Global Metrology Services Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

1.85 Billion

2024

2032

USD

1.23 Billion

USD

1.85 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.85 Billion | |

|

|

|

|

Global Metrology Services Market Size

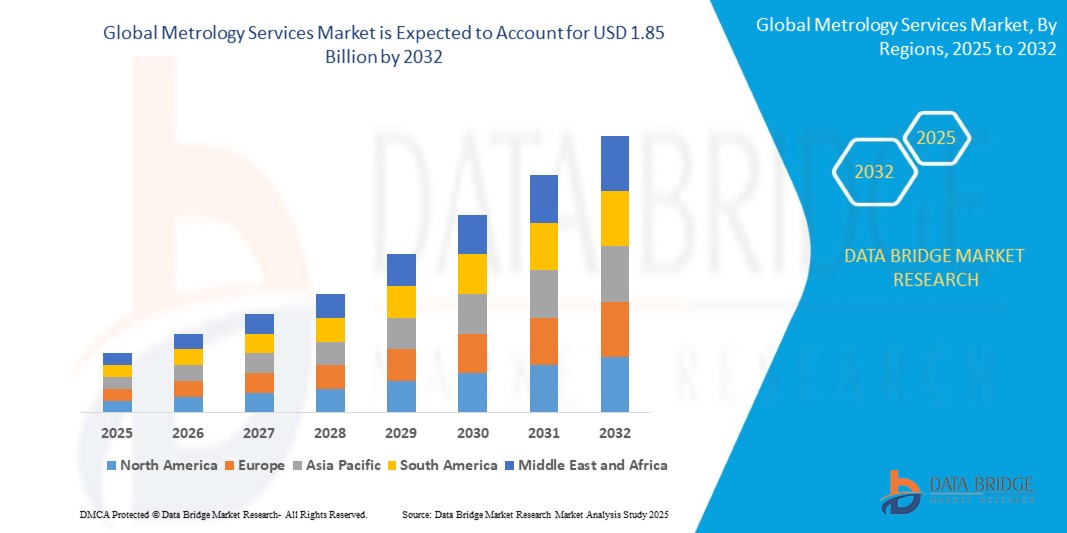

- The global Metrology Services market was valued at USD 1.23 billion in 2024 and is projected to reach USD 1.85 billion by 2032, growing at a steady CAGR of 6.02% during the forecast period.

- Growth is driven by the increasing demand for high-precision measurement in manufacturing, rising adoption of automated quality control systems, and the integration of metrology solutions in Industry 4.0 frameworks across automotive, aerospace, and semiconductor industries.

Global Metrology Services Market Analysis

- Global Metrology Services refer to precision measurement services that ensure the accuracy, calibration, and standardization of manufacturing processes, components, and equipment across various industries.

- With the growing adoption of advanced manufacturing, automation, and quality assurance protocols, metrology services are playing a critical role in sectors such as aerospace, automotive, electronics, and energy.

- Industries are leveraging metrology services for dimensional inspection, reverse engineering, and machine calibration—enabling faster prototyping, reduced errors, and improved product performance.

- The demand for non-contact, high-speed, and automated metrology solutions is accelerating with the rise of Industry 4.0, driving innovations in 3D scanning, optical measurement, and digital twin technologies.

- Metrology services also support compliance with global quality standards, making them indispensable for manufacturers aiming to enhance operational efficiency, minimize downtime, and deliver precision-engineered products.

Report Scope and Global Metrology Services Market Segmentation

|

Attributes |

Global Metrology Services Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to core insights on market scenarios such as market value, growth rate, segmentation, regional performance, and major players, the Global Metrology Services Market report curated by Data Bridge Market Research also features detailed import-export analysis, assessment of installed and utilized production capacities, production-to-consumption mapping, and prevailing price trends across key regions. Furthermore, the report offers a comprehensive review of climate impact scenarios, supply chain dynamics, and value chain structures. It also includes raw material and consumables overview, vendor benchmarking and selection criteria, PESTLE analysis, Porter’s Five Forces analysis, and a summary of relevant regulatory frameworks shaping the global metrology services landscape. |

Global Metrology Services Market Trends

Evolution of Precision, Automation, and Real-Time Insights Across Industries

- Increased Adoption of Inline and Real-Time Inspection: Manufacturers are integrating metrology services directly into production lines to enable real-time quality control, reducing downtime and improving process reliability in sectors like automotive, aerospace, and electronics.

