Global Micronized Salt Market

Market Size in USD Billion

CAGR :

%

USD

3.23 Billion

USD

5.54 Billion

2024

2032

USD

3.23 Billion

USD

5.54 Billion

2024

2032

| 2025 –2032 | |

| USD 3.23 Billion | |

| USD 5.54 Billion | |

|

|

|

|

What is the Global Micronized Salt Market Size and Growth Rate?

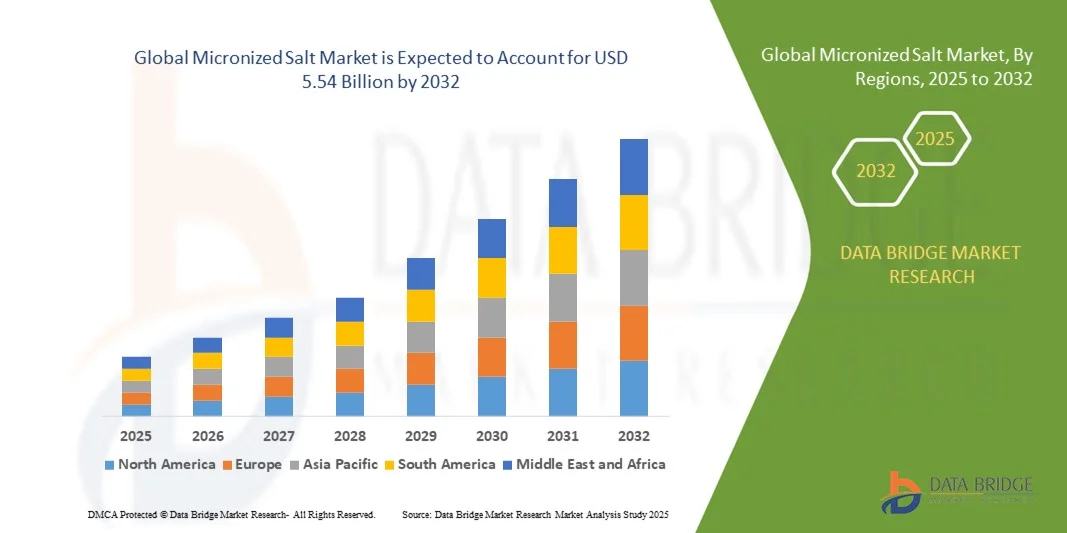

- The global micronized salt market size was valued at USD 3.23 billion in 2024 and is expected to reach USD 5.54 billion by 2032, at a CAGR of 6.99% during the forecast period

- The increase in the export of processed preparations and meat products and the extensive use of the salt in increasing the shelf life of meat and vegetables and as a flavoring agent are the major factors driving the micronized salt market

- The high usage of the product in the food industry owning to its high purity and consistency and rising demand in processed food and beverage industry accelerate the micronized salt market growth

- The growth in popularity of micronized salt as an ideal flavoring agent which also extends shelf life of vegetables and meat and the high utilization of the product in the end-use applications including bakery and confectionery products, beverages and dairy products influence the micronized salt market

What are the Major Takeaways of Micronized Salt Market?

- The expansion of food and beverage industry, inclination of consumer towards packaged and frozen food products due to busy lifestyle and high food expenditure positively affect the micronized salt market

- Furthermore, technological advancement and product innovations extend profitable opportunities to the micronized salt market players

- North America dominated the micronized salt market with the largest revenue share of 39.2% in 2025, supported by the region’s robust processed food and bakery sectors, advanced refining technologies, and growing consumer awareness of high-purity food-grade salts

- The Asia-Pacific region is projected to witness the fastest growth of 10.6% from 2026 to 2033, driven by urbanization, population growth, and expanding food processing industries

- The purity above 99.5% segment dominated the market with the largest revenue share of 61.8% in 2025, driven by its widespread use in food, beverage, and pharmaceutical industries where high-purity salts are essential for safety, consistency, and flavor enhancement

Report Scope and Micronized Salt Market Segmentation

|

Attributes |

Micronized Salt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Micronized Salt Market?

