Global Mice Model Market

Market Size in USD Billion

CAGR :

%

USD

1.91 Billion

USD

4.09 Billion

2025

2033

USD

1.91 Billion

USD

4.09 Billion

2025

2033

| 2026 –2033 | |

| USD 1.91 Billion | |

| USD 4.09 Billion | |

|

|

|

|

Mice Model Market Size

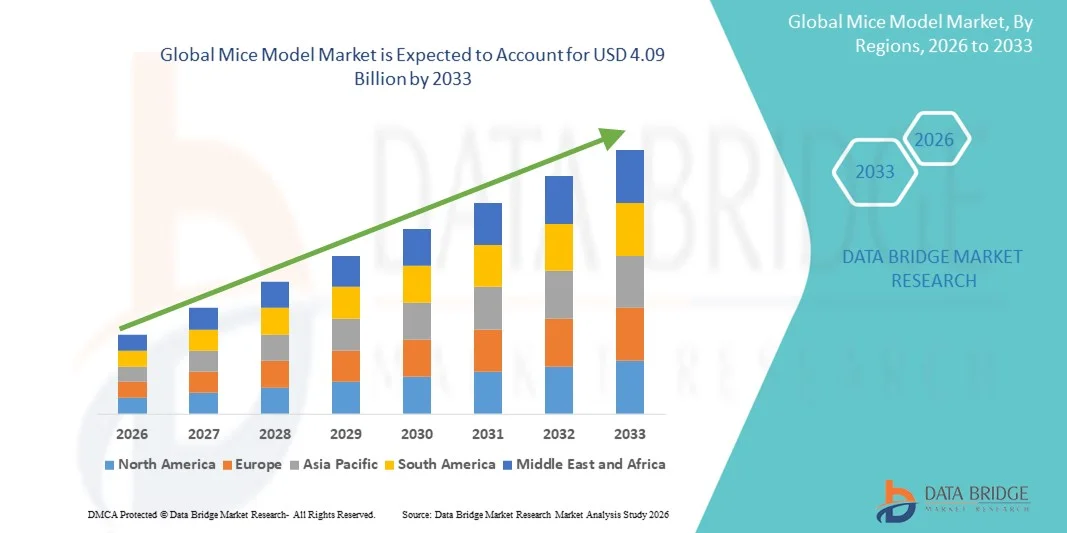

- The global mice model market size was valued at USD 1.91 billion in 2025 and is expected to reach USD 4.09 billion by 2033, at a CAGR of 10.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced preclinical research models and technological progress in genetic engineering, leading to enhanced disease modeling and drug discovery capabilities

- Furthermore, rising demand for precise, reproducible, and human-relevant experimental models is establishing mice models as a critical tool in biomedical research, oncology, immunology, and neuroscience studies. These converging factors are accelerating the uptake of Mice Model solutions, thereby significantly boosting the industry's growth

Mice Model Market Analysis

- Mice models, widely used in preclinical research and drug discovery, are critical tools for studying human diseases, testing novel therapies, and advancing biomedical research due to their genetic similarity to humans, ease of handling, and adaptability to various experimental designs

- The escalating demand for mice models is primarily fueled by growing investment in pharmaceutical and biotechnology R&D, increasing prevalence of chronic and genetic diseases, and rising adoption of advanced genetically engineered models for precision research

- North America dominated the Mice Model market with the largest revenue share of approximately 38.5% in 2025, driven by a strong presence of key research institutions, high R&D investment, and extensive adoption of advanced mouse models for preclinical studies in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the mice model market during the forecast period, registering an estimated CAGR of 9.2%, supported by rapid growth in life sciences research, expanding pharmaceutical and biotechnology sectors, and increasing adoption of genetically engineered mouse models in countries such as China, Japan, and India

- The human use segment held the largest market revenue share of 48.3% in 2025, due to extensive use in disease modeling, drug development, and genetic research

Report Scope and Mice Model Market Segmentation

|

Attributes |

Mice Model Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• JAX Mice (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Mice Model Market Trends

Increasing Adoption of Genetically Engineered and Disease-Specific Models

- A significant and accelerating trend in the global Mice Model market is the growing use of genetically engineered, transgenic, and disease-specific mice for preclinical research

