical equipment and heavy-duty applications

- The automotive sector is one of the largest consumers of forged components, utilizing forged steel for crankshafts, connecting rods, gears, and axles due to their superior mechanical strength. In addition, heavy trucks and off-road vehicles increasingly rely on forged parts for resilience and longer operational life under demanding conditions

- Industrial growth in sectors such as renewable energy, defense, and construction machinery further enhances the market scope, as these segments require high-precision forged products capable of long-term structural reliability. Forged steel and alloys are essential for these applications to ensure operational safety and robustness in critical environments

- The expansion of infrastructure projects across both developed and developing economies reinforces the demand for forgings as primary inputs for equipment, machinery, and construction-grade components. As a result, the need for reliable, durable, and high-strength materials remains a strong driver aligning with the pace of global industrialization and modernization

Restraint/Challenge

High Production Costs and Energy Requirements

- One of the key restraints for the metal forging market is the high cost structure associated with production processes, which demand substantial energy input for heating, forming, and finishing operations. In addition, specialized equipment and skilled labor add to the overall cost burden for manufacturers operating in global competitive environments

- For instance, companies such as Schuler Group and ThyssenKrupp face persistent challenges in managing production costs due to the energy-intensive nature of forging equipment and the constant need for technological upgrades. This demonstrates how international players are impacted by rising input costs while striving to maintain profitability and competitiveness

- Energy consumption remains one of the highest operational expenses in metal forging, especially for processes involving high melting points such as steel or titanium alloys. This makes manufacturers vulnerable to fluctuations in energy prices, further influencing production planning and cost management strategies

- Rising labor wages, combined with a shortage of skilled forging professionals, intensify the operational challenges faced by producers. In addition, stricter environmental regulations demanding lower emissions and sustainable production further raise compliance costs and constrain overall profit margins

- To ensure long-term sustainability, forging companies must adopt more energy-efficient technologies, automate critical processes, and increase recycling practices to reduce input dependency. By addressing these challenges, the metal forging market can maintain its ability to cater to growing industrial demand while balancing competitiveness in high-cost operating environments

Metal Forging Market Scope

The market is segmented on the basis of raw material and application.

- By Raw Material

On the basis of raw material, the metal forging market is segmented into carbon steel, alloy steel, aluminum, magnesium, stainless steel, titanium, and others. The carbon steel segment dominated the largest market revenue share of 38.5% in 2024, owing to its high strength-to-cost ratio, widespread availability, and suitability for a broad range of forging applications. Carbon steel forgings are widely used in automotive, construction, and industrial machinery due to their durability, fatigue resistance, and ease of processing. Manufacturers prefer carbon steel for its versatility, allowing production of both complex and large-sized forged components with reliable mechanical properties. The segment’s dominance is further strengthened by established supply chains and proven performance across diverse end-use industries.

The aluminum segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for lightweight materials in automotive and aerospace sectors. Aluminum forgings offer excellent strength-to-weight ratio, corrosion resistance, and energy efficiency, making them ideal for applications requiring fuel economy and reduced emissions. The rising adoption of electric vehicles and aerospace components is boosting the need for high-performance aluminum forgings. In addition, advances in aluminum forging technologies have improved precision and surface finish, further enhancing their attractiveness in modern engineering applications.

- By Application

On the basis of application, the metal forging market is segmented into automotive, aerospace, oil & gas, construction, agriculture, and others. The automotive segment dominated the largest market revenue share of 42.5% in 2024, driven by the continuous need for high-strength, durable components such as crankshafts, gears, axles, and suspension parts. Automotive manufacturers rely heavily on forged components to ensure vehicle safety, performance, and longevity. The adoption of lightweight materials in passenger and commercial vehicles further supports the demand for forged parts, as these components balance weight reduction with mechanical robustness. Well-established automotive supply chains and consistent demand for replacement and aftermarket parts reinforce the dominance of this segment.

