Global Microcontroller For Functional Safety Technology Market

Market Size in USD Billion

CAGR :

%

USD

3.77 Billion

USD

6.88 Billion

2024

2032

USD

3.77 Billion

USD

6.88 Billion

2024

2032

| 2025 –2032 | |

| USD 3.77 Billion | |

| USD 6.88 Billion | |

|

|

|

|

Microcontroller for Functional Safety Technology Market Size

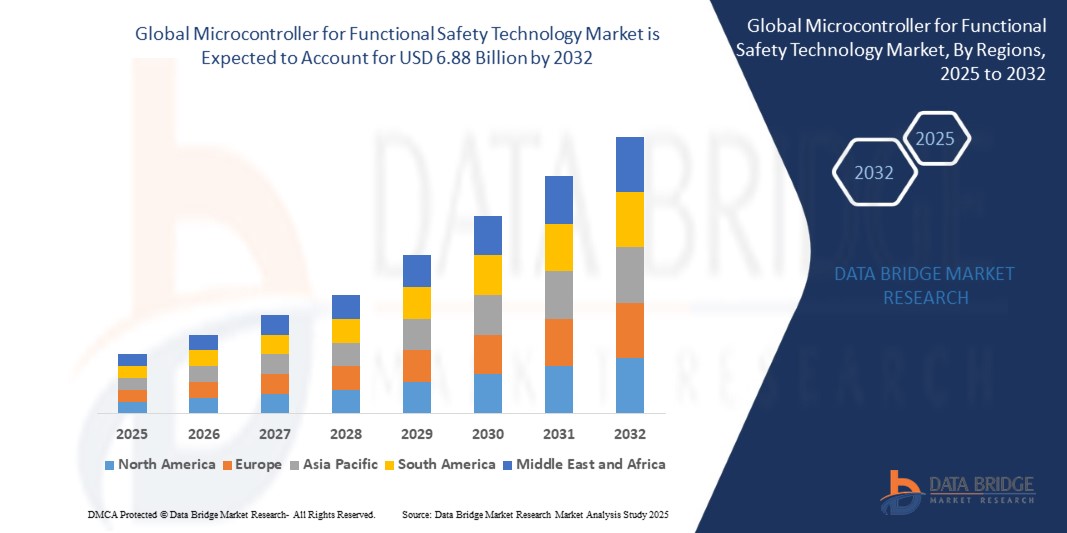

- The global microcontroller for functional safety technology market size was valued at USD 3.77 billion in 2024 and is expected to reach USD 6.88 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of functional safety standards across industries such as automotive, industrial machinery, aerospace, and medical devices, driven by stringent regulatory frameworks and the rising complexity of safety-critical systems

- Furthermore, the growing need for high-reliability microcontrollers with built-in safety mechanisms to ensure fault detection, redundancy, and compliance with standards such as ISO 26262 and IEC 61508 is accelerating the uptake of safety-certified MCU solutions, thereby significantly boosting the industry's growth

Microcontroller for Functional Safety Technology Market Analysis

- Microcontrollers for functional safety technology are specialized integrated circuits designed to perform critical safety functions with high reliability in applications where failure could result in hazards. These MCUs feature built-in diagnostics, redundancy, and compliance-ready architectures to meet strict safety integrity requirements across automotive, industrial, medical, and aerospace systems

- The escalating demand for functional safety microcontrollers is primarily fueled by the surge in autonomous vehicle technologies, Industry 4.0 automation, and advanced medical equipment, coupled with the growing emphasis on meeting international safety certifications to ensure operational security and reduce the risk of catastrophic failures

- North America dominated the microcontroller for functional safety technology market with a share of 34.5% in 2024, due to stringent safety regulations in automotive, industrial machinery, and medical sectors, alongside advanced manufacturing capabilities and early adoption of certified microcontrollers

- Asia-Pacific is expected to be the fastest growing region in the microcontroller for functional safety technology market during the forecast period due to rapid industrialization, urbanization, and the expansion of automotive manufacturing hubs

- Single-core segment dominated the market with a market share of 58.9% in 2024, due to its long-standing use in safety-critical applications where deterministic performance and predictable execution are essential. Single-core microcontrollers remain a preferred choice in applications with well-defined safety functions, as their simpler architecture facilitates easier certification to safety standards such as ISO 26262 and IEC 61508. They are widely adopted in cost-sensitive environments where processing demands are moderate and reliability is paramount. In addition, their lower power consumption and minimal design complexity make them attractive for embedded safety systems in industrial machinery and medical devices

