Global Military Communication Market

Market Size in USD Billion

CAGR :

%

USD

25.32 Billion

USD

61.49 Billion

2024

2032

USD

25.32 Billion

USD

61.49 Billion

2024

2032

| 2025 –2032 | |

| USD 25.32 Billion | |

| USD 61.49 Billion | |

|

|

|

|

Military Communication Market Size

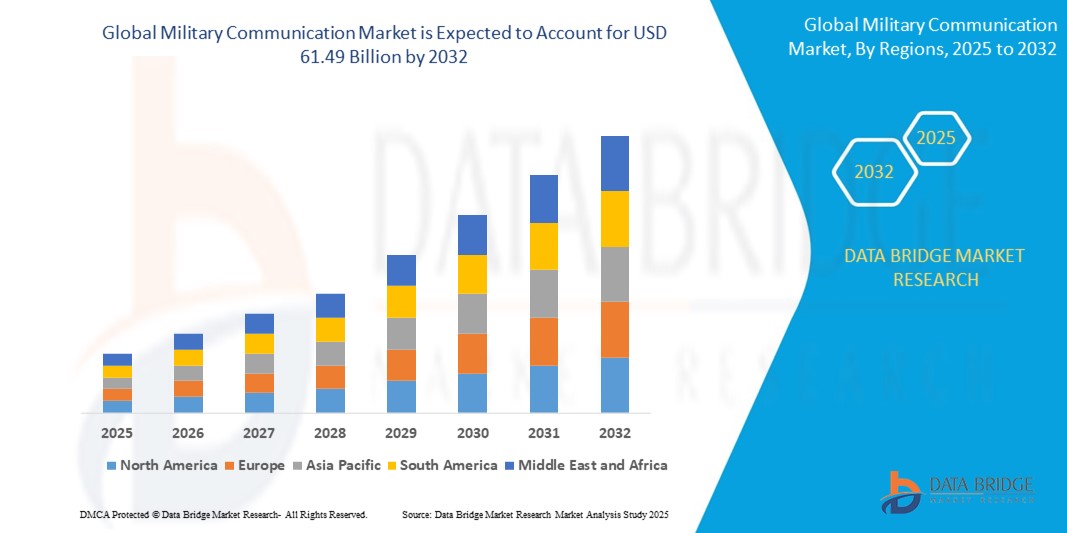

- The global Military Communication market size was valued at USD 25.32 billion in 2024 and is expected to reach USD 61.49 billion by 2032, at a CAGR of 11.73% during the forecast period

- The market growth is largely fueled by rising global defense spending and the increasing need for secure, real-time information exchange during missions. As modern warfare becomes more reliant on advanced technologies, demand for robust communication systems that support data, voice, and video is surging

- Furthermore, Rapid advancements in satellite communication and AI-based systems are further enhancing situational awareness and operational efficiency. The growth of unmanned systems like drones and autonomous vehicles also necessitates strong, reliable communication links. Governments are heavily investing in network-centric warfare capabilities, fueling demand for upgraded communication infrastructure. Additionally, geopolitical tensions and modernization programs across various nations are reinforcing this upward trend.

Military Communication Market Analysis

- The global spending over the military communication has crossed a trillion mark, as a huge investment is made by the federal government to accept advanced communication solutions in the diverse government departments. For the interoperability and better security of military services are the factors boosting the demand growth. Military communication market contains the advanced mechanisms and the technologies.

- North America dominates the Military Communication market with the largest revenue share of 48.33% in 2025, characterized by large defense expenditure and increased penetration of technology in defense sector.

- Europe is expected to be the fastest growing region in the Military Communication market during the forecast period because of the incidence of the numerous naval and airborne communication solution manufacturers.

- Airborne Communications segment is expected to dominate the Military Communication market with a market share of 39.21% in 2025, driven by its critical role in real-time data sharing and mission coordination across air-based defense operations.

Report Scope and Military Communication Market Segmentation

|

Attributes |

Military Communication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Military Communication Market Trends

“Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Military Communications”

- The military communications sector is increasingly leveraging AI and ML to enhance operational efficiency and security. AI algorithms are being employed to optimize network performance, automate decision-making processes, and improve data analysis. ML is utilized for predictive maintenance of communication systems, identifying patterns in data traffic to detect anomalies or potential threats.

- Additionally, AI-powered natural language processing (NLP) is improving human-machine interactions, enabling more intuitive and efficient communication interfaces for military personnel.

- This integration is expected to continue growing as defense organizations seek to leverage AI and ML to gain operational advantages, improve situational awareness, and streamline communication processes across diverse operational environments.

- For Instance, In September 2023, Curtiss-Wright Defense Solutions and Vectra AI introduced an AI-powered hunt kit for advanced threat detection in tactical-edge communications. The modular system incorporates over 120 patented AI algorithms and self-learning machine learning models. It identifies cyber threats in real-time, enhancing national security and ensuring secure, resilient communication for military operations in the field. This technology aims to counter evolving adversarial cyberattacks.

