Global Methacrylic Acid Market

Market Size in USD Billion

CAGR :

%

USD

4.09 Billion

USD

5.86 Billion

2024

2032

USD

4.09 Billion

USD

5.86 Billion

2024

2032

| 2025 –2032 | |

| USD 4.09 Billion | |

| USD 5.86 Billion | |

|

|

|

|

Methacrylic Acid Market Size

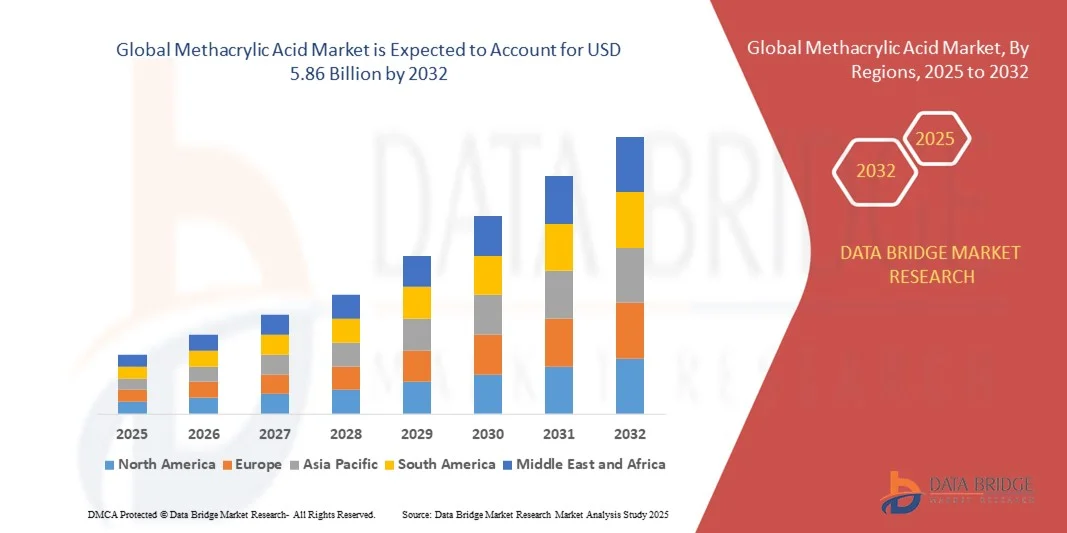

- The global methacrylic acid market size was valued at USD 4.09 billion in 2024 and is expected to reach USD 5.86 billion by 2032, at a CAGR of 4.60% during the forecast period

- The market growth is largely fuelled by the increasing demand for methacrylic acid in the production of coatings, adhesives, plastics, and textiles, driven by rapid industrialization and urbanization

- Rising consumption in emerging economies, coupled with growth in the automotive, construction, and electronics sectors, is further accelerating market expansion

Methacrylic Acid Market Analysis

- The demand for high-quality methacrylic acid is being driven by its use in acrylic sheet manufacturing, adhesives, and superabsorbent polymers, which are critical in construction, packaging, and personal care products

- Increasing investment in research and development to produce eco-friendly and bio-based methacrylic acid is creating new opportunities and expanding market applications globally

- North America dominated the methacrylic acid market with the largest revenue share of 38.50% in 2024, driven by strong demand from paints, coatings, adhesives, and automotive applications. The region’s advanced chemical manufacturing infrastructure and presence of major MAA producers further support market growth

- Asia-Pacific region is expected to witness the highest growth rate in the global methacrylic acid market, driven by increasing demand from coatings, adhesives, plastics, and electronics industries, along with government initiatives supporting industrial expansion and local production capacities

- The Paint and Adhesives segment held the largest market revenue share in 2024, driven by the increasing demand for high-performance coatings, adhesives, and sealants in automotive, construction, and industrial sectors. MAA-based formulations improve durability, chemical resistance, and adhesion, making them ideal for premium applications

Report Scope and Methacrylic Acid Market Segmentation

|

Attributes |

Methacrylic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Methacrylic Acid Market Trends

Increasing Use of Methacrylic Acid in Coatings, Adhesives, and Plastics

- The growing adoption of methacrylic acid (MAA) in the production of coatings, adhesives, and plastics is transforming the chemical industry by enabling high-performance, durable, and versatile end-products. Its functional properties improve surface hardness, chemical resistance, and adhesion in various applications, boosting product quality and lifespan. In addition, MAA contributes to enhanced optical clarity and UV resistance in acrylic-based products, making it a preferred choice across multiple industrial segments

