Global Microcontroller For Transmission Control Market

Market Size in USD Billion

CAGR :

%

USD

4.91 Billion

USD

9.02 Billion

2024

2032

USD

4.91 Billion

USD

9.02 Billion

2024

2032

| 2025 –2032 | |

| USD 4.91 Billion | |

| USD 9.02 Billion | |

|

|

|

|

Microcontroller for Transmission Control Market Size

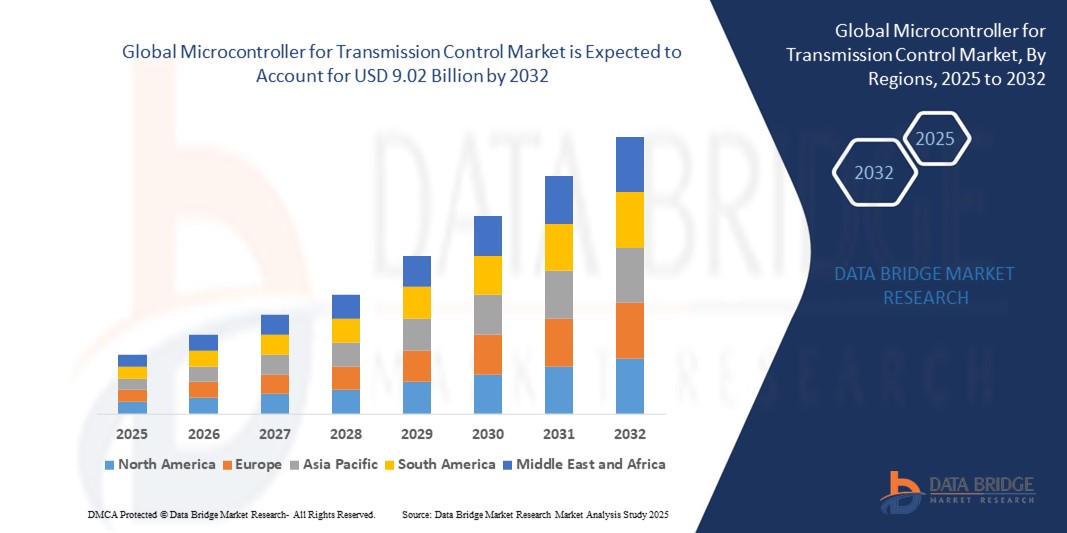

- The global microcontroller for transmission control market size was valued at USD 4.91 billion in 2024 and is expected to reach USD 9.02 billion by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced driver-assistance systems (ADAS), rising demand for fuel-efficient vehicles, and the integration of electronic control units in modern automotive transmissions.

- The expansion of electric and hybrid vehicle production, coupled with technological advancements in automotive electronics, is further boosting market demand

Microcontroller for Transmission Control Market Analysis

- Growing regulatory pressure to reduce vehicle emissions is accelerating the adoption of microcontrollers in transmission systems, as they enable precise control over gear shifting and engine performance.

- The rising preference for automatic and semi-automatic transmission systems across both passenger and commercial vehicles is increasing the demand for high-performance microcontroller

- North America dominated the microcontroller for transmission control market with the largest revenue share of 38.5% in 2024, driven by the strong presence of leading automotive manufacturers and high adoption of advanced transmission technologies in passenger and commercial vehicles

- Asia-Pacific region is expected to witness the highest growth rate in the global microcontroller for transmission control market, driven by increasing vehicle production, rising disposable incomes, expanding EV market, and the integration of advanced electronic systems in automobiles across emerging economies

- The 32-bit microcontrollers segment dominated the market with the largest market revenue share in 2024, driven by their superior processing power, ability to handle complex algorithms, and enhanced memory capacity required for modern transmission systems. Automotive manufacturers increasingly prefer 32-bit MCUs due to their capability to support advanced functionalities such as adaptive gear shifting and integrated diagnostic systems, ensuring higher vehicle performance and fuel efficiency

Report Scope and Microcontroller for Transmission Control Market Segmentation

|

Attributes |

Microcontroller for Transmission Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of AI and Machine Learning In Transmission Control |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Microcontroller for Transmission Control Market Trends

Integration of AI and Machine Learning in Transmission Control Units

- The adoption of artificial intelligence (AI) and machine learning (ML) in transmission control units (TCUs) is reshaping vehicle performance optimization. These technologies enable adaptive shift strategies based on driving conditions, vehicle load, and driver behavior, improving fuel efficiency and reducing emissions. Real-time data processing allows for quicker response to changing road conditions, enhancing overall driving experience

- The growing demand for connected vehicles and smart mobility solutions is accelerating the deployment of AI-powered TCUs. Automakers are increasingly integrating predictive algorithms that proactively adjust transmission settings, leading to smoother gear shifts and reduced wear on transmission components

