Global Microwave Oven Trays Market

Market Size in USD Million

CAGR :

%

USD

723.60 Million

USD

1,077.26 Million

2024

2032

USD

723.60 Million

USD

1,077.26 Million

2024

2032

| 2025 –2032 | |

| USD 723.60 Million | |

| USD 1,077.26 Million | |

|

|

|

|

Microwave Oven Trays Market Size

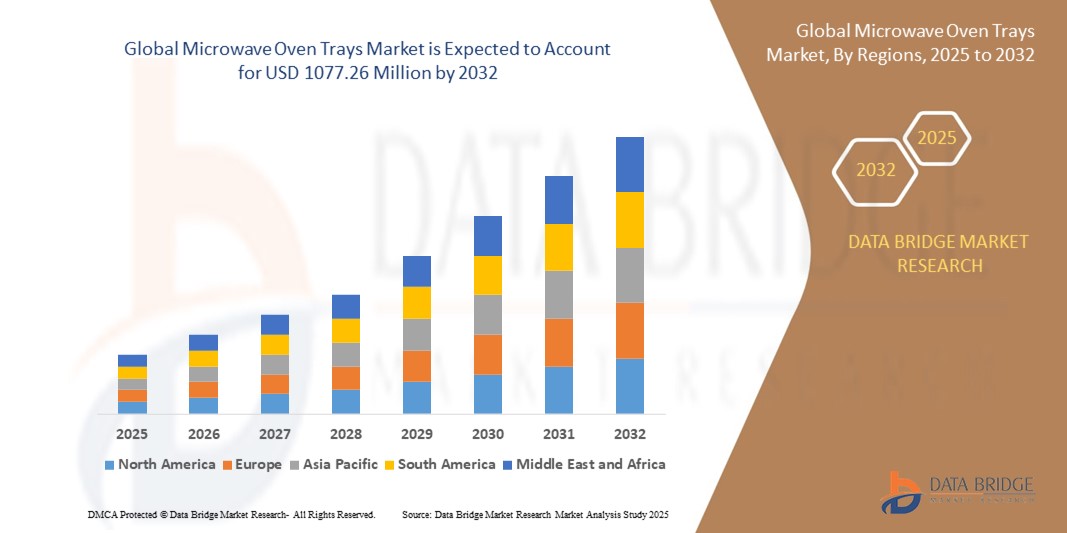

- The global microwave oven trays market size was valued at USD 723.60 million in 2024 and is expected to reach USD 1077.26 million by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is primarily driven by the increasing adoption of microwave ovens in households and commercial kitchens, coupled with advancements in microwave-safe materials and tray designs that enhance cooking efficiency and convenience

- Rising consumer demand for versatile, durable, and easy-to-clean microwave trays, along with growing awareness of sustainable and food-safe materials, is positioning microwave oven trays as essential kitchen accessories, significantly boosting industry growth

Microwave Oven Trays Market Analysis

- Microwave oven trays, designed for safe and efficient cooking, reheating, and steaming in microwave ovens, are increasingly integral to modern kitchen ecosystems due to their convenience, compatibility with diverse cooking needs, and ability to support healthy cooking practices

- The demand for microwave oven trays is fueled by the growing popularity of microwave cooking, increasing consumer preference for time-saving kitchen solutions, and the rising trend of meal prepping and home-cooked meals

- North America dominated the microwave oven trays market with the largest revenue share of 42.5% in 2024, driven by widespread microwave oven usage, high consumer spending power, and the presence of leading kitchenware manufacture

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing adoption of microwave ovens in households, and rising disposable incomes

- The Basic Microwave Trays segment dominated the largest market revenue share of 38% in 2024, driven by their affordability, widespread availability, and suitability for everyday reheating and cooking tasks in households

Report Scope and Microwave Oven Trays Market Segmentation

|

Attributes |

Microwave Oven Trays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Microwave Oven Trays Market Trends

“Increasing Adoption of Eco-Friendly and Sustainable Materials”

- The global microwave oven trays market is experiencing a notable trend toward the use of eco-friendly and sustainable materials in tray manufacturing

- Consumers are increasingly prioritizing environmentally conscious products, driving demand for trays made from biodegradable plastics, recyclable composites, and sustainable materials such as paperboard and corrugated fiberboard

