Global Metal Stamping Market

Market Size in USD Billion

CAGR :

%

USD

255.35 Billion

USD

320.97 Billion

2024

2032

USD

255.35 Billion

USD

320.97 Billion

2024

2032

| 2025 –2032 | |

| USD 255.35 Billion | |

| USD 320.97 Billion | |

|

|

|

|

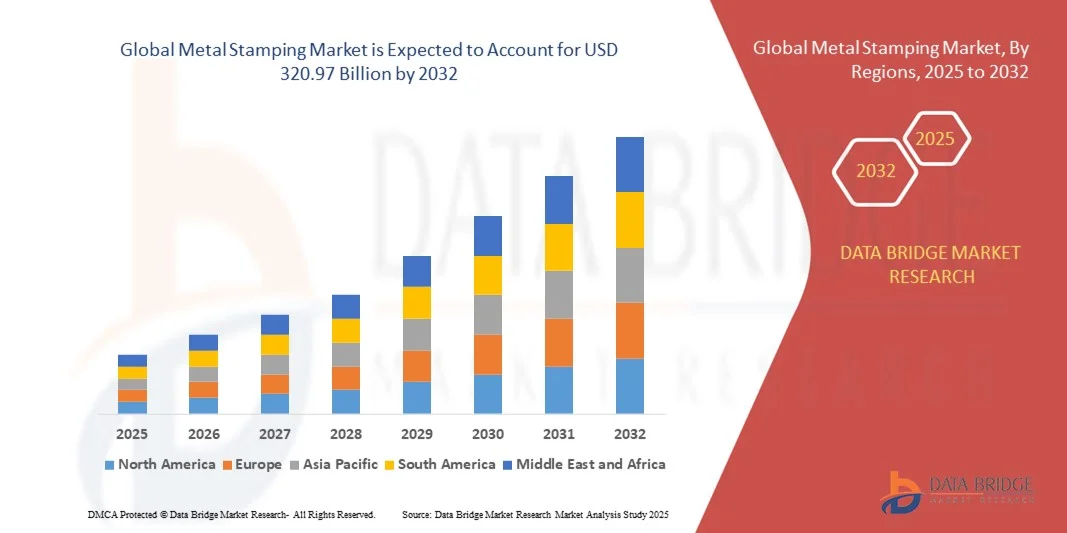

What is the Global Metal Stamping Market Size and Growth Rate?

- The global metal stamping market size was valued at USD 255.35 billion in 2024 and is expected to reach USD 320.97 billion by 2032, at a CAGR of 2.90% during the forecast period

- The growing technological developments and innovations in the automotive sector increases the demand of metal stamping which act as a major key driver for the metal stamping market. The metal stamping is extensively used in the manufacturing of automobiles finding its utilization in brackets, hangers, bonnets, side panels and others

- The increase in demand for metal stamping by industries such as electrical & electronics, consumer electronics, aerospace, telecommunication and engineering machinery influence the market

What are the Major Takeaways of Metal Stamping Market?

- The next generation of metal stamping has generated a dynamic pull as it is cost effective and efficient which accelerates the market growth. Furthermore, penetration of additive fabrication and 3D printing extend profitable opportunity

- Asia-Pacific dominated the metal stamping market with the largest revenue share of 42.36% in 2024, driven by rapid industrialization, rising urbanization, and increasing adoption of advanced manufacturing technologies

- The North America metal stamping market is poised to grow at the fastest CAGR of 7.69% during the forecast period of 2025 to 2032, driven by increasing automotive production, rising industrial output, and technological advancements in precision stamping processes

- The blanking segment dominated the Metal Stamping market with the largest market revenue share of 38.5% in 2024, driven by its essential role in cutting high-precision parts from sheet metal efficiently and cost-effectively

Report Scope and Metal Stamping Market Segmentation

|

Attributes |

Metal Stamping Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Metal Stamping Market?

Adoption of Advanced Automation and Smart Manufacturing

- A significant and accelerating trend in the global metal stamping market is the increasing integration of advanced automation technologies, including robotics, artificial intelligence (AI), and machine learning, into production processes. These technologies are enhancing precision, reducing operational downtime, and improving overall manufacturing efficiency

- For instance, modern stamping lines now incorporate AI-driven quality inspection systems, allowing real-time defect detection and predictive maintenance, which minimizes scrap and reduces production losses. Similarly, collaborative robots (cobots) assist operators in handling heavy dies, enhancing safety and throughput

- Automation also enables flexible manufacturing setups that can quickly adapt to changing product designs and customer demands, supporting mass customization and reducing lead times. AI-powered process optimization tools help manufacturers improve cycle times, energy efficiency, and die longevity, offering both cost and operational benefits

- The trend towards smart, automated metal stamping operations is reshaping industry expectations, compelling manufacturers such as Arconic and Magna International to invest heavily in Industry 4.0-enabled facilities

- The demand for high-precision, fast, and reliable metal stamping solutions is rising globally across automotive, aerospace, and industrial applications, driven by manufacturers’ focus on cost reduction, quality improvement, and digital integration

What are the Key Drivers of Metal Stamping Market?

