Global Microcontroller For Start Stop System Market

Market Size in USD Billion

CAGR :

%

USD

43.56 Billion

USD

69.96 Billion

2024

2032

USD

43.56 Billion

USD

69.96 Billion

2024

2032

| 2025 –2032 | |

| USD 43.56 Billion | |

| USD 69.96 Billion | |

|

|

|

|

Microcontroller for Start Stop System Market Size

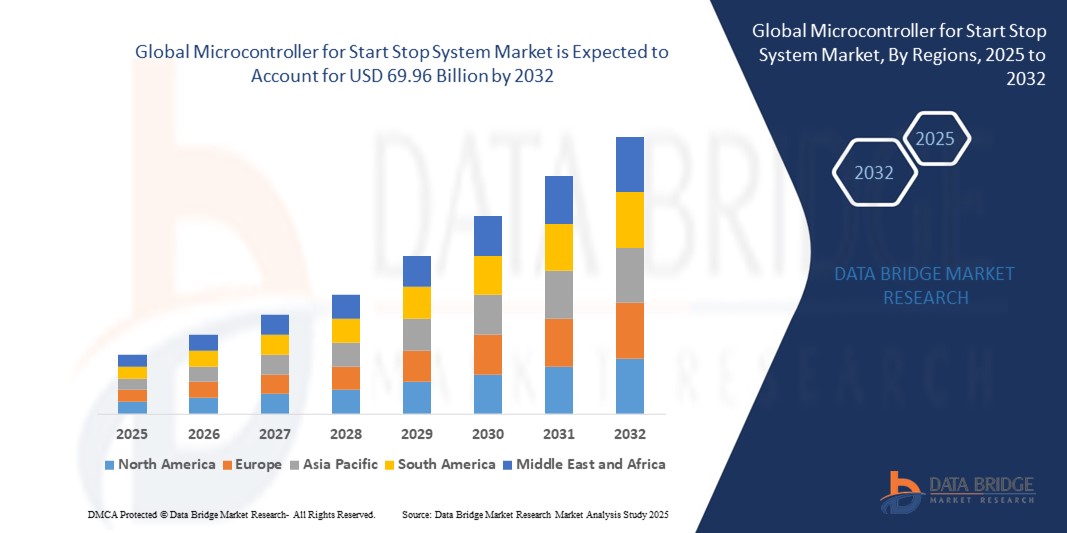

- The global microcontroller for start stop system market size was valued at USD 43.56 billion in 2024 and is expected to reach USD 69.96 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by increasing adoption of fuel-efficient technologies, stringent government emission regulations, and rising demand for start-stop systems in both conventional and hybrid vehicles

- Growing integration of microcontrollers with advanced vehicle electronics and smart energy management systems is further boosting market expansion

Microcontroller for Start Stop System Market Analysis

- The market is experiencing steady growth as automakers focus on improving fuel economy and meeting stricter CO₂ emission targets, especially in urban driving conditions where start-stop systems are most effective

- Growing demand for microcontrollers that can operate efficiently in harsh automotive environments, with high reliability and fast processing capability, is encouraging innovation in digital signal processors (DSPs) and low-latency analog microcontrollers

- Asia-Pacific dominated the microcontroller for start stop system market with the largest revenue share of 37.5% in 2024, driven by increasing vehicle production, rapid electrification trends, and supportive government policies promoting fuel-efficient technologies in countries such as China, Japan, India, and South Korea

- North America is projected to be the fastest-growing region during the forecast period, fuelled by rising hybrid and EV adoption, tightening CAFE (Corporate Average Fuel Economy) standards, and strong investments in advanced automotive electronics

- The gasoline segment dominated the largest market revenue share of 34.2% in 2024, driven by the widespread use of gasoline-powered vehicles in both developed and developing economies, coupled with regulatory mandates to reduce CO₂ emissions. Start stop systems with advanced microcontrollers are highly compatible with gasoline engines due to their relatively lower vibration and noise levels, making them more acceptable to consumers seeking comfort without sacrificing fuel efficiency