- Rising Demand for Reverse Engineering Solutions: With the growing need to replicate legacy components and optimize product design, industries are increasingly leveraging 3D scanning and digital metrology tools to support innovation and reduce prototyping cycles.

- Sustainability Through Predictive Maintenance and Process Optimization: Metrology services are contributing to resource-efficient operations by enabling condition monitoring and precision alignment, ultimately reducing waste, rework, and energy consumption.

- Technological Advancements in Non-Contact and Optical Metrology: The shift toward high-speed, non-invasive measurement systems such as laser scanners and structured light technologies is enhancing throughput and accuracy in complex part geometries.

- Integration with Smart Manufacturing and Industrial IoT: The market is seeing strong convergence with Industry 4.0, where metrology data is seamlessly connected with digital twins, cloud analytics, and edge computing, empowering predictive insights and autonomous process control..

Global Metrology Services Market Dynamics

Driver

Rising Need for Precision, Efficiency, and Quality Control Across Advanced Manufacturing Sectors

- The growing complexity of components in automotive, aerospace, and electronics industries is driving the demand for metrology services that ensure dimensional accuracy, structural integrity, and compliance with stringent quality standards.

- Applications such as reverse engineering, 3D scanning, and real-time inspection are gaining traction as manufacturers adopt smart factory models and demand faster, more reliable measurement processes.

- Industries are increasingly relying on portable and automated metrology solutions—such as laser scanners and articulated arm CMMs—to reduce downtime, optimize workflows, and enhance product development cycles.

- Investments in Industry 4.0 technologies and digital twin ecosystems are fueling the integration of metrology services into production lines, supported by government initiatives and private-sector collaboration focused on innovation and standards compliance.

Restraint/Challenge

High Equipment Costs and Lack of Standardized Calibration Protocols in Complex Environments

- Advanced metrology solutions such as laser trackers, CMMs, and 3D scanners require significant capital investment, making them less accessible to small and mid-sized enterprises (SMEs) in cost-sensitive sectors

- The absence of globally harmonized calibration procedures and validation frameworks leads to inconsistent measurement outcomes, especially in high-precision industries like aerospace, automotive, and semiconductor manufacturing.

- Metrology service providers often face integration challenges due to varying software platforms, hardware interfaces, and data compatibility issues, which hinder seamless workflow automation across global production lines.

- Environmental conditions—such as temperature, vibration, and humidity—can affect measurement accuracy, and managing these variations in real-world shop-floor environments remains a persistent technical and operational hurdle.

Global Metrology Services Market Scope

The market is segmented by product, application, service type, and end user, reflecting its critical role in quality assurance, precision engineering, and advanced manufacturing environments..

- By Products

Includes Coordinate Measuring Machines (CMM), Optical Digitizers & Scanners (ODS), and Others. CMMs dominate the market in 2025, widely used for dimensional inspection across automotive and aerospace sectors due to their high accuracy and repeatability. Optical digitizers and scanners are the fastest-growing segment, driven by their non-contact capabilities and use in complex geometries and reverse engineering tasks..

- By Application

Key applications include Quality Control & Inspection, Reverse Engineering, Mapping & Modeling, and Others. Quality control & inspection leads the market, as manufacturers prioritize precision and compliance in production workflows. Reverse engineering is witnessing rapid growth, particularly in design validation, legacy part duplication, and 3D modeling for high-performance components.

- By Service Type

Covers Onsite Services and Offsite Services. Onsite services are the preferred mode in 2025, offering immediate, tailored inspection at client facilities, especially in high-throughput industries. Offsite services remain essential for calibration and in-depth assessments requiring lab-grade metrology infrastructure.

- By End User

Includes Automotive, Aerospace & Defense, Semiconductor & Electronics, Energy & Power, Construction, Healthcare, Heavy Equipment, and Others. Automotive is the leading end-use sector due to its demand for tight tolerances and robust inspection across vehicle components. Semiconductor & electronics is a fast-emerging segment, propelled by miniaturization trends and the need for sub-micron accuracy in device manufacturing.

Global Metrology Services Market Regional Analysis

- North America leads the global market in 2025 due to strong integration of metrology services across aerospace, automotive, and semiconductor industries. The U.S. dominates the region with advanced deployment of coordinate measuring machines (CMMs) and 3D scanning systems, driven by automation in manufacturing, quality assurance initiatives, and robust R&D investments from both government and private sectors.

