Global Microcars Market

Market Size in USD Billion

CAGR :

%

USD

27.20 Billion

USD

41.05 Billion

2024

2032

USD

27.20 Billion

USD

41.05 Billion

2024

2032

| 2025 –2032 | |

| USD 27.20 Billion | |

| USD 41.05 Billion | |

|

|

|

|

Microcars Market Size

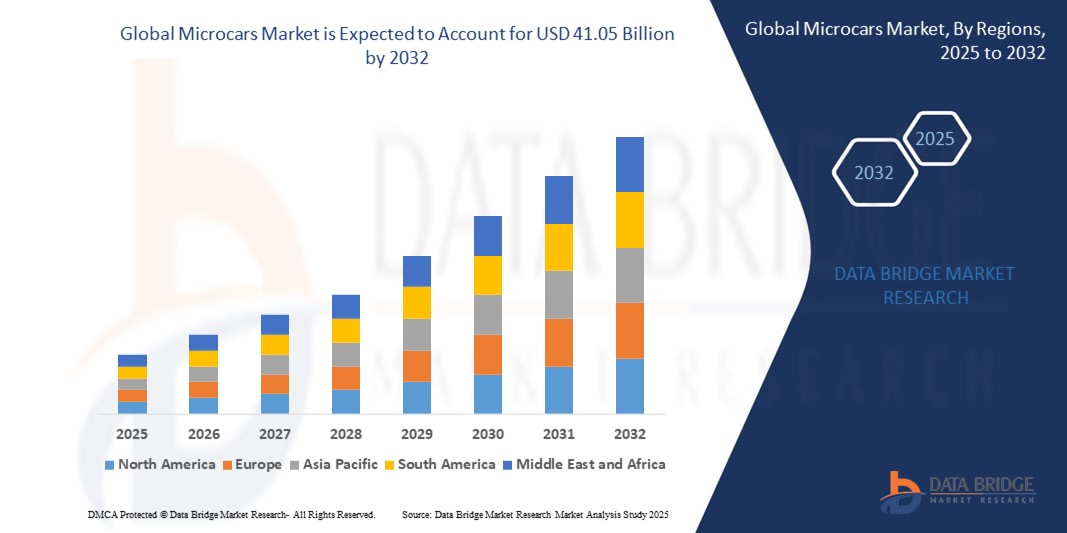

- The global microcars market size was valued at USD 27.20 billion in 2024 and is expected to reach USD 41.05 billion by 2032, at a CAGR of 5.28% during the forecast period

- The market growth is primarily driven by the increasing demand for compact, fuel-efficient vehicles, rapid urbanization, and advancements in electric and hybrid vehicle technologies, particularly in densely populated urban areas

- Rising consumer preference for cost-effective, eco-friendly, and easy-to-park transportation solutions, coupled with supportive government policies promoting electric vehicles, is accelerating the adoption of microcars, significantly boosting industry growth

Microcars Market Analysis

- Microcars, characterized by their compact size and fuel efficiency, are increasingly vital for urban mobility, catering to both personal and commercial applications due to their affordability, maneuverability, and low environmental impact

- The growing demand for microcars is fueled by rising urbanization, increasing fuel costs, and a shift toward sustainable transportation solutions, with electric microcars gaining traction due to advancements in battery technology and charging infrastructure

- North America dominated the microcars market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness, advanced infrastructure, and strong presence of key manufacturers, with the U.S. leading in microcar adoption, particularly in urban centers and for commercial fleets, supported by innovations in electric vehicle technology

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, rising disposable incomes, and government incentives for electric and hybrid vehicles in countries such as China and India

- The 4-wheel microcar segment dominated the largest market revenue share of 77% in 2024, driven by consumer preference for enhanced stability, better handling on rough terrain, and improved steering experience

Report Scope and Microcars Market Segmentation

|

Attributes |

Microcars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Microcars Market Trends

“Increasing Adoption of Electric and Hybrid Microcars”

- The global microcars market is experiencing a notable shift toward the integration of electric and hybrid powertrains, driven by growing environmental concerns and stringent emission regulations.

- Electric microcars, powered by advanced battery technologies, offer eco-friendly and cost-effective transportation, with lower operating and maintenance costs compared to traditional vehicles.

- Hybrid microcars, combining electric motors with internal combustion engines, are gaining traction for their fuel efficiency and extended driving range, appealing to consumers in regions with limited charging infrastructure.

- For instance, companies such as MG Motor India have introduced models such as the MG Comet EV, a compact electric microcar with features such as dual 10.25-inch screens and a 200 km range, catering to urban mobility needs.

- This trend is enhancing the appeal of microcars for both personal and commercial applications, particularly in densely populated urban areas where compact, efficient vehicles are ideal.

- Advancements in lightweight materials and battery technologies are further improving the performance, range, and affordability of electric and hybrid microcars, driving market growth.

Microcars Market Dynamics

Driver

“Rising Demand for Compact and Fuel-Efficient Urban Mobility Solutions”

- Increasing urbanization and traffic congestion in cities worldwide are driving demand for microcars, which are compact, fuel-efficient, and easier to maneuver and park than conventional vehicles.

