Global Microbiology Cro Services Market

Market Size in USD Billion

CAGR :

%

USD

4.79 Billion

USD

8.71 Billion

2024

2032

USD

4.79 Billion

USD

8.71 Billion

2024

2032

| 2025 –2032 | |

| USD 4.79 Billion | |

| USD 8.71 Billion | |

|

|

|

|

Microbiology CRO Services Market Size

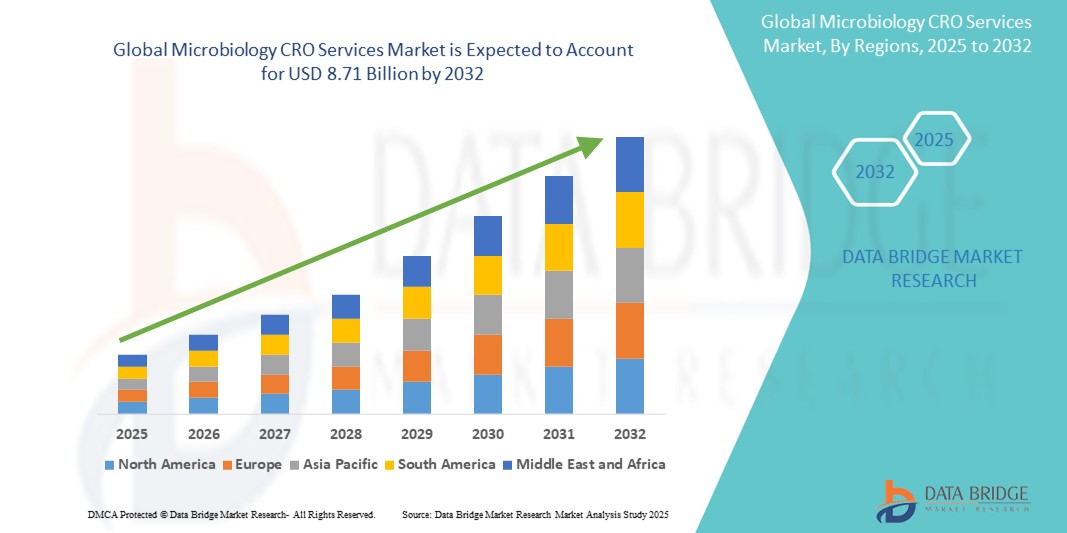

- The global microbiology CRO services market was valued at USD 4.79 billion in 2024 and is expected to reach USD 8.71 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.2%, primarily driven by the Rising R&D Investment in Pharmaceuticals and Biotechnology

- This growth is driven by factors such as the growing demand for drug and vaccine development, advancements in microbiological technologies

Microbiology CRO Services Market Analysis

- Microbiology CRO services are essential in supporting pharmaceutical, biotechnology, and medical device companies by conducting microbiological testing, analysis, and regulatory compliance. These services are vital in drug development, vaccine production, sterility assurance, and antimicrobial efficacy testing

- The demand for microbiology CRO services is significantly driven by the rising prevalence of infectious diseases, increasing R&D activities in drug and vaccine development, and growing regulatory pressures for microbial safety and quality assurance. A notable portion of global demand stems from pharmaceutical companies seeking to streamline operations and reduce time-to-market

- North America emerges as a dominant region in the microbiology CRO services market, attributed to its robust pharmaceutical industry, strong regulatory frameworks, and a well-established CRO ecosystem. The region is also home to several key market players offering specialized microbiological services to a diverse range of clients

- For instance, U.S.-based CROs have seen a rise in outsourced microbiological testing from both domestic and international pharmaceutical firms, especially in support of clinical trials and regulatory submissions

- Globally, microbiology CRO services rank among the top outsourced services in pharmaceutical R&D, following clinical trial management and toxicology services. They play a crucial role in accelerating drug development timelines, ensuring product safety, and meeting global regulatory standards

Report Scope and Microbiology CRO Services Market Segmentation

|

Attributes |

Microbiology CRO Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Microbiology CRO Services Market Trends

“Integration of Automation and Rapid Microbial Testing Technologies in CRO Services”

- A key trend transforming the microbiology CRO services market is the growing integration of automation and rapid microbial testing technologies, streamlining workflows and enhancing testing accuracy

- These advancements significantly reduce turnaround times for critical microbiological assays such as sterility, endotoxin, and microbial identification testing, which are essential in pharmaceutical and biologic product development

- For instance, automated systems leveraging MALDI-TOF mass spectrometry and PCR-based rapid methods enable real-time microbial identification, offering greater speed and precision over conventional culture-based techniques

- The incorporation of digital data management and AI-driven analytics also improves traceability, regulatory compliance, and quality assurance, offering enhanced insights during product development and manufacturing processes

- These technological upgrades are reshaping microbiology CRO services, improving operational efficiency, ensuring regulatory readiness, and increasing client reliance on specialized outsourcing partners for advanced testing solutions

Microbiology CRO Services Market Dynamics

Driver

“Rising Demand for Microbial Safety in Drug and Biologic Development”

- The increasing demand for microbial safety testing across all stages of drug and biologic development is a major driver for the microbiology CRO services market. Pharmaceutical and biotech companies are under growing pressure to ensure product sterility, safety, and compliance with stringent global regulations

- As drug pipelines grow more complex—particularly with the rise of biologics, biosimilars, and personalized therapies—there is a heightened need for specialized microbiological testing, including sterility, endotoxin, bioburden, and microbial limits testing

- Regulatory authorities such as the U.S. FDA, EMA, and WHO require comprehensive microbiological testing to ensure patient safety, especially for injectable drugs, vaccines, and implantable medical devices. This regulatory landscape drives companies to partner with CROs that have the expertise and infrastructure to manage these rigorous requirements

- Outsourcing to microbiology-focused CROs also allows companies to reduce costs, improve turnaround times, and access advanced testing technologies without investing in their own in-house capabilities

- The growing threat of antimicrobial resistance (AMR) and emerging infectious diseases has further emphasized the need for robust microbial testing during drug development and manufacturing, bolstering the relevance and demand for CRO services

For instance,

- In October 2022, according to the World Health Organization, antimicrobial resistance was recognized as a top global public health threat, leading to urgent calls for strengthened drug development pipelines and reliable microbial testing protocols, creating an increased reliance on specialized CRO services

- According to the FDA's 2023 Annual Report, the Office of Pharmaceutical Quality (OPQ) supported the approval of 29 biologics license applications (including biosimilars) in that fiscal year. Notably, OPQ also supported 55 novel drug approvals, which includes 17 novel biotechnology products

- As pharmaceutical and biotechnology companies prioritize product safety, regulatory compliance, and operational efficiency, the demand for microbiology CRO services is expected to continue rising, making it a critical growth driver for the global market

Opportunity

“Expanding Biologics and Biosimilars Market Creating Demand for Specialized Microbiology Testing”

- The global expansion of biologics and biosimilars represents a major growth opportunity for microbiology CRO services. These products, which include monoclonal antibodies, recombinant proteins, and cell therapies, require highly specialized microbiological testing due to their complexity and sensitivity

- Unlike traditional small-molecule drugs, biologics are produced using living cells, making them more susceptible to microbial contamination. This increases the need for advanced testing such as sterility, mycoplasma, endotoxin, and bioburden assays, which CROs are well-positioned to provide

- The biosimilars market is also growing rapidly as patents for originator biologics expire. To ensure safety and regulatory compliance, biosimilar developers rely on CROs for robust microbial testing, accelerating product development and submission timelines

- Microbiology-focused CROs offering cutting-edge testing technologies, regulatory expertise, and global reach stand to benefit the most from this biologics boom. This trend is further amplified by the push for faster approvals and cost-effective production in emerging and developed markets

For instance,

- According to the U.S. FDA, as of 2023, over 40 biosimilars had been approved, with many more in the pipeline, further intensifying the need for specialized testing support from microbiology CROs to meet regulatory standards

- As the biologics and biosimilars pipeline continues to grow globally, microbiology CROs have a key opportunity to expand their services and capture a larger share of the pharmaceutical testing market by offering targeted, high-value solutions

Restraint/Challenge

“Stringent and Evolving Regulatory Requirements Increase Operational Complexity”

- One of the key challenges facing the microbiology CRO services market is the constantly evolving and increasingly stringent regulatory landscape governing microbiological testing for pharmaceuticals, biologics, and medical devices

- Regulatory authorities such as the U.S. FDA, EMA, and WHO continue to update guidelines and impose higher standards for sterility, endotoxin, and bioburden testing. While these changes are essential for ensuring product safety, they create significant compliance burdens for CROs

- Smaller or mid-sized CROs, in particular, may struggle to keep pace with these regulatory updates due to limited resources, outdated infrastructure, or lack of in-house regulatory expertise. This limits their ability to compete in the global market and serve high-value clients

- Additionally, varying regulatory requirements across regions make it difficult for CROs to standardize their testing services globally. Companies operating in multiple countries must tailor testing protocols and documentation to meet the specific standards of each market, increasing operational complexity and cost

For instance,

- According to the U.S. FDA, frequent warning letters have been issued to manufacturers and laboratories for failing to comply with microbial contamination testing standards, especially in sterile injectable drug facilities, underscoring the high level of scrutiny and enforcement in this domain

- Tightening regulatory requirements are driving CROs to invest significantly in quality systems, staff training, and technology upgrades, creating challenges to profitability and scalability, particularly for smaller market players

Microbiology CRO Services Market Scope

The market is segmented on the basis application, service type, microorganisms, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

Service Type |

|

|

Microorganisms |

|

|

End User |

|

Microbiology CRO Services Market Regional Analysis

“North America is the Dominant Region in the Microbiology CRO Services Market”

- North America leads the global microbiology CRO services market, driven by a robust pharmaceutical and biotechnology industry, well-established CRO infrastructure, and high regulatory compliance standards.

- The U.S holds a significant market share due to increasing R&D investments, the presence of leading pharmaceutical companies, and strong partnerships between CROs and academic institutions.

- The region benefits from a mature regulatory framework (such as FDA guidelines), which encourages pharmaceutical and biotech companies to outsource microbiological testing to specialized CROs to ensure product safety and fast-track regulatory approval.

- Moreover, the growing focus on biologics, personalized medicine, and advanced therapeutic products has further accelerated demand for specialized microbiology services, including sterility testing, endotoxin testing, and microbial identification.

- The presence of major CROs such as Charles River Laboratories, Eurofins Scientific, and Labcorp Drug Development contributes significantly to regional dominance, offering a full suite of microbiological services.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Global Microbiology CRO Services Market, driven by the rapid growth of pharmaceutical manufacturing, expanding clinical trials, and increasing government support for R&D.

- Countries such as China, India, South Korea, and Japan are emerging as major outsourcing hubs, offering cost-effective microbiology services and access to a large patient population for drug development.

- China and India, in particular, are experiencing a surge in contract research activities due to their expanding biotech sectors and government initiatives to strengthen quality control and regulatory standards.

- Japan, with its advanced biopharmaceutical landscape and emphasis on high-quality compliance, continues to be a key market for microbiology CROs offering sophisticated analytical services.

- The growing presence of global CROs and the establishment of state-of-the-art microbiology labs across Asia-Pacific are further propelling market growth by enhancing service availability, speed, and scalability.

Microbiology CRO Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Charles River Laboratories International, Inc. (U.S.)

- Eurofins Scientific SE (Luxembourg)

- SGS SA (Switzerland)

- Labcorp Drug Development (formerly Covance) (U.S.)

- WuXi AppTec (China)

- Pace Analytical Life Sciences (U.S.)

- Nelson Labs (a Sotera Health Company) (U.S.)

- Microbac Laboratories, Inc. (U.S.)

- Intertek Group plc (UK)

- Thermo Fisher Scientific (Patheon division) (U.S.).

Latest Developments in Global Microbiology CRO Services Market

- In August 2023, frontage Laboratories, Inc. and its subsidiary, Frontage Canada, Inc., acquired Nucro-Technics Inc. and its affiliate, Nucro-Technics Holdings, Inc., a pharmaceutical contract research organization offering various services.

- In May 2022, Pacific BioLabs announced the launch of In Vitro Services. These In Vitro Services offer in vitro, cell-based assays supporting the pharmaceutical, biopharma, and medical device industries. The addition of this group to the PBL testing portfolio increases and is complimentary to well-established testing capabilities in our Microbiology, Analytical/Bioanalytical, and In Vivo departments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.