- Europe follows closely, supported by precision engineering, digital industrialization, and adoption of Industry 4.0 standards. Countries like Germany, the U.K., and France are incorporating metrology services in electric vehicle production, turbine components, and smart manufacturing processes. The region’s focus on sustainability and high regulatory standards reinforces the need for meticulous inspection and reverse engineering capabilities.

- Asia-Pacific emerges as the fastest-growing region, fueled by rapid industrialization, expanding electronics and automotive manufacturing, and increasing demand for precision measurement solutions. China, Japan, South Korea, and India are major contributors, with significant investments in automation, robotics, and semiconductor fabrication where real-time metrology services ensure production accuracy and quality compliance.

- Middle East & Africa (MEA) is witnessing growing adoption in energy infrastructure, construction, and defense sectors. Countries like the UAE and Saudi Arabia are integrating advanced metrology systems into infrastructure development and manufacturing parks, particularly through initiatives tied to smart cities and localization of industrial production.

- South America, led by Brazil and Argentina, is gradually adopting metrology services in sectors such as mining, automotive, and public infrastructure. Government-supported industrial expansion and rising attention to manufacturing quality standards are pushing demand for both on-site and off-site metrology support, particularly for calibration and dimensional inspection.

United States

The U.S. maintains leadership in the global metrology services landscape, thanks to high adoption across aerospace, medical devices, and automotive sectors. Strategic investments in smart factories, digital twins, and high-precision quality control technologies are bolstered by collaborations between federal agencies and private manufacturing clusters..

Germany

Germany is a stronghold for precision metrology, with a high concentration of automotive, aerospace, and industrial equipment manufacturers. Industry 4.0 implementation, along with strong ties between academia and tech firms, is advancing metrology automation and integration into smart production lines.

China

China remains a powerhouse in metrology service demand, driven by its extensive manufacturing base. From electronics to heavy machinery, real-time quality control, inspection, and mapping technologies are being widely adopted. The country also benefits from substantial investment in homegrown metrology equipment and sensor technologies.

India

India is rapidly emerging as a key growth market for metrology services, supported by Make in India, smart manufacturing policies, and a growing ecosystem of domestic production across automotive, defense, and electronics sectors. There's rising demand for portable and affordable metrology tools for SMEs and industrial clusters..

South Korea

South Korea is investing in high-precision metrology tools for electronics, semiconductor manufacturing, and aerospace applications. Major tech and hardware manufacturers like Samsung and Hyundai are integrating automated quality inspection systems in advanced production facilities, enhancing export quality and operational efficiency.

Global Metrology Services Market Share

The Global Metrology Services industry is primarily led by well-established companies, including:

- Carl Zeiss AG (Germany)

- Creaform Inc. (Canada)

- FARO Technologies (U.S.)

- Hexagon AB (Sweden)

- Intertek Group plc (U.K.)

- Jenoptik AG (Germany)

- KLA Corporation (U.S.)

- Metrologic Group (France)

- Nikon Corporation (Japan)

- Renishaw plc (U.K.)

- SGS S.A. (Switzerland)

- Ametek (U.S.)

- Percepton, Inc. (U.S.)

- GOM GmbH (Germany)

- Bruker Corporation (U.S.)

Latest Developments in Global Metrology Services Market

- April 2025, Verus Metrology launched a hybrid metrology inspection platform that integrates AI-powered 3D scanning and real-time analytics, enabling faster reverse engineering and dimensional verification in automotive and aerospace production environments.

- March 2025, Nikon Metrology introduced its next-generation NEXIV robotic optical inspection system for semiconductor and electronics manufacturers, offering automated, high-precision part measurements compatible with smart factory operations.

- February 2025, Cognex Corporation expanded its In-Sight L38 3D vision lineup with AI-based inspection software, improving detection accuracy and defect classification for complex components in automotive and industrial automation sectors.

- January 2025, NASA awarded its Glenn Logistics and Metrology (GLAM) services contract, valued at over USD 72 million, to support precision calibration, measurement, and inspection operations for space missions and research programs through 2030.

- December 2024, ZEISS Industrial Quality Solutions unveiled INSPECT 3D, a high-speed metrology software suite featuring advanced evaluation tools and automated reporting capabilities for high-volume manufacturing and quality control labs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metrology Services Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metrology Services Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metrology Services Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.