- The scalability and flexibility of software-defined microcontrollers allow for over-the-air (OTA) updates, enabling continuous performance enhancements without physical intervention. This is particularly beneficial for electric and hybrid vehicles, where transmission management plays a crucial role in extending battery range

- For instance, in 2024, a leading European automaker partnered with a semiconductor manufacturer to develop AI-enabled TCUs that improved urban fuel efficiency by 12% and reduced transmission-related maintenance calls by 18% within the first year of deployment

- While AI and ML are transforming transmission control, their success depends on continued advancements in embedded processing power, cybersecurity measures, and standardized communication protocols to ensure interoperability across vehicle platforms

Microcontroller for Transmission Control Market Dynamics

Driver

Growing Demand for Fuel Efficiency and Emission Reduction

- Rising environmental regulations and consumer demand for fuel-efficient vehicles are driving the adoption of advanced transmission control microcontrollers. By enabling precise gear selection and shift timing, these systems optimize engine performance and reduce unnecessary fuel consumption

- Automakers are leveraging these solutions to comply with stringent emission standards set by regulatory bodies across North America, Europe, and Asia-Pacific. Compliance with these norms not only avoids penalties but also enhances brand reputation among eco-conscious buyers

- Advancements in microcontroller architecture have increased processing speed and memory capacity, enabling more complex transmission algorithms that respond dynamically to road, load, and driving conditions

- For instance, in 2023, Japanese automotive manufacturers reported a 7% improvement in fleet-wide fuel economy after upgrading to microcontroller-based adaptive transmission systems, contributing to reduced CO₂ emissions

- While fuel efficiency and emission control are key drivers, automakers must balance these goals with cost-effectiveness and seamless integration into existing vehicle platforms to maintain competitiveness

Restraint/Challenge

High Cost and Complexity of Advanced Transmission Control Systems

- The integration of high-performance microcontrollers into transmission control units significantly increases vehicle production costs. This is especially challenging for low-cost vehicle segments where price sensitivity is high

- The complexity of advanced TCU systems requires specialized design, testing, and calibration, increasing development timelines and engineering expenses. Smaller automotive manufacturers often struggle to absorb these costs without impacting profitability

- Maintenance and repair of sophisticated transmission systems demand skilled technicians and diagnostic equipment, which are not always readily available, particularly in emerging markets. This limits widespread adoption

- For instance, in 2024, several small automakers in Southeast Asia delayed rollout of advanced transmission control systems due to prohibitive costs and lack of trained service personnel, opting instead for simpler, cost-effective alternatives

- Addressing these challenges requires industry-wide collaboration to develop modular, scalable solutions that reduce costs while maintaining performance benefits, ensuring accessibility for all vehicle classes

Microcontroller for Transmission Control Market Scope

The market is segmented on the basis of type, application, vehicle type, and communication protocol.

- By Type

On the basis of type, the microcontroller for transmission control market is segmented into 32-bit microcontrollers, 16-bit microcontrollers, and 8-bit microcontrollers. The 32-bit microcontrollers segment dominated the market with the largest market revenue share in 2024, driven by their superior processing power, ability to handle complex algorithms, and enhanced memory capacity required for modern transmission systems. Automotive manufacturers increasingly prefer 32-bit MCUs due to their capability to support advanced functionalities such as adaptive gear shifting and integrated diagnostic systems, ensuring higher vehicle performance and fuel efficiency.

The 16-bit microcontrollers segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by their balance between cost-effectiveness and performance efficiency. These MCUs are widely used in mid-range vehicle models for tasks such as torque regulation and gear change optimization. Their compact architecture and lower power consumption make them a preferred choice for manufacturers aiming to integrate smart control solutions without significantly increasing production costs.

- By Application

On the basis of application, the microcontroller for transmission control market is segmented into torque control, gear shifting control, transmission fluid temperature control, traction control, transmission solenoid control, and others. The torque control segment held the largest revenue share in 2024, driven by its critical role in optimizing engine output for smooth power delivery and enhanced driving comfort. The rising demand for fuel efficiency and emission reduction in compliance with global automotive regulations has increased the adoption of precise torque control systems

The gear shifting control segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the growing demand for advanced automatic and dual-clutch transmissions. The integration of microcontrollers in gear shift systems ensures faster, smoother, and more responsive gear changes, improving both vehicle performance and driver experience.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment dominated the market in 2024, supported by higher global car production volumes and the adoption of advanced transmission systems in premium and mid-range models. Increasing consumer preference for smoother driving experiences and enhanced fuel efficiency further boosts demand in this segment.

The commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for robust and reliable transmission systems capable of handling heavy loads and extended operational hours. Advanced microcontrollers in commercial vehicle transmissions help optimize power output, reduce wear and tear, and improve fuel economy, which is critical for fleet operators.