Military Communication Market Dynamics

Driver

“Advancements in AI and Machine Learning Integration”

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is revolutionizing military communication systems. AI and ML enable real-time data analysis, predictive maintenance, and autonomous decision-making, enhancing the efficiency and reliability of communication networks.

- These technologies facilitate the development of adaptive communication systems capable of responding to dynamic operational environments and emerging threats.

- For example, AI-driven algorithms can optimize network performance by dynamically allocating resources and managing traffic, ensuring uninterrupted communication even in challenging conditions.

- Additionally, ML models can predict potential system failures, allowing for proactive maintenance and reducing downtime. The adoption of AI and ML is becoming increasingly prevalent as defense organizations seek to enhance the capabilities of their communication infrastructures.

- For Instance, In April 2025, Himera, a Ukrainian company, introduced the G1 Pro walkie-talkie, designed to resist electronic warfare. Utilizing frequency-hopping technology, the G1 Pro ensures secure communication by avoiding jamming and interference. The device has garnered attention from the U.S. military, highlighting the growing demand for secure communication solutions in modern warfare

Restraint/Challenge

“High Initial Development and Deployment Costs”

- The substantial financial investment required for developing and deploying advanced military communication systems poses a significant barrier to many nations. For instance, the development of a single military communication satellite can cost upwards of USD 1 billion, with launch expenses ranging between USD 55 million and USD 90 million.

- These high costs encompass research, development, procurement, testing, and integration of cutting-edge technologies to meet specific military requirements. Such substantial financial burdens can limit the ability of some nations, particularly those with constrained defense budgets, to invest in state-of-the-art communication technologies. This financial challenge is further compounded by the rapid pace of technological advancements, necessitating continuous investment to keep systems updated and effective.

- Consequently, the high initial development and deployment costs can impede the growth and modernization of military communication infrastructures, especially in developing countries

- For Instance, In June 2023, India awarded a contract to ICOMM Tele Limited to deliver 1,035 5/7.5 Ton radio relay communication equipment containers for USD 60.29 million. This initiative aimed to address the long-overdue requirement of mobile communication detachments of the Indian Army. The project underscores the significant financial investment involved in upgrading and modernizing military communication systems, highlighting the challenges faced by nations in balancing defense needs with budgetary constraints.

Military Communication Market Scope

The market is segmented on the basis communication type, component, application and end user.

- By Communication Type

Based on the communication type, the military communication market is segmented into airborne communications, air-ground communications, underwater communications, ground-based communications, and shipborne communications. The Airborne Communications segment is expected to dominate the Military Communication market with a market share of 39.21% in 2025, driven by its critical role in real-time data sharing and mission coordination across air-based defense operations.

The air-ground communications segment is anticipated to witness the fastest growth rate of 23.1% from 2025 to 2032, fueled by increasing reliance on unmanned aerial systems and network-centric warfare strategies. Enhanced situational awareness and mission coordination are key factors fueling the surge in this segment.

- By Component

Based on the component, the military communication market is segmented into military satcom systems, military radio systems, military security systems, communication management systems. The military satcom systems held the largest market revenue share in 2025 of, driven by the critical role in ensuring secure, long-range communication in defense operations. With rising global defense modernization programs, reliance on satellite-based communication has surged. These systems provide vital connectivity in remote and hostile environments where traditional networks fail. The growing need for uninterrupted, encrypted communication across air, land, and sea further supports their dominance.

The military radio systems segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its increasing demand for reliable, secure, and portable communication devices on the battlefield. Advances in software-defined radios and tactical communication solutions are enhancing flexibility and interoperability. Additionally, growing defense budgets and the need for rapid information exchange among troops are key growth factors. This segment’s expansion is also supported by the rising use of handheld and vehicle-mounted radios in modern military operations.

- By Application

Based on the application, the military communication market is segmented into command and control, routine operations, situational awareness, others. The command and control held the largest market revenue share in 2025, driven by the critical need for centralized coordination and real-time decision-making in military operations. Advanced communication technologies enable seamless integration of data from multiple sources, enhancing situational awareness. Growing investments in network-centric warfare and battlefield management systems further boost demand. This segment’s importance in ensuring effective command structures and rapid response continues to drive its market dominance.

The routine operations segment held a significant market share in 2025, favored for its essential role in maintaining continuous, secure communication across daily military activities. Reliable and efficient communication systems support logistics, training, and administrative functions. This steady demand ensures stable growth within the segment.

- By End User

Based on the end user, the military communication market is segmented into land forces, naval forces, air forces. The land forces segment accounted for the largest market revenue share in 2024, driven by the extensive need for robust, secure communication systems in ground combat and tactical operations. Increasing modernization of army communication networks and growing defense budgets contribute to this demand. Reliable connectivity is crucial for coordination and mission success on the battlefield.

The naval forces segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing deployment of advanced communication systems on ships and submarines for enhanced maritime security. Growing investments in naval modernization and the need for secure, real-time data exchange during missions are key factors.

Military Communication Market Regional Analysis

- North America dominates the Military Communication market with the largest revenue share of 48.33% in 2025, characterized by large defense expenditure and increased penetration of technology in defense sector

- advanced defense infrastructure and substantial government investments. The region benefits from the presence of major defense contractors and continuous innovation in communication technologies. The U.S. military’s focus on modernizing its communication networks, including satellite and tactical systems, drives strong demand.