- Microcars cater to consumer needs for affordable transportation, particularly in emerging markets such as India and China, where rising disposable incomes and cost sensitivity boost adoption.

- Government incentives, such as tax subsidies and exemptions for electric and hybrid microcars, are encouraging manufacturers to expand their offerings and consumers to adopt these vehicles.

- The integration of advanced technologies, such as 4-wheel drive and ADAS is enhancing the safety and appeal of microcars, particularly for personal use in urban environments.

- The proliferation of smart city initiatives and the development of 5G technology are enabling advanced telematics and connectivity features in microcars, supporting applications such as last-mile delivery and car-sharing services.

Restraint/Challenge

“High Initial Costs and Safety Concerns”

- The high upfront costs associated with developing and integrating advanced technologies, such as electric powertrains and ADAS, can be a barrier to adoption, particularly in price-sensitive markets.

- Retrofitting existing vehicles with modern microcar features, such as all-wheel drive or connectivity systems, is complex and expensive, limiting accessibility for some consumers.

- Safety concerns, particularly with 3-wheel microcars, pose a challenge due to their lower stability compared to 4-wheel models, which can deter potential buyers despite their affordability.

- Data privacy and cybersecurity risks associated with connected microcars, which collect and transmit driver and vehicle data, raise concerns about potential breaches and compliance with varying global regulations.

- The lack of a consistent regulatory framework across regions for microcar homologation and emissions standards complicates manufacturing and market expansion for international players.

Microcars market Scope

The market is segmented on the basis of wheels, drive type, fuel types, and application.

- By Wheels

On the basis of wheels, the global microcars market is segmented into 4-wheel microcars and 3-wheel microcars. The 4-wheel microcar segment dominated the largest market revenue share of 77% in 2024, driven by consumer preference for enhanced stability, better handling on rough terrain, and improved steering experience. These vehicles are favored for their fuel efficiency and suitability for urban environments.

The 3-wheel microcar segment is expected to witness significant growth from 2025 to 2032, driven by its compact design and patented tilting technology, which enhances maneuverability in congested urban areas, making it ideal for navigating traffic jams.

- By Drive Type

On the basis of wheels, the global microcars market is segmented into All Wheel Drive (AWD) and 2 Wheel Drive/1 Wheel Drive. The AWD segment captured the largest market revenue share in 2024, attributed to its superior traction and performance in adverse conditions, such as wet or snowy environments, enhancing safety and versatility for urban commuters.

The 2 Wheel Drive/1 Wheel Drive segment is anticipated to experience the fastest growth rate from 2025 to 2032, owing to its affordability, making it more prevalent in developing economies. The lower cost of these vehicles appeals to price-sensitive consumers, particularly in emerging markets.

- By Fuel Types

On the basis of wheels, the global microcars market is segmented into electric, petrol/diesel, and hybrid microcars. The electric segment held the largest market share in 2024, driven by increasing demand for eco-friendly vehicles, lower operating costs, and supportive government policies such as tax incentives and subsidies for electric vehicles.

The hybrid segment is expected to witness the fastest growth from 2025 to 2032, fueled by advancements in hybrid technology, offering a balance of fuel efficiency and extended driving range. This segment appeals to consumers seeking environmentally friendly options with the flexibility of traditional combustion engines.

- By Application

On the basis of wheels, the global microcars market is segmented into commercial and personal applications. The personal segment dominated the market with the largest revenue share in 2024, driven by consumer preference for compact, affordable vehicles for urban commuting, shopping, and short trips. The small size and ease of parking make microcars ideal for city dwellers.

The commercial segment is anticipated to experience rapid growth from 2025 to 2032, propelled by the increasing use of microcars for last-mile delivery and car-sharing services. Their compact size and low operating costs make them suitable for urban logistics and fleet management.

Microcars Market Regional Analysis

- North America dominated the microcars market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness, advanced infrastructure, and strong presence of key manufacturers, with the U.S. leading in microcar adoption, particularly in urban centers and for commercial fleets, supported by innovations in electric vehicle technology

- Consumers prioritize microcars for their affordability, ease of parking, and reduced environmental impact, particularly in densely populated urban areas with high traffic congestion

- Growth is supported by advancements in electric and hybrid vehicle technologies, alongside rising adoption in both commercial and personal applications

U.S. Microcars Market Insight

The U.S. microcars market captured the largest revenue share of 77.3% in 2024 within North America, fueled by strong demand for cost-effective and eco-friendly transportation options. Growing consumer awareness of fuel efficiency and urban space constraints boosts market expansion. The trend towards vehicle electrification and supportive government incentives for low-emission vehicles further enhance market growth. Automakers’ integration of microcars in commercial fleets and personal use complements market dynamics.

Europe Microcars Market Insight

The Europe microcars market is expected to witness significant growth, driven by stringent emission regulations and a focus on sustainable urban mobility. Consumers seek microcars that offer compact designs, improved fuel efficiency, and enhanced maneuverability. Growth is prominent in both 4-wheel and 3-wheel microcar segments, with countries such as Germany and France showing notable adoption due to environmental concerns and urban infrastructure demands.