The aerospace segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing demand for lightweight, high-strength forged components in aircraft engines, landing gears, and structural parts. Aerospace forgings require precision, reliability, and compliance with stringent quality standards, driving investments in advanced forging technologies. The growth of commercial aviation, rising defense budgets, and focus on fuel-efficient aircraft designs are accelerating the adoption of forged aluminum, titanium, and high-performance alloys. The segment’s growth is further supported by innovations in alloy development and automation in aerospace forging processes.

Metal Forging Market Regional Analysis

- Asia-Pacific dominated the metal forging market with the largest revenue share of 54% in 2024, driven by rapid industrialization, rising automotive and aerospace manufacturing, and strong presence of forging production hubs

- The region’s cost-effective manufacturing landscape, growing investments in advanced forging technologies, and increasing exports of forged components are accelerating market expansion

- Availability of skilled labor, favorable government policies, and rising adoption of high-strength forged materials across multiple industries are contributing to increased metal forging consumption

China Metal Forging Market Insight

China held the largest share in the Asia-Pacific metal forging market in 2024, owing to its status as a global leader in automotive, aerospace, and industrial equipment manufacturing. The country’s robust industrial base, favorable policies supporting advanced manufacturing, and extensive export capabilities for forged components are major growth drivers. Demand is further bolstered by ongoing investments in alloy development, high-precision forging, and adoption of lightweight metals for automotive and aerospace applications.

India Metal Forging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding automotive production, infrastructure development, and rising demand for durable forged components in industrial machinery. Initiatives such as “Make in India” and investment in advanced forging facilities are strengthening market growth. In addition, growing adoption of high-strength steels and aluminum forgings for energy, transport, and defense sectors is supporting robust market expansion.

Europe Metal Forging Market Insight

The Europe metal forging market is expanding steadily, supported by established automotive and aerospace industries, stringent quality standards, and increasing demand for precision forged components. The region emphasizes energy-efficient production, high-strength materials, and sustainable manufacturing practices, particularly in automotive and aerospace applications. Demand for specialty alloy and titanium forgings is further enhancing market growth.

Germany Metal Forging Market Insight

Germany’s metal forging market is driven by its strong automotive and aerospace manufacturing base, advanced industrial technology, and export-oriented production model. The country benefits from well-established R&D networks, precision engineering expertise, and adoption of high-performance forged components. Demand is particularly strong for use in high-strength steels, lightweight alloys, and critical machinery components.

U.K. Metal Forging Market Insight

The U.K. market is supported by mature aerospace and defense sectors, investments in advanced manufacturing, and growing focus on high-performance forged materials. Rising R&D activities, adoption of lightweight alloys, and collaboration between industry and academic institutions are driving growth. Increasing demand for customized forged components in automotive, industrial machinery, and energy applications reinforces market development.

North America Metal Forging Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by strong demand for forged components in automotive, aerospace, oil & gas, and construction sectors. Investments in advanced forging technologies, lightweight materials, and precision components are boosting market expansion. Rising reshoring of manufacturing operations and strategic partnerships between industrial players are further supporting growth.

U.S. Metal Forging Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its well-established automotive and aerospace industries, strong R&D infrastructure, and adoption of high-performance forged materials. Focus on innovation, precision manufacturing, and sustainable production practices is encouraging the use of advanced steel, aluminum, and titanium forgings. Presence of key industrial players and robust supply chains further solidify the U.S.’s leading position in the region.

Metal Forging Market Share

The metal forging industry is primarily led by well-established companies, including:

- Ansteel Vigano' Srl. (Italy)

- Arconic (U.S.)

- ATI. (U.S.)

- Bharat Forge (India)

- Bruck GmbH (Germany)

- ELLWOOD Group Inc. (U.S.)

- JAPAN CASTING & FORGING CORP (Japan)

- Hilton Metal Forging Ltd. (India)

- Ace Forge pvt. ltd. (India)

- Chauhan Metal Forging Works. (India)

- Trenton Forging (U.S.)

- Pradeep Metals Limited (India)

- A V Steel Forgings (India)

- Green Bay Drop Forge (U.S.)

- Advance Forgings (India)

- CALMET (U.S.)