- These materials reduce environmental impact by minimizing plastic waste and supporting recycling initiatives, aligning with global sustainability goals

- For instances, companies are innovating with BPA-free plastics, glass-ceramic composites, and silicone trays that offer durability and safety without compromising environmental standards

- This trend enhances the appeal of microwave trays for both household and commercial users, as sustainable options cater to health-conscious and eco-aware consumers

- Advanced material technologies, such as heat-resistant and non-reactive coatings, are being integrated to ensure trays maintain food safety and quality during microwave cooking

Microwave Oven Trays Market Dynamics

Driver

“Rising Demand for Convenience and Ready-to-Eat Food Solutions”

- The growing consumer preference for convenience-driven food preparation, such as ready-to-eat meals and frozen foods, is a key driver for the global microwave oven trays market

- Microwave trays facilitate quick and efficient meal preparation, catering to busy lifestyles and urban households with limited time for cooking

- Features such as multi-compartment trays, steaming, and grilling capabilities enhance functionality, making trays versatile for various cooking needs

- Government regulations promoting food safety and the increasing penetration of microwave ovens in households and commercial kitchens further boost market growth

- The expansion of e-commerce platforms has made microwave trays more accessible, offering consumers a wide range of options for household and commercial applications

- Manufacturers are responding to consumer demand by offering trays in various sizes to meet diverse household and commercial kitchen requirements

Restraint/Challenge

“High Production Costs and Regulatory Compliance”

- The high cost of producing advanced microwave trays, particularly those made from eco-friendly materials such as glass, ceramic, or silicone, poses a significant barrier to market growth, especially in cost-sensitive emerging markets

- Integrating specialized technologies, such as Energy Dispersive X-ray Fluorescence (EDXRF) and Wavelength Dispersive X-ray Fluorescence (WDXRF), for quality assurance and material analysis adds to manufacturing expenses

- In addition, compliance with varying regional regulations on food safety, material standards, and environmental impact creates challenges for manufacturers operating across multiple markets

- Concerns about chemical leaching from certain plastic trays during microwave heating raise consumer safety issues, necessitating costly innovations in safer, non-reactive materials

- The fragmented regulatory landscape across regions, particularly in North America and Asia-Pacific, complicates production and distribution, potentially limiting market expansion

- These factors may deter smaller manufacturers and slow adoption in regions with high cost sensitivity or stringent regulatory environments

Microwave Oven Trays market Scope

The market is segmented on the basis of product type, material, end-user application, size and capacity, and technology.

- By Product Type

On the basis of product type, the Global Microwave Oven Trays Market is segmented into Basic Microwave Trays, Microwave Safe Cookware, Multi-Compartment Microwave Trays, Steaming Microwave Trays, and Grilling Microwave Trays. The Basic Microwave Trays segment dominated the largest market revenue share of 38% in 2024, driven by their affordability, widespread availability, and suitability for everyday reheating and cooking tasks in households. Their simple design and compatibility with a wide range of microwave ovens contribute to their dominance.

The Steaming Microwave Trays segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer awareness of healthy cooking methods. Steaming trays, equipped with features such as ventilated lids and steam vents, cater to health-conscious individuals seeking nutrient-preserving cooking solutions. Advancements in tray designs and rising demand for convenience foods further accelerate adoption.

- By Material

On the basis of material, the Global Microwave Oven Trays Market is segmented into Plastic Microwave Trays, Glass Microwave Trays, Ceramic Microwave Trays, and Silicone Microwave Trays. The Plastic Microwave Trays segment is expected to hold the largest market revenue share of 45% in 2024, primarily due to their lightweight nature, cost-effectiveness, and widespread use in both household and commercial settings. Innovations in BPA-free and heat-resistant plastics enhance their safety and appeal.

The Silicone Microwave Trays segment is anticipated to experience the fastest growth rate from 2025 to 2032. Silicone’s flexibility, durability, and dishwasher-safe properties, combined with its collapsible design for easy storage, drive its popularity. The growing demand for eco-friendly and reusable materials further supports this segment’s growth.

- By End-user Application

On the basis of end-user-application, the Global Microwave Oven Trays Market is segmented into Household and Commercial Kitchens. The Household segment dominated the market with a revenue share of 68% in 2024, driven by the high penetration of microwave ovens in homes and the rising demand for convenient, time-saving meal preparation solutions. The increasing popularity of ready-to-eat meals and frozen foods further boosts this segment.

