Global Microcontroller For Brake Control System Market

Market Size in USD Billion

CAGR :

%

USD

25.80 Billion

USD

63.43 Billion

2024

2032

USD

25.80 Billion

USD

63.43 Billion

2024

2032

| 2025 –2032 | |

| USD 25.80 Billion | |

| USD 63.43 Billion | |

|

|

|

|

Microcontroller for Brake Control System Market Size

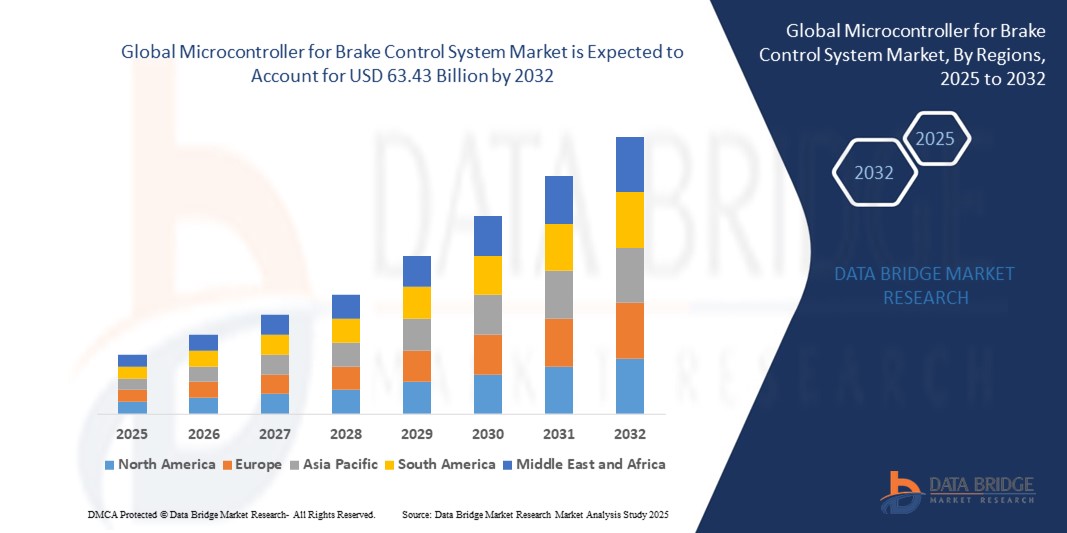

- The global microcontroller for brake control system market size was valued at USD 25.80 billion in 2024 and is expected to reach USD 63.43 billion by 2032, at a CAGR of 11.90% during the forecast period

- The market growth for microcontrollers in brake control systems is largely fueled by increasing adoption of advanced vehicle safety technologies and the shift towards electronic braking solutions in both passenger and commercial vehicles

- Furthermore, stringent government regulations and safety standards worldwide are driving automakers to integrate sophisticated microcontrollers to enhance braking performance, reliability, and vehicle stability. The rising demand for electric and autonomous vehicles further accelerates the need for high-performance microcontrollers capable of real-time processing and seamless integration with other vehicle systems

Microcontroller for Brake Control System Market Analysis

- Microcontrollers for brake control systems are specialized semiconductor devices that manage electronic braking functions such as anti-lock braking systems (ABS), electronic stability control (ESC), and traction control systems (TCS). These microcontrollers enable precise control of brake mechanisms, improving vehicle safety, handling, and performance

- The growing focus on reducing accidents, increasing vehicle electrification, and integrating advanced driver assistance systems (ADAS) is expanding the demand for microcontrollers with enhanced processing power, low latency, and advanced safety features. Rising consumer awareness about vehicle safety and technological advancements in semiconductor design are key factors propelling market growth

- Asia-Pacific dominated the microcontroller for brake control system market with a share of 49.93% in 2024, due to rapid automotive production growth, increasing adoption of advanced driver-assistance systems (ADAS), and stringent vehicle safety regulations across emerging economies

- North America is expected to be the fastest growing region in the microcontroller for brake control system market during the forecast period due to

- Passenger cars segment dominated the market with a market share of 65.5% in 2024, due to increasing penetration of advanced safety technologies and stricter regulatory norms regarding vehicle braking performance. The rising consumer awareness about vehicle safety and the increasing adoption of electric and hybrid passenger cars further bolster the demand for sophisticated brake control microcontrollers in this segment. Passenger cars typically require a high degree of integration between braking systems and other onboard electronics, favoring microcontrollers that provide reliable performance and compact design

Report Scope and Microcontroller for Brake Control System Market Segmentation

|

Attributes |

Microcontroller for Brake Control System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Microcontroller for Brake Control System Market Trends

Growing Integration with ADAS Systems

- The market is expanding due to increasing integration of microcontrollers with advanced driver-assistance systems (ADAS), enabling enhanced safety features such as anti-lock braking (ABS), electronic stability control (ESC), and brake-by-wire technologies that improve vehicle control and accident prevention