- Shree Siddheshwari Metal Forging Pvt. Ltd (India)

- Viking Forge (U.S.)

- LARSEN & TOUBRO LIMITED (India)

- Precision Castparts Corp (U.S.)

Latest Developments in Global Metal Forging Market

- In October 2024, Bharat Forge Ltd. announced an agreement to acquire AAMIMCPL, a strategic move designed to strengthen its presence in the global metal forging market. This acquisition is expected to enhance Bharat Forge’s competitive position by integrating AAMIMCPL’s advanced manufacturing capabilities and specialized expertise in producing high-quality forged components. The collaboration will expand product offerings in key sectors such as automotive and aerospace while enabling operational efficiencies, research and development synergies, and improved supply chain management, ultimately supporting growth and market share expansion

- In May 2024, Balu Forge Industries Ltd. completed the strategic acquisition of 72,000-tonne forging lines in Karnataka, India, significantly bolstering its production capabilities. This expansion is critical for meeting the rising demand for precision-engineered forged components across automotive, aerospace, and defense sectors. Equipped with advanced technology, the new forging lines allow Balu Forge to manufacture a wider range of high-quality products efficiently, strengthening its market position and enhancing its ability to serve both domestic and international industrial clients

- In February 2024, Ovako and Tibnor announced a strategic partnership to promote low-carbon footprint steel solutions, reflecting a growing industry emphasis on sustainable production. This collaboration aims to support industrial players in meeting science-based environmental targets while addressing regulatory pressures to reduce emissions. The initiative positions both companies as leaders in sustainable metal production, appealing to environmentally conscious clients and strengthening their competitiveness in markets increasingly prioritizing green manufacturing practices

- In May 2023, Arconic Corporation entered into a definitive agreement to be acquired by Apollo Global Management Inc. in an all-cash transaction valued at approximately USD 5.2 billion. This acquisition provides Arconic with access to substantial financial resources and strategic expertise from a leading global investment firm, enabling enhanced operational capabilities, accelerated growth initiatives, and improved service delivery to customers. The move is expected to solidify Arconic’s market position and expand its influence in the metal and aerospace components sector

- In November 2022, Arconic Corporation completed the sale of its 100% stake in its Russian operations to Promishlennie Investitsii LLC, the parent company of VSMPO-AVISMA Corporation, in a cash deal valued at USD 230 million. This divestment aimed to mitigate risks stemming from geopolitical uncertainties and ensure shareholder value protection. The transaction allowed Arconic to refocus resources on stable and high-growth markets, improving operational resilience and long-term competitiveness in global metal forging and aerospace supply chains

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL METAL FORGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL METAL FORGING MARKET

2.3 MARKETS COVERED

2.4 GEOGRAPHIC SCOPE

2.5 YEARS CONSIDERED FOR THE STUDY

2.6 CURRENCY AND PRICING

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL METAL FORGING MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 IMPORT EXPORT SCENARIO

5.3 TECHNOLOGICAL ADVANCEMENT BY COMPANIES

5.4 PORTER’S FIVE FORCES

5.5 VENDOR SELECTION CRITERIA

5.6 PESTEL ANALYSIS

5.7 REGULATION COVERAGE

5.7.1 PRODUCT CODES

5.7.2 CERTIFIED STANDARDS

5.7.3 SAFETY STANDARDS

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 GLOBAL METAL FORGING MARKET, BY TYPE, 2022-2031 (USD MILLION)