U.K. Microcars Market Insight

The U.K. market for microcars is expected to experience rapid growth, driven by demand for compact vehicles suited for urban and suburban environments. Increased interest in fuel-efficient and electric microcars, coupled with rising awareness of environmental benefits, encourages adoption. Evolving regulations promoting low-emission vehicles influence consumer preferences, balancing affordability with compliance.

Germany Microcars Market Insight

Germany is expected to witness rapid growth in the microcars market, attributed to its advanced automotive manufacturing sector and strong consumer focus on sustainability and urban mobility. German consumers prefer technologically advanced microcars, particularly electric and hybrid models, that reduce fuel consumption and emissions. The integration of microcars in premium and commercial applications supports sustained market growth.

Asia-Pacific Microcars Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production, rising disposable incomes, and rapid urbanization in countries such as China, India, and Japan. Increasing demand for affordable, compact vehicles for personal and commercial use boosts market growth. Government initiatives promoting electric vehicles and energy efficiency further encourage the adoption of microcars across fuel types.

Japan Microcars Market Insight

Japan’s microcars market is expected to witness rapid growth due to strong consumer preference for compact, high-quality vehicles that enhance urban mobility and fuel efficiency. The presence of major automotive manufacturers and the integration of electric and hybrid microcars in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization and commercial applications also contributes to growth.

China Microcars Market Insight

China holds the largest share of the Asia-Pacific microcars market, propelled by rapid urbanization, increasing vehicle ownership, and growing demand for compact, eco-friendly transportation solutions. The country’s expanding middle class and focus on smart mobility support the adoption of electric and hybrid microcars. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Microcars Market Share

The microcars industry is primarily led by well-established companies, including:

- Toyota Motor Corporation (Japan)

- Honda Motor Co., Ltd. (Japan)

- Suzuki Motor Corporation (Japan)

- Daihatsu Motor Co., Ltd. (Japan)

- Mitsubishi Motors Corporation (Japan)

- Smart (Germany)

- Fiat (Italy)

- Renault (France)

- Aixam-Mega (France)

- Ligier Group (France)

- Microcar (France)

- Tata Motors (India)

- Mahindra Electric (India)

- Chery Automobile Co., Ltd. (China)

- Geely Auto (China)

- BYD Company Ltd. (China)

- SAIC Motor Corporation (China)

- Bajaj Auto Ltd. (India)

- Polaris Inc. (U.S.)

- Club Car (U.S.)

What are the Recent Developments in Global Microcars Market?

- In May 2024, Eli Electric Vehicles introduced the Eli ZERO, a compact electric microcar tailored for urban commuting and short-distance travel. With a top speed of 25 mph and a range of up to 90 miles, the two-seater NEV offers features such as keyless entry, regenerative braking, and a tilting sunroof. To support its U.S. rollout, Eli expanded its production capacity to 4,000 units annually and adopted a dealership-based distribution model. The company began accepting reservations with refundable deposit, aiming to start deliveries in Q3 2024

- In February 2024, Chatenet Group unveiled its CH46e ST and CH46e RR electric microcars, designed to promote sustainable urban mobility. Both models operate with zero CO₂ emissions and incorporate regenerative braking technology, which recaptures energy during deceleration to enhance efficiency. The CH46e ST offers a refined, comfort-oriented experience, while the CH46e RR delivers a sportier aesthetic with bold styling and advanced multimedia features. Powered by a 48V electric motor and LiFePO₄ batteries, these vehicles provide a quiet, eco-friendly ride with a range of up to 120 km

- In February 2024, Mitsubishi Motors Corporation, through its local distributor PT MMKSI, officially launched the Minicab EV L100 EV in Indonesia. This compact electric commercial vehicle was introduced following extensive joint testing with logistics, transport, and tourism companies, demonstrating its suitability for fleet operations and urban delivery services. Locally assembled in Cikarang, the L100 EV offers a range of up to 180 km, regenerative braking, and efficient charging options. Its compact size and low operating costs make it ideal for businesses seeking sustainable mobility solutions

- At CES in January 2024, VinFast made its global debut of the VF 3, a compact electric mini-SUV designed for urban mobility. With bold styling and a practical footprint, the VF 3 offers a driving range of over 125 miles and features a minimalist interior with smart connectivity, including Android Auto and Apple CarPlay. Alongside the VF 3, VinFast also showcased an electric pickup concept, highlighting its expansion into innovative microcar formats. These launches reflect the company’s commitment to accessible, sustainable transportation and its growing presence in the global EV market

- In November 2022, Mumbai-based startup PMV Electric unveiled the EaS-E, a two-seater electric microcar aimed at redefining urban mobility. Designed as a Personal Mobility Vehicle (PMV), the EaS-E features a compact footprint, feet-free driving, regenerative braking, and remote connectivity. It offers three range options—120 km, 160 km, and 200 km—and a top speed of 70 km/h. With over 6,000 pre-orders received, PMV announced plans to begin deliveries by mid-2023. The vehicle is priced from ₹4.79 lakh and is positioned as an affordable, eco-friendly solution for daily commuting

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.