Global Microcontroller Market

Market Size in USD Billion

CAGR :

%

USD

4.21 Billion

USD

8.61 Billion

2024

2032

USD

4.21 Billion

USD

8.61 Billion

2024

2032

| 2025 –2032 | |

| USD 4.21 Billion | |

| USD 8.61 Billion | |

|

|

|

Microcontroller Market Size

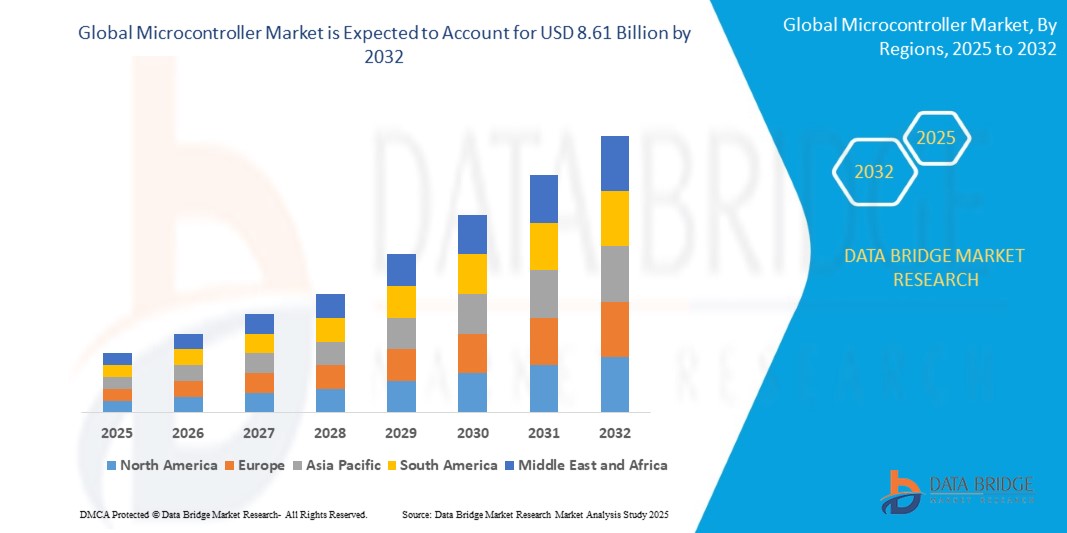

- The global microcontroller market was valued at USD 4.21 billion in 2024 and is expected to reach USD 8.61 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.35%, primarily driven by increasing demand for smart devices and IoT applications

- This growth is driven by rise of industrial automation and the growing penetration of consumer electronics such as smartphones, wearables, and home appliances

Microcontroller Market Analysis

- The microcontroller market is experiencing steady growth, driven by the increasing demand for smart consumer electronics, industrial automation, automotive applications, and IoT devices across various industries such as healthcare, automotive, and consumer electronics

- The rapid advancements in semiconductor technology, coupled with the growing adoption of connected devices, are accelerating the demand for more powerful, energy-efficient, and cost-effective microcontrollers in both embedded systems and consumer gadgets

- For instance, in the U.S., companies such as Intel and Qualcomm are making significant investments in developing next-generation microcontroller technologies to support IoT ecosystems and smart home applications

- Emerging trends such as the integration of artificial intelligence (AI) for real-time processing, the adoption of microcontrollers for electric vehicles (EVs) and autonomous driving, and advancements in low-power microcontrollers for wearables are reshaping the market, ensuring more advanced and energy-efficient solutions for diverse applications

Report Scope and Microcontroller Market Segmentation

|

Attributes |

Microcontroller Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to tfhe insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Microcontroller Market Trends

“Growing Demand for Low-Power, High-Performance Microcontrollers”

- A major trend reshaping the microcontroller market is the growing demand for low-power, high-performance microcontrollers, driven by the increasing number of battery-powered and energy-efficient applications in IoT devices, wearables, and automotive systems

- Manufacturers are focusing on developing microcontrollers with enhanced processing power, improved power management features, and longer battery life to meet the needs of these increasingly power-sensitive applications

- For instance, in February 2024, Texas Instruments introduced a new low-power microcontroller series designed to extend battery life in connected devices such as wearables and IoT sensors

- Technological advances such as integrated low-power modes, energy harvesting capabilities, and improved sleep/wake cycles are increasing the efficiency of microcontrollers in energy-conscious applications

- This trend is driving the microcontroller market toward a new generation of ultra-low-power devices, fueling growth in applications requiring extended battery life and increased energy efficiency

Microcontroller Market Dynamics

Driver

“Rising Adoption of IoT and Smart Devices”

- The microcontroller market is experiencing robust growth fueled by the increasing adoption of IoT devices and smart consumer electronics

