Global Microcontroller For Electronic Power Steering Market

Market Size in USD Billion

CAGR :

%

USD

27.89 Billion

USD

41.84 Billion

2024

2032

USD

27.89 Billion

USD

41.84 Billion

2024

2032

| 2025 –2032 | |

| USD 27.89 Billion | |

| USD 41.84 Billion | |

|

|

|

|

Microcontroller for Electronic Power Steering Market Size

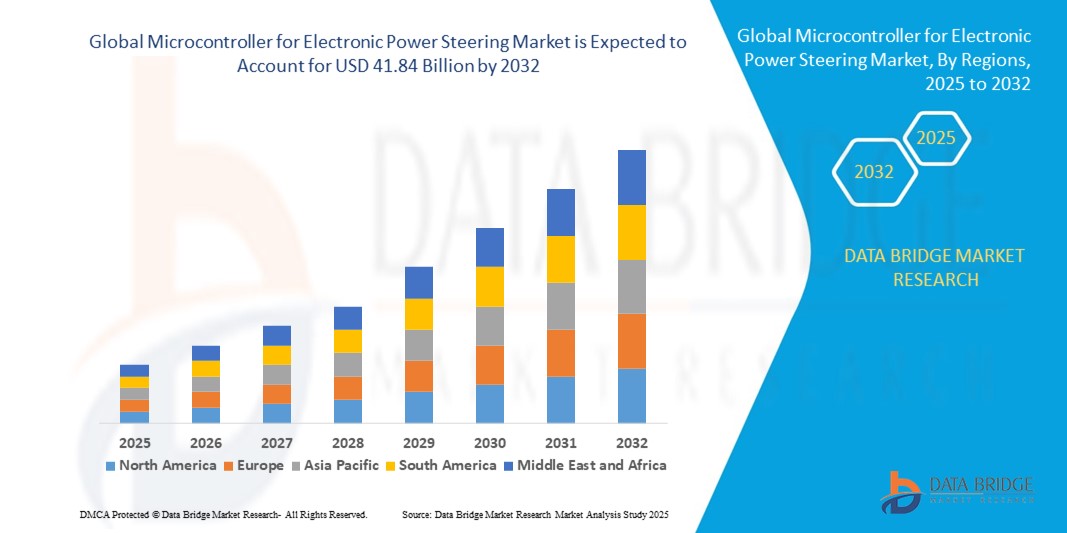

- The global microcontroller for electronic power steering market size was valued at USD 27.89 billion in 2024 and is expected to reach USD 41.84 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electronic power steering systems over hydraulic steering for improved fuel efficiency, rising production of passenger and commercial vehicles, and advancements in microcontroller technology enhancing steering precision and safety

- In addition, drivers include stringent safety regulations, growing penetration of advanced driver assistance systems (ADAS), and rising demand for EV-compatible steering systems across global automotive markets

Microcontroller for Electronic Power Steering Market Analysis

- Automakers are increasingly integrating high-performance microcontrollers with EPS systems to deliver responsive steering control, reduce driver fatigue, and improve energy efficiency

- The shift toward electric and hybrid vehicles is accelerating demand for EPS-compatible microcontrollers that offer high processing power, low energy consumption, and seamless communication with vehicle ECUs

- North America dominated the global microcontroller for electronic power steering market with the largest revenue share in 2024, driven by the strong presence of leading automotive OEMs, high adoption of advanced driver assistance systems (ADAS), and the growing penetration of electric and hybrid vehicles.

- Asia-Pacific region is expected to witness the highest growth rate in the global microcontroller for electronic power steering market, driven by increasing vehicle production in countries such as China, Japan, South Korea, and India, along with growing demand for lightweight, fuel-efficient, and electronically controlled steering systems

- The MCU segment dominated the market with the largest market revenue share in 2024, driven by its critical role in processing steering inputs, controlling motor functions, and integrating with advanced driver-assistance systems (ADAS). Automotive MCUs are valued for their high processing power, real-time response capabilities, and compliance with functional safety standards, making them indispensable for modern EPS systems