- By Communication Protocol

On the basis of communication protocol, the market is segmented into CAN, LIN, and FlexRay. The CAN segment accounted for the largest market share in 2024, owing to its widespread adoption as a reliable and cost-effective communication standard in automotive applications. CAN’s robust data transfer capability ensures seamless integration of microcontrollers with other transmission and powertrain components.

The FlexRay segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high-speed data transmission capabilities essential for real-time control in advanced and autonomous vehicle systems. Its superior bandwidth and fault-tolerant design make it well-suited for next-generation transmission control applications.

Microcontroller for Transmission Control Market Regional Analysis

• North America dominated the microcontroller for transmission control market with the largest revenue share of 38.5% in 2024, driven by the strong presence of leading automotive manufacturers and high adoption of advanced transmission technologies in passenger and commercial vehicles.

• The region benefits from increasing consumer demand for improved fuel efficiency, reduced emissions, and enhanced driving comfort, all of which require sophisticated transmission control systems powered by advanced microcontrollers.

• Supportive government regulations on vehicle emissions and safety standards, coupled with ongoing R&D in automotive electronics, are further accelerating the integration of microcontrollers in transmission systems.

U.S. Microcontroller for Transmission Control Market Insight

The U.S. market accounted for the largest share within North America in 2024, fueled by the robust production of high-performance vehicles and the rising penetration of electric and hybrid models. Automotive OEMs are increasingly incorporating advanced 32-bit microcontrollers to manage complex transmission functions, ensuring smooth gear shifts and optimized power delivery. The growing focus on autonomous and connected vehicles is also driving demand for microcontrollers with enhanced processing capabilities and communication protocols such as CAN and FlexRay.

Europe Microcontroller for Transmission Control Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent emission norms such as Euro 7 and the push towards electrification. European automakers are leading in the adoption of advanced powertrain technologies, with microcontrollers playing a central role in managing efficiency and performance. The integration of transmission control units with vehicle-wide electronics for improved diagnostics, predictive maintenance, and adaptive driving modes is gaining traction across the region.

U.K. Microcontroller for Transmission Control Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s rising focus on vehicle electrification and compliance with stringent emission standards. Automotive manufacturers in the U.K. are increasingly adopting advanced 32-bit microcontrollers to enhance the performance and efficiency of automatic and hybrid transmission systems. The push for connected and autonomous vehicle technologies, combined with government-backed R&D initiatives in green mobility, is further accelerating the integration of intelligent transmission control solutions across both passenger and commercial vehicle segments.

Germany Microcontroller for Transmission Control Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, driven by its position as a global hub for premium automotive brands. The country’s focus on engineering excellence and high-quality manufacturing is fostering the adoption of next-generation microcontrollers to power advanced transmission systems. The shift towards electric mobility, alongside innovations in dual-clutch and continuously variable transmissions, is boosting demand for high-performance, low-power microcontrollers.

Asia-Pacific Microcontroller for Transmission Control Market Insight

Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid automotive production in China, Japan, India, and South Korea. The region’s large-scale manufacturing capabilities, coupled with growing consumer demand for technologically advanced vehicles, are accelerating the deployment of microcontrollers in transmission systems. Government policies promoting fuel efficiency and emission reduction, along with the rising popularity of hybrid and electric vehicles, are major growth drivers.

Japan Microcontroller for Transmission Control Market Insight

Japan’s market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by its strong automotive manufacturing base and commitment to innovation in powertrain technologies. Microcontrollers are increasingly integrated into transmission systems to enable smoother driving experiences, optimize energy use in hybrids, and support autonomous driving features. The country’s leading electronics and semiconductor expertise also facilitates the development of highly reliable and compact automotive microcontrollers.

China Microcontroller for Transmission Control Market Insight

China held the largest revenue share in the Asia-Pacific region in 2024, driven by its vast automotive market and rapid technological adoption. The country’s significant investments in EV production, coupled with policies encouraging energy efficiency, are fueling demand for microcontrollers in transmission control systems. Domestic manufacturers are also producing cost-effective yet advanced microcontrollers, making them accessible for both domestic and export markets.

Microcontroller for Transmission Control Market Share

The microcontroller for transmission control industry is primarily led by well-established companies, including:

- Renesas Electronics Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Microchip Technology Inc. (U.S.)

- Cypress Semiconductor Corporation (U.S.)

- Analog Devices, Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Maxim Integrated Products, Inc. (U.S.)

Latest Developments in Global Microcontroller for Transmission Control Market

- In June 2024, Infineon Technologies AG and GlobalFoundries (GF) today announced a new multi-year agreement on the supply of Infineon’s AURIX TC3x 40 nanometer automotive microcontrollers as well as power management and connectivity solutions. The additional capacity will contribute to secure Infineon’s business growth from 2024 through 2030

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.