- Microcontrollers are essential components in IoT devices, providing processing capabilities, power management, and connectivity for applications ranging from home automation to industrial systems

- For instance, in January 2024, Arm Ltd. announced the development of a new series of microcontrollers designed specifically for IoT applications, enhancing connectivity and data processing capabilities

- The expansion of 5G networks and the growing demand for connected devices are contributing to the rapid adoption of microcontrollers, particularly in industrial automation, smart cities, and healthcare systems

- As IoT applications proliferate, the microcontroller market will continue to experience strong growth, driven by the need for more efficient and capable microcontroller solutions

Opportunity

“Expansion of Electric Vehicles (EVs) and Autonomous Driving”

- The microcontroller market stands to benefit from the growth of the electric vehicle (EV) industry and advancements in autonomous driving technologies.

- Microcontrollers are used extensively in EVs for battery management systems (BMS), motor control, infotainment systems, and safety features, as well as in autonomous driving systems for real-time data processing and decision-making

- For instance, in March 2024, Renesas Electronics introduced a new microcontroller optimized for use in EV battery management systems, improving energy efficiency and performance

- As the demand for electric vehicles and autonomous driving technologies continues to rise, microcontrollers will play a critical role in improving performance, safety, and efficiency, driving further market growth

- This opportunity is expected to create significant demand for microcontrollers in the automotive sector, contributing to the continued expansion of the market

Restraint/Challenge

“Supply Chain Disruptions and Semiconductor Shortages”

- The microcontroller market faces significant challenges due to ongoing supply chain disruptions and semiconductor shortages, which are affecting the production and availability of critical microcontroller components.

- Manufacturers are struggling to meet the rising demand for microcontrollers, leading to longer lead times and increased production costs

- For instance, in February 2024, Microchip Technology Inc. announced production delays due to semiconductor shortages, impacting the timely delivery of microcontroller solutions to customers in various industries

- These challenges are exacerbated by the complexity of global supply chains and the reliance on limited semiconductor fabrication plants, making it difficult to scale up production

- Addressing these challenges is critical for microcontroller manufacturers to ensure a steady supply of components, maintain market competitiveness, and meet growing demand in key industries such as automotive, IoT, and consumer electronics

Microcontroller Market Scope

The market is segmented on the basis of product, architecture, memory, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Architecture |

|

|

By Memory |

|

|

By Application

|

|

Microcontroller Market Regional Analysis

“North America is the Dominant Region in the Microcontroller Market”

- North America leads the microcontroller market and is expected to maintain its dominant position throughout the forecast period

- The presence of major semiconductor players in the region is a key factor driving the market's growth

- Increasing penetration of smartphones, tablets, and other consumer electronic devices is contributing to market expansion

- With rising industrial automation, North America's microcontroller market is poised for sustained growth, reinforcing its leading role globally

““Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to register the highest compound annual growth rate (CAGR) during the forecast period

- The growing demand for smart home electronic appliances is driving market growth in the region

- Increased adoption of cloud-based solutions and the rising demand for internet of things (IoT) technology are major growth factors

- The expansion of semiconductor and electronics industries further propels the microcontroller market in Asia-Pacific, positioning it for strong future growth

Microcontroller Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Infineon Technologies AG (Germany)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- STMicroelectronics (Switzerland)

- TE Connectivity (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Zilog, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Arm Limited (U.K.)

- Analog Devices, Inc. (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Parallax Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- LAPIS Semiconductor Co., Ltd. (Japan)

- Intel Corporation (U.S.)

- Danfoss (Denmark)

- EM Microelectronic (Switzerland)

- Silicon Laboratories (U.S.)

Latest Developments in Global Microcontroller Market

- In May 2023, STMicroelectronics launched the second generation of its STM32 MPUs (microprocessors), featuring an enhanced architecture within the existing ecosystem to deliver elevated performance and security for industrial and IoT edge applications. The STM32MP2 Series devices featured 64-bit Arm Cortex-A35 cores operating at 1.5GHz, complemented by a 400MHz Cortex-M33 embedded core for real-time processing, offering a powerful and efficient solution. This development bolstered the company's position in the industrial and IoT markets

- In April 2023, Renesas Electronics Corporation revealed the successful manufacturing of its inaugural microcontroller (MCU) using cutting-edge 22-nm process technology. This advanced process enabled improved performance, reduced power consumption through lower core voltages, and seamless integration of a diverse feature set, including RF capabilities, providing customers with a superior product offering. This technological breakthrough highlights Renesas' commitment to innovation in the microcontroller market

- In March 2023, NXP Semiconductors released the MCUXpresso toolset, empowering developers with enhanced scalability, usability, and portability for faster development of complex embedded applications. The toolset included a custom-built MCUXpresso extension for Microsoft's Visual Studio Code (VS Code), open-source hardware abstraction for code reuse, streamlined partner code delivery via Open-CMSIS-Packs, and an intuitive Application Launch Pad for easy access to application software and NXP documentation. This release significantly accelerated embedded development, improving efficiency for developers