- Rising demand from automotive, construction, and electronics sectors is accelerating market adoption. MAA-based polymers enhance clarity, durability, and thermal stability in specialty coatings and acrylic sheets, making them ideal for premium and industrial applications. Furthermore, its integration into innovative composites and adhesives is promoting the development of lightweight, eco-friendly, and high-strength materials

- The cost-effectiveness and functional benefits of modern methacrylic acid are making it attractive for polymer and chemical manufacturers, leading to improved product reliability and broader industrial acceptance. Manufacturers benefit from process flexibility, consistent product quality, and compatibility with various monomers and additives, enabling diverse formulations

- For instance, in 2023, several coating and adhesive manufacturers in North America and Europe reported enhanced product performance and reduced material failure rates after incorporating MAA-based formulations, highlighting the impact on quality and customer satisfaction. Companies also observed increased customer retention and market share growth due to higher product reliability and extended service life

- While methacrylic acid adoption is increasing, market growth depends on continued innovation in production technologies, cost optimization, and regulatory compliance. Manufacturers must focus on sustainable production, scalable supply chains, and renewable feedstocks to meet rising global demand and align with environmental goals

Methacrylic Acid Market Dynamics

Driver

Rising Demand From End-Use Industries Including Automotive, Construction, And Electronics

- Increasing use of MAA in coatings, adhesives, and acrylic sheets is driving market growth, as manufacturers seek high-performance materials with superior chemical and mechanical properties. This enhances product durability, aesthetics, and functional performance. In addition, MAA is being increasingly used in specialty plastics, impact-resistant materials, and transparent barriers, opening new avenues in packaging and construction

- Growing industrialization and infrastructure development worldwide are increasing demand for methacrylic acid-based products, particularly in urban construction, automotive components, and electronics housings. Rapid urbanization and industrial expansion in Asia-Pacific and North America are further fueling the need for high-performance polymers and coatings

- Supportive regulations encouraging the use of eco-friendly and high-performance polymers are further boosting adoption, ensuring safer and more sustainable products. Policies promoting VOC-free coatings and low-emission adhesives are accelerating the replacement of conventional chemicals with MAA-based alternatives

- For instance, in 2022, several European and North American construction and automotive companies integrated MAA-based polymers into coatings and adhesives, significantly improving product life and reducing maintenance costs. Manufacturers also reported reduced warranty claims and improved operational efficiency due to higher material reliability

- While technological advancements and industrial growth are driving market expansion, continuous R&D and cost optimization remain essential for wider adoption. Investment in advanced catalysts, continuous production processes, and energy-efficient technologies can further strengthen competitiveness and market penetration

Restraint/Challenge

High Production Costs And Environmental Regulations

- The complex and energy-intensive production process of methacrylic acid leads to higher costs, limiting its accessibility for price-sensitive applications and smaller manufacturers. Premium pricing remains a challenge for widespread adoption, especially in emerging economies and low-margin applications. In addition, fluctuations in raw material prices can impact production economics and profitability

- Strict environmental regulations related to VOC emissions and chemical handling increase compliance costs and operational complexity, particularly in developed regions. Manufacturers must invest in eco-friendly production, emission control systems, and waste management solutions to meet regulatory standards while minimizing environmental impact

- Supply chain constraints, including raw material availability and transportation challenges, can impact consistent product supply and timely delivery to end-use industries. Global trade disruptions, logistical bottlenecks, and geopolitical tensions may further exacerbate supply shortages, affecting downstream polymer and coating manufacturers

- For instance, in 2023, several MAA producers in Asia and Europe faced temporary supply disruptions due to raw material shortages and regulatory compliance delays, affecting downstream polymer manufacturers. These disruptions led to increased lead times, higher prices, and temporary production slowdowns for key end-use industries

- While production technologies continue to improve, addressing cost, regulatory, and supply chain challenges is crucial for unlocking the long-term potential of the global methacrylic acid market. Companies focusing on energy-efficient processes, strategic partnerships, and alternative feedstocks are better positioned to sustain growth and meet rising demand

Methacrylic Acid Market Scope

The market is segmented on the basis of application, end-user, and type.

- By Application

On the basis of application, the methacrylic acid (MAA) market is segmented into Paint and Adhesives, Fiber Processing Agent, Rubber Modifier, Leather Treatment, Paper Processing Agent, Lubricant Additive, Cement Mixing Agent, and Others. The Paint and Adhesives segment held the largest market revenue share in 2024, driven by the increasing demand for high-performance coatings, adhesives, and sealants in automotive, construction, and industrial sectors. MAA-based formulations improve durability, chemical resistance, and adhesion, making them ideal for premium applications.