- Additionally, ongoing geopolitical tensions encourage increased defense spending. Collaborative defense programs with allies further boost market growth. Overall, North America’s leadership in technology and funding cements its dominant position in the market.

U.S. Military Communication Market Insight

The U.S. Military Communication market captured the largest revenue share of 51% within North America in 2025, fueled by the substantial defense budgets focused on upgrading communication infrastructure. Advanced research and development in secure, interoperable systems also drive growth. Additionally, ongoing military operations and modernization programs boost demand for cutting-edge communication solutions.

Europe Military Communication Market Insight

The European Military Communication market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased defense spending and modernization efforts across NATO countries. Emphasis on interoperable and secure communication systems for joint operations boosts demand. Additionally, rising geopolitical tensions in the region further accelerate investments in advanced military communication technologies.

U.K. Military Communication Market Insight

The U.K. Military Communication market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the government initiatives to modernize defense communication networks. Increased focus on cybersecurity and secure data transmission fuels demand. Additionally, collaborations with allied forces enhance the development and deployment of advanced communication technologies.

Germany Military Communication Market Insight

The German Military Communication market is expected to expand at a considerable CAGR during the forecast period, fueled by increased defense investments and modernization of communication infrastructure. Emphasis on integrating advanced technologies like secure satellite and tactical radio systems drives demand. Additionally, Germany’s active role in NATO and regional security initiatives supports market expansion.

Asia-Pacific Military Communication Market Insight

The Asia-Pacific Military Communication market is poised to grow at the fastest CAGR of over 22% in 2025, driven by rising defense budgets and modernization efforts across countries like China and India. Increasing geopolitical tensions in the region are prompting investments in advanced communication technologies. Additionally, the expansion of network-centric warfare capabilities fuels market demand.

India Military Communication Market Insight

The India Military Communication market is gaining momentum due to the government’s increased defense spending and focus on modernizing communication infrastructure. Growing regional security concerns drive the demand for advanced, secure communication systems. Additionally, partnerships with global defense technology providers accelerate market growth.

China Military Communication Market Insight

The China Military Communication market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the significant defense budget and rapid modernization of military communication systems. Advanced technology adoption and focus on network-centric warfare further boost growth. Additionally, China’s strategic emphasis on enhancing secure and resilient communication capabilities drives market dominance.

Military Communication Market Share

The Military Communication industry is primarily led by well-established companies, including:

- DSM,

- ADM,

- Harvest Fuel Sweetpro Feeds,

- BASF SE,

- Evonik Industries AG,

- AJINOMOTO CO., INC.,

- Chr. Hansen Holding A/S,

- Adisseo,

- Cargill,

- Incorporated,

- Novozymes,

- Novus International,

- Lonza,

- Kerry.,

- Alltech,

- AB Vista,

- AngelYeast Co., Ltd.,

- Kemin Industries, Inc.,

- CJ CheilJedang Corp.,

- Lallemand Inc.,

- Fermented Nutrition Corporation,

- DuPont.,

- Döhler Group,

- Ultra International B.V.,

- Diana Group,

- Olam International,

- BNP Media.,

- Sensient Technologies Corporation

Latest Developments in Global Military Communication Market

-

In early 2025, Evonik announced the expansion of its AQUAVI® Met-Met production facility in Singapore. This move aims to meet the growing demand for high-quality methionine in aquaculture, enhancing feed efficiency and sustainability in the region.

- In September 2024, DSM-Firmenich announced the EU authorization of HiPhorius™, a next-generation phytase enzyme. This enzyme enhances phosphorus digestibility in animals, reducing the need for costly inorganic phosphorus supplements and improving growth rates and feed conversion ratios. HiPhorius™ is approved for use in poultry, swine, and aquaculture across the European Union. The enzyme's advanced formulation ensures superior product forms, delivering enzyme activity effectively during all feed production processes. This development underscores DSM-Firmenich's dedication to providing sustainable and efficient solutions for the animal nutrition industry.

- In March 2025, Adisseo completed the acquisition of Nor-Feed, a French company specializing in plant-based specialty ingredients for animal nutrition. This acquisition strengthens Adisseo's portfolio in natural feed additives, aligning with the industry's shift towards sustainable and plant-based solutions.

- In April 2025, DSM-Firmenich announced a share repurchase program to cover share-based compensation plans and reduce capital. The program commenced with an initial €580 million, with plans to increase to €1 billion upon the completion of the previously announced sale of the company's stake in the Feed Enzymes Alliance. The repurchase program aims to return value to shareholders and optimize the company's capital structure. This initiative demonstrates DSM-Firmenich's commitment to enhancing shareholder value and maintaining financial flexibility.

- In February 2025, Kemin launched Pathorol, a supplement designed to improve hepatopancreas health in shrimp. Initially available in India, Thailand, Vietnam, Indonesia, and Singapore, this product addresses the growing demand for sustainable aquaculture practices.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Military Communication Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Military Communication Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Military Communication Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.