- For instance, manufacturers are developing highly sophisticated 32-bit microcontrollers optimized for real-time data processing from multiple sensors within ADAS architectures, supporting rapid decision-making in automated braking, collision avoidance, and adaptive cruise control systems, with key players including Infineon, NXP, and Texas Instruments innovating in this space

- Integration with AI and machine learning algorithms within microcontrollers facilitates predictive maintenance and improved fault detection in brake systems

- Increasing demand for electric and autonomous vehicles is driving adoption of microcontrollers that manage complex braking functions in these advanced platforms

- The trend toward networked vehicle systems and over-the-air software updates is promoting microcontrollers designed for secure connectivity and lifecycle management within brake control modules

- Growing emphasis on customizable and modular microcontroller solutions supports diverse vehicle types from passenger cars to commercial and heavy-duty trucks

Microcontroller for Brake Control System Market Dynamics

Driver

Increasing Emphasis on Vehicle Safety Regulations

- Stricter global vehicle safety regulations and mandatory implementation of electronic braking systems are strong growth drivers, compelling OEMs to deploy advanced microcontrollers that meet compliance with standards such as ISO 26262 functional safety and UNECE braking directives

- For instance, regulations in the U.S., Europe, and China require advanced braking functions including ABS, ESC, and brake assist to be standard on new vehicles, accelerating microcontroller demand in passenger and commercial vehicle segments

- Increasing public and government focus on reducing road fatalities and enhancing accident prevention technologies fuels investment in brake control systems integrated with intelligent microcontrollers

- Incentives and mandates promoting ADAS and autonomous vehicle technologies indirectly boost microcontroller uptake by requiring integrated braking solutions for safety-critical applications

- Regulations also drive innovation in fail-safe and redundant microcontroller architectures to ensure braking system reliability and fault tolerance under all operating conditions

Restraint/Challenge

Challenges Associated with Automotive Supply Chain Disruptions

- Disruptions in the global automotive supply chain—including shortages of semiconductor components and logistics delays—pose significant challenges to the timely production and delivery of microcontrollers for brake control systems

- For instance, the semiconductor shortage experienced globally since 2020 has led to extended lead times and increased costs for automotive-grade microcontrollers, affecting production schedules and profitability for OEMs and tier-1 suppliers

- Complexity in supply chain management and geopolitical factors impacting chip manufacturing regions create uncertainty and supply volatility, forcing manufacturers to seek alternative sourcing or redesign solutions

- High dependency on specialized foundries and strict automotive quality standards limit flexibility in sourcing, making the brake control microcontroller segment particularly vulnerable to disruptions

- The need for continual product validation and compliance testing amidst supply changes adds operational burdens and raises costs, potentially delaying innovation and market introduction of next-generation microcontrollers

Microcontroller for Brake Control System Market Scope

The market is segmented on the basis of product type, vehicle type, sales channel, and application.

- By Product Type

On the basis of product type, the microcontroller for brake control system market is segmented into 16-bit microcontroller, 32-bit microcontroller, and 64-bit microcontroller. The 32-bit microcontroller segment dominated the largest market revenue share in 2024, owing to its optimal balance between processing power, energy efficiency, and cost-effectiveness. These microcontrollers offer enhanced computational capabilities essential for managing complex braking algorithms and real-time safety functions in modern vehicles. Their compatibility with advanced automotive protocols and ability to handle multitasking efficiently make them the preferred choice among automotive OEMs. Furthermore, 32-bit microcontrollers facilitate integration with advanced driver-assistance systems (ADAS), boosting their demand in brake control applications.

The 64-bit microcontroller segment is anticipated to witness the fastest growth rate during 2025 to 2032, driven by the rising demand for high-performance computing in electric and autonomous vehicles. These microcontrollers support advanced functionalities such as predictive braking, machine learning algorithms, and real-time data analytics, essential for next-generation brake control systems. The growing trend towards sophisticated vehicle safety features and increased computational requirements in commercial vehicles is accelerating the adoption of 64-bit microcontrollers.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. Passenger cars held the largest market revenue share of 65.5% in 2024, primarily due to the increasing penetration of advanced safety technologies and stricter regulatory norms regarding vehicle braking performance. The rising consumer awareness about vehicle safety and the increasing adoption of electric and hybrid passenger cars further bolster the demand for sophisticated brake control microcontrollers in this segment. Passenger cars typically require a high degree of integration between braking systems and other onboard electronics, favoring microcontrollers that provide reliable performance and compact design.

