Global Metal Metallic Salts Market

Market Size in USD Billion

CAGR :

%

USD

10.47 Billion

USD

15.00 Billion

2024

2032

USD

10.47 Billion

USD

15.00 Billion

2024

2032

| 2025 –2032 | |

| USD 10.47 Billion | |

| USD 15.00 Billion | |

|

|

|

|

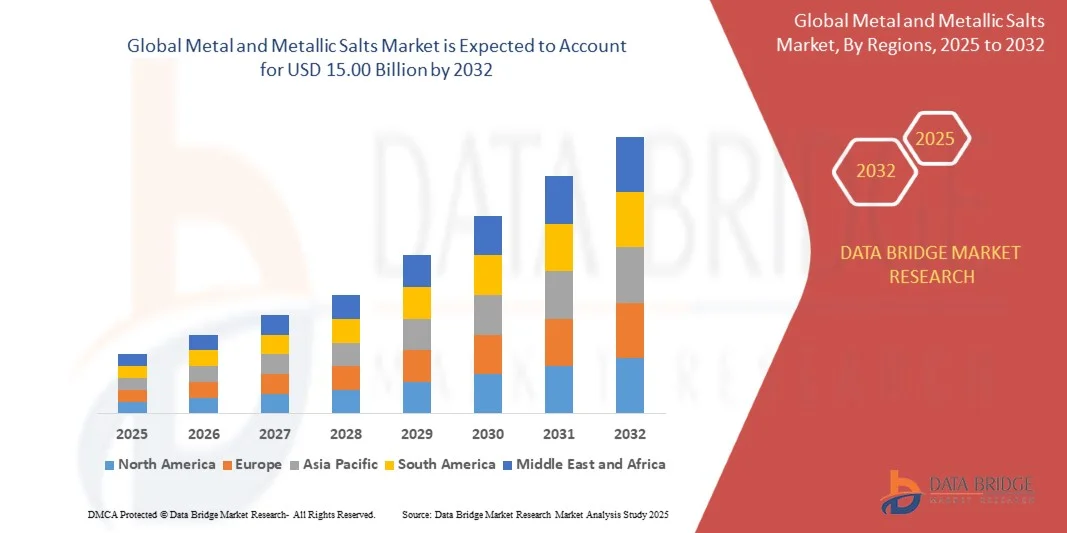

What is the Global Metal and Metallic Salts Market Size and Growth Rate?

- The global metal and metallic salts market size was valued at USD 10.47 billion in 2024 and is expected to reach USD 15.00 billion by 2032, at a CAGR of 4.6% during the forecast period

- The rise in the demand of metal and metallic salts as an auxiliary agent in the manufacturing industry is expected to influence the growth of the metal and metallic salts market. In line with this, the rise in the U.S.ge of metal and metallic salts as an additive in consumer goods and the increase in the applicability of metal and metallic salts from the end users are also anticipated to act as key determinants favoring the growth of the metal and metallic salts market.

What are the Major Takeaways of Metal and Metallic Salts Market?

- the high price of metallic salts and toxicity associated with some salts are likely to act as key restraints towards metal and metallic salts market growth rate

- Furthermore, the rise in the demand from various industrial applications and continuous research and technological advancements are expected to offer a variety of growth opportunities for the metal and metallic salts market in the above-mentioned forecast period

- Asia-Pacific dominated the metal and metallic salts market with the largest revenue share of 39.54% in 2024, driven by increasing industrialization, growing electronics manufacturing, and rapid adoption of renewable energy technologies

- The Europe metal and metallic salts market is projected to expand at the fastest CAGR of 7.35% during 2025–2032, driven by stringent environmental regulations, rising demand for sustainable manufacturing, and adoption of advanced electronics

- The non-ferrous segment dominated the market with the largest revenue share of 57.3% in 2024, driven by its extensive applications in electronics, aerospace, automotive, and specialty chemicals

Report Scope and Metal and Metallic Salts Market Segmentation

|

Attributes |

Metal and Metallic Salts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Metal and Metallic Salts Market?

“Rising Demand for High-Purity and Specialty Metal Salts”

- A significant and accelerating trend in the global Metal and Metallic Salts market is the increasing demand for high-purity and specialty metal salts tailored for advanced applications in electronics, pharmaceuticals, and specialty chemicals. This trend is driving manufacturers to innovate and produce highly refined salts with consistent quality

- For instance, companies are increasingly offering ultra-pure copper, zinc, and rare earth metal salts to meet stringent requirements in semiconductor manufacturing and battery production, highlighting the growing importance of precision-grade materials

- Specialty metal salts with tailored particle sizes, coatings, and chemical compositions are gaining traction for use in catalysts, coatings, and advanced industrial processes. These innovations are enabling better process efficiency, reduced waste, and higher performance in end-use applications

- The focus on environmentally sustainable and low-impurity metal salts is also shaping the market, with manufacturers adopting cleaner production technologies and green chemistry principles

- Consequently, companies such as American Elements and Loba Chemie are investing in R&D to expand their portfolio of high-purity metal salts and develop application-specific solutions

- The demand for specialized and high-quality Metal and Metallic Salts is rapidly increasing across pharmaceutical, electronics, and chemical manufacturing industries, fueling market expansion globally

What are the Key Drivers of Metal and Metallic Salts Market?