The Commercial Kitchens segment is expected to witness robust growth from 2025 to 2032, fueled by the rising adoption of microwave trays in restaurants, cafes, and food service providers. Multifunctional trays that support steaming, grilling, and baking streamline operations and reduce equipment costs, driving their demand in commercial settings.

- By Size and Capacity

On the basis of size and capacity, the Global Microwave Oven Trays Market is segmented into Small Capacity Trays, Medium Capacity Trays, and Large Capacity Trays. The Medium Capacity Trays segment is expected to hold the largest market revenue share of 50% in 2024, as they offer a balance between versatility and convenience, catering to both small households and larger families. Their suitability for a variety of meal types, including ready-to-eat and frozen foods, drives their dominance.

The Large Capacity Trays segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increasing demand for family-sized meals and bulk cooking in households and commercial kitchens. The rise in popularity of large microwave ovens and the need for trays that accommodate bigger portions fuel this segment’s growth.

- By Technology

On the basis of technology, the Global Microwave Oven Trays Market is segmented into Energy Dispersive X-ray Fluorescence (EDXRF) and Wavelength Dispersive X-ray Fluorescence (WDXRF). The EDXRF segment is expected to hold the largest market revenue share of 60% in 2024, owing to its widespread use in quality control and material analysis for microwave trays. EDXRF’s ability to ensure material safety and compliance with food-grade standards drives its adoption in manufacturing.

The WDXRF segment is anticipated to witness significant growth from 2025 to 2032, as it offers higher precision in material characterization, particularly for advanced materials such as glass-ceramics and silicone. Its application in ensuring the safety and durability of microwave trays in demanding environments supports its growth.

Microwave Oven Trays Market Regional Analysis

- North America dominated the microwave oven trays market with the largest revenue share of 42.5% in 2024, driven by widespread microwave oven usage, high consumer spending power, and the presence of leading kitchenware manufacture

- Consumers prioritize microwave trays for their versatility, ease of use, and ability to support diverse cooking needs, such as steaming, grilling, and multi-compartment meal preparation, particularly in households and commercial kitchens

- Market growth is supported by advancements in tray materials, including heat-resistant plastics, glass, ceramics, and silicone, alongside increasing adoption in both household and commercial applications

U.S. Microwave Oven Trays Market Insight

The U.S. microwave oven trays market captured the largest revenue share of 82.3% in 2024 within North America, fueled by strong consumer preference for innovative kitchen solutions and growing awareness of microwave-safe cookware benefits. The trend toward quick meal preparation and increasing demand for multi-functional trays, such as steaming and grilling trays, boost market expansion. The integration of microwave trays in both household and commercial kitchens, coupled with advancements in material durability, supports a diverse product ecosystem.

Europe Microwave Oven Trays Market Insight

The Europe microwave oven trays market is expected to witness significant growth, driven by increasing consumer focus on convenience and energy-efficient cooking solutions. Consumers seek trays that offer versatility, such as multi-compartment and steaming options, while ensuring safety and durability. Growth is prominent in both household and commercial applications, with countries such as Germany and France showing notable adoption due to rising demand for sustainable and high-quality kitchen products.

U.K. Microwave Oven Trays Market Insight

The U.K. market for microwave oven trays is expected to witness rapid growth, driven by demand for convenient and versatile cooking solutions in urban and suburban households. Increased interest in healthy cooking methods, such as steaming, and rising awareness of material safety standards encourage adoption. Evolving regulations on kitchenware safety and sustainability further influence consumer preferences, balancing functionality with compliance.

Germany Microwave Oven Trays Market Insight

Germany is expected to witness rapid growth in the microwave oven trays market, attributed to its advanced kitchen appliance sector and high consumer focus on convenience and energy efficiency. German consumers prefer technologically advanced trays made from durable materials such as glass and ceramics, which support healthy cooking and contribute to efficient meal preparation. The integration of these trays in premium kitchen setups and commercial applications supports sustained market growth.