The Rubber Modifier segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its ability to enhance elasticity, thermal stability, and mechanical properties in rubber products. MAA-modified rubbers are increasingly used in automotive components, industrial belts, and specialty elastomers, boosting adoption across manufacturing industries.

- By End-User

On the basis of end-user, the market is segmented into Paints and Coatings, Textile, Leather, Paper Manufacture, Construction, Automobiles, Electronics, and Others. The Paints and Coatings segment captured the largest revenue share in 2024, owing to growing demand for durable, high-performance coatings in both commercial and residential construction. MAA-based polymers provide enhanced gloss, scratch resistance, and long-lasting protection, increasing adoption among manufacturers.

The Electronics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for lightweight, transparent, and thermally stable polymers in electronic housings, display panels, and circuit boards. Integration of MAA improves product reliability and performance in high-tech applications.

- By Type

On the basis of type, the methacrylic acid market is segmented into Liquid Products and Glacial Products. The Liquid Products segment held the largest market revenue share in 2024, due to easier handling, formulation flexibility, and wide applicability in coatings, adhesives, and plastics. Liquid MAA is preferred by manufacturers for blending and copolymerization processes.

The Glacial Products segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its high purity, concentrated form, and suitability for specialty applications such as UV-curable coatings, precision adhesives, and high-performance polymers. Glacial MAA ensures better control over polymerization reactions and product consistency.

Methacrylic Acid Market Regional Analysis

- North America dominated the methacrylic acid market with the largest revenue share of 38.50% in 2024, driven by strong demand from paints, coatings, adhesives, and automotive applications. The region’s advanced chemical manufacturing infrastructure and presence of major MAA producers further support market growth

- Manufacturers in the region highly value MAA for its versatility, functional performance, and compatibility with various polymer applications, leading to widespread adoption across industrial and construction sectors

- This dominance is further supported by stringent quality standards, technological advancements, and increasing industrialization, establishing North America as a key market for methacrylic acid production and consumption

U.S. Methacrylic Acid Market Insight

The U.S. methacrylic acid market captured the largest revenue share in North America in 2024, fueled by strong end-use demand in coatings, adhesives, and automotive applications. The increasing focus on high-performance polymers and acrylic-based products is driving growth. In addition, supportive industrial policies, R&D activities in polymer technologies, and the adoption of eco-friendly formulations are further propelling market expansion.

Europe Methacrylic Acid Market Insight

The Europe methacrylic acid market is expected to witness the fastest growth rate from 2025 to 2032, driven by robust demand from automotive, construction, and electronics sectors. Stringent environmental regulations and the push for sustainable, high-performance materials are fostering MAA adoption. European manufacturers are increasingly integrating MAA into coatings, adhesives, and specialty plastics, boosting overall market growth.

U.K. Methacrylic Acid Market Insight

The U.K. methacrylic acid market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for specialty coatings, adhesives, and industrial polymers. The growth is further aided by technological advancements, sustainability initiatives, and the expanding construction and automotive sectors, encouraging manufacturers to adopt MAA-based solutions.

Germany Methacrylic Acid Market Insight

The Germany methacrylic acid market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong industrial base, innovation-driven chemical sector, and high demand for eco-friendly and high-performance polymers. MAA is increasingly incorporated into coatings, adhesives, and automotive components, supporting product durability and functional performance in line with local consumer expectations.

Asia-Pacific Methacrylic Acid Market Insight

The Asia-Pacific methacrylic acid market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and growing demand from automotive, construction, and electronics industries in countries such as China, Japan, and India. The region’s expanding chemical manufacturing capacity, availability of raw materials, and government support for polymer-based industries are boosting adoption.

Japan Methacrylic Acid Market Insight

The Japan methacrylic acid market is expected to witness the fastest growth rate from 2025 to 2032 due to high demand for advanced coatings, adhesives, and electronics components. The country’s focus on high-tech manufacturing, innovation in polymer applications, and increasing integration of MAA into specialty products are fueling market growth. In addition, the aging population and demand for durable, eco-friendly materials further drive adoption across residential and industrial sectors.

China Methacrylic Acid Market Insight

The China methacrylic acid market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s booming construction, automotive, and electronics sectors. Rapid urbanization, industrial growth, and strong domestic production capacities are enabling widespread MAA adoption. Government initiatives promoting high-performance and sustainable polymers, along with competitive pricing from local manufacturers, are key factors propelling the market in China.