Commercial vehicles are projected to exhibit the fastest growth rate from 2025 to 2032, propelled by the rising focus on vehicle safety, fuel efficiency, and regulatory compliance in freight, logistics, and public transportation sectors. The integration of electronic braking systems and automated stability control in heavy-duty trucks and buses demands robust microcontroller solutions capable of handling complex control logic and harsh operating environments. Growth in commercial vehicle production, along with increasing investments in intelligent transport systems, is expected to drive this segment’s rapid expansion.

- By Sales Channel

On the basis of sales channel, the market is categorized into OEM (Original Equipment Manufacturer) and aftermarket. The OEM segment dominated the largest market revenue share in 2024, owing to direct integration of microcontrollers during vehicle manufacturing and stringent quality control standards mandated by automotive companies. OEM partnerships ensure tailored microcontroller solutions that meet specific vehicle braking system requirements, providing higher reliability and compliance with safety regulations. The rising production of new vehicles with embedded advanced brake control systems also fuels the demand in this channel.

The aftermarket segment is expected to witness the fastest growth rate during 2025 to 2032, driven by increasing vehicle fleet ages and rising demand for replacement or upgraded brake control system components. Vehicle owners are increasingly opting to retrofit or enhance their existing braking systems with advanced microcontrollers to improve safety and performance. The growing trend of vehicle customization and maintenance services, especially in regions with large vehicle populations, supports the expansion of the aftermarket sales channel.

- By Application

On the basis of application, the microcontroller for brake control system market is segmented into Anti-lock Braking System (ABS), Electronic Stability Control (ESC), Traction Control System (TCS), Electric Parking Brake (EPB), and others. The ABS segment dominated the largest market revenue share in 2024, as it remains a critical safety feature mandatory in many regions worldwide. Microcontrollers in ABS systems regulate wheel speed sensors and hydraulic braking pressure to prevent wheel lockup, enhancing vehicle control and stopping distance in emergency braking scenarios. The widespread adoption of ABS in passenger and commercial vehicles reinforces this segment’s leadership position.

The Electronic Stability Control (ESC) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing government regulations enforcing ESC installation in new vehicles and rising consumer demand for enhanced vehicle safety. ESC microcontrollers coordinate data from multiple sensors to detect and mitigate loss of control by adjusting braking force and engine power. The growing focus on accident prevention technologies, especially in electric and autonomous vehicles, drives the accelerated adoption of ESC applications requiring advanced microcontroller solutions.

Microcontroller for Brake Control System Market Regional Analysis

- Asia-Pacific dominated the microcontroller for brake control system market with the largest revenue share of 49.93% in 2024, driven by rapid automotive production growth, increasing adoption of advanced driver-assistance systems (ADAS), and stringent vehicle safety regulations across emerging economies

- Rising demand for passenger and commercial vehicles equipped with electronic braking systems is fueling microcontroller integration in the region. Strong manufacturing capabilities, presence of major semiconductor companies, and government incentives supporting automotive electronics development are accelerating market expansion

- China leads the region with its vast automotive base, followed by fast growth in India due to increasing vehicle safety awareness and electrification trends

China Microcontroller for Brake Control System Market Insight

China held the largest share in the Asia-Pacific market in 2024, supported by its dominant automotive manufacturing industry and escalating implementation of electronic brake control systems in new vehicles. The government’s push for safer and greener vehicles is boosting demand for high-performance microcontrollers capable of handling ABS, ESC, and other brake applications. Domestic semiconductor manufacturers are scaling up production to meet local demand, while increasing investments in R&D foster innovation in automotive-grade microcontrollers. The growing adoption of electric vehicles (EVs) and autonomous driving technologies further reinforces China’s leadership position in this market.

India Microcontroller for Brake Control System Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rising vehicle production, government initiatives promoting automotive safety standards, and growing demand for commercial vehicles equipped with advanced braking systems. The expansion of domestic semiconductor manufacturing and increasing adoption of electric and hybrid vehicles are accelerating microcontroller market growth. Improving infrastructure for automotive electronics and increasing awareness of vehicle safety features among consumers are further propelling demand. In addition, growth in the aftermarket for brake control system upgrades is contributing to India’s rapid market expansion.

Europe Microcontroller for Brake Control System Market Insight

Europe remains a significant contributor to the global microcontroller for brake control system market, driven by stringent vehicle safety regulations, high adoption of advanced braking technologies, and presence of leading automotive manufacturers. Countries such as Germany, France, and Italy exhibit strong demand for electronic stability control and traction control applications, requiring reliable and high-performance microcontrollers. The region’s focus on reducing vehicle emissions through electrification and hybrid technologies is further pushing innovation in brake control microcontrollers. Europe also benefits from a mature automotive supply chain, robust R&D infrastructure, and increasing integration of safety electronics in commercial and passenger vehicles.