- These models are increasingly being employed to study complex human diseases such as cancer, neurological disorders, cardiovascular conditions, and metabolic diseases, allowing for more accurate simulation of human pathophysiology

- Pharmaceutical and biotechnology companies are leveraging advanced mouse models to streamline drug discovery and development processes

- For instance, in 2024, a leading European biotech firm adopted CRISPR-engineered mice for oncology studies, reducing preclinical study timelines while improving the reliability of efficacy and toxicity results

- Research institutions and contract research organizations (CROs) are progressively integrating specialized mice models into high-throughput screening platforms and personalized medicine research, facilitating precise evaluation of novel therapeutics

- The trend is also supported by increasing collaborations between academic centers, pharmaceutical companies, and animal model providers, which drive innovation and wider availability of disease-specific mice models across regions

Mice Model Market Dynamics

Driver

Rising Investments in Drug Discovery and Preclinical Research

- The expanding global pharmaceutical and biotechnology research sector is a major driver for the Mice Model market. Increased R&D expenditure, coupled with the growing demand for efficient preclinical testing, fuels the need for high-quality mouse models

- For instance, in 2025, a North American pharmaceutical company announced significant investments in developing customized mouse models for neurology and immuno-oncology studies, aimed at accelerating drug development pipelines

- The growing prevalence of chronic diseases, rising incidence of cancer, and increasing focus on precision medicine are encouraging the adoption of specialized mouse models for targeted drug testing and disease mechanism studies

- Increasing collaborations between CROs, academic institutions, and biotech firms are further expanding the market reach, particularly in regions such as North America, Europe, and Asia-Pacific

Restraint/Challenge

High Costs and Ethical Considerations in Animal Research

- The relatively high costs of breeding, maintaining, and genetically modifying mice pose a challenge to market growth, particularly for small research laboratories and institutions in developing regions

- Advanced transgenic and humanized mouse models often require sophisticated infrastructure, skilled personnel, and significant investment, limiting accessibility

- Ethical concerns and stringent regulations surrounding animal testing are another major restraint

- For instance, in 2023, several European universities postponed oncology research projects due to delays in obtaining ethical approvals for genetically modified mouse studies, highlighting how compliance challenges can directly impact research timelines

- Regulatory frameworks in Europe, the U.S., and parts of Asia demand strict adherence to animal welfare standards, increasing administrative and operational burdens for research facilities

- Overcoming these challenges through cost-effective breeding solutions, alternatives such as organ-on-chip models, and harmonized regulatory practices will be essential for sustained growth in the global Mice Model market

Mice Model Market Scope

The market is segmented on the basis of mice type, technology, application, use, and end-use.

- By Mice Type

On the basis of mice type, the Mice Model market is segmented into inbred, outbred, knockout, and hybrid. The inbred segment dominated the largest market revenue share of 41.5% in 2025, driven by its widespread use in controlled genetic studies and disease modeling. Inbred mice provide near-identical genetic backgrounds, ensuring reproducibility across preclinical trials, pharmacology research, and immunology studies. They are preferred for oncology, cardiovascular, and neurological research due to consistency in experimental results. High adoption in both academic and industrial research supports its dominance. Availability of multiple strains and compatibility with advanced gene-editing tools such as CRISPR further strengthens its market position. Pharmaceutical and biotechnology companies rely on inbred mice for toxicology studies and drug development. Government-funded research projects in North America, Europe, and Asia-Pacific prioritize inbred models for translational research. Contract research organizations (CROs) extensively use inbred mice for outsourcing services. Rising focus on precision medicine, genomics research, and reproducible outcomes enhances market share. Integration with automated breeding facilities improves availability and scalability. The segment also benefits from regulatory support for standardized preclinical testing.