Report Scope and Microcontroller for Electronic Power Steering Market Segmentation

|

Attributes |

Microcontroller for Electronic Power Steering Key Market Insights |

|

Segments Covered |

• By Component: Microcontroller Unit (MCU), Power Management Integrated Circuit (PMIC), and Sensors • By Application: Passenger Cars and Commercial Vehicles • By Technology: CAN Bus, and LIN Bus • By Vehicle Type: Conventional EPS and Electric EPS • By Sales Channel: OEMs and Aftermarket |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Increasing Integration Of EPS With Advanced Driver Assistance Systems (ADAS) |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Microcontroller for Electronic Power Steering Market Trends

Integration of Advanced Microcontrollers to Enhance Steering Precision and Energy Efficiency

- The growing demand for fuel-efficient vehicles and stricter emission norms are accelerating the integration of advanced microcontrollers in electronic power steering systems. These MCUs enable precise control of steering torque, reduce energy consumption, and support advanced driver assistance systems (ADAS), enhancing both safety and driving comfort

- Increasing adoption of electric and hybrid vehicles is fueling the need for high-performance microcontrollers capable of managing variable steering loads and regenerative functionalities. This trend supports overall vehicle efficiency and extends battery life, making MCUs critical for next-generation mobility solutions

- Advancements in semiconductor manufacturing, including smaller node sizes and higher processing speeds, are allowing MCUs to handle complex algorithms for torque vectoring, lane-keeping assist, and autonomous driving features. This technological evolution is enabling smarter and more adaptive steering responses

- The shift toward steer-by-wire technology is further boosting demand for robust microcontrollers with enhanced safety redundancy and fail-safe features. These systems rely heavily on real-time signal processing and fault detection, areas where modern MCUs are increasingly specialized

- In 2024, several Tier 1 suppliers announced collaborations with semiconductor manufacturers to co-develop MCUs optimized for EPS applications, aiming to reduce latency, improve thermal efficiency, and ensure compatibility with evolving automotive communication protocols such as CAN FD and Ethernet

Microcontroller for Electronic Power Steering Market Dynamics

Driver

Rising Demand for Advanced Steering Systems in EVs and Autonomous Vehicles

- Increasing sales of electric and autonomous vehicles are driving the adoption of electronic power steering systems that require high-performance MCUs for precise and adaptive control. These systems not only improve maneuverability and reduce driver effort but also enable advanced safety features, making them indispensable in modern vehicle architectures. The combination of efficiency gains and seamless integration with driver assistance technologies is accelerating global demand

- Stringent fuel economy and emission regulations are pushing automakers to replace traditional hydraulic steering with electric solutions, creating a surge in MCU demand for EPS integration. Electric systems significantly reduce parasitic energy losses compared to hydraulics, contributing to compliance with environmental policies. This regulatory push is fostering innovation in MCU efficiency and thermal management for steering systems

- Growing consumer preference for vehicles with enhanced comfort and safety features, including lane departure warning and parking assist, is boosting the role of microcontrollers in enabling these functionalities within EPS systems. Modern MCUs process steering inputs in milliseconds, ensuring responsive and smooth handling. This ability to integrate multiple assistance systems into one control platform further increases their market appeal

- Automakers are investing heavily in R&D to develop EPS systems compatible with Level 2+ and Level 3 autonomous driving, further increasing reliance on MCUs for high-speed data processing and control. These systems require redundancy, fail-safe mechanisms, and real-time decision-making, all of which are heavily dependent on MCU performance. The growing sophistication of self-driving algorithms is directly influencing MCU architecture evolution

- For instance, in 2024, global EV production rose by over 30%, prompting multiple OEMs to upgrade EPS hardware and software platforms, directly expanding the market for automotive-grade MCUs. These upgrades often include higher computational capacity, advanced diagnostics, and integration with over-the-air update systems. This surge in EV output has created a ripple effect across the semiconductor supply chain for EPS components

Restraint/Challenge

High Development Costs and Semiconductor Supply Chain Constraints

- Designing automotive-grade MCUs with high processing capacity, low power consumption, and functional safety compliance (ISO 26262) significantly increases R&D expenses, raising overall EPS system costs. Such MCUs undergo extensive validation for thermal stability, electromagnetic compatibility, and long-term durability. This cost burden can deter smaller suppliers from entering the market

- The global semiconductor shortage, exacerbated by geopolitical tensions and natural disasters, continues to disrupt MCU supply for automotive manufacturers, leading to production delays and cost volatility. EPS manufacturers are forced to seek alternative sourcing strategies or redesign systems for available chipsets. These disruptions have intensified the push for regional semiconductor fabrication facilities