9.1 OVERVIEW

9.2 OPEN DIE FORGING

9.3 CLOSED DIE FORGING / IMPRESSION FORGING

9.4 FLASHLESS FORGING

9.5 BLOCKER FORGING

9.6 CONVENTIONAL FORGING

9.7 PRECISION FORGING

9.8 OTHERS

10 GLOBAL METAL FORGING MARKET, BY MATERIAL , 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 ALUMINUM

10.2.1 1000 SERIES

10.2.2 2000 SERIES

10.2.3 3000 SERIES

10.2.4 4000 SERIES

10.2.5 5000 SERIES

10.2.6 6000 SERIES

10.2.7 7000 SERIES

10.2.8 8000 SERIES

10.3 STEEL

10.3.1 CARBON STEEL

10.3.2 ALLOY STEEL

10.3.3 STAINLESS STEEL

10.3.4 OTHERS

10.4 BRASS

10.5 IRON

10.6 COPPER

10.7 MANGANESIUM

10.8 TITANIUM

10.9 OTHERS

11 GLOBAL METAL FORGING MARKET, BY EQUIPMENT, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 PRESSES

11.2.1 HYDRAULIC PRESSES

11.2.2 MECHANICAL PRESSES

11.2.3 SCREW PRESSES

11.2.4 OTHERS

11.3 HAMMERS

11.3.1 SINGLE EFFECT (DROP FORGING)

11.3.2 DOUBLE EFFECT

11.3.3 COUNTERBLOW HAMMERS

11.3.4 OTHERS

12 GLOBAL METAL FORGING MARKET, BY PROCESS, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 HOT FORGING

12.3 COLD FORGING

13 GLOBAL METAL FORGING MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 GEARS

13.3 CRANKSHAFT

13.4 PISTON

13.5 AXLE

13.6 BEARING

13.7 INNER-OUTER RING

13.8 TAPER ROLLER BEARING OUTER RING

13.9 ENGINE PARTS

13.1 TRANSMISSION PARTS

13.11 ENGINE DISCS

13.12 COMPRESSOR PARTS

13.13 EXHAUST

13.14 SPINNERS

13.15 SEAMLESS PIPES AND FITTINGS

13.16 BARS

13.17 WELDING PRODUCTS

13.18 GASKETS

13.19 WASHERS

13.2 CONNECTING RODS

13.21 OTHERS

14 GLOBAL METAL FORGING MARKET, BY END-USE, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 AUTOMOTIVE

14.2.1 AUTOMOTIVE, BY END-USE

14.2.1.1. PASSENGER VEHICLES

14.2.1.2. COMMERCIAL VEHICLES

14.2.1.3. HEAVY DUTY VEHICLES

14.2.1.4. OTHERS

14.2.2 AUTOMOTIVE, BY FORGING TYPE

14.2.2.1. OPEN DIE FORGING

14.2.2.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.2.2.3. FLASHLESS FORGING

14.2.2.4. BLOCKER FORGING

14.2.2.5. CONVENTIONAL FORGING

14.2.2.6. PRECISION FORGING

14.2.2.7. OTHERS

14.3 AEROSPACE

14.3.1 AEROSPACE, BY FORGING TYPE

14.3.1.1. OPEN DIE FORGING

14.3.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.3.1.3. FLASHLESS FORGING

14.3.1.4. BLOCKER FORGING

14.3.1.5. CONVENTIONAL FORGING

14.3.1.6. PRECISION FORGING

14.3.1.7. OTHERS

14.4 MARINE

14.4.1 MARINE, BY FORGING TYPE

14.4.1.1. OPEN DIE FORGING

14.4.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.4.1.3. FLASHLESS FORGING

14.4.1.4. BLOCKER FORGING

14.4.1.5. CONVENTIONAL FORGING

14.4.1.6. PRECISION FORGING

14.4.1.7. OTHERS

14.5 RAILWAYS

14.5.1 RAILWAYS, BY FORGING TYPE

14.5.1.1. OPEN DIE FORGING

14.5.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.5.1.3. FLASHLESS FORGING

14.5.1.4. BLOCKER FORGING

14.5.1.5. CONVENTIONAL FORGING

14.5.1.6. PRECISION FORGING

14.5.1.7. OTHERS

14.6 BUILDING & CONSTRUCTION

14.6.1 BULDING & CONSTRUCTION, BY FORGING TYPE

14.6.1.1. OPEN DIE FORGING

14.6.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.6.1.3. FLASHLESS FORGING

14.6.1.4. BLOCKER FORGING

14.6.1.5. CONVENTIONAL FORGING

14.6.1.6. PRECISION FORGING

14.6.1.7. OTHERS

14.7 POWER GENERATION AND TRANSMISSION

14.7.1 POWER GENERATION AND TRANSMISSION, BY FORGING TYPE

14.7.1.1. OPEN DIE FORGING

14.7.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.7.1.3. FLASHLESS FORGING