The knockout segment is expected to witness the fastest CAGR of 8.9% from 2026 to 2033, propelled by the increasing demand for genetically modified models to study gene functions and disease pathways. Knockout mice are critical for investigating cancers, metabolic disorders, and neurological diseases. Pharmaceutical and biotech companies increasingly leverage knockout models for drug discovery, toxicology testing, and preclinical trials. Academic institutions use knockout mice to understand complex genetic mechanisms. Expansion of contract breeding and outsourcing services accelerates growth. Government programs promoting personalized medicine and biotechnology research further support adoption. CRISPR-based gene-editing technologies make knockout mice faster and cost-effective to produce. The need for high-precision disease modeling drives segment adoption. Pharmaceutical R&D outsourcing to CROs also fuels market growth. Knockout mice enable testing for vaccines, biosimilars, and novel therapeutics. Demand for transgenic and humanized knockout mice is increasing. Global R&D investment and rising healthcare expenditure support the high CAGR.

- By Technology

On the basis of technology, the Mice Model market is segmented into CRISPR, microinjection, embryonic stem cell, and nuclear transfer. The CRISPR segment held the largest market revenue share of 39.8% in 2025, owing to its precision, efficiency, and cost-effectiveness for genome editing. CRISPR allows rapid creation of targeted genetic modifications in mice, making it ideal for disease modeling, oncology research, and metabolic studies. Pharmaceutical and biotechnology firms widely adopt CRISPR-enabled mice for preclinical trials. Academic research institutions also rely on CRISPR mice for high-throughput genetic studies. CRISPR’s flexibility in multi-gene modifications strengthens its market position. Government-backed research projects in genomics and personalized medicine drive adoption. CRISPR reduces time and cost compared to older technologies. High reproducibility and scalability make it ideal for contract research services. The technology supports both human and veterinary disease modeling. Demand for advanced therapeutics and immunotherapy research further enhances adoption. Overall, CRISPR ensures rapid results and robust data generation for preclinical studies.

The microinjection segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by the need for precise introduction of genetic material into embryos to create transgenic and knockout mice. Microinjection enables accurate manipulation of the mouse genome, improving success rates for genetic modification. It is heavily used in pharmaceutical R&D, vaccine development, and regenerative medicine research. Outsourcing to specialized breeding facilities accelerates segment growth. Academic institutions increasingly rely on microinjection for complex genetic studies. High-throughput breeding techniques further fuel adoption. Pharmaceutical and biotechnology companies use microinjection for preclinical testing and translational research. Integration with CRISPR and other technologies enhances efficiency. Government support for genetic research and compliance with international standards drives growth. Microinjection ensures high reproducibility, reliability, and consistency. Expansion in contract research services further contributes. Rising focus on producing humanized models strengthens demand.

- By Application

On the basis of application, the Mice Model market is segmented into research & development, production and quality control, and academics. The research & development segment dominated with a market share of 45.1% in 2025, driven by extensive preclinical studies, drug development, and translational research programs. Pharmaceutical companies and biotechnology firms extensively use mice models to evaluate drug efficacy, safety, and mechanism of action. Academic research institutions use mice for disease modeling and basic science studies. CROs provide outsourced R&D services using mice models. Government-funded research programs in oncology, immunology, and neurological disorders contribute to high adoption. Precision medicine and genomics research support the segment’s dominance. Availability of inbred, knockout, and transgenic mice ensures reliable experimental outcomes. Rising global R&D expenditure further strengthens market share. Standardized breeding and quality control practices enhance reliability. Research focus on vaccines, biologics, and novel therapeutics increases demand. International collaborations and partnerships in R&D reinforce segment leadership.

The production and quality control segment is expected to witness the fastest CAGR of 8.6% from 2026 to 2033, fueled by rising demand for standardized, high-quality mice models to ensure reproducible results in preclinical testing. Regulatory requirements for reproducible preclinical experiments necessitate strict production and quality control practices. Contract breeding facilities expand globally to meet demand. Pharmaceutical and biotech firms increasingly outsource mice model production and QC services. Adoption of high-throughput breeding technologies enhances scalability. Quality assessment ensures compliance with international research standards. Demand for knockout, transgenic, and humanized mice drives segment growth. Government programs promoting life sciences research support adoption. CROs and academic collaborations enhance market expansion. Investments in infrastructure, automation, and technology further boost CAGR. Production and QC segment ensures traceable and reproducible results for preclinical studies.