Asia-Pacific Microwave Oven Trays Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding kitchen appliance markets and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of microwave-safe cookware, healthy cooking practices, and kitchen aesthetics boosts demand. Government initiatives promoting energy-efficient appliances and safe cooking materials further encourage the adoption of advanced microwave trays

Japan Microwave Oven Trays Market Insight

Japan’s microwave oven trays market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced trays that enhance cooking convenience and safety. The presence of major kitchen appliance manufacturers and the integration of microwave trays in household and commercial kitchens accelerate market penetration. Rising interest in innovative tray designs, such as multi-compartment and steaming trays, also contributes to growth.

China Microwave Oven Trays Market Insight

China holds the largest share of the Asia-Pacific microwave oven trays market, propelled by rapid urbanization, rising household appliance ownership, and increasing demand for convenient cooking solutions. The country’s growing middle class and focus on modern kitchen setups support the adoption of advanced microwave trays. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Microwave Oven Trays Market Share

The microwave oven trays industry is primarily led by well-established companies, including:

- Tupperware (U.S.)

- Pyrex (U.S.)

- Anchor Hocking (U.S.)

- Nordic Ware (U.S.)

- Sistema Plastics (New Zealand)

- LocknLock (South Korea)

- Corelle Brands (U.S.)

- Rubbermaid (U.S.)

- Joseph Joseph (U.K.)

- Lékué (Spain)

- Mastrad (France)

- Tescoma (Czech Republic)

- Zwilling J.A. Henckels (Germany)

- Huizhou Yangrui (China)

- Guangdong Haixing Plastic (China)

What are the Recent Developments in Global Microwave Oven Trays Market?

- In July 2024, Mars Food & Nutrition expanded into the ready-to-eat microwave meal market with the launch of Ben's Original Street Food in the US and Canada, and Ben's Original Lunch Bowls and Favorites in the UK. This strategic move reflects the rising consumer demand for quick, flavorful, and microwavable meal options that suit busy lifestyles. The new offerings are designed to deliver bold global flavors and nutritional value in convenient formats, prompting innovation in microwave-compatible packaging. Mars aims to redefine mealtime convenience while maintaining the trusted quality of the Ben’s Original brand

- In May 2024, ProAmpac unveiled its ProActive Recyclable R-2000 series, a line of polyethylene-based films engineered for microwave and frozen food packaging. These mono-material films—R-2000, R-2000F, and R-2000S—are designed to withstand high heat while maintaining seal integrity and dimensional stability. The R-2000F targets frozen food applications, while the R-2000S is optimized for microwave use, especially for non-fat vegetables. All variants are pre-qualified for store drop-off recycling, marking a significant step toward sustainable, high-performance packaging solutions that meet growing consumer and regulatory demands for eco-friendly materials

- In March 2024, Kevin's Natural Foods announced its expansion into the frozen food aisle with a new line of microwave-ready entrée bowls. These meals feature Kevin’s signature sous-vide cooked proteins paired with flavorful sauces, vegetables, and bases such as cauliflower rice, cauliflower pasta, or brown rice. Designed for quick heating and bold taste, the bowls offer up to 33 grams of protein per serving, are gluten-free, and include Paleo-certified options. Packaged in compostable bowls and ready in just five minutes, they cater to consumers seeking clean, convenient, and restaurant-quality meals

- In December 2023, Blue Apron expanded its ready-to-eat category with the launch of Prepared & Ready meals—chef-crafted, single-serving dishes delivered fresh and designed for microwave reheating in under five minutes. These non-frozen meals feature nutritionist-approved recipes with options such as Carb Conscious, 30g+ protein, and 600 calories or less. With recyclable packaging and a variety of globally inspired flavors, the line caters to consumers seeking fast, high-quality meals without the prep, marking a strategic shift toward convenience and flexibility in meal delivery services

- In October 2023, Kraft Heinz launched Lunchables Grilled Cheesies, marking its debut in the frozen food category with a microwave-ready snack powered by 360CRISP™ technology. This innovative packaging delivers a pan-such as crisp and melty cheese texture in just 60 seconds, eliminating the soggy or uneven heating often associated with microwaved foods. Available in Original and Pepperoni Pizza flavors, the sandwiches are designed for easy preparation—especially by kids—without the need for pans or stovetops. The launch reflects Kraft Heinz’s push to revolutionize microwave meals through food-tech innovation and consumer convenience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Microwave Oven Trays Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Microwave Oven Trays Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Microwave Oven Trays Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.