- The rising adoption of metal and metallic salts in electronics, pharmaceuticals, water treatment, and specialty chemicals is a major growth driver, driven by increasing industrialization and technological advancements

- For instance, the surge in battery production for electric vehicles has intensified the need for high-purity lithium, cobalt, and nickel salts, stimulating the market significantly

- Strict regulatory standards in pharmaceutical and food industries are also driving demand for highly pure metal salts with controlled compositions, reinforcing quality-driven growth

- Furthermore, the increasing focus on sustainable and green production methods encourages manufacturers to develop environmentally friendly metal salts, catering to eco-conscious end-users

- The ability of Metal and Metallic Salts to improve product performance, enable advanced coatings, catalysis, and specialty chemical applications enhances their adoption across multiple industries. The rise of R&D in materials science further strengthens demand

Which Factor is Challenging the Growth of the Metal and Metallic Salts Market?

- The high cost of producing ultra-pure and specialty metal salts poses a significant challenge for broader adoption, particularly in price-sensitive regions

- For instance, fluctuations in raw material prices for metals such as lithium, cobalt, and rare earth elements can significantly impact production costs, making some metal salts expensive for smaller industrial players

- Moreover, strict environmental and safety regulations regarding the handling and disposal of certain metal salts may limit large-scale production in some regions

- The complex manufacturing processes and dependency on high-quality raw materials restrict entry for smaller manufacturers, affecting market penetration

- Although efforts to optimize production costs are underway, the perceived premium for high-purity salts can hinder widespread use, particularly in developing regions or for industries with lower purity requirements

- Addressing these challenges through cost-efficient production technologies, sustainable sourcing, and improved regulatory compliance will be crucial for sustained growth in the Metal and Metallic Salts market

How is the Metal and Metallic Salts Market Segmented?

The market is segmented on the basis of metal, application, and end user.

• By Metal

On the basis of metal type, the metal and metallic salts market is segmented into ferrous and non-ferrous metals. The non-ferrous segment dominated the market with the largest revenue share of 57.3% in 2024, driven by its extensive applications in electronics, aerospace, automotive, and specialty chemicals. Non-ferrous metal salts such as copper, aluminum, and nickel are favored for their corrosion resistance, lightweight properties, and superior conductivity, making them essential in high-performance industrial applications.

The ferrous segment is anticipated to witness the fastest CAGR of 19.5% from 2025 to 2032, fueled by rising demand in steel processing, water treatment, and catalyst production. Ferrous metal salts offer cost-effectiveness and broad industrial utility, particularly in large-scale manufacturing and construction applications. The growing need for environmentally sustainable and efficient metal salt solutions further drives adoption across both ferrous and non-ferrous categories.

• By Application

On the basis of application, the metal and metallic salts market is segmented into phototransistors, photovoltaic cells, transparent electrodes, liquid crystal displays, IR detectors, anti-reflection coatings, fireworks, and others. The photovoltaic cells segment accounted for the largest market revenue share of 35.8% in 2024, driven by the accelerating global adoption of solar energy solutions and renewable energy technologies. Metal salts used in photovoltaic cells provide high efficiency, stability, and durability, making them crucial for solar panel manufacturing.

The IR detectors and transparent electrodes segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, owing to increasing adoption in advanced electronics, wearable devices, and display technologies. Growth in consumer electronics, industrial sensors, and optoelectronic applications is further propelling demand across these segments, making Metal and Metallic Salts a vital component in emerging technologies.

• By End User

On the basis of end user, the metal and metallic salts market is segmented into the mining industry, electroplating industry, and others. The electroplating industry segment dominated the market with the largest revenue share of 48.6% in 2024, owing to the extensive use of metal salts in surface treatment, corrosion protection, and decorative applications. Electroplating processes rely on consistent quality and high-purity salts to ensure coating uniformity and long-term performance.

The mining industry segment is anticipated to witness the fastest CAGR of 20.7% from 2025 to 2032, driven by increased extraction of specialty metals and rare earth elements for electronics, batteries, and renewable energy applications. Growth in industrial production, technological advancement, and stringent quality standards across end-use industries continues to stimulate demand for Metal and Metallic Salts.