Report Scope and Microcontroller for Start Stop System Market Segmentation

|

Attributes |

Microcontroller for Start Stop System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Microcontroller for Start Stop System Market Trends

Increasing Integration of AI and Advanced Power Management Technologies

- The global microcontroller for start stop system market is experiencing a major trend toward integrating Artificial Intelligence (AI) with advanced power management technologies

- AI-powered microcontrollers enable real-time decision-making for optimal engine start-stop performance, reducing fuel consumption and minimizing emissions

- These smart systems can predict driving patterns and traffic conditions to manage engine restarts more efficiently, thereby enhancing both vehicle efficiency and driver comfort

- For instances, manufacturers are developing AI-driven microcontroller units that optimize energy recovery during braking, improve battery health monitoring, and extend the lifespan of key components

- This integration is making microcontrollers more appealing to OEMs and aftermarket service providers looking to deliver high-performance, eco-friendly start stop systems

- AI algorithms can process large volumes of sensor data to adjust start stop timing based on variables such as road gradient, load weight, engine temperature, and even climate control demand

Microcontroller for Start Stop System Market Dynamics

Driver

Growing Demand for Fuel Efficiency and Emission Reduction

- The increasing global emphasis on reducing vehicle emissions and improving fuel economy is a major driver for the microcontroller for start stop system market

- Microcontrollers play a critical role in enabling smooth and efficient engine stop-start functionality, which contributes to significant fuel savings and lower CO₂ emissions

- Government regulations and emission standards in Asia-Pacific and other regions are accelerating adoption, with many automakers integrating start stop systems as standard features in new models

- The rise of hybrid vehicles, especially in urban areas with heavy traffic, is further boosting demand for microcontrollers designed for start stop applications

- Technological advancements in microcontroller units, digital signal processors, and analog microcontrollers are enabling faster response times and higher processing capabilities, improving system performance across passenger cars, commercial vehicles, two wheelers, and heavy-duty vehicles

Restraint/Challenge

High Development Costs and Complex Integration

- The high cost of designing, testing, and integrating microcontrollers into start stop systems remains a significant challenge for manufacturers, particularly in price-sensitive markets

- Retrofitting advanced start stop functionality into existing vehicles can be technically complex and costly, limiting adoption in the aftermarket segment

- Data and signal accuracy requirements are extremely high, as microcontrollers must operate flawlessly under varying environmental and driving conditions

- Short product development cycles in the automotive industry put pressure on microcontroller manufacturers to deliver high-performance solutions without compromising reliability

- The regional differences in emission regulations, powertrain designs, and fuel types across global markets add complexity for companies aiming to standardize microcontroller solutions

Microcontroller for Start Stop System market Scope

The market is segmented on the basis of fuel type, application, technology outlook, and end use.

- By Fuel Type

On the basis of fuel type, the global microcontroller for start stop system market is segmented into gasoline, diesel, and hybrid. The gasoline segment dominated the largest market revenue share of 34.2% in 2024, driven by the widespread use of gasoline-powered vehicles in both developed and developing economies, coupled with regulatory mandates to reduce CO₂ emissions. Start stop systems with advanced microcontrollers are highly compatible with gasoline engines due to their relatively lower vibration and noise levels, making them more acceptable to consumers seeking comfort without sacrificing fuel efficiency. The increasing production of small and mid-sized gasoline vehicles across Asia-Pacific has further reinforced this segment’s leadership.

The hybrid segment is expected to register the fastest growth rate from 2025 to 2032, supported by the surging adoption of electrified powertrains and government incentives promoting green mobility. Hybrid vehicles demand sophisticated microcontrollers to seamlessly manage start stop functions alongside electric motor integration, ensuring optimal performance and extended battery life. As OEMs accelerate hybrid production to meet emission reduction targets, demand for high-performance microcontrollers in this category will grow exponentially.