- Integration of advanced communication interfaces and cybersecurity features in MCUs adds to design complexity, extending time-to-market for new EPS models. Enhanced protocols such as CAN FD and automotive Ethernet require rigorous firmware development and testing. Cybersecurity compliance, including secure boot and encrypted communication, further lengthens the development cycle

- Dependence on a limited number of semiconductor fabrication facilities increases vulnerability to capacity constraints, impacting MCU availability for EPS suppliers. Concentration of chip production in certain geographies exposes the market to risks from political instability or trade restrictions. This lack of diversification can significantly affect lead times and pricing stability

- In 2023, a major chip production disruption in Asia led to a temporary halt in EPS assembly lines for several OEMs, highlighting the sector’s supply chain fragility. This incident underscored the importance of supply chain resilience strategies, such as multi-sourcing agreements and buffer inventory management. As a result, OEMs are now reevaluating long-term supplier relationships to mitigate future risks

Microcontroller for Electronic Power Steering Market Scope

The market is segmented on the basis of component, application, technology, vehicle type, and sales channel.

- By Component

On the basis of component, the microcontroller for electronic power steering market is segmented into microcontroller unit (MCU), power management integrated circuit (PMIC), and sensors. The MCU segment dominated the market with the largest market revenue share in 2024, driven by its critical role in processing steering inputs, controlling motor functions, and integrating with advanced driver-assistance systems (ADAS). Automotive MCUs are valued for their high processing power, real-time response capabilities, and compliance with functional safety standards, making them indispensable for modern EPS systems.

The sensors segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for precise torque, position, and speed measurements to enhance steering accuracy and driver comfort. These sensors enable adaptive steering functions, integration with lane-keeping assist, and improved safety, driving their adoption in both conventional and electric EPS systems.

- By Application

On the basis of application, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment held the largest market revenue share in 2024 due to the rapid adoption of EPS in mid-range and premium vehicle categories, driven by rising consumer demand for enhanced handling and fuel efficiency. OEMs are increasingly equipping passenger cars with advanced MCU-controlled EPS systems to support safety features and lightweight vehicle architectures.

The commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing electrification in trucks and buses and the need for high-durability, low-maintenance steering solutions. The integration of MCUs in commercial EPS systems ensures improved maneuverability, reduced driver fatigue, and better energy efficiency.

- By Technology

On the basis of technology, the market is segmented into CAN Bus and LIN Bus. The CAN Bus segment accounted for the largest market revenue share in 2024, driven by its robust data transmission capabilities, high reliability, and compatibility with safety-critical automotive applications. CAN Bus technology supports complex EPS functionalities, making it the preferred choice for both OEMs and Tier-1 suppliers.

The LIN Bus segment is expected to witness the fastest growth rate from 2025 to 2032 due to its cost-effectiveness, simple architecture, and suitability for low-bandwidth EPS communication needs. It is increasingly being used in entry-level and small vehicle platforms where affordability and basic functionality are prioritized.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into conventional EPS and electric EPS. The conventional EPS segment dominated the market in 2024 owing to its widespread use in existing vehicle fleets and relatively lower system complexity compared to fully electric steering solutions. OEMs continue to enhance conventional EPS with improved MCU capabilities to extend their lifecycle.

The electric EPS segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the global shift toward EV adoption and the need for highly efficient, software-driven steering systems. Electric EPS offers superior integration with autonomous driving technologies, further boosting MCU demand.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEMs and aftermarket. The OEMs segment held the largest revenue share in 2024, attributed to the direct integration of advanced MCU-based EPS systems into new vehicles during manufacturing. Strong partnerships between MCU suppliers and automotive manufacturers are enhancing technological innovation in this segment.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the replacement and upgrade of EPS components in aging vehicle fleets. Rising availability of advanced retrofit MCU kits for steering systems is also contributing to aftermarket expansion.

Microcontroller for Electronic Power Steering Market Regional Analysis

• North America dominated the global microcontroller for electronic power steering market with the largest revenue share in 2024, driven by the strong presence of leading automotive OEMs, high adoption of advanced driver assistance systems (ADAS), and the growing penetration of electric and hybrid vehicles.