- By Use

On the basis of use, the Mice Model market is segmented into human and veterinary. The human use segment held the largest market revenue share of 48.3% in 2025, due to extensive use in disease modeling, drug development, and genetic research. Human-targeted studies in oncology, metabolic disorders, and neurological diseases drive adoption. Pharmaceutical and biotechnology companies, academic institutions, and CROs extensively utilize these models. Integration with CRISPR and transgenic technologies enhances research efficiency. Government funding for human disease research further boosts segment dominance. Reproducibility and predictive accuracy for human outcomes make these models highly reliable. Availability of standardized inbred and knockout strains supports research reliability. Preclinical testing of novel therapeutics relies heavily on human-use mice. Collaborative projects between universities and pharma enhance adoption. Regulatory compliance and ethical approvals further reinforce the segment’s market share.

The veterinary use segment is expected to witness the fastest CAGR of 7.8% from 2026 to 2033, driven by rising research in animal health, vaccine development, and disease prevention. Veterinary pharmaceutical R&D programs increasingly adopt genetically modified mice models. Contract breeding and outsourcing services support segment expansion. Government initiatives for zoonotic disease research boost adoption. Veterinary schools and research institutions integrate mice models for teaching and experimentation. Rising demand for transgenic and knockout mice in veterinary research accelerates growth. Preclinical studies for veterinary drugs increasingly use mice models. Technological advancements such as CRISPR enhance research outcomes. Outsourced testing and quality control services drive market growth. Veterinary R&D collaborations with biotech firms support adoption. Focus on reproducibility and animal welfare strengthens the segment’s growth trajectory.

- By End-Use

On the basis of end-use, the Mice Model market is segmented into companies, organizations, academic and research institutes, and contract research organizations (CROs). The academic and research institutes segment dominated with a 44.7% market share in 2025, driven by extensive use for fundamental research, teaching, and preclinical studies. Universities, government labs, and private research centers are major users. Demand for knockout, inbred, and transgenic mice supports segment dominance. Funding from government and non-profits sustains adoption. Collaborative research with pharmaceutical firms increases utilization. Focus on reproducible, high-quality experimental results further strengthens leadership. Genetic, oncology, and immunology studies drive widespread adoption. Standardized breeding ensures high-quality outcomes. Advanced gene-editing integration enhances research capabilities. Global R&D investments continue to support growth.

The CROs segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, driven by the outsourcing of preclinical studies, specialized breeding services, and regulatory compliance requirements. CROs provide end-to-end services, including production, quality control, and study management. Expansion of global preclinical outsourcing fuels growth. Adoption of advanced technologies such as CRISPR accelerates CRO demand. International collaborations with biotech and academic institutions enhance adoption. Need for scalable, high-throughput production supports strong CAGR. Compliance with global research standards ensures reliability. Increasing demand for humanized and knockout mice models boosts segment growth. Contract research and breeding services expand market opportunities. Focus on reproducible and traceable research outcomes strengthens CRO market share.

Mice Model Market Regional Analysis

- North America dominated the mice model market with the largest revenue share of approximately 38.5% in 2025

- Driven by a strong presence of key research institutions

- High R&D investment, and extensive adoption of advanced mouse models for preclinical studies

U.S. Mice Model Market Insight

The U.S. mice model market captured the majority of North America’s revenue share in 2025, fueled by the widespread use of genetically engineered and transgenic mouse models in pharmaceutical, biotechnology, and academic research. The growing focus on drug discovery, translational research, and precision medicine further propels market growth. Additionally, strong government and private funding for life sciences research accelerates the adoption of sophisticated mouse models across preclinical studies.

Europe Mice Model Market Insight

The Europe mice model market is expected to expand at a steady CAGR throughout the forecast period, supported by increasing investments in biomedical research, advanced academic and clinical research facilities, and growing adoption of humanized and disease-specific mouse models. Key countries contributing to market growth include Germany, France, and the U.K., where regulatory support for preclinical testing is robust.

U.K. Mice Model Market Insight

The U.K. mice model market is anticipated to grow at a notable CAGR during the forecast period, driven by rising demand for transgenic and knockout mice in drug development and neurological research. Strong academic and clinical research infrastructure, coupled with funding for innovative preclinical studies, supports market expansion.