- By Application

On the basis of application, the global microcontroller for start stop system market is categorized into passenger cars, commercial vehicles, two wheelers, and heavy-duty vehicles. The passenger car segment accounted for the highest revenue share in 2024, bolstered by rising consumer preference for fuel-efficient, eco-friendly vehicles and the incorporation of start stop systems in mid-range and premium models. Technological advancements enabling smoother engine restarts and minimal cabin vibration have made these systems a standard offering in many passenger vehicles, particularly in urban regions with frequent traffic stops.

The commercial vehicle segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by fleet operators’ increasing focus on fuel savings and compliance with stringent emission standards. Start stop systems in commercial vehicles require robust and durable microcontrollers capable of handling frequent cycles without performance degradation. Adoption is further supported by regulatory pressures in North America and Europe, alongside the rising penetration of advanced telematics and energy management systems in the logistics sector.

- By Technology Outlook

On the basis of technology, the global market is segmented into microcontroller unit (MCU), digital signal processor (DSP), and analog microcontrollers. The microcontroller unit segment held the largest revenue share in 2024, as MCUs form the core of start stop systems, enabling precise control of engine ignition, fuel injection, and ancillary power management. Their proven reliability, cost efficiency, and adaptability to multiple vehicle architectures have made MCUs the preferred choice for OEMs.

The digital signal processor segment is projected to grow at the fastest pace from 2025 to 2032, supported by the increasing need for real-time data processing to optimize start stop performance in varying driving conditions. DSPs enhance predictive analytics and integrate seamlessly with other advanced driver assistance systems (ADAS), offering automakers the ability to fine-tune system response and improve fuel efficiency.

- By End Use Outlook

On the basis of end use, the global microcontroller for start stop system market is segmented into OEM and aftermarket. The OEM segment dominated the market in 2024, driven by the integration of start stop systems into new vehicle models as a standard feature to meet environmental regulations and improve fuel economy ratings. OEMs benefit from economies of scale in sourcing and installing advanced microcontrollers, ensuring compatibility and reliability from the production line.

The aftermarket segment is expected to record the highest growth rate from 2025 to 2032, as consumers increasingly retrofit older vehicles with start stop capabilities to achieve fuel savings and comply with local emission norms. Rising awareness of sustainable driving practices, combined with the availability of cost-effective retrofit kits, will drive aftermarket expansion, especially in emerging markets.

Microcontroller for Start Stop System Market Regional Analysis

- Asia-Pacific dominated the microcontroller for start stop system market with the largest revenue share of 37.5% in 2024, driven by increasing vehicle production, rapid electrification trends, and supportive government policies promoting fuel-efficient technologies in countries such as China, Japan, India, and South Korea

- Consumers prioritize microcontrollers for start-stop systems to enhance fuel efficiency, reduce emissions, and comply with stringent environmental regulations, particularly in urbanized regions with heavy traffic.

- Growth is supported by advancements in microcontroller technology, including enhanced processing power, energy efficiency, and integration with hybrid and electric vehicle systems, alongside rising adoption in both OEM and aftermarket segments.

Japan Microcontroller for Start Stop System Market Insight

Japan’s microcontroller for start-stop system market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced microcontrollers that enhance fuel efficiency and vehicle safety. The presence of major automotive manufacturers and the integration of start-stop systems in OEM vehicles accelerate market penetration. Rising interest in aftermarket solutions for hybrid and internal combustion engine vehicles also contributes to growth.

China Microcontroller for Start Stop System Market Insight

China holds the largest share of the Asia-Pacific microcontroller for start-stop system market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for fuel-efficient and low-emission solutions. The country’s growing middle class and focus on sustainable mobility support the adoption of advanced microcontrollers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Microcontroller for Start Stop System Market Insight

The U.S. microcontroller for start stop system market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of fuel efficiency and emission reduction benefits. The trend towards vehicle electrification and compliance with Corporate Average Fuel Economy (CAFE) standards further boosts market expansion. Automakers’ increasing integration of start-stop systems in new vehicles complements aftermarket sales, creating a diverse product ecosystem.