• Automakers in the region increasingly integrate high-performance MCUs into EPS systems to enhance steering precision, improve fuel efficiency, and support autonomous driving functionalities.

• This dominance is further supported by robust R&D investments, well-established semiconductor manufacturing infrastructure, and favorable government regulations promoting vehicle safety and low emissions.

U.S. Microcontroller for EPS Market Insight

The U.S. microcontroller for electronic power steering market captured the largest revenue share within North America in 2024, fueled by rapid adoption of connected and autonomous vehicle technologies. Increasing demand for luxury and high-performance vehicles, combined with stringent fuel efficiency standards, is driving the shift from hydraulic to electronic power steering. Strong collaborations between semiconductor companies and automotive manufacturers, alongside expanding EV infrastructure, are accelerating market growth in the country.

Europe Microcontroller for EPS Market Insight

The Europe microcontroller for EPS market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict EU emission standards, rising electric vehicle adoption, and the region’s focus on safety and automation. The integration of MCUs in EPS systems aligns with Europe’s sustainability goals, offering improved steering efficiency and reduced energy consumption. Additionally, strong demand for premium vehicles and advanced steering technologies in countries such as Germany, France, and the U.K. is fueling market expansion.

U.K. Microcontroller for EPS Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of electric and hybrid vehicles and advancements in semi-autonomous driving systems. Government incentives promoting EV purchases, coupled with the country’s strong engineering and automotive design expertise, are encouraging the integration of advanced MCUs in EPS applications.

Germany Microcontroller for EPS Market Insight

Germany’s microcontroller for EPS market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by its position as a global automotive manufacturing hub. The country’s emphasis on innovation, engineering excellence, and the adoption of cutting-edge steering solutions is fostering rapid MCU integration. Furthermore, collaborations between domestic automakers and semiconductor producers are ensuring continuous technological advancement in EPS systems.

Asia-Pacific Microcontroller for EPS Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, led by China, Japan, and India. Rising vehicle production, government-backed EV initiatives, and the increasing localization of MCU manufacturing are fueling rapid growth. Expanding middle-class populations, urbanization, and the demand for improved vehicle handling are further driving adoption.

Japan Microcontroller for EPS Market Insight

Japan’s market is expected to witness the fastest growth rate from 2025 to 2032, driven by its leadership in automotive technology, commitment to fuel efficiency, and strong EV adoption. Japanese automakers’ focus on integrating EPS systems with autonomous driving features is increasing demand for high-speed, reliable MCUs. The country’s well-established electronics manufacturing ecosystem also supports continuous innovation in MCU design and production.

China Microcontroller for EPS Market Insight

China accounted for the largest share of the Asia-Pacific microcontroller for EPS market in 2024, driven by rapid vehicle electrification, strong domestic MCU manufacturing capacity, and supportive government policies promoting smart mobility. The country’s role as a major automotive and electronics production hub enables cost-efficient mass adoption of advanced EPS systems, particularly in both passenger and commercial vehicles.

Microcontroller for Electronic Power Steering Market Share

The microcontroller for electronic power steering industry is primarily led by well-established companies, including:

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Renesas Electronics Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Cypress Semiconductor Corporation (U.S.)

- Microchip Technology Inc. (U.S.)

- Semiconductor Componants Industries, LLC (U.S.)

- ROHM CO., LTD. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Maxim Integrated (U.S.)

- Analog Devices, Inc. (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Silicon Laboratories (U.S.)

Latest Developments in Global Microcontroller for Electronic Power Steering Market

- In 2023, Infineon Technologies AG launched a new family of microcontrollers designed for electronic power steering applications, aimed at delivering higher processing performance, improved reliability, and enhanced control for next-generation automotive systems. The introduction of these MCUs is expected to boost the adoption of advanced EPS solutions, enabling automakers to improve vehicle safety, precision, and energy efficiency, while strengthening Infineon’s position in the global automotive semiconductor market

- In 2023, STMicroelectronics developed a new power management integrated circuit (PMIC) for electric power steering systems, offering optimized power delivery, efficient thermal management, and reduced energy consumption. This development supports the growing demand for lightweight, high-performance EPS solutions, enhances system reliability, and positions STMicroelectronics as a key contributor to the advancement of electric and autonomous vehicle technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Microcontroller For Electronic Power Steering Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Microcontroller For Electronic Power Steering Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Microcontroller For Electronic Power Steering Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.