Rising Demand for Clean-Label and Natural Ingredient-Based Micronized Salt

- The micronized salt market is experiencing a notable transition toward clean-label, natural, and additive-free formulations, driven by heightened consumer awareness regarding health, transparency, and sustainable sourcing. Manufacturers are focusing on micronized salt products that avoid anti-caking agents and synthetic additives, aligning with the broader clean-label trend in the food and beverage sector

- For instance, K+S Aktiengesellschaft (Germany) and Tata Chemicals Ltd. (India) have introduced micronized salt variants with reduced chemical treatment and enhanced purity levels, designed for health-conscious consumers and clean-label food producers. This reflects the growing intersection between functionality, safety, and natural product formulation

- The demand for organic and mineral-enriched salts is also increasing due to consumer preference for trace-element-rich and sustainably processed products. Food processors and pharmaceutical firms are seeking naturally processed micronized salts that comply with eco-friendly and ethical production standards

- Manufacturers are investing in advanced purification and micronization technologies to improve particle uniformity and dissolve rates while maintaining mineral integrity. This ensures consistency in flavor, texture, and appearance across diverse applications such as bakery, dairy, meat, and snacks

- Furthermore, the rise of premium food and personal care segments has accelerated the development of ultra-pure, fine-grade salts used in nutritional supplements and cosmetics. Companies are expanding portfolios to include iodized, low-sodium, and mineral-fortified variants catering to evolving wellness trends

- Overall, the shift toward clean-label, natural, and sustainable micronized salt formulations is redefining industry standards. As global consumers prioritize health, transparency, and eco-conscious consumption, this trend will remain a crucial driver of innovation and product differentiation in the Micronized Salt market

What are the Key Drivers of Micronized Salt Market?

- The growing demand for processed and convenience foods is a primary factor boosting the Micronized Salt market. Micronized salt enhances flavor uniformity and improves solubility in snacks, bakery, dairy, and meat products, supporting the rising global appetite for convenient, ready-to-eat foods

- For instance, in 2025, CIECH Group (Poland) reported increased sales of fine-grade salts to European food processors catering to the expanding processed food market. This reflects how changing lifestyles and time constraints are fueling consumption of convenience-oriented products

- The expansion of the pharmaceutical and nutraceutical sectors is another major driver. Micronized salt’s controlled purity and particle size make it suitable for formulations of saline solutions, oral rehydration salts, and mineral supplements

- Technological advancements in refining and drying processes, such as vacuum evaporation and fluidized bed drying, are enabling manufacturers to achieve higher product quality with reduced contamination. These improvements support scalability, consistency, and compliance with stringent safety standards

- The rising preference for low-sodium diets and healthier salt alternatives is encouraging manufacturers to develop micronized salts that provide better flavor impact at lower dosages. This allows food manufacturers to meet both taste and nutritional goals

- As the global demand for high-purity, versatile, and functional salt products continues to grow, innovations in production efficiency, sustainable mining, and tailored applications will remain pivotal in shaping the expansion of the Micronized Salt market

Which Factor is Challenging the Growth of the Micronized Salt Market?

- Fluctuations in raw material and energy costs pose a significant challenge to the Micronized Salt market. Salt production heavily depends on mining operations, brine extraction, and evaporation processes—all of which are energy-intensive and subject to environmental and economic uncertainties

- For instance, between 2023 and 2025, Akzo Nobel N.V. (Netherlands) and INEOS (U.K.) reported increased operational costs due to rising energy tariffs and supply chain disruptions, affecting salt production profitability across Europe

- Environmental regulations and sustainability pressures are further impacting the market. Restrictions on brine disposal, water consumption, and land usage challenge manufacturers to adopt eco-friendly processing technologies, which often require substantial capital investment

- Logistics and transportation costs also hinder growth, particularly for companies exporting to distant regions where bulk salt shipping remains cost-sensitive. In addition, price competition among local players in emerging economies affects overall market margins

- Smaller manufacturers face constraints in adopting advanced refining technologies due to high setup costs and limited access to modern infrastructure. This leads to quality variations and lower competitiveness against established global producers

- To counter these challenges, industry leaders are focusing on vertical integration, renewable energy adoption, and recycling-based production systems to ensure long-term cost stability and environmental compliance. Such strategic initiatives are essential to sustaining market growth and maintaining profitability in the global Micronized Salt landscape

How is the Micronized Salt Market Segmented?

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the micronized salt market is segmented into purity 98% to 99.5% and purity above 99.5%. The purity above 99.5% segment dominated the market with the largest revenue share of 61.8% in 2025, driven by its widespread use in food, beverage, and pharmaceutical industries where high-purity salts are essential for safety, consistency, and flavor enhancement. This grade offers excellent solubility, minimal impurities, and uniform granulation, making it ideal for processed foods, dairy products, and medical-grade applications. Increasing demand for high-purity salt in the production of premium food products and nutraceuticals is further supporting segment expansion.

Meanwhile, the purity 98% to 99.5% segment is projected to witness the fastest CAGR during 2026–2033, owing to its cost-effectiveness and rising adoption in industrial food processing and seasoning applications. Its versatility in catering to both large-scale food manufacturers and small commercial producers makes it a preferred choice in emerging markets. The growing focus on balanced mineral content and affordability is expected to sustain the segment’s momentum in the forecast period.

