Global Methyl Acrylate Market

Market Size in USD Million

CAGR :

%

USD

443.05 Million

USD

738.77 Million

2024

2032

USD

443.05 Million

USD

738.77 Million

2024

2032

| 2025 –2032 | |

| USD 443.05 Million | |

| USD 738.77 Million | |

|

|

|

|

Methyl Acrylate Market Size

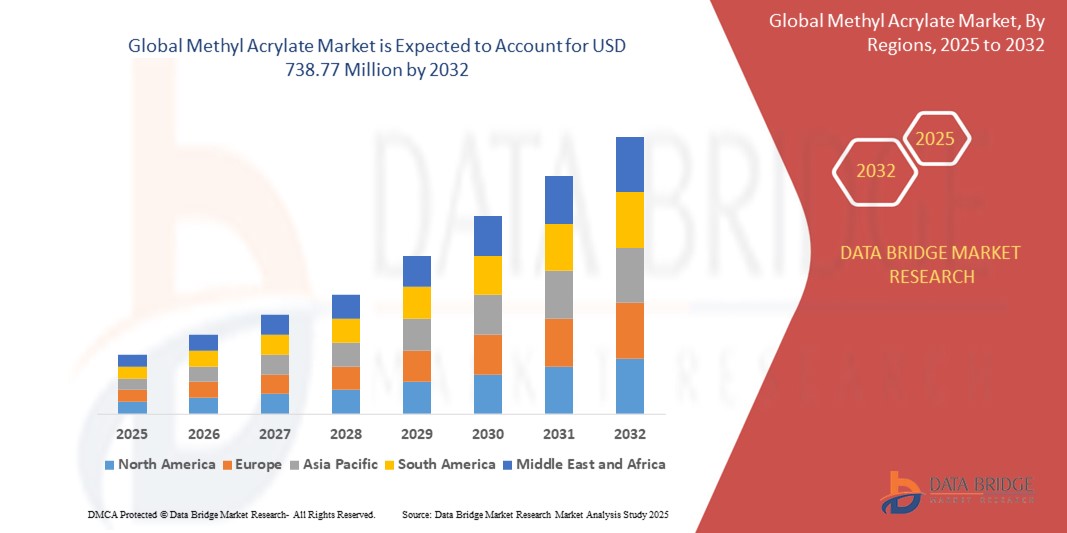

- The global methyl acrylate market size was valued at USD 443.05 million in 2024 and is expected to reach USD 738.77 million by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by rising demand for high-performance polymers, coatings, and adhesives across construction, automotive, and packaging industries, driven by infrastructure development and expanding manufacturing output in emerging economies

- Furthermore, increasing emphasis on lightweight, durable, and weather-resistant materials is promoting the use of methyl acrylate in formulations requiring flexibility, adhesion, and chemical resistance. These converging factors are accelerating its adoption in industrial and consumer applications, thereby significantly boosting the market’s growth

Methyl Acrylate Market Analysis

- Methyl acrylate, a key acrylate monomer, plays a critical role in the production of polymers, coatings, adhesives, and sealants due to its excellent reactivity, adhesion properties, and flexibility, making it essential across a wide range of industrial applications

- The escalating demand for methyl acrylate is primarily fueled by the rapid growth of the construction, automotive, packaging, and textile sectors, along with increasing preference for water-based and low-VOC formulations that support environmental compliance and performance efficiency

- Asia-Pacific dominated the methyl acrylate market with a share of 43.61% in 2024, due to rapid industrialization, expansion of manufacturing capacity, and high demand from end-use sectors such as paints and coatings, adhesives, and textiles across countries such as China and India

- North America is expected to be the fastest growing region in the methyl acrylate market during the forecast period due to the country’s position as a global leader in chemical production and export

- Industrial segment dominated the market with a market share of 79.1% in 2024, due to the compound’s essential role as a monomer and intermediate in large-scale chemical and polymer production processes. Methyl acrylate is widely used in the formulation of surface coatings, resins, elastomers, and adhesives due to its reactivity and compatibility with other acrylates. Industries favor this type for its cost-efficiency, availability in bulk, and effectiveness in delivering high-performance polymeric products