Germany Mice Model Market Insight

The Germany mice model market is expected to witness significant growth due to the country’s emphasis on life sciences research, presence of leading biotechnology firms, and increasing use of mouse models in oncology, immunology, and neuroscience studies. Adoption of advanced genetically modified models is particularly prevalent in academic and pharmaceutical research centers.

Asia-Pacific Mice Model Market Insight

The Asia-Pacific mice model market is poised to grow at the fastest CAGR of 9.2% during the forecast period, supported by rapid growth in life sciences research, expanding pharmaceutical and biotechnology sectors, and increasing adoption of genetically engineered mouse models. Countries such as China, Japan, and India are emerging as key contributors, with rising investments in preclinical and translational research fueling market expansion.

Japan Mice Model Market Insight

The Japan mice model market is gaining momentum due to advanced biomedical research facilities, increasing adoption of transgenic and knockout models, and growing focus on drug discovery and regenerative medicine. The government’s initiatives supporting research in genetic engineering further enhance market growth.

China Mice Model Market Insight

The China mice model market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid expansion of pharmaceutical and biotechnology research, rising adoption of humanized and disease-specific mouse models, and government support for life sciences research infrastructure. The growing focus on preclinical studies and precision medicine continues to drive demand for sophisticated mouse models in the country.

Mice Model Market Share

The Mice Model industry is primarily led by well-established companies, including:

• JAX Mice (U.S.)

• Cyagen Biosciences (China)

• Charles River Laboratories (U.S.)

• Envigo (U.S.)

• Taconic Biosciences (U.S.)

• Labcorp (U.S.)

• Oriental BioService (Japan)

• Biocytogen (China)

• Shanghai Model Organisms (China)

• GenOway (France)

• GemPharmatech (China)

• Bioreliance (U.S.)

• PhenoGen (U.S.)

• Transgenic Inc. (U.S.)

• Harlan Laboratories (U.S.)

• Charles River – Calco (U.S.)

• SLC, Inc. (Japan)

• Envigo RMS (U.S.)

• Animal Biotech Solutions (India)

Latest Developments in Global Mice Model Market

- In July 2024, researchers from the University of Texas Health Science Center at San Antonio developed the TruHuX humanized mouse model, equipped with a human immune system and human‑like gut microbiome to support specific antibody responses for diseases such as tuberculosis and SARS‑CoV‑2. The TruHuX model replicates human immune function more faithfully than previous models, making it valuable for vaccine research and immunotherapy evaluation, and demonstrating significant progress in humanized model development

- In July 2025, Taconic Biosciences launched a new humanized transferrin receptor (hTFRC) mouse model designed specifically for central nervous system therapeutic research, enabling scientists to more accurately simulate human brain diseases and improve preclinical evaluation of drug candidates targeting neurological disorders. This new precision model expands the capabilities of translational neuroscience research by providing enhanced insights into blood‑brain barrier transport and receptor‑mediated drug delivery pathways, supporting Pharma and biotech efforts in developing targeted therapies

- In July 2025, Twist Bioscience Corporation announced the launch of a humanized transgenic (HuTg) mouse model for antibody discovery services, aimed at accelerating monoclonal antibody identification and optimization. The HuTg model generates robust human immune responses, improving the efficiency of therapeutic antibody development programs in immuno‑oncology and infectious disease research. This launch underscores the continued demand for advanced humanized mouse models in precision biologics research

- In March 2025, Alamar Biosciences launched the NULISAseq Mouse Panel 120, a comprehensive biomarker profiling solution for expression analysis of multiple protein targets in mouse models. The panel enables profiling of 120 proteins involved in inflammation, neurodegeneration, and immuno‑oncology, thereby enhancing preclinical research and facilitating deeper understanding of disease mechanisms. This launch supports integrated biomarker strategies in drug development and translational studies

- In September 2025, the global mice model market was reported to grow at a robust CAGR driven by genomic advances and R&D investments, reflecting the increasing use of these models in personalized medicine, preclinical studies, and drug discovery. Reports highlighted the growing demand for genetically engineered and humanized mice models, reinforcing the trend toward specialized and disease‑specific in vivo models

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.