Germany Microcontroller for Brake Control System Market Insight

Germany’s market is fueled by its advanced automotive manufacturing sector, rigorous safety standards, and emphasis on electronic and autonomous vehicle technologies. Strong collaboration between semiconductor manufacturers and automotive OEMs supports the development of specialized microcontrollers for brake control applications. High consumer demand for premium vehicles with advanced safety systems ensures steady adoption of ESC, ABS, and electronic parking brake microcontrollers. Germany’s leadership in automotive innovation and biomechanical research underpins the growth of cutting-edge brake control microcontrollers optimized for performance and reliability.

U.K. Microcontroller for Brake Control System Market Insight

The U.K. market benefits from a well-established automotive sector, increasing vehicle safety regulations, and growing electrification trends. Domestic manufacturers and technology firms are focusing on developing microcontrollers that enable seamless integration with connected vehicle platforms and ADAS. Government initiatives encouraging automotive innovation post-Brexit are strengthening the local semiconductor ecosystem. The rising demand for aftermarket upgrades and the adoption of electric parking brake systems contribute to steady market growth. Sustainability efforts also drive interest in energy-efficient microcontroller solutions.

North America Microcontroller for Brake Control System Market Insight

North America is expected to grow at the fastest CAGR from 2025 to 2032, propelled by high consumer focus on vehicle safety, rapid adoption of advanced braking technologies, and the presence of major automotive and semiconductor companies. Increasing incidences of road accidents and stringent safety mandates are driving the integration of electronic stability control and traction control microcontrollers. The expanding electric vehicle market and the push toward autonomous driving technologies further boost demand. The region’s mature automotive aftermarket and widespread adoption of OEM and retrofit solutions are accelerating microcontroller sales.

U.S. Microcontroller for Brake Control System Market Insight

The U.S. accounted for the largest share in the North American market in 2024, supported by strong regulatory frameworks enforcing advanced brake control systems and substantial investments in automotive R&D. The country’s extensive automotive production base and consumer preference for safety-focused vehicles drive demand for microcontrollers used in ABS, ESC, and electric parking brake systems. Growing electric and autonomous vehicle adoption necessitates sophisticated microcontroller solutions, fostering innovation. Furthermore, the presence of leading OEMs and semiconductor manufacturers facilitates rapid development and deployment of cutting-edge brake control microcontrollers.

Microcontroller for Brake Control System Market Share

The microcontroller for brake control system industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Denso Corporation (Japan)

- Aptiv (Ireland)

- Infineon Technologies AG (Germany)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- Texas Instruments Incorporated (U.S.)

- STMicroelectronics (Switzerland)

- Hitachi Astemo, Ltd. (Japan)

- Panasonic Corporation (Japan)

Latest Developments in Global Microcontroller for Brake Control System Market

- In January 2025, Infineon Technologies AG launched the PSOC Control family, a new line of high-performance Arm® Cortex-M33 based microcontrollers. This launch represents a significant advancement in microcontroller technology, offering scalable performance, enhanced efficiency, and robust security features tailored for motor control and power conversion applications. With comprehensive design tools such as ModusToolbox, Infineon empowers developers to accelerate innovation in diverse sectors, including automotive brake control systems. This development strengthens Infineon’s position in the market by addressing the growing demand for efficient, high-reliability microcontrollers capable of supporting complex automotive braking and power management requirements, thereby enhancing system safety and performance

- In February 2024, NXP Semiconductors unveiled its latest microcontroller platform specifically engineered for next-generation brake-by-wire systems. This platform integrates advanced sensor interfaces, real-time processing capabilities, and cybersecurity measures to support seamless integration with electronic braking systems (EBS) and advanced driver assistance systems (ADAS). By targeting the evolving autonomous vehicle and smart braking market, NXP’s innovation accelerates the deployment of safer and more efficient automotive braking technologies. This development positions NXP as a key player in enabling the future of autonomous driving, where reliable and secure brake control microcontrollers are critical

- In January 2024, Infineon Technologies AG announced a new generation of microcontrollers designed explicitly for automotive brake control systems. These microcontrollers feature enhanced processing power, advanced safety functionalities, and improved power efficiency to comply with stringent automotive standards. This strategic launch addresses the automotive industry's increasing demand for dependable and high-performance brake control solutions, reinforcing Infineon’s competitive edge in supplying critical components that ensure vehicle safety and operational reliability in modern braking applications

- In April 2022, Nanjing SemiDrive Technology Ltd. introduced the E3 series of ARM-based automotive microcontrollers. This product launch marked a significant milestone for the Chinese semiconductor industry by offering locally developed microcontrollers tailored for automotive applications, including brake control systems. The E3 series supports the region’s push towards automotive electrification and smart vehicle technologies, reducing dependence on foreign suppliers and promoting innovation within the domestic market. This advancement is expected to enhance market competitiveness and contribute to the broader adoption of advanced brake control microcontrollers in China and beyond

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.