Report Scope and Methyl Acrylate Market Segmentation

|

Attributes |

Methyl Acrylate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Methyl Acrylate Market Trends

“Growing Demand for Adhesives and Sealants”

- A significant and accelerating trend in the global methyl acrylate market is the rising demand for adhesives and sealants across various industrial sectors such as construction, automotive, and packaging. This demand is driven by the superior bonding capabilities and flexibility offered by methyl acrylate-based formulations

- For instance, in construction applications, methyl acrylate adhesives provide high durability and weather resistance, making them ideal for both indoor and outdoor use. Similarly, the automotive industry utilizes these adhesives for lightweight component assembly and vibration reduction

- The shift toward sustainable and low-VOC adhesive solutions is also boosting the appeal of methyl acrylate products, as manufacturers seek alternatives that comply with environmental regulations while maintaining performance

- Advancements in polymer chemistry have further expanded the utility of methyl acrylate in hybrid adhesive systems, improving their applicability across substrates and enhancing mechanical strength

- This trend toward high-performance, eco-friendly adhesives is reshaping formulation strategies in key industries, reinforcing the role of methyl acrylate as a preferred raw material. Consequently, companies are expanding production capacities and focusing on specialty acrylate grades to meet growing global demand

- The demand for methyl acrylate in adhesives and sealants is rising across both developed and developing regions, as industries seek efficient, reliable, and compliant bonding solutions for a wide range of structural and non-structural applications

Methyl Acrylate Market Dynamics

Driver

“Increasing Demand for Methyl Acrylate-Based Products”

- The growing use of methyl acrylate-based products across diverse applications including surface coatings, textiles, plastic additives, and chemical synthesis is a significant driver of market expansion

- For instance, rising demand in the paint and coatings industry for fast-drying, weather-resistant finishes is accelerating the use of methyl acrylate polymers. Similarly, in packaging, methyl acrylate-based films offer enhanced flexibility and clarity

- As industries seek performance-enhancing materials that also align with evolving regulatory and sustainability standards, methyl acrylate’s versatility and functional benefits position it as a key material choice

- Furthermore, rapid industrialization in Asia-Pacific and increasing investments in infrastructure and automotive production globally are boosting demand for methyl acrylate across end-use sectors

- The compatibility of methyl acrylate with other monomers enables the production of tailored copolymers, extending its application range and supporting innovations in product development across multiple industries

Restraint/Challenge

“Stringent Government Regulations Regarding the use of Methyl Acrylate”

- Stringent government regulations concerning the use, handling, and emissions of volatile organic compounds (VOCs) such as methyl acrylate present a significant challenge for manufacturers and users

- For instance, regulatory bodies in North America and Europe enforce strict limits on workplace exposure levels and emissions during production, storage, and transportation, increasing compliance costs

- These regulations require companies to invest in advanced containment, ventilation, and monitoring systems to ensure worker safety and environmental protection

- In addition, concerns over toxicity and flammability necessitate careful management of methyl acrylate during formulation and application, particularly in high-volume industrial settings

- These factors can limit market expansion, especially among small and mid-sized enterprises that may struggle with regulatory compliance costs. While technological advancements and alternative formulation strategies are helping to mitigate these challenges, regulatory hurdles remain a persistent restraint for widespread adoption

Methyl Acrylate Market Scope

The market is segmented on the basis of type, purity grade, application, and end user.

• By Type

On the basis of type, the methyl acrylate market is segmented into industrial and pharmaceutical. The industrial segment dominated the largest market revenue share of 79.1% in 2024, driven by the compound’s essential role as a monomer and intermediate in large-scale chemical and polymer production processes. Methyl acrylate is widely used in the formulation of surface coatings, resins, elastomers, and adhesives due to its reactivity and compatibility with other acrylates. Industries favor this type for its cost-efficiency, availability in bulk, and effectiveness in delivering high-performance polymeric products.