- In January 2023, STMicroelectronics unveiled the STM32C0 series, a cost-effective lineup of 32-bit microcontrollers designed for applications in home appliances, industrial pumps, fans, and smoke detectors, traditionally served by simpler 8-bit and 16-bit MCUs. The modern design of the STM32C0 provided enhanced performance, faster response, additional functionalities, and network connectivity, while maintaining comparable cost and power consumption. This product launch expanded STMicroelectronics' offerings in the mid-range MCU market

- In January 2022, Infineon Technologies AG introduced the latest iteration of its AURIX microcontroller family, the AURIX TC4x series, engineered to address evolving trends in the automotive industry, including eMobility, advanced driver assistance systems (ADAS), automotive electric-electronic (E/E) architectures, and cost-effective artificial intelligence (AI) applications. The AURIX TC4x series marked a significant milestone in automotive MCU development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MICROCONTROLLER MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MICROCONTROLLER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 TECHNOLOGICAL ASPECT

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL MICROCONTROLLER MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL MICROCONTROLLER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 8-BIT MICROCONTROLLER

7.3 16-BIT MICROCONTROLLER

7.4 32-BIT MICROCONTROLLER

8 GLOBAL MICROCONTROLLER MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 CENTRAL PROCESSING UNIT (CPU)

8.3 RANDOM-ACCESS MEMORY (RAM)

8.4 FLASH MEMORY

8.5 SERIAL BUS INTERFACE

8.6 INPUT/OUTPUT PORTS (I/O PORTS)

8.7 ELECTRICAL ERASABLE PROGRAMMABLE READ-ONLY MEMORY (EEPROM)

9 GLOBAL MICROCONTROLLER MARKET, BY MEMORY

9.1 OVERVIEW

9.2 EXTERNAL MEMORY

9.3 EMBEDDED MEMORY

10 GLOBAL MICROCONTROLLER MARKET, BY INSTRUCTION SET

10.1 OVERVIEW

10.2 COMPLEX INSTRUCTION SET COMPUTER (CISC)

10.3 REDUCED INSTRUCTION SET COMPUTERS (RISC)

11 GLOBAL MICROCONTROLLER MARKET, BY FREQUENCY RANGE

11.1 OVERVIEW

11.2 1MHZ-100MHZ

11.3 101MHZ-200 MHZ

11.4 201MHZ-500MHZ

11.5 501MHZ-1000MHZ

11.6 MORE THAN 1000 MHZ

12 GLOBAL MICROCONTROLLER MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 CONSUMER ELECTRONICS

12.2.1 BY TYPE

12.2.1.1. SMARTPHONES

12.2.1.2. WEARABLES

12.2.1.2.1. SMART WATCH

12.2.1.2.2. WRIST BAND

12.2.1.2.3. AR & VR GHEADSETS

12.2.1.2.4. HEARABLES

12.2.1.3. PC

12.2.1.4. HOME APPLIANCES

12.2.1.5. GAMING

12.2.1.6. SPEAKERS

12.2.1.7. OTHERS

12.2.2 BY PRODUCT TYPE

12.2.2.1. 8-BIT MICROCONTROLLER

12.2.2.2. 16-BIT MICROCONTROLLER

12.2.2.3. 32-BIT MICROCONTROLLER

12.3 AUTOMOTIVE

12.3.1 BY TYPE

12.3.1.1. POWERTRAIN AND CHASSIS

12.3.1.2. BODY AND CONVENIENCE

12.3.1.3. SAFETY AND SECURITY

12.3.1.4. ADAS

12.3.1.5. TELEMATICS AND INFOTAINMENT

12.3.1.6. OTHERS

12.3.2 BY VEHICLE TYPE

12.3.2.1. PASSENGER VEHICLE

12.3.2.2. COMMERCIAL VEHICLE

12.3.2.3. ELECTRIC VEHICLE

12.3.3 BY PRODUCT TYPE

12.3.3.1. 8-BIT MICROCONTROLLER

12.3.3.2. 16-BIT MICROCONTROLLER

12.3.3.3. 32-BIT MICROCONTROLLER

12.4 AEROSPACE AND DEFENSE

12.4.1 BY PRODUCT TYPE

12.4.1.1. 8-BIT MICROCONTROLLER

12.4.1.2. 16-BIT MICROCONTROLLER

12.4.1.3. 32-BIT MICROCONTROLLER

12.5 INDUSTRIAL

12.5.1 BY TYPE

12.5.1.1. AUTOMATION

12.5.1.2. POWER AND ENERGY

12.5.1.3. BUILDING AND HOME CONTROL

12.5.1.4. SECURITY AND VIDEO SURVEILLANCE

12.5.1.5. TEST AND MEASUREMENT

12.5.1.6. OTHERS

12.5.2 BY PRODUCT TYPE

12.5.2.1. 8-BIT MICROCONTROLLER

12.5.2.2. 16-BIT MICROCONTROLLER

12.5.2.3. 32-BIT MICROCONTROLLER

12.6 HEALTHCARE