Which Region Holds the Largest Share of the Metal and Metallic Salts Market?

- Asia-Pacific dominated the metal and metallic salts market with the largest revenue share of 39.54% in 2024, driven by increasing industrialization, growing electronics manufacturing, and rapid adoption of renewable energy technologies

- Consumers and industries in the region highly value the performance, durability, and cost-effectiveness offered by metal and metallic salts in applications such as photovoltaics, electronics, and coatings

- This widespread adoption is further supported by government initiatives promoting industrial modernization, strong manufacturing infrastructure, and a rising focus on sustainable and technologically advanced materials, establishing metal and metallic salts as a key industrial solution across APAC

China Metal and Metallic Salts Market Insight

The China metal and metallic salts market captured the largest revenue share of 52% in 2024 within Asia-Pacific, fueled by rapid urbanization, expansion of the electronics and renewable energy sectors, and high domestic production capacity. The increasing demand for high-purity metal salts in photovoltaic cells, LCDs, and industrial coatings is driving the market. Moreover, the development of smart cities and investment in advanced manufacturing is significantly contributing to market expansion, solidifying China’s position as a regional leader.

Japan Metal and Metallic Salts Market Insight

The Japan metal and metallic salts market is experiencing steady growth due to the country’s advanced electronics sector, high-tech manufacturing culture, and focus on precision materials. The adoption of metal salts in transparent electrodes, IR detectors, and anti-reflection coatings is expanding rapidly. In addition, Japan’s aging population and emphasis on automation in industrial and residential sectors are driving the need for user-friendly, reliable, and high-performance metal salt solutions.

Europe Metal and Metallic Salts Market Insight

The Europe metal and metallic salts market is projected to expand at the fastest CAGR of 7.35% during 2025–2032, driven by stringent environmental regulations, rising demand for sustainable manufacturing, and adoption of advanced electronics. Increased urbanization and industrial modernization are fostering market growth across Germany, France, and the U.K. European consumers and manufacturers are focusing on energy-efficient, high-performance metal salts, supporting expansion in applications such as photovoltaics, coatings, and optoelectronics.

Germany Metal and Metallic Salts Market Insight

The Germany metal and metallic salts market is expected to witness considerable growth, fueled by awareness of digital security, sustainability, and technological innovation. The integration of metal salts into high-tech applications, industrial coatings, and renewable energy sectors is increasingly prevalent. Strong infrastructure, R&D investments, and local manufacturing capabilities further reinforce Germany’s position as a key contributor to the European market.

U.K. Metal and Metallic Salts Market Insight

The U.K. metal and metallic salts market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by industrial modernization and the adoption of high-purity metal salts in electronics, coatings, and energy applications. The country’s well-developed supply chain, robust R&D ecosystem, and growing emphasis on sustainable production continue to stimulate market growth, positioning the U.K. as a strategic market in Europe.

Which are the Top Companies in Metal and Metallic Salts Market?

The metal and metallic salts industry is primarily led by well-established companies, including:

- PERRYCHEM (India)

- Loba Chemie Pvt. Ltd. (India)

- VOPELIUS CHEMIE AG (Germany)

- American Elements (U.S.)

- Eastman Chemical Company (U.S.)

- World Metal, LLC (U.S.)

- Tema Process BV (Netherlands)

- Uma Chemicals (India)

- Ottokemi (India)

What are the Recent Developments in Global Metal and Metallic Salts Market?

- In October 2023, Arkema announced a major capacity expansion at its Nansha site in China, aiming to increase production of high-performance materials, particularly high-temperature-resistant polymers and advanced coatings, and meet the rising demand across automotive, electronics, and renewable energy sectors, reinforcing its strategic growth objectives in Asia

- In September 2022, Eastman completed the acquisition of Taminco, a leading producer of alkylamines and metal carboxylates, for USD 2.8 billion, enhancing its position in the specialty chemicals market and strengthening capabilities in high-performance metal carboxylates for industrial and agricultural applications, marking a significant strategic move

- In September 2021, Arkema announced a price increase of 15% for its hydrogen peroxide and sodium chlorate products, effective from 1st October 2021, reflecting market adjustments and operational cost considerations, while ensuring continued supply reliability

- In April 2021, K+S Group declared the divestment of its Americas salts business, associated with the Operating Unit Americas, to Stone Canyon Industries Holdings LLC and Mark Demetree and Partners for USD 2.93 billion, focusing on portfolio optimization and strategic realignment in global operations, supporting long-term growth initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metal Metallic Salts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metal Metallic Salts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metal Metallic Salts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.