- By Application

On the basis of application, the micronized salt market is segmented into bakery and confectionery products, meat, poultry, and seafood, milk and dairy products, beverages, canned/preserved fruits and vegetables, prepared meals, and others. The bakery and confectionery products segment dominated the market with the largest revenue share of 39.5% in 2025, attributed to the critical role of micronized salt in flavor enhancement, dough strengthening, and yeast activity regulation. Its fine particle size ensures uniform distribution, improving texture and taste in bread, cookies, and pastries. The expansion of global bakery chains and increasing consumer preference for premium, artisanal baked goods are further fueling the segment’s dominance.

The meat, poultry, and seafood segment is anticipated to register the fastest CAGR between 2026 and 2033, supported by the rising demand for processed and preserved meat products. Micronized salt is widely used for curing, seasoning, and moisture retention, enhancing both shelf life and taste stability. The trend toward protein-rich diets and the expansion of frozen and ready-to-cook meat products are key growth catalysts. As consumer focus shifts toward freshness, safety, and convenience, this segment is poised for significant growth in the years ahead.

Which Region Holds the Largest Share of the Micronized Salt Market?

- North America dominated the micronized salt market with the largest revenue share of 39.2% in 2025, supported by the region’s robust processed food and bakery sectors, advanced refining technologies, and growing consumer awareness of high-purity food-grade salts

- The increasing use of micronized salt in snack processing, dairy, beverages, and meat preservation is driving demand, as it provides enhanced solubility, texture uniformity, and taste balance in processed foods

- In addition, stringent food quality standards, combined with a high adoption rate of natural and fortified salts, reinforce North America’s leadership in the global Micronized Salt market

U.S. Micronized Salt Market Insight

The U.S. held the largest share in the North America Micronized Salt market in 2025, driven by strong demand from the bakery, meat, and dairy industries. The country’s advanced food processing infrastructure and increasing shift toward low-sodium and mineral-enriched salt variants have enhanced market growth. Key producers are investing in automated refining processes and micronization technology to ensure consistent quality and particle size uniformity. In addition, growing consumer awareness of clean-label and fortified food ingredients supports the adoption of high-purity micronized salt. The U.S. continues to lead globally in both production capacity and innovation, ensuring sustained market dominance.

Canada Micronized Salt Market Insight

The Canada micronized salt market is expanding steadily due to rising consumption of processed foods, bakery snacks, and dairy-based items. Canada’s strong regulatory framework promoting food safety and purity is driving the demand for high-grade micronized salts. In addition, the increasing adoption of organic and additive-free formulations aligns with consumer preferences for natural food ingredients. The growth of local food manufacturing industries, coupled with favorable trade conditions and abundant mineral resources, strengthens Canada’s regional standing. Ongoing investments in sustainable salt mining and refining are also enhancing production efficiency and quality standards across the country.

Asia-Pacific Micronized Salt Market Insight

The Asia-Pacific region is projected to witness the fastest growth of 10.6% from 2026 to 2033, driven by urbanization, population growth, and expanding food processing industries. Rising demand for packaged snacks, convenience foods, and dairy products in countries such as China, India, and Japan is fueling the adoption of micronized salt. The region’s increasing awareness of food quality and hygiene, coupled with investments in refining infrastructure, is transforming its salt production landscape. Moreover, the expanding middle-class population and dietary shift toward processed foods contribute significantly to regional growth. Asia-Pacific’s cost-efficient manufacturing and growing export potential position it as a key future growth hub for the global market.

China Micronized Salt Market Insight

China accounted for the largest share in the Asia-Pacific Micronized Salt market in 2025, driven by large-scale industrial salt production and strong demand from food, beverage, and dairy manufacturers. Government initiatives promoting modernization of salt refineries and strict quality regulations are enhancing product purity and safety. The rise of packaged food consumption and the rapid expansion of the country’s food export industry further strengthen China’s dominance. Domestic producers are also investing in energy-efficient production techniques and advanced micronization equipment, ensuring competitiveness in both local and international markets.

India Micronized Salt Market Insight

India is experiencing the fastest growth within the Asia-Pacific region, propelled by increasing food manufacturing capacity, growing retail networks, and rising consumer awareness of high-purity salt. The rapid development of the snack and dairy industries, along with the “Make in India” initiative, is encouraging domestic salt refining and value-added production. Indian consumers’ growing demand for packaged, convenient, and healthy foods is driving the adoption of micronized salt in diverse applications. The government’s support for industrial modernization and food safety compliance further positions India as a key emerging market with strong export potential in the coming decade.