12.6.1 BY TYPE

12.6.1.1. BLOOD GLUCOSE MANAGEMENT

12.6.1.2. ANESTHESIA UNIT MONITOR

12.6.1.3. HEART MONITOR

12.6.1.4. MEDICAL IMAGING

12.6.1.5. VENTILATOR RESPIRATOR

12.6.1.6. HOSPITAL ADMISSION MACHINE

12.6.1.7. OTHERS

12.6.2 BY PRODUCT TYPE

12.6.2.1. 8-BIT MICROCONTROLLER

12.6.2.2. 16-BIT MICROCONTROLLER

12.6.2.3. 32-BIT MICROCONTROLLER

12.7 COMMUNICATIONS

12.7.1 BY TYPE

12.7.1.1. DATACENTER INFRASTRUCTURE

12.7.1.2. WIRED NETWORK INFRASTRUCTURE

12.7.1.3. WIRELESS NETWORK INFRASTRUCTURE

12.7.1.4. OTHERS

12.7.2 BY PRODUCT TYPE

12.7.2.1. 8-BIT MICROCONTROLLER

12.7.2.2. 16-BIT MICROCONTROLLER

12.7.2.3. 32-BIT MICROCONTROLLER

12.8 OTHERS

13 GLOBAL MICROCONTROLLER MARKET, BY PRICE CATEGORY

13.1 OVERVIEW

13.2 LOW

13.3 MEDIUM

13.4 HIGH

14 GLOBAL MICROCONTROLLER MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 OFFLINE

14.3 ONLINE

14.3.1 E-COMMERCE

14.3.2 COMPANY WEBSITE

15 GLOBAL MICROCONTROLLER MARKET, BY COUNTRY

GLOBAL MICROCONTROLLER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1.1 NORTH AMERICA

15.1.1.1. U.S.

15.1.1.2. CANADA

15.1.1.3. MEXICO

15.1.2 EUROPE

15.1.2.1. GERMANY

15.1.2.2. U.K.

15.1.2.3. FRANCE

15.1.2.4. ITALY

15.1.2.5. SPAIN

15.1.2.6. THE NETHERLANDS

15.1.2.7. SWITZERLAND

15.1.2.8. TURKEY

15.1.2.9. BELGIUM

15.1.2.10. RUSSIA

15.1.2.11. REST OF EUROPE

15.1.3 ASIA-PACIFIC

15.1.3.1. CHINA

15.1.3.2. JAPAN

15.1.3.3. SOUTH KOREA

15.1.3.4. INDIA

15.1.3.5. SINGAPORE

15.1.3.6. AUSTRALIA

15.1.3.7. MALAYSIA

15.1.3.8. PHILIPPINES

15.1.3.9. THAILAND

15.1.3.10. INDONESIA

15.1.3.11. REST OF ASIA-PACIFIC

15.1.4 SOUTH AMERICA

15.1.4.1. BRAZIL

15.1.4.2. ARGENTINA

15.1.4.3. REST OF SOUTH AMERICA

15.1.5 MIDDLE EAST AND AFRICA

15.1.5.1. SOUTH AFRICA

15.1.5.2. EGYPT

15.1.5.3. SAUDI ARABIA

15.1.5.4. U.A.E

15.1.5.5. ISRAEL

15.1.5.6. REST OF MIDDLE EAST AND AFRICA

15.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL MICROCONTROLLER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL MICROCONTROLLER MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL MICROCONTROLLER MARKET, COMPANY PROFILE

18.1 NXP SEMICONDUCTOR

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ANALOG DEVICES, INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 INFINEON TECHNOLOGIES AG

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 RENESAS ELECTRONICS CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 TEXAS INSTRUMENTS INCORPORATED

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ZILOG, INC.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 PANASONIC CORPORATION

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 SILICON LABORATORIES

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 STMICROELECTRONICS

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 MICROCHIP TECHNOLOGY INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 FUJITSU

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 CYPRESS SEMICONDUCTOR CORPORATION

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 TE CONNECTIVITY

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 INTEGRATED SILICON SOLUTION INC.

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 ATMEL

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 ROHM SEMICONDUCTOR

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUVOTON TECHNOLOGY CORPORATION

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 EUROCIRCUITS

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Microcontroller Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Microcontroller Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Microcontroller Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.