The pharmaceutical segment is anticipated to witness a steady yet significant growth rate from 2025 to 2032, supported by its growing utilization in drug synthesis and biomedical research. High-purity methyl acrylate is used selectively in pharmaceutical formulations for its controlled reactivity and ability to serve as a building block in the synthesis of active pharmaceutical ingredients and polymer-based drug delivery systems.

• By Purity Grade

On the basis of purity grade, the methyl acrylate market is segmented into less than or equal to 99% and greater than 99%. The ≤99% segment held the largest market revenue share in 2024, driven by its widespread use in general industrial applications where ultra-high purity is not essential. This grade is favored for producing coatings, adhesives, sealants, and thermoplastic polymers, offering an optimal balance of performance and cost for bulk processing needs.

The >99% segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its increasing demand in high-end applications such as pharmaceutical synthesis, specialty chemicals, and electronics. High-purity methyl acrylate ensures enhanced chemical stability, reduced contamination, and improved reaction control, which are critical factors in sensitive formulations and regulatory-compliant manufacturing environments.

• By Application

On the basis of application, the methyl acrylate market is segmented into surface coatings, chemical synthesis, adhesives and sealants, plastic additives, detergents, textiles, and others. The surface coatings segment accounted for the largest market revenue share in 2024, driven by the compound’s excellent adhesion, flexibility, and weather resistance properties that make it a preferred component in both architectural and industrial coatings. Methyl acrylate enhances durability and provides a smooth finish, contributing to its growing use in exterior and protective coatings across construction and automotive sectors.

The adhesives and sealants segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising demand across packaging, consumer goods, and construction industries. Its application in adhesive formulations enables strong bonding strength, fast curing, and chemical resistance, making it ideal for high-performance bonding and sealing solutions.

• By End User

On the basis of end user, the market is segmented into paint and coating, automobile, packaging, construction, cosmetics, and others. The paint and coating segment captured the largest market revenue share in 2024, driven by expanding infrastructure projects, rising urbanization, and demand for decorative and industrial finishes. Methyl acrylate plays a key role in enhancing surface hardness, gloss retention, and resistance to environmental degradation, supporting its dominance in both solvent-borne and waterborne coating systems.

The automobile segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing focus on lightweight materials, high-performance finishes, and durable interior applications. The compound is widely used in automotive paints, plastic components, and noise-dampening materials, offering thermal stability, impact resistance, and design flexibility that align with modern automotive manufacturing standards.

Methyl Acrylate Market Regional Analysis

- Asia-Pacific dominated the methyl acrylate market with the largest revenue share of 43.61% in 2024, driven by rapid industrialization, expansion of manufacturing capacity, and high demand from end-use sectors such as paints and coatings, adhesives, and textiles across countries such as China and India

- The region’s strong chemical production infrastructure, low-cost labor, and rising investments in construction and automotive manufacturing are major contributors to methyl acrylate consumption

- In addition, favorable government policies supporting industrial growth and export-oriented chemical production are reinforcing the region’s position as a global supplier of methyl acrylate

Japan Methyl Acrylate Market Insight

The Japan market is growing steadily, supported by increased demand for specialty chemicals in automotive and electronics manufacturing. Japanese producers emphasize high-purity methyl acrylate for precision applications in coatings and polymer blends. Stringent quality standards and advanced R&D investments are enabling innovation in value-added applications such as UV-curable coatings and specialty adhesives.

China Methyl Acrylate Market Insight

The China methyl acrylate market held the largest share in Asia-Pacific in 2024, driven by the country’s position as a global leader in chemical production and export. Surging domestic demand from the packaging, textile, and construction sectors fuels bulk consumption, while Chinese manufacturers benefit from scale economies and supportive government policies. Efforts toward cleaner production technologies and expanding acrylic ester capacities are further boosting market growth.