- The rising demand for automotive and industrial components requiring high precision and consistency is a primary driver of market growth. Metal stamping is essential for producing lightweight, durable, and cost-effective parts

- Increasing adoption of lightweight materials such as aluminum and high-strength steel in automotive and aerospace industries is further boosting the need for advanced metal stamping technologies. Manufacturers are seeking reliable stamping processes to handle these materials without compromising quality

- Growing industrialization and expansion in emerging markets are driving demand for stamped components in electrical, construction, and machinery sectors, creating consistent growth opportunities

- Integration of advanced manufacturing technologies, such as robotics, AI, and IoT, is enabling manufacturers to improve efficiency, reduce scrap, and enhance operational flexibility, further propelling market adoption

- The push towards sustainable manufacturing, including energy-efficient presses and optimized die designs, is encouraging companies to upgrade metal stamping lines, supporting long-term growth across multiple sectors

Which Factor is Challenging the Growth of the Metal Stamping Market?

- High initial capital investment for automated stamping lines and Industry 4.0 technologies poses a significant barrier for small and medium-sized enterprises, limiting broader adoption in developing regions

- The complexity of handling advanced materials such as high-strength steels and aluminum alloys requires skilled operators and precise equipment, which can increase operational costs

- Market fluctuations in raw material prices, such as steel and aluminum, can impact production costs and reduce profit margins, creating uncertainty for manufacturers

- Competition from alternative manufacturing processes, including additive manufacturing and CNC machining, challenges traditional metal stamping for low-volume or highly customized components

- Overcoming these challenges through cost-efficient automation, workforce training, and flexible manufacturing solutions will be essential for sustained growth in the global metal stamping market

How is the Metal Stamping Market Segmented?

The market is segmented on the basis of process and application.

- By Process

On the basis of process, the metal stamping market is segmented into blanking, embossing, bending, coining, flanging, and others. The blanking segment dominated the Metal Stamping market with the largest market revenue share of 38.5% in 2024, driven by its essential role in cutting high-precision parts from sheet metal efficiently and cost-effectively. Blanking is widely used across automotive and industrial applications due to its speed, accuracy, and minimal material waste. Manufacturers prioritize blanking for large-scale production runs, as it ensures uniformity and reduces downstream processing costs.

The embossing segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by growing demand for decorative and functional features in consumer electronics and specialty components. Embossing enables the creation of intricate designs, logos, and surface textures while improving rigidity in thin metals, supporting applications across industrial machinery and aerospace sectors. Overall, process innovation and automation continue to drive adoption across all stamping processes.

- By Application

On the basis of application, the metal stamping market is segmented into automotive, industrial machinery, consumer electronics, aerospace, electrical and electronics, telecommunications, and others. The automotive segment dominated the market with the largest revenue share of 42.3% in 2024, reflecting the sector’s heavy reliance on stamped components such as body panels, structural frames, and engine parts. The segment’s dominance is supported by the shift towards lightweight materials and electric vehicle production, which require precise, durable, and high-strength stamped components.

The consumer electronics segment is anticipated to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by rising demand for compact, intricately designed components for smartphones, laptops, and wearable devices. Manufacturers increasingly rely on stamping for casings, chassis, connectors, and heat-dissipation parts. The overall growth across applications is being propelled by the need for cost-effective, high-volume manufacturing solutions that maintain quality, precision, and repeatability in complex and diverse industries.

Which Region Holds the Largest Share of the Metal Stamping Market?

- Asia-Pacific dominated the metal stamping market with the largest revenue share of 42.36% in 2024, driven by rapid industrialization, rising urbanization, and increasing adoption of advanced manufacturing technologies

- Manufacturers in the region highly value the efficiency, cost-effectiveness, and high-volume production capabilities offered by Metal Stampings across automotive, electronics, and industrial applications

- This widespread adoption is further supported by strong government initiatives promoting industrial automation, a growing skilled workforce, and expanding automotive and electronics manufacturing hubs, establishing Metal Stampings as a core production technology in the region

China Metal Stamping Market Insight

The China metal stamping market captured the largest revenue share of 82% in 2024 within APAC, fueled by rapid industrial expansion and high demand from automotive, consumer electronics, and industrial machinery sectors. Local manufacturers are increasingly investing in automated stamping lines to meet high production efficiency and quality standards. Moreover, government-backed smart manufacturing initiatives and the growth of EV production further contribute to the market’s expansion.

Japan Metal Stamping Market Insight

The Japan metal stamping market is experiencing strong growth due to advanced manufacturing practices, technological innovations, and the country’s emphasis on precision engineering. The demand for compact, high-precision components in automotive, aerospace, and consumer electronics sectors is driving adoption. Japan’s focus on automation and quality control ensures consistent market expansion.

Which Region is the Fastest Growing Region in the Metal Stamping Market?

The North America metal stamping market is poised to grow at the fastest CAGR of 7.69% during the forecast period of 2025 to 2032, driven by increasing automotive production, rising industrial output, and technological advancements in precision stamping processes. The region’s growing adoption of lightweight materials, electric vehicles, and advanced manufacturing technologies fuels demand for high-quality stamped components.

U.S. Metal Stamping Market Insight

The U.S. metal stamping market accounted for the largest share within North America, with a strong focus on automotive, aerospace, and electronics applications. Investments in smart manufacturing, automation, and precision metal stamping technologies are expanding production efficiency and supporting market growth.

Canada Metal Stamping Market Insight

Canada’s metal stamping market is growing steadily due to increasing investments in automotive and aerospace sectors, along with adoption of advanced production techniques. The demand for high-strength, lightweight components in EVs and industrial machinery continues to drive growth in the country.

Which are the Top Companies in Metal Stamping Market?

The metal stamping industry is primarily led by well-established companies, including:

- Arconic (U.S.)

- ACRO Building Systems (U.S.)

- Manor Tool & Manufacturing Company (U.S.)

- LINDY MANUFACTURING CO (U.S.)

- D&H Industries, Inc. (U.S.)

- Kenmode, Inc. (U.S.)

- Klesk Metal Stamping Co. (U.S.)

- Aro Metal Stamping Company, Inc. (U.S.)

- Tempco Manufacturing Company, Inc. (U.S.)

- Interplex Holdings Pte. Ltd. (Singapore)

- Caparo Group (U.K.)

- Goshen Stamping Company (U.S.)

- Clow Stamping Company (U.S.)

- American Industrial Co. (U.S.)

- Martinrea International Inc. (Canada)

- Magna International Inc. (Canada)

- Hayes Lemmerz International (U.S.)

- Harvey Vogel Manufacturing Co. (U.S.)

- Ningbo Haitong Metal Fabrication Co., LTD. (China)

- Dongguan Fortuna Metal & Electronics Co., Ltd (China)

- thyssenkrupp AG (Germany)

- Alcoa Corporation (U.S.)

What are the Recent Developments in Global Metal Stamping Market?

- In February 2024, Sewon Precision Industry Co., a South Korean company and Hyundai supplier, announced plans to invest USD 300 million to establish a 740-employee metal stamping plant in Rincon, Georgia, U.S., near Savannah. This new facility will make Sewon the fifth Hyundai Motor Group supplier in the region, and upon completion, the combined workforce across both plants is expected to reach 1,600 employees, strengthening the company’s manufacturing capabilities and regional presence

- In February 2024, American Cadrex inaugurated a new 150,000-square-foot facility in Juarez, Mexico, adjacent to its existing plant in the Monterrey metropolitan area. With this addition, Cadrex now operates 405,000 square feet of manufacturing space in Mexico, becoming the company’s largest operational site, enhancing production capacity and supporting growing demand for metal stamping components

- In November 2023, Generational Growth Capital, an equity firm based in Milwaukee, U.S., acquired Federal Tool & Engineering, BP Metals, and Rockford Specialties, located in Wisconsin, Minnesota, and Illinois, U.S., respectively. These metal stamping and structural steel manufacturers will allow the new entity to expand manufacturing capacity and provide customers with uninterrupted delivery through a strengthened logistics supply chain

- In October 2023, Ryerson acquired Norlen Inc., a metal stamping fabricator based in Wisconsin, U.S., for an undisclosed sum. This acquisition will enable Ryerson to strengthen its service offerings to the agricultural and defense markets and enhance its metal stamping production capabilities

- In June 2023, General Motors announced plans to invest over USD 500 million in its Arlington, Texas, U.S., assembly plant to produce next-generation SUVs. The investment includes the purchase of new equipment for metal stamping, body shop, and other assembly operations, supporting production efficiency and long-term capacity expansion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metal Stamping Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metal Stamping Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metal Stamping Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.