14.7.1.4. BLOCKER FORGING

14.7.1.5. CONVENTIONAL FORGING

14.7.1.6. PRECISION FORGING

14.7.1.7. OTHERS

14.8 AGRICULTURE

14.8.1 AGRICULTURE, BY FORGING TYPE

14.8.1.1. OPEN DIE FORGING

14.8.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.8.1.3. FLASHLESS FORGING

14.8.1.4. BLOCKER FORGING

14.8.1.5. CONVENTIONAL FORGING

14.8.1.6. PRECISION FORGING

14.8.1.7. OTHERS

14.9 HEALTHCARE

14.9.1 HEALTHCARE, BY FORGING TYPE

14.9.1.1. OPEN DIE FORGING

14.9.1.2. CLOSED DIE FORGING / IMPRESSION FORGING

14.9.1.3. FLASHLESS FORGING

14.9.1.4. BLOCKER FORGING

14.9.1.5. CONVENTIONAL FORGING

14.9.1.6. PRECISION FORGING

14.9.1.7. OTHERS

14.1 OTHERS

15 GLOBAL METAL FORGING MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

15.1 GLOBAL METAL FORGING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 OVERVIEW

15.3 NORTH AMERICA

15.3.1 U.S.

15.3.2 CANADA

15.3.3 MEXICO

15.4 EUROPE

15.4.1 GERMANY

15.4.2 U.K.

15.4.3 ITALY

15.4.4 FRANCE

15.4.5 SPAIN

15.4.6 SWITZERLAND

15.4.7 RUSSIA

15.4.8 TURKEY

15.4.9 BELGIUM

15.4.10 NETHERLANDS

15.4.11 REST OF EUROPE

15.5 ASIA-PACIFIC

15.5.1 JAPAN

15.5.2 CHINA

15.5.3 SOUTH KOREA

15.5.4 INDIA

15.5.5 AUSTRALIA

15.5.6 NEW ZEALAND

15.5.7 TAIWAN

15.5.8 SINGAPORE

15.5.9 THAILAND

15.5.10 INDONESIA

15.5.11 MALAYSIA

15.5.12 PHILIPPINES

15.5.13 REST OF ASIA-PACIFIC

15.6 SOUTH AMERICA

15.6.1 BRAZIL

15.6.2 ARGENTINA

15.6.3 REST OF SOUTH AMERICA

15.7 MIDDLE EAST AND AFRICA

15.7.1 SOUTH AFRICA

15.7.2 EGYPT

15.7.3 SAUDI ARABIA

15.7.4 UNITED ARAB EMIRATES

15.7.5 ISRAEL

15.7.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL METAL FORGING MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.4 COMPANY SHARE ANALYSIS: EUROPE

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL METAL FORGING MARKET - COMPANY PROFILE

18.1 ARCONIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 ATI LADISH LLC

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 BHARAT FORGE

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 NIPPON STEEL CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 LARSEN & TOUBRO LIMITED

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 AMERICAN HANDFORGE

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ANDERSON SHUMAKER

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 BRAWO USA

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 BUNTY LLC

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 MATTCO FORGE INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 QUEEN CITY FORGING COMPANY

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 ARC UNITED ENGINEERING, INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 CAB INCORPORATED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 ALL METALS & FORGE GROUP

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 KEYSTONE FORGING COMPANY

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 FOTOGRAFIC.DE

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 MAN GROUP

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 HENRY WILLIAMS LIMITED

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 WYMAN GORDON

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 SHULTZ STEEL

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 CONSOLIDATED INDUSTRIES, INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 PACIFIC FORGE INCORPORATED

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 OTTO FUCHS

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 WEBER METALS

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 ALCOA CORPORATION

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 RELATED REPORTS

20 QUESTIONNAIRE

21 CONCLUSION

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Metal Forging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metal Forging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metal Forging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.