Europe Methyl Acrylate Market Insight

Europe held a significant share of the methyl acrylate market in 2024, fueled by demand for environmentally compliant coating and sealant products across automotive, construction, and packaging industries. The region’s focus on sustainable chemistry, low-VOC formulations, and material recyclability aligns with methyl acrylate’s role in waterborne systems and biodegradable polymers. Strong regulatory oversight and innovation in eco-friendly materials are enhancing adoption among European manufacturers focused on performance and compliance

U.K. Methyl Acrylate Market Insight

The U.K. market is projected to grow steadily, driven by increasing demand for high-performance acrylic resins in architectural coatings and adhesives. The shift toward greener chemical formulations, combined with the growth of renovation and infrastructure projects, is supporting usage. Domestic R&D efforts are centered on bio-based and low-toxicity acrylic derivatives for safer use in residential and public environments.

Germany Methyl Acrylate Market Insight

The Germany methyl acrylate market is expected to witness robust expansion, supported by a well-established automotive sector, strong demand for industrial coatings, and advanced polymer processing capabilities. With a focus on circular economy practices, Germany is promoting the use of low-emission and recyclable acrylic-based materials in manufacturing and packaging sectors. Integration of automation in chemical plants is further enhancing efficiency and output.

North America Methyl Acrylate Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by technological advancements in formulation chemistry and increased demand for specialty acrylates in packaging, medical devices, and construction application. Rising investments in sustainable infrastructure, combined with regulatory emphasis on VOC reduction, are pushing the adoption of water-based and solvent-free formulations

U.S. Methyl Acrylate Market Insight

The U.S. methyl acrylate market captured the largest revenue share in 2024 within North America, backed by strong demand across adhesives, sealants, and thermoplastic industries. The rise in residential construction, automotive refinishing, and consumer packaging is fueling applications that require durable and weather-resistant acrylic materials. Moreover, advancements in green chemistry and increasing use of methyl acrylate in biomedical applications are expanding its domestic footprint.

Methyl Acrylate Market Share

The methyl acrylate industry is primarily led by well-established companies, including:

- Mitsubishi Chemical Group (Japan)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- LG Chem (South Korea)

- Dow (U.S.)

- BASF (Germany)

- Arkema (France)

- DuPont (U.S.)

- EVONIK INDUSTRIES AG (Germany)

- Merck KGaA (Germany)

- Solventis (France)

- Shanghai Huayi Acrylic Acid Co., Ltd. (China)

- SIBUR INTERNATIONAL (Russia)

- Nouryon (Netherlands)

- Jurong Group Su (China)

- SHANDONG KAITAI PETROCHEMICAL Co., LTD. (China)

Latest Developments in Global Methyl Acrylate Market

- In 2024, LG Chem announced the adoption of an advanced polymerization technique that increased methyl acrylate yield by 15%. This innovation is intended to enhance production efficiency and reduce operational costs, serving high-demand sectors such as automotive and packaging that rely on high-quality, large-volume methyl acrylate.

- In 2023, Mitsubishi Chemical Group launched a new line of methyl acrylate-based adhesives and coatings specifically engineered for electric vehicles. These products led to a 25% rise in adoption across the automotive sector due to their superior heat resistance, flexibility, and durability—qualities essential for lightweight and energy-efficient EVs.

- In 2024, Dow Inc. introduced a new range of high-barrier packaging solutions utilizing methyl acrylate under its “SustainBarrier” product line. These packaging materials are expected to fulfill approximately 15% of global demand for high-performance packaging by offering enhanced protection and environmental sustainability.

- In June 2020, Merck KGaA achieved a significant milestone with the approval of BAVENCIO, a PD-L1 targeted NK-cell therapy specifically designed for patients with locally advanced or metastatic urothelial carcinoma. This innovative treatment option strengthens Merck KGaA’s commitment to advancing cancer care and also expands its product portfolio, providing clinicians with more effective tools to combat this challenging form of cancer and improve patient outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Methyl Acrylate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Methyl Acrylate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Methyl Acrylate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.