Europe Microcontroller for Start Stop System Market Insight

The Europe microcontroller for start-stop system market is expected to witness significant growth, supported by stringent regulatory emphasis on emission reduction and fuel efficiency. Consumers seek microcontrollers that enable seamless start-stop functionality while ensuring vehicle performance. The growth is prominent in both OEM installations and aftermarket upgrades, with countries such as Germany and France showing significant uptake due to environmental concerns and urban traffic conditions.

U.K. Microcontroller for Start Stop System Market Insight

The U.K. market for microcontrollers in start-stop systems is expected to witness rapid growth, driven by demand for fuel-efficient vehicles and emission reduction in urban and suburban settings. Increased awareness of environmental benefits and the need for compliance with the U.K.’s Road to Zero strategy encourage adoption. Evolving regulations balancing system efficiency with vehicle performance influence consumer choices, supporting market growth.

Germany Microcontroller for Start Stop System Market Insight

Germany is expected to witness rapid growth in the microcontroller for start-stop system market, attributed to its advanced automotive manufacturing sector and high consumer focus on fuel efficiency and environmental sustainability. German consumers prefer technologically advanced microcontrollers that optimize start-stop functionality and contribute to lower fuel consumption. The integration of these systems in premium vehicles and aftermarket options supports sustained market growth.

Microcontroller for Start Stop System Market Share

The microcontroller for start stop system industry is primarily led by well-established companies, including:

- HELLA GmbH & Co. KGaA (Germany)

- Hitachi Astemo, Ltd (Japan)

- Magna International Inc. (Canada)

- Mobileye (Israel)

- NXP Semiconductors (Netherlands)

- Panasonic Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Phinia (U.K.)

- Denso Corporation (Japan)

- Quanergy Systems, Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

What are the Recent Developments in Global Microcontroller for Start Stop System Market?

- In March 2024, SemiDrive, a Chinese semiconductor company, launched the improved E3 series automotive MCUs, specifically the E3119F8 and E3118F4 models. These microcontrollers are designed for advanced automotive applications such as body domain control, zone controllers, and LiDAR systems. Built on the ARM Cortex R5F CPU, they feature up to two independent 400MHz cores and a 200MHz security core, along with hardware security modules to meet stringent functional safety (ISO 26262 ASIL D) and cybersecurity standards (EVITA Full). Their compact design and high-performance capabilities support efficient deployment in next-gen electric and autonomous vehicles

- In October 2023, AutoChips (Jiefa Technology) introduced the AC7870x, its first multi-kernel, high-frequency automotive MCU. Built on the Arm Cortex-R52 core, the AC7870x meets ASIL-D functional safety standards and includes a hardware security module (HSM) that complies with EVITA Full and supports domestic cryptographic standards such as SM2/3/4. With up to 360MHz core frequency, 12MB Flash storage, and support for AUTOSAR and MCAL, it’s designed for demanding applications such as power chassis, new energy vehicle “three electrics”, and zone controllers. The MCU also supports silent upgrades and Hypervisor functionality for next-gen automotive architectures

- In May 2023, STMicroelectronics launched its Stellar family of automotive microcontrollers, marking a major advancement in vehicle electrification and zonal architecture. This Arm-based portfolio is the first to span the entire automotive MCU spectrum, supporting applications from powertrain to body control. The Stellar MCUs feature Phase Change Memory (PCM) and are built on 28nm FD-SOI technology, offering enhanced performance, lower power consumption, and robust safety features. These innovations enable real-time virtualization, over-the-air updates, and compliance with stringent automotive safety standards, positioning Stellar as a key enabler for next-generation software-defined vehicles

- In November 2022, Infineon Technologies AG launched the XMC7000 microcontroller (MCU) family, designed for advanced industrial applications such as two-wheel electric vehicles, EV charging, and robotics. While not exclusively built for start-stop systems, its emphasis on power management and motor control makes it highly relevant to the broader ecosystem of electrified vehicle technologies. The XMC7000 series features Arm Cortex-M7 and Cortex-M0+ cores, up to 8MB Flash, and robust peripherals such as CAN FD and Gigabit Ethernet, all built on a 40nm embedded flash process for high performance and energy efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.