Report Scope and Microcontroller for Functional Safety Technology Market Segmentation

|

Attributes |

Microcontroller for Functional Safety Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Microcontroller for Functional Safety Technology Market Trends

Rising Technological Advancements

- The market is expanding as microcontroller architectures evolve to incorporate advanced features such as AI-driven fault detection, digital twins, and real-time data analytics, enhancing the safety integrity of industrial and automotive systems that must meet increasingly complex safety standards

- For instance, semiconductor companies are releasing next-generation microcontrollers equipped for safety-critical applications, supporting compliance with ISO 26262 and IEC 61508 standards in sectors such as automotive, robotics, and process control

- Integration of functional safety microcontrollers with IoT connectivity enables remote monitoring, predictive maintenance, and automated safety responses, advancing smart factory and Industry 4.0 initiatives across global manufacturing hubs

- Enhanced in-hardware support for cybersecurity and encrypted communications aligns with the convergence of functional safety and digital risk management, reducing vulnerabilities in industrial automation and vehicle platforms

- The development of specialized microcontrollers for autonomous vehicles and collaborative robotics is accelerating, with manufacturers investing in embedded redundancy and advanced error correction for mission-critical operations

- Growing collaboration between microcontroller vendors and safety certification bodies is streamlining adoption of pre-certified microcontrollers, expediting time-to-market for end-user products and increasing reliability in regulated industries

Microcontroller for Functional Safety Technology Market Dynamics

Driver

Increasing Focus on Functional Safety Compliance

- Stricter global regulations and industrial standards are driving manufacturers to prioritize functional safety compliance, triggered by the need to avoid operational, legal, and reputational risks in automotive, medical, energy, and factory automation segments

- For instance, automotive OEMs are integrating safety-certified microcontrollers in electric vehicles to fulfill ISO 26262 and UNECE cybersecurity mandates, with regulatory changes in Europe, North America, and Asia encouraging proactive investment in safety technology

- The proliferation of autonomous systems and advanced driver-assistance features increases reliance on microcontrollers capable of managing safety-critical tasks, bolstering market growth across connected and intelligent transportation

- Industrial automation players require functional safety technology to meet IEC 61508 lifecycle standards, with predictive diagnostics and self-testing microcontrollers enabling hazard mitigation and compliance readiness

- Leading manufacturers are adopting functional safety microcontrollers to improve quality, reduce recall risks, and address customer demand for reliable solutions, expanding the breadth and depth of compliant product offerings

Restraint/Challenge

High Initial Investment

- The need for high-performance, safety-certified microcontrollers elevates initial R&D, certification, and component costs, posing barriers for small and mid-sized enterprises who face financial constraints and long development cycles

- For instance, certification for ISO 26262 and IEC 61508 compliance involves rigorous design, testing, and documentation requirements that can lengthen time-to-market and increase the capital needed for new product introductions

- Complexity in integration, validation, and lifecycle maintenance of functional safety microcontrollers results in greater technical and staffing investments, contributing to increased operational expenditures

- The rapid pace of technological change further intensifies capital risk, as frequent platform upgrades and new regulatory updates require ongoing hardware and software investments

- Uncertainty around global regulatory harmonization and evolving standards for functional safety impose risks to future-proofing investments, challenging manufacturers to anticipate long-term compliance and market sustainability

Microcontroller for Functional Safety Technology Market Scope

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the microcontroller for functional safety technology market is segmented into single-core and multi-core. The single-core segment held the largest market revenue share of 58.9% in 2024, driven by its long-standing use in safety-critical applications where deterministic performance and predictable execution are essential. Single-core microcontrollers remain a preferred choice in applications with well-defined safety functions, as their simpler architecture facilitates easier certification to safety standards such as ISO 26262 and IEC 61508. They are widely adopted in cost-sensitive environments where processing demands are moderate and reliability is paramount. In addition, their lower power consumption and minimal design complexity make them attractive for embedded safety systems in industrial machinery and medical devices.

The multi-core segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the rising complexity of safety-critical systems that require higher computational capacity and redundancy. Multi-core microcontrollers enable the integration of parallel safety and non-safety tasks, enhancing both system performance and safety assurance. They are increasingly adopted in autonomous vehicles, advanced robotics, and aerospace applications where real-time processing of sensor data and fault tolerance are critical. The growing demand for AI-enabled safety systems and functional safety compliance in next-generation designs is further accelerating multi-core adoption across industries.

• By Application

On the basis of application, the market is segmented into automotive, industrial machinery, medical devices, aerospace and defense, and others. The automotive segment dominated the market share in 2024, supported by stringent functional safety standards such as ISO 26262 and the rapid integration of electronic control units in modern vehicles. Microcontrollers play a pivotal role in managing safety functions in advanced driver-assistance systems (ADAS), braking systems, and electric powertrains. The surge in electric vehicle (EV) production and the development of autonomous driving technologies are driving higher microcontroller adoption for safety-critical automotive applications.

The industrial machinery segment is expected to witness significant growth over the forecast period due to the increasing automation of manufacturing processes and the rising need for safety-compliant control systems under IEC 61508 standards. In medical devices, functional safety-certified microcontrollers are in high demand for life-support systems, infusion pumps, and imaging equipment where operational integrity is non-negotiable. The aerospace and defense sector is embracing advanced microcontrollers for flight control systems, mission-critical avionics, and safety monitoring in harsh environments, benefiting from multi-core architectures that ensure fault tolerance. Other applications, such as rail transport and energy systems, are also contributing to market growth by adopting safety-focused microcontrollers for reliable and continuous operations.

Microcontroller for Functional Safety Technology Market Regional Analysis

- North America dominated the microcontroller for functional safety technology market with the largest revenue share of 34.5% in 2024, driven by stringent safety regulations in automotive, industrial machinery, and medical sectors, alongside advanced manufacturing capabilities and early adoption of certified microcontrollers

- Manufacturers in the region benefit from strong R&D ecosystems, well-established semiconductor infrastructure, and close collaboration between OEMs and safety regulatory bodies, enabling faster product certification and deployment in mission-critical applications

- This growing adoption is further supported by the increasing integration of autonomous driving systems, industrial automation, and safety-critical medical devices, positioning functional safety microcontrollers as an essential component across diverse industries

U.S. Microcontroller for Functional Safety Technology Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, fueled by the rapid development of autonomous vehicles, industrial IoT, and safety-focused robotics. Strict compliance requirements, such as ISO 26262 and IEC 61508, are prompting manufacturers to adopt certified microcontrollers for mission-critical applications. The presence of major automotive, aerospace, and semiconductor companies further accelerates innovation. In addition, the growing demand for multi-core MCUs capable of handling high computational loads in real time is expanding adoption in both automotive and defense sectors.

Europe Microcontroller for Functional Safety Technology Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by rigorous safety legislation, a strong automotive manufacturing base, and a focus on Industry 4.0. European industries are increasingly implementing safety-certified MCUs for factory automation, robotics, and smart transportation systems. The push towards electrification in automotive production is further intensifying demand. OEMs and tier-1 suppliers in the region prioritize compliance with functional safety standards, ensuring reliable operation of mission-critical systems in harsh conditions.

U.K. Microcontroller for Functional Safety Technology Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, supported by increasing investments in aerospace, automotive, and defense projects requiring high-reliability electronics. The adoption of safety-certified MCUs is expanding in electric vehicles, smart manufacturing, and critical infrastructure projects. The country’s growing focus on cyber-physical system safety and the integration of AI-driven monitoring in industrial environments further boosts demand for advanced microcontroller architectures.

Germany Microcontroller for Functional Safety Technology Market Insight

The Germany market is expected to expand at a considerable CAGR, propelled by the country’s leadership in automotive engineering, industrial automation, and precision manufacturing. German OEMs and suppliers are prioritizing multi-core MCUs to meet high safety integrity levels (ASIL) in next-gen vehicles. The emphasis on quality, sustainability, and technological innovation drives strong adoption in both automotive and machinery sectors. Moreover, Germany’s significant role in global semiconductor R&D ensures the development of application-specific MCUs tailored to European safety requirements.

Asia-Pacific Microcontroller for Functional Safety Technology Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapid industrialization, urbanization, and the expansion of automotive manufacturing hubs. Countries such as China, Japan, and South Korea are heavily investing in safety-compliant electronics for EVs, factory automation, and medical devices. Government-backed initiatives promoting smart manufacturing and autonomous transport systems are further accelerating adoption. The region’s strong semiconductor production base also ensures cost-effective supply of advanced MCUs for both domestic and export markets.

Japan Microcontroller for Functional Safety Technology Market Insight

Japan’s market growth is supported by the nation’s advanced robotics industry, automotive safety innovations, and emphasis on precision engineering. Functional safety microcontrollers are being widely integrated into autonomous driving systems, collaborative robots, and high-reliability medical devices. The country’s strong focus on miniaturization and energy efficiency aligns with the development of MCUs optimized for compact, low-power safety systems.

China Microcontroller for Functional Safety Technology Market Insight

China accounted for the largest revenue share in the Asia-Pacific market in 2024, driven by its dominant automotive production capacity, large-scale infrastructure projects, and expanding medical device manufacturing sector. The government’s push for industrial automation, combined with the rise of EV adoption, is fueling demand for safety-compliant MCUs. Domestic semiconductor companies are increasingly developing competitive, certified solutions, making advanced functional safety technology more accessible and affordable for a wide range of applications.

Microcontroller for Functional Safety Technology Market Share

The microcontroller for functional safety technology industry is primarily led by well-established companies, including:

- Infineon Technologies AG (Germany)

- Renesas Electronics Corporation (Japan)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors (Netherlands)

- Microchip Technology Inc. (U.S.)

- Cypress Semiconductor Corporation (U.S.)

- Semiconductor Components Industries (U.S.)

- Maxim Integrated (U.S.)

- Silicon Laboratories (U.S.)

- Analog Devices, Inc. (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- ROHM CO., LTD. (Japan)

- Microsemi (Microchip Technology Inc.) (U.S.)

- Panasonic Corporation (Japan)

Latest Developments in Global Microcontroller for Functional Safety Technology Market

- In May 2025, Microchip Technology unveiled a new family of 8-bit AVR microcontrollers at Embedded World 2025, engineered to support compliance with advanced safety standards such as Automotive Safety Integrity Level C (ASIL C) and Safety Integrity Level 2 (SIL 2). This launch strengthens Microchip’s position in the functional safety microcontroller segment by addressing rising demand for compact, cost-effective, and safety-certified solutions in automotive, industrial, and medical sectors. The addition of affordable, safety-compliant 8-bit MCUs is expected to broaden adoption among cost-sensitive markets and emerging economies, where safety requirements are tightening alongside automation trends

- In March 2025, Microchip Technology introduced the AVR SD family of microcontrollers, specifically designed to help engineers meet stringent safety requirements while minimizing design costs and complexity. These MCUs integrate built-in functional safety mechanisms, are supported by a dedicated safety software framework, and are certified under a functional safety management system by TÜV Rheinland. The AVR SD family’s capability to meet ASIL C and SIL 2 standards positions it as a breakthrough in the entry-level MCU segment, enabling wider accessibility of advanced safety features in automotive and industrial applications, thereby expanding the addressable market

- In October 2023, Infineon Technologies AG launched a new series of microcontrollers with enhanced functional safety features aimed at the evolving demands of automotive and industrial sectors. By addressing the rising complexity of safety-critical systems, this release bolsters Infineon’s portfolio for applications requiring high reliability and regulatory compliance. The introduction is expected to strengthen Infineon’s competitive standing in markets driven by electrification, automation, and autonomous technologies

- In September 2023, Renesas Electronics Corporation introduced a multi-core microcontroller platform delivering advanced processing capabilities for applications demanding high-level functional safety. This move supports the growing market need for multi-core architectures capable of handling parallel safety and performance tasks in complex systems. By enhancing processing power and fault tolerance, Renesas is positioned to capture a larger share in automotive, industrial automation, and aerospace applications where functional safety compliance is critical

- In June 2020, Microchip Technology released its AVR DA family of microcontrollers, marking the company’s first Functional Safety Ready AVR MCU series. Featuring core independent peripherals, advanced analog capabilities, and a Peripheral Touch Controller (PTC), the AVR DA family was designed for high memory density and versatility in connected sensor nodes and stack-intensive applications. This development expanded Microchip’s presence in early functional safety markets, particularly in industrial IoT, automotive sensing, and home automation, laying the groundwork for future safety-certified product lines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.