Europe Micronized Salt Market Insight

The Europe micronized salt market is expanding steadily, backed by strong demand from the processed food, meat, and dairy industries. The region’s emphasis on quality assurance, food safety, and clean-label production is driving the adoption of high-purity micronized salts. Countries such as Germany, France, and the Netherlands are leading producers, focusing on eco-friendly refining and mineral fortification. Rising health awareness and regulatory efforts to reduce sodium intake have encouraged innovation in low-sodium micronized salts. Europe’s advanced processing technology and growing export trade make it a stable and mature market with consistent growth prospects.

Germany Micronized Salt Market Insight

Germany remains one of Europe’s leading markets for micronized salt, driven by its technological expertise and strong food processing sector. The demand for fine-particle, food-grade salts is increasing across bakery, dairy, and beverage segments. Local manufacturers are adopting advanced refining systems to meet stringent European standards for purity and sustainability. In addition, the rising popularity of health-oriented and organic food products is encouraging the use of fortified and low-sodium salts. Germany’s strong industrial base and export-oriented production continue to reinforce its position as a key hub within the European salt industry.

U.K. Micronized Salt Market Insight

The U.K. market is expanding due to a growing focus on processed and ready-to-eat foods, coupled with rising consumer interest in healthier and clean-label ingredients. Increasing investments in sustainable salt production and government-backed initiatives promoting lower sodium levels are driving innovation. The country’s vibrant food manufacturing and retail sectors, along with the growing presence of private-label brands, support continuous demand for micronized salt. Post-Brexit trade flexibility and localization efforts are also strengthening domestic production. The trend toward natural, mineral-rich, and additive-free salts positions the U.K. as a dynamic growth market within Europe.

Which are the Top Companies in Micronized Salt Market?

The micronized salt industry is primarily led by well-established companies, including:

- K+S Aktiengesellschaft (Germany)

- Tata Chemicals Ltd. (India)

- CIECH Group (Poland)

- Akzo Nobel N.V. (Netherlands)

- INEOS (U.K.)

- Dominion Salt (New Zealand)

- Cheetham Salt (Australia)

- Kensalt (Kenya)

- WA Salt Group (Australia)

- ACI Limited (Bangladesh)

- Nirma (India)

- Cerebos SA (South Africa)

- INFOSA (Spain)

- ZOUTMAN (Belgium)

- CHINASALT JINTAN CO., LTD (China)

- BGR INTERNATIONAL (India)

- Südwestdeutsche Salzwerke (Germany)

- Australian Saltworks (Australia)

- GHCL Limited (India)

What are the Recent Developments in Global Micronized Salt Market?

- In May 2024, Puratos, a leading multinational company specializing in baking, patisserie, and chocolate ingredients, introduced Sapore Lavida, the first fully traceable active sourdough produced in Belgium. This innovative ingredient is made from 100% whole wheat flour sourced through regenerative agriculture, enabling European bakers to meet the growing demand for locally-made and sustainable sourdough products. This launch reinforces Puratos’ commitment to sustainability and transparency across its bakery ingredient portfolio

- In March 2024, Royal Avebe and the University Medical Center Groningen (UMCG) secured approximately €1.4 million in European funding from the Just Transition Fund (JTF) for their Fibers Project. The initiative focuses on developing starch-based solutions that are both eco-friendly and health-promoting, supporting the transition toward more sustainable food systems. This funding highlights Avebe’s ongoing leadership in sustainable innovation and product diversification

- In November 2022, Dawn Food Products, Inc. launched a new vegan-friendly Vanilla Flavour Crème Filling, crafted without titanium dioxide. Designed for diverse applications such as donuts, pastries, muffins, and cake fillings, this product delivers a smooth texture and rich vanilla flavor while adhering to clean-label trends. This launch underscores Dawn Foods’ dedication to plant-based innovation and evolving consumer preferences in the bakery industry

- In September 2021, Dr. Oetker, a German packaged food leader, acquired Indian start-up Kuppies to strengthen its presence in India’s growing ready-to-eat (RTE) dessert segment. The acquisition included Kuppies’ manufacturing facility, innovation center, and brand assets to support Dr. Oetker’s RTE cake and dessert expansion in the Indian market. This strategic move enhances Dr. Oetker’s regional footprint and aligns with its global growth objectives in convenience foods

- In March 2021, Dawn Foods acquired JABEX, a Polish family-owned manufacturer renowned for its high-quality fruit-based bakery ingredients. The acquisition expanded Dawn Foods’ global manufacturing presence and strengthened its supply chain operations across Central and Eastern Europe. This strategic step enables Dawn Foods to better serve its customers and broaden its product reach within the European bakery ingredients market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Micronized Salt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Micronized Salt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Micronized Salt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.