Methacrylic Acid Market Share

The Methacrylic Acid industry is primarily led by well-established companies, including:

- Dow (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Formosa M Co., Ltd. (Taiwan)

- KURARAY CO., LTD. (Japan)

- LG Chem (South Korea)

- TCI Chemicals (India) Pvt. Ltd. (India)

- MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan)

- DHALOP CHEMICALS (India)

- Parchem Fine & Specialty Chemicals (U.S.)

- Polymers Enterprises (U.K.)

- AECOCHEM (U.K.)

- Central Drug House (India)

- Shree Chemicals (India)

- Petrochemicals Europe (Germany)

- KH Chemicals (India)

- Kowa India Pvt. Ltd (India)

- Biesterfeld AG (Germany)

- TWI Ltd. (U.K.)

- DIOCHEM (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL METHACRYLIC ACID MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL METHACRYLIC ACID MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL METHACRYLIC ACID MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 REGULATION COVERAGE

6 INDUSTRY INSIGHTS

7 IMPACT OF COVID-19 PANDEMIC ON GLOBAL METHACRYLIC ACID MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 PRICE IMPACT

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 GLOBAL METHACRYLIC ACID MARKET, BY TYPE

8.1 OVERVIEW

8.2 LIQUID

8.3 GLACIAL

9 GLOBAL METHACRYLIC ACID MARKET, BY PURITY

9.1 OVERVIEW

9.2 PURITY ABOVE 99.0%

9.3 PURITY ABOVE 99.5%

9.4 OTHERS

10 GLOBAL METHACRYLIC ACID MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 PAINT AND ADHESIVES

10.3 FIBER PROCESSING AGENT

10.4 RUBBER MODIFIER

10.5 LEATHER TREATMENT

10.6 PAPER PROCESSING AGENT

10.7 LUBRICANT ADDITIVE

10.8 CEMENT MIXING AGENT

10.9 OTHERS

11 GLOBAL METHACRYLIC ACID MARKET, BY END- USER

11.1 OVERVIEW

11.2 PAINTS AND COATINGS

11.2.1 LIQUID

11.2.2 GLACIAL

11.3 TEXTILE

11.3.1 LIQUID

11.3.2 GLACIAL

11.4 LEATHER

11.4.1 LIQUID

11.4.2 GLACIAL

11.5 AUTOMOBILES

11.5.1 LIQUID

11.5.2 GLACIAL

11.6 COSMETICS

11.6.1 LIQUID

11.6.2 GLACIAL

11.7 PHARMACEUTICAL INTERMEDIATE

11.7.1 LIQUID

11.7.2 GLACIAL

11.8 OTHERS

11.8.1 LIQUID

11.8.2 GLACIAL

12 GLOBAL METHACRYLIC ACID MARKET, BY GEOGRAPHY

12.1 GLOBAL METHACRYLIC ACID MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 U.K.

12.3.3 ITALY

12.3.4 FRANCE

12.3.5 SPAIN

12.3.6 RUSSIA

12.3.7 SWITZERLAND

12.3.8 TURKEY

12.3.9 BELGIUM

12.3.10 NETHERLANDS

12.3.11 REST OF EUROPE

12.4 ASIA-PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 SOUTH KOREA

12.4.4 INDIA

12.4.5 SINGAPORE

12.4.6 THAILAND

12.4.7 INDONESIA

12.4.8 MALAYSIA

12.4.9 PHILIPPINES

12.4.10 AUSTRALIA & NEW ZEALAND

12.4.11 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 UNITED ARAB EMIRATES

12.6.5 ISRAEL

12.6.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL METHACRYLIC ACID MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL METHACRYLIC ACID MARKET- COMPANY PROFILE

15.1 DOW

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 BASF SE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 EVONIK INDUSTRIES AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 FORMOSA M CO., LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 KURARAY CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 MITSUBISHI GAS CHEMICAL COMPANY, INC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 DHALOP CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 PARCHEM FINE & SPECIALTY CHEMICALS

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 POLYMERS ENTERPRISES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 AECOCHEM

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 CENTRAL DRUG HOUSE

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 SHREE CHEMICALS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 PETROCHEMICALS EUROPE.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 KH CHEMICALS

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 TOJIRO CO., LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 BIESTERFELD AG

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 TWI LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 SIGMA-ALDRICH CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 LIAONING HEFA CHEMICAL CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 ZHEJIANG DONGUE CHEMICAL CO., LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Methacrylic